The Van Kampen Municipal Closed-End Funds (“Funds”) listed below

hereby announce the dates for the partial redemptions of their

respective preferred shares. The announced partial redemptions

total approximately $99 million of the total outstanding preferred

shares issued by the Funds.

This is the third redemption announcement since the August 18,

2008 press release in which Van Kampen provided information

regarding additional refinancing of a portion of the Funds’

preferred shares with the use of tender option bonds (TOBs). In

light of the continued failed auctions, each Fund’s Board of

Trustees approved the use of TOBs as a replacement source of

leverage. In the previous announcements dated May 1, 2009 and June

9, 2009, Van Kampen announced the redemption of approximately $120

million and $24 million, respectively, of the total outstanding

preferred shares issued by the Funds.

The amount of preferred shares being redeemed at this time

equates to approximately 5 percent of the original shares issued

for each Fund. This partial redemption affects seven of the Firms’

closed-end municipal funds.

With respect to this partial redemption, The Depository Trust

Company (DTC), the securities’ holder of record, will determine how

the partial series redemptions will be allocated among each

participant broker-dealer account. Each participant broker-dealer,

as nominee for underlying beneficial owners (street name

shareholders), in turn will determine how redeemed shares are to be

allocated among its underlying beneficial owners. The procedures

used by various broker-dealers to allocate redeemed shares among

beneficial owners may differ from each other as well as from the

procedures used by DTC.

Redemption Schedule

Van Kampen Advantage Municipal

Income Trust II (NYSE: VKI)

Series CUSIP Number

# of Shares

Redeemed

Amount

Redeemed

Redemption Date A 921-12K-206 80

$ 2,000,000 October 23, 2009 B 921-12K-305

80 $ 2,000,000 October 19, 2009 C

921-12K-404 80 $ 2,000,000

October 23, 2009 D 921-12K-503 80 $ 2,000,000

October 22, 2009 E 921-12K-602 70

$ 1,750,000 October 19, 2009 F

921-12K-701 100 $ 2,500,000 October 21,

2009 G 921-12K-800 100 $ 2,500,000

November 16, 2009 H 921-12K-883 100 $

2,500,000 November 9, 2009 I 921-12K-875

100 $ 2,500,000 November 23, 2009 J

921-12K-867 50 $ 1,250,000

October 20, 2009

Van Kampen Municipal Opportunity

Trust (NYSE:VMO)

Series CUSIP Number

# of Shares

Redeemed

Amount

Redeemed

Redemption Date A 920-935-202 150

$ 3,750,000 November 6, 2009 B

920-935-301 150 $ 3,750,000 November 4,

2009 C 920-935-400 100 $ 2,500,000

November 18, 2009 D 920-935-509 100 $

2,500,000 November 4, 2009 E 920-935-608

100 $ 2,500,000 November 13, 2009 F

920-935-707 80 $ 2,000,000

November 18, 2009

Van Kampen Municipal Trust

(NYSE:VKQ)

Series CUSIP Number

# of Shares

Redeemed

Amount

Redeemed

Redemption Date A 920-919-206 150

$ 3,750,000 October 23, 2009 B

920-919-305 150 $ 3,750,000 November

23, 2009 C 920-919-404 150 $ 3,750,000

October 20, 2009 D 920-919-503 150 $

3,750,000 November 18, 2009 E 920-919-602

50 $ 1,250,000 November 16, 2009

Van Kampen Select Sector Municipal

Trust (NYSE:VKL)

Series CUSIP Number

# of Shares

Redeemed

Amount

Redeemed

Redemption Date A 921-12M-202 34 $

850,000 October 16, 2009 B 921-12M-301 34

$ 850,000 November 27, 2009 C 921-12M-400

100 $ 2,500,000 November 10, 2009 D

921-12M-509 90 $ 2,250,000 November 12, 2009

Van Kampen Trust for Insured

Municipals (NYSE:VIM)

Series CUSIP Number

# of Shares

Redeemed

Amount

Redeemed

Redemption Date A 920-928-207 90 $

2,250,000 November 24, 2009 B 920-928-306 90

$ 2,250,000 November 23, 2009

Van Kampen Trust for Investment

Grade Municipals (NYSE:VGM)

Series CUSIP Number

# of Shares

Redeemed

Amount

Redeemed

Redemption Date A 920-929-205 150 $

3,750,000 November 19, 2009 B 920-929-304 150

$ 3,750,000 November 25, 2009 C 920-929-403

150 $ 3,750,000 November 3, 2009 D

920-929-502 80 $ 2,000,000 November 6, 2009 E

920-929-601 110 $ 2,750,000 November

19, 2009 F 920-929-700 110 $ 2,750,000

November 25, 2009 G 920-929-809 110 $

2,750,000 November 5, 2009 H 920-929-882 112

$ 2,800,000 November 3, 2009 I 920-929-874

100 $ 2,500,000 November 23, 2009

Van Kampen Trust for Investment

Grade New York Municipals (NYSE:VTN)

Series CUSIP Number

# of Shares

Redeemed

Amount

Redeemed

Redemption Date A 920-931-201 120 $

3,000,000 November 17, 2009 B 920-931-300 90

$ 2,250,000 November 20, 2009 C 920-931-409

80 $ 2,000,000 October 20, 2009

Van Kampen Asset Management, the Funds' investment adviser, is a

wholly owned subsidiary of Van Kampen Investments Inc. (“Van

Kampen”). Van Kampen is one of the nation’s largest investment

management companies, with approximately $86 billion in assets

under management or supervision, as of June 30, 2009. With roots in

money management dating back to 1927, Van Kampen has helped nearly

four generations of investors achieve their financial goals. For

more information, visit Van Kampen’s website at

www.vankampen.com.

# # #

Copyright ©2009 Van Kampen Funds Inc.

All Rights Reserved. Member FINRA/SIPC.

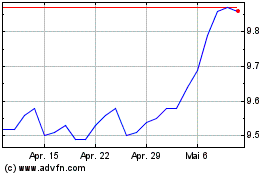

Invesco Trust for Invest... (NYSE:VGM)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Invesco Trust for Invest... (NYSE:VGM)

Historical Stock Chart

Von Jul 2023 bis Jul 2024