All figures in Canadian dollars unless otherwise noted.

Investors, analysts and other interested parties can access Acadian Timber

Corp.'s 2014 First Quarter Results conference call via webcast on Tuesday, May

13, 2014 at 1:00 p.m. ET at www.acadiantimber.com or via teleconference at

1-800-319-4610, toll free in North America. For overseas calls please dial

+1-604-638-5340, at approximately 12:50 p.m. ET. The recorded teleconference

rebroadcast can be accessed at 1-800-319-6413 or +1-604-638-9010 and enter

passcode 2826.

Acadian Timber Corp. ("Acadian" or the "Company") (TSX:ADN) today reported

financial and operating results(1) for the three months ended March 29, 2014

(the "first quarter").

"Acadian's operations ran well this quarter with favorable winter operating

conditions extending through the end of the quarter", said Reid Carter, Chief

Executive Officer of Acadian. "Recent announcements of capital investments and

additional operating shifts in the region are expected to result in continued

strong demand for softwood sawlogs going forward."

For the first quarter, Acadian generated net sales of $21.2 million on sales

volume of 350 thousand m3 which represents a $3.0 million, or 16%, increase in

net sales compared to the same period in 2013. Strong market demand, the

strengthening of the U.S. dollar and the discontinuation of the vendor managed

inventory ("VMI") program in our New Brunswick operation drove this improved

performance.

Adjusted EBITDA of $6.7 million for the first quarter was $2.0 million higher

than in the first quarter of 2013, while Adjusted EBITDA margin increased to 32%

from 26% in the same period of last year.

Acadian continues to actively pursue business development opportunities in

support of Acadian's global growth strategy. After a prolonged period of limited

investment opportunities, management is currently seeing an increasing number of

owners willing to test the market and is optimistic that Acadian will be in a

position to participate in attractive opportunities during 2014.

(1) This news release makes reference to Adjusted EBITDA and Free Cash Flow

which are key performance measures in evaluating Acadian's operations and are

important in enhancing investors' understanding of Acadian's operating

performance. Acadian's management defines Adjusted EBITDA as earnings before

interest, taxes, fair value adjustments, recovery of or impairment of land and

roads, unrealized exchange gain/loss on debt, depreciation and amortization and

Free Cash Flow as Adjusted EBITDA less interest paid, current income tax

expense, additions to, and gains from the sale of, fixed assets plus losses on,

and proceeds from, the sale of fixed assets. As these performance measures do

not have standardized meanings prescribed by International Financial Reporting

Standards ("IFRS"), they may not be comparable to similar measures presented by

other companies. As a result, we have provided in this news release

reconciliations of net income, as determined in accordance with IFRS, to

Adjusted EBITDA and Free Cash Flow.

Financial and Operating Highlights

----------------------------------------------------------------------------

Three Months Ended

(CAD thousands, except per share

information) March 29, 2014 March 30, 2013

----------------------------------------------------------------------------

Sales volume (000s m3) 350.2 339.2

Net sales $ 21,243 $ 18,252

Operating earnings 6,465 4,514

Net income 697 1,291

Adjusted EBITDA 6,697 4,655

Free Cash Flow 5,600 3,911

Dividends declared 3,451 3,451

Per share (fully diluted)

Net income 0.04 0.08

Free Cash Flow 0.33 0.23

Dividends declared 0.21 0.21

----------------------------------------------------------------------------

Operating earnings for the period, at $6.5 million, increased $2.0 million

year-over-year reflecting improved log selling prices and sales volumes. Net

income totaled $0.7 million, or $0.04 per share, for the first quarter, a

decrease of $0.6 million or $0.04 per share from the same period in 2013. The

decrease in net income primarily reflects a higher non-cash fair value

adjustment to timber and an increased unrealized exchange loss on long-term

debt.

Acadian's operations ran well during the first quarter with favorable winter

operating conditions extending through the end of the quarter. Harvest volume

for the first quarter, excluding biomass, was 349 thousand m3, in line with the

same period in the prior year. Sales volume of 350 thousand m3 was up 3% from

the first quarter of 2013, with the increase coming from Acadian's operations in

New Brunswick.

Acadian's weighted average log price for the first quarter of 2014 increased 9%

year-over-year reflecting increased prices across most products and changes in

product mix. Stronger softwood sawlog markets and the strengthening of the U.S.

dollar resulted in a 7% increase in the weighted average softwood sawlog price

relative to the first quarter of 2013. Most of this benefit came from the Maine

operations. Hardwood sawlog markets improved for both the New Brunswick and

Maine operations with weighted average selling prices increasing by 16%. Prices

for softwood and hardwood pulpwood decreased 7% and increased 10%, respectively,

year-over-year. While market conditions for hardwood pulpwood continued to be

strong, softwood pulpwood markets were challenged during the quarter due to a

limited customer base. Biomass markets remained stable, however, realized gross

margins on this product decreased 23% year-over-year due to fewer export

customers.

New Brunswick Timberlands

The table below summarizes operating and financial results for New Brunswick

Timberlands.

Three Months Ended March 29, Three Months Ended March 30,

2014 2013

------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

Softwood 120.6 100.1 $ 5,379 156.0 87.0 $ 4,573

Hardwood 123.9 115.7 7,759 94.6 97.0 6,055

Biomass 29.3 29.3 646 44.9 44.9 819

----------------------------------------------------------------------------

273.8 245.1 13,784 295.5 228.9 11,447

Other sales 662 706

----------------------------------------------------------------------------

Net sales $ 14,446 $ 12,153

----------------------------------------------------------------------------

Adjusted EBITDA $ 4,458 $ 2,992

Adjusted EBITDA margin 31% 25%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 100 thousand m3, 116 thousand m3

and 29 thousand m3, respectively, during the first quarter. This represents a

year-over-year increase in sales volume of 7%. Approximately 38% of sales volume

was sold as sawlogs, 50% as pulpwood and 12% as biomass in the first quarter.

This compares to 27% sold as sawlogs, 53% as pulpwood and 20% as biomass in the

first quarter of 2013.

Net sales for the first quarter totaled $14.4 million compared to $12.2 million

for the same period last year, reflecting the positive impact of not operating

under the VMI program that resulted in the deferral of softwood sawlog sales

into the second quarter in 2013. Net sales also benefited from increases in

selling prices across most products and a more favourable product mix. The

weighted average log selling price was $60.88 per m3 in the first quarter, a 5%

increase from $57.77 per m3 in the same period of 2013.

Costs for the first quarter were $10.0 million, compared to $9.2 million in the

same period in 2013, due to 1% higher variable costs per m3 resulting primarily

from higher hardwood harvest volumes.

Adjusted EBITDA for the first quarter was $4.5 million, compared to $3.0 million

in the first quarter of 2013 reflecting improved market demand for most products

and the impact of the VMI program in 2013. Adjusted EBITDA margin increased to

31% from 25% in the prior year.

During the first quarter of 2014, NB Timberlands experienced no recordable

incidents among employees and one reportable incident among contractors.

Maine Timberlands

The table below summarizes operating and financial results for Maine Timberlands.

Three Months Ended March 29, Three Months Ended March 30,

2014 2013

------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

Softwood 71.6 71.3 $ 4,676 76.5 76.2 $ 4,342

Hardwood 32.5 27.1 1,991 25.7 26.4 1,607

Biomass 6.7 6.7 61 7.7 7.7 81

----------------------------------------------------------------------------

110.8 105.1 6,728 109.9 110.3 6,030

Other sales 69 69

----------------------------------------------------------------------------

Net sales $ 6,797 $ 6,099

----------------------------------------------------------------------------

Adjusted EBITDA $ 2,477 $ 2,028

Adjusted EBITDA margin 36% 33%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 71 thousand m3, 27 thousand m3,

and 7 thousand m3, respectively, during the first quarter. This represents a

year-over-year decrease in sales volume of 5%. Approximately 55% of sales volume

was sold as sawlogs, 39% as pulpwood and 6% as biomass during the first quarter.

This compares to 56% sold as sawlogs, 37% as pulpwood and 7% as biomass in the

first quarter of 2013.

Net sales for the first quarter totaled $6.8 million compared to $6.1 million

for the same period last year. The improvement was the result of improved

pricing across most products and the positive impact of foreign exchange

movements. The weighted average log selling price was $67.75 per m3 in the first

quarter, a 17% increase from $57.95 per m3 in the same period of 2013 in

Canadian dollar terms. Weighted average log selling prices in U.S. dollar terms

increased 7% year-over-year.

Costs for the first quarter were $4.3 million, compared to $4.1 million during

the same period in 2013. This increase primarily reflects adverse foreign

exchange movements during the year as variable costs per m3 increased 11% in

Canadian dollar terms compared to 2% in U.S. dollar terms.

Adjusted EBITDA for the first quarter was $2.5 million, compared to $2.0 million

for the same period in 2013, while Adjusted EBITDA margin increased from 33% to

36%.

There were no recordable safety incidents among employees and contractors during

the first quarter of 2014.

Market Outlook

The following Market Outlook contains forward-looking statements about Acadian

Timber Corp.'s market outlook for the remainder of fiscal 2014. Reference should

be made to the "Forward-looking Statements" section of this news release. For a

description of material factors that could cause actual results to differ

materially from the forward-looking statements in the following, please see the

Risk Factors section of our management's discussion and analysis of Acadian's

most recent Annual Report and Annual Information Form available on our website

at www.acadiantimber.com or filed with SEDAR at www.sedar.com.

The U.S. housing market has struggled in 2014 despite significant increases in

pent up demand. While severe winter weather is almost certainly behind much of

the slowdown, underlying demand remains weak as traditional buyers continue to

defer home purchases while they wait for employment conditions to strengthen

further. Although the current housing outlook is uncertain, almost all industry

watchers are forecasting year-over-year increases in total housing starts of

approximately 15% in 2014 with increases of the same magnitude forecast for

2015.

Meanwhile, Acadian's key solid wood customers continue to operate at high levels

and, following the New Brunswick government's announcement of its Forestry Plan

in mid-March, there have been announcements of significant capital investments

and additional operating shifts at Irving's St. Leonard and Kedgwick sawmills

and Twin Rivers' Plaster Rock sawmill. This is in addition to last summer's

announcement of Irving's new sawmill in Portage, Maine. As a result, we expect

to see continued strong demand for softwood sawlogs in the region.

In addition to our positive outlook for softwood sawlogs, markets for hardwood

sawlogs have been positive and are expected to remain stable while demand and

pricing for hardwood pulpwood continues to be strong. While Acadian has been

successful in selling its softwood pulpwood production, this market continues to

be challenging owing to the closure of regional groundwood mills. Fortunately,

this product represents only a small portion of Acadian's sales and an even

lower proportion of our operating earnings. Biomass markets are mixed owing to a

slowdown in export markets, with demand and pricing expected to remain

reasonable offering modest margins.

Quarterly Dividend

Acadian is pleased to announce a dividend of $0.20625 per share, payable on July

15, 2014 to shareholders of record on June 30, 2014.

Acadian Timber Corp. is a leading supplier of primary forest products in Eastern

Canada and the Northeastern U.S. With a total of 2.4 million acres of land under

management, Acadian is the second largest timberland operator in New Brunswick

and Maine.

Acadian owns and manages approximately 1.1 million acres of freehold timberlands

in New Brunswick and Maine, and provides management services relating to

approximately 1.3 million acres of Crown licensed timberlands in New Brunswick.

Acadian also owns and operates a forest nursery in Second Falls, New Brunswick.

Acadian's products include softwood and hardwood sawlogs, pulpwood and biomass

by-products, sold to approximately 90 regional customers.

Acadian's business strategy is to maximize cash flows from its existing

timberland assets while growing our business by acquiring assets on a value

basis and utilizing our operations-oriented approach to drive improved

performance.

Acadian's shares are listed for trading on the Toronto Stock Exchange under the

symbol ADN.

For further information, please visit our website at www.acadiantimber.com.

Forward-Looking Statements

This News Release contains forward-looking information within the meaning of

applicable Canadian securities laws that involve known and unknown risks,

uncertainties and other factors that may cause the actual results, performance

or achievements of Acadian Timber Corp. and its subsidiaries (collectively,

"Acadian"), or industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. When used in this News Release, such statements may

contain such words as "may," "will," "intend," "should," "expect," "believe,"

"outlook," "predict," "remain," "anticipate," "estimate," "potential,"

"continue," "plan," "could," "might," "project," "targeting" or the negative of

these terms or other similar terminology. Forward-looking information in this

News Release includes, without limitation, statements made in the section

entitled "Market Outlook" and other statements regarding management's beliefs,

intentions, results, performance, goals, achievements, future events, plans and

objectives, business strategy, growth strategy and prospects, access to capital,

liquidity and trading volumes, dividends, taxes, capital expenditures, projected

costs, market trends and similar statements concerning anticipated future

events, results, achievements, circumstances, performance or expectations that

are not historical facts. These statements, which reflect management's current

expectations regarding future events and operating performance, are based on

information currently available to management and speak only as of the date of

this News Release. All forward-looking statements in this News Release are

qualified by these cautionary statements. Forward-looking statements involve

significant risks and uncertainties, should not be read as guarantees of future

performance or results, should not be unduly relied upon, and will not

necessarily be accurate indications of whether or not such results will be

achieved.

Factors that could cause actual results to differ materially from the results

discussed in the forward-looking statements include, but are not limited to:

general economic and market conditions; product demand; concentration of

customers; commodity pricing; interest rate and foreign currency fluctuations;

seasonality; weather and natural conditions; regulatory, trade or environmental

policy changes; changes in Canadian income tax law; economic situation of key

customers; Brookfield's ability to source and secure potential investment

opportunities; the availability of potential acquisitions that suit Acadian's

growth profile; and other risks and factors discussed under the heading "Risk

Factors" in each of the Annual Information Form dated March 28, 2014 and other

filings of Acadian made with securities regulatory authorities, which are

available on SEDAR at www.sedar.com. Forward-looking information is based on

various material factors or assumptions, which are based on information

currently available to Acadian. Material factors or assumptions that were

applied in drawing a conclusion or making an estimate set out in the

forward-looking information may include, but are not limited to: anticipated

financial performance; anticipated market conditions; business prospects; the

economic situation of key customers; strategies; regulatory developments;

exchange rates; the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour and services and the

ability to obtain financing on acceptable terms. Readers are cautioned that the

preceding list of material factors or assumptions is not exhaustive. Although

the forward-looking statements contained in this News Release are based upon

what management believes are reasonable assumptions, Acadian cannot assure

readers that actual results will be consistent with these forward-looking

statements. The forward-looking statements in this News Release are made as of

the date of this News Release, and should not be relied upon as representing

Acadian's views as of any date subsequent to the date of this News Release.

Acadian assumes no obligation to update or revise these forward-looking

statements to reflect new information, events, circumstances or otherwise,

except as may be required by applicable law.

Acadian Timber Corp.

Interim Consolidated Statements of Net Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended

(CAD thousands) March 29, 2014 March 30, 2013

----------------------------------------------------------------------------

Net sales $ 21,243 $ 18,252

----------------------------------------------------------------------------

Operating costs and expenses

Cost of sales 13,179 11,988

Selling, administration and other 1,463 1,604

Reforestation - 5

Depreciation and amortization 136 141

----------------------------------------------------------------------------

14,778 13,738

----------------------------------------------------------------------------

Operating earnings 6,465 4,514

Interest expense, net (797) (739)

Other items

Fair value adjustments (1,190) 19

Unrealized exchange loss on long-term debt (3,096) (1,842)

Gain on sale of timberlands 96 -

----------------------------------------------------------------------------

Earnings before income taxes 1,478 1,952

Current income tax expense (297) -

Deferred income tax expense (484) (661)

----------------------------------------------------------------------------

Net income $ 697 $ 1,291

----------------------------------------------------------------------------

Net income per share - basic and diluted $ 0.04 $ 0.08

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statements of Comprehensive Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended

(CAD thousands) March 29, 2014 March 30, 2013

----------------------------------------------------------------------------

Net income $ 697 $ 1,291

----------------------------------------------------------------------------

Other comprehensive income (loss)

Items that may be reclassified subsequently

to net income:

Unrealized foreign currency translation

income 3,697 2,209

Amortization of derivatives designated as

hedges (47) (49)

----------------------------------------------------------------------------

Comprehensive income $ 4,347 $ 3,451

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Balance Sheets

(unaudited)

----------------------------------------------------------------------------

As at December 31,

(CAD thousands) March 29, 2014 2013

----------------------------------------------------------------------------

ASSETS

Current Assets

Cash and cash equivalents $ 11,039 $ 8,564

Accounts receivable and other assets 8,154 7,673

Inventory 3,098 1,380

----------------------------------------------------------------------------

22,291 17,617

Timber 242,514 240,143

Land, roads and other fixed assets 32,730 32,268

Intangible assets 6,140 6,140

----------------------------------------------------------------------------

$ 303,675 $ 296,168

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 9,452 $ 7,680

Dividends payable to shareholders 3,451 3,451

----------------------------------------------------------------------------

12,903 11,131

Long-term debt 79,648 76,496

Deferred income tax liability 28,035 26,348

Shareholders' equity 183,089 182,193

----------------------------------------------------------------------------

$ 303,675 $ 296,168

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statements of Cash Flows

(unaudited)

----------------------------------------------------------------------------

Three Months Ended

(CAD thousands) March 29, 2014 March 30, 2013

----------------------------------------------------------------------------

Cash provided by (used for):

----------------------------------------------------------------------------

Operating activities

Net income $ 697 $ 1,291

Adjustments to net income:

Deferred income tax expense 484 661

Depreciation and amortization 136 141

Fair value adjustments 1,190 (19)

Unrealized exchange loss on long-term debt 3,096 1,842

Interest expense, net 797 739

Interest paid, net (801) (744)

Gain on sale of timberlands (96) -

Net change in non-cash working capital and

other 326 (154)

----------------------------------------------------------------------------

5,829 3,757

----------------------------------------------------------------------------

Financing activities

Dividends paid to shareholders (3,451) (3,451)

----------------------------------------------------------------------------

(3,451) (3,451)

----------------------------------------------------------------------------

Investing activities

Proceeds from sale of timberlands 97 -

----------------------------------------------------------------------------

97 -

----------------------------------------------------------------------------

Increase in cash and cash equivalents during

the period 2,475 306

Cash and cash equivalents, beginning of

period 8,564 6,136

----------------------------------------------------------------------------

Cash and cash equivalents, end of period $ 11,039 $ 6,442

----------------------------------------------------------------------------

Reconciliations to Adjusted EBITDA and Free Cash Flow

----------------------------------------------------------------------------

Three Months Ended

(CAD thousands) March 29, 2014 March 30, 2013

----------------------------------------------------------------------------

Net income $ 697 $ 1,291

Add (deduct):

Interest expense, net 797 739

Current income tax expense 297 -

Deferred income tax expense 484 661

Depreciation and amortization 136 141

Fair value adjustments 1,190 (19)

Unrealized exchange loss on long-term debt 3,096 1,842

----------------------------------------------------------------------------

Adjusted EBITDA 6,697 4,655

Add (deduct):

Interest paid on debt, net (801) (744)

Gain on sale of timberlands (96) -

Proceeds from sale of timberlands 97 -

Current income tax expense (297) -

----------------------------------------------------------------------------

Free cash flow $ 5,600 $ 3,911

----------------------------------------------------------------------------

Dividends declared $ 3,451 $ 3,451

----------------------------------------------------------------------------

Payout ratio 62% 88%

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Acadian Timber Corp.

Robert Lee

Investor Relations and Communications

604-661-9607

rlee@acadiantimber.com

www.acadiantimber.com

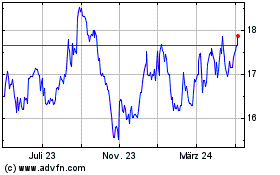

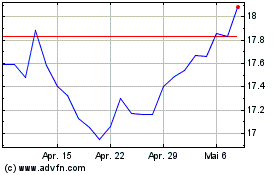

Acadian Timber (TSX:ADN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Acadian Timber (TSX:ADN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024