Watsco Declares $2.45 Quarterly Dividend

02 Oktober 2023 - 1:30PM

Watsco, Inc.’s (NYSE: WSO) Board of Directors has declared a

regular quarterly cash dividend of $2.45 on each outstanding share

of its Common and Class B common stock payable on October 31, 2023

to shareholders of record at the close of business on October 17,

2023.

Watsco has paid dividends for 49 consecutive

years and has consistently shared increasing levels of cash flow

through dividends while maintaining a conservative balance sheet

with continued capacity to build its distribution network.

Watsco is the largest participant in the

highly fragmented $50+ billion North American HVAC/R distribution

market. Since entering distribution in 1989, revenues and operating

income have grown at compounded annual growth rates (CAGRs) of 15%

and 19%, respectively, reflecting strong and consistent performance

across various macroeconomic and industry cycles.

Over this period, Watsco’s dividends have grown

at a 21% CAGR along with a healthy balance sheet and strong cash

flow. Future changes in dividends are considered in light of

investment opportunities, cash flow, general economic conditions

and Watsco’s overall financial condition.

About Watsco

Watsco operates the largest distribution network

for heating, air conditioning and refrigeration (HVAC/R) products

with locations in the United States, Canada, Mexico, and Puerto

Rico, and on an export basis to Latin America and the Caribbean.

Watsco estimates that over 350,000 contractors and technicians

visit or call one of its 689 locations each year to get

information, obtain technical support and buy products.

Our business is focused on the replacement

market, which has increased in size and importance as a result of

the aging of installed systems, the introduction of higher energy

efficient models and the necessity of HVAC products in homes and

businesses. According to data published in May 2022 by the Energy

Information Administration, there are approximately 102 million

HVAC systems installed in the United States that have been in

service for more than 10 years, most of which operate well below

current minimum efficiency standards.

Accordingly, Watsco has the opportunity to be a

significant and important contributor toward climate change as its

business plays an important role in the drive to lower CO2e

emissions. According to the Department of Energy, HVAC systems

account for roughly half of U.S. household energy consumption. As

such, replacing existing systems at higher efficiency levels is one

of the most meaningful steps homeowners can take to reduce

electricity consumption and carbon footprint over time.

Based on estimates validated by independent

sources, Watsco averted an estimated 17.4 million metric tons of

CO2e emissions from January 1, 2020 to June 30, 2023 through the

sale of replacement HVAC systems at higher-efficiency standards, an

equivalent of removing 3.9 million gas powered vehicles annually

off the road. More information, including sources and assumptions

used to support the Company’s estimates, can be found at

www.watsco.com.

This document includes certain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements may address,

among other things, our expected financial and operational results

and the related assumptions underlying our expected results. These

forward-looking statements are distinguished by use of words such

as “will,” “would,” “anticipate,” “expect,” “believe,” “designed,”

“plan,” or “intend,” the negative of these terms, and similar

references to future periods. These statements are based on

management's current expectations and are subject to uncertainty

and changes in circumstances. Actual results may differ materially

from these expectations due to changes in economic, business,

competitive market, new housing starts and completions, capital

spending in commercial construction, consumer spending and debt

levels, regulatory and other factors, including, without

limitation, the effects of supplier concentration, competitive

conditions within Watsco’s industry, the seasonal nature of sales

of Watsco’s products, the ability of the Company to expand its

business, insurance coverage risks and final GAAP adjustments.

Detailed information about these factors and additional important

factors can be found in the documents that Watsco files with the

Securities and Exchange Commission, such as Form 10-K, Form 10-Q

and Form 8-K. Forward-looking statements speak only as of the date

the statements were made. Watsco assumes no obligation to update

forward-looking information to reflect actual results, changes in

assumptions or changes in other factors affecting forward-looking

information, except as required by applicable law.

Barry S. LoganExecutive Vice President(305)

714-4102e-mail: blogan@watsco.com

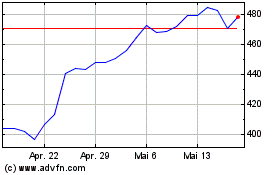

Watsco (NYSE:WSO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Watsco (NYSE:WSO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025