Waste Management, Inc. (NYSE: WM) (“WM” or the “Company”) today

announced that it has priced a public offering of $5,200,000,000

aggregate principal amount of senior notes under an effective shelf

registration statement previously filed with the Securities and

Exchange Commission (the “SEC”), as follows:

- $1,000,000,000 aggregate principal amount of 4.500% senior

notes due March 15, 2028;

- $700,000,000 aggregate principal amount of 4.650% senior notes

due March 15, 2030;

- $750,000,000 aggregate principal amount of 4.800% senior notes

due March 15, 2032;

- $1,500,000,000 aggregate principal amount of 4.950% senior

notes due March 15, 2035; and

- $1,250,000,000 aggregate principal amount of 5.350% senior

notes due October 15, 2054.

The notes will be fully and unconditionally guaranteed by the

Company’s wholly owned subsidiary, Waste Management Holdings, Inc.

The notes have been assigned ratings of A- by Standard &

Poor’s, A- by Fitch and A3 by Moody’s.

The offering is expected to close on November 4, 2024, subject

to the satisfaction of closing conditions. The Company has elected

to draw $5.2 billion principal amount of borrowings under its

delayed draw Term Credit Agreement, dated as of August 28, 2024

(the “Term Credit Agreement”). The Company intends to fund

consideration for the previously announced merger of Stag Merger

Sub Inc., an indirect wholly-owned subsidiary of the Company

(“Merger Sub”) with and into Stericycle Inc., a Delaware

corporation (“Stericycle”) pursuant to the Agreement and Plan of

Merger, dated as of June 3, 2024, among the Company, Merger Sub and

Stericycle (the “Merger”) and to pay related fees and expenses with

borrowings under the Term Credit Agreement, together with

borrowings under the Company’s commercial paper program and cash on

hand. The Company intends to use the net proceeds from the offering

of the notes to repay such borrowings under its Term Credit

Agreement upon completion of the Merger. Consummation of the

offering is not contingent on the completion of the Merger. If for

any reason the Merger is not consummated, the Company intends to

use the net proceeds from the offering for general corporate

purposes, which may include (but is not limited to) (i) the

repayment or redemption of the Company’s senior notes, (ii) the

funding of acquisitions and, (iii) upon the Company’s return to

target leverage ratios, share repurchases. If the Merger is not

consummated, the Company’s management team will retain broad

discretion as to the allocation of the net proceeds of the

offering. Pending application of the net proceeds of the offering

for the foregoing purposes, the Company may use the net proceeds to

repay any current or future borrowings under the Company’s

commercial paper program used to pay the consideration for the

Merger and for working capital, which is fully supported by the

Company’s $3.5 billion revolving credit facility, for short-term

investments or for general corporate purposes.

J.P. Morgan Securities LLC, Barclays Capital Inc., Deutsche Bank

Securities Inc., Goldman Sachs & Co. LLC, Mizuho Securities USA

LLC and Scotia Capital (USA) Inc. are acting as Joint Bookrunners.

In addition, BNP Paribas Securities Corp., MUFG Securities

Americas, Inc., PNC Capital Markets LLC, RBC Capital Markets, LLC,

SMBC Nikko Securities America, Inc., Truist Securities, Inc., U.S.

Bancorp Investments, Inc., Wells Fargo Securities, LLC, Academy

Securities, Inc., Loop Capital Markets LLC, Blaylock Van, LLC,

Mischler Financial Group, Inc. and Stern Brothers & Co. are

acting as co-managers of the offering. Copies of the final

prospectus supplement and related prospectus for the offering may

be obtained by visiting EDGAR on the SEC website at www.sec.gov or,

upon request, from any of the joint book-running managers at: J.P.

Morgan Securities LLC, by mail: Attn: Investment Grade Syndicate

Desk, 383 Madison Avenue, New York, NY 10179 or by phone at

1-212-834-4533; Barclays Capital Inc., by mail: c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

by phone at 1-888-603-5847 or by email at

barclaysprospectus@broadridge.com; Deutsche Bank Securities Inc.,

by mail: Attn: Prospectus Group, 1 Columbus Circle, New York, NY

10019, by phone at 1-800-503-4611 or by email at

prospectus.CPDG@db.com; Goldman Sachs & Co. LLC, by mail: Attn:

Prospectus Department, 200 West Street, New York, NY 10282, by

phone at 1-866-471-2526 or by email at

prospectus-ny@ny.email.gs.com; Mizuho Securities USA LLC, by mail

Attn: Debt Capital Markets, 1271 Avenue of the Americas, New York,

NY 10020 or by phone at 1-866-271-7403; or Scotia Capital (USA)

Inc., by mail: 250 Vesey Street, New York, NY 10281 or by phone at

1-800-372-3930.

This press release does not constitute an offer to sell or

the solicitation of an offer to buy the notes described herein, nor

shall there be any sale of these notes in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. The notes will be offered only by means of a

prospectus, including the prospectus supplement relating to the

notes, and any free writing prospectus prepared by or on behalf of

us, each of which meeting the requirements of Section 10 of the

Securities Act of 1933, as amended. A securities rating is not a

recommendation to buy, sell or hold securities and may be subject

to revision, suspension or withdrawal at any time. Each credit

rating should be evaluated independently of any other credit

rating.

ABOUT WM WM is North America's leading provider of

comprehensive environmental solutions. Previously known as Waste

Management and based in Houston, Texas, WM is driven by commitments

to put people first and achieve success with integrity. WM, through

its subsidiaries, provides collection, recycling and disposal

services to millions of residential, commercial, industrial and

municipal customers throughout the U.S. and Canada. With innovative

infrastructure and capabilities in recycling, organics and

renewable energy, WM provides environmental solutions to and

collaborates with its customers in helping them achieve their

sustainability goals. WM has the largest disposal network and

collection fleet in North America, is the largest recycler of

post-consumer materials and is a leader in beneficial use of

landfill gas, with a growing network of renewable natural gas

plants and the most landfill gas-to-electricity plants in North

America. WM's fleet includes more than 12,000 natural gas trucks –

the largest heavy-duty natural gas truck fleet of its kind in North

America.

FORWARD-LOOKING STATEMENTS This press release contains

forward-looking statements that involve risks and uncertainties.

Factors that could cause actual results to differ materially from

those expressed or implied by the forward-looking statements in

this press release are discussed in the Company’s most recent

Annual Report on Form 10-K and subsequent reports on Form 10-Q.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030176057/en/

Waste Management

Analysts Ed Egl 713.265.1656 eegl@wm.com

Media Toni Werner media@wm.com

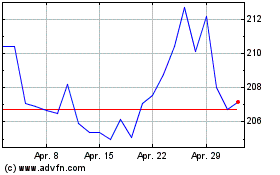

Waste Management (NYSE:WM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Waste Management (NYSE:WM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024