atai Life Sciences Reports Second Quarter 2023 Financial Results

and Operational Highlights, and Announces Clinical Data from the

Phase 1 Study of DMX-1002 (Ibogaine)

atai Life Sciences (NASDAQ: ATAI) (“atai”), a

clinical-stage biopharmaceutical company aiming to transform the

treatment of mental health disorders, reported second quarter 2023

financial results and provided corporate updates.

“We continue to focus on our vision to heal mental health

disorders so that everyone, everywhere can live a more fulfilled

life,” said Florian Brand, CEO and Co-Founder of atai. “Looking

ahead to the second half of 2023 and beyond, we believe we are well

positioned to continue advancing our key clinical programs. We are

especially encouraged by the progress our team has made in

advancing RL-007 in the on-going randomized, placebo-controlled

Phase 2b study as well as further evaluating VLS-01 in Part 3 of

the on-going Phase 1 study. Today, we are pleased to report data

from the Phase 1 trial of DMX-1002 (Ibogaine).”

“Current treatment options for Opioid Use Disorder (OUD)

patients are not highly effective, with approximately 75% of

patients undergoing therapy experiencing relapse within one year,”

said Srinivas Rao, CSO and Co-Founder. “DMX-1002 has the potential

to be a disease modifying treatment for this vulnerable patient

population seeking to end their intractable cycle of drug

dependence.”

“The results from this trial are consistent with the known

side-effect profile of ibogaine, the active moiety in DMX-1002,”

said Dr. Marek Malik, Professor Emeritus of Cardiac

Electrophysiology, Imperial College, London and clinical advisor

for the DMX-1002 development program. “Ibogaine is known to cause

prolongation of the electrocardiographic QT interval. Drug-induced

prolongation of the QT interval is a phenomenon that has been, with

many but not all drugs, associated with cardiac arrhythmias. The

QT-related side effect of ibogaine is anticipated to be manageable

in a controlled setting with appropriate cardiac monitoring and

safety protocols. In severe patient populations, like those living

with OUD, ibogaine treatment administered in such a setting has a

potential to be a paradigm shift for patients.”

DMX-1002 (Ibogaine) Phase 1 Results and Program

Update:

Today, the company announced results from the Phase 1 study of

DMX-1002, a cholinergic, glutamatergic and monoaminergic receptor

modulator being developed for the treatment of OUD.

The single-blinded Phase 1 study assessed the safety,

tolerability and pharmacokinetics of single-ascending doses of

DMX-1002 in healthy volunteers. Oral doses of 3 mg/kg, 6 mg/kg

& 9 mg/kg were evaluated in 20 participants. Results of the

Phase 1 trial demonstrated that oral doses of DMX-1002 at 9 mg/kg

achieved plasma concentrations in line with those described in

previous studies1,2 in which subjects reported psychedelic

experiences and obtained therapeutic benefit in OUD.

The treatment-related adverse events (AEs) were similar to those

observed in prior trials of DMX-1002, and nearly all (>94%) were

rated mild-to-moderate in severity. There were no serious adverse

events reported.

In one of the two participants who received 9 mg/kg of DMX-1002,

QTc prolongation reached levels near those seen at the 10 mg/kg

dose in the published literature3 (median change: 95ms). In this

participant, a QTcF prolongation of 90-94ms was observed with a

QTcF interval of 493-501ms. The patient was asymptomatic, with no

cardiac arrythmias, and the QTc change resolved without

intervention or sequalae.

During the study the company closely worked with cardiology

experts who concluded that while QT prolongation of this order is a

clinical risk, monitoring can help mitigate the risk to ensure the

safety of patients, especially in a medical setting. The benefit of

the drug will need to be defined in efficacy trials and will need

to be weighed against the risks that have been defined.

The company plans to engage regulatory authorities to assess

progressing DMX-1002 into an efficacy study in patients with

OUD.

Recent Developments:

RL-007 (Pro-Cognitive Neuromodulator for Cognitive

Impairment Associated with Schizophrenia)

- The on-going Phase 2b study is a

randomized, placebo-controlled, double-blind, study of 6 weeks

duration evaluating 20mg and 40mg of RL-007 vs placebo.

- The primary endpoint of the study is

the change from baseline in the MATRICS Consensus Cognitive Battery

(MCCB) neurocognitive composite score, a well-established

regulatory endpoint.

- The company expects to report topline

results from this study in the 2nd half of 2024.

VLS-01 (N,N-dimethyltryptamine [DMT] for

Treatment-Resistant Depression (“TRD”))

- The on-going Phase 1 study is designed

to evaluate the safety, tolerability, PK and PD of VLS-01 delivered

by intravenous (IV) infusion and using our proprietary oral

transmucosal film (OTF) formulation.

- In Part 1 (IV) and Part 2 (OTF), VLS-01

was well-tolerated, with no dose-limiting toxicity and a favorable

safety profile. VLS-01 produced generally dose-dependent increases

in exposure, and administration resulted in subjective psychedelic

experiences in the majority of subjects. Part 3 is exploring

further optimization of PK and PD of our proprietary OTF

formulation, including further dose ranging.

- The company expects to report

additional clinical data in Q3 2023.

PCN-101 (R-Ketamine for TRD)

- The company recently announced

completion of the Phase 1 open-label bridging study designed to

assess the safety, tolerability, and pharmacokinetic profile of

60mg, 90mg and 120mg of PCN-101 delivered subcutaneously (SQ) as

compared to 60mg of PCN-101 delivered IV.

- Pharmacokinetic (PK) analysis indicates

that 120mg of PCN-101 delivered SQ resulted in an approximate

doubling of drug exposure (AUC) while maintaining approximately the

same maximum concentration (Cmax) as the 60mg IV dose.

- At the highest SQ dose of 120mg, rates

of sedation (defined as MOAA/S score <5) and dissociation

(defined as CADSS total score >4 and change from baseline >0)

were each 14%. Overall, the data support testing the concept of

at-home use of PCN-101 in future studies.

- The company continues to work with

Perception Neuroscience to explore strategic partnership

options.

EMP-01 (3,4-methylenedioxy-methamphetamine [MDMA]

derivative for Post-Traumatic Stress Disorder

(“PTSD”))

- The Phase 1 study is designed to

evaluate the safety and tolerability of single-ascending doses of

EMP-01 in healthy adult participants.

- Enrollment has been recently completed

and the company expects to report initial clinical data in Q4

2023.

COMP360 (Psilocybin Therapy for TRD, Anorexia Nervosa

and PTSD)

- COMPASS Pathways is currently

conducting a Phase 3 program composed of two pivotal trials, each

of which will have a long-term follow-up component. Topline data

from Pivotal Trial 1 (COMP005) is expected in the summer 2024. The

primary endpoint in both pivotal trials is the change from baseline

in MADRS total score at week 6.

- The American Medical Association

recently released the language of its new Current Procedural

Terminology (CPT®) III code for Continuous In-Person Monitoring and

Intervention During Psychedelic Medication Therapy. The code will

go into effect and will be published in the CPT manual on January

1, 2024. Once effective, the new code will provide a mechanism to

track and report the delivery of psychedelic treatments.

Consolidated Financial Results

Cash, Cash Equivalents, and Short-term investments: Cash, cash

equivalents and short-term investments totaled $227.5 million as of

June 30, 2023, compared to $273.1 million as of December 31, 2022.

The decrease of $45.6 million was primarily driven by net cash used

in operating activities of $43.7 million and $3.0 million of loans

to related parties. The Company expects its cash position and

committed term loan funding will be sufficient to fund operations

into 1H 2026.

Research and Development (R&D) Expenses: Research and

development expenses for the three months ended June 30, 2023 were

$15.5 million, including $3.3 million of stock-based compensation

compared to $17.9 million, including $3.9 million of stock-based

compensation for the three months ended June 30, 2022. The decrease

of $2.4 million was primarily attributable to a $1.8 million

decrease of costs related to our non-clinical activities and $0.6

million decrease in contract research organization expenses.

General and Administrative (G&A) Expenses: General and

administrative expenses were $16.6 million, including $5.4 million

of stock-based compensation for the three months ended June 30,

2023 compared to $17.2 million, including $5.7 million of

stock-based compensation for the three months ended June 30, 2022.

The decrease of $0.6 million was largely attributable to a decrease

of $0.4 million in personnel related costs and $0.2 million net

decrease in public company administrative costs.

Net Loss: Net loss attributable to shareholders for the three

months ended June 30, 2023, was $33.1 million (including non-cash

share-based compensation expense of $8.8 million) as compared to

$36.6 million (including non-cash share-based compensation expense

of $9.5 million) for the comparable prior year period.

About atai Life Sciences

atai is a clinical-stage biopharmaceutical company aiming to

transform the treatment of mental health disorders and was founded

as a response to the significant unmet need and lack of innovation

in the mental health treatment landscape. atai is dedicated to

efficiently developing innovative therapeutics to treat depression,

anxiety, addiction, and other mental health disorders.

By pooling resources and best practices, atai aims to

responsibly accelerate the development of new medicines to achieve

clinically meaningful and sustained behavioral change in mental

health patients.

atai's vision is to heal mental health disorders so that

everyone, everywhere can live a more fulfilled life. For more

information, please visit www.atai.life.

References:

1. DC Mash et. al. [1998]2. DC Mash et. al. [2018]3. T Knuijver

et al. [2021]

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. The words “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “could,” “would,” “project,”

“plan,” “potentially,” “preliminary,” “likely,” and similar

expressions are intended to identify forward-looking statements.

Examples of these forward-looking statements include but are not

limited to statements concerning our expectations and projections

regarding any or all of the following: our future operating results

and financial position; the success, cost, and timing of

development of our product candidates, including the progress of

preclinical studies and clinical trials and related milestones; the

timing for announcing our study results and development plans,

including our clinical trials for RL-007, VLS-01, DMX-1002, PCN-101

and EMP-01; the timing of and our ability to obtain and maintain

regulatory approvals; our business strategy and plans, including

the benefits of our corporate restructuring; potential

acquisitions, partnerships and other strategic arrangements; the

sufficiency of our cash and cash equivalents to fund our

operations; available funding under the Hercules Capital, Inc. loan

facility; the plans and objectives of management for future

operations and capital expenditures; and our participation in

upcoming events and conferences.

Because forward-looking statements are subject to risks and

uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements. These

risks and uncertainties include, among others: our limited

operating history, historical losses, and anticipation that we will

continue to incur significant losses for the foreseeable future; we

will require substantial additional funding to achieve our business

goals, including the development and any commercialization of our

product candidates; we have never generated revenue and may never

be profitable; our product candidates contain controlled

substances, the use of which may generate public controversy;

clinical and preclinical development is uncertain, and our programs

may experience delays or may never advance to clinical trials; our

reliance on third parties to assist in conducting our clinical

trials and impact to such trials based on factors including failure

by third parties to meet trial or testing deadlines; our reliance

on qualified therapists working at third-party clinical trial sites

to administer certain of our product candidates and failure to

recruit and retain a sufficient number of therapists; the timing

and outcome of regulatory review and/or approvals, which are

necessary prior to commercialization; research and development of

drugs targeting the central nervous system, or CNS, is particularly

difficult, and it can be difficult to predict and understand why a

drug has a positive effect on some patients but not others;

significant competition; obtaining, maintaining and protecting our

intellectual property; restricted operating activity as a result of

covenants in any financing arrangements, including our loan

agreement with Hercules Capital, Inc.; our aggregate tax burden

based on our management and operational activity. These

forward-looking statements are subject to a number of important

factors that could cause actual results to differ materially from

those in the forward-looking statements, including the risks,

uncertainties, and assumptions described in our Form 10-K for the

year ended December 31, 2022, filed with the Securities and

Exchange Commission (“SEC”) and our quarterly reports on Form 10-Q,

as may be updated by other filings we file with or furnish to the

SEC.

Any forward-looking statements made herein speak only as of the

date of this press release. Except as required by applicable law,

we undertake no obligation to update any of these forward-looking

statements for any reason after the date of this press release or

to conform these statements to actual results or revised

expectations.

|

|

|

ATAI LIFE SCIENCES N.V. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Amounts in thousands, except share and per share

amounts) |

|

(unaudited) |

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| License revenue |

$ |

172 |

|

|

$ |

170 |

|

|

$ |

209 |

|

|

$ |

170 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

15,476 |

|

|

|

17,949 |

|

|

|

34,757 |

|

|

|

33,409 |

|

|

Acquisition of in-process research and development |

|

— |

|

|

|

357 |

|

|

|

— |

|

|

|

357 |

|

|

General and administrative |

|

16,558 |

|

|

|

17,221 |

|

|

|

30,529 |

|

|

|

35,203 |

|

|

Total operating expenses |

|

32,034 |

|

|

|

35,527 |

|

|

|

65,286 |

|

|

|

68,969 |

|

| Loss from operations |

|

(31,862 |

) |

|

|

(35,357 |

) |

|

|

(65,077 |

) |

|

|

(68,799 |

) |

| Other income (expense), net |

|

204 |

|

|

|

4,551 |

|

|

|

263 |

|

|

|

6,072 |

|

| Loss before income taxes |

|

(31,658 |

) |

|

|

(30,806 |

) |

|

|

(64,814 |

) |

|

|

(62,727 |

) |

| Provision for income taxes |

|

(185 |

) |

|

|

(51 |

) |

|

|

(351 |

) |

|

|

(92 |

) |

| Losses from investments in equity

method investees, net of tax |

|

(1,928 |

) |

|

|

(6,652 |

) |

|

|

(2,961 |

) |

|

|

(12,248 |

) |

| Net loss |

|

(33,771 |

) |

|

|

(37,509 |

) |

|

|

(68,126 |

) |

|

|

(75,067 |

) |

| Net loss attributable to

noncontrolling interests |

|

(729 |

) |

|

|

(891 |

) |

|

|

(1,948 |

) |

|

|

(1,580 |

) |

| Net loss attributable to ATAI

Life Sciences N.V. stockholders |

$ |

(33,042 |

) |

|

$ |

(36,618 |

) |

|

$ |

(66,178 |

) |

|

$ |

(73,487 |

) |

| Net loss per share attributable

to ATAI Life Sciences N.V. stockholders — basic and diluted |

$ |

(0.21 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.42 |

) |

|

$ |

(0.48 |

) |

| Weighted average common shares

outstanding attributable to ATAI Life Sciences N.V. stockholders —

basic and diluted |

|

155,792,490 |

|

|

|

153,971,202 |

|

|

|

155,793,323 |

|

|

|

153,751,456 |

|

| |

|

|

|

|

|

|

|

|

|

|

ATAI LIFE SCIENCES N.V. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Amounts in thousands) |

| |

June 30 |

|

December 31, |

| |

2023 |

|

2022 |

| |

(unaudited) |

|

(1) |

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

141,090 |

|

$ |

190,613 |

|

| Securities carried at fair

value |

|

86,402 |

|

|

82,496 |

|

| Prepaid expenses and other

current assets |

|

6,257 |

|

|

14,036 |

|

| Short term notes receivable -

related parties, net |

|

9,021 |

|

|

— |

|

| Property and equipment,

net |

|

1,043 |

|

|

928 |

|

| Operating lease right-of-use

asset, net |

|

1,367 |

|

|

226 |

|

| Other investments |

|

3,991 |

|

|

6,755 |

|

| Long term notes receivable -

related parties, net |

|

1,157 |

|

|

7,262 |

|

| Other assets |

|

3,267 |

|

|

3,125 |

|

|

Total assets |

$ |

253,595 |

|

$ |

305,441 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Accounts payable |

|

3,859 |

|

|

2,399 |

|

| Accrued liabilities |

|

12,855 |

|

|

17,306 |

|

| Current portion of lease

liability |

|

322 |

|

|

180 |

|

| Other current liabilities |

|

890 |

|

|

12 |

|

| Non-current portion of

contingent consideration liability - related parties |

|

842 |

|

|

953 |

|

| Non-current portion of lease

liability |

|

1,095 |

|

|

44 |

|

| Convertible promissory notes -

related parties, net of discounts and deferred issuance costs |

|

420 |

|

|

415 |

|

| Long-term debt, net |

|

14,868 |

|

|

14,702 |

|

| Other liabilities |

|

2,807 |

|

|

3,664 |

|

| Total stockholders' equity

attributable to ATAI Life Sciences N.V. stockholders |

|

212,550 |

|

|

260,740 |

|

| Noncontrolling interests |

|

3,087 |

|

|

5,026 |

|

| Total liabilities and

stockholders' equity |

$ |

253,595 |

|

$ |

305,441 |

|

| |

|

|

|

| (1) The condensed

consolidated financial statements as of and for the year ended

December 31, 2022 are derived from the audited consolidated

financial statements as of that date. |

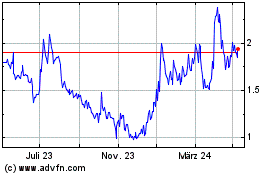

ATAI Life Sciences NV (TG:9VC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

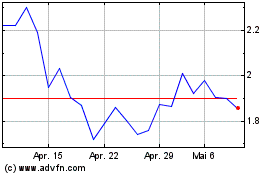

ATAI Life Sciences NV (TG:9VC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025