Verde AgriTech Ltd. (TSX: “NPK”)

("

Verde” or the “

Company”) held

its Extraordinary General Meeting of Shareholders (the

“

Meeting”) on Friday, December 20, 2024, at 300

Prof. Antônio Aleixo, Lourdes, Belo Horizonte, Minas Gerais,

Brazil. The Company is pleased to announce that all resolutions

presented to shareholders have been approved. Additionally, Verde

has set the Record Date for the distribution of interests in Oby

Rare Earths Pty Ltd (“

Oby”) to shareholders of the

Company, marking a significant milestone in its strategic growth.

Record Date for Oby Rare Earths and

Capital Reduction:

The Company established the Record Date for the

distribution of interests in Oby for January 27th, 2025, in

compliance with regulatory requirements, ensuring the minimum

notice period of five trading days prior to the earliest possible

completion date of the share capital reduction process.

The distribution will transition the Man of War

project to an independent entity, Oby, enabling greater focus and

autonomy for its development. This step allows Verde to focus

exclusively on its core fertilizer operations while enabling Oby to

focus on rare earth elements and correlated mineralization in the

Man of War project. As part of this process, the Company is

conducting a share capital reduction, reducing the issued and

paid-up share capital of the Company by CD$350,000, taking into

account the net book value of the Oby Shares.

As informed in the Management Information

Circular (“MIC”) published on November 20th,

20241, there will be a distribution of Verde’s interests in Oby to

the shareholders of the Company by way of a capital reduction, in

proportion to their respective shareholdings in the Company, on the

basis of 1 Oby Share for every 1 ordinary share in the share

capital of the Company held by a Shareholder on January 27th, 2025,

disregarding fractional entitlements.

_______________1 See more:

https://investor.verde.ag/wp-content/uploads/2024/11/VAL-2024-Extraordinary-General-Meeting-MIC-Nov-11-DMS-cmts_13-Nov-2024.pdf

The capital reduction is currently in progress

and is expected to be completed between February 3rd and February

13th, 2025, subject to the conclusion of all necessary approvals

and procedural steps.

The spin-off of Oby will enable the focused

development and progress of the Man of War project, which is

composed of three targets hosting a maiden mineral resource

estimate of 1.35 billion tons, with an average grade of 3,437 ppm

Total Rare Earth Oxides (TREO)2 and 793 ppm Magnet Rare Earth

Oxides3, calculated using a 1,000 ppm TREO cut-off. It presents

significant potential and warrants investment for its further

development.

In Q1 2025, Oby plans to raise funds aimed

primarily at completing a scoping study and advancing environmental

impact assessment. Verde shareholders who are accredited

investors and interested in participating in this opportunity are

encouraged to contact Verde directly

at investor@verde.ag.

_______________2 Total Rare Earth Oxides (TREO)

refers to the sum of the oxides of rare earth elements, which

include: Lanthanum Oxide (La₂O₃), Cerium Oxide (CeO₂), Praseodymium

Oxide (Pr₆O₁₁), Neodymium Oxide (Nd₂O₃), Samarium Oxide (Sm₂O₃),

Europium Oxide (Eu₂O₃), Gadolinium Oxide (Gd₂O₃), Terbium Oxide

(Tb₄O₇), Dysprosium Oxide (Dy₂O₃), Holmium Oxide (Ho₂O₃), Erbium

Oxide (Er₂O₃), Thulium Oxide (Tm₂O₃), Ytterbium Oxide (Yb₂O₃),

Lutetium Oxide (Lu₂O₃), and Yttrium Oxide (Y₂O₃).

3 Magnetic Rare Earth Oxides (MREO) refers to

the sum of the oxides of rare earth elements with magnetic

properties, which include: Praseodymium Oxide (Pr₆O₁₁), Neodymium

Oxide (Nd₂O₃), Terbium Oxide (Tb₄O₇), and Dysprosium Oxide

(Dy₂O₃).

Cost Reduction

As part of its ongoing commitment to operational

excellence, Verde has implemented a robust cost-reduction

initiative that is projected to achieve savings of up to R$9.3

million in the coming year. This represents a 15% reduction in

manageable costs, including both expenses and operational costs.

The reduction has been accomplished through comprehensive

renegotiations of supplier contracts, streamlining operations by

reducing team size, and eliminating middle management positions.

Furthermore, the Company has undertaken a thorough review of its

internal processes to identify inefficiencies and implement

targeted optimizations.

These measures are designed to enhance

productivity, agility, and long-term sustainability, while reducing

costs.

“Operational efficiency, coupled with strict and

effective management of costs and expenses, is essential to excel

in today’s challenging economic environment. At Verde, we will

leverage the lessons and performance metrics of the past years to

further evolve and achieve productivity excellence at reduced

costs”, stated Cristiano Veloso, Founder & CEO of Verde.

Resolution passed at the 2024

Extraordinary General Meeting of Shareholders:

The results were as follows:

|

Item Voted On |

Votes For |

Votes Against / Withheld |

| Appointment of RSM SG Assurance

as Auditors of the Company |

13,162,519(98.172%) |

245,028(1.828%) |

| |

|

|

| Reduction of the share capital of

the Company, and authority for directors to do all such acts and

things to complete the share capital reduction |

13,284,880(99.085%) |

122,667(0.915%) |

| |

|

|

About Verde AgriTech

Verde AgriTech is dedicated to advancing

sustainable agriculture through the innovation of specialty

multi-nutrient potassium fertilizers. Our mission is to increase

agricultural productivity, enhance soil health, and significantly

contribute to environmental sustainability. Utilizing our unique

position in Brazil, we harness proprietary technologies to develop

solutions that not only meet the immediate needs of farmers but

also address global challenges such as food security and climate

change. Our commitment to carbon capture and the production of

eco-friendly fertilizers underscores our vision for a future where

agriculture contributes positively to the health of our planet.

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

(i) the estimated amount and grade of Mineral

Resources and Mineral Reserves;

(ii) the estimated amount of CO2 removal per ton

of rock;

(iii) the PFS representing a viable development

option for the Project;

(iv) estimates of the capital costs of

constructing mine facilities and bringing a mine into production,

of sustaining capital and the duration of financing payback

periods;

(v) the estimated amount of future production,

both produced and sold;

(vi) timing of disclosure for the PFS and

recommendations from the Special Committee;

(vii) the Company’s competitive position in

Brazil and demand for potash;

(viii) estimates of operating costs and total

costs, net cash flow, net present value and economic returns from

an operating mine.

(ix) the expected terms of the debt

restructuring;

(x) the expected financial impact of the debt

restructuring to the Company;

(xi) the timeline for court approval of the debt

restructuring; and

(xii) the potential arising from the re-assaying

of certain core samples.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

(i) the presence of and continuity of resources

and reserves at the Project at estimated grades;

(ii) the estimation of CO2 removal based on the

chemical and mineralogical composition of assumed resources and

reserves;

(iii) the geotechnical and metallurgical

characteristics of rock conforming to sampled results; including

the quantities of water and the quality of the water that must be

diverted or treated during mining operations;

(iv) the capacities and durability of various

machinery and equipment;

(v) the availability of personnel, machinery and

equipment at estimated prices and within the estimated delivery

times;

(vi) currency exchange rates;

(vii) Super Greensand® and K Forte® sales

prices, market size and exchange rate assumed;

(viii) appropriate discount rates applied to the

cash flows in the economic analysis;

(ix) tax rates and royalty rates applicable to

the proposed mining operation;

(x) the availability of acceptable financing

under assumed structure and costs;

(xi) anticipated mining losses and dilution;

(xii) reasonable contingency requirements;

(xiii) success in realizing proposed

operations;

(xiv) receipt of permits and other regulatory

approvals on acceptable terms; and

(xv) the fulfilment of environmental assessment

commitments and arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks related to the

court approval process for the debt restructuring; risks relating

to variations in the mineral content within the material identified

as Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2023. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:Cristiano Veloso, Chief Executive

Officer and FounderTel: +55 (31) 3245 0205; Email:

investor@verde.agwww.verde.ag | www.investor.verde.ag

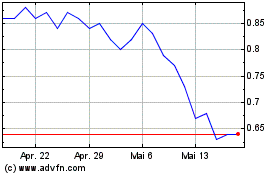

Verde Agritech (TSX:NPK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Verde Agritech (TSX:NPK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024