Robex Extends Life of Mine for Nampala Gold Mine With Updated

Technical Study

HIGHLIGHTS:

-

Increased Reserves Life of Mine (“LoM”): Nampala

mine life extended to December 2026 (from June 2026) with Mineral

Reserves at 121Koz ounces @ 0.93g/t;

-

Potential to grow Mineral Reserves: Indicated

Mineral Resources (inclusive of Mineral Reserves) of 243Koz

@ 0.94g/t Au;

-

Economics: Consensus Case (Gold Price:

US$2,490/oz):

-

Pre-tax Net Present Value at discount rate of 5%

(“NPV5%”) of US$106.1M, and

-

Post-tax NPV5% of US$71.1M.

-

Average annual gold production: Nampala is

expected to produce 52,000 ounces gold per year over LoM

-

Costs in line with budget: LoM All-In Sustaining

Costs (“AISC”) of US$1,106 /oz.

QUÉBEC CITY, Jan. 16, 2025 (GLOBE NEWSWIRE) --

Robex Resources Inc. (“Robex” or the

“Company”) (TSXV: RBX) is pleased to announce the

results of an updated NI43-101 technical report (the

“Study” or the “Report”) for its

Nampala Mine (“Nampala”) in Mali.

Robex Managing Director Matthew

Wilcox commented: “Increasing the life of mine at

Nampala is an important step for Robex to define the future for

this asset. The team at Nampala has done a fantastic job

of continuing to produce gold at low costs in a challenging

environment.

Nampala is expected to continue to produce

free cash on a monthly basis and continue to support our

development of the Kiniero gold mine in Guinea, which we have

demonstrated can produce 139,000oz gold per year over its 9.5-year

mine life and is set to pour first gold later this year.”

The Report was prepared in accordance with

Canadian Securities Administrators’ National Instrument 43-101 -

Standards of Disclosure for Mineral Projects (“NI

43-101”). The independent NI 43-101 technical report

supporting the Nampala Study will be published on SEDAR at

www.sedar.com within the next 45 days.

Napala’s updated economic model was run at two

gold prices;

- Scenario 1 with

gold price of US$1,800/oz used for the Mineral Reserve, and

- Scenario 2 with

the S&P consensus long-term gold price at end of October 2024,

ranging from US$2,490/oz to US$2,314/oz.

The Study extends Nampala Life of Mine (“LoM”)

to December 2026 (versus June 2026) with Mineral Reserves of 121Koz

at 0.93 g/t Au. The post-tax NPV5% at consensus gold

price is US$71.1m as shown in Table 1

Table 1: Summary of NPV Scenarios

(as of 1 September 2024)

Scenario

|

Unit

|

NPV 5% |

|

Pre-Tax |

Post-Tax |

|

Scenario 1: $1800/oz |

US$m |

48.2 |

28.8 |

|

Scenario 2: The S&P consensus gold price (at end October

2024) |

US$m |

106.1 |

71.1 |

TECHNICAL STUDY DETAILS

Overview

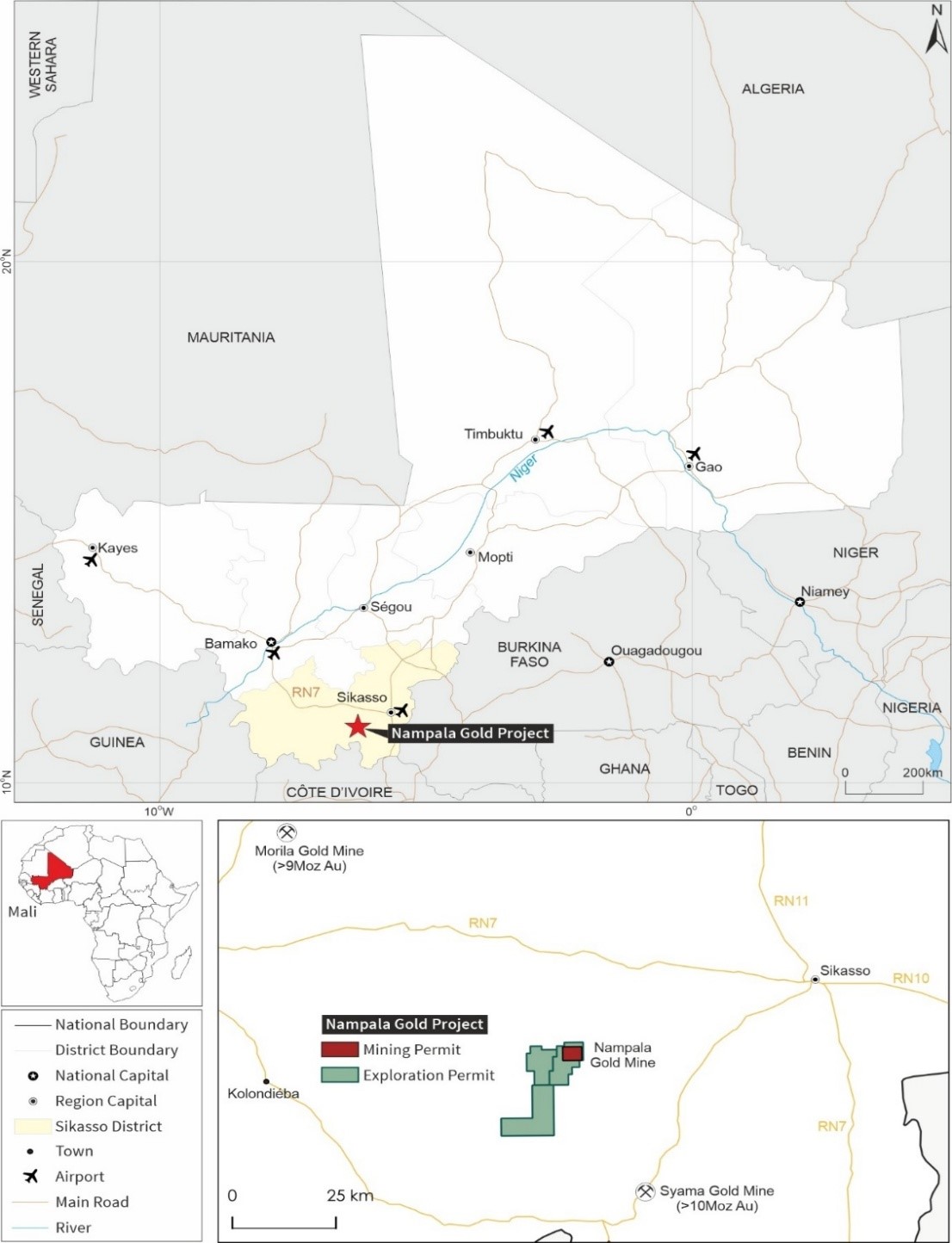

The Nampala Property is comprised of a

contiguous block of one mining permit (Nampala Mine) and three

adjoining exploration permits (Mininko, Gladie and Kamasso). The

Property is located in the Sikasso and Kolondieba Circles of the

Sikasso Region in southern Mali, and is approximately 255km

southeast of Bamako, the capital of Mali, and ~60km southwest of

Sikasso, the capital of the Sikasso Region as shown in Figure 1 .

The Nampala Gold Mine is approximately 40km northwest of Resolute

Mining’s 4.0Moz Syama Gold Mine.

Within the Property, the Nampala Gold Mine is a

Production Project that involves ongoing mining and processing

activities. The adjacent exploration permits are advanced

exploration projects with detailed exploration work, including

drilling and trenching.

Figure 1 Regional location of the Nampala

Gold Project

Geology

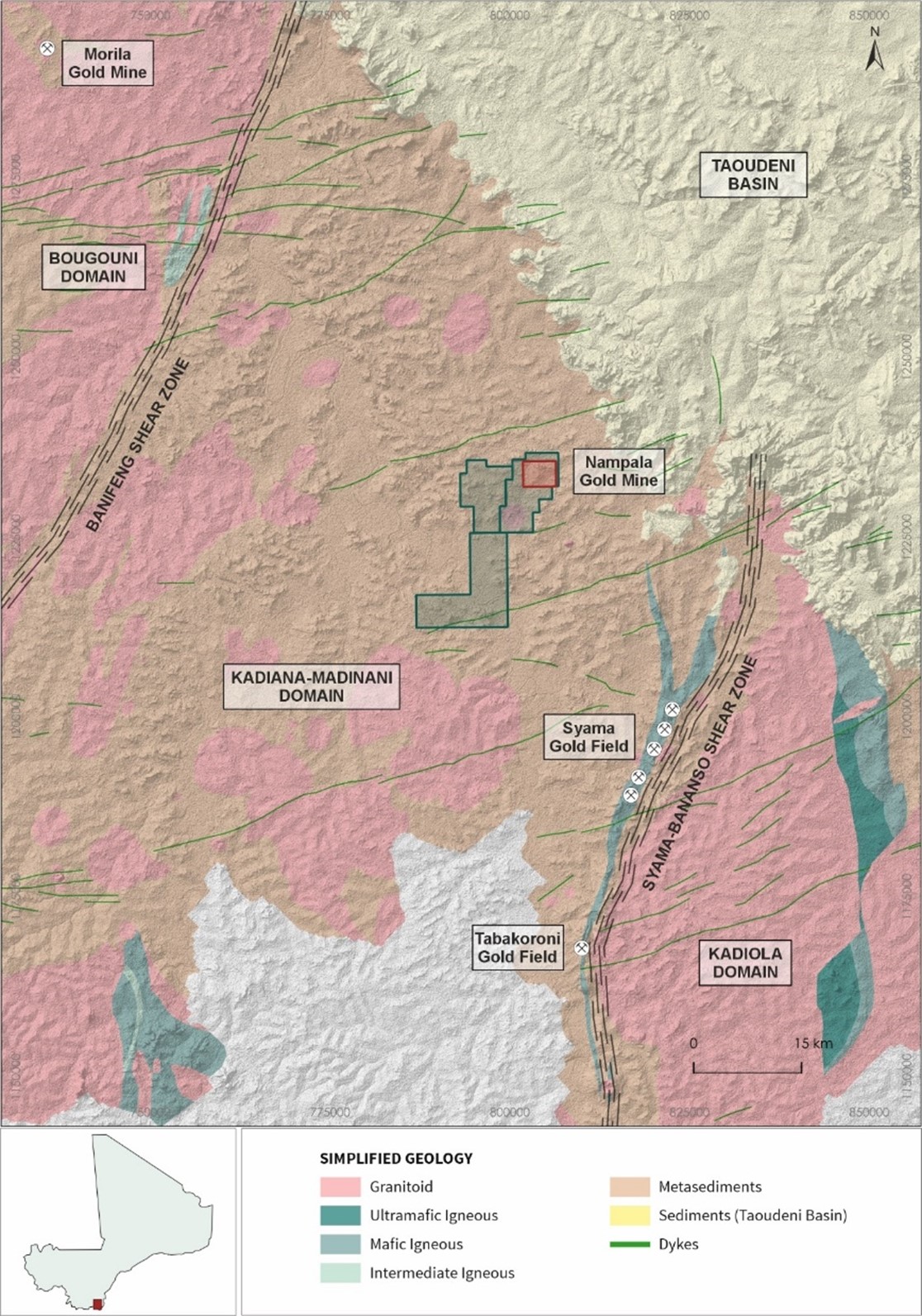

The Property is located within the

Kadiana-Madinana Domain of the Birimian Supergroup in southern Mali

(Figure 2). This Domain is located within the broader Baoulé-Mossi

Domain, a significant greenstone belt of West Africa renowned for

its gold mineralisation.

Figure 2 Simplified Regional Geology of the

Bagoe Greenstone Belt

Source: Micon (2024) modified from Ballo, et al.

(2015)

The Birimian Supergroup is a significant

component of the West African Craton, formed around 2.2 Ga to 2.0

Ga. It comprises a sequence of intensely deformed and metamorphosed

volcanic and sedimentary rocks. The Birimian is typically divided

into two parts: a lower volcanic group with basalts and andesites

and an upper sedimentary group with greywackes, sandstones, and

shales. These turbiditic sedimentary rocks are significant, as they

often host significant gold mineralisation.

The local geology of the Nampala Property and

its surrounding permits are primarily based on the studies

conducted by Baril et al. (2011), Boisse et al. (2020), the mapping

and studies completed by BRGM and the geological interpretations

made by Micon International Co Limited (Micon) who were responsible

for the geological and resource modelling for this Report, and

overall compilation thereof.

The Nampala Mine and the adjacent Mininko

permit exhibit geological characteristics like those observed

within the neighbouring Gladie and Kamasso permits. The primary

lithological units, include significant marker horizons such as

graphitic shales that extend southward from the Nampala Permit into

these areas, continuing beyond the southwestern boundary of

Kamasso.

The Nampala Mine and the Mininko permit are

situated within the pelitic shale and arenite units of the Bagoe

Formation, which belong to the Birimian Supergroup. This formation

trends north-northeast, spanning several hundred kilometres into

Côte d'Ivoire and dipping beneath the Taoudeni Basin to the

north.

Gold mineralisation of the Nampala Property is

like many other Palaeoproterozoic gold deposits in the Baoulé-Mossi

domain of the West African Craton that formed during a craton-wide

gold metallogenic event late in the Eburnean Orogeny (Lawrence,

Treloar, Rankin, Harbidge, & Holliday, 2013).

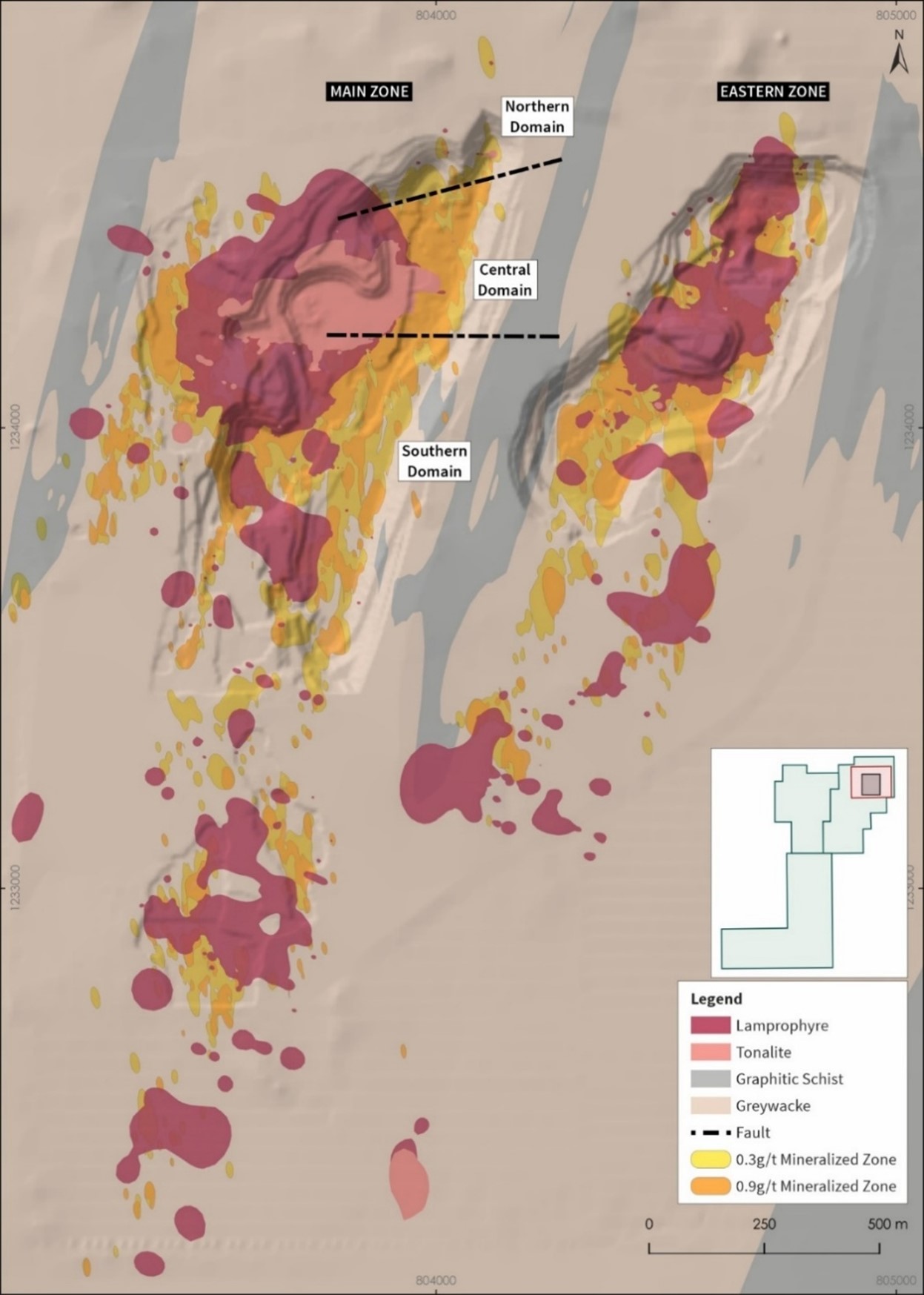

Gold mineralisation is primarily hosted within

competent, coarse-grained turbiditic units, specifically greywackes

and siliceous sandstones. These lithologies, characterised by their

brittle nature, facilitated the fracturing and subsequent vein

formation. Gold occurs predominantly within structurally controlled

tension quartz vein systems and stockworks that exploit these

fractures and associated zones of enhanced porosity.

The tonalite intrusion, enveloped by

lamprophyres, also contains mineralised quartz veins that share a

similar orientation with those observed in the metasediments,

suggesting a common structural control on mineralisation. Although

the lamprophyre intrusions exhibit limited mineralisation, confined

primarily to their margins, they appear to influence the spatial

distribution of gold significantly. This is evidenced by the

preferential concentration of gold mineralisation in the

metasediments proximal to the lamprophyre contacts, supported by

lithological competency contrasts and geochemical gradients.

Conversely, shear zones are predominantly

developed within the more ductile, often graphitic, shales. These

shear zones, however, are typically barren of significant gold

mineralisation.

Figure 3 Geology of the Nampala Gold

Mine

Source: Micon (2024) from the Robex Mapping Data

and Micon 2024 interpretation

Mineral Resources and

Reserves

The 2024 Mineral Resource Estimate (MRE) was

prepared by Micon and has an effective date of 30th September 2024.

It has been constrained by a topographic surface of the same date.

The 2024 Mineral Resource statement is presented in Table 2

Table 2: Nampala Mineral Resource Statement,

effective date 30th September

2024

|

Regolith |

Cut-Off

(g/t Au) |

Tonnage

(Mt) |

Gold Grade

(g/t Au) |

Contained Gold

(koz) |

|

INDICATED |

| Oxide |

0.35 |

5.85 |

0.84 |

158.33 |

| Transition |

0.43 |

2.09 |

1.13 |

76.03 |

| Fresh |

1.89 |

0.10 |

3.00 |

9.36 |

|

TOTAL |

- |

8.04 |

0.94 |

243.72 |

|

INFERRED |

|

| Oxide |

0.35 |

0.32 |

0.79 |

8.05 |

| Transition |

0.43 |

0.23 |

1.62 |

8.50 |

| Fresh |

1.89 |

0.01 |

2.53 |

0.41 |

|

TOTAL |

- |

0.56 |

0.95 |

16.97 |

Source: Micon (2024)

Notes:

- The Mineral

Resource Estimate has been prepared in accordance with National

Instrument 43-101 (NI 43-101) Standards of Disclosure for Mineral

Projects with an effective date of 30 September 2024. Dr Ryan

Langdon of Micon is the QP responsible for the MRE.

- The database

was closed on 10 September 2024 and the Mineral Resources were

constrained to a topographic survey dated 30 September

2024.

- To

demonstrate Reasonable Prospects for Eventual Economic Extraction

(RPEEE), open pit Mineral Resources were constrained by an

optimised pit shell. All blocks above the cut-off and within the

pit shell were included in the Mineral Resources. Robex created the

optimised pit shell.

- Cut-off

grades for Mineral Resource reporting were calculated using a gold

price of US$2,200 oz and are: oxide (laterite, mottled zone,

saprolite) 0.35 g/t Au; transition (upper saprock, lower saprock)

0.43 g/t Au; and fresh (fresh rock)1.89 g/t Au.

- Mineral

Resources are not Mineral Reserves and have not demonstrated

economic viability. There is no certainty that all or any part of

the estimated Mineral Resources will be converted into Mineral

Reserves.

- Average

density values used are: laterite and mottled zone 1.56 t/m3 to

1.74 t/m3; saprolite 1.55 t/m3 to 1.68 t/m3; upper saprock 2.05

t/m3 to 2.24 t/m3; lower saprock 2.40 t/m3to 2.42 t/m3; and fresh

rock 2.63 t/m3to 2.74 t/m3.

- Grade

interpolation by ordinary kriging using a block model with a block

size of 10 m (X) by 20 m (Y) by 5 m (Z). Outlier management used

grade capping for extreme outliers and a restricted search

neighbourhood for outliers on a domain-by-domain basis.

- Mineral

Resources in volumes with a drill grid spacing of 40 m by 40 m were

classified as Indicated Mineral Resources. All other volumes were

classified as Inferred Mineral Resources. To limit extrapolation, a

wireframe was used to constrain the interpolated blocks to

approximately 10 m below the base of the drilling.

- Totals

presented in this table reported from the Mineral Resource models,

are subject to rounding, and may not total exactly.

The Mineral Reserves for Nampala were derived

from the Mineral Resources using the modifying factors outlined in

the Mining Plan. All Mineral Reserves are classified as Probable,

as they are based on Indicated Mineral Resources. Inferred and

Unclassified Mineral Resources were excluded from the

resource-to-reserve conversion, ensuring compliance with reporting

standards. The stockpiles are excluded from the Mineral Reserve

estimate, as it is not classified as a Mineral Resource and

therefore cannot be converted to Reserves. The Nampala Mineral

Reserves with effective date 30th September 2024 is presented

in Table 3.

Table 3: Nampala Mine Mineral

Reserves, effective date 30th

September 2024

|

Nampala Mine Mineral Reserves |

Ore Type

|

Proven |

Probable |

Ore

(Mt) |

Gold Grade

(g/t Au) |

Total Gold

(koz) |

Ore

(Mt) |

Gold Grade

(g/t Au) |

Total Gold

(koz) |

|

Oxide |

- |

- |

- |

3.268 |

0.90 |

94.61 |

| Transition |

- |

- |

- |

0.776 |

1.06 |

26.35 |

|

Total |

- |

- |

- |

4.044 |

0.93 |

120.96 |

Source: Robex (2024)

Notes:

- The Mineral

Reserves have been depleted for mining up to the 30th September

2024.

- Figures have

been rounded to the appropriate level of precision for

reporting.

- Due to

rounding, some columns or rows may not compute exactly as

shown.

- Mineral

Reserves are stated as in-situ dmt (dry metric tonnes).

- Mining

recovery of 100% and waste dilution of 6% were applied to each

pit.

- Mineral

Reserves reporting were calculated at a cut-off grade of 0.4g/t for

oxide (laterite, mottled zone, saprolite and transition).

- Probable

Mineral Reserves were derived from Indicated Mineral

Resources.

- There are no

known legal, political, environmental, or other risks that could

materially affect the Mineral Reserves.

Exploration

Non-invasive exploration completed by Robex on

the Nampala Property has been extensive, and Property-wide. First

commenced in 2005, the Property-wide exploration has included:

- Remote

Sensing: a remote sensing assessment by GaiaPix in 2022 that

included a photogeological interpretation of satellite-borne remote

sensing data using Landsat 8 OLI, SPOT 7, Shuttle Radar Topography

Mission (SRTM) and regional airborne geophysical data. The

geological interpretation of the remote-sensing data used anaglyph

images to generate 3D topographic relief renditions. GaiaPix

concluded that the geological mapping delineated structural

elements that represented targets for gold exploration and that

surface soil geochemical sampling was the recommended follow-up

prospecting tool.

-

Geophysics: during the 2005 to 2008 exploration campaign, a 25

m-spaced IP survey was conducted over the Nampala geochemical

anomaly. In 2021, Robex engaged Eureka Consulting (Pty) Ltd

(Eureka) to merge two historical geophysical data sets comprising

magnetics and resistivity. Geophysical data has proven valuable in

correlating the known geology and structures against the

bulk-leach-extractable-gold (BLEG) Au-in-soil geochemical

fabric.

- Rock Chip

Sampling: during 2009, Robex conducted fieldwork across its

exploration permits. A total of 255 rock chip and grab samples were

collected.

- Soil

Sampling: In line with the recommendations from GaiaPix, Robex

commenced a Property-wide BLEG soil sampling geochemistry campaign

in December 2021. The BLEG sampling method was used to accurately

measure fine-grade gold and sampling heterogeneity, reducing the

inherent nugget effect in samples. There is a demonstrated strong

relationship between the BLEG Au-in-soil, magnetics, intrusives,

and structures.

Drilling

Since drilling first commenced at Nampala

pre-1992, >342,000 m of drilling has been completed on the

Property. This includes a combination of DD, RC, AC, Rotary Air

Blast (RAB) and auger drilling. Current drilling by Robex commenced

in 2005. Robex drilling accounts for >312,000 m of the drilling

completed on the Property. Drilling has primarily focussed on

drilling the Nampala deposit of the Nampala Mine, accounting for

~74% of all drilling. Drilling purposes has included exploration,

verification, sterilisation, resource, and reserve delineation,

mining geotechnical and water. Drilling completed on the Nampala

Property can be summarised as:

- Historical

drilling (pre-2005) accounts for 575 drill holes for 30,073 m –

almost exclusively AC and RAB drilling.

- Robex drilling

(2005 to present) accounts for 5,668 drill holes for 312,851 m (126

x DD drill holes for 21,640 m; 874 x RC drill holes for 88,044 m;

1,806 AC drill holes for 160,735 m; 352 RAB drill holes for 16,465

m; and 2,510 auger drill holes for 25,967 m).

Sample Preparation, Analysis and Security

The Robex procedures for geological sample

preparation, analysis, and security are well documented and

publicly available. They adhere to best practice procedures and

protocols. Robex has utilised two independent commercial

laboratories to analyse drilling samples - Bamako SGS Mineral

Laboratory in Mali (SGS Bamako) with accreditation number T0652,

and SGS Robex-Nampala laboratory at the Nampala mine site, which

does not hold formal accreditation. The sample preparation

methodology is standard comprising crushing and pulverising of

samples to collect a subsample for fire assay using a lead

collection fire assay technique with an Atomic Absorption

Spectroscopy (AAS) finish. The Robex QA/QC protocol includes the

insertion of standards, blanks and field duplicates. One standard,

one blank and one field duplicate are inserted into every batch of

samples, for 20 samples per batch.

Mining Methods

Mining at Nampala is conducted using a

conventional open-pit method, involving contractor operated

hydraulic excavators for loading and dump trucks for hauling. In

areas of transitional lithology and laterites, drilling and

blasting are employed, although most of the material is mined

through free digging.

The mining sequence at Nampala is primarily

influenced by the plant requirements and the tropical climate’s dry

and wet seasons. Oxide and transitional materials differ in

processing throughput, with transitional ore typically having a

higher grade than oxide ore.

Ore from the Nampala and East Pits will be

partially transported to the ROM pad near the crusher, while the

remainder will be stockpiled at various locations around the pits

to ensure a steady feed to the plant during the wet season. The ore

will be segregated into stockpiles based on grade to facilitate

optimal blending.

Processing Operations

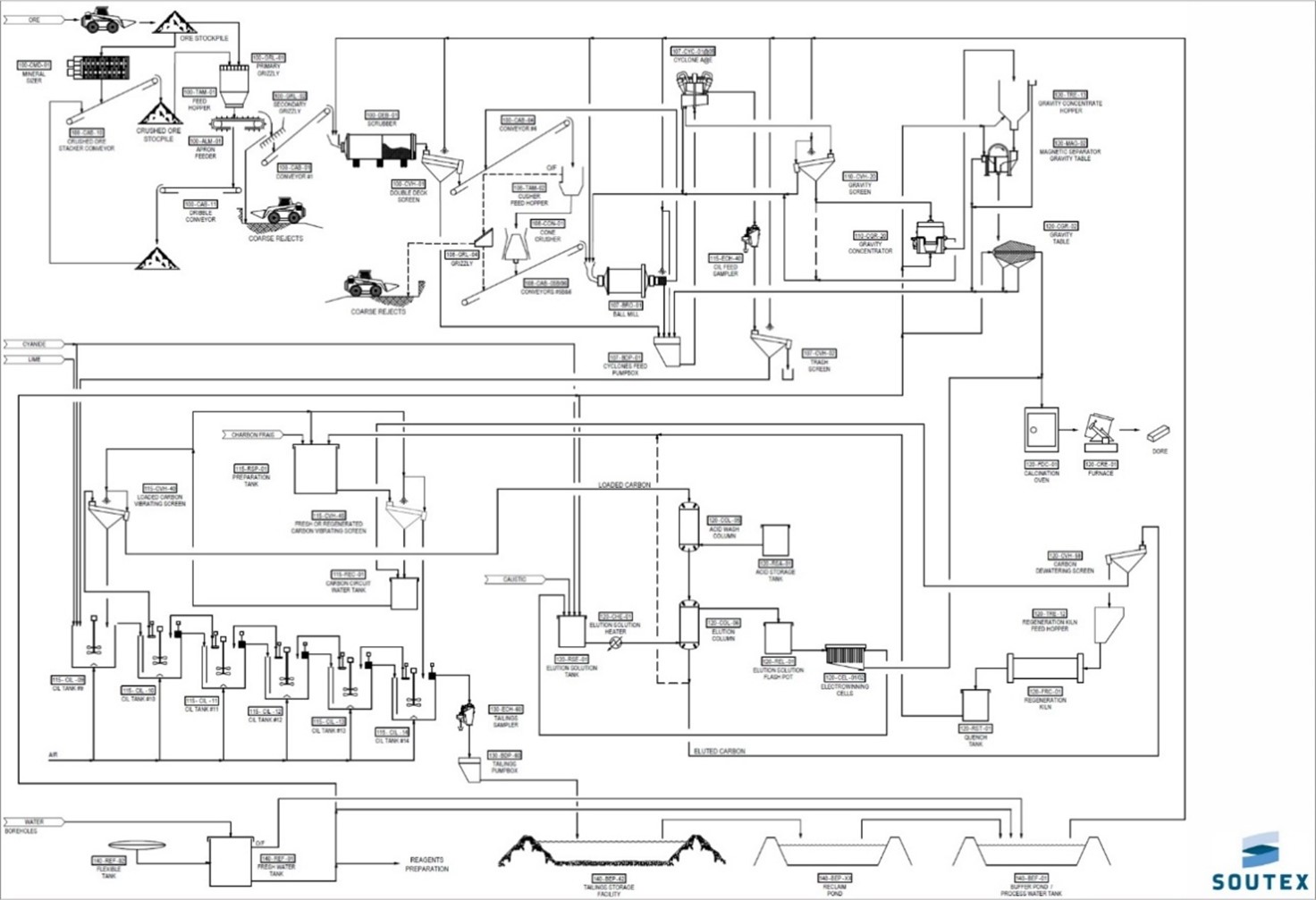

Since 2017, the Nampala Mine has been in

continuous operation, processing primarily oxide material

(saprolite). The current processing flowsheet (Figure 4) for the

Nampala Mine employs a design consisting of a scrubber, ball mill

circuit, and cyclone classification. Gold recovery is achieved

through a combination of gravity concentration followed by a

carbon-in-leach (“CIL”) process and Zadra elution. Since the

initial implementation of the flowsheet), enhancements have been

made to improve processing efficiency. A mineral sizer was added to

manage large ore blocks, ensuring smoother material handling, and a

cone crusher was integrated into the grinding circuit to address

critical-size particles, optimising overall grinding

performance.

Continuous efforts have been made to reduce

reagent consumption, while lime consumption remains high, as is

typical for saprolite, cyanide consumption is notably low, with a

set point of less than 140 NaCN ppm in the first leach tank and no

further additions required.

The requirements associated with the current

process are the following:

- Ore: 5,800 t/d of

oxidised material with a minimal feed grade of 0.50 g/t Au.

- Water: 1

m3 of water per tonne of processed ore which 2/3 is

recirculated.

- Energy: 8 kWh/t to

12 kWh/t for the mill including operation support

infrastructures.

- Plant availability

of 90%.

Figure 4 Nampala Mine Process Plant

Flowsheet

The total gold produced since January 2017 is

approximately 370 koz Au. Mill throughput has shown an increasing

trend and attributable gold production has averaged 123.7 kg/month.

The mine has achieved consistent increases in throughput since

2020. Table 4 shows the production performance from 2020 to 2023.

However, in 2024, the introduction of harder transitional ore led

to a slight reduction in throughput.

The gold recovery shows an increasing trend to

early 2022, resulting from continuous plant optimisation. From

early 2022, the gold recovery averaged 88.8% which matches that

predicted by metallurgical testwork by Soutex in 2020 (88.8% to

88.9%). Plant availability has shown a constant trend and has

averaged 90.3% which matches industry norms. Compared to the 2020

predictions made by Soutex, during the period 2020 to 2023 the mill

throughputs were higher than predicted and mill feed gold grades

were higher by more than 10%. Target gold recoveries were met,

resulting overall in the total gold production being more than 25%

higher than predicted.

Table 4: Comparison of Predicted and

Actual Production and Recovery Data

|

Period |

Predicted

Plant

Feed

(t) |

Actual

Plant

Feed

(t) |

Predicted

Feed

Grade

(g/t Au) |

Actual

Feed Grade

(g/t Au) |

Predicted

Gold Rec.

(Au %) |

Actual

Gold Rec.

(Au%) |

Predicted

Gold Rec.

(Au oz) |

Actual

Gold Rec.

(Au oz) |

|

2020 |

1,905,000 |

1,886,317 |

0.83 |

0.94 |

88.8 |

88.6 |

45,400 |

50,348 |

|

2021 |

1,905,000 |

1,948,284 |

0.69 |

0.81 |

88.9 |

91.4 |

37,400 |

46,555 |

|

2022 |

1,905,000 |

2,025,463 |

0.67 |

0.81 |

88.8 |

88.6 |

36,300 |

46,650 |

|

2023 |

1,911,000 |

2,224,888 |

0.65 |

0.81 |

88.8 |

89.6 |

35,600 |

51,826 |

|

|

+6% |

+19% |

+1%

|

+26% |

Source: Micon (2024) from Soutex (2024) and

Robex (2024)

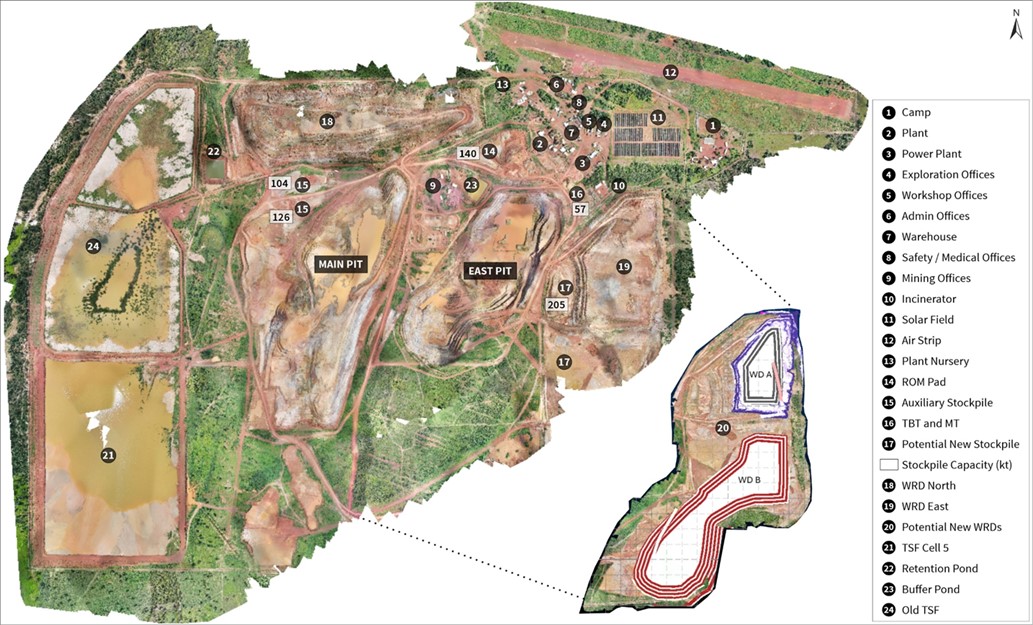

Infrastructure

The current Nampala mine boundary fence has a

total length of 12,900 m, enclosing an area of 803 ha. This

expansion ensures that the entire mining operation is within a

secured boundary, enhancing operational safety and site

management.

The Nampala Mine is supplied by two water

sources: fresh water and potable water. Potable water is currently

sourced from one of three available wells (Well No. 17). For fresh

water, 23 wells have been constructed, with 15 currently in

operation. These sources ensure a reliable water supply to support

operational and domestic needs at the site. Additional water

storage is maintained with a buffer water pond with a capacity of

32,734 m3 and a retention pond with a capacity of 32,474

m3.

The Nampala Mine relies on a hybrid power system

consisting of two energy sources: a solar plant and a thermal

(diesel) power plant. The solar plant includes 7,280 photovoltaic

panels with a total installed capacity of 3.39 MW, of which 96%

(3.25 MW) is utilised. The thermal power plant provides an

additional 10 MW of installed capacity. The system is further

supported by a 2.6 MWh battery storage unit, ensuring stability and

optimising energy use.

There are two waste dumps near the pits: Waste

Dump North, located north of both the East and West Pits, and Waste

Dump East, situated east of the East Pit. Waste Dump North had an

initial capacity of 3.8 Mm3 of waste, with a planned

expansion to accommodate an additional 21.3 Mt. As of October 2023,

the Waste Dump North is nearly full, and further expansion is not

feasible. Consequently, a new waste dump area was designated east

of the East Pit in November 2023 (East Waste Dump). An additional

area south of the East Pit has been identified and sterilised for

future expansions as a potential waste dump.

Construction of Tailings Pond Cell No. 5

commenced in October 2023. At its current level (340), the cell has

a capacity of 591,419 m3, equating to approximately 4 to

5 months of storage at a consolidated density of 1.4

t/m3. Plans are underway to extend Cell No. 5 to Level

345, a process expected to take approximately two months. Once

completed, the capacity will increase to 3.2 Mm3,

equivalent to 4.48 Mt, providing more than two years of storage

capacity. The expansion is permitted.

The principal stockpiles are located north of

the pits, near the processing plant. The principal stockpiles have

capacity of approximately 250 kt, categorised into high-grade,

medium-grade, and low-grade materials.

The Nampala Mine is equipped with a four-bed

medical clinic staffed by four nurses and a part-time medical

doctor. The facility also includes a pharmacy and a laboratory, the

latter currently under construction, to enhance on-site medical

services.

There are offices for administration, plant,

medical services, training, exploration, mining, geology, and

contractors. Other infrastructure on site includes a rubbish

treatment plant, warehouse, hangar and airstrip, plant nursery, and

communications systems.

The accommodation and welfare facilities at

Nampala include a lodging area for security personnel and a camp

equipped with a gym, mini shop, and canteen. The total lodging

capacity is 119 people. A kitchen dedicated to mill employees

provides up to 480 meals per day.

Figure 5 shows layout of the Nampala mine

infrastructure

Figure 5 Nampala Mine Infrastructure Layout

Capital and Operating Costs

The mine is currently in production so there is

no development capital cost required.

The total capital and closure costs from 1st

September 2024 until the end of the LOM are US$37.8m. This includes

sustaining capital at US$2.2M and capitalised stripping costs at

US$31.5 million and US$4.06M in Closure and contract termination

costs. Sustaining Capex was calculated with the latest operating

data updated as of December 2024.

The operating costs used in the economic

analysis are summarised in Table 5.

Table 5 Operating Costs Summary

Across the LOM, starting September 2024

|

Total |

Unit Cost |

Costs |

|

(US$ million) |

(US$/t ore milled) |

(per oz US$/oz) |

| Mining |

47,902 |

11.8 |

414 |

| Processing |

50,237 |

11.2 |

434 |

| General and

Administration |

21,221 |

4.7 |

184 |

| Transport, Insurance and

Refining |

224 |

0 |

2 |

| Royalty and Statutory

Cost |

36,078 |

8 |

312 |

| C1 Costs |

119,584 |

27.8 |

1,034 |

| C2 Costs |

125,885 |

29.2 |

1,089 |

| C3 Costs |

163,095 |

29.4 |

1,410 |

| AISC |

161,963 |

37.2 |

1,401 |

|

Revenue |

230,846 |

66 |

2,308 |

Source: Robex December (2024)

Economic Analysis

An updated economic assessment of the Nampala

Mine has been conducted, incorporating actual operational data and

the new technical inputs outlined in this Report. The economic

model was prepared by Australian based Infinity Corporate Finance

Pty Ltd., with input data sourced from a variety of contributors,

including consultants, current suppliers and contractors, and

Robex’s internal technical and financial teams. Key financial

parameters, such as the Project’s taxation regime and exchange

rates, were also provided by Robex.

The economic model was run at two gold prices;

Scenario 1 with gold price of US$1,800/oz used for the Mineral

Reserve and Scenario 2 with the S&P consensus long term gold

price at end of October 2024 as shown in Table 6.

Table 6: LoM Gold Price

|

LOM Gold Price |

Years |

2025 |

2026 |

2027 |

|

Scenario 1 Mineral Reserve |

US$/oz |

1,800 |

1,800 |

1,800 |

|

Scenario 2 S&P consensus gold price (end of October 2024) |

US$/oz |

2,490 |

2,431 |

2,320 |

The cashflow analysis excludes inflation and presents all financial

data in real US dollars as of 30th September 2024.

Only cashflows post 30th September 2024 are

considered.

The mine has an expected LOM of 27 months

(inclusive of stockpiles) from 30th September 2024. As

of 30th September 2024, based on consensus forward

gold prices and a 5% discount rate, the Project's estimated NPV is

US$71 million post-tax as show in in Table 7.

Table 7: Summary of NPV Scenario’s

(as of 1 September 2024)

Scenario

|

Unit

|

NPV 5% |

|

Pre-Tax |

Post-Tax |

|

Scenario 1: $1800/oz |

US$m |

48.2 |

28.8 |

|

Scenario 2: The S&P consensus gold price (at end October

2024) |

US$m |

106.1 |

71.1 |

Source: Robex December (2024)

Post-tax annual cash flows are show in Table

8.

Table 8: Post-tax cashflow at

consensus forward gold prices

|

Production Summary |

Unit |

Total / Average |

2024 |

2025 |

2026 |

2027 |

|

Ore & Waste Mined |

|

|

|

|

|

|

| Ore |

kt |

4,044 |

554 |

1,934 |

1,556 |

- |

| Waste |

kt |

11,935 |

1,599 |

6,969 |

3,367 |

- |

|

Grade |

g/t /Au |

0.93 |

0.85 |

0.88 |

1.02 |

- |

|

|

|

Ore Processed |

|

|

|

|

|

|

| Oxide |

kt |

3,723 |

564 |

1,899 |

1,260 |

- |

| Transitional |

kt |

776 |

4 |

208 |

564 |

- |

| Oxide |

g/t Au |

0.90 |

0.81 |

0.84 |

0.93 |

- |

|

Transitional |

g/t Au |

1.06 |

0.99 |

0.92 |

1.11 |

- |

|

|

|

Contained Metal |

|

|

|

|

|

|

| Processed |

koz |

130 |

14.80 |

57.20 |

57.90 |

- |

| Recovered |

koz |

115.4 |

13.14 |

50.81 |

51.69 |

- |

|

Recovery |

% |

- |

89% |

89% |

89% |

- |

|

|

|

Project Cashflows After Tax |

|

|

|

|

|

| Net Revenue |

US$ million |

230 |

24 |

100 |

106 |

- |

| Opex |

US$ million |

(120) |

(15) |

(60) |

(45) |

- |

| Tax |

US$ million |

(30) |

- |

(11) |

(16) |

(3) |

| Change in Working Capital |

US$ million |

- |

7 |

- |

(3) |

(4) |

| Capex |

US$ million |

- |

- |

- |

- |

- |

| Sustaining Capex |

US$ million |

(6) |

(.5) |

(2) |

(4) |

- |

| Annual

Cash Flow |

US$ million |

75 |

16 |

28 |

38 |

(7) |

Note: the figures have been rounded

Source: Infinity and Robex (2024)

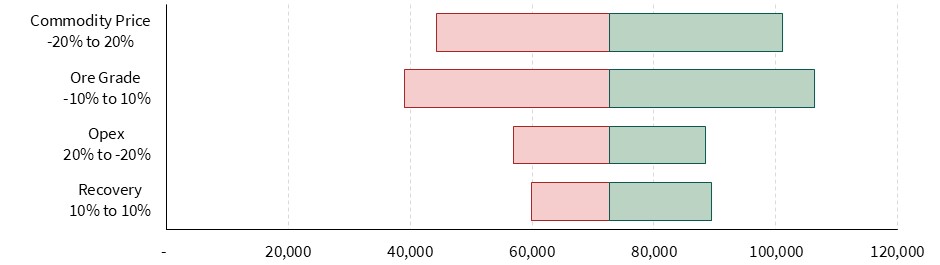

The Project value was evaluated through

sensitivity (Figure 6) analyses examining the impact of changes in

gold price and operating costs. The analysis indicates that the

Project is most sensitive to fluctuations in the gold price,

followed by changes in operating costs.

Figure 6 Post-tax

NPV5% Sensitivity

Qualified Person

Scientific or technical information in this

press release that relates to the geology and exploration history

of the Nampala Property was prepared or supervised by Andrew de

Klerk, B.Sc.(Hons.), Pr.Sci.Nat. (400030/11), SAIMM, GSSA Principal

Geologist and Project Manager, is a full-time employee for Micon

International Co Limited. Mr de Klerk is a professional

Geoscientist with the South African Council for Natural Scientific

Professions (Membership No. 400030/11). He is a member of the South

African Institute of Mining and Metallurgy (SAIMM) and a Fellow of

the Geological Society of Africa and has sufficient experience that

is relevant to the project under consideration which he is

undertaking to qualify as a Qualified Person

(“QP”) under NI 43-101.

Scientific or technical information in this

press release that relates to the geology and exploration history

of the Nampala Property was prepared or supervised by André

Bezuidenhout, a full-time employee for Micon International Co. Mr

Bezuidenhout is a Fellow of The Geological Society of London (No.

1044812) and a registered Professional Natural Scientist

(Pr.Sci.Nat. No. 008765) and has sufficient experience that is

relevant to the project under consideration which he is undertaking

to qualify as a QP under NI 43-101.

Scientific or technical information in this

press release that relates to the geological modelling and Mineral

Resources was prepared or supervised by Ryan Langdon, a full-time

employee for Micon International Co Ltd. Dr Langdon is a Fellow of

The Geological Society of London and a registered Chartered

Geologist (No. 1022491) and has sufficient experience that is

relevant to the project under consideration which he is undertaking

to qualify as a QP under NI 43-101.

Scientific or technical information in this

press release that relates to the Mineral Reserves was reviewed and

prepared by Michiel Frederik Breed, an associate of for Micon

International Co Ltd. Mr Breed is a fellow of the South African

Institute of Mining and Metallurgy (SAIMM), Member No. 702556 and a

Professional Engineer with Engineering Council of South Africa,

Registration No. 20130531) and has sufficient experience that is

relevant to the project under consideration which he is undertaking

to qualify as a QP under NI 43-101.

Scientific or technical information in this

press release that relates to the metallurgy and mineral processing

of the Nampala Mine was prepared or supervised by Nigel Smalley, a

full-time employee for Micon International Co Ltd. Mr Smalley is a

Member of the Institute of Materials, Minerals & Mining, MIMMM

(No. 459181) and an Associate Member of the Australasian Institute

of Mining and Metallurgy (AAusIMM (No. 322114) and has sufficient

experience that is relevant to the project under consideration

which he is undertaking to qualify as a QP under NI 43-101.

Scientific or technical information in this

press release that relates to Environmental Studies, Permitting and

Social or Community Impacts was prepared or supervised by Becky

Humphrey, an associate of for Micon International Co Ltd. Ms

Humphrey is a Full Member of the Chartered Institute of

Environmental Management and Assessment (MIEMA), a Professional

Member of the Institute of Materials, Minerals and Mining (MIMMM)

and a Chartered Environmentalist (CEnv) registered with the Society

for the Environment (Registration No. 10664) and has sufficient

experience that is relevant to the project under consideration

which she is undertaking to qualify as a QP under NI 43-101.

Further details on the scientific and technical

information relating to Nampala will be provided in the technical

report for the Independent Technical Report on the Nampala,

Mininko, Gladie and Kamasso Permits and a Mineral Resource and

Reserve Estimate of the Nampala Gold Mine, Mali, West Africa which

will be filed on SEDAR at www.sedar.com within the next 45

days.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this press release.

About Robex Resources Inc.

Robex is a multi-jurisdictional West African

gold production and development company with near-term exploration

potential. The Company is dedicated to safe, diverse and

responsible operations in the countries in which it operates with a

goal to foster sustainable growth. The Company has been operating

the Nampala mine in Mali since 2017 and is advancing the Kiniero

Gold Project in Guinea.

Robex is supported by two strategic shareholders

and has the ambition to become one of the most important mid-tier

gold producers in West Africa.

For more information

ROBEX RESOURCES INC.

Matthew Wilcox, Chief Executive Officer

Alain William, Chief Financial Officer

+1 581 741-7421

Email: investor@robexgold.com

www.robexgold.com

Forward-looking information and forward-looking

statements

This press release contains “forward-looking

information” and “forward-looking statements” within the meaning of

applicable Canadian securities legislation

(“forward-looking statements”). Forward-looking

statements are included to provide information about Management’s

current expectations and plans that allows investors and others to

have a better understanding of the Company’s business plans and

financial performance and condition.

Statements made in this press release that

describe the Company’s or Management’s estimates, expectations,

forecasts, objectives, predictions, projections of the future or

strategies may be “forward-looking statements”, and can be

identified by the use of the conditional or forward-looking

terminology such as “aim”, “anticipate”, “assume”, “believe”,

“can”, “contemplate”, “continue”, “could”, “estimate”, “expect”,

“forecast”, “future”, “guidance”, “guide”, “indication”, “intend”,

“intention”, “likely”, “may”, “might”, “objective”, “opportunity”,

“outlook”, “plan”, “potential”, “should”, “strategy”, “target”,

“will” or “would” or the negative thereof or other variations

thereon. Forward-looking statements also include any other

statements that do not refer to historical facts. Such statements

may include, but are not limited to, statements regarding the

perceived merit and further potential of the Company’s properties;

the Company’s estimate of mineral resources and mineral reserves

(within the meaning ascribed to such expressions in the Definition

Standards on Mineral Resources and Mineral Reserves adopted by the

Canadian Institute of Mining Metallurgy and Petroleum (“CIM

Definition Standards”) and incorporated into NI 43-101;

capital expenditures and requirements; the Company’s access to

financing (including any project finance facility); preliminary

economic assessments (within the meaning ascribed to such

expressions in NI 43-101) and other development study results;

exploration results at the Company’s properties; budgets; strategic

plans; market price of precious metals; the Company’s ability to

successfully advance the Kiniero Gold project on the basis of, and

achieve, the results projected in the feasibility study (within the

meaning ascribed to such expression in the CIM Definition Standards

incorporated into NI 43-101) with respect thereto (including

economic and production results), as the same may be updated from

time to time by the Company; the potential development and

exploitation of the Kiniero Gold Project and the Company’s existing

mineral properties and business plan, including the completion of

feasibility studies or the making of production decisions in

respect thereof; work programs; permitting or other timelines;

government regulations and relations; optimization of the Company’s

mine plan; the future financial or operating performance of the

Company and the Kiniero Gold Project; exploration potential and

opportunities at the Company’s existing properties; costs and

timing of future exploration and development of new deposits;.

Forward-looking statements and forward-looking

information are made based upon certain assumptions and other

important factors that, if untrue, could cause the actual results,

performance or achievements of the Company to be materially

different from future results, performance or achievements

expressed or implied by such statements or information. There can

be no assurance that such statements or information will prove to

be accurate. Such statements and information are based on numerous

assumptions, including: the ability to execute the Company’s plans

relating to the Kiniero Gold Project as set out in the feasibility

study with respect thereto, as the same may be updated from time to

time by the Company ; the Company’s ability to reach an agreement

with the Malian authorities to establish a sustainable new tax

framework for the Company, and for the sustainable continuation of

the Company's activities and further exploration investments at

Nampala; the Company’s ability to complete its planned exploration

and development programs; the absence of adverse conditions at the

Kiniero Gold Project; the absence of unforeseen operational delays;

the absence of material delays in obtaining necessary permits; the

price of gold remaining at levels that render the Kiniero Gold

Project profitable; the Company’s ability to continue raising

necessary capital to finance its operations; the Company’s ability

to restructure the Taurus USD35 million bridge loan and adjust the

mandate to accommodate for the revised timeline of the enlarged

project; the Company’s ability to enter into definitive

documentation for the USD115 million project finance facility for

the Kiniero Gold Project (including a USD15 million cost overrun

facility) on acceptable terms or at all, and to satisfy the

conditions precedent to closing and advances thereunder (including

satisfaction of remaining customary due diligence and other

conditions and approvals); the ability to realize on the mineral

resource and mineral reserve estimates; and assumptions regarding

present and future business strategies, local and global

geopolitical and economic conditions and the environment in which

the Company operates and will operate in the future.

Certain important factors could cause the

Company’s actual results, performance or achievements to differ

materially from those in the forward-looking statements and

forward-looking information including, but not limited to:

geopolitical risks and security challenges associated with its

operations in West Africa, including the Company’s inability to

assert its rights and the possibility of civil unrest and civil

disobedience; fluctuations in the price of gold; limitations as to

the Company’s estimates of mineral reserves and mineral resources;

the speculative nature of mineral exploration and development; the

replacement of the Company’s depleted mineral reserves; the

Company’s limited number of projects; the risk that the Kiniero

Gold Project will never reach the production stage (including due

to a lack of financing); the Company’s capital requirements and

access to funding; changes in legislation, regulations and

accounting standards to which the Company is subject, including

environmental, health and safety standards, and the impact of such

legislation, regulations and standards on the Company’s activities;

equity interests and royalty payments payable to third parties;

price volatility and availability of commodities; instability in

the global financial system; the effects of high inflation, such as

higher commodity prices; fluctuations in currency exchange rates;

the risk of any pending or future litigation against the Company;

limitations on transactions between the Company and its foreign

subsidiaries; the risk that the listing of the Company’s shares on

the ASX is not approved and/or otherwise implemented, and even if

it is, that is fails to support the long-term growth of the

Company; volatility in the market price of the Company’s shares;

tax risks, including changes in taxation laws or assessments on the

Company; the Company’s inability to successfully defend its

positions in negotiations with the Malian authorities to establish

a new tax framework for the Company, including with respect to the

current tax contingencies in Mali; the Company obtaining and

maintaining titles to property as well as the permits and licenses

required for the Company’s ongoing operations; changes in project

parameters and/or economic assessments as plans continue to be

refined; the risk that actual costs may exceed estimated costs;

geological, mining and exploration technical problems; failure of

plant, equipment or processes to operate as anticipated; accidents,

labour disputes and other risks of the mining industry; delays in

obtaining governmental approvals or financing; the effects of

public health crises, on the Company’s activities; the Company’s

relations with its employees and other stakeholders, including

local governments and communities in the countries in which it

operates; the risk of any violations of applicable anti-corruption

laws, export control regulations, economic sanction programs and

related laws by the Company or its agents; the risk that the

Company encounters conflicts with small-scale miners; competition

with other mining companies; the Company’s dependence on

third-party contractors; the Company’s reliance on key executives

and highly skilled personnel; the Company’s access to adequate

infrastructure; the risks associated with the Company’s potential

liabilities regarding its tailings storage facilities; supply chain

disruptions; hazards and risks normally associated with mineral

exploration and gold mining development and production operations;

problems related to weather and climate; the risk of information

technology system failures and cybersecurity threats; and the risk

that the Company may not be able to insure against all the

potential risks associated with its operations.

Although the Company believes its expectations

are based upon reasonable assumptions and has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. These factors are not intended to represent a complete

and exhaustive list of the factors that could affect the Company;

however, they should be considered carefully. There can be no

assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information.

The Company undertakes no obligation to update

forward-looking information if circumstances or Management’s

estimates, assumptions or opinions should change, except as

required by applicable law. The reader is cautioned not to place

undue reliance on forward-looking information. The forward-looking

information contained herein is presented for the purpose of

assisting investors in understanding the Company’s expected

financial and operational performance and results as at and for the

periods ended on the dates presented in the Company’s plans and

objectives and may not be appropriate for other purposes.

Please refer to the “Risk Factors” section of

the Company’s Annual Information Form for the year ended December

31, 2023, dated April 29, 2024, and to the “Risks and

Uncertainties” section of each of the Company’s Management’s

Discussion and Analysis dated April 29, 2024 for the years ended

December 31, 2023, and the Company’s Management’s Discussion and

Analysis dated November 29, 2024 for the three-month periods ended

September 30, 2024 and September 30, 2023, all of which are

available electronically on SEDAR+ at www.sedarplus.ca or on the

Company’s website at www.robexgold.com All forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/372b8372-904c-4afb-b149-370a7aa1bebe

https://www.globenewswire.com/NewsRoom/AttachmentNg/67522c9b-4ff2-4ef9-9dfa-54732e9185d5

https://www.globenewswire.com/NewsRoom/AttachmentNg/f4bf0bf0-c02b-449e-8a45-cbb5716dc8da

https://www.globenewswire.com/NewsRoom/AttachmentNg/d1553f18-d685-4721-bfac-514c7b6cec79

https://www.globenewswire.com/NewsRoom/AttachmentNg/7469abd0-9d2d-41d7-b369-e2e62a9ee300

https://www.globenewswire.com/NewsRoom/AttachmentNg/7e72fcb9-d8c9-4545-89db-ef55d34eddcd

Robex Resources (TG:RB4)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Robex Resources (TG:RB4)

Historical Stock Chart

Von Jan 2024 bis Jan 2025