UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number 001-41180

_______________________________

Ermenegildo Zegna N.V.

(Translation of registrant’s name into English)

_______________________________

Viale Roma 99/100

13835 Valdilana loc. Trivero

Italy

(Address of principal executive offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

The following exhibit is furnished herewith:

Exhibit 99.1 Press Release, dated September 18, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorised.

| | | | | | | | | | | |

| Date: September 18, 2024 | ERMENEGILDO ZEGNA N.V. |

| | | |

| By: | /s/ Gianluca Ambrogio Tagliabue |

| | Name: | Gianluca Ambrogio Tagliabue |

| | Title: | Chief Operating Officer and Chief Financial Officer |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 99.1 | | Press Release, dated September 18, 2024. |

| | |

ERMENEGILDO ZEGNA GROUP REPORTS FIRST HALF 2024 REVENUES OF €960 MILLION WITH PROFIT AT €31 MILLION AND ADJUSTED EBIT AT €81 MILLION.

•Revenues of €960.1 million, up 6% from H1 2023 (+8% at constant currency and -2.7% organic1)

•Profit of €31.3 million (3.3% profit margin) compared to €52.1 million in H1 2023 (5.8% profit margin)

•Gross profit margin of 66.4% up 220bps from 64.2% in H1 2023

•Adjusted EBIT1 of €80.9 million with an Adjusted EBIT Margin of 8.4% (13.3% in H1 2023)

•Important investments to further strengthen Group’s brands concentrated in H1 2024

September 18, 2024 – MILAN— (Business Wire)—Ermenegildo Zegna N.V. (NYSE:ZGN) (the “Company” and, together with its consolidated subsidiaries, the “Ermenegildo Zegna Group” or “the Group”) today announced profit of €31.3 million in H1 2024 compared to €52.1 million in H1 2023. In H1 2024, Adjusted EBIT was equal to €80.9 million compared to €119.9 million in H1 2023.

Ermenegildo “Gildo” Zegna, Group Chairman and CEO, said: “The first half of 2024 was marked by important investments in all three of our brands to further strengthen and foster ongoing value creation for each of them. We continued to double down on the successful ZEGNA One Brand Strategy, recently exemplified by the VILLA ZEGNA event in New York. We have taken decisive actions to reinforce the Thom Browne organization both at HQ and in key regions. And, at TOM FORD FASHION, we recently announced Haider Ackermann as the new TOM FORD Creative Director – a pairing that we are confident will take the brand to new heights.

I believe these steps are what is needed for our Group as the luxury industry goes through an important normalization phase and continues to face macroeconomic and geopolitical uncertainties around the world. Our first half operating results – with Adjusted EBIT Margin at 8.4% vs. 13.3% in H1 2023 – were also affected by our decision to continue investing in key projects, some of which were concentrated in the first six months of the year. Along with these investments, we have also implemented cost controls while continuing to operate with appropriate caution. Even though the overall environment is expected to remain even more challenging, I am confident that our projects and actions are the right ones to unleash the untapped long-term potential of all three of our brands.”

1 Revenues on organic growth basis (organic or organic growth) and on a constant currency basis (constant currency), are non-IFRS financial measures. Constant currency growth is calculated excluding foreign exchange. Organic growth is calculated excluding (a) foreign exchange, (b) acquisitions & disposals, (c) changes in license agreements where the Group operates as a licensee. See the non-IFRS financial measures section starting on page 8 of this press release for the definition and reconciliation of non-IFRS financial measures.

Results of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands, except percentages) | 2024 | | Percentage of revenues | | 2023 | | Percentage of revenues |

| Revenues | 960,122 | | 100.0 | % | | 903,059 | | 100.0 | % |

| Costs of sales | (322,678) | | (33.6 | %) | | (323,228) | | (35.8 | %) |

| Gross profit | 637,444 | | 66.4 | % | | 579,831 | | 64.2 | % |

| Selling, general and administrative expenses | (497,612) | | (51.8 | %) | | (415,792) | | (46.0 | %) |

| Marketing expenses | (66,751) | | (7.0 | %) | | (47,530) | | (5.3 | %) |

| Operating profit | 73,081 | | 7.6 | % | | 116,509 | | 12.9 | % |

| Financial income | 12,106 | | 1.3 | % | | 15,601 | | 1.7 | % |

| Financial expenses | (29,267) | | (3.0 | %) | | (44,592) | | (4.9 | %) |

| Foreign exchange losses | (7,684) | | (0.8 | %) | | (7,003) | | (0.8 | %) |

| Result from investments accounted for using the equity method | 314 | | — | % | | (2,237) | | (0.2 | %) |

| Profit before taxes | 48,550 | | 5.1 | % | | 78,278 | | 8.7 | % |

| Income taxes | (17,218) | | (1.8 | %) | | (26,162) | | (2.9 | %) |

| Profit | 31,332 | | 3.3 | % | | 52,116 | | 5.8 | % |

Half Year 2024 Key Financial Highlights

Revenues

In H1 2024 the Group recorded revenues of €960.1 million, +6.3% YoY and -2.7% organic. The ZEGNA brand recorded €566.1 million, +4.6% YoY and +5.9% organic growth. Thom Browne revenues were €166.7 million, -19.4% YoY and -26.7% organic. TOM FORD FASHION recorded €148.5 million of revenues, +132.0% YoY and +4.7% organic growth while Textile revenues were €71.8 million (-1.7% YoY and -0.6% organic).

Gross Profit, Operating Profit and Profit

Gross profit in H1 2024 reached €637.4 million compared to €579.8 million in H1 2023 with a gross profit margin of 66.4% compared to 64.2% in H1 2023. This improvement was driven by two main factors: first, channel mix, given the increasing proportion of direct-to-consumer (“DTC”) revenues which rose from 72% in H1 2023 to 76% in H1 2024 of branded group revenues (excluding Textile and Other businesses), and second, better inventory management.

Selling, general, and administrative (SG&A) expenses were €497.6 million (51.8% of revenues) in H1 2024, compared to €415.8 million (46.0% of revenues) in H1 2023. The SG&A higher incidence on revenues largely reflects investments made in talents to support the future growth of all the Group’s brands, as well as to develop the store network, and the consolidation of Tom Ford Fashion segment results for the entire six months (compared to approximately two months in H1 2023).

Marketing expenses in H1 2024 were €66.8 million (7.0% of revenues) compared to €47.5 million (5.3% of revenues) in H1 2023. The increase in incidence of the marketing expenses is largely due to a higher number of events concentrated in the first part of the year compared to H1 2023.

As a result of the above, the Group reported an operating profit of €73.1 million compared to €116.5 million in H1 2023 and a profit of €31.3 million, with a 3.3% profit margin, compared to €52.1 million in H1 2023 (5.8% profit margin).

Adjusted EBIT and Adjusted EBIT Margin

The table below shows the reconciliation of Profit to Adjusted EBIT and the calculation of the profit margin and the Adjusted EBIT Margin in H1 2024 and 2023. Adjusted EBIT is the main performance metric used by the Group’s management at the consolidated and reporting segment level.

| | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands, except percentages) | 2024 | | 2023 |

| Profit | 31,332 | | 52,116 |

| Income taxes | 17,218 | | 26,162 |

| Financial income | (12,106) | | (15,601) |

| Financial expenses | 29,267 | | 44,592 |

| Foreign exchange losses | 7,684 | | 7,003 |

| Result from investments accounted for using the equity method | (314) | | 2,237 |

| Operating profit | 73,081 | | 116,509 |

| Adjustments: | | | |

| Net impairment of leased and owned stores | 4,979 | | — |

| Severance indemnities and provisions for severance expenses | 1,436 | | 738 |

| Legal costs for trademark dispute | 1,388 | | 649 |

| Transaction costs related to acquisitions | 26 | | 4,975 |

| Costs related to the Business Combination | — | | 1,059 |

| Special donations for social responsibility | — | | 100 |

| Net income related to lease agreements | — | | (4,126) |

| Adjusted EBIT | 80,910 | | 119,904 |

| | | |

| Revenues | 960,122 | | 903,059 |

| Profit margin (Profit / Revenues) | 3.3 | % | | 5.8 | % |

| Adjusted EBIT Margin (Adjusted EBIT / Revenues) | 8.4 | % | | 13.3 | % |

Analysis by Segment

In H1 2024, Adjusted EBIT for the Zegna segment was €84.7 million from €99.7 million in H1 2023. Adjusted EBIT for the Thom Browne segment was €20.2 million, from €31.5 million in H1 2023. The Tom Ford Fashion segment reported an Adjusted EBIT of negative €11.9 million, versus positive €4.3 million in H1 2023. The latter comparison, however, is not meaningful since H1 2023 consists of approximately just two months of TOM FORD FASHION results (consolidated since April 29, 2023).

| | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | | Change |

| (€ thousands, except percentages) | 2024 | | 2023 | | 2024 vs 2023 | | % |

| Revenues | | | | | | | |

| Zegna | 660,538 | | 644,310 | | 16,228 | | 2.5 | % |

| Thom Browne | 166,935 | | 207,959 | | (41,024) | | (19.7 | %) |

| Tom Ford Fashion | 148,493 | | 64,027 | | 84,466 | | 131.9 | % |

| Eliminations | (15,844) | | (13,237) | | (2,607) | | n.m. (*) |

| Total revenues | 960,122 | | 903,059 | | 57,063 | | 6.3 | % |

________________________________________

(*) Throughout this document “n.m.” means not meaningful.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | | Change |

| (€ thousands, except percentages) | 2024 | | 2023 | | 2024 vs 2023 | | % |

| Adjusted EBIT | | | | | | | |

| Zegna | 84,695 | | 99,718 | | (15,023) | | (15.1 | %) |

| Thom Browne | 20,186 | | 31,521 | | (11,335) | | (36.0 | %) |

| Tom Ford Fashion | (11,913) | | 4,303 | | (16,216) | | n.m. |

| Corporate | (11,965) | | (15,626) | | 3,661 | | 23.4 | % |

| Eliminations | (93) | | (12) | | (81) | | n.m. |

| Total | 80,910 | | 119,904 | | (38,994) | | (32.5 | %) |

| | | | | | | |

| Adjusted EBIT Margin | | | | | | | |

| Zegna | 12.8 | % | | 15.5 | % | | | | |

| Thom Browne | 12.1 | % | | 15.2 | % | | | | |

| Tom Ford Fashion | (8.0 | %) | | 6.7 | % | | | | |

Zegna segment

In H1 2023, the Zegna segment (which includes ZEGNA brand, Textile and Third Party Brands) generated revenues of €660.5 million2, +2.5% YoY (+3.5% organic growth).

Adjusted EBIT for the Zegna segment was €84.7 million in H1 2024 with an Adjusted EBIT Margin of 12.8% compared to 15.5% in H1 2023. This performance was primarily driven by the increase in marketing expenses, due to a higher concentration of events and projects in the first half of 2024 compared to the first six months of the prior year, investments in talents and on the stores network expansions.

Thom Browne segment

In H1 2024, the Thom Browne segment generated revenues of €166.9 million, -19.7% YoY (-27.0% organic).

Adjusted EBIT for the Thom Browne segment was €20.2 million in H1 2024, with an Adjusted EBIT Margin of 12.1% compared to 15.2% in H1 2023. The decrease was led by a lower operating leverage due to the decline in revenues.

Tom Ford Fashion segment

In H1 2024, the Tom Ford Fashion (“TFF”) segment generated revenues of €148.5 million, +131.9% YoY and +4.7% organic growth. Adjusted EBIT for this segment in H1 2024 was negative €11.9 million, compared to positive €4.3 million in H1 2023. Given that the Tom Ford Fashion segment was consolidated for only approximately two months in H1 2023, the comparison between H1 2024 and H1 2023 results is not meaningful.

Additionally, since the acquisition, the Group has started to strengthen the TFF organization – investing in talent, store networks, marketing and in IT systems – to support its future growth, which also explain the increase in costs in H1 2024.

Corporate costs

Corporate costs amounted to €12.0 million in H1 2024 compared to €15.6 million in H1 2023. The decrease is largely due to a lower impact of incentive plans.

2 Before inter-segment eliminations.

Capital Expenditure, Trade Working Capital, Net Financial Indebtedness/(Cash Surplus) and Free Cash Flow

Capital expenditure

| | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands) | 2024 | | 2023 |

| Payments for property, plant and equipment | 47,926 | | 25,699 |

| Payments for intangible assets | 12,151 | | 8,801 |

| Capital expenditure | 60,077 | | 34,500 |

Capital expenditure (capex) in H1 2024 achieved €60.1 million compared to €34.5 million in H1 2023. This increase is mainly attributable to the first part of investments for the new footwear production plant in Parma (Italy) and the expansion in the DTC channel mainly for ZEGNA and Tom Ford Fashion.

Trade Working Capital

| | | | | | | | | | | | | | | | | |

| (€ thousands) | At June 30, 2024 | | At December 31, 2023 | | At June 30, 2023 |

| Trade Working Capital | 475,642 | | 448,909 | | 465,419 |

| of which trade receivables | 216,670 | | 240,457 | | 217,208 |

| of which inventories | 540,791 | | 522,589 | | 545,176 |

| of which trade payables and customer advances | (281,819) | | (314,137) | | (296,965) |

Trade Working Capital was €475.6 million at June 30, 2024, 2.2% higher compared to €465.4 million at June 30, 2023. The increase is mainly attributable to a lower level of trade payable (-5.1% vs. June 30, 2023) partially counterbalanced by a better management of inventories and stable receivables.

Net Financial Indebtedness/(Cash Surplus)

| | | | | | | | | | | | | | | | | |

| (€ thousands) | At June 30, 2024 | | At December 31, 2023 | | At June 30, 2023 |

| Net Financial Indebtedness/(Cash Surplus) | 65,509 | | 10,810 | | 17,033 |

Net Financial Indebtedness was €65.5 million at June 30, 2024, compared to €17.0 million at June 30, 2023, reflecting the net cash outflows mainly related to capex and investments in controlled entities.

Free Cash Flow

| | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands) | 2024 | | 2023 |

| Net cash flows from operating activities | 120,448 | | 107,583 |

| Payments for property, plant and equipment | (47,926) | | (25,699) |

| | | |

| Payments for intangible assets | (12,151) | | (8,801) |

| Payments of lease liabilities | (66,950) | | (59,115) |

| Free Cash Flow | (6,579) | | 13,968 |

In H1 2024 the Group generated negative Free Cash Flow of €6.6 million compared to positive €14.0 million in H1 2023, primarily driven by the increase in capex.

***

Conference Call

As previously announced, today, at 8a.m. ET (2p.m. CET), the Group will host a live webcast and conference call.

To access the webcast please visit our website (https://ir.zegnagroup.com/events-and-presentations/events).

To participate in the call, please dial:

Italy: +39 06 9450 1060

United States: +1 646 787 9445

United Kingdom: +44 20 3936 2999

Access Code: 594212

Webcast link: https://events.q4inc.com/attendee/321182422

An online archive of the broadcast will be available on the website shortly after the live call and will be available for twelve months.

Upcoming Announcements

The Ermenegildo Zegna Group’s next scheduled announcement is October 22, 2024 Q3 2024 Revenues (*)

______________________________________

(*) Unaudited figures

To receive email alerts of the timing of future financial news releases, as well as future announcements, please register at https://ir.zegnagroup.com.

***

About Ermenegildo Zegna Group

Founded in 1910 in Trivero, Italy, the Ermenegildo Zegna Group (NYSE:ZGN) is a global luxury company with a leading position in the high-end menswear business. Through its three complementary brands, the Group reaches a wide range of communities and market segments across the high-end fashion industry, from ZEGNA’s timeless luxury to the modern tailoring of Thom Browne, to luxury glamour with TOM FORD FASHION. The Ermenegildo Zegna Group is internationally recognized for its unique Filiera, owned and controlled by the Group, which is made up of the finest Italian textile producers fully integrated with unique luxury manufacturing capabilities, to ensure superior excellence, quality and innovation capacity. The Ermenegildo Zegna Group has more than 7,000 employees and recorded revenues of €1.9 billion in 2023.

***

Contacts

Paola Durante, Chief of External Relations

Alice Poggioli, Investor Relations Director

Clementina Tito, Head of Corporate Communication

ir@zegna.com / corporatepress@zegna.com

***

Forward Looking Statements

This communication contains forward-looking statements that are based on beliefs and assumptions and on information currently available to the Company. In particular, statements regarding future financial performance and the Group’s expectations as to the achievement of certain targeted metrics at any future date or for any future period are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek”, “aspire,” “goal,” “outlook,” “guidance,” “forecast,” “prospect” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. Any statements that refer to expectations, projections or other characterizations of future events or circumstances, including strategies or plans, are also forward-looking statements. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements, and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the recognition, integrity and reputation of our brands; our ability to anticipate trends and to identify and respond to new and changing consumer preference; the COVID-19 pandemic or similar public health crises; international business, regulatory, social and political risks; the conflict in Ukraine and sanctions imposed onto Russia; the occurrence of acts of terrorism or similar events, conflicts, civil unrest or situations of political instability; developments in Greater China and other growth and emerging markets; our ability to implement our strategy; recent and potential future acquisitions; disruption to our manufacturing and logistics facilities; risks related to the sale of our products through our direct-to-consumer channel, as well as through points of sale operated by third parties; our dependence on our local partners to sell our products in certain markets; fluctuations in the price or quality of, or disruptions in the availability of, raw materials; our ability to negotiate, maintain or renew our license or co-branding agreements with high end third party brands; tourist traffic and demand; our dependence on certain key senior personnel as well as skilled personnel; our ability to protect our intellectual property rights; disruption in our information technology, including as a result of cybercrime; the theft or unauthorized use of personal information of our customers, employees or other parties; fluctuations in currency exchange rates or interest rates; the level of competition in the industry in which we operate; global economic conditions and macro events, including inflation; failures to comply with applicable laws and regulations; climate change and other environmental impacts and our ability to meet our customers’ and other stakeholders’ expectations on environment, social and governance matters; the enactment of tax reforms or other changes in tax laws and regulations; and other risks and uncertainties, including those described in our filings with the SEC.

Most of these factors are outside the Company’s control and are difficult to predict. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by the Company and its directors, officers or employees or any other person that the Company will achieve its objectives and plans in any specified time frame, or at all. The forward-looking statements in this communication represent the views of the Company as of the date of this communication. Subsequent events and developments may cause that view to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company disclaims any obligation to update or revise publicly forward-looking statements. You should, therefore, not rely on these forward-looking statements as representing the views of the Company as of any date subsequent to the date of this communication.

***

First Half 2024 - Group Revenues Tables

Revenues by Segment (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | | H1 2024 vs H1 2023 | | For the three months ended June 30, | | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023 (1) | | % | | Organic | | 2024 | | 2023 (1) | | % | | Organic |

| Zegna | 660,538 | | 644,310 | | 2.5 | % | | 3.5 | % | | 335,638 | | 324,986 | | 3.3 | % | | 2.7 | % |

| Thom Browne | 166,935 | | 207,959 | | (19.7 | %) | | (27.0 | %) | | 87,869 | | 94,708 | | (7.2 | %) | | (17.8 | %) |

| Tom Ford Fashion | 148,493 | | 64,027 | | 131.9 | % | | 4.7 | % | | 83,473 | | 64,027 | | 30.4 | % | | 4.7 | % |

| Eliminations | (15,844) | | (13,237) | | n.m. | | n.m. | | (10,015) | | (8,974) | | n.m. | | n.m. |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________

(1)Revenues from Pelletteria Tizeta, a manufacturing company of the Group, which were allocated to the Zegna segment in H1 2023, are now presented within the Tom Ford Fashion segment in H1 2024. As a result, the related revenues in H1 2023 have been reclassified from the Zegna segment to the Tom Ford Fashion segment to conform to the current period presentation.

Revenues by Brand and Product Line (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | H1 2024 vs H1 2023 | | For the three months ended June 30, | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023 | | % | | Organic | | 2024 | | 2023 | | % | | Organic |

| ZEGNA brand | 566,067 | | 541,319 | | 4.6 | % | | 5.9 | % | | 283,197 | | 269,430 | | 5.1 | % | | 5.0 | % |

| Thom Browne | 166,721 | | 206,951 | | (19.4 | %) | | (26.7 | %) | | 87,514 | | 94,399 | | (7.3 | %) | | (17.9 | %) |

| TOM FORD FASHION | 148,493 | | 64,015 | | 132.0 | % | | 4.7 | % | | 83,473 | | 64,015 | | 30.4 | % | | 4.7 | % |

| Textile | 71,836 | | 73,072 | | (1.7 | %) | | (0.6 | %) | | 38,593 | | 39,254 | | (1.7 | %) | | (0.5 | %) |

Other (1) | 7,005 | | 17,702 | | (60.4 | %) | | (32.9 | %) | | 4,188 | | 7,649 | | (45.2 | %) | | (23.0 | %) |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________

(1)Other mainly includes revenues from agreements with third party brands.

Revenues by Distribution Channel (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | H1 2024 vs H1 2023 | | For the three months ended June 30, | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023 | | % | | Organic | | 2024 | | 2023 | | % | | Organic |

| Direct to Consumer (DTC) | | |

| ZEGNA brand | 486,561 | | 465,710 | | 4.5 | % | | 5.1 | % | | 246,946 | | 236,114 | | 4.6 | % | | 4.0 | % |

| Thom Browne | 89,976 | | 82,924 | | 8.5 | % | | (12.8 | %) | | 45,257 | | 40,075 | | 12.9 | % | | (11.6 | %) |

| TOM FORD FASHION | 93,062 | | 34,751 | | 167.8 | % | | 1.3 | % | | 49,361 | | 34,751 | | 42.0 | % | | 1.3 | % |

| Total Direct to Consumer (DTC) | 669,599 | | 583,385 | | 14.8 | % | | 2.4 | % | | 341,564 | | 310,940 | | 9.8 | % | | 1.7 | % |

As a percentage of branded products (1) | 76% | | 72% | | | | | | 75% | | 73% | | | | |

| Wholesale branded | | |

| ZEGNA brand | 79,506 | | 75,609 | | 5.2 | % | | 10.4 | % | | 36,251 | | 33,316 | | 8.8 | % | | 11.8 | % |

| Thom Browne | 76,745 | | 124,027 | | (38.1 | %) | | (36.0 | %) | | 42,257 | | 54,324 | | (22.2 | %) | | (22.4 | %) |

| TOM FORD FASHION | 55,431 | | 29,264 | | 89.4 | % | | 8.7 | % | | 34,112 | | 29,264 | | 16.6 | % | | 8.7 | % |

| Total Wholesale branded | 211,682 | | 228,900 | | (7.5 | %) | | (14.9 | %) | | 112,620 | | 116,904 | | (3.7 | %) | | (5.0 | %) |

| As a percentage of branded products | 24% | | 28% | | | | | | 25% | | 27% | | | | |

| Textile | 71,836 | | 73,072 | | (1.7 | %) | | (0.6 | %) | | 38,593 | | 39,254 | | (1.7 | %) | | (0.5 | %) |

Other (2) | 7,005 | | 17,702 | | (60.4 | %) | | (32.9 | %) | | 4,188 | | 7,649 | | (45.2 | %) | | (23.0 | %) |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________

(1)Branded products refer to the products sold under the three brands that the Group operates, through the DTC or wholesale branded distribution channels.

(2)Other mainly includes revenues from agreements with third party brands.

Revenues by Geographical Area (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended June 30, | | H1 2024 vs H1 2023 | | For the three months ended June 30, | | Q2 2024 vs Q2 2023 |

| (€ thousands, except percentages) | 2024 | | 2023 | | % | | Organic | | 2024 | | 2023 | | % | | Organic |

EMEA (1) | 336,591 | | 322,680 | | 4.3 | % | | (1.5 | %) | | 180,029 | | 172,572 | | 4.3 | % | | 2.8 | % |

Americas (2) | 246,046 | | 190,112 | | 29.4 | % | | 6.7 | % | | 131,869 | | 117,705 | | 12.0 | % | | 4.5 | % |

| Greater China Region | 266,324 | | 306,835 | | (13.2 | %) | | (11.7 | %) | | 126,925 | | 142,309 | | (10.8 | %) | | (10.0 | %) |

Rest of APAC (3) | 109,990 | | 82,190 | | 33.8 | % | | 5.4 | % | | 57,556 | | 41,463 | | 38.8 | % | | 5.9 | % |

Other (4) | 1,171 | | 1,242 | | (5.7 | %) | | (17.5 | %) | | 586 | | 698 | | (16.0 | %) | | (21.2 | %) |

| Total revenues | 960,122 | | 903,059 | | 6.3 | % | | (2.7 | %) | | 496,965 | | 474,747 | | 4.7 | % | | (0.4 | %) |

________________________________________(1)EMEA includes Europe, the Middle East and Africa.

(2)Americas includes the United States of America, Canada, Mexico, Brazil and other Central and South American countries.

(3)Rest of APAC includes Japan, South Korea, Singapore, Thailand, Malaysia, Vietnam, Indonesia, Philippines, Australia, New Zealand, India and other Southeast Asian countries.

(4)Other revenues mainly include royalties.

***

Group Monobrand (1) Store Network at June 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At June 30, 2024 | | At December 31, 2023 | | At June 30, 2023 |

| Stores | ZEGNA | | Thom Browne | | TOM FORD FASHION | | Group | | ZEGNA | | Thom Browne | | TOM FORD FASHION | | Group | | ZEGNA | | Thom Browne | | TOM FORD FASHION | | Group |

EMEA (2) | 75 | | 9 | | 7 | | 91 | | 71 | | 9 | | 4 | | 84 | | 69 | | 10 | | 4 | | 83 |

| Americas | 64 | | 20 | | 12 | | 96 | | 59 | | 7 | | 12 | | 78 | | 55 | | 7 | | 11 | | 73 |

| Greater China Region | 82 | | 35 | | 11 | | 128 | | 79 | | 33 | | 10 | | 122 | | 79 | | 32 | | 11 | | 122 |

Rest of APAC | 58 | | 38 | | 26 | | 122 | | 44 | | 37 | | 25 | | 106 | | 43 | | 17 | | 25 | | 85 |

| Total Direct to Consumer (DTC) | 279 | | 102 | | 56 | | 437 | | 253 | | 86 | | 51 | | 390 | | 246 | | 66 | | 51 | | 363 |

EMEA (2) | 46 | | 7 | | 16 | | 69 | | 55 | | 7 | | 14 | | 76 | | 59 | | 7 | | 12 | | 78 |

| Americas | 67 | | 3 | | 50 | | 120 | | 63 | | 3 | | 50 | | 116 | | 63 | | 3 | | 51 | | 117 |

| Greater China Region | 13 | | 10 | | — | | 23 | | 13 | | 10 | | — | | 23 | | 13 | | 11 | | — | | 24 |

Rest of APAC | 4 | | 4 | | 5 | | 13 | | 20 | | 5 | | 6 | | 31 | | 22 | | 22 | | 7 | | 51 |

| Total Wholesale | 130 | | 24 | | 71 | | 225 | | 151 | | 25 | | 70 | | 246 | | 157 | | 43 | | 70 | | 270 |

| Total | 409 | | 126 | | 127 | | 662 | | 404 | | 111 | | 121 | | 636 | | 403 | | 109 | | 121 | | 633 |

________________________________________(1)Monobrand store count includes our DOSs (which are divided into boutiques and outlets) and our Wholesale monobrand stores (including also monobrand franchisees).

(2)Does not include any stores in Russia at June 30, 2024, December 31, 2023 or at June 30, 2023. Although some stores may still be operating at June 30, 2024, they have not been supplied by the Group since February 2022 and have therefore been excluded from the Group’s store count.

Ermenegildo Zegna N.V.

SEMI-ANNUAL CONDENSED CONSOLIDATED STATEMENT OF PROFIT

for the six months ended June 30, 2024 and 2023

(Unaudited)

| | | | | | | | | | | | | | |

| | For the six months ended June 30, |

| (€ thousands) | | 2024 | | 2023 |

| Revenues | | 960,122 | | 903,059 |

| Cost of sales | | (322,678) | | (323,228) |

| Gross profit | | 637,444 | | 579,831 |

| Selling, general and administrative expenses | | (497,612) | | (415,792) |

| Marketing expenses | | (66,751) | | (47,530) |

| Operating profit | | 73,081 | | 116,509 |

| Financial income | | 12,106 | | 15,601 |

| Financial expenses | | (29,267) | | (44,592) |

| Foreign exchange losses | | (7,684) | | (7,003) |

| Result from investments accounted for using the equity method | | 314 | | (2,237) |

| Profit before taxes | | 48,550 | | 78,278 |

| Income taxes | | (17,218) | | (26,162) |

| Profit | | 31,332 | | 52,116 |

| Attributable to: | | | | |

| Shareholders of the Parent Company | | 25,085 | | 45,967 |

| Non-controlling interests | | 6,247 | | 6,149 |

| | | | |

| Basic earnings per share in € | | 0.10 | | 0.19 |

| Diluted earnings per share in € | | 0.10 | | 0.19 |

Ermenegildo Zegna N.V.

SEMI-ANNUAL CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

at June 30, 2024 and at December 31, 2023

(Unaudited)

| | | | | | | | | | | |

| (€ thousands) | At June 30, 2024 | | At December 31, 2023 |

| Assets | | | |

| Non-current assets | | | |

| Intangible assets | 594,936 | | 572,274 |

| Property, plant and equipment | 176,094 | | 159,608 |

| Right-of-use assets | 561,176 | | 533,952 |

| Investments accounted for using the equity method | 19,066 | | 18,765 |

| Deferred tax assets | 165,254 | | 160,878 |

| Other non-current financial assets | 36,121 | | 33,898 |

| Total non-current assets | 1,552,647 | | 1,479,375 |

| Current assets | | | |

| Inventories | 540,791 | | 522,589 |

| Trade receivables | 216,670 | | 240,457 |

| Derivative financial instruments | 4,345 | | 11,110 |

| Tax receivables | 36,112 | | 31,024 |

| Other current financial assets | 99,451 | | 90,917 |

| Other current assets | 105,967 | | 95,260 |

| Cash and cash equivalents | 225,316 | | 296,279 |

| Total current assets | 1,228,652 | | 1,287,636 |

| Total assets | 2,781,299 | | 2,767,011 |

| Liabilities and Equity | | | |

| Equity attributable to shareholders of the Parent Company | 852,678 | | 840,294 |

| Equity attributable to non-controlling interests | 61,527 | | 60,602 |

| Total equity | 914,205 | | 900,896 |

| Non-current liabilities | | | |

| Non-current borrowings | 218,132 | | 113,285 |

| Other non-current financial liabilities | 141,239 | | 136,556 |

| Non-current lease liabilities | 497,543 | | 471,083 |

| Non-current provisions for risks and charges | 20,323 | | 19,849 |

| Employee benefits | 35,727 | | 29,645 |

| Deferred tax liabilities | 77,843 | | 73,885 |

| Other non-current liabilities | 4,758 | | 9,689 |

| Total non-current liabilities | 995,565 | | 853,992 |

| Current liabilities | | | |

| Current borrowings | 167,963 | | 289,337 |

| Other current financial liabilities | — | | 22,102 |

| Current lease liabilities | 133,554 | | 122,642 |

| Derivative financial instruments | 2,741 | | 897 |

| Current provisions for risks and charges | 13,111 | | 16,019 |

| Trade payables and customer advances | 281,819 | | 314,137 |

| Tax liabilities | 41,957 | | 41,976 |

| Other current liabilities | 230,384 | | 205,013 |

| Total current liabilities | 871,529 | | 1,012,123 |

| Total equity and liabilities | 2,781,299 | | 2,767,011 |

Ermenegildo Zegna N.V.

SEMI-ANNUAL CONDENSED CONSOLIDATED CASH FLOW STATEMENT

for the six months ended June 30, 2024 and 2023

(Unaudited)

| | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands) | 2024 | | 2023 |

| Operating activities | | | |

| Profit | 31,332 | | 52,116 |

| Income taxes | 17,218 | | 26,162 |

| Depreciation, amortization and impairment of assets | 113,527 | | 86,983 |

| Financial income | (12,106) | | (15,601) |

| Financial expenses | 29,267 | | 44,592 |

| Foreign exchange losses | 7,684 | | 7,003 |

| Write downs and other provisions | 1,450 | | 962 |

| Write downs of the provision for obsolete inventory | 7,775 | | 19,292 |

| Result from investments accounted for using the equity method | (314) | | 2,237 |

| Other non-cash expenses, net | 36,124 | | 18,839 |

| Change in inventories | (21,568) | | (79,454) |

| Change in trade receivables | 21,286 | | (26,851) |

| Change in trade payables including customer advances | (28,354) | | 3,710 |

| Change in other operating assets and liabilities | (42,268) | | 2,870 |

| Interest paid | (19,587) | | (13,480) |

| Income taxes paid | (21,018) | | (21,797) |

| Net cash flows from operating activities | 120,448 | | 107,583 |

| Investing activities | | | |

| Payments for property, plant and equipment | (47,926) | | (25,699) |

| Payments for intangible assets | (12,151) | | (8,801) |

| Payments for purchases of non-current financial assets | (1,319) | | (585) |

| Proceeds from disposals of current financial assets and derivative instruments | 15,707 | | 221,869 |

| Payments for acquisitions of current financial assets and derivative instruments | (21,444) | | (6,023) |

| Business combinations, net of cash acquired | (14,608) | | (108,575) |

| Acquisition of investments accounted for using the equity method | — | | (11,228) |

| Net cash flows (used in)/from investing activities | (81,741) | | 60,958 |

| Financing activities | | | |

| Proceeds from borrowings | 154,713 | | 65,000 |

| Repayments of borrowings | (174,223) | | (173,407) |

| Payments of lease liabilities | (66,950) | | (59,115) |

| Payments for acquisition of non-controlling interests | (23,502) | | — |

| Proceeds from the exercise of warrants | — | | 4,409 |

| Sales of shares held in treasury | — | | 3,654 |

| Dividends paid to non-controlling interests | (1,444) | | (6,068) |

| Net cash flows used in financing activities | (111,406) | | (165,527) |

| Effects of exchange rate changes on cash and cash equivalents | 1,736 | | (2,295) |

| Net (decrease)/increase in cash and cash equivalents | (70,963) | | 719 |

| | | |

| Cash and cash equivalents at the beginning of the period | 296,279 | | 254,321 |

| Cash and cash equivalents at the end of the period | 225,316 | | 255,040 |

Non-IFRS Financial Measures

The Group’s management monitors and evaluates operating and financial performance using several non-IFRS financial measures including: adjusted earnings before interest and taxes (“Adjusted EBIT”), Adjusted EBIT Margin, Net Financial Indebtedness/(Cash Surplus), Trade Working Capital, Free Cash Flow, revenues on a constant currency basis (constant currency) and revenues on an organic growth basis (organic or organic growth). The Group’s management believes that these non-IFRS financial measures provide useful and relevant information regarding the Group’s financial performance and financial condition, and improve the ability of management and investors to assess and compare the financial performance and financial position of the Group with those of other companies. They also provide comparable measures that facilitate management’s ability to identify operational trends, as well as make decisions regarding future spending, resource allocations and other strategic and operational decisions. While similar measures are widely used in the industry in which the Group operates, the financial measures that the Group uses may not be comparable to other similarly named measures used by other companies nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. A definition, explanation of relevance and a reconciliation of each non-IFRS financial measure to the most directly comparable measure calculated and presented in accordance with IFRS are set out below.

Adjusted EBIT and Adjusted EBIT Margin

Adjusted EBIT is defined as profit or loss before income taxes plus financial income, financial expenses, foreign exchange losses and the result from investments accounted for using the equity method, adjusted for income and costs which are significant in nature and that management considers not reflective of underlying operating activities, including, for one or all of the periods presented and as further described below, net impairment of leased and owned stores, severance indemnities and provisions for severance expenses, legal costs for trademark dispute, transaction costs related to acquisitions, costs related to the Business Combination, special donations for social responsibility and net income related to lease agreements.

Adjusted EBIT Margin is defined as Adjusted EBIT divided by revenues of the applicable period.

The Group’s management uses Adjusted EBIT and Adjusted EBIT Margin for internal reporting to assess performance and as part of the forecasting, budgeting and decision-making processes as they provide additional transparency regarding the Group’s underlying operating performance. The Group’s management believes these non-IFRS financial measures are useful because they exclude items that management believes are not indicative of the Group’s underlying operating performance and allow management to view operating trends, perform analytical comparisons and benchmark performance between periods and among segments. The Group’s management also believes that Adjusted EBIT and Adjusted EBIT Margin are useful for investors and analysts to better understand how management assesses the Group’s underlying operating performance on a consistent basis and to compare the Group’s performance with that of other companies. Accordingly, management believes that Adjusted EBIT and Adjusted EBIT Margin provide useful information to third party stakeholders in understanding and evaluating the Group’s operating results.

The following table presents a reconciliation of Profit to Adjusted EBIT and the calculation of the profit margin and the Adjusted EBIT Margin for the six months ended June 30, 2024 and 2023:

| | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands, except percentages) | 2024 | | 2023 |

| Profit | 31,332 | | 52,116 |

| Income taxes | 17,218 | | 26,162 |

| Financial income | (12,106) | | (15,601) |

| Financial expenses | 29,267 | | 44,592 |

| Foreign exchange losses | 7,684 | | 7,003 |

| Result from investments accounted for using the equity method | (314) | | 2,237 |

| Operating profit | 73,081 | | 116,509 |

| Adjustments: | | | |

Net impairment of leased and owned stores (1) | 4,979 | | — |

Severance indemnities and provisions for severance expenses (2) | 1,436 | | 738 |

Legal costs for trademark dispute (3) | 1,388 | | 649 |

Transaction costs related to acquisitions (4) | 26 | | 4,975 |

Costs related to the Business Combination (5) | — | | 1,059 |

Special donations for social responsibility (6) | — | | 100 |

Net income related to lease agreements (7) | — | | (4,126) |

| Adjusted EBIT | 80,910 | | 119,904 |

| | | |

| Revenues | 960,122 | | 903,059 |

| Profit margin (Profit / Revenues) | 3.3 | % | | 5.8 | % |

| Adjusted EBIT Margin (Adjusted EBIT / Revenues) | 8.4 | % | | 13.3 | % |

________________________________________

(1)Net impairment of leased and owned stores of €4,979 thousand for the six months ended June 30, 2024 includes (i) impairment of €3,036 thousand related to right-of-use assets, and (ii) impairment of €1,943 thousand related to property, plant and equipment.

(2)Relates to severance indemnities of €1,436 thousand and €738 thousand for the six months ended June 30, 2024 and 2023, respectively.

(3)Relates to legal costs of €1,388 thousand and €649 thousand for the six months ended June 30, 2024 and 2023, respectively, in connection with a legal dispute between Adidas AG (“adidas”) and Thom Browne, primarily in relation to the use of trademarks.

(4)Relates to transaction costs of €26 thousand and €4,975 thousand, for the six months ended June 30, 2024 and 2023, respectively, primarily for consultancy and legal fees related to the acquisition of the ZEGNA business in South Korea and for 2023 only, to the TFI Acquisition and the acquisition of a 25% interest in Norda.

(5)Costs related to the Business Combination of €1,059 thousand for the six months ended June 30, 2023 relate to the grant of equity awards to management in 2021 with vesting subject to the public listing of the Company’s shares and certain other performance and/or service conditions.

(6)Relates to donations to support initiatives related to humanitarian emergencies in Turkey of €100 thousand for the six months ended June 30, 2023.

(7)Net income related to lease agreements of €4,126 thousand for the six months ended June 30, 2023 relates to the derecognition of lease liabilities following a change in terms of a lease agreement in Hong Kong.

Net Financial Indebtedness/(Cash Surplus)

Net Financial Indebtedness/(Cash Surplus) is defined as the sum of financial borrowings (current and non-current) and derivative financial instrument liabilities, net of cash and cash equivalents, derivative financial instrument assets, securities (recorded within other current financial assets in the semi-annual condensed consolidated statement of financial position).

The Group’s management believes that Net Financial Indebtedness/(Cash Surplus) is useful to monitor the level of net liquidity and financial resources available to the Group. The Group’s management believes this non-IFRS financial measure aids management, investors and analysts to analyze the Group’s financial position and financial resources available, and to compare the Group’s financial position and financial resources available with that of other companies.

The following table sets forth the calculation of Net Financial Indebtedness/(Cash Surplus) at June 30, 2024, at December 31, 2023 and June 30, 2023:

| | | | | | | | | | | | | | | | | |

| (€ thousands) | At June 30, 2024 | | At December 31, 2023 | | At June 30, 2023 |

| Non-current borrowings | 218,132 | | 113,285 | | 112,747 |

| Current borrowings | 167,963 | | 289,337 | | 283,077 |

| Derivative financial instruments — Liabilities | 2,741 | | 897 | | 2,186 |

| Total borrowings, other financial liabilities and derivatives | 388,836 | | 403,519 | | 398,010 |

| Cash and cash equivalents | (225,316) | | (296,279) | | (255,040) |

| Derivative financial instruments — Assets | (4,345) | | (11,110) | | (17,985) |

Other current financial assets (1) | (93,666) | | (85,320) | | (107,952) |

| Total cash and cash equivalents, other current financial assets and derivatives | (323,327) | | (392,709) | | (380,977) |

| Net Financial Indebtedness/(Cash Surplus) | 65,509 | | 10,810 | | 17,033 |

________________________________________

(1)Includes (i) the Group’s investments in securities amounting to €105,752 thousand and (ii) a financial receivable from an associated company of €2,200 thousand at June 30, 2023.

Trade Working Capital

Trade Working Capital is defined as current assets less current liabilities adjusted for derivative assets and liabilities, tax receivables and liabilities, cash and cash equivalents, borrowings, lease liabilities, and certain other current assets and liabilities.

The Group’s management uses Trade Working Capital to understand and evaluate the Group’s liquidity generation/absorption. The Group’s management believes this non-IFRS financial measure is important supplemental information for investors in evaluating liquidity in that it provides insight into the availability of net current resources to fund our ongoing operations. Trade Working Capital is a measure used by management in internal evaluations of cash availability and operational performance.

The following table sets forth the calculation of Trade Working Capital at June 30, 2024, at December 31, 2023 and June 30, 2023:

| | | | | | | | | | | | | | | | | |

| (€ thousands) | At June 30, 2024 | | At December 31, 2023 | | At June 30, 2023 |

| Current assets | 1,228,652 | | 1,287,636 | | 1,262,741 |

| Current liabilities | (871,529) | | (1,012,123) | | (1,021,920) |

| Working capital | 357,123 | | 275,513 | | 240,821 |

| Less: | | | | | |

| Derivative financial instruments - Assets | 4,345 | | 11,110 | | 17,985 |

| Tax receivables | 36,112 | | 31,024 | | 17,734 |

| Other current financial assets | 99,451 | | 90,917 | | 109,918 |

| Other current assets | 105,967 | | 95,260 | | 99,680 |

| Cash and cash equivalents | 225,316 | | 296,279 | | 255,040 |

| Current borrowings | (167,963) | | (289,337) | | (283,077) |

| Current lease liabilities | (133,554) | | (122,642) | | (121,761) |

| Derivative financial instruments - Liabilities | (2,741) | | (897) | | (2,186) |

| Other current financial liabilities | — | | (22,102) | | (23,373) |

| Current provisions for risks and charges | (13,111) | | (16,019) | | (15,458) |

| Tax liabilities | (41,957) | | (41,976) | | (46,928) |

| Other current liabilities | (230,384) | | (205,013) | | (232,172) |

| Trade Working Capital | 475,642 | | 448,909 | | 465,419 |

| of which trade receivables | 216,670 | | 240,457 | | 217,208 |

| of which inventories | 540,791 | | 522,589 | | 545,176 |

| of which trade payables and customer advances | (281,819) | | (314,137) | | (296,965) |

Trade Working Capital increased by €26,733 thousand from €448,909 thousand at December 31, 2023 to €475,642 thousand at June 30, 2024, primarily related to (i) lower trade payables and customer advances of €32,318 thousand, and (ii) higher inventories of €18,202 thousand, partially offset by (iii) lower trade receivables of €23,787 thousand. The increase in inventories was driven by ZEGNA and TOM FORD FASHION to support growth of the business, including the effects of new store openings and the conversion of ZEGNA stores in South Korea from wholesale to DTC, as well as foreign exchange impact (mainly the United States Dollar and the Chinese Renminbi) and a build up of Textile inventories for the upcoming season, partially offset by a reduction in Thom Browne driven by improved inventory management. The changes in trade receivables and in trade payables and customer advances were primarily driven by seasonality, and the change in trade receivables also reflects the impact of the conversion of several stores from wholesale to DTC.

Free Cash Flow

Free Cash Flow is defined as net cash flows from operating activities less payments for property, plant and equipment (net of proceeds from disposals), intangible assets and lease liabilities.

The Group’s management believes that Free Cash Flow is a useful metric for management, investors and analysts to evaluate and monitor the Group’s ability to generate cash, including in comparison to other companies. Free Cash Flow is not representative of residual cash flows available for discretionary purposes.

The following table sets forth the Free Cash Flow for the six months ended June 30, 2024, and 2023:

| | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands) | 2024 | | 2023 |

| Net cash flows from operating activities | 120,448 | | 107,583 |

| Payments for property, plant and equipment | (47,926) | | (25,699) |

| | | |

| Payments for intangible assets | (12,151) | | (8,801) |

| Payments of lease liabilities | (66,950) | | (59,115) |

| Free Cash Flow | (6,579) | | 13,968 |

Revenues on a constant currency basis (constant currency)

In addition to presenting our revenues on a current currency basis, we also present certain revenue information on a constant currency basis (constant currency), which excludes the effects of foreign currency translation from our subsidiaries with functional currencies different from the Euro.

We calculate constant currency revenues by applying the current period average foreign currency exchange rates to translate prior period revenues of foreign subsidiaries expressed in local functional currencies different than the Euro.

We use revenues on a constant currency basis to analyze how our underlying revenues have changed between periods independent of the effects of foreign currency translation.

Revenues on a constant currency basis are not a substitute for revenues on a current currency basis or any IFRS-related measures, however we believe that revenues excluding the impact of foreign currency translation provide additional useful information to management and to investors in analyzing and evaluating our revenues and operating performance.

Revenues on an organic growth basis (organic growth or organic)

In addition to presenting our revenues on a current currency basis, we also present certain revenue information on an organic growth basis (organic growth or organic). Organic growth is calculated as the change in revenues from period to period, excluding the effects of (a) foreign exchange, (b) acquisitions and disposals and (c) changes in license agreements where the Group operates as a licensee.

In calculating organic growth, the following adjustments are made to revenues:

(a) Foreign exchange – Current period average foreign currency exchange rates are used to translate prior period revenues of foreign subsidiaries expressed in local functional currencies different than the Euro.

(b) Acquisitions and disposals – Revenues generated by businesses and operations acquired in the current year are excluded. Revenues generated by businesses and operations acquired in the prior year are excluded from the current year for the same period that corresponds to the pre-acquisition period in the prior year. Additionally, where a business or operation was a customer prior to an acquisition, the related pre-acquisition revenues are excluded from the current and prior periods. Revenues generated by businesses and operations disposed of in the current year or prior year are excluded from both periods as applicable.

(c) Changes in license agreements where the Group operates as a licensee – Revenues generated from license agreements where the Group operates as a licensee that are new or terminated in the current year or prior year are excluded from both periods (except if the effects are already included in acquisitions and disposals). Additionally, revenues generated from license agreements where the Group operates as a licensee that experienced a structural change in the scope or perimeter in the current year or prior year are excluded from both periods, including changes to product categories, distribution channels or geographies of the underlying license agreements.

We believe the presentation of organic growth is useful to better understand and analyze the underlying change in the Group’s revenues from period to period on a consistent perimeter and constant currency basis.

Revenues on an organic growth basis are not a substitute for revenues on a current currency basis or any IFRS-related measures, however we believe that revenues excluding the effects of (a) foreign exchange, (b) acquisitions and disposals and (c) changes in license agreements where the Group operates as a licensee provide additional useful information to management and to investors in analyzing and evaluating our revenues and operating performance.

The tables below show a reconciliation of reported revenue growth to constant currency, excluding the effects of foreign exchange, and to organic, which excludes also acquisitions and disposals and changes in license agreements where the Group operates as a licensee, by segment, by brand and product line, by distribution channel and by geographic area for the six months ended June 30, 2024 compared to the six months ended June 30, 2023 (H1 2024 vs H1 2023) and for the three months ended June 30, 2024 compared to the three months ended June 30, 2023 (Q2 2024 vs Q2 2023).

Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic |

| Zegna | 2.5 | % | | (1.9 | %) | | 4.4 | % | | 0.7 | % | | 0.2 | % | | 3.5 | % |

| Thom Browne | (19.7 | %) | | (1.2 | %) | | (18.5 | %) | | 8.5 | % | | — | % | | (27.0 | %) |

| Tom Ford Fashion | 131.9 | % | | (1.4 | %) | | 133.3 | % | | 128.6 | % | | — | % | | 4.7 | % |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic |

| Zegna | 3.3 | % | | (1.1 | %) | | 4.4 | % | | 1.1 | % | | 0.6 | % | | 2.7 | % |

| Thom Browne | (7.2 | %) | | (1.0 | %) | | (6.2 | %) | | 11.6 | % | | — | % | | (17.8 | %) |

| Tom Ford Fashion | 30.4 | % | | (1.0 | %) | | 31.4 | % | | 26.7 | % | | — | % | | 4.7 | % |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

Brand and product line

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic |

| ZEGNA brand | 4.6 | % | | (2.1 | %) | | 6.7 | % | | 0.8 | % | | — | % | | 5.9 | % |

| Thom Browne | (19.4 | %) | | (1.2 | %) | | (18.2 | %) | | 8.5 | % | | — | % | | (26.7 | %) |

| TOM FORD FASHION | 132.0 | % | | (1.3 | %) | | 133.3 | % | | 128.6 | % | | — | % | | 4.7 | % |

| Textile | (1.7 | %) | | (1.0 | %) | | (0.7 | %) | | (0.1 | %) | | — | % | | (0.6 | %) |

| Other | (60.4 | %) | | (0.2 | %) | | (60.2 | %) | | (0.3 | %) | | (27.0 | %) | | (32.9 | %) |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less

Foreign exchange | | Constant

Currency | | less

Acquisitions and disposals | | less

Changes in license agreements where the Group operates as a licensee | | Organic |

| ZEGNA brand | 5.1 | % | | (1.2 | %) | | 6.3 | % | | 1.3 | % | | — | % | | 5.0 | % |

| Thom Browne | (7.3 | %) | | (1.0 | %) | | (6.3 | %) | | 11.6 | % | | — | % | | (17.9 | %) |

| TOM FORD FASHION | 30.4 | % | | (1.0 | %) | | 31.4 | % | | 26.7 | % | | — | % | | 4.7 | % |

| Textile | (1.7 | %) | | (1.2 | %) | | (0.5 | %) | | — | % | | — | % | | (0.5 | %) |

| Other | (45.2 | %) | | — | % | | (45.2 | %) | | — | % | | (22.2 | %) | | (23.0 | %) |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

Distribution channel

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic |

| Direct to Consumer (DTC) | | | | | | | | | | | |

| ZEGNA brand | 4.5 | % | | (2.3 | %) | | 6.8 | % | | 1.7 | % | | — | % | | 5.1 | % |

| Thom Browne | 8.5 | % | | (4.2 | %) | | 12.7 | % | | 25.5 | % | | — | % | | (12.8 | %) |

| TOM FORD FASHION | 167.8 | % | | (2.9 | %) | | 170.7 | % | | 169.4 | % | | — | % | | 1.3 | % |

| Total Direct to Consumer (DTC) | 14.8 | % | | (2.7 | %) | | 17.5 | % | | 15.1 | % | | — | % | | 2.4 | % |

| Wholesale branded | | | | | | | | | | | |

| ZEGNA brand | 5.2 | % | | (0.7 | %) | | 5.9 | % | | (4.5 | %) | | — | % | | 10.4 | % |

| Thom Browne | (38.1 | %) | | — | % | | (38.1 | %) | | (2.1 | %) | | — | % | | (36.0 | %) |

| TOM FORD FASHION | 89.4 | % | | (0.1 | %) | | 89.5 | % | | 80.8 | % | | — | % | | 8.7 | % |

| Total Wholesale branded | (7.5 | %) | | (0.2 | %) | | (7.3 | %) | | 7.6 | % | | — | % | | (14.9 | %) |

| Textile | (1.7 | %) | | (1.0 | %) | | (0.7 | %) | | (0.1 | %) | | — | % | | (0.6 | %) |

| Other | (60.4 | %) | | (0.2 | %) | | (60.2 | %) | | (0.3 | %) | | (27.0 | %) | | (32.9 | %) |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic |

| Direct to Consumer (DTC) | | | | | | | | | | | |

| ZEGNA brand | 4.6 | % | | (1.3 | %) | | 5.9 | % | | 1.9 | % | | — | % | | 4.0 | % |

| Thom Browne | 12.9 | % | | (2.9 | %) | | 15.8 | % | | 27.4 | % | | — | % | | (11.6 | %) |

| TOM FORD FASHION | 42.0 | % | | (1.8 | %) | | 43.8 | % | | 42.5 | % | | — | % | | 1.3 | % |

| Total Direct to Consumer (DTC) | 9.8 | % | | (1.6 | %) | | 11.4 | % | | 9.7 | % | | — | % | | 1.7 | % |

| Wholesale branded | | | | | | | | | | | |

| ZEGNA brand | 8.8 | % | | (0.3 | %) | | 9.1 | % | | (2.7 | %) | | — | % | | 11.8 | % |

| Thom Browne | (22.2 | %) | | — | % | | (22.2 | %) | | 0.2 | % | | — | % | | (22.4 | %) |

| TOM FORD FASHION | 16.6 | % | | (0.4 | %) | | 17.0 | % | | 8.3 | % | | — | % | | 8.7 | % |

| Total Wholesale branded | (3.7 | %) | | (0.2 | %) | | (3.5 | %) | | 1.5 | % | | — | % | | (5.0 | %) |

| Textile | (1.7 | %) | | (1.2 | %) | | (0.5 | %) | | — | % | | — | % | | (0.5 | %) |

| Other | (45.2 | %) | | — | % | | (45.2 | %) | | — | % | | (22.2 | %) | | (23.0 | %) |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

Geographic area

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs H1 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic |

EMEA (1) | 4.3 | % | | (0.1 | %) | | 4.4 | % | | 6.9 | % | | (1.0 | %) | | (1.5 | %) |

Americas (2) | 29.4 | % | | 0.1 | % | | 29.3 | % | | 24.4 | % | | (1.8 | %) | | 6.7 | % |

| Greater China Region | (13.2 | %) | | (2.9 | %) | | (10.3 | %) | | 1.4 | % | | — | % | | (11.7 | %) |

Rest of APAC (3) | 33.8 | % | | (8.5 | %) | | 42.3 | % | | 37.8 | % | | (0.9 | %) | | 5.4 | % |

Other (4) | (5.7 | %) | | — | % | | (5.7 | %) | | 11.8 | % | | — | % | | (17.5 | %) |

| Total | 6.3 | % | | (1.8 | %) | | 8.1 | % | | 11.6 | % | | (0.8 | %) | | (2.7 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs Q2 2023 |

| Revenues Growth | | less Foreign exchange | | Constant

Currency | | less Acquisitions and disposals | | less Changes in license agreements where the Group operates as a licensee | | Organic |

EMEA (1) | 4.3 | % | | 0.3 | % | | 4.0 | % | | 2.0 | % | | (0.8 | %) | | 2.8 | % |

Americas (2) | 12.0 | % | | (0.2 | %) | | 12.2 | % | | 8.4 | % | | (0.7 | %) | | 4.5 | % |

| Greater China Region | (10.8 | %) | | (1.5 | %) | | (9.3 | %) | | 0.8 | % | | (0.1 | %) | | (10.0 | %) |

Rest of APAC (3) | 38.8 | % | | (9.7 | %) | | 48.5 | % | | 42.9 | % | | (0.3 | %) | | 5.9 | % |

Other (4) | (16.0 | %) | | (0.1 | %) | | (15.9 | %) | | 5.3 | % | | — | % | | (21.2 | %) |

| Total | 4.7 | % | | (1.1 | %) | | 5.8 | % | | 6.7 | % | | (0.5 | %) | | (0.4 | %) |

________________________________________

(1)EMEA includes Europe, the Middle East and Africa.

(2)Americas includes the United States of America, Canada, Mexico, Brazil and other Central and South American countries.

(3)Rest of APAC includes Japan, South Korea, Singapore, Thailand, Malaysia, Vietnam, Indonesia, Philippines, Australia, New Zealand, India and other Southeast Asian countries.

(4)Other revenues mainly include royalties.

***

Capital expenditure

Capital expenditure is defined as the sum of cash outflows that result in additions to property, plant and equipment and intangible assets.

The following table shows a breakdown of capital expenditure by category for the six months ended June 30, 2024 and 2023.

| | | | | | | | | | | |

| For the six months ended June 30, |

| (€ thousands) | 2024 | | 2023 |

| Payments for property, plant and equipment | 47,926 | | 25,699 |

| Payments for intangible assets | 12,151 | | 8,801 |

| Capital expenditure | 60,077 | | 34,500 |

***

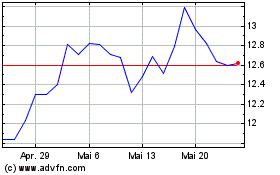

Ermenegildo Zegna NV (NYSE:ZGN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Ermenegildo Zegna NV (NYSE:ZGN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024