Assets include the FDA-approved LIKMEZ™, the

ATI-1701 tularemia vaccine defense program that has been awarded a

USD $14 million non-dilutive award from the DoD, and the ATI-1801

topical formulation

Aditxt, Inc. (“Aditxt” or the “Company”) (NASDAQ: ADTX), a

company dedicated to discovering, developing, and deploying

promising health innovations, today announced that it has entered

into a definitive arrangement agreement ("Arrangement Agreement")

to acquire Appili Therapeutics Inc. (TSX: APLI; OTCQX: APLIF)

(“Appili”), a biopharmaceutical company focused on drug development

for infectious diseases and medical countermeasures. Under the

Arrangement Agreement, Aditxt’s wholly owned subsidiary, Adivir,

Inc. (“Adivir”) agreed to acquire all issued and outstanding Class

A common shares of Appili (the “Appili Shares”) through a

court-approved plan of arrangement under the Canada Business

Corporations Act ("Transaction").

Since its inception in 2015, Appili has developed a diverse

portfolio, including the FDA-approved LIKMEZ™ (previously

ATI-1501), ATI-1701 biodefense program supported by a USD $14

million non-dilutive award from the U.S DoD., and ATI-1801, a

topical formulation targeting cutaneous leishmaniasis, a painful

and disfiguring disease.

LIKMEZ, FDA-Approved Taste-Masked Oral Suspension for

Bacterial Infections

Appili developed LIKMEZ, a new formulation of the antibiotic

metronidazole, specifically tailored to improve patient experience

and adherence, particularly in patients who have difficulty

swallowing large tablets. The patent-protected LIKMEZ is a

reformulated taste-masking technology containing metronidazole,

which makes it easier to swallow and better tasting, increasing

patient compliance.

The U.S. FDA's approval of LIKMEZ highlighted Appili’s capacity

to identify and develop significant opportunities within the

infectious disease domain. Appili licensed the manufacturing and

commercialization rights in the U.S. and other selected territories

to Saptalis Pharmaceuticals, LLC (“Saptalis”). Appili, in

collaboration with Saptalis, continued the product's development,

ultimately achieving FDA approval in the United States. With FDA

approval, future revenue is expected to be derived from milestone

payments and royalties from Saptalis under the license

agreement.

ATI-1701, Live Attenuated Vaccine for Francisella

Tularensis

Appili is developing ATI-1701 as a live attenuated vaccine to

combat Francisella tularensis, which is classified by the U.S.

National Institutes of Health (NIH) as a Category A pathogen, an

organism that poses the highest risk to national security and

public health due to its high rate of infectivity and ability to

cause lethal pneumonia and systemic infection. Estimated to be

1,000-fold more infectious than anthrax, experts consider the

aerosolized form to have a high potential for use in a bioterrorism

attack.

Appili's strategic alignment with governmental and public health

priorities has secured non-dilutive funding of USD $14 million from

the U.S. DoD for its ATI-1701 biodefense program. This funding has

been crucial in advancing the development of ATI-1701, including

support for manufacturing, non-clinical studies, and regulatory

activities through the submission of an Investigational New Drug

(IND) application. ATI-1701 may be eligible for a Priority Review

Voucher (PRV) if the U.S. Government extends the Medical

Countermeasures PRV program. A PRV enables its recipient to

expedite the review process for future drug applications upon

issuance. While no assurance can be provided that ATI-1701 will be

deemed eligible for a priority review voucher or, what its ultimate

worth will be if approved, and recent secondary market transactions

involving PRVs have ranged from USD $80 million to USD $100

million, their strategic value extends beyond the secondary market,

offering significant advantages in accelerating the development

timeline of new treatments.

ATI-1801, Topical Formulation for the Treatment of Cutaneous

Leishmaniasis (CL)

ATI-1801 represents Appili’s innovative approach to combating

cutaneous leishmaniasis (CL), a devastating skin infection

classified by the World Health Organization (WHO) as a Neglected

Tropical Disease (NTD) that impacts hundreds of thousands of

individuals globally. This topical product is formulated with

paromomycin, a previously approved antibiotic available in oral or

injectable form. The topical formulation allows a more direct and

comfortable application for patients who suffer from painful CL

lesions.

Having undergone evaluation in a Phase 3 study, ATI-1801 targets

CL infections that manifest through skin lesions and ulcers,

leading to potential scarring, disfigurement, and societal stigma.

Appili is committed to collaborating with stakeholders worldwide to

advance the development of ATI-1801 and to obtain regulatory

approvals, ensuring global access to this critical treatment.

Additionally, Appili is assessing the potential for ATI-1801 to

qualify for a Priority Review Voucher (PRV), a step that could

further expedite bringing this essential therapy to those in

need.

Synergy with Aditxt’s Programs

This acquisition will enhance Aditxt’s portfolio of subsidiaries

and create synergies with its existing programs, particularly

precision diagnostics. Integrating Appili’s expertise and product

lines would pave the way for a comprehensive approach to population

health, from early detection and prevention to treatment. The

potential for collaboration within the Aditxt ecosystem can

streamline patient care, from early detection through precision

diagnostics to developing tailored treatment strategies.

Amro Albanna, Co-Founder, Chairman, and CEO of Aditxt,

elaborated on the significance of this acquisition, stating, “The

acquisition of Appili would represent another step in Aditxt’s

journey towards advancing promising innovations in health. Our

mission is to accelerate some of the most promising health

innovations, like those developed by Appili, to reach their full

potential and to have a lasting impact. The urgency for innovative

and effective public health solutions is unprecedented. The need to

discover and bring new treatments to the market or to enhance

existing ones to combat public health challenges has never been

more critical. By integrating Appili’s proven expertise and diverse

portfolio in the infectious disease and biodefense domain, Aditxt

can substantially contribute to advancing public health

solutions.”

“This transaction with Aditxt aligns with our goals on multiple

levels. We see this as an opportunity for growth, innovation, and

collaboration. Our shared vision and combined expertise will

undoubtedly accelerate our mission to develop innovative treatments

and solutions for some of the most challenging health threats

facing the world today. Appili can now leverage Aditxt’s proven

research and development, operations, and commercialization

expertise to accelerate the development of our three programs.

Secondly, as a NASDAQ-listed company, we believe Aditxt can

facilitate capital access in this challenging economic environment.

We welcome this new chapter, confident that together, we will

achieve even greater heights in deploying innovative healthcare

solutions,” said Dr. Don Cilla, President and CEO of Appili

Therapeutics.

Transaction Details:

The Transaction will be effected through a court-approved plan

of arrangement under the Canada Business Corporations Act. Under

the terms of the Arrangement Agreement, Adivir will acquire all of

the issued and outstanding Appili Shares, with each Appili

Shareholder receiving (i) 0.002745004 of a share of common stock

(each whole share, an “Aditxt Share”) of Aditxt (the

“Share Consideration”) and (ii) US$0.0467 for each Appili

Share held (the “Cash Consideration” and together with the

Share Consideration collectively, the “Transaction

Consideration”) representing total consideration per Appili

Share of approximately US$0.0561 based on the closing price of

Aditxt stock on March 28, 2024 After giving effect to the

Transaction, Appili Shareholders will hold approximately 19.99% of

the issued and outstanding Aditxt Shares (on a non-diluted basis)

based on the currently issued and outstanding Aditxt Shares

(calculated on a non-diluted basis). In connection with the

Transaction, each outstanding option and warrant of Appili will be

cashed out based on the implied in-the-money value of the

Transaction Consideration.

In connection with the Transaction Aditxt will: (i) agree to

repay no less than 50% in outstanding senior secured debt at the

closing of the Transaction (the “Closing”) and to repay the

remaining outstanding senior secured debt by no later than December

31, 2024; (ii) acquire all of Appili’s remaining outstanding

liabilities and indebtedness; and (iii) agree to satisfy certain

payables of Appili at Closing as further detailed in the

Arrangement Agreement.

The Transaction is subject to the approval of at least

two-thirds of the votes cast at the special meeting of the Appili

Shareholders, which is expected to be held before the end of

calendar Q2 2024 to approve the Transaction.

Appili's directors, officers, and certain shareholders holding

approximately 11.9% of the total voting power of the issued and

outstanding Appili Shares have entered into voting support

agreements with the Buyer to vote in favor of the Transaction.

The Transaction is conditional upon Aditxt raising at least

US$20 million in financing (the “Aditxt Financing”) prior to

Closing. In addition, completion of the Transaction is subject to

other customary conditions, including the receipt of all necessary

court, regulatory and stock exchange approvals. Subject to

receiving all required approvals, Closing is expected to occur not

later than early Q3 2024.

The Arrangement Agreement contains customary terms and

conditions, including non-solicitation provisions, which are

subject to Appili's right to consider and accept a superior

proposal subject to a matching right in favor of Aditxt. The

Arrangement Agreement also provides for paying a termination fee of

Cdn$1.25 million in certain circumstances.

None of the securities to be issued pursuant to the Arrangement

Agreement have been or will be registered under the United States

Securities Act of 1933, as amended (the "U.S. Securities

Act"), or any state securities laws, and any securities issued

in the Transaction are anticipated to be issued in reliance upon

available exemptions from such registration requirements pursuant

to Section 3(a)(10) of the U.S. Securities Act and applicable

exemptions under state securities laws. This news release does not

constitute an offer to sell or the solicitation of an offer to buy

any securities.

If the Transaction is completed, the Appili Shares will be

delisted from the TSX and the OTCQX and Appili will apply to cease

to be a reporting issuer.

Advisors

Aird & Berlis LLP acted as Canadian legal counsel to Aditxt.

Sheppard, Mullin, Richter & Hampton LLP acted as US securities

counsel to Aditxt and Nelson Mullins Riley & Scarborough LLP

acted as US M&A counsel to Aditxt.

Dentons Canada LLP acted as legal counsel to Appili. Bloom

Burton & Co. acted as financial advisor to the Appili Board and

BDO Canada LLP acted as independent financial advisor to the Appili

Special Committee.

About Aditxt, Inc.

Aditxt, Inc.® (“Aditxt”) (NASDAQ: ADTX) is an innovation

platform dedicated to discovering, developing, and deploying

promising innovations. Aditxt’s ecosystem of research institutions,

industry partners, and shareholders collaboratively drives their

mission to “Make Promising Innovations Possible Together.” The

innovation platform is the cornerstone of Aditxt’s strategy, where

multiple disciplines drive disruptive growth and address

significant societal challenges. Aditxt operates a unique model

that democratizes innovation, ensures every stakeholder’s voice is

heard and valued, and empowers collective progress.

Aditxt has a diverse innovation portfolio, including Adimune™,

Inc., which is leading the charge in developing a novel class of

therapeutics for retraining the immune system to combat organ

rejection, autoimmunity, and allergies. Adivir™, Inc. focuses on

enhancing national and population health and impacting public

health globally. Pearsanta™, Inc., delivers rapid, personalized,

and high-quality lab testing accessible anytime, anywhere, led by

its CLIA-certified and CAP-accredited clinical laboratory based in

Richmond, VA.

For more information see: www.aditxt.com

About Appili Therapeutics

Appili Therapeutics is an infectious disease biopharmaceutical

company that is purposefully built, portfolio-driven, and

people-focused to fulfill its mission of solving life-threatening

infections. By systematically identifying urgent infections with

unmet needs, Appili aims to strategically develop a pipeline of

novel therapies to prevent deaths and improve lives. The Company is

currently advancing a diverse range of anti-infectives, including a

vaccine candidate to eliminate a severe biological weapon threat, a

topical antiparasitic for the treatment of a disfiguring disease,

and a novel easy to use, liquid oral formulation targeting

parasitic and anaerobic infections. Appili is at the epicenter of

the global fight against infection, led by a proven management

team.

For more information, visit www.AppiliTherapeutics.com.

Forward-Looking Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of federal

securities laws. Forward-looking statements include statements

regarding the Company’s ability to close the proposed transaction,

including but not limited to, the Company’s ability to raise the

necessary capital to close the transaction; the ability of both

companies to secure all required regulatory, third-party and

shareholder approvals for the proposed transaction; the Company’s

expectation that shares of its common stock will remain listed on

the Nasdaq Stock Market; the anticipated timing to close the

transaction; the anticipated financial performances of the Company

and Appili both before and after the proposed transaction; the

anticipated benefits of the proposed transaction including

synergies to Aditxt’s business following the proposed transaction;

Appili’s ability to secure PRV vouchers for one or more of its

programs; Aditxt’s ability to leverage Appili for subsequent

product acquisitions and license agreements subsequent to the

transaction; Appili’s ability to secure and maintain requisite

regulatory approvals; costs related to the transaction; and changes

to the potential market size and the size of the patient

populations utilizing LIKMEZ. You are cautioned not to place undue

reliance on these forward-looking statements, which are current

only as of the date of this press release. Each of these

forward-looking statements involves risks and uncertainties.

Important factors that could cause actual results to differ

materially from those discussed or implied in the forward-looking

statements are disclosed in the each company’s SEC filings,

including Aditxt’s Annual Report on Form 10-K for the year ended

December 31, 2022 filed with the SEC on April 17, 2023 as amended

April 28, 2023 and July 12, 2023, Quarterly Report on Form 10-Q for

the quarter ended September 30, 2023 filed with the SEC on November

14, 2023, and any subsequent filings. All forward-looking

statements are expressly qualified in their entirety by such

factors. The Company does not undertake any duty to update any

forward-looking statement except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240402301815/en/

Media Relations Contact: Mary O’ Brien mobrien@aditxt.com

(516) 753-9933

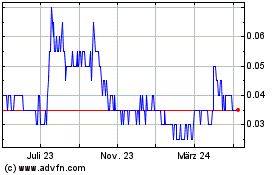

Appili Therapeutics (TSX:APLI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

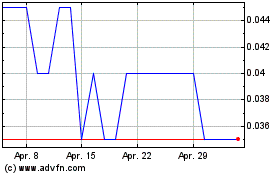

Appili Therapeutics (TSX:APLI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024