Husky Energy Inc. (TSX:HSE) (“Husky” or the “Company”) today

announced that it has formally commenced its offer (the “Offer”) to

acquire all of the outstanding common shares of MEG Energy Corp.

(TSX:MEG) (“MEG”).

The notice and advertisement of the Offer appear

in the Tuesday, October 2, 2018 editions of The Globe and Mail and

Le Devoir, and the Offer is contained in the Offer to Purchase and

Bid Circular (the “Offer and Circular”) and related documents,

which have been filed with the Canadian securities regulators on

SEDAR under MEG’s profile at www.sedar.com. Under the terms and

subject to the conditions of the Offer, each MEG shareholder will

have the option to choose to receive consideration per MEG share of

$11 in cash or 0.485 of a Husky share, subject to maximum aggregate

cash consideration of $1 billion and a maximum aggregate number of

Husky shares issued of approximately 107 million.

The Offer is open for acceptance until 5 p.m.

Eastern Time (3 p.m. Mountain Time) on Wednesday, January 16,

2019.

“MEG shareholders now have the opportunity to

directly determine the future of their investment,” said CEO Rob

Peabody.

“Together, Husky and MEG will create a stronger

Canadian integrated energy company with a stronger balance sheet,

and a rich portfolio of low cost, higher margin projects – all of

which contribute to substantially more free cash flow with much

greater stability than MEG could achieve on its own.”

The combination will result in a stronger

technical and operating team that can apply its expertise across a

much larger asset base, added Peabody.

“We are committed to realizing this opportunity

and strongly believe the Offer is in the best interests of Husky

and MEG shareholders, as well as our respective employees and other

stakeholders.”

CONDITIONS OF THE OFFER

The Offer will be subject to certain conditions,

including that the MEG shares tendered under the Offer constitute

more than 66 2/3 percent of the shares of MEG then outstanding, on

a fully-diluted basis. The Offer will also be conditional upon

receipt of all necessary regulatory approvals, confirmation that

the MEG shareholder rights plan will not adversely affect the

Offer, no material adverse effect at MEG, and other customary

conditions. The Offer will not be subject to any financing

conditions, and the cash component of the Offer will be financed

through Husky’s existing cash resources.

Husky encourages shareholders of MEG to read the

full details of the Offer set forth in the Offer and Circular,

which contains the full terms and conditions of the Offer and other

important information as well as detailed instructions on how MEG

shareholders can tender their MEG shares to the Offer.

For assistance in depositing MEG shares to the

Offer, MEG shareholders should contact the Information Agent D.F.

King Canada, by telephone at 1-800-761-6707 (North American Toll

Free Number) or +1-212-771-1133 (outside North America) or by email

at inquiries@dfking.com.

Copies of the Offer and Circular, once filed,

will be available upon request made to Husky’s Senior Vice

President, General Counsel & Secretary at 707 8th Avenue S.W.

Calgary, Alberta, T2P 1H5, or telephone 403-298-6111. The Offer

documents will also be available on Husky’s website at

www.huskyenergy.com/bettertogether

Goldman Sachs Canada Inc. is acting as financial

advisor and Osler, Hoskin & Harcourt LLP is acting as lead

legal advisor to Husky.

Investor Relations

Team:

Todd McBride587-774-5923

Jon Gorrie403-298-7436

Media Inquiries:

Mel Duvall, Senior Manager, Media &

Issues403-513-7602

NO OFFER OR SOLICITATION

This news release is for informational purposes

only and does not constitute an offer to buy or sell, or a

solicitation of an offer to sell or buy, any securities. The

offer to acquire MEG securities and to issue securities of the

Company will be made solely by, and subject to the terms and

conditions set out in, the formal offer to purchase and takeover

bid circular and accompanying letter of transmittal and notice of

guaranteed delivery.

NOTICE TO U.S. HOLDERS MEG

SHARES

The Company intends to make the offer

and sale of the Company’s shares in the acquisition subject to a

registration statement covering such offer and sale to be filed

with the United States Securities and Exchange Commission (the

“SEC”) under the U.S. Securities Act of 1933, as amended.

Such registration statement covering such offer and sale will

include various documents related to such offer and sale. THE

COMPANY URGES INVESTORS AND SHAREHOLDERS OF MEG TO READ SUCH

REGISTRATION STATEMENT AND ANY AND ALL OTHER RELEVANT DOCUMENTS

FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH SUCH OFFER AND

SALE OF THE COMPANY’S SHARES AS THOSE DOCUMENTS BECOME AVAILABLE,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS,

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION.

You will be able to obtain a free copy of such registration

statement, as well as other relevant filings regarding the Company

or such transaction involving the issuance of the Company’s shares,

at the SEC’s website (www.sec.gov) under the issuer profile

for the Company, or on request without charge from the Senior Vice

President, General Counsel & Secretary of the Company, at 707,

8th Avenue S.W. Calgary Alberta or, telephone

403-298-6111.

The Company is a foreign private issuer

and permitted to prepare the offer to purchase and takeover bid

circular and related documents in accordance with Canadian

disclosure requirements, which are different from those of the

United States. The Company prepares its

financial statements in accordance with Canadian generally accepted

accounting principles, and they may be subject to Canadian auditing

and auditor independence standards. They may not be

comparable to financial statements of United States

companies.

Shareholders of MEG should be aware that

owning the Company’s shares may subject them to tax consequences

both in the United States and in Canada. The offer to

purchase and takeover bid circular may not describe these tax

consequences fully. MEG shareholders should read any tax discussion

in the offer to purchase and takeover bid circular, and holders

of MEG shares are urged to

consult their tax advisors.

A MEG shareholder’s ability to enforce

civil liabilities under the United States federal securities laws

may be affected adversely because the Company is

incorporated in Alberta, Canada, some or all of the Company’s

officers and directors and some or all of the experts named in the

offering documents reside outside of the United States, and all or

a substantial portion of the Company’s assets and of the assets of

such persons are located outside the United States.

MEG shareholders in the United States may

not be able to sue the Company or the Company’s

officers or directors in a non-U.S. court for violation of United

States federal securities laws. It may be difficult to compel

such parties to subject themselves to the jurisdiction of a court

in the United States or to enforce a judgment obtained from a court

of the United States.

NEITHER THE SECURITIES EXCHANGE

COMMISSION NOR ANY STATE SECURITIES REGULATOR HAS OR WILL HAVE

APPROVED OR DISAPPROVED THE COMPANY’S SHARES OFFERED IN THE

OFFERING DOCUMENTS, OR HAS OR WILL HAVE DETERMINED IF ANY OFFERING

DOCUMENTS ARE TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE

CONTRARY IS A CRIMINAL OFFENSE.

MEG shareholders should

be aware that, during the period of the Offer, the Company or its

affiliates, directly or indirectly, may bid for or make purchases

of the securities to be distributed or to be exchanged, or certain

related securities, as permitted by applicable laws or regulations

of Canada or its provinces or territories.

FORWARD-LOOKING STATEMENTS

Certain statements in this news release are

forward-looking statements and information (collectively,

“forward-looking statements”) within the meaning of the applicable

Canadian securities legislation, Section 21E of the United States

Securities Exchange Act of 1934, as amended, and Section 27A of the

United States Securities Act of 1933, as amended. The

forward-looking statements contained in this news release are

forward-looking and not historical facts.

Some of the forward-looking statements may be

identified by statements that express, or involve discussions as

to, expectations, beliefs, plans, objectives, assumptions or future

events or performance (often, but not always, through the use of

words or phrases such as “will likely result”, “are expected to”,

“will continue”, “is anticipated”, “is targeting”, “is estimated”,

“intend”, “plan”, “projection”, “could”, “should”, “aim”, “vision”,

“goals”, “objective”, “target”, “scheduled” and “outlook”).

In particular, forward-looking statements in this news release

include, but are not limited to, references to: the

anticipated benefits that may result from a combination of the

Company and MEG; and the intended timing of mailing the Offer and

Circular and related documents.

Although the Company believes that the

expectations reflected by the forward-looking statements presented

in this news release are reasonable, the Company’s forward-looking

statements have been based on assumptions and factors concerning

future events that may prove to be inaccurate, including the

ability to obtain regulatory approvals and meet other closing

conditions to any possible transaction, and the ability to

integrate the Company’s and MEG’s businesses and operations and

realize financial, operational and other synergies from the

proposed transaction. Those assumptions and factors are based

on information currently available to the Company about itself, MEG

and the businesses in which they operate. Information used in

developing forward-looking statements has been acquired from

various sources, including third-party consultants, suppliers and

regulators, among others.

Because actual results or outcomes could differ

materially from those expressed in any forward-looking statements,

investors should not place undue reliance on any such

forward-looking statements. By their nature, forward-looking

statements involve numerous assumptions, inherent risks and

uncertainties, both general and specific, which contribute to the

possibility that the predicted outcomes will not occur. Some of

these risks, uncertainties and other factors are similar to those

faced by other oil and gas companies and some are unique to the

Company.

The Company’s Annual Information Form for the

year ended December 31, 2017 and other documents filed with

securities regulatory authorities (accessible through the SEDAR

website www.sedar.com and the EDGAR website www.sec.gov) describe

risks, material assumptions and other factors that could influence

actual results and are incorporated herein by reference.

New factors emerge from time to time and it is

not possible for management to predict all of such factors and to

assess in advance the impact of each such factor on the Company’s

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statement. The impact of any

one factor on a particular forward-looking statement is not

determinable with certainty as such factors are dependent upon

other factors, and the Company’s course of action would depend upon

management’s assessment of the future considering all information

available to it at the relevant time. Any forward-looking

statement speaks only as of the date on which such statement is

made and, except as required by applicable securities laws, the

Company undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made or to reflect the occurrence of

unanticipated events.

All currency is expressed in this news release

in Canadian dollars unless otherwise indicated.

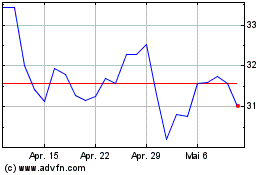

MEG Energy (TSX:MEG)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

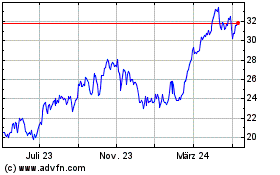

MEG Energy (TSX:MEG)

Historical Stock Chart

Von Feb 2024 bis Feb 2025