Suncor released its 2021 corporate guidance today which reflects

its capital allocation framework and includes:

- average upstream production of 740,000 to 780,000 barrels of

oil equivalent per day (boe/d);

- expected debt repayment in 2021 of between $500 million and

$1.0 billion;

- a capital program of between $3.8 and $4.5 billion (sustaining

capital of $2.9 to $3.4 billion which includes In Situ well pads);

and

- $500 million share repurchase program for the fiscal year

2021.

“The decisions we made this year give us the ability to

strengthen the balance sheet, increase shareholder returns, and

invest in our business to grow future free funds flow,” said Mark

Little, president and chief executive officer. “As we look to 2021,

with a focus on the safe and reliable operation of our assets and

disciplined cost management, we’re well-positioned to make

significant progress in all of these important areas.”

Suncor’s debt levels remain reasonable at current strip pricing

given the progress we have made to date in resetting the cost and

capital structure of the business. However, Suncor remains firmly

committed to reducing absolute debt levels consistent with its

capital allocation framework as consumer demand, refining margins,

and commodity prices improve. As these are expected to continue to

recover in 2021, increased funds from operation and the reversal of

the 2020 working capital build from the expected receipt of the

cash tax recovery in late 2021 will allow the repayment of between

$500 million and $1.0 billion of debt in 2021.

CAPITAL GUIDANCE

Suncor's 2021 capital program is largely focused on sustaining

capital ($2.9 – $3.4 billion which includes In Situ well pads)

given the major planned maintenance programs in Oil Sands upgrading

operations, Syncrude and Downstream refineries. These investments

are critical to ensure continued safe, reliable and efficient

operations. Despite the increased level of maintenance across the

asset base in 2021, including the five-year planned maintenance

turnaround at Base Plant Upgrader 2 and planned maintenance at the

largest Syncrude coker, our sustaining capital is below the

midpoint of $2.75 to $3.75 billion targeted sustaining capital

range. This reflects the cost reduction actions taken in 2020.

Approximately $250 million of the 2021 capital program is

allocated towards free funds flow growth projects across the

business excluding the Cogeneration Facility at Base Plant (Cogen)

to replace the existing coke fired boilers. A final decision on

re-starting the construction of the Cogen will be made in 2021. As

demonstrated in 2020, Suncor’s 2021 capital guidance range will

remain flexible and agile depending on commodity prices and

accommodates the potential restart of the Cogeneration

Facility.

| Capital

Expenditures (C$ millions) (1) |

|

| |

2021 Full Year OutlookNovember 30, 2020 |

% Economic Capital (2) |

| Upstream |

2,900 – 3,400 |

30% |

| Downstream |

700 – 800 |

10% |

| Corporate |

200 – 300 |

60% |

| Total |

3,800 – 4,500 |

30% |

|

|

| (1) Capital

expenditures exclude capitalized interest of approximately $120

million.(2) The balance of capital expenditures represents

Asset Sustainment and Maintenance capital expenditures. For

definitions of Economic Investment and Asset Sustainment and

Maintenance capital expenditures, see the Capital Investment Update

section of Suncor’s Management’s Discussion and Analysis dated

October 28, 2020 (the MD&A). |

PRODUCTION & OPERATING COST GUIDANCE

Suncor’s average expected upstream production of 740,000 to

780,000 boe/d represents a year over year production increase of

approximately 10% compared to the midpoint guidance range of 2020.

Suncor's Oil Sands operations cash operating costs(1) per barrel

are expected to reduce by 8% to $26.00 - $28.50 when compared to

the 2020 guidance midpoint. These costs include the impact of the

five-year major planned maintenance turnaround at Base Plant

Upgrader 2. The turnaround activities will begin in the second

quarter of 2021. A portion of the reduced synthetic crude oil

volumes will be offset by increasing bitumen sales and optimizing

the value of the interconnecting pipelines between our Base Plant

and Syncrude.

The Fort Hills expected production of 65,000 to 85,000 barrels

per day (bbls/d), net to Suncor, represents a 20% increase when

compared to the midpoint guidance range in 2020. The increased Fort

Hills production is grounded in long-term value creation ensuring a

disciplined focus on costs by maintaining the operating and capital

costs savings achieved in 2020. Suncor will operate Fort Hills with

structurally lower costs and continue to work with the joint

venture partners on a plan to operate the asset at nameplate post

2021. Through the emphasis on cost reduction and maximizing cash

flow of each barrel, Fort Hills cash operating costs(1) per barrel

are anticipated to be reduced by approximately 20% to $25.00 -

$29.00 when compared to the 2020 guidance midpoint.

As announced on Nov. 23, the Syncrude joint venture owners have

reached an agreement in principle for Suncor to take over

operatorship of the Syncrude asset by the end of 2021. The

commissioning of the interconnecting pipelines between our Base

Plant and Syncrude is near completion. The pipelines are expected

to enter into operation in December. These important milestones are

expected to enable further improved operational performance and

drive down the overall joint venture cost structure. Syncrude

expected production includes the impact of planned maintenance of

the largest coker unit (150,000 bbls/d) which is expected to begin

in the second quarter of 2021. Syncrude cash operating costs(1) per

barrel are expected to reduce by 6% to $32.00 - $35.00 when

compared to the 2020 guidance midpoint.

No production volumes or capital commitments associated with

Terra Nova or West White Rose are currently forecast for 2021.

Suncor and its partners have deferred these projects until an

economically viable way forward can be agreed upon with all

stakeholders.

The downstream utilization guidance is expected to improve by

approximately 6% in 2021 to 93% at the midpoint, consistent with

historic levels. Consumer demand in 2021 is expected to continue to

increase from the lows reached in the second quarter of 2020 as a

result of COVID 19 restrictions.

(1) Non-GAAP financial measures. See the Non-GAAP Financial

Measures section of this news release.

| |

2021 Full Year OutlookNovember 30,

2020 |

| Suncor Total

Production (boe/d) |

740,000 - 780,000 (1) |

| Oil Sands Operations

(bbls/d) |

410,000 - 445,000 (2) |

| Fort Hills

(bbls/d) Suncor working interest of 54.11% |

65,000 – 85,000 |

| Syncrude (bbls/d) Suncor

working interest of 58.74% |

170,000 - 185,000 |

| Exploration & Production

(boe/d) |

80,000 - 95,000 (1) |

| |

|

| |

|

| Suncor Refinery

Throughput (bbls/d) |

415,000 - 445,000 |

| |

|

| Suncor Refinery

Utilization |

90% - 96% (3) |

| Refined Product

Sales (bbls/d) |

535,000 - 575,000 |

| |

| (1) At the time of

publication, production in Libya continues to be affected by

political unrest and therefore no forward-looking production for

Libya is factored into the Exploration & Production and Suncor

Total Production guidance. Production ranges for Oil Sands

operations, Fort Hills, Syncrude and Exploration & Production

are not intended to add to equal Suncor Total Production(2) Oil

Sands operations production includes synthetic crude oil, diesel,

and bitumen and excludes Fort Hills PFT bitumen and Syncrude

synthetic crude oil production. These ranges reflect the integrated

upgrading and bitumen production performance risk.(3) Refinery

utilization is based on the following crude processing capacities:

Montreal - 137,000 bbls/d; Sarnia - 85,000 bbls/d; Edmonton –

142,000 bbls/d; and Commerce City - 98,000 bbls/d. |

Suncor's corporate guidance provides management's outlook for

2021 in certain key areas of the company's business. Users of this

forward-looking information are cautioned that actual results may

vary materially from the targets disclosed. Readers are cautioned

against placing undue reliance on this guidance.

For more detail on Suncor's outlook and capital spending plan,

see suncor.com/guidance.

For an updated Investor Relations presentation and the third

quarter Investor Relations deck,

see suncor.com/investor-centre.

Legal Advisory - Forward-Looking

Information

This news release contains certain forward-looking information

and forward-looking statements (collectively referred to herein as

"forward-looking statements") within the meaning of applicable

Canadian and U.S. securities laws. Forward-looking statements in

this news release include references to: Suncor's expected debt

repayment in 2021 of between $500 million and $1.0 billion and a

$500 million share repurchase program for the fiscal year 2021 and

the basis for these expectations; Suncor's belief that the

decisions it made in 2020 will give Suncor the ability to

strengthen the balance sheet, increase shareholder returns and

invest in its business to grow future funds flow and that it is

well-positioned to make significant progress in all of these

important areas; Suncor's belief that its debt levels remain

reasonable and the basis for such belief; Suncor's expectation that

consumer demand, refining margins and commodity prices will

continue to recover in 2021; that a final decision on re-starting

the construction of the Cogen will be made in 2021; the expectation

that Suncor's capital spending program will be between $3.8 and

$4.5 billion (sustaining capital of $2.9 to $3.4 billion which

includes In Situ well pads), and expectations of where that

spending will be directed, and will remain flexible and agile

depending on commodity prices and accommodates the potential

restart of the Cogeneration Facility; Suncor's expectations around

production, including planned average upstream production of

740,000 - 780,000 boe/d and planned ranges for Oil Sands operations

(410,000 – 445,000 bbls/d), made up of Synthetic Crude Oil (290,000

– 310,000 bbls/d) and Bitumen (120,000 – 135,000 bbls/d), Suncor's

working interest in Fort Hills (65,000 – 85,000 bbls/d), Suncor's

working interest in Syncrude (170,000 – 185,000 bbls/d) and

Exploration & Production (80,000 – 95,000 boe/d); Suncor's

expected Oil Sands operations cash operating costs, projected to be

in the range of $26.00 - $28.50 (US $20.00 – $21.95) per

barrel; expected Fort Hills cash operating costs, projected to be

in the range of $25.00 – $29.00 (US $19.25 – $22.30) per barrel;

expected Syncrude cash operating costs, projected to be in the

range of $32.00 – $35.00 (US $24.65 – $26.95) per barrel;

Suncor's expected Refinery Throughputs (415,000 – 445,000 bbls/d)

and Utilization (90% – 96%); Suncor's expected Refined Product

Sales (535,000 – 575,000 bbls/d); the expected impacts of planned

maintenance, including the five-year major planned maintenance

turnaround at Base Plant Upgrader 2 and the largest Syncrude coker;

the expectation that Fort Hills will be operated with structurally

lower costs and that work will continue with our partners on a plan

to operate the asset at nameplate post 2021; the expectation Suncor

will take over operatorship of the Syncrude asset by the end of

2021; and the expectation that the interconnecting pipelines

between our Base Plant and Syncrude will enter into operation in

December and the expected impacts thereof. In addition, all other

statements and information about Suncor's strategy for growth,

expected and future expenditures or investment decisions, commodity

prices, costs, schedules, production volumes, operating and

financial results and the expected impact of future commitments are

forward-looking statements. Some of the forward-looking statements

may be identified by words like "guidance", "outlook", "will",

"expected", "estimated", "focus", “planned”, “believe”,

"anticipate" and similar expressions.

Forward-looking statements are based on Suncor's current

expectations, estimates, projections and assumptions that were made

by the company in light of its information available at the time

the statement was made and consider Suncor's experience and its

perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves and resources

estimates; the current and potential adverse impacts of the

COVID-19 pandemic, including the status of the pandemic and future

waves and any associated policies around current business

restrictions, shelter-in-place orders or gatherings of individuals;

commodity prices and interest and foreign exchange rates; the

performance of assets and equipment; capital efficiencies and

cost-savings; applicable laws and government policies; future

production rates; the sufficiency of budgeted capital expenditures

in carrying out planned activities; the availability and cost of

labour, services and infrastructure; the satisfaction by third

parties of their obligations to Suncor; the development and

execution of projects; and the receipt, in a timely manner, of

regulatory and third-party approvals.

Forward-looking statements are not guarantees of future

performance and involve a number of risks and uncertainties, some

that are similar to other oil and gas companies and some that are

unique to Suncor. Suncor's actual results may differ materially

from those expressed or implied by its forward- looking statements,

so readers are cautioned not to place undue reliance on them.

Assumptions for the Oil Sands operations, Syncrude and Fort

Hills 2021 production outlook include those relating to reliability

and operational efficiency initiatives that the company expects

will minimize unplanned maintenance in 2021. Assumptions for the

Exploration & Production 2021 production outlook include those

relating to reservoir performance, drilling results and facility

reliability. Factors that could potentially impact Suncor's 2021

corporate guidance include, but are not limited to:

- Bitumen supply.

Bitumen supply may be dependent on unplanned maintenance of mine

equipment and extraction plants, bitumen ore grade quality,

tailings storage and in situ reservoir performance.

- Third-party

infrastructure. Production estimates could be negatively impacted

by issues with third- party infrastructure, including pipeline or

power disruptions, that may result in the apportionment of

capacity, pipeline or third-party facility shutdowns, which would

affect the company's ability to produce or market its crude

oil.

- Performance of

recently commissioned facilities or well pads. Production rates

while new equipment is being brought into service are difficult to

predict and can be impacted by unplanned maintenance.

- Unplanned

maintenance. Production estimates could be negatively impacted if

unplanned work is required at any of our mining, extraction,

upgrading, in situ processing, refining, natural gas processing,

pipeline, or offshore assets.

- Planned

maintenance events. Production estimates, including production mix,

could be negatively impacted if planned maintenance events are

affected by unexpected events or are not executed effectively. The

successful execution of maintenance and start-up of operations for

offshore assets, in particular, may be impacted by harsh weather

conditions, particularly in the winter season.

- Commodity prices.

Declines in commodity prices may alter our production outlook

and/or reduce our capital expenditure plans.

- Foreign

operations. Suncor's foreign operations and related assets are

subject to a number of political, economic and socio-economic

risks.

- Government

Action. This guidance is subject to any production curtailments

imposed by the Government of Alberta. Further action by the

Government of Alberta regarding production curtailment may impact

Suncor’s corporate guidance and such impact may be material.

- COVID-19

Pandemic: This guidance is subject to a number of external factors

beyond our control that could significantly influence this outlook,

including the status of the COVID-19 pandemic and future waves, and

any associated policies around current business restrictions,

shelter-in-place orders, or gatherings of individuals. As a result

of the volatile business environment and the uncertain pace of an

economic recovery it is challenging to determine the overall

outlook for crude oil and refined product demand, which remains

dependent on the status of the COVID-19 pandemic.

The MD&A, together with Suncor's most recently filed Annual

Information Form, Form 40-F and Annual Report to Shareholders and

other documents Suncor files from time to time with securities

regulatory authorities describe the risks, uncertainties, material

assumptions and other factors that could influence actual results

and such factors are incorporated herein by reference. Copies of

these documents are available without charge from Suncor at 150 6th

Avenue S.W., Calgary, Alberta T2P 3E3; by email request

to invest@suncor.com; by calling 1-800-558-9071; or by

referring to suncor.com/FinancialReports or to the

company's profile on SEDAR at sedar.com or EDGAR

at sec.gov. Except as required by applicable securities laws,

Suncor disclaims any intention or obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Non-GAAP Financial Measures

Oil Sands operations cash operating costs, Fort Hills cash

operating costs and Syncrude cash operating costs are not

prescribed by Canadian generally accepted accounting principles

("GAAP"). These non-GAAP financial measures are included because

management uses the information to analyze business performance,

including on a per barrel basis, as applicable, and it may be

useful to investors on the same basis. These non-GAAP financial

measures do not have any standardized meaning and, therefore, are

unlikely to be comparable to similar measures presented by other

companies. These non-GAAP financial measures should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. These non-GAAP

financial measures are defined in the Non-GAAP Financial Measures

Advisory section of the MD&A and, for the period ended

September 30, 2020, are reconciled to the comparable GAAP measure

in the MD&A. Oil Sands operations cash operating costs of

$26.00 - $28.50 (US $20.00 – $21.95) per barrel is based on

the assumptions that: (i) Suncor will produce 410,000 - 445,000

bbls/d at Oil Sands operations (of which 290,000 - 310,000 bbls/d

will be synthetic crude oil and 120,000 – 135,000 will be bitumen);

and (ii) natural gas used at Suncor's Oil Sands operations (AECO -

C Spot ($CAD)) will be priced at an average of $2.50/GJ over 2021.

Fort Hills cash operating costs of $25.00 – $29.00 (US $19.25 –

$22.30) per barrel is based on the assumptions that: (i) Fort Hills

production (net to Suncor) will be 65,000 – 85,000 bbls/d; and (ii)

natural gas used at Fort Hills (AECO - C Spot ($CAD)) will be

priced at an average of $2.50/GJ over 2021. Syncrude cash operating

costs of $32.00 – $35.00 (US $24.65 – $26.95) per barrel is

based on the assumptions that: (i) Syncrude will produce 170,000 -

185,000 bbls/d of synthetic crude oil (net to Suncor); and (ii)

natural gas used at Syncrude (AECO - C Spot ($CAD)) will be priced

at an average of $2.50/GJ over 2021. The Syncrude cash operating

costs per barrel and Fort Hills cash operating costs per barrel

measures may not be fully comparable to similar information

calculated by other entities (including Suncor's Oil Sands

operations cash operating costs per barrel) due to differing

operations.

Suncor Energy is Canada's leading integrated energy company.

Suncor's operations include oil sands development and upgrading,

offshore oil and gas production, petroleum refining, and product

marketing under the Petro-Canada brand. A member of Dow Jones

Sustainability indexes, FTSE4Good and CDP, Suncor is working to

responsibly develop petroleum resources while also growing a

renewable energy portfolio. Suncor is listed on the UN Global

Compact 100 stock index. Suncor's common shares (symbol: SU) are

listed on the Toronto and New York stock exchanges.

For more information about Suncor, visit our website at

suncor.com and follow us on Twitter @Suncor

| Investor

inquiries: |

Media

inquiries: |

| 800-558-9071 |

1-833-296-4570 |

| invest@suncor.com |

media@suncor.com |

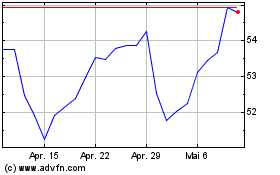

Suncor Energy (TSX:SU)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Suncor Energy (TSX:SU)

Historical Stock Chart

Von Jan 2024 bis Jan 2025