TRI-CONTINENTAL CORP MD false 0000099614 0000099614 2023-11-16 2023-11-16 0000099614 us-gaap:CommonStockMember 2023-11-16 2023-11-16 0000099614 us-gaap:PreferredStockMember 2023-11-16 2023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2023

Tri-Continental Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| MARYLAND |

|

811-00266 |

|

13-5441850 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 290 Congress Street, Boston, Massachusetts |

|

02210 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 800-345-6611

NOT APPLICABLE

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

TY |

|

The New York Stock Exchange |

| Preferred Stock |

|

TYPR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7 — REGULATION FD

| Item 7.01 |

Regulation FD Disclosure. |

Registrant is furnishing as Exhibit 99.1 the attached Press Release dated November 16, 2023 for Tri-Continental Corporation.

SECTION 9 — FINANCIAL STATEMENTS AND EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits. |

Registrant is furnishing as Exhibit 99.1 the attached Press Release dated November 16, 2023 for Tri-Continental Corporation.

2

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 16, 2023

|

|

|

| TRI-CONTINENTAL CORPORATION |

|

|

| By: |

|

/s/ Joseph D’Alessandro |

|

|

Joseph D’Alessandro |

|

|

Assistant Secretary |

4

|

|

|

| Stockholder contact: |

|

800-345-6611, option 3 |

|

|

| Media contact: |

|

Lisa Feuerbach

617-897-9344

lisa.feuerbach@columbiathreadneedle.com |

TRI-CONTINENTAL CORPORATION

DECLARES FOURTH QUARTER DISTRIBUTION

BOSTON, MA, November 16, 2023 - Tri-Continental Corporation (the “Corporation”) (NYSE: TY) today

declared a fourth quarter ordinary income distribution of $0.2765 per share of Common Stock and $0.6250 per share of Preferred Stock. In addition, the Corporation declared a total long-term capital gain distribution of $0.1010 per share of Common

Stock. Distributions on Common Stock will be paid on December 19, 2023 to Common Stockholders of record on December 11, 2023 and dividends on Preferred Stock will be paid on January 2, 2024 to Preferred Stockholders of record on

December 11, 2023. The ex-dividend date for both the Common Stock and the Preferred Stock is December 8, 2023. The $0.2765 per share ordinary income distribution and the $0.1010 per share capital

gain distribution on the Common Stock is in accordance with the Corporation’s distribution policy. The capital gain distribution, being a special distribution, will be paid in stock except that any stockholder of record as of December 11,

2023 may elect to receive such distribution as follows: 75% in shares and 25% in cash; 50% in shares and 50% in cash; or 100% in cash.

The Corporation

has paid dividends on its common stock for 79 consecutive years. The Corporation’s investment manager is Columbia Management Investment Advisers, LLC, a wholly owned subsidiary of Ameriprise Financial, Inc.

The Corporation’s distributions on common stock will vary. The Corporation’s current distributions (as estimated by the Corporation based on current

information) are from the earnings and profits of the Corporation. No amount of the Corporation’s current distribution consists of a return of capital (i.e., a return of some or all of your original investment in the Corporation).

The net asset value of the Corporation’s common shares may not always correspond to the market price of such shares. Shares of many closed-end funds frequently trade at a discount from their net asset value. An investment in the Corporation is subject to stock market risk, which is the risk that market prices for the Corporation’s common

shares may decline over short or long periods, adversely affecting the value of an investment in the Corporation.

Securities selected for the Corporation using quantitative methods may perform differently from the market as a whole, and there can be no assurance that this methodology will enable it to

achieve its objective. The Corporation’s portfolio

investments are subject to market risk, which may affect a single issuer, sector of the economy,

industry or the market as a whole. Fixed-income investments, including convertible securities, are subject to credit risk, interest rate risk, and prepayment and extension risk. These risks may be more pronounced for longer-term securities and

high-yield securities (“junk bonds”). In general, bond prices rise when interest rates fall and vice versa. Convertible securities are subject to both the risks of their security type prior to conversion as well as their security type

after conversion. The Corporation’s use of leverage, including through its preferred stock, exposes it to greater risks due to unanticipated market movements, which may magnify losses and increase volatility of returns.

You should consider the investment objectives, risks, charges, and expenses of the Corporation carefully before investing. A prospectus containing

information about the Corporation (including its investment objectives, risks, charges, expenses, and other information) may be obtained by contacting your financial advisor or Columbia Management Investment Services Corp. at 800-345-6611. The prospectus can also be found on the Securities and Exchange Commission’s EDGAR database. The prospectus should be read carefully before investing in the

Corporation. There is no guarantee that the Corporation’s investment goals/objectives will be met or that distributions will be made, and you could lose money.

Tri-Continental Corporation is managed by Columbia Management Investment Advisers, LLC.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.

Past performance does not guarantee future results.

The

Corporation is not insured by the FDIC, NCUA or any federal agency, is not a deposit or obligation of, or guaranteed by any financial institution, and involves investment risks including possible loss of principal and fluctuation in value.

© 2023 Columbia Management Investment Advisers, LLC. All rights reserved.

columbiathreadneedleus.com

Adtrax #6095901

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

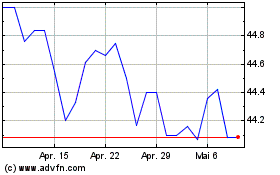

Tri Continental (NYSE:TY-)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Tri Continental (NYSE:TY-)

Historical Stock Chart

Von Jul 2023 bis Jul 2024