Sustained growth of sales and increased

profitability

- Improvement in key profitability

indicators

- Balanced growth in Licenses and

Services businesses

- A strong increase in new business

and a high level of repeat business

- Continued integration of

acquisitions, to strengthen the overall Immersive Virtual

Engineering approach to the product full lifecycle

Regulatory News:

Alain de Rouvray, ESI Group’s (Paris:ESI) Chairman and CEO,

comments: "The very solid performance over the period, as measured

by our economic indicators, clearly and again illustrates the

market relevance of our unique strategic positioning based on

Immersive Virtual Engineering (IVE1) of the full lifecycle of

industrial products.

At IVE’s core are our Virtual Prototyping and Virtual Reality

integrated solutions which are now being extended to include “Big

Data”, “Machine Learning” and “IoT2”. Leveraging our recent

acquisitions our proven Physics based modelling may now be coupled

with the end-to-end management of the product full lifecycle, i.e.

from design and development (traditional “CAD-CAE-PLM3”) to

performance in operation, a critical step towards aided and

autonomous products (the new disruptive “PPL4”).

During this first semester Licenses sales experienced solid

growth, in particular with new business and high level of repeat

business. In parallel the significant progression in high

valued-added services demonstrates the specific need to support

industrialists, adapted to their maturity level in transition to

IVE. The continued improvement of our profitability indicators

confirms that our continuously monitored discipline of execution

allows us to combine the dynamics of profitable and sustainable

growth with high level of investments.

In this demanding global context and accounting for the renewed

challenges of the timely integration of our several recent

acquisitions, we expect our dynamic sales trend to continue with

solid, diversified and balanced growth.”

*****************************************

1 IVE: Immersive Virtual Engineering2 IoT: Internet of Things3

CAD-CAE-PLM: Computer Aided Design - Computer Aided Engineering -

Product Lifecycle Management4 PPL: Product Performance

Lifecycle

Consolidated half-year results

Half-year closed on July 31

In € millions H1-FY 16 H1-FY 15

Evolution atcurrent

rates

Exchangerateimpacts

Total sales 56.0

48.4 +7.6 (+15.7%) 0.7 Licenses 40.2 34.7 +5.5

(+15.7%) 0.5 Services 15.8 13.7 +2.1 (+15.4%) 0.2

Gross

margin 39.1 32.3 +6.8 (+21.1%) 0.8 % of

sales 69.8% 66.7%

EBITDA* -0.3 -2.5

+2.2 1.2 % of sales -0.6% -5.2%

Core Operating

Profit -1.8 -3.7 +1.9 1.2 % of sales -3.3%

-7.7%

EBIT -2.8 -4.6 +1.7 1.2 %

of sales -5.1% -9.5%

Attributable net profit/loss

-3.5 -3.6 +0.1 0.8 % of sales -6.2%

-7.4%

Available cash

19.3 10.0 +9.3

These figures were approved by the Board of Directors on

September 16, 2016.

(*) EBITDA excluding non-recurrent income, including the impact

from development expenses capitalization and allowances/impairment

reversals on client receivables.

Acquisitions over the period: “Mineset” was added to the scope

of consolidation on February 5, 2016.

Reminder: the strong seasonal nature of the ESI Group’s Licenses

business results in the recognition of the largest share of annual

revenue and results in the fourth quarter of the year. The annual

closing date is January 31.

Changes in revenue by quarter

In €millions

Q1 2016closedApril 30

Q12015

% chg.

% chg.(cer*)

Q2 2016

closed July31

Q22015

% chg.

% chg.(cer*)

Licenses

19.5 17.1

+14.3% +14.3% 20.6

17.6

+17.1% +14.0%

Services 7.9 7.0

+12.3%

+12.4% 7.9 6.7

+18.7% +16.4%

Total 27.4 24.1

+13.7% +13.8%

28.6 24.3

+17.6% +14.7%

* cer: at constant exchange rates

First-half 2016 revenue: sustained and balanced

growth

H1 2016 Total revenue - Revenue for the first half

was €56.0 million, an increase of +15.7% at current rates. Revenue

from acquisitions was €3.1 million, primarily from the business

activities of ESI ITI GmbH which was consolidated on January 6,

2016. The positive exchange impact over the period was moderate at

€0.7 million. It was tied to the net strengthening of the Japanese

yen compared to the euro, that more than compensated the

unfavorable change in other currencies, primarily the Korean won,

the Indian rupee, the US dollar and the pound sterling.

The product mix remained stable with Licensing accounting for

71.8% of total revenue compared to 71.7% for the same period of the

previous fiscal year.

H1 2016 Licenses - Revenue generated by the Licenses

business grew strongly at +15.7% at current exchange rates (‘cer’)

compared to the first half of the previous fiscal year, notably

sustained by strong performance in Asia. New business grew

significantly, up +24.5% (+11.1% in organic terms) and confirmed

the momentum seen during 2016 first quarter. Recurring growth in

the installed base was up +14.4% at current rates (+8.6% in organic

terms). It was particularly dynamic following positive performance

in the first half of 2015 (+26.9% at current rates). The rate of

repeat business therefore remained high at 91.8%.

H1 2016 Services - Revenue growth in Services was up

+15.4%, spurred by ongoing strategic development in high added

value engineering studies, the core of our innovative business and

an essential competitive advantage, which grew by +18.2%. This

trend was particularly apparent in Japan and is supported and

accentuated by our recent acquisitions. It also confirms the

relevance of our business model which promotes robust growth in

Licensing fostered by a solid Services business that supports and

sustains the innovative and functional value of our proposed

solutions.

H1 2016 geographical mix - The geographical distribution

of total revenues over the period reflects the stronger trend in

the Licenses business in Asia (which represented 45.6% versus last

year’s 41.1% at current exchange rates) in comparison with the

Americas (now 16.5% vs last year’s 20.4%) and Europe (stable at

38.0% vs last year’s 38.5%). Revenue from the BRIC regions grew by

+8.9% to end the period at 11.2% of the total revenue (vs last

year’s 12.2%), negatively affected by the difficult regional

economic context.

First-Half 2016 results: a continued improvement in

profitability

Increase in H1 gross margin

Gross Margin increased significantly reaching 69.8% of revenue

versus 66.7% in the first half of 2015. The growth was sustained by

steady improvements in the gross margins of both Licensing and

Services activities, the latter benefiting from the added focus on

high value engineering studies and advanced innovative

projects.

Operations cost control and ongoing investments

Over the period, the cost of Sales and Marketing (S&M) and

General and Administrative costs (G&A) increased globally by

+6.4%, compared to the revenue growth of +15.7%. These costs

represent respectively 33.8 % and 16.0 % of total revenues, a 432

basis points drop from the previous semester. This development

reflects a continuous cost control discipline during the

period.

In line with our strategy based on technology innovation,

R&D investments increased by +11.7% at current exchange rates.

R&D expenses reached €15.5 million (excluding the French

Research Tax Credit, 'CIR') and accounted for 38.7% of Licenses

revenue over the period, a 140 basis points drop from the previous

semester. This high first semester relative rate needs to be put

into perspective given the strong seasonality of the licenses

business. The continuous investment was for existing technologies

as well as for the latest external growth activities. The total

amount of R&D posted to the P&L income statement after

taking the CIR and capitalization of development costs into account

was €13.1 million at current exchange rates, up +33.0% compared to

the first half of 2015, notably due to the lesser impact of organic

R&D, and to the increased release of new software versions.

Marked improvement in EBITDA and operational

profitability

EBITDA increased significantly to -€0.3 million, up +€2.2

million compared to the first half of 2015. This performance was

nevertheless impacted by the lower capitalization of R&D

costs.

Core Operating Profit (ROC) was -€1.8 million, with a -3.3% to

the revenue margin, a marked improvement over the previous

year.

EBIT was -€2.8 million, that is, a margin of -5.1% on revenue,

also up considerably compared to the first half of 2015. The

increase is more limited than for EBITDA and ROC, primarily

consequent to non-recurring costs linked to amortization of the

intangible assets of ESI ITI GmbH.

Attributable net profit/loss was -€3.5 million, that is, a net

margin of -6.2% on revenue. It consists primarily of tax income of

+€1.4 million and financial loss of -€1.6 million. The latter was

impacted by the negative revaluation of certain foreign currency

hedging tools, especially following the strong Yen increase in the

six months period.

A robust financial structure

The cash available at closing was €19.3 million compared to

€10.0 million on July 31, 2015. Net debt was €23.7 million on July

31, 2016 while gearing (ratio of net debt to equity) was 26.7% as a

result of recent acquisitions.

Extension of the IVE offering and disruptive transition from

“PLM” to “PPL”

ESI's Immersive Virtual Engineering (IVE) solution offering for

the full development and fabrication of industrial products is

already significantly challenging the traditional PLM market. The

solution is based on the creation of a reliable ‘physics based’

Virtual Prototype, manufactured, assembled and articulated

component by component, and animated at the product ‘system’ level

by the multiple connections, (e.g.: mechanical, hydraulic,

electro-magnetic, etc.) that model component interactions within

the operational and functional full product system. This extremely

effective Virtual Prototyping approach is further enhanced by our

unique Virtual Reality (VR) solution (IC-IDO) which allows

users to share across distributed interdisciplinary teams worldwide

and in real time their intended product as in real life, in an

immersive 3D-4D environment, to enhance, facilitate and accelerate

the decision-making process throughout the product development

phase.

However, to this date not much if anything is available to

anticipate, improve and control what happens to the product after

rolling off of the assembly line to be handed out to users…”like

us” ! This is where ESI’s next generation extended IVE approach

comes in, and inaugurates the new era of “Product Performance

Lifecycle” (PPL), where the new product is further experienced and

managed in the Virtual PPL space in its predicted and observed real

life operational context.

With this objective in mind and leveraging several years of

carefully planned recent acquisitions, our proven IVE solutions are

now solidly positioned to be extended to include the best promises

of the Information and Communication Technologies (“ICT”5), which

are poised to dramatically transform all industries towards the new

paradigms of: ‘Smart Factory’, Industry 4.0, Horizon 2020 etc.,

namely incorporating the exponential technologies of: “Big Data”,

“Machine Learning”, ‘Cloud mobility’ and “IoT”.

This highly promising and transformational approach carried by

our IVE and PPL strategies, is a source of considerable added value

and benefits for most industries. It leads to a complete control of

the product full lifecycle, including the basic phases of design

and development of standard PLM while adding the disruptive virtual

modeling of product performance in real life operation, connected

or not, and addressing predictive maintenance through the full

service life of the product. This unique value proposition,

incorporating many disruptive innovations, comes from an original

and distinctive technology growth strategy, pursued for a very long

time by ESI and across multiple international partnerships and

highly innovative 'co-creation' industrial projects, to firmly

position the Group to address the whole manufacturing and

operational lifecycle of the product.

This new PPL approach builds on the ability of ESI's IVE

solutions, on the one hand, to combine and “articulate” detailed 3D

(spaced)-4D (time-dependent) level models, and on the other hand to

integrate and “animate” condensed and simplified 0D-1D level system

models representing the complexity of the full product in real life

operation. This highly innovative multi-level modeling opens the

way to the development of smart products with increasing degrees of

autonomy, expected to exploit the exponential growth of Information

and Communication Technologies (ICT) and to derive huge benefits

from Big Data Analytics, Machine Learning, the Cloud and the

Internet of Things (IoT).

In this respect ESI Group recently took a highly relevant

initiative when it shared its complete, transformational endeavor

to connect its Virtual Prototyping expertise with the demand for

controlled operational performance of autonomous and interconnected

industrial products.

Concurrently ESI is also making significant efforts to

accelerate the commercial deployment of its IVE/PPL

transformational approach and to target the very extensive and

rapidly expanding community of professionals involved in product

manufacturing and industrial processes for connected (or not)

innovative and ‘smart’ products.

For added momentum, ESI is also strengthening its global

ecosystem, with, for example, the recent signature of a new

strategic partnership with the Chinese ICT global leader “Huawei”.

The two companies are consolidating their collaboration in the

fields of High Performance Computing (HPC) and Cloud flexibility to

provide innovative solutions for industrial manufacturing, in

China, Europe and the rest of the world.

5 ICT : Information and Communication Technologies

For more ESI news, visit: www.esi-group.com/press

Next Events:

Berenberg Pan-European

Actionaria Exhibition

Revenue for

Discovery Conference USA

November 18-19, 2016

the first quarter of 2016:

October 27, 2016 - New York

(US)

Paris (France)

November 23, 2016

About ESI

ESI Group is a leading innovator in Virtual Prototyping software

and services. Specialist in material physics, ESI has developed a

unique proficiency in helping industrial manufacturers replace

physical prototypes by virtually replicating the fabrication,

assembly and testing of products in different environments. Today,

coupled with Virtual Reality, animated by systems models, and

benefiting from data analytics, Virtual Prototyping becomes

immersive and interactive: ESI’s clients can bring their products

to life, ensuring reliable performance, serviceability and

maintainability. ESI solutions help world-leading OEM’s and

innovative companies make sure that their products will pass

certification tests - before any physical prototype is built - and

that new products are competitive in their market space. Virtual

Prototyping addresses the emerging need for products to be smart

and autonomous and supports industrial manufacturers in their

digital transformation.

Today, ESI’s customer base spans nearly every industry sector.

The company employs about 1100 high-level specialists worldwide to

address the needs of customers in more than 40 countries. For more

information, please visit www.esi-group.com/

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160919006410/en/

Media RelationsESI Group – Europe/AsiaCorentine

Lemarchand, +33 1 53 65 14 51orESI Group - AmericasCorinne

Romefort-Régnier, + 1 415 994

3570orNewCapEmmanuel HuynhLouis-Victor

Delouvrier+33 1 44 71 98 53

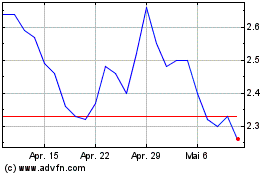

Ensign Energy Services (TSX:ESI)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Ensign Energy Services (TSX:ESI)

Historical Stock Chart

Von Feb 2024 bis Feb 2025