All figures in Canadian dollars unless otherwise noted

Investors, analysts and other interested parties can access Acadian Timber

Corp.'s 2014 Second Quarter Results conference call via webcast on Tuesday, July

29, 2014 at 1:00 p.m. ET at www.acadiantimber.com or via teleconference at

1-800-319-4610, toll free in North America. For overseas calls please dial

+1-604-638-5340, at approximately 12:50 p.m. ET. The recorded teleconference

rebroadcast can be accessed at 1-800-319-6413 or +1-604-638-9010 and enter

passcode 2826.

Acadian Timber Corp. ("Acadian" or the "Company") (TSX:ADN) today reported

financial and operating results(1) for the three months ended June 28, 2014 (the

"second quarter").

"Demand remains strong in Acadian's operating region," said Reid Carter, Chief

Executive Officer of Acadian. "Softwood timber selling prices are benefiting

from the continued positive outlook for lumber demand and strong demand from

regional hardwood pulp and structural panel producers is supporting hardwood

pulpwood prices."

For the second quarter, Acadian generated net sales of $12.0 million on sales

volume of 229 thousand m3 which represents a $3.6 million, or 23%, decrease in

net sales compared to the same period in 2013. Results were less than the same

period last year reflecting the delayed recognition of sales in the prior year

due to the vendor managed inventory ("VMI") program that

was in place at the New Brunswick operation. On a year-to-date basis, net sales

are 2% lower than in the same period last year with a slower start-up of

operations in the second quarter due to an extended mud season being largely

offset by improved log pricing.

Adjusted EBITDA of $1.9 million for the second quarter was $1.0 million lower

than in the second quarter of 2013, while Adjusted EBITDA margin decreased to

16% from 19% in the same period of last year. On a year-to-date basis, Free Cash

Flow improved $1.0 million to $6.7 million resulting in a payout ratio of 104%,

below the ratio of 121% in the same period last year.

(1) This news release makes reference to Adjusted EBITDA and Free Cash Flow

which are key performance measures in evaluating Acadian's operations and are

important in enhancing investors' understanding of Acadian's operating

performance. Acadian's management defines Adjusted EBITDA as earnings before

interest, taxes, fair value adjustments, recovery of or impairment of land and

roads, unrealized exchange gain/loss on debt, depreciation and amortization and

Free Cash Flow as Adjusted EBITDA less interest paid, current income tax

expense, additions to, and gains from the sale of, fixed assets plus losses on,

and proceeds from, the sale of fixed assets. As these performance measures do

not have standardized meanings prescribed by International Financial Reporting

Standards ("IFRS"), they may not be comparable to similar measures presented by

other companies. As a result, we have provided in this news release

reconciliations of net income, as determined in accordance with IFRS, to

Adjusted EBITDA and Free Cash Flow.

Financial and Operating Highlights

Three Months Ended Six Months Ended

------------------------------------------------

(CAD thousands, except per June 28 June 29 June 28 June 29

share information) 2014 2013 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Sales volume (000s m3) 228.9 330.5 579.1 669.7

Net sales $ 12,029 $ 15,608 $ 33,272 $ 33,860

Operating earnings 1,797 2,667 8,262 7,181

Net income / (loss) 4,738 (857) 5,435 434

Adjusted EBITDA 1,935 2,897 8,632 7,552

Free Cash Flow 1,052 1,774 6,652 5,685

Dividends declared 3,451 3,451 6,902 6,902

Per share (fully diluted)

Net income / (loss) 0.28 (0.05) 0.32 0.03

Free Cash Flow 0.06 0.11 0.40 0.34

Dividends declared 0.21 0.21 0.41 0.41

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operating earnings for the second quarter, at $1.8 million, decreased $0.9

million year-over-year, largely reflecting the timing of sales. Net income

totaled $4.7 million, or $0.28 per share, for the second quarter, an increase of

$5.6 million or $0.33 per share from the same period in 2013. The increase in

net income reflects a higher non-cash fair value adjustment due to lower harvest

levels and a $2.7 million unrealized exchange gain on long-term debt compared to

a $2.5 million unrealized loss in the same period of the prior year.

Acadian traditionally experiences low levels of operating, marketing and selling

activity during the second quarter of each year owing to the spring thaw period

("mud season") that causes much of the infrastructure to be temporarily

inoperable. Harvest volume for the second quarter, excluding biomass, was 138

thousand m3, down 21% compared to the same period in the prior year due to a

slower start-up at the New Brunswick operation resulting from the well

above-average snowpack of the prior winter. Sales volume of 229 thousand m3 was

down 31% from the second quarter of 2013, with the decrease largely coming from

Acadian's operations in New Brunswick due to the discontinuation of the VMI

program.

Acadian's weighted average log price during the second quarter increased 11%

year-over-year primarily due to higher softwood sawlog and hardwood log prices,

a stronger U.S. dollar and a higher proportion of high value hardwood sawlogs in

the sales mix. Softwood sawlog prices were up 10% relative to the same period

last year, benefiting from our customers' continued positive outlook for lumber

demand. Prices for hardwood sawlogs and pulpwood were both up 7% relative to the

second quarter of last year reflecting strong market demand. Softwood pulpwood

pricing has weakened, declining 8% year-over-year, with fewer groundwood

customers operating. Biomass gross margin was down 27% year-over-year due to

fewer export customers during the period, but is expected to recover in the

coming quarters.

New Brunswick Timberlands

The table below summarizes operating and financial results for New Brunswick

Timberlands.

Three Months Ended June 28, Three Months Ended June 29,

2014 2013

------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 45.5 67.6 $ 3,745 57.4 124.4 $ 6,538

Hardwood 62.0 74.1 4,914 89.8 95.6 5,807

Biomass 40.0 40.0 663 68.2 68.2 1,199

----------------------------------------------------------------------------

147.5 181.7 9,322 215.4 288.2 13,544

Other sales (32) (36)

----------------------------------------------------------------------------

Net sales $ 9,290 $ 13,508

----------------------------------------------------------------------------

Adjusted EBITDA $ 1,652 $ 2,943

Adjusted EBITDA margin 18% 22%

----------------------------------------------------------------------------

Six Months Ended June 28, Six Months Ended June 29,

2014 2013

------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 166.1 167.7 $ 9,124 213.4 211.4 $ 11,111

Hardwood 185.9 189.8 12,673 184.4 192.6 11,862

Biomass 69.3 69.3 1,309 113.1 113.1 2,018

----------------------------------------------------------------------------

421.3 426.8 23,106 510.9 517.1 24,991

Other sales 630 670

----------------------------------------------------------------------------

Net sales $ 23,736 $ 25,661

----------------------------------------------------------------------------

Adjusted EBITDA $ 6,110 $ 5,935

Adjusted EBITDA margin 26% 23%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 68 thousand m3, 74 thousand m3 and

40 thousand m3, respectively, during the second quarter. This represents a

year-over-year decrease in sales volume of 37% largely reflecting the impact of

the VMI program that was in place in 2013 which deferred sales from the first

quarter to the second. Harvest volume in the second quarter of 2014 was typical

of seasonal conditions, but lower than the same period last year as the well

above-average snowpack of the prior winter led to a slow start-up. Approximately

40% of sales volume was sold as sawlogs, 38% as pulpwood and 22% as biomass in

the second quarter. This compares to 42% sold as sawlogs, 34% as pulpwood and

24% as biomass in the second quarter of 2013.

Net sales for the second quarter totaled $9.3 million compared to $13.5 million

for the same period last year, again reflecting the impact of not operating

under the VMI program in the current year, but partially offset by increased

softwood sawtimber and hardwood selling prices. The weighted average log selling

price was $61.11 per m3 in the second quarter of 2014, a 9% increase from $56.12

per m3 in the same period of 2013 as a result of improved selling prices for

most product and a higher proportion of hardwood in the sales mix. Net sales for

the six months ended June 28, 2014 were $23.7 million, a decrease of $1.9

million over the first half of 2013, due to lower sales volumes.

Costs for the second quarter were $7.6 million, compared to $10.6 million in the

same period in 2013, due to lower harvest volumes of primary products, partially

offset by 3% higher variable costs per m3 caused by a higher proportion of

hardwood products being supplied from log handling yards. For the six months

ended June 28, 2014, costs were $17.6 million, $2.0 million lower than during

the first half of 2013, due to lower harvest volumes.

Adjusted EBITDA for the second quarter was $1.7 million, compared to $2.9

million in the second quarter of 2013 reflecting the discontinuation of the VMI

program. Adjusted EBITDA margin decreased to 18% from 22% in the prior year. For

the six months ended June 28, 2014, adjusted EBITDA was $6.1 million, an

increase of $0.2 million over the first half of 2013.

There were no recordable safety incidents among employees and contractors during

the second quarter of 2014.

Maine Timberlands

The table below summarizes operating and financial results for Maine Timberlands.

Three Months Ended June 28, Three Months Ended June 29,

2014 2013

------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 17.6 17.6 $ 1,030 18.1 18.1 $ 875

Hardwood 12.7 19.9 1,529 9.9 15.6 1,051

Biomass 9.7 9.7 52 8.6 8.6 44

----------------------------------------------------------------------------

40.0 47.2 2,611 36.6 42.3 1,970

Other sales 128 130

----------------------------------------------------------------------------

Net sales $ 2,739 $ 2,100

----------------------------------------------------------------------------

Adjusted EBITDA $ 385 $ 215

Adjusted EBITDA margin 14% 10%

----------------------------------------------------------------------------

Six Months Ended June 28, Six Months Ended June 29,

2014 2013

------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 89.2 88.9 $ 5,706 94.6 94.3 $ 5,217

Hardwood 45.2 47.0 3,520 35.6 42.0 2,658

Biomass 16.4 16.4 113 16.3 16.3 125

----------------------------------------------------------------------------

150.8 152.3 9,339 146.5 152.6 8,000

Other sales 197 199

----------------------------------------------------------------------------

Net sales $ 9,536 $ 8,199

----------------------------------------------------------------------------

Adjusted EBITDA $ 2,862 $ 2,243

Adjusted EBITDA margin 30% 27%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 18 thousand m3, 20 thousand m3,

and 10 thousand m3, respectively, during the second quarter. This represents a

year-over-year increase in sales volume of 12%. Approximately 36% of sales

volume was sold as sawlogs, 43% as pulpwood and 21% as biomass during the second

quarter. This compares to 37% sold as sawlogs, 43% as pulpwood and 20% as

biomass in the second quarter of 2013.

Net sales for the second quarter totaled $2.7 million compared to $2.1 million

for the same period last year. The improvement was the result of increased

hardwood sales volume and improved pricing across all products, as well as the

positive impact of the stronger U.S. dollar. The weighted average log selling

price was $68.34 per m3 in the second quarter of 2014, a 19% increase from

$57.30 per m3 in the same period of 2013 in Canadian dollar terms. Weighted

average log selling prices in U.S. dollar terms increased 11% year-over-year.

Net sales for the six months ended June 28, 2014 were $9.5 million, an increase

of $1.3 million over the first half of 2013, due to improved log selling prices.

Costs for the second quarter were $2.3 million, compared to $2.0 million during

the same period in 2013. Variable costs per m3 increased 14% in Canadian dollar

terms and 7% in U.S. dollar terms reflecting a shift in product mix during the

period with a greater proportion of the sales being higher cost hardwood

sawtimber processed through the woodyard as well as longer hauling distances for

softwood pulpwood due to the closure of the paper mill in East Millinocket. For

the six months ended June 28, 2014, costs were $6.7 million, $0.7 million higher

than during the first half of 2013, due to higher harvest volumes and adverse

foreign exchange movements.

Adjusted EBITDA for the second quarter was $0.4 million, compared to $0.2

million for the same period in 2013, while Adjusted EBITDA margin increased to

14% from 10% in the prior year. For the six months ended June 28, 2014, Adjusted

EBITDA was $2.9 million, an increase of $0.7 million over the first half of

2013.

There were no recordable safety incidents among employees and contractors during

the second quarter of 2014.

Market Outlook

The following contains forward-looking statements about Acadian Timber Corp.'s

market outlook for the remainder of 2014. Reference should be made to the

"Forward-looking Statements" section of this news release. For a description of

material factors that could cause actual results to differ materially from the

forward-looking statements in the following, please see the Risk Factors section

of Acadian's most recent Annual Report and Annual Information Form available on

our website at www.acadiantimber.com or filed with SEDAR at www.sedar.com.

U.S. housing market forecasts continue to be adjusted downward despite

significant pent up demand. Analysts have concluded that last spring's increase

in mortgage rates coupled with increases in home prices and tighter mortgage

lending rules explains much more of the current weakness in mortgage

applications and new home sales than the harsh winter weather experienced in

2014. Improved economic growth, with further gains in employment and wages, will

need to take place before a more robust recovery in housing can be expected.

Despite this than less robust outlook, most industry watchers continue to

forecast year-over-year increases in total housing starts of approximately 10 to

20% in 2014 with increases of the same magnitude in 2015. This optimism has kept

North American lumber prices strong throughout 2013 and 2014 encouraging

Acadian's key solid wood customers to continue to operate at full capacity. As

such, we expect to see ongoing strong demand for softwood sawlogs in the region.

Markets for hardwood sawlogs have been positive and are expected to remain

stable and demand and pricing for hardwood pulpwood continues to be strong.

While Acadian has been successful in selling its softwood pulpwood production,

this market is challenging due to the closure of several regional groundwood

mills. Biomass sales have been somewhat slow during the first half of 2014,

although we expect to see modest improvements through the remainder of the year

as several of the logistical challenges currently constraining export markets

are relieved.

Quarterly Dividend

Acadian is pleased to announce a dividend of $0.20625 per share, payable on

October 15, 2014 to shareholders of record on September 30, 2014.

Acadian Timber Corp. is a leading supplier of primary forest products in Eastern

Canada and the Northeastern U.S. With a total of 2.4 million acres of land under

management, Acadian is the second largest timberland operator in New Brunswick

and Maine.

Acadian owns and manages approximately 1.1 million acres of freehold timberlands

in New Brunswick and Maine, and provides management services relating to

approximately 1.3 million acres of Crown licensed timberlands in New Brunswick.

Acadian also owns and operates a forest nursery in Second Falls, New Brunswick.

Acadian's products include softwood and hardwood sawlogs, pulpwood and biomass

by-products, sold to approximately 90 regional customers.

Acadian's business strategy is to maximize cash flows from its existing

timberland assets while growing our business by acquiring assets on a value

basis and utilizing our operations-oriented approach to drive improved

performance.

Acadian's shares are listed for trading on the Toronto Stock Exchange under the

symbol ADN.

For further information, please visit our website at www.acadiantimber.com.

Forward-Looking Statements

This News Release contains forward-looking information within the meaning of

applicable Canadian securities laws that involve known and unknown risks,

uncertainties and other factors that may cause the actual results, performance

or achievements of Acadian Timber Corp. and its subsidiaries (collectively,

"Acadian"), or industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. When used in this News Release, such statements may

contain such words as "may," "will," "intend," "should," "expect," "believe,"

"outlook," "predict," "remain," "anticipate," "estimate," "potential,"

"continue," "plan," "could," "might," "project," "targeting" or the negative of

these terms or other similar terminology. Forward-looking information in this

News Release includes, without limitation, statements made in the section

entitled "Market Outlook" and other statements regarding management's beliefs,

intentions, results, performance, goals, achievements, future events, plans and

objectives, business strategy, growth strategy and prospects, access to capital,

liquidity and trading volumes, dividends, taxes, capital expenditures, projected

costs, market trends and similar statements concerning anticipated future

events, results, achievements, circumstances, performance or expectations that

are not historical facts. These statements, which reflect management's current

expectations regarding future events and operating performance, are based on

information currently available to management and speak only as of the date of

this News Release. All forward-looking statements in this News Release are

qualified by these cautionary statements.

Forward-looking statements involve significant risks and uncertainties, should

not be read as guarantees of future performance or results, should not be unduly

relied upon, and will not necessarily be accurate indications of whether or not

such results will be achieved. Factors that could cause actual results to differ

materially from the results discussed in the forward-looking statements include,

but are not limited to: general economic and market conditions; product demand;

concentration of customers; commodity pricing; interest rate and foreign

currency fluctuations; seasonality; weather and natural conditions; regulatory,

trade or environmental policy changes; changes in Canadian income tax law;

economic situation of key customers; Brookfield Asset Management Inc.'s and its

affiliates' ability to source and secure potential investment opportunities; the

availability of potential acquisitions that suit Acadian's growth profile; and

other risks and factors discussed under the heading "Risk Factors" in each of

the Annual Information Form dated March 28, 2014 and the Management Information

Circular dated May 13, 2014, and other filings of Acadian made with securities

regulatory authorities, which are available on SEDAR at www.sedar.com.

Forward-looking information is based on various material factors or assumptions,

which are based on information currently available to Acadian. Material factors

or assumptions that were applied in drawing a conclusion or making an estimate

set out in the forward-looking information may include, but are not limited to:

anticipated financial performance; anticipated market conditions; business

prospects; the economic situation of key customers; strategies; regulatory

developments; exchange rates; the sufficiency of budgeted capital expenditures

in carrying out planned activities; the availability and cost of labour and

services and the ability to obtain financing on acceptable terms. Readers are

cautioned that the preceding list of material factors or assumptions is not

exhaustive. Although the forward-looking statements contained in this News

Release are based upon what management believes are reasonable assumptions,

Acadian cannot assure readers that actual results will be consistent with these

forward-looking statements. The forward-looking statements in this News Release

are made as of the date of this News Release, and should not be relied upon as

representing Acadian's views as of any date subsequent to the date of this News

Release. Acadian assumes no obligation to update or revise these forward-looking

statements to reflect new information, events, circumstances or otherwise,

except as may be required by applicable law.

Acadian Timber Corp.

Interim Consolidated Statements of Net Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

----------------------------------------------------------------------------

June 28 June 29 June 28 June 29

(CAD thousands) 2014 2013 2014 2013

----------------------------------------------------------------------------

Net sales $ 12,029 $ 15,608 $ 33,272 $ 33,860

----------------------------------------------------------------------------

Operating costs and expenses

Cost of sales 8,680 11,122 21,859 23,110

Selling, administration and

other 1,351 1,542 2,814 3,146

Reforestation 65 134 65 139

Depreciation and

amortization 136 143 272 284

----------------------------------------------------------------------------

10,232 12,941 25,010 26,679

----------------------------------------------------------------------------

Operating earnings 1,797 2,667 8,262 7,181

Interest expense, net (773) (773) (1,570) (1,512)

Other items

Fair value adjustments 1,795 1,224 605 1,243

Unrealized exchange gain

(loss) on long-term debt 2,747 (2,473) (349) (4,315)

Gain on sale of timberlands 2 87 98 87

----------------------------------------------------------------------------

Earnings before income taxes 5,568 732 7,046 2,684

Current income tax recovery

(expense) 28 - (269) -

Deferred income tax expense (858) (1,589) (1,342) (2,250)

----------------------------------------------------------------------------

Net income / (loss) for the

period $ 4,738 $ (857) $ 5,435 $ 434

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income / (loss) per

share - basic and diluted $ 0.28 $ (0.05) $ 0.32 $ 0.03

Acadian Timber Corp.

Interim Consolidated Statements of Comprehensive Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

----------------------------------------------------------------------------

June 28 June 29 June 28 June 29

(CAD thousands) 2014 2013 2014 2013

----------------------------------------------------------------------------

Net income / (loss) $ 4,738 $ (857) $ 5,435 $ 434

----------------------------------------------------------------------------

Other comprehensive income

(loss)

Items that may be

reclassified subsequently

to net income:

Unrealized foreign currency

translation (3,278) 2,670 419 4,880

Amortization of derivatives

designated as hedges (47) (45) (94) (95)

----------------------------------------------------------------------------

Comprehensive income $ 1,413 $ 1,768 $ 5,760 $ 5,219

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Balance Sheets

(unaudited)

----------------------------------------------------------------------------

As at June 28, December 31,

(CAD thousands) 2014 2013

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 7,922 $ 8,564

Accounts receivable and other assets 6,538 7,673

Inventory 1,025 1,380

----------------------------------------------------------------------------

15,485 17,617

Timber 241,351 240,143

Land, roads and other fixed assets 32,202 32,268

Intangible assets 6,140 6,140

----------------------------------------------------------------------------

$ 295,178 $ 296,168

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 5,922 $ 7,680

Dividends payable to shareholders 3,451 3,451

----------------------------------------------------------------------------

9,373 11,131

Long-term debt 76,963 76,496

Deferred income tax liability 27,791 26,348

Shareholders' equity 181,051 182,193

----------------------------------------------------------------------------

$ 295,178 $ 296,168

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statements of Cash Flows

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

----------------------------------------------------------------------------

June 28 June 29 June 28 June 30

(CAD thousands) 2014 2013 2014 2013

----------------------------------------------------------------------------

Cash provided by (used for):

----------------------------------------------------------------------------

Operating activities

Net income / (loss) $ 4,738 $ (857) $ 5,435 $ 434

Adjustments to net income /

(loss):

Deferred income tax expense 858 1,589 1,342 2,250

Depreciation and

amortization 136 143 272 284

Fair value adjustments (1,795) (1,224) (605) (1,243)

Unrealized exchange (gain)

loss on long term debt (2,747) 2,473 349 4,315

Interest expense, net 773 773 1,570 1,512

Interest paid, net (778) (778) (1,579) (1,522)

Gain on sale of timberlands (2) (87) (98) (87)

Net change in non-cash

working capital and other (718) 684 (392) 530

----------------------------------------------------------------------------

465 2,716 6,294 6,473

----------------------------------------------------------------------------

Financing activities

Dividends paid to

shareholders (3,451) (3,451) (6,902) (6,902)

----------------------------------------------------------------------------

(3,451) (3,451) (6,902) (6,902)

----------------------------------------------------------------------------

Investing activities

Additions to timber, land,

roads and other fixed

assets (133) (345) (133) (345)

Proceeds from sale of

timberlands 2 87 99 87

----------------------------------------------------------------------------

(131) (258) (34) (258)

----------------------------------------------------------------------------

Decrease in cash and cash

equivalents during the

period (3,117) (993) (642) (687)

Cash and cash equivalents,

beginning of period 11,039 6,442 8,564 6,136

----------------------------------------------------------------------------

Cash and cash equivalents,

end of period $ 7,922 $ 5,449 $ 7,922 $ 5,449

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Reconciliations to Adjusted EBITDA and Free Cash Flow

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

----------------------------------------------------------------------------

June 28 June 29 June 28 June 29

(CAD thousands) 2014 2013 2014 2013

----------------------------------------------------------------------------

Net income / (loss) $ 4,738 $ (857) $ 5,435 $ 434

Add (deduct):

Interest expense, net 773 773 1,570 1,512

Current income tax expense

(recovery) (28) - 269 -

Deferred income tax expense 858 1,589 1,342 2,250

Depreciation and

amortization 136 143 272 284

Fair value adjustments (1,795) (1,224) (605) (1,243)

Unrealized exchange (gain)

loss on long-term debt (2,747) 2,473 349 4,315

----------------------------------------------------------------------------

Adjusted EBITDA 1,935 2,897 8,632 7,552

Add (deduct):

Interest paid on debt, net (778) (778) (1,579) (1,522)

Additions to timber, land,

roads and other fixed

assets (133) (345) (133) (345)

Gain on sale of timberlands (2) (87) (98) (87)

Proceeds on sale of

timberlands 2 87 99 87

Current income tax recovery

(expense) 28 - (269) -

----------------------------------------------------------------------------

Free cash flow $ 1,052 $ 1,774 $ 6,652 $ 5,685

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Dividends declared $ 3,451 $ 3,451 $ 6,902 $ 6,902

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Payout ratio 328% 195% 104% 121%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Acadian Timber Corp.

Robert Lee

Investor Relations and Communications

604-661-9607

rlee@acadiantimber.com

www.acadiantimber.com

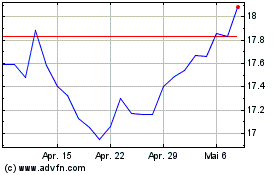

Acadian Timber (TSX:ADN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

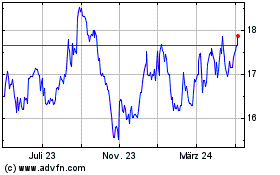

Acadian Timber (TSX:ADN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024