Credit Union Balances Rise, Led by Consumers on Both Ends of the Credit Risk Spectrum

05 September 2024 - 2:00PM

The newly released Q3 2024 Credit Union Market Perspectives Report

from TransUnion (NYSE: TRU) found that balances continue to rise

across all credit products, led by share growth among consumers in

the super prime and subprime risk tiers.

Among credit unions, balances grew among all consumer lending

areas in Q2 2024. Growth ranged from 2.7% in credit union auto

balances up to 14.4% for home equity loan balances as borrowers

continue tapping into the equity in their home to make home

improvements, consolidate other debt, or pay for other large

purchases, like education expenses. Bankcards also saw significant

YoY balance growth, up 8.6% over the period.

“Despite a consumer credit market in which originations for many

products remain below levels we saw two years ago, credit unions

continue to see their total balances increase as they continue to

serve the needs of their members,” said Jason Laky, executive vice

president and head of financial services at TransUnion. “It will be

interesting to watch new loan growth as credit union deposits

return to growth and interest rates likely begin falling later this

year.”

Taking a deeper look at credit balances, growth has not been

equal among all credit risk tiers. In fact, credit unions are now

seeing a greater share of their overall balances being found among

consumers in the super prime and subprime risk tiers, while other

risk tiers saw their shares decline YoY. Each of these other risk

tiers has seen their balance share decline for two consecutive

years.

Overall Concentrations in Super Prime and

Subprime Consumer Balances Have Increased, While Balances in Other

Tiers Declined

|

|

Q2 2022 |

Q2 2023 |

Q2 2024 |

|

Super Prime |

38.8% |

39.6% |

40.6% |

|

Prime Plus |

18.9% |

18.0% |

17.3% |

|

Prime |

17.6% |

17.1% |

16.4% |

|

Near Prime |

12.3% |

12.2% |

12.0% |

|

Subprime |

12.4% |

13.1% |

13.7% |

Source: TransUnion Consumer Credit

Database

Among subprime, Q2 2024 represented the fourth consecutive YoY

growth in balance share.

On the origination front, Q2 2024 (the latest quarter available

for origination data) saw increases in two key lending areas with

personal loans up 7.0% YoY and mortgage finally seeing a slight

uptick (+1.8% YoY) after a long period in which higher interest

rates have kept people waiting to buy. With the Federal Reserve’s

recent signaling that the time has come to cut interest rates,

other lending products may similarly see the beginning of an upward

trend in loans among credit union customers.

“With the Fed all but confirming that their next meeting will

finally be the time for rate cuts, it would not be surprising to

see much of that pent-up demand for mortgages and auto loans begin

to finally be realized as more people who have been on the

sidelines finally engage,” said Sean Flynn, senior director of

community financial institutions at TransUnion.

Delinquencies remain lower among credit union members as

compared to other financial institutions

Delinquencies across most credit union lending products are no

longer seeing the elevated growth rates of 2021 and 2022, leveling

off for some products and even declining YoY for unsecured personal

loans and HELoans. Additionally, credit unions continue to see

delinquency rates lower than other lenders. Credit unions saw 0.8%

account-level 60+DPD delinquency in Q2 2024. In comparison,

FinTech/specialty lenders saw 3.0% 60+ DPD in Q2 2024 while other

banks ranged from 0.9% to 1.6%.

Flynn concluded, "It's exciting watching the growth and

innovation taking place in credit unions. As we look to 2025, it's

becoming increasingly clear that to remain relevant and to continue

attracting today's consumers, credit unions need to have

data-driven, modernized marketing strategies in place. Whether

that's more optimized marketing spend in digital advertising or

advanced acquisition tools that drive more targeted campaigns,

credit unions will need to leverage data and technology to meet

consumers where they are, with offers that mean something to

them."

To learn more, visit the Q3 2024 Credit Union Market

Perspectives Report.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with

over 13,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good® — and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the

world.http://www.transunion.com/business

|

|

|

|

Contact |

Dave BlumbergTransUnion |

|

|

|

|

E-mail |

dblumberg@transunion.com |

|

|

|

|

Telephone |

312-972-6646 |

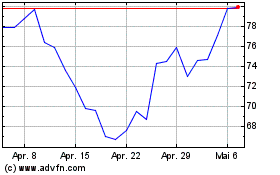

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Dez 2024 bis Dez 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024