Ag Growth International Inc. (TSX: AFN) (“AGI”, the “Company”, “we”

or “our”) announced today a financing and operational update.

Offering of Convertible Unsecured

Subordinated DebenturesAGI announced that it has reached

an agreement with a syndicate of underwriters led by CIBC Capital

Markets (the “Underwriters”), pursuant to which AGI will issue on a

“bought deal” basis, subject to regulatory approval, $100,000,000

aggregate principal amount of convertible unsecured subordinated

debentures (the “Debentures”) at a price of $1,000 per Debenture

(the “Offering”). AGI has granted to the Underwriters an

over-allotment option, exercisable in whole or in part for a period

expiring 30 days following closing, to purchase up to an additional

$15,000,000 aggregate principal amount of Debentures at the same

price. If the over-allotment option is fully exercised, the total

gross proceeds from the Offering to AGI will be $115,000,000.

The net proceeds of the Offering will be used to

redeem Ag Growth’s outstanding 4.50% Convertible Unsecured

Subordinated Debentures due December 31, 2022 (the “December 2022

Debentures”) and for general corporate purposes.

“This offering addresses our near-term debt

maturity while we continue to focus on execution and organic growth

opportunities,” commented Tim Close, President & CEO of AGI.

“We continue to see strong demand as customers across all segments

continue to invest in critical equipment and technologies to

support their operations. Backlogs and sales pipelines remain at

record levels providing good visibility for 2022. We do expect that

a combination of project timing and typical seasonality will shift

the growth towards the last nine months of the year, particularly

in the second and third quarters.”

Additional operational update:

- Full year 2022 Adjusted EBITDA (see

“Non-IFRS measures”) outlook of at least $200 million, representing

continued growth and expansion over a record 2021 result, with

growth over 2021 to be realized in the last nine months of the

year, particularly in the second and third quarters.

- The outlook is supported by our

backlog, up 24% year-over-year as of March 27, 2022, and sitting at

record-levels on a dollar basis, as well as elevated sales

pipelines globally.

A preliminary short form prospectus qualifying

the distribution of the Debentures will be filed with the

securities regulatory authorities in each of the provinces of

Canada (other than Quebec). Closing of the Offering is expected to

occur on or about April 19, 2022. The Offering is subject to normal

regulatory approvals, including approval of the Toronto Stock

Exchange.

The Debentures will bear interest from the date

of issue at 5.20% per annum, payable semi-annually in arrears on

June 30 and December 31 each year commencing June 30, 2022. The

Debentures will have a maturity date of December 31, 2027 (the

“Maturity Date”).

The Debentures will be convertible at the

holder’s option at any time prior to the close of business on the

earlier of the business day immediately preceding the Maturity Date

and the date specified by AGI for redemption of the Debentures into

fully paid and non-assessable common shares (“Common Shares”) of

the Company at a conversion price of $70.50 per Common Share (the

“Conversion Price”), being a conversion rate of approximately

14.1844 Common Shares for each $1,000 principal amount of

Debentures.

The Debentures will not be redeemable by the

Company before December 31, 2025. On and after December 31, 2025

and prior to December 31, 2026, the Debentures may be redeemed in

whole or in part from time to time at AGI’s option at a price equal

to their principal amount plus accrued and unpaid interest,

provided that the volume weighted average trading price of the

Common Shares on the Toronto Stock Exchange for the 20 consecutive

trading days ending on the fifth trading day preceding the date on

which the notice of the redemption is given is not less than 125%

of the Conversion Price. On and after December 31, 2026, the

Debentures may be redeemed in whole or in part from time to time at

AGI’s option at a price equal to their principal amount plus

accrued and unpaid interest regardless of the trading price of the

Common Shares.

Redemption of December 2022

DebenturesConcurrent with the Offering, AGI also announced

today that it has given notice of its intention to redeem its

December 2022 Debentures in accordance with the terms of the

supplemental trust indenture dated January 3, 2018, governing the

December 2022 Debentures. The redemption of the December 2022

Debentures will be effective on May 2, 2022 (the "Redemption

Date"). Upon redemption, AGI will pay to the holders of December

2022 Debentures the redemption price (the "Redemption Price") equal

to the outstanding principal amount of the December 2022 Debentures

to be redeemed, together with all accrued and unpaid interest

thereon up to but excluding the Redemption Date, less any taxes

required to be deducted or withheld.

This press release is not an offer of Debentures

for sale in the United States. The Debentures may not be offered or

sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended, or an exemption from such

registration. The Company has not registered and will not register

the Debentures under the U.S. Securities Act of 1933, as amended.

The Company does not intend to engage in a public offering of

Debentures in the United States. This press release shall not

constitute an offer to sell, nor shall there be any sale of, the

Debentures in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

AGI Company ProfileAGI is a

provider of the physical equipment and digital technology solutions

required to support global food infrastructure including grain,

fertilizer, seed, feed, and food processing systems. AGI has

manufacturing facilities in Canada, the United States, the United

Kingdom, Brazil, India, France, and Italy and distributes its

product globally.

For More Information

Contact:Andrew JacklinDirector, Investor

Relations+1-437-335-1630investor-relations@aggrowth.com

CAUTIONARY STATEMENTS

Non-IFRS MeasuresIn analyzing

our results, we supplement our use of financial measures that are

calculated and presented in accordance with International Financial

Reporting Standards (“IFRS”) with a number of non-IFRS financial

measures, including “adjusted EBITDA”. A non-IFRS financial measure

is a numerical measure of a company's historical performance,

financial position or cash flow that excludes [includes] amounts,

or is subject to adjustments that have the effect of excluding

[including] amounts, that are included [excluded] in the most

directly comparable measures calculated and presented in accordance

with IFRS. Non-IFRS financial measures are not standardized;

therefore, it may not be possible to compare these financial

measures with other companies' non-IFRS financial measures having

the same or similar businesses. We strongly encourage investors to

review our consolidated financial statements and publicly filed

reports in their entirety and not to rely on any single financial

measure.

We use these non-IFRS financial measures in

addition to, and in conjunction with, results presented in

accordance with IFRS. These non-IFRS financial measures reflect an

additional way of viewing aspects of our operations that, when

viewed with our IFRS results and the accompanying reconciliations

to corresponding IFRS financial measures, may provide a more

complete understanding of factors and trends affecting our

business.

In our annual MD&A, we discuss the non-IFRS

financial measures, including the reasons that we believe that

these measures provide useful information regarding our financial

condition, results of operations, cash flows and financial

position, as applicable, and, to the extent material, the

additional purposes, if any, for which these measures are used.

Reconciliations of non-IFRS financial measures to the most directly

comparable IFRS financial measures are contained in our annual

MD&A.

Management believes that the Company's financial

results may provide a more complete understanding of factors and

trends affecting our business and be more meaningful to management,

investors, analysts, and other interested parties when certain

aspects of our financial results are adjusted for the gain (loss)

on foreign exchange and other operating expenses and income. These

measurements are non-IFRS measurements. Management uses the

non-IFRS adjusted financial results and non-IFRS financial measures

to measure and evaluate the performance of the business and when

discussing results with the Board of Directors, analysts,

investors, banks, and other interested parties.

“Adjusted EBITDA” is defined as profit (loss)

before income taxes before finance costs, depreciation and

amortization, share of associate’s net loss, gain on remeasurement

of equity investment, gain or loss on foreign exchange, non-cash

share based compensation expenses, gain or loss on financial

instruments, M&A expenses, change in estimate on variable

considerations, other transaction and transitional costs, net loss

on the sale of property, plant & equipment, gain or loss on

settlement of right-of-use assets, gain on disposal of foreign

operation, equipment rework and remediation and impairment.

Adjusted EBITDA is a non-IFRS financial measure and its most

directly comparable financial measure that is disclosed in our

consolidated financial statements is profit (loss) before income

taxes. Our adjusted EBITDA for the year ended 2021 was $176.3

million. See "Profit (loss) before income taxes and Adjusted

EBITDA" in our annual MD&A available under the Company's

profile on SEDAR [www.sedar.com]. Management believes that, in

addition to profit or loss, EBITDA and adjusted EBITDA are useful

supplemental measures in evaluating the Company’s performance.

Management cautions investors that EBITDA and adjusted EBITDA

should not replace profit or loss as indicators of performance, or

cash flows from operating, investing, and financing activities as a

measure of the Company’s liquidity and cash flows.

Forward-Looking Information

This press release contains forward-looking statements and

information [collectively, "forward-looking information"] within

the meaning of applicable securities laws that reflect our

expectations regarding the future growth, results of operations,

performance, business prospects, and opportunities of the Company.

All information and statements contained herein that are not

clearly historical in nature constitute forward-looking

information, and the words “anticipate”, “estimate”, “believe”,

“continue”, “could”, “expects”, “intend”, “plans”, “will”, “may” or

similar expressions suggesting future conditions or events or the

negative of these terms are generally intended to identify

forward-looking information. Forward-looking information involves

known or unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking information. In addition, this

press release may contain forward-looking information attributed to

third party industry sources. Undue reliance should not be placed

on forward-looking information, as there can be no assurance that

the plans, intentions or expectations upon which it is based will

occur. In particular, the forward-looking information in this press

release includes: the proposed timing of completion of the Offering

and redemption of the December 2022 Debentures; the anticipated use

of the net proceeds of the Offering; the reaffirmation of our

previously disclosed outlook for near-term financial results,

including our expectations for 2022 full-year results. Such

forward-looking information reflects our current beliefs and is

based on information currently available to us, including certain

key expectations and assumptions concerning: the anticipated

impacts of the COVID-19 outbreak on our business, operations and

financial results; future debt levels; anticipated grain production

in our market areas; financial performance; the financial and

operating attributes of recently acquired businesses and the

anticipated future performance thereof and contributions therefrom;

business prospects; strategies; product and input pricing;

regulatory developments; tax laws; the sufficiency of budgeted

capital expenditures in carrying out planned activities; political

events; currency exchange and interest rates; the cost of

materials, labour and services; the value of businesses and assets

and liabilities assumed pursuant to recent acquisitions; the impact

of competition; the general stability of the economic and

regulatory environment in which the Company operates; the timely

receipt of any required regulatory and third party approvals; the

ability of the Company to obtain and retain qualified staff and

services in a timely and cost efficient manner; the timing and

payment of dividends; the ability of the Company to obtain

financing on acceptable terms; the regulatory framework in the

jurisdictions in which the Company operates; and the ability of the

Company to successfully market its products and services.

Forward-looking information involves significant risks and

uncertainties. A number of factors could cause actual results to

differ materially from results discussed in the forward-looking

information, including:; the failure or delay in satisfying any of

the conditions to the completion of the Offering; the effects of

global outbreaks of pandemics or contagious diseases or the fear of

such outbreaks, such as the COVID-19 pandemic, including the

effects on the Company's operations, personnel, and supply chain,

the demand for its products and services, its ability to expand and

produce in new geographic markets or the timing of such expansion

efforts, and on overall economic conditions and customer confidence

and spending levels; changes in international, national and local

macroeconomic and business conditions, as well as sociopolitical

conditions in certain local or regional markets; weather patterns;

crop planting, crop yields, crop conditions, the timing of harvest

and conditions during harvest; the ability of management to execute

the Company’s business plan; seasonality; industry cyclicality;

volatility of production costs; agricultural commodity prices; the

cost and availability of capital; currency exchange and interest

rates; the availability of credit for customers; competition; AGI’s

failure to achieve the expected benefits of recent acquisitions

including to realize anticipated synergies and margin improvements;

changes in trade relations between the countries in which the

Company does business including between Canada and the United

States; cyber security risks; the risk that the assumptions and

estimates underlying the provision for remediation in our financial

statements and related insurance coverage for the bin collapse

disclosed in our public filings will prove to be incorrect as

further information becomes available to the Company; and the risk

that the Company incurs material liabilities as a result of

litigation and claims arising from such bin collapse. These risks

and uncertainties are described under “Risks and Uncertainties” our

annual MD&A and in our most recently filed Annual Information

Form, all of which are available under the Company's profile on

SEDAR [www.sedar.com]. These factors should be considered

carefully, and readers should not place undue reliance on the

Company’s forward-looking information. We cannot assure readers

that actual results will be consistent with this forward-looking

information. Readers are further cautioned that the preparation of

financial statements in accordance with IFRS requires management to

make certain judgments and estimates that affect the reported

amounts of assets, liabilities, revenues and expenses and the

disclosure of contingent liabilities. These estimates may change,

having either a negative or positive effect on profit, as further

information becomes available and as the economic environment

changes. Without limitation of the foregoing, the provision for

remediation related to the remediation work in respect of the bin

collapse required significant estimates and judgments about the

scope, nature, timing and cost of work that will be required. It is

based on management’s assumptions and estimates at the current date

and is subject to revision in the future as further information

becomes available to the Company. The forward-looking information

contained herein is expressly qualified in its entirety by this

cautionary statement. The forward-looking information included in

this press release is made as of the date of this press release and

AGI undertakes no obligation to publicly update such

forward-looking information to reflect new information, subsequent

events or otherwise unless so required by applicable securities

law.

Also included in this press release are

estimates of full year 2022 adjusted EBITDA, which are based on,

among other things, the various assumptions disclosed in this news

release. To the extent such estimates constitute financial

outlooks, they were approved by management on March 29, 2022 and

are included to provide readers with an understanding of AGI's

anticipated adjusted EBITDA for the relevant periods based on the

assumptions described herein and readers are cautioned that the

information may not be appropriate for other purposes.

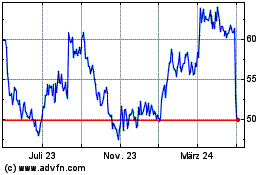

Ag Growth (TSX:AFN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

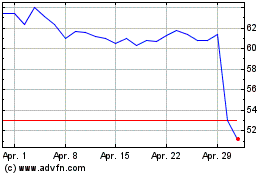

Ag Growth (TSX:AFN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024