“Suncor generated $2.4 billion in funds from operations in the

quarter while also completing significant turnaround activities in

the upstream and downstream businesses,” said Mark Little,

president and chief executive officer. “The improved cash

generation enabled us to increase shareholder returns to

approximately $1.0 billion, representing approximately 40% of our

funds from operations and we’re targeting further debt reduction in

the latter half of the year in line with our previously announced

capital allocation strategy.”

- Funds from operations increased to $2.362 billion ($1.57 per

common share) in the second quarter of 2021, compared to $488

million ($0.32 per common share) in the prior year quarter. Cash

flow provided by operating activities, which includes changes in

non-cash working capital, was $2.086 billion ($1.39 per common

share) in the second quarter of 2021, compared to cash flow used in

operating activities of $768 million ($0.50 per common share) in

the prior year quarter.

- The company recorded operating earnings1 of $722 million ($0.48

per common share) in the second quarter of 2021 compared to an

operating loss of $1.345 billion ($0.88 per common share) in the

prior year quarter. The company had net earnings of $868 million

($0.58 per common share) in the second quarter of 2021, compared to

a net loss of $614 million ($0.40 per common share) in the prior

year quarter.

- Suncor’s total upstream production increased to 699,700 barrels

of oil equivalent per day (boe/d) in the second quarter of 2021,

compared to 655,500 boe/d in the prior year quarter, due to strong

Oil Sands operations production including record In Situ volumes,

partially offset by the impact of planned turnaround maintenance at

Syncrude.

- Significant turnaround activities were completed at Syncrude,

Buzzard and across all of the company’s refineries during the

second quarter of 2021.The company exited the quarter with refinery

utilization of approximately 94%, and with Syncrude and Buzzard

having returned to production, the company is set up for a strong

second half of the year.

- Canadian gasoline and diesel demand in the second quarter of

2021 is estimated to be 13%2 below the comparable pre-COVID-19

period in 2019, reflecting the continued COVID-19 related

restrictions across Canada. With the lifting of many restrictions

in July, gasoline and diesel demand is estimated to have improved

to 6%2 below the comparable 2019 levels.

- The company shared its updated strategy, which focuses on

increasing shareholder returns while accelerating its greenhouse

gas (GHG) emissions reduction targets, growing its business in low

GHG fuels, electricity and hydrogen, sustaining and optimizing its

base business and transforming its GHG footprint to be a net-zero

company by 2050.

- Suncor, together with four industry partners representing 90%

of Canada’s oil sands production, announced the Oil Sands Pathways

to Net Zero alliance whose initiative is aimed at working

collectively with the federal and Alberta governments to achieve

net-zero GHG emissions from oil sands operations by 2050.

- In the second quarter of 2021, Suncor remained focused on

maximizing the return to its shareholders through the repurchase of

approximately 23 million common shares for $643 million under the

company’s share repurchase program, and payment of $315 million of

dividends. Share repurchases in the quarter represent 1.5% of

Suncor’s issued and outstanding common shares as at January 31,

2021. Since the start of the normal course issuer program (NCIB) in

February 2021, the company has repurchased $961 million in common

shares, representing approximately 35 million common shares at an

average share price of $27.47 per common share, or the equivalent

of 2.3% of Suncor’s issued and outstanding common shares as at

January 31, 2021.

- Subsequent to the second quarter of 2021, Suncor’s Board of

Directors (the Board) approved an increase to the company’s share

repurchase program to approximately 5% of the company’s outstanding

common shares as at January 31, 2021. Concurrently, the Toronto

Stock Exchange (TSX) accepted a notice to increase the maximum

number of common shares the company may repurchase pursuant to its

NCIB to approximately 5%. The increase to the program demonstrates

management’s confidence in the company’s ability to generate cash

flow and its commitment to return cash to shareholders.

Financial Results

Operating Earnings (Loss)

Suncor’s second quarter 2021 operating earnings

were $722 million ($0.48 per common share), compared to an

operating loss of $1.345 billion ($0.88 per common share) in the

prior year quarter. In the second quarter of 2021, crude oil and

refined product realizations increased significantly compared to

the prior year quarter, which reflected the impact of the

unprecedented decline in transportation fuel demand, due to the

impacts of the COVID-19 pandemic, and the increase in OPEC+ crude

supply. The improving business environment in the second quarter of

2021 also resulted in a net inventory valuation gain, reflecting a

first-in, first-out gain as a result of the increasing value of

refinery feedstock. Operating earnings were partially offset by an

increase in royalties and operating expenses associated with

Suncor’s increased production in the second quarter of 2021 and

reflected lower costs in the prior year quarter related to specific

measures taken by the company to reduce operating costs in response

to the COVID-19 pandemic.

Net Earnings (Loss)

Suncor’s net earnings were $868 million ($0.58 per

common share) in the second quarter of 2021, compared to a net loss

of $614 million ($0.40 per common share) in the prior year

quarter. In addition to the factors impacting operating earnings

(loss) discussed above, net earnings for the second quarter of 2021

included a $156 million unrealized after-tax foreign exchange gain

on the revaluation of U.S. dollar denominated debt and a $10

million after-tax unrealized loss on risk management activities.

The net loss in the prior year quarter included a $478 million

unrealized after-tax foreign exchange gain on the revaluation of

U.S. dollar denominated debt and a $144 million after-tax

unrealized loss on risk management activities.

Funds from Operations and Cash Flow

Provided by (Used in) Operating Activities

Funds from operations were $2.362 billion

($1.57 per common share) in the second quarter of 2021, compared to

$488 million ($0.32 per common share) in the second quarter of

2020. Funds from operations were influenced by the same factors

impacting operating earnings (loss) noted above.

Cash flow provided by operating activities, which

includes changes in non-cash working capital, was $2.086 billion

($1.39 per common share) for the second quarter of 2021, compared

to cash flow used in operating activities of $768 million

($0.50 per common share) in the prior year quarter. In addition to

the factors noted above, cash flow provided by operating activities

was further impacted by a use of cash associated with the company’s

working capital balances in both periods. The use of cash in the

second quarter of 2021 was primarily due to an increase in

production and commodity prices at the end of the quarter,

resulting in an increase in accounts receivable and inventory

balances, which was partially offset by a decrease in income tax

receivable balances related to the receipt of a portion of the

company’s 2020 income tax refund.

Operating Results

Suncor’s total upstream production increased to

699,700 boe/d in the second quarter of 2021, compared to 655,500

boe/d in the prior year quarter, reflecting strong Oil Sands

operations production during the quarter, partially offset by the

impact of planned turnaround maintenance at Syncrude. The prior

year quarter was impacted by the significant decline in crude oil

demand due to the impacts of the COVID-19 pandemic.

The company’s net synthetic crude oil production

increased to 437,200 barrels per day (bbls/d) in the second quarter

of 2021 from 436,600 bbls/d in the second quarter of 2020. Strong

mining and upgrading performance at Oil Sands Base resulted in

upgrader utilization of 96%, compared to 93% in the prior year

quarter. At Syncrude, both periods were impacted by planned

maintenance, and following the completion of planned turnaround

activities in the second quarter of 2021, Syncrude ramped up to

full operating rates subsequent to the end of the quarter. Due to

the impacts of the COVID-19 pandemic in the Fort McMurray region,

the company staggered its planned turnarounds at Oil Sands Base

plant Upgrader 2 and Syncrude, resulting in the deferral of the Oil

Sands Base turnaround to the third quarter of 2021. This decision

supported the safe and efficient completion of the Syncrude

turnaround activities and minimized the overlap between the two

assets. The deferral of the turnaround activities at Oil Sands Base

is not anticipated to impact annual production volumes and has been

reflected in the company’s 2021 guidance. Suncor continues to work

with the community of Fort McMurray, various levels of government

and other industry stakeholders to accelerate rapid testing and

vaccinations in the region.

The company’s non-upgraded bitumen production

increased to 178,500 bbls/d in the second quarter of 2021 from

117,100 bbls/d in the prior year quarter, which, for the second

quarter in a row, included the best In Situ quarterly production in

the company’s history. During the quarter, the increase in

non-upgraded production to market was further supported by strong

mining performance at Oil Sands Base, which resulted in less

Firebag volumes utilized at the upgrader and overall higher Oil

Sands operations production volumes. At MacKay River, production in

the prior year quarter was impacted by an outage that occurred in

late 2019.

Production at Fort Hills during the quarter

reflected the previously communicated change in the mine ramp up

strategy. This strategy is principally focused on building

ore inventory as appropriate ore inventory levels are required to

operate the plant at 90% of nameplate capacity on a two-train

operation. By the end of the quarter, ore inventory build was

slower than expected with access to additional contract equipment

and labour being more constrained than expected. Access to

additional resources has increased and we anticipate being at

expected contractor capacity by August 2021. Subsequent to the

quarter, slope instability on the south side of the mine, which

contains the majority of the exposed ore, will require overburden

removal to occur earlier than expected to provide full access to

the exposed ore and maintain slope integrity. This activity is

underway and is expected to be completed by the end of 2021. As a

result, Fort Hills plans to continue at the current production

level for the remainder of the year, with a transition to both

primary extraction trains beginning in late 2021 to enable full

production in early 2022. 2021 annual guidance for Fort Hills

production and Fort Hills cash operating costs have been updated to

reflect these changes.

Exploration and Production (E&P) production

during the second quarter of 2021 decreased to 84,000 boe/d from

101,800 boe/d in the prior year quarter, primarily due to planned

turnaround activities at Buzzard and natural declines. Both periods

were impacted by the absence of production from Terra Nova as the

asset has remained off-line since the fourth quarter of 2019.

During the second quarter of 2021, the company announced that the

co-owners of the Terra Nova Floating, Production, Storage and

Offloading facility and associated Terra Nova Field have reached an

agreement, in principle, to restructure the project ownership and

provide short-term funding towards continuing the development of

the Asset Life Extension Project, with the intent to move to a

sanction decision in the third quarter of 2021. The agreement is

subject to finalized terms and approval from all parties to the

agreement and is contingent upon the previously disclosed royalty

and financial support from the Government of Newfoundland &

Labrador.

Refinery crude throughput was 325,300 bbls/d and

refinery utilization was 70% in the second quarter of 2021,

compared to refinery crude throughput of 350,400 bbls/d and

refinery utilization of 76% in the prior year quarter, reflecting

planned turnaround activities in the current quarter and reduced

rates in response to lower demand due to the COVID-19 pandemic in

the prior year quarter. During the second quarter of 2021, the

company completed turnaround activities for the year across all its

refineries, enabling them to exit the quarter with a refinery

utilization of approximately 94%. Refined product sales in the

second quarter of 2021 increased to 463,300 bbls/d, compared to

438,800 bbls/d in the prior year quarter, due to improved refined

product demand and a draw in product inventory as we strategically

built inventory in support of significant planned turnaround

activities and an improving business environment. With the

completion of turnarounds across the company’s refineries and the

phased lifting of COVID-19-related restrictions, the company is

positioned to capture improved margins in the second half of the

year as domestic demand continues to recover towards pre-pandemic

levels.

“In the first half of 2021, we achieved strong Oil

Sands Base mining and upgrading production and consecutive

quarterly production records at In Situ leading to the best start

to the year in the company’s history at Oil Sands operations,” said

Little. “During the quarter we completed significant turnaround

activities at Syncrude and across all our refineries. Following the

quarter, we’ve ramped up our assets and are positioned for a strong

second half of 2021.”

The company’s total operating, selling and general

expenses increased to $2.720 billion in the second quarter of 2021

from $2.129 billion in the prior year quarter due to increased

production at Oil Sands Base, and higher planned maintenance that

was conducted at the same time as the planned turnaround activities

at Syncrude. These expenses were partially offset by cost

reductions related to digital technology and transformation

initiatives. Increased production in the quarter resulted in higher

absolute costs but lower cash operating costs per barrel at Oil

Sands operations, despite a significant increase in natural gas

prices compared to the prior year quarter. The prior year quarter

reflected lower costs related to specific measures taken by the

company to reduce operating costs in response to the COVID-19

pandemic and was also favourably impacted by the Government of

Canada’s Emergency Wage Subsidy.

Strategy Update

In May, Suncor held its investor day event to

outline the company’s medium-term corporate outlook, provide an

update on the progress made to date on its $2.15 billion

incremental free funds flow target and discuss other strategic

objectives. In the near term the company expects to continue to

execute its plans to structurally lower its cost base and improve

productivity, including ensuring the smooth transition of Syncrude

operatorship and continuing Suncor’s digital transformation. Once

Syncrude operatorship is transferred, gross synergies of

approximately $100 million are expected for the joint venture

owners within the first six months with an additional $200 million

through 2022-2023. Building on the achievements in 2020, which

included debottlenecks and tailings management, initiatives in 2021

such as mine optimization and digital, process and technology

projects are expected to contribute to the company's $2.15 billion

incremental free funds flow target.

Suncor also announced its new strategic objective

to become a net-zero GHG emissions company by 2050 (on emissions

produced from running its facilities, including those it has a

working interest in) and to substantially contribute to society’s

net-zero ambitions. While Suncor will continue to track and report

emissions intensity, the company has set a more ambitious near-term

goal to better align with its objective to reach net-zero emissions

and to provide a clearer way to demonstrate progress: targeting

annual emissions reductions of 10 megatonnes across its value chain

by 2030. Suncor plans to achieve this by reducing its base business

emissions, investing in profitable low emissions ventures and

technologies, taking actions that reduce others’ emissions and

investing in offsets outside its business. Additionally, Suncor,

together with Canadian Natural Resources, Cenovus Energy, Imperial

Oil and MEG Energy – who together operate 90% of oil sands

production – announced the Oil Sands Pathways to Net

Zero alliance. The goal of this alliance is to work

collectively with the federal and Alberta governments to achieve

net-zero GHG emissions from oil sands operations by 2050. The

Pathways initiative will explore several parallel pathways to

address GHG emissions, including the creation of a Carbon Capture,

Utilization and Storage trunkline connected to a carbon

sequestration hub to enable multi-sector ‘tie-in’ projects as well

as the implementation of other next-generation technologies.

Suncor’s new strategic objectives and targets

around absolute GHG emissions reductions will be supported by

pragmatic and economic investments that are part of – or

synergistic with – the company’s core capabilities. This includes

investments in the cogeneration facility at Oil Sands and the Forty

Mile Wind Power Project, which are expected to generate mid-teen

returns. Additionally, during the second quarter of 2021, Suncor

and ATCO Ltd. announced a partnership on a potential world-scale

clean hydrogen project to be developed in Alberta, Canada. A

sanctioning decision is expected in 2024 and the facility could be

operational as early as 2028, provided it has the required

regulatory and fiscal support to render it economic.

The company also recently released its 2021 Report

on Sustainability and Climate Report, marking over 25 years of

dedication to improve sustainability performance and increase

transparency and reporting. The details of Suncor’s new GHG

emissions reductions objectives can be accessed at

sustainability.suncor.com.

“We continue to progress on our ambition to be

Canada’s leading energy company – focusing on increasing

shareholder returns while accelerating our GHG emissions reduction

targets,” said Little. “Our strategy will optimize the value of our

base business, improving its cost and capital efficiency, while

supplementing it with economically robust energy expansion

investments that will contribute to increasing free funds flow.

This balance will be critical to increasing our shareholder

returns, fortifying our balance sheet while significantly lowering

GHG emissions by 2030 and progressing to net zero by 2050.”

The updated strategy and progress on the company’s

GHG emissions reduction objectives will continue to be underpinned

by capital discipline. The company has set an annual ceiling for

total capital expenditures of $5 billion, including lowered

sustaining and economic capital, to sustain its base business while

investing in energy expansion and building out its low-carbon

business. Over the medium-term, Suncor expects to allocate

approximately 10% of its annual capital budget (approximately $500

million per year) on investments that are intended to advance its

lower-carbon energy offering.

The company plans to allocate incremental funds to

shareholder returns in the form of dividends and share buybacks as

well as towards debt reduction, with the company targeting absolute

net debt, inclusive of leases, of $12 - $15 billion by 2025.

Dividends are expected to increase in line with the $2.15 billion

incremental free funds flow growth, with additional free funds flow

being allocated to share buybacks.

To accelerate reaching these debt reduction

targets, in 2021 the company plans to allocate two-thirds of its

annual free funds flow, after its dividend, towards debt reductions

and one-third toward shareholder cash returns through share

buybacks. In the second quarter of 2021, the company returned

$958 million to shareholders, including $643 million in common

share repurchases and $315 million in dividends paid. Since the

start of the NCIB program in February 2021, the company has

repurchased $961 million in common shares, representing

approximately 35 million common shares at an average share price of

$27.47 per common share, or the equivalent of 2.3% of Suncor’s

issued and outstanding common shares as at January 31, 2021.

Subsequent to the second quarter of 2021, the

Board approved an increase to the company’s share repurchase

program to approximately 5% of the company’s outstanding common

shares as at January 31, 2021. Concurrently, the TSX accepted a

notice to increase the maximum number of common shares the company

may repurchase pursuant to its NCIB to approximately 5%. The

increase to the program demonstrates management’s confidence in the

company’s ability to generate cash flow and its commitment to

return cash to shareholders.

Subsequent to June 30, 2021, the agreement for the

sale of Suncor’s 26.69% working interest in the Golden Eagle Area

Development was approved by the purchaser’s shareholders with

financing conditions met. The effective date of the sale is January

1, 2021 for gross proceeds of US$325 million and contingent

consideration up to US$50 million before closing adjustments and

other closing costs and is expected to close in the third quarter

of 2021.

Operating Earnings (Loss)

Reconciliation(1)

| |

|

|

|

|

|

|

Three months ended

June 30 |

|

Six months ended June

30 |

|

|

($ millions) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Net earnings (loss) |

868 |

|

(614 |

) |

1 689 |

|

(4 139 |

) |

|

Unrealized foreign exchange (gain) loss on U.S. dollar denominated

debt |

(156 |

) |

(478 |

) |

(337 |

) |

543 |

|

|

Unrealized loss (gain) on risk management activities(2) |

10 |

|

144 |

|

(10 |

) |

32 |

|

|

Restructuring charge(3) |

- |

|

- |

|

126 |

|

- |

|

|

Asset impairment(4) |

- |

|

- |

|

- |

|

1 798 |

|

|

Impact of inventory write-down to net realizable value(5) |

- |

|

(397 |

) |

- |

|

- |

|

|

Operating earnings (loss)(1)(2) |

722 |

|

(1 345 |

) |

1 468 |

|

(1 766 |

) |

- Operating earnings (loss) is a non‑GAAP financial measure. All

reconciling items are presented on an after‑tax basis. See the

Non‑GAAP Financial Measures Advisory section of this news

release.

- Beginning in the first quarter of 2021, the company has revised

its calculation of operating earnings, a non-GAAP financial

measure, to exclude unrealized (gains) losses on derivative

financial instruments that are recorded at fair value to

better align the earnings impact of the activity with the

underlying items being risk-managed. Prior period comparatives

have been restated to reflect this change.

- Restructuring charge in the Corporate segment recorded in the

first quarter of 2021.

- During the first quarter of 2020, the company recorded non-cash

after-tax impairment charges of $1.376 billion on its share of the

Fort Hills assets, in the Oil Sands segment, and $422 million

against its share of the White Rose and Terra Nova assets, in the

E&P segment, due to a decline in forecasted crude oil prices as

a result of decreased global demand due to the COVID-19 pandemic

and changes to their respective capital, operating and production

plans.

- During the first quarter of 2020, the company recorded an

after-tax hydrocarbon inventory write-down to net realizable value

of $177 million in the Oil Sands segment and $220 million in the

Refining and Marketing (R&M) segment as a result of a

significant decline in benchmarks and demand for crude oil and

refined products due to COVID-19 mitigation efforts. The full

hydrocarbon inventory write-down of $397 million after-tax was

excluded from operating earnings and funds from operations in the

first quarter of 2020, and realized through operating earnings and

funds from operations in the second quarter of 2020 when the

product was sold.

Corporate Guidance

Suncor has updated its full-year business

environment outlook assumptions for Brent Sullom Voe from

US$63.00/bbl to US$68.00/bbl, WTI at Cushing from US$60.00/bbl to

US$65.00/bbl, WCS at Hardisty from US$48.00/bbl to US$52.00/bbl,

New York Harbor 2-1-1 crack from US$17.00/bbl to US$18.00/bbl and

AECO-C Spot from $2.50/GJ to $3.50/GJ, due to improvements in key

forward curve pricing for the remainder of the year. As a result of

these updates, the full-year current income tax expense range has

increased from $1.0 billion – $1.3 billion to $1.2 billion – $1.5

billion.

In addition, the production range for Fort Hills

has been updated from 65,000 – 85,000 bbls/d to 45,000 – 55,000

bbls/d reflecting additional work required to maintain slope

integrity on the south side of the mine. As a result, Fort Hills

cash operating costs per barrel have been updated from $25.00 -

$29.00 to $37.00 - $42.00.

Suncor has also modified its capital expenditure

allocation between business areas to reflect lower spending at East

Coast Canada projects in E&P, offset by increased scope of

refinery turnaround activities in R&M. As a result, Upstream

E&P capital expenditure guidance has been reduced from $350 -

$450 million to $300 - $400 million, and Downstream capital

expenditure guidance has been increased from $700 - $800 million to

$750 - $850 million. The overall capital expenditure range for the

company remains unchanged.

For further details and advisories regarding

Suncor’s 2021 annual guidance, see suncor.com/guidance.

Normal Course Issuer Bid

Subsequent to the second quarter of 2021, Suncor

received approval from the TSX to amend its existing NCIB effective

as of the close of markets on July 30, 2021, to purchase common

shares through the facilities of the TSX, New York Stock Exchange

and/or alternative trading platforms. The notice provides that

Suncor may increase the maximum number of common shares that may be

repurchased in the period beginning February 8, 2021, and ending

February 7, 2022, from 44,000,000 common shares, or approximately

2.9% of Suncor’s issued and outstanding common shares as at January

31, 2021, to 76,250,000 common shares, or approximately 5% of

Suncor’s issued and outstanding common shares as at January 31,

2021. No other terms of the NCIB have been amended.

Between February 8, 2021 and July 26, 2021 and

pursuant to the NCIB, Suncor has already repurchased approximately

$1.142 billion of common shares on the open market, representing

41,501,992 common shares. Pursuant to the NCIB (as amended), Suncor

has agreed that it will not purchase more than 76,250,000 common

shares.

The actual number of common shares that may be

purchased and the timing of any such purchases will be determined

by Suncor. Suncor believes that, depending on the trading price of

its common shares and other relevant factors, purchasing its own

shares represents an attractive investment opportunity and is in

the best interests of the company and its shareholders. The company

does not expect that the decision to allocate cash to repurchase

shares will affect its long-term growth strategy.

Non-GAAP Financial Measures

Certain financial measures referred to in this

news release (funds from operations, operating earnings (loss) and

free funds flow) are not prescribed by GAAP. Operating earnings

(loss) is defined in the Non‑GAAP Financial Measures Advisory

section of Suncor's management's discussion and analysis dated July

28, 2021 (the MD&A) and reconciled to the most directly

comparable GAAP measure in the Consolidated Financial Information

and Segment Results and Analysis sections of the MD&A.

Beginning in the first quarter of 2021, the company has revised its

calculation of operating earnings to exclude unrealized (gains)

losses on derivative financial instruments that are recorded at

fair value to better align the earnings impact of the activity with

the underlying items being risk-managed. Prior period comparatives

have been restated to reflect this change. Funds from operations

and free funds flow are defined and reconciled, where applicable,

to the most directly comparable GAAP measures in the Non-GAAP

Financial Measures Advisory section of the MD&A. These non-GAAP

financial measures are included because management uses this

information to analyze business performance, leverage and liquidity

and it may be useful to investors on the same basis. These non-GAAP

measures do not have any standardized meaning and therefore are

unlikely to be comparable to similar measures presented by other

companies and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

GAAP.

Legal Advisory – Forward-Looking

Information

This news release contains certain forward-looking

information and forward-looking statements (collectively referred

to herein as “forward-looking statements”) within the meaning of

applicable Canadian and U.S. securities laws. Forward-looking

statements in this news release include references to: Suncor’s

capital allocation strategy, including that: it is targeting

further debt reductions in the latter half of the year, the annual

ceiling Suncor has set with respect to total capital expenditures

of $5 billion annually to sustain its base business while investing

in energy expansion and building out its low carbon business, its

expectation that over the medium term Suncor will allocate

approximately 10% of its annual capital budget (approximately $500

million per year) on investments that are intended to advance its

lower-carbon energy offering, its plans to allocate incremental

funds to shareholder returns in the form of dividends and share

buybacks as well as towards debt reduction with the company

targeting absolute net debt (inclusive of capital leases) of $12 –

$15 billion by 2025, it expects dividends to increase in line with

its $2.15 billion incremental free funds flow target with

additional free funds flow being allocated to share buybacks, and

the plans the company will take to accelerate reaching its debt

reduction targets; Suncor’s updated strategy which focuses on

increasing shareholder returns while accelerating its GHG emissions

reduction targets, growing its business in low GHG fuels,

electricity, and hydrogen, sustaining and optimizing its base

business and transforming its GHG footprint to be a net-zero

company by 2050; statements surrounding Suncor’s recently announced

strategic objective to become a net zero GHG emissions company by

2050 on emissions produced from running its facilities, including

those it has a working interest in, and to substantially contribute

to society’s net zero ambitions and its target of reducing its

annual emissions by 10 megatonnes across its value chain by 2030

and its plans on how to achieve these goals; Suncor’s initiative,

together with four industry partners and collectively with the

federal and Alberta governments, to achieve net-zero GHG emissions

from oil sands operations by 2050 and the steps this initiative

will explore to address GHG emissions, including the creation of a

Carbon Capture, Utilization and Storage trunkline as well as the

implementation of other next generation technologies; Suncor’s

expectation regarding Fort Hills’ ramp up strategy, including its

belief that it will be at expected contractor capacity by August

2021, that overburden removal activity will be completed by the end

of 2021 and its plan to continue at the current production level

for the remainder of the year, with a transition to both primary

extraction trains beginning in late 2021 to enable full production

in early 2022; Suncor’s expectations with respect to the Terra Nova

Floating, Production, Storage and Offloading facility and

associated Terra Nova Field and the Asset Life Extension Project,

including that a sanction decision will occur in the third quarter

of 2021; the company’s belief that, with the completion of

turnarounds across all of the company’s refineries, Buzzard and

Syncrude (and with Syncrude and Buzzard having returned to

production), Suncor will be able to ramp up its assets and position

them for a strong second half of 2021 and that, together with the

completion of turnarounds, the phased lifting of restrictions will

position Suncor to capture improved margins in the second half of

the year as domestic demand continues to recover towards pre-

pandemic levels; Suncor’s plan to continue to structurally lower

its cost base and improve productivity, including ensuring the

smooth transition of Syncrude operatorship and continue its digital

transformation; the expectation that, once operatorship of Syncrude

is transferred, that there will be gross synergies of approximately

$100 million for the joint venture owners within the first six

months with an additional $200 million through 2022-2023; Suncor’s

expectation that initiatives undertaken in 2021 such as mine

optimization and digital, process and technology projects will

contribute to the company’s $2.15 billion free funds flow target;

statements surrounding the cogeneration project at Oil Sands Base

to replace the existing coke-fired boilers, the Forty Mile Wind

Power Project and the recently announced partnership on a potential

world-scale clean hydrogen project in Alberta with ATCO Ltd.,

including expectations on timing and the impact these projects will

have on Suncor’s new strategic carbon objectives and targets around

absolute carbon emissions reductions; Suncor’s ambition to be

Canada’s leading energy company by focusing on increasing

shareholder returns while accelerating its GHG emissions reductions

target and that its strategy will optimize the value of its base

business and improve its cost and capital efficiency while

supplementing it with economically robust energy expansion

investments that will contribute to increasing free funds flow;

Suncor’s expectation that its updated strategy and progress on its

carbon objectives will continue to be underpinned by capital

discipline; Suncor's expectation that the sale of its 26.69%

working interest in the Golden Eagle Area Development will close in

the third quarter of 2021; statements with respect to planned

maintenance events and the timing thereof, including the planned

maintenance turnaround at Oil Sands Base plant Upgrader 2; and

Suncor’s full-year outlook range on Upstream E&P capital

expenditures, Downstream capital expenditures, Fort Hills

production, Fort Hills cash operating costs and current income

taxes as well as business environment outlook assumptions for Brent

Sullom Voe, WTI at Cushing, WCS at Hardisty, New York Harbor 2-1-1

crack and AECO-C Spot. In addition, all other statements and

information about Suncor’s strategy for growth, expected and future

expenditures or investment decisions, commodity prices, costs,

schedules, production volumes, operating and financial results and

the expected impact of future commitments are forward-looking

statements. Some of the forward-looking statements and information

may be identified by words like “expects”, “anticipates”, “will”,

“estimates”, “plans”, “scheduled”, “intends”, “believes”,

“projects”, “indicates”, “could”, “focus”, “vision”, “goal”,

“outlook”, “proposed”, “target”, “objective”, “continue”, “should”,

“may” and similar expressions.

Forward-looking statements are based on Suncor’s

current expectations, estimates, projections and assumptions that

were made by the company in light of its information available at

the time the statement was made and consider Suncor’s experience

and its perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves estimates; the

current and potential adverse impacts of the COVID-19 pandemic,

including the status of the pandemic and future waves and any

associated policies around current business restrictions,

shelter-in-place orders or gatherings of individuals; commodity

prices and interest and foreign exchange rates; the performance of

assets and equipment; capital efficiencies and cost savings;

applicable laws and government policies; future production rates;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour, services

and infrastructure; the satisfaction by third parties of their

obligations to Suncor; the development and execution of projects;

and the receipt, in a timely manner, of regulatory and third-party

approvals.

Forward-looking statements and information are not

guarantees of future performance and involve a number of risks and

uncertainties, some that are similar to other oil and gas companies

and some that are unique to Suncor. Suncor’s actual results may

differ materially from those expressed or implied by its

forward-looking statements, so readers are cautioned not to place

undue reliance on them.

Suncor’s Annual Information Form and Annual Report

to Shareholders, each dated February 24, 2021, Form 40-F dated

February 25, 2021, the MD&A and other documents it files from

time to time with securities regulatory authorities describe the

risks, uncertainties, material assumptions and other factors that

could influence actual results and such factors are incorporated

herein by reference. Copies of these documents are available

without charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta

T2P 3E3; by email request to invest@suncor.com; by calling

1-800-558-9071; or by referring to suncor.com/FinancialReports or

to the company’s profile on SEDAR at sedar.com or EDGAR at sec.gov.

Except as required by applicable securities laws, Suncor disclaims

any intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Suncor Energy is Canada's leading integrated

energy company, with a global team of over 30,000 people. Suncor's

operations include oil sands development, production and upgrading,

offshore oil and gas, petroleum refining in Canada and the US, and

our national Petro-Canada retail distribution network (now

including our Electric Highway network of fast-charging EV

stations). A member of Dow Jones Sustainability indexes, FTSE4Good

and CDP, Suncor is responsibly developing petroleum resources,

while profitably growing a renewable energy portfolio and advancing

the transition to a low-emissions future. Suncor is listed on the

UN Global Compact 100 stock index. Suncor's common shares (symbol:

SU) are listed on the Toronto and New York stock exchanges.

Legal Advisory – BOEs

Certain natural gas volumes have been converted to

barrels of oil equivalent (boe) on the basis of one barrel to six

thousand cubic feet. Any figure presented in boe may be misleading,

particularly if used in isolation. A conversion ratio of one bbl of

crude oil or natural gas liquids to six thousand cubic feet of

natural gas is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

For more information about Suncor, visit our web

site at suncor.com, follow us on Twitter @Suncor or Living our

Purpose.

A full copy of Suncor's second quarter 2021 Report

to Shareholders and the financial statements and notes (unaudited)

can be downloaded at

https://www.suncor.com/en-ca/investor-centre/financial-reports.

To listen to the conference call discussing

Suncor's second quarter results, visit suncor.com/webcasts.

Media inquiries: 1-833-296-4570

media@suncor.com

Investor inquiries: 800-558-9071

invest@suncor.com

1 Beginning in the first quarter of 2021, the

company has revised its calculation of operating earnings, a

non-GAAP financial measure, to exclude unrealized (gains) losses on

derivative financial instruments that are recorded at fair value to

better align the earnings impact of the activity with the

underlying items being risk-managed. Prior period comparatives have

been restated to reflect this change. 2 Sources: IHS Markit and

Statistics Canada.

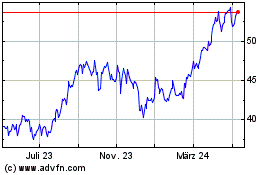

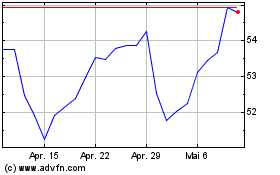

Suncor Energy (TSX:SU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Suncor Energy (TSX:SU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024