0001650164FALSE00016501642024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 15, 2024

___________________________________

Toast, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of Incorporation) | 001-40819 (Commission File Number) | 45-4168768 (I.R.S. Employer Identification No.) |

| | |

401 Park Drive Boston, Massachusetts | | 02215 |

(Address of principal executive offices) | | (Zip code) |

| | |

(617) 297-1005 |

(Registrant's telephone number, including area code) |

| | |

| N/A | |

| (Former name or former address, if changed since last report) |

___________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A common stock, par value $0.000001 per share | TOST | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On February 15, 2024, Toast, Inc. announced its financial results for the fiscal quarter and fiscal year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 2.05. Costs Associated with Exit or Disposal Activities

On February 13, 2024, the Company’s board of directors (the “Board”) approved a restructuring plan designed to promote overall operating expense efficiency (the “Restructuring Plan”). The Restructuring Plan includes a reduction in force which is expected to impact approximately 550 employees, as well as certain other actions to reorganize the Company’s facilities and operations. The Company expects to complete the Restructuring Plan by the end of fiscal year 2024. As part of this Restructuring Plan, the Company expects to incur restructuring and restructuring-related charges of approximately $45 to $55 million, primarily related to severance and severance-related costs and certain other costs related to facilities. Substantially all of these charges are expected to be incurred in the first quarter of fiscal year 2024.

Information provided in this Current Report on Form 8-K including information concerning the expected amount and timing of charges and cash expenditures and expected completion of the contemplated actions are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon the Company’s current plans, assumptions, beliefs, and expectations. Forward-looking statements are subject to the occurrence of many events outside of the Company’s control. Actual results and the timing of events may differ materially from those contemplated by such forward-looking statements due to numerous factors that involve substantial known and unknown risks and uncertainties.

These risks and uncertainties include, among other things, the risk that the restructuring costs and charges may be greater than anticipated or incurred in different periods than anticipated; the risk that the Company’s restructuring efforts may adversely affect the Company’s internal programs and the Company’s ability to recruit and retain skilled and motivated personnel, and may be distracting to employees and management; the risk that the Company’s restructuring efforts may negatively impact the Company’s business operations and reputation; the risk that the Company’s restructuring efforts may not generate their intended benefits to the extent or as quickly as anticipated; and other risks and uncertainties included in the reports on Forms 10-K, 10-Q and 8-K and in other filings the Company makes with the Securities and Exchange Commission from time to time, available at www.sec.gov. Forward-looking statements should be considered in light of these risks and uncertainties. Investors and others are cautioned not to place undue reliance on forward-looking statements. All forward-looking statements contained herein speak only as of the date hereof. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Item 8.01 Other Events

On February 13, 2024, the Board approved the authorization of a share repurchase program for the repurchase of shares of the Company’s Class A common stock, par value $0.000001 per share (the “Class A Common Stock”), in an aggregate amount of up to $250 million. The repurchase program has no expiration date, does not obligate the Company to acquire any particular amount of the Company’s Class A Common Stock, and it may be suspended at any time at the Company’s discretion.

Repurchases may be made from time to time through open market repurchases subject to market conditions, applicable legal requirements and other relevant factors. Open market repurchases may be structured to occur in accordance with the requirements of Rule 10b-18 of the Exchange Act. The Company may also, from time to time, enter into Rule 10b5-1 plans to facilitate repurchases of its shares under this authorization. The timing and actual number of shares repurchased may depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities.

Item 9.01 - Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: February 15, 2024 | | TOAST, INC. |

| | | |

| | By: | /s/ Elena Gomez |

| | Name: | Elena Gomez |

| | Title: | Chief Financial Officer

(Principal Financial Officer) |

Exhibit 99.1

Toast Announces Fourth Quarter and Full Year 2023 Financial Results

Ended 2023 with approximately 106,000 Locations; added over 6,500 net new Locations in fourth quarter

Annualized recurring run-rate (ARR) as of December 31, 2023 increased 35% to over $1.2 billion

Toast’s Board of Directors authorized a share repurchase program

Anticipate GAAP Operating Income profit by first half 2025

BOSTON, MA – February 15, 2024 – Toast (NYSE: TOST), the all-in-one digital technology platform built for restaurants, today reported financial results for the fourth quarter and full year ended December 31, 2023.

Financial Highlights for the Fourth Quarter of 2023

•ARR as of December 31, 2023 was $1.2 billion, up 35% year over year.

•Gross Payment Volume (GPV) increased 32% year over year to $33.7 billion.

•Total Locations increased 34% year over year to approximately 106,000.

•Revenue for Q4 2023 grew 35% year over year to $1.0 billion.

•Gross profit of $226 million was up 43% year over year from Q4 2022. Non-GAAP gross profit grew 42% year over year to $245 million.

•Subscription services and financial technology solutions gross profit was up 35% year over year from Q4 2022 to $270 million. Non-GAAP subscription services and financial technology solutions gross profit grew 36% year over year to $281 million.

•Net loss was $(36) million in Q4 2023 compared to net loss of $(99) million in Q4 2022. Adjusted EBITDA was $29 million in Q4 2023 compared to Adjusted EBITDA of $(18) million in Q4 2022.

•Net cash provided by operating activities of $92 million and Free Cash Flow of $81 million in Q4 2023, compared to net cash used in operating activities of $(19) million and Free Cash Flow of $(29) million in Q4 2022.

Financial Highlights for the Full Year 2023

•Revenue for the full year 2023 grew 42% year over year to $3.9 billion.

•GPV for the full year 2023 increased 38% year over year to $126.1 billion.

•Gross profit of $834 million was up 63% year over year from full year 2022. Non-GAAP gross profit grew 61% year over year to $903 million.

•Subscription services and financial technology solutions gross profit was up 48% year over year from full year 2022 to $1.0 billion. Non-GAAP subscription services and financial technology solutions gross profit grew 49% year over year to $1.1 billion.

•Net loss was $(246) million in full year 2023 compared to net loss of $(275) million for the full year 2022. Adjusted EBITDA was $61 million in full year 2023 compared to Adjusted EBITDA of $(115) million in full year 2022.

•Net cash provided by operating activities of $135 million and Free Cash Flow of $93 million in full year 2023, compared to net cash used in operating activities of $(156) million and Free Cash Flow of $(189) million in full year 2022.

For more information on the non-GAAP financial measures and key metrics discussed in this press release, please see the sections titled “Non-GAAP Financial Measures” and “Key Business Metrics,” as well as the reconciliations of non-GAAP financial measures to their nearest comparable GAAP financial measures at the end of this press release.

Outlook(1)

For the first quarter ending March 31, 2024, Toast expects to report:

•Non-GAAP subscription services and financial technology solutions gross profit in the range of $275 million to $285 million (20-24% growth compared to Q1 2023)

•Adjusted EBITDA in the range of $15 million to $25 million

For the full year ending December 31, 2024, Toast expects to report:

•Non-GAAP subscription services and financial technology solutions gross profit in the range of $1,300 million to $1,320 million (23-25% growth compared to 2023)

•Adjusted EBITDA in the range of $200 million to $220 million

The outlook provided above constitutes forward-looking information within the meaning of applicable securities laws and is based on a number of assumptions and subject to a number of risks. See cautionary note regarding “Forward-looking Statements” in this press release.

Beginning in fiscal year 2024, Toast is providing forward-looking guidance for Non-GAAP Subscription Services and Financial Technology Solutions Gross Profit which Toast considers its recurring gross profit streams. This is defined as subscription services gross profit (GAAP) and financial technology solutions gross profit (GAAP), adjusted to exclude stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense, as set forth below (including historical comparison for reference):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Gross profit (GAAP): | | | | | | | |

Subscription services | $ | 94 | | | $ | 63 | | | $ | 334 | | | $ | 212 | |

Financial technology solutions | 176 | | | 137 | | | 686 | | | 476 | |

| | | | | | | |

Adjustments: | | | | | | | |

Stock-based compensation expense and related payroll tax | 5 | | | 4 | | | 20 | | | 13 | |

Depreciation and amortization | 6 | | | 3 | | | 17 | | | 10 | |

| Non-GAAP Subscription Services and Financial Technology Solutions Gross Profit (Non-GAAP) | $ | 281 | | | $ | 207 | | | $ | 1,057 | | | $ | 711 | |

(1) A reconciliation of these forward looking Non-GAAP measures to the corresponding GAAP measure is not available without unreasonable effort because of the inherent difficulty of accurately forecasting the occurrence and financial impact of the various adjusting items necessary for such reconciliations that have not yet occurred, are out of our control, or cannot be reasonably predicted, including but not limited to the change in fair value of our warrant liability and stock-based compensation. For the same reasons, the Company is unable to assess the probable significance of the unavailable information, which could have a material impact on its future GAAP financial results.

Company Restructuring

On February 13, 2024, Toast’s Board of Directors approved a restructuring plan (the “Plan”) designed to promote overall operating expense efficiency, including a reduction in force that is expected to impact approximately 550 employees, as well as certain other actions to reorganize the Company’s facilities and operations. The Company expects to complete the Plan by the end of fiscal year 2024. As part of this Plan, the Company expects to incur restructuring and restructuring-related charges of approximately $45 to $55 million, primarily related to severance and severance-related costs and certain other costs related to facilities. Substantially all of these charges are expected to be incurred in the first quarter of fiscal year 2024.

Share Repurchase Program

On February 13, 2024, Toast’s Board of Directors authorized a share repurchase program of up to $250 million of its Class A common stock. The Company intends to opportunistically repurchase shares based on market conditions, providing a way to return capital to stockholders and offset a portion of dilution associated with employee equity grants. The Company plans to repurchase shares through open market repurchases or Rule 10b5-1 plans. The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities.

Recent Business Highlights

•Effective January 1, 2024, Aman Narang became Toast’s Chief Executive Officer, taking over from Chris Comparato. Mr. Narang previously served as Toast’s Co-President since December 2012 and Chief Operating Officer since June 2021. Both Mr. Comparato and Mr. Narang remain on Toast’s Board of Directors. Lead Independent Director Mark Hawkins became Chair of Toast’s Board of Directors, also effective January 1, 2024.

•Toast signed agreements with Caribou Coffee and Choice Hotels International. Caribou Coffee will implement Toast Enterprise Solutions across 500 initial coffeehouse locations in the United States. Choice Hotels International will make Toast for Hotel Restaurants technology a brand standard for two of Choice’s upscale brands, Cambria Hotels and Radisson. Toast is also a qualified vendor for Choice’s other brands.

•Toast announced a milestone for its Toast Fundraising feature, which enabled restaurants to raise $1.5M for various causes in 2023. Created in 2023 and available to Toast customers at no additional cost, the Toast Fundraising feature enables restaurants to select a charitable cause to support, giving guests the option to round up their check to the next dollar and donate the difference or contribute a flat donation.

Conference Call Information

Toast will host a live conference call at 5:00 p.m. Eastern Time on Thursday, February 15, 2024. The live webcast of the conference call can be accessed through Toast’s investor relations website at http://investors.toasttab.com. A replay of the webcast will be available for a period of 90 days after the call.

Toast has used, and intends to continue to use, its Investor Relations website (http://investors.toasttab.com), as well as the Toast Newsroom (https://pos.toasttab.com/news), as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Information on or that can be accessed through Toast’s Investor Relations website, or that is contained in any website to which a hyperlink is provided herein is not part of this press release, and the inclusion of Toast’s Investor Relations website address, and any hyperlinks are only inactive textual references.

About Toast

Toast is a cloud-based, all-in-one digital technology platform purpose-built for the entire restaurant community. Toast provides a comprehensive platform of software as a service (SaaS) products and financial technology solutions that give restaurants everything they need to run their business across point of sale, payments, operations, digital ordering and delivery, marketing and loyalty, and team management. We serve as the restaurant operating system, connecting front of house and back of house operations across service models including dine-in, takeout, delivery, catering, and retail. Toast helps restaurants streamline operations, increase revenue and deliver amazing guest experiences. For more information, visit www.toasttab.com.

Contacts

Media: media@toasttab.com

Investors: IR@toasttab.com

Forward-looking Statements

This press release contains “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the context of the statement and generally arise when Toast or its management is discussing its beliefs, estimates or expectations. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “may,” “could,” “should,” “will,” “expects,” “estimates,” “suggests,” “anticipates,” “outlook,” “continues,” or similar expressions. These statements are not historical facts or guarantees of future performance, but represent the beliefs of Toast and its management at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside Toast’s control. Actual results and outcomes may differ materially from what is expressed or forecast in such forward-looking statements. Forward-looking statements include, without limitation, statements about expected financial positions or growth; results of operations; cash flows; statements about expected timeline and plan to reach profitability on an GAAP operating income basis; guidance on financial results for the first fiscal quarter and full year of 2024; statements about future operating results; the expectations of demand for Toast’s products and growth of its business; the growth rates in the markets in which Toast competes; Toast’s investments in technology and infrastructure; statements regarding the arrangement between Toast and its customers, including the planned and future implementation of the Toast platform at such customers’ locations; Toast’s ability to deliver innovative solutions; Toast’s ability to attract and retain customers; financing plans; business strategy; operating plans; competitive positions; growth opportunities for existing products; statements regarding Toast’s share repurchase program; and statements regarding Toast’s restructuring plan.

The forward-looking statements contained in this release are also subject to other risks and uncertainties, including those more fully described in Toast’s filings with the Securities and Exchange Commission (“SEC”), including in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations'' in Toast’s Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2023 and Toast’s Annual Report on Form 10-K for the year ended December 31, 2023, that will be filed following this earnings release, and Toast’s subsequent SEC filings. Toast can give no assurance that the plans, intentions, expectations or strategies as reflected in or suggested by those forward-looking statements will be attained or achieved. The forward-looking statements in this release are based on information available to Toast as of the date hereof, and Toast disclaims any obligation to update any forward-looking statements, except as required by law. These forward-looking statements should not be relied upon as representing Toast’s views as of any date subsequent to the date of this press release.

TOAST, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Revenue: | | | | | | | | | | | |

| Subscription services | $ | 142 | | | $ | 95 | | | $ | 500 | | | $ | 324 | | | | | |

| Financial technology solutions | 851 | | | 640 | | | 3,189 | | | 2,268 | | | | | |

Hardware and professional services | 43 | | | 34 | | | 176 | | | 139 | | | | | |

| | | | | | | | | | | |

| Total revenue | 1,036 | | | 769 | | | 3,865 | | | 2,731 | | | | | |

| Costs of revenue: | | | | | | | | | | | |

| Subscription services | 48 | | | 32 | | | 166 | | | 112 | | | | | |

| Financial technology solutions | 675 | | | 503 | | | 2,503 | | | 1,792 | | | | | |

Hardware and professional services | 86 | | | 75 | | | 357 | | | 311 | | | | | |

| | | | | | | | | | | |

| Amortization of acquired intangible assets | 1 | | | 1 | | | 5 | | | 5 | | | | | |

| Total costs of revenue | 810 | | | 611 | | | 3,031 | | | 2,220 | | | | | |

| Gross profit | 226 | | | 158 | | | 834 | | | 511 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Sales and marketing | 102 | | | 87 | | | 401 | | | 319 | | | | | |

| Research and development | 94 | | | 79 | | | 358 | | | 282 | | | | | |

| General and administrative | 86 | | | 91 | | | 362 | | | 294 | | | | | |

| Total operating expenses | 282 | | | 257 | | | 1,121 | | | 895 | | | | | |

| Loss from operations | (56) | | | (99) | | | (287) | | | (384) | | | | | |

| Other income (expense): | | | | | | | | | | | |

Interest income, net | 10 | | | 6 | | | 37 | | | 11 | | | | | |

| Change in fair value of warrant liability | 8 | | | (7) | | | 3 | | | 95 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Other income, net | 3 | | | 3 | | | 3 | | | 1 | | | | | |

Loss before income taxes | (35) | | | (97) | | | (244) | | | (277) | | | | | |

Income tax (expense) benefit | (1) | | | (2) | | | (2) | | | 2 | | | | | |

Net loss | $ | (36) | | | $ | (99) | | | $ | (246) | | | $ | (275) | | | | | |

Net loss per share attributable to common stockholders: | | | | | | | | | | | |

| Basic | $ | (0.07) | | | $ | (0.19) | | | $ | (0.46) | | | $ | (0.54) | | | | | |

| Diluted | $ | (0.07) | | | $ | (0.19) | | | $ | (0.47) | | | $ | (0.72) | | | | | |

Weighted average shares used in computing net loss per share: | | | | | | | | | | | |

| Basic | 541 | | | 519 | | | 532 | | | 512 | | | | | |

| Diluted | 541 | | | 519 | | | 533 | | | 512 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

TOAST, INC.

CONSOLIDATED BALANCE SHEETS

(unaudited)

(in millions, except per share amounts)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 605 | | | $ | 547 | |

| Marketable securities | 519 | | | 474 | |

| Accounts receivable, net | 69 | | | 77 | |

| Inventories, net | 118 | | | 110 | |

| | | |

Other current assets | 259 | | | 199 | |

| Total current assets | 1,570 | | | 1,407 | |

| Property and equipment, net | 75 | | | 61 | |

| Operating lease right-of-use assets | 36 | | | 77 | |

| Intangible assets, net | 26 | | | 29 | |

| Goodwill | 113 | | | 107 | |

| Restricted cash | 55 | | | 28 | |

| | | |

| Other non-current assets | 83 | | | 52 | |

| Total non-current assets | 388 | | | 354 | |

| Total assets | $ | 1,958 | | | $ | 1,761 | |

| Liabilities and Stockholders’ Equity: | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 32 | | | $ | 30 | |

| | | |

| Deferred revenue | 39 | | | 39 | |

| Accrued expenses and other current liabilities | 592 | | | 427 | |

| Total current liabilities | 663 | | | 496 | |

| Warrants to purchase common stock | 64 | | | 68 | |

| | | |

| Operating lease liabilities, non-current | 33 | | | 80 | |

| Other long-term liabilities | 4 | | | 19 | |

| Total liabilities | 764 | | | 663 | |

| Commitments and Contingencies | | | |

| Stockholders’ Equity: | | | |

Preferred stock - par value $0.000001; 100 million shares authorized, no shares issued or outstanding | — | | | — | |

Common stock, $0.000001 par value: Class A - 7,000 shares authorized, 429 and 353 shares issued and outstanding as of December 31, 2023 and 2022, respectively; Class B - 700 shares authorized, 114 and 170 shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| | | |

Treasury stock, at cost - no shares and 0 shares outstanding at December 31, 2023 and 2022, respectively | — | | | — | |

| Accumulated other comprehensive loss | — | | | (2) | |

| Additional paid-in capital | 2,817 | | | 2,477 | |

| Accumulated deficit | (1,623) | | | (1,377) | |

| Total stockholders’ equity | 1,194 | | | 1,098 | |

| Total liabilities and stockholders’ equity | $ | 1,958 | | | $ | 1,761 | |

TOAST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(in millions) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | |

Net loss | $ | (36) | | | $ | (99) | | | $ | (246) | | | $ | (275) | |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | |

| Depreciation and amortization | 10 | | | 6 | | | 32 | | | 24 | |

| Stock-based compensation expense | 71 | | | 61 | | | 277 | | | 228 | |

Amortization of deferred contract acquisition costs | 18 | | | 12 | | | 62 | | | 44 | |

| | | | | | | |

| Change in fair value of warrant liability | (8) | | | 7 | | | (3) | | | (95) | |

| | | | | | | |

| | | | | | | |

| Credit loss expense | 20 | | | 16 | | | 64 | | | 34 | |

| | | | | | | |

Stock-based charitable contribution expense | — | | | 10 | | | 10 | | | 10 | |

Asset impairments | — | | | — | | | 15 | | | — | |

| Other non-cash items | (3) | | | 2 | | | (17) | | | 3 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable, net | 21 | | | (5) | | | (3) | | | (35) | |

| | | | | | | |

Other current assets | (5) | | | (19) | | | (12) | | | (36) | |

Deferred contract acquisition costs | (30) | | | (18) | | | (107) | | | (71) | |

| Inventories, net | (20) | | | (15) | | | (7) | | | (68) | |

| | | | | | | |

| Accounts payable | 4 | | | 1 | | | 1 | | | (11) | |

| Accrued expenses and other current liabilities | 64 | | | 25 | | | 81 | | | 116 | |

| Deferred revenue | (11) | | | (2) | | | (5) | | | (11) | |

Operating lease right-of-use assets and operating lease liabilities, net | 1 | | | — | | | 1 | | | — | |

| Other assets and liabilities | (4) | | | (1) | | | (8) | | | (13) | |

Net cash provided by (used in) operating activities | 92 | | | (19) | | | 135 | | | (156) | |

| Cash flows from investing activities: | | | | | | | |

| Cash paid for acquisition, net of cash acquired | — | | | — | | | (9) | | | (46) | |

Capital expenditures | (11) | | | (10) | | | (42) | | | (33) | |

| | | | | | | |

| Purchases of marketable securities | (144) | | | (247) | | | (623) | | | (434) | |

| Proceeds from the sale of marketable securities | 12 | | | 5 | | | 35 | | | 46 | |

| Maturities of marketable securities | 142 | | | 179 | | | 556 | | | 369 | |

| Other | — | | | — | | | (3) | | | — | |

| Net cash used in investing activities | (1) | | | (73) | | | (86) | | | (98) | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Proceeds from issuance of common stock | 5 | | | 3 | | | 36 | | | 15 | |

| Change in customer funds obligations, net | — | | | — | | | 27 | | | 26 | |

| | | | | | | |

| | | | | | | |

| Other financing activities | — | | | (1) | | | — | | | (3) | |

| Net cash provided by financing activities | 5 | | | 2 | | | 63 | | | 38 | |

| Net increase (decrease) in cash, cash equivalents, cash held on behalf of customers and restricted cash | 96 | | | (90) | | | 112 | | | (216) | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | 1 | | | 1 | | | — | | | — | |

| Cash, cash equivalents, cash held on behalf of customers and restricted cash at beginning of period | 650 | | | 724 | | | 635 | | | 851 | |

| Cash, cash equivalents, cash held on behalf of customers and restricted cash at end of period | $ | 747 | | | $ | 635 | | | $ | 747 | | | $ | 635 | |

| Reconciliation of cash, cash equivalents, cash held on behalf of customers and restricted cash | | | | | | | |

| Cash and cash equivalents | $ | 605 | | | $ | 547 | | | $ | 605 | | | $ | 547 | |

| Cash held on behalf of customers | 87 | | | 60 | | | 87 | | | 60 | |

| Restricted cash | 55 | | | 28 | | | 55 | | | 28 | |

| Total cash, cash equivalents, cash held on behalf of customers and restricted cash | $ | 747 | | | $ | 635 | | | $ | 747 | | | $ | 635 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Non-GAAP Financial Measures

In this press release, Toast refers to non-GAAP financial measures that are derived on the basis of methodologies other than in accordance with United States generally accepted accounting principles (“GAAP”). Toast uses certain non-GAAP financial measures, as described below, to understand and evaluate its core operating performance. These non-GAAP financial measures, which may be different than similarly-titled measures used by other companies, are presented to enhance investors’ overall understanding of Toast’s financial performance and should not be considered substitutes for, or superior to, the financial information prepared and presented in accordance with GAAP. Toast believes that these non-GAAP financial measures provide useful information about its financial performance, enhance the overall understanding of its past performance and future prospects, and allow for greater transparency with respect to important metrics used by Toast’s management for financial and operational decision-making.

In the tables below, Toast has provided reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. These non-GAAP financial measures should not be considered substitutes for financial measures calculated in accordance with GAAP, and the financial results that Toast calculates and presents in the table in accordance with GAAP, as well as the corresponding reconciliations from those results, should be carefully evaluated.

The following are the non-GAAP financial measures referenced in this press release and presented in the tables below:

•Adjusted EBITDA is defined as net income (loss), adjusted to exclude stock-based compensation expense and related payroll tax expense, depreciation and amortization expense, interest income (expense), net, income taxes and certain other items that are not considered to reflect our operating activities and performance within the ordinary course of business, such as restructuring and restructuring-related expenses, acquisition expenses, fair value adjustments on warrant liabilities, expenses related to early termination of leases (which includes associated asset impairments) and stock-based charitable contribution expense, as applicable.

•Non-GAAP Subscription Services and Financial Technology Solutions Gross Profit is defined as subscription services gross profit and financial technology solutions gross profit, adjusted to exclude stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP Costs of Revenue are defined as costs of revenue excluding stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP Gross Profit is defined as gross profit excluding stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP Subscription Services Gross Profit is defined as subscription services gross profit excluding stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP Financial Technology Solutions Gross Profit is defined as financial technology solutions gross profit excluding stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP Hardware and Professional Services Gross Profit is defined as hardware and professional services gross profit excluding stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP Non-Payments Financial Technology Solutions Gross Profit is defined as financial technology gross profit excluding payments financial technology gross profit.

•Non-GAAP Sales and Marketing Expenses are defined as sales and marketing expenses excluding stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP Research and Development Expenses are defined as research and development expenses excluding stock-based compensation expense and related payroll tax expense, and depreciation and amortization expense.

•Non-GAAP General and Administrative Expenses are defined as general and administrative expenses excluding stock-based compensation expense and related payroll tax expense, depreciation and amortization expense, acquisition expenses, expenses associated to early termination of leases (which includes associated asset impairments), and stock-based charitable contribution expense.

•Free Cash Flow is defined as net cash provided by (used in) operating activities reduced by purchases of property and equipment and capitalization of internal-use software costs (referred to as capital expenditures).

Adjusted EBITDA, Non-GAAP Subscription Services and Financial Technology Solutions Gross Profit, Non-GAAP Costs of Revenue, Non-GAAP Gross Profit, Non-GAAP Subscription Services Gross Profit, Non-GAAP Financial Technology Gross Profit, Non-GAAP Hardware and Professional Services Gross Profit, Non-GAAP Non-Payments Financial Technology Solutions Gross Profit, Non-GAAP Sales and Marketing Expenses, Non-GAAP Research and Development Expenses, Non-GAAP General and Administrative Expenses, and Free Cash Flow do not purport to represent profitability and liquidity measures as defined in accordance with GAAP. These measures are provided to investors and others to improve the quarter-to-quarter and year-to-year comparability of Toast's financial results and to ensure that investors understand the information Toast uses to evaluate the performance of its businesses.

Our definitions may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may not publish these or similar metrics. Further, these metrics have certain limitations since they do not include the impact of certain expenses and cash flows that are reflected in our Consolidated Statements of Operations and Consolidated Statements of Cash Flows. Thus, our Adjusted EBITDA, Non-GAAP Subscription Services and Financial Technology Solutions Gross Profit, Non-GAAP Costs of Revenue, Non-GAAP Gross Profit, Non-GAAP Subscription Services Gross Profit, Non-GAAP Financial Technology Gross Profit, Non-GAAP Hardware and Professional Services Gross Profit, Non-GAAP Non-Payments Financial Technology Solutions Gross Profit, Non-GAAP Sales and Marketing Expenses, Non-GAAP Research and Development Expenses, Non-GAAP General and Administrative Expenses, and Free Cash Flow should be considered in addition to, not as substitutes for, or in isolation from, measures prepared in accordance with GAAP.

Key Business Metrics

In addition, Toast also uses the following key business metrics to help it evaluate its business, identify trends affecting its business, formulate business plans, and make strategic decisions:

1.Gross Payment Volume (“GPV”) is defined as the sum of total dollars processed through the Toast payments platform across Toast Processing Locations in a given period. GPV is a key measure of the scale of Toast’s platform, which in turn drives its financial performance. As Toast customers generate more sales and therefore more GPV, Toast generally sees higher financial technology solutions revenue.

2.Annualized Recurring Run-Rate (“ARR”) is defined as a key operational measure of the scale of Toast’s subscription and payment processing services for both new and existing customers. To calculate ARR, Toast first calculates recurring run-rate on a monthly basis. Monthly Recurring Run-Rate (“MRR”), is measured on the final day of each month as the sum of (i) Toast’s monthly billings of subscription services fees, which is referred to as the subscription component of MRR, and (ii) Toast’s in-month adjusted payments services fees, exclusive of estimated transaction-based costs, which is referred to as the payments component of MRR. MRR does not include fees derived from Toast Capital or related costs. MRR is also not burdened by the impact of SaaS credits offered. The MRR calculation includes all locations on the Toast platform and locations on legacy solutions, which have a negligible impact on ARR.

ARR is determined by taking the sum of (i) twelve times the subscription component of MRR and (ii) four times the trailing-three-month cumulative payments component of MRR. Toast believes this approach provides an indication of its scale, while also controlling for short-term fluctuations in payments volume. ARR may decline or fluctuate as a result of a number of factors, including customers’ satisfaction with the Toast platform, pricing, competitive offerings, economic conditions, or overall changes in Toast’s customers’ and their guests’ spending levels. ARR is an operational measure, does not reflect Toast’s revenue or gross profit determined in accordance with GAAP, and should be viewed independently of, and not combined with or substituted for, Toast’s revenue, gross profit, and other financial information determined in accordance with GAAP. Further, ARR is not a forecast of future revenue and investors should not place undue reliance on ARR as an indicator of Toast’s future or expected results.

Locations

We define a live location, or Location, as a unique location that has used Toast Point of Sale to record transaction volumes above a minimum threshold, and has not been marked as a churned location as of the date of determination. A Location can use Toast payment services, which we refer to as a Toast Processing Location, or for select enterprise customers, not use Toast’s payment services, which we refer to as a Non-Toast Processing Location. Customers of legacy solutions provided by companies that we have acquired, that do not use Toast Point of Sale, are not included in our Location count.

Key Business Metrics and Reconciliation of Non-GAAP Results

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, | | |

| (dollars in billions) | 2023 | | 2022 | | % Growth | | 2023 | | 2022 | | % Growth |

| Gross Payment Volume (GPV) | $ | 33.7 | | | $ | 25.5 | | | 32 | % | | $ | 126.1 | | | $ | 91.7 | | | 38 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | As of December 31, | | |

| (dollars in millions) | | | | | | | 2023 | | 2022 | | % Growth |

Payments Annualized Recurring Run-Rate | | $ | 589 | | | $ | 460 | | | 28 | % |

Subscription Annualized Recurring Run-Rate | | $ | 629 | | | $ | 441 | | | 43 | % |

Total Annualized Recurring Run-Rate (ARR) | $ | 1,218 | | | $ | 901 | | | 35 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Net loss | $ | (36) | | | $ | (99) | | | $ | (246) | | | $ | (275) | |

| Stock-based compensation expense and related payroll tax | 72 | | | 62 | | | 288 | | | 232 | |

| Depreciation and amortization | 10 | | | 6 | | | 32 | | | 24 | |

Interest income, net | (10) | | | (6) | | | (37) | | | (11) | |

| Change in fair value of warrant liability | (8) | | | 7 | | | (3) | | | (95) | |

| Termination of leases | — | | | — | | | 14 | | | (1) | |

Stock-based charitable contribution expense | — | | | 10 | | | 10 | | | 10 | |

| Acquisition expenses | — | | | — | | | 1 | | | 2 | |

Other expense, net | — | | | — | | | — | | | 1 | |

| | | | | | | |

| | | | | | | |

Income tax expense (benefit) | 1 | | | 2 | | | 2 | | | (2) | |

| Adjusted EBITDA | $ | 29 | | | $ | (18) | | | $ | 61 | | | $ | (115) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Costs of Revenue | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Costs of revenue | $ | 810 | | | $ | 611 | | | $ | 3,031 | | | $ | 2,220 | |

| Stock-based compensation expense and related payroll tax | 12 | | | 10 | | | 46 | | | 35 | |

| Depreciation and amortization | 7 | | | 4 | | | 23 | | | 16 | |

| Non-GAAP costs of revenue | $ | 791 | | | $ | 597 | | | $ | 2,962 | | | $ | 2,169 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Gross Profit | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Gross profit | $ | 226 | | | $ | 158 | | | $ | 834 | | | $ | 511 | |

| Stock-based compensation expense and related payroll tax | 12 | | | 10 | | | 46 | | | 35 | |

| Depreciation and amortization | 7 | | | 4 | | | 23 | | | 16 | |

| Non-GAAP gross profit | $ | 245 | | | $ | 172 | | | $ | 903 | | | $ | 562 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Non-GAAP Subscription Services Gross Profit | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Subscription services gross profit | $ | 94 | | | $ | 63 | | | $ | 334 | | | $ | 212 | |

| Stock-based compensation expense and related payroll tax | 5 | | | 4 | | | 20 | | | 13 | |

| Depreciation and amortization | 6 | | | 3 | | | 17 | | | 10 | |

Non-GAAP subscription services gross profit | $ | 105 | | | $ | 70 | | | $ | 371 | | | $ | 235 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Non-GAAP Financial Technology Solutions Gross Profit | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Financial technology solutions gross profit | $ | 176 | | | $ | 137 | | | $ | 686 | | | $ | 476 | |

| Stock-based compensation expense and related payroll tax | — | | | — | | | — | | | — | |

| Depreciation and amortization | — | | | — | | | — | | | — | |

Non-GAAP financial technology solutions gross profit | $ | 176 | | | $ | 137 | | | $ | 686 | | | $ | 476 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Non-GAAP Hardware and Professional Services Gross Profit | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Hardware and professional services gross profit | $ | (43) | | | $ | (41) | | | $ | (181) | | | $ | (172) | |

| Stock-based compensation expense and related payroll tax | 7 | | | 6 | | | 26 | | | 22 | |

| Depreciation and amortization | — | | | — | | | 1 | | | 1 | |

Non-GAAP hardware and professional services gross profit | $ | (36) | | | $ | (35) | | | $ | (154) | | | $ | (149) | |

| | | | | | | | | | | | | | | | | | | | | | | |

Non-GAAP Non-Payments Financial Technology Solutions Gross Profit | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Financial technology solutions gross profit | $ | 176 | | | $ | 137 | | | $ | 686 | | | $ | 476 | |

| | | | | | | |

Payments financial technology solutions gross profit | 142 | | | 113 | | | 561 | | | 418 | |

Non-GAAP non-payments financial technology solutions gross profit | $ | 34 | | | $ | 24 | | | $ | 125 | | | $ | 58 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Sales and Marketing Expenses | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Sales and marketing expenses | $ | 102 | | | $ | 87 | | | $ | 401 | | | $ | 319 | |

| Stock-based compensation expense and related payroll tax | 15 | | | 13 | | | 61 | | | 51 | |

| Depreciation and amortization | 1 | | | 1 | | | 3 | | | 3 | |

| Non-GAAP sales and marketing expenses | $ | 86 | | | $ | 73 | | | $ | 337 | | | $ | 265 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Research and Development Expenses | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Research and development expenses | $ | 94 | | | $ | 79 | | | $ | 358 | | | $ | 282 | |

| Stock-based compensation expense and related payroll tax | 25 | | | 20 | | | 97 | | | 73 | |

| Depreciation and amortization | 1 | | | 1 | | | 4 | | | 2 | |

| Non-GAAP research and development expenses | $ | 68 | | | $ | 58 | | | $ | 257 | | | $ | 207 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP General and Administrative Expenses | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| General and administrative expenses | $ | 86 | | | $ | 91 | | | $ | 362 | | | $ | 294 | |

| Stock-based compensation expense and related payroll tax | 20 | | | 19 | | | 84 | | | 74 | |

| Depreciation and amortization | 1 | | | 1 | | | 2 | | | 2 | |

| Acquisition expenses | — | | | — | | | 1 | | | 2 | |

| Termination of leases | — | | | — | | | 14 | | | (2) | |

Stock-based charitable contribution expense | — | | | 10 | | | 10 | | | 10 | |

| Non-GAAP general and administrative expenses | $ | 65 | | | $ | 61 | | | $ | 251 | | | $ | 208 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Free Cash Flow | Three Months Ended December 31, | | Year Ended December 31, |

| (dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Net cash provided by (used in) operating activities | $ | 92 | | | $ | (19) | | | $ | 135 | | | $ | (156) | |

| | | | | | | |

Capital expenditures | (11) | | | (10) | | | (42) | | | (33) | |

Free cash flow | $ | 81 | | | $ | (29) | | | $ | 93 | | | $ | (189) | |

Sums may not equal totals due to rounding.

TOST-FIN

Source: Toast

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

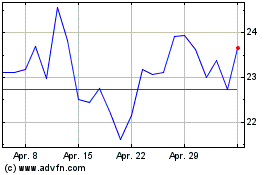

Toast (NYSE:TOST)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Toast (NYSE:TOST)

Historical Stock Chart

Von Jul 2023 bis Jul 2024