Pathward partners with Propel to launch new line of credit for consumers overlooked by traditional banks

20 Juni 2023 - 3:07PM

Business Wire

Lending as a Service partner and fintech, Propel, will service

new Pathward consumer loans

Pathward®, N.A., a national bank driven by its purpose to power

financial inclusion, is adding a new line of credit to open access

for credit challenged consumers. While credit options are abundant

for some consumers, others find themselves with limited

opportunities to access credit. The new Pathward Line of Credit can

provide credit solutions to an underserved population in a

responsible way. In addition to the appeal of credit access,

consumers really find value in the flexibility of the line of

credit because they can move the funds to their core spending

account.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230620101276/en/

Pathward has engaged fintech partner, Propel Holdings Inc.

(“Propel”) (TSX: PRL), to service the loans through its lending as

a service (LaaS) platform. Propel is an innovative financial

technology company (fintech) dedicated to credit inclusion, and by

leveraging the fintech’s experience and AI-powered, proprietary

platform, the program enables Pathward to provide consumers access

to credit while limiting credit risk. Powered by their proprietary

technology, Propel manages customer service and outreach,

applications, collections and more through its online platform.

“Creating financial access for individuals who often get

overlooked by more traditional lenders by offering the Pathward

Line of Credit aligns with our purpose,” said Pathward President

Anthony Sharett. “We are thrilled to partner with Propel to bring

this program to the market as a part of our Banking as a Service

offering. Working together, we can provide eligible borrowers with

year-round access to credit through a better alternative to high

interest programs.”

The Pathward Line of Credit is a pre-approved option offered to

consumers through Pathward’s existing partner distribution

channels. This model enables existing partners to connect their

customers to credit access they might not otherwise have. Borrowers

only pay interest on the drawn amount when they sign up for

Pathward Line of Credit, and there are zero fees affiliated with

the product.

“Propel and Pathward are driven by a common mission to expand

financial access to consumers. For Propel, this partnership marks

the launch of our lending as a service product offering, a natural

and critical evolution of our business. When we founded Propel, we

saw the limitations of existing technology and service to the tens

of millions of underserved consumers and have met our goal of

building out a best-in-class AI-powered solution. We believe that

this is the beginning of a strong partnership that will have real

impact for consumers overlooked by traditional lenders,” said Clive

Kinross, CEO of Propel.

Learn more about Pathward and how the bank can help you grow

your business.

Learn more about Propel and how the fintech can help you reach

underserved markets.

About Pathward®

Pathward®, N.A., a national bank, is a subsidiary of Pathward

Financial, Inc. (Nasdaq: CASH). Pathward is a U.S.-based financial

empowerment company driven by its purpose to power financial

inclusion. Pathward strives to increase financial availability,

choice and opportunity across our Banking as a Service and

Commercial Finance business lines. The strategic business lines

provide end-to-end support to individuals and businesses. Learn

more at Pathward.com.

About Propel

Propel is an innovative, online financial technology (“fintech”)

company, committed to credit inclusion by providing and

facilitating fair, fast and transparent access to credit with

exceptional service using its proprietary online lending platform.

Through its operating brands, Propel is focused on providing access

to credit to underserved consumers who struggle to access credit

from mainstream credit providers. Propel’s revenue growth and

profitability have accelerated significantly over the past two

years as Propel has been able to facilitate access to credit for an

increasing number of consumers, helping them move forward in their

credit journeys.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230620101276/en/

Pathward Media Relations Contact: Courtney Heidelberg

605.291.7044 mediarelations@pathward.com

Propel Media Relations Contact: Lindsay Finneran-Gingras

media@propelholdings.com

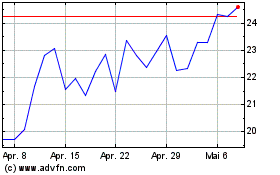

Propel (TSX:PRL)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Propel (TSX:PRL)

Historical Stock Chart

Von Jul 2023 bis Jul 2024