0000097745FALSE00000977452024-10-232024-10-230000097745us-gaap:CommonStockMember2024-10-232024-10-230000097745tmo:SeniorNotes0.125Due2025Member2024-10-232024-10-230000097745tmo:SeniorNotes200Due2025Member2024-10-232024-10-230000097745tmo:SeniorNotes3200Due2026Member2024-10-232024-10-230000097745tmo:SeniorNotes1.40Due2026Member2024-10-232024-10-230000097745tmo:A1.45SeniorNotesDue2027Member2024-10-232024-10-230000097745tmo:SeniorNotes175Due2027Member2024-10-232024-10-230000097745tmo:SeniorNotes0.500Due2028Member2024-10-232024-10-230000097745tmo:SeniorNotes1.375Due2028Member2024-10-232024-10-230000097745tmo:SeniorNotes1.95Due2029Member2024-10-232024-10-230000097745tmo:SeniorNotes0.875Due2031Member2024-10-232024-10-230000097745tmo:SeniorNotes2375Due2032Member2024-10-232024-10-230000097745tmo:SeniorNotes3650Due2034Member2024-10-232024-10-230000097745tmo:SeniorNotes2.875Due2037Member2024-10-232024-10-230000097745tmo:SeniorNotes1.500Due2039Member2024-10-232024-10-230000097745tmo:SeniorNotes1.875Due2049Member2024-10-232024-10-23

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2024

THERMO FISHER SCIENTIFIC INC.

(Exact name of Registrant as specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-8002 | | 04-2209186 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

168 Third Avenue

Waltham, Massachusetts 02451

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (781) 622-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $1.00 par value | | TMO | | New York Stock Exchange |

| 0.125% Notes due 2025 | | TMO 25B | | New York Stock Exchange |

| 2.000% Notes due 2025 | | TMO 25 | | New York Stock Exchange |

| 3.200% Notes due 2026 | | TMO 26B | | New York Stock Exchange |

| 1.400% Notes due 2026 | | TMO 26A | | New York Stock Exchange |

| 1.450% Notes due 2027 | | TMO 27 | | New York Stock Exchange |

| 1.750% Notes due 2027 | | TMO 27B | | New York Stock Exchange |

| 0.500% Notes due 2028 | | TMO 28A | | New York Stock Exchange |

| 1.375% Notes due 2028 | | TMO 28 | | New York Stock Exchange |

| 1.950% Notes due 2029 | | TMO 29 | | New York Stock Exchange |

| 0.875% Notes due 2031 | | TMO 31 | | New York Stock Exchange |

| 2.375% Notes due 2032 | | TMO 32 | | New York Stock Exchange |

| 3.650% Notes due 2034 | | TMO 34 | | New York Stock Exchange |

| 2.875% Notes due 2037 | | TMO 37 | | New York Stock Exchange |

| 1.500% Notes due 2039 | | TMO 39 | | New York Stock Exchange |

| 1.875% Notes due 2049 | | TMO 49 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 23, 2024, the Registrant announced its financial results for the fiscal quarter ended September 28, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information contained in this report and exhibits hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release dated October 23, 2024 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | THERMO FISHER SCIENTIFIC INC. |

| | | |

| | | |

| Date: | October 23, 2024 | By: | /s/ Joseph R. Holmes |

| | | Joseph R. Holmes |

| | | Vice President and Chief Accounting Officer |

News

| | | | | | |

|

FOR IMMEDIATE RELEASE |

|

| Media Contact Information: Sandy Pound Thermo Fisher Scientific | Investor Contact Information: Rafael Tejada Thermo Fisher Scientific |

| Phone: 781-622-1223 | Phone: 781-622-1356 |

| E-mail: sandy.pound@thermofisher.com | E-mail: rafael.tejada@thermofisher.com |

|

|

|

Thermo Fisher Scientific Reports Third Quarter 2024 Results

WALTHAM, Mass. (October 23, 2024) – Thermo Fisher Scientific Inc. (NYSE: TMO), the world leader in serving science, today reported its financial results for the third quarter ended September 28, 2024.

Third Quarter 2024 Highlights

•Third quarter revenue was $10.60 billion.

•Third quarter GAAP diluted earnings per share (EPS) was $4.25.

•Third quarter adjusted EPS was $5.28.

•Advanced our proven growth strategy, launching a range of high-impact, innovative new products during the quarter. To enable the development of advanced materials, we launched the groundbreaking Thermo Scientific Iliad scanning transmission electron microscope, which integrates a number of our advanced technologies into a user-friendly workflow to enable research of the most sophisticated modern materials down to the atomic level. To advance life sciences research, we launched the Applied Biosystems MagMAX Sequential DNA/RNA kit, which maximizes the isolation of DNA and RNA from blood cancer samples helping researchers identify unique insights into cancer-causing genetic alterations; and the Invitrogen Vivofectamine Delivery Solutions, a novel method for delivering nucleic acids into multiple targets with therapeutic effect, paving the way for groundbreaking new medicines.

•Continued to deepen our trusted partner status with customers to accelerate their innovation and enhance their productivity. In the quarter, we announced a partnership with the National Cancer Institute on the myeloMATCH precision medicine umbrella trial, which will leverage our next-generation sequencing technology to test patients for specific genetic biomarkers to match them more quickly with optimal treatments based on their unique cancer profile. In our pharma services business, we announced the expansion of our Cincinnati, Ohio, and Bend, Oregon, sites to further enhance our solid dose formulation capabilities for our pharma and biotech customers. In our clinical research business, we also announced the expansion of our global laboratory services network with a new bioanalytical lab in Gothenburg, Sweden, which will provide pharma and biotech customers with advanced laboratory services to support all phases of development.

“We are pleased to deliver strong financial results in the third quarter, reflecting another quarter of sequential improvement in growth” said Marc N. Casper, chairman, president and chief executive officer of Thermo Fisher Scientific. “We continue to deliver differentiated performance through our proven growth strategy and PPI Business System. Our trusted partner status is resonating strongly with customers, and this is translating into meaningful commercial wins.”

Casper added, “Looking ahead, we’re in a great position to deliver on our 2024 objectives, as we continue to create value for all of our stakeholders and build an even brighter future for our company.”

Third Quarter 2024

Revenue for the quarter was $10.60 billion in 2024 versus $10.57 billion in 2023. Growth in revenue, organic revenue and Core organic revenue all improved sequentially from Q2 and were flat versus the prior-year quarter.

GAAP Earnings Results

GAAP diluted EPS in the third quarter of 2024 was $4.25, versus $4.42 in the same quarter last year. GAAP operating income for the third quarter of 2024 was $1.84 billion, compared with $1.86 billion in the year-ago quarter. GAAP operating margin was 17.3%, compared with 17.6% in the third quarter of 2023.

Non-GAAP Earnings Results

Adjusted EPS in the third quarter of 2024 was $5.28, versus $5.69 in the third quarter of 2023. Adjusted operating income for the third quarter of 2024 was $2.36 billion, compared with $2.56 billion in the year-ago quarter. Adjusted operating margin was 22.3%, compared with 24.2% in the third quarter of 2023.

Annual Guidance for 2024

Thermo Fisher is raising its full-year adjusted EPS guidance to a new range of $21.35 to $22.07 versus its previous guidance of $21.29 to $22.07. Revenue guidance continues to be in the range of $42.4 to $43.3 billion.

Use of Non-GAAP Financial Measures

Adjusted EPS, adjusted net income, adjusted operating income, adjusted operating margin, free cash flow, organic revenue growth and Core organic revenue growth are non-GAAP measures that exclude certain items detailed after the tables that accompany this press release, under the heading “Supplemental Information Regarding Non-GAAP Financial Measures.” The reconciliations of GAAP to non-GAAP financial measures are provided in the tables that accompany this press release.

Note on Presentation

Certain amounts and percentages reported within this press release are presented and calculated based on underlying unrounded amounts. As a result, the sum of components may not equal corresponding totals due to rounding.

Conference Call

Thermo Fisher Scientific will hold its earnings conference call today, October 23, at 8:30 a.m. Eastern Daylight Time. During the call, the company will discuss its financial performance, as well as future expectations. To listen, call (833) 470-1428 within the U.S. or (404) 975-4839 outside the U.S. The access code is 296868. You may also listen to the call live on the “Investors” section of our website, www.thermofisher.com. The earnings press release and related information can also be found in that section of our website under the heading “Financials”. A replay of the call will be available under “News, Events & Presentations” through November 6, 2024.

About Thermo Fisher Scientific

Thermo Fisher Scientific Inc. is the world leader in serving science, with annual revenue over $40 billion. Our Mission is to enable our customers to make the world healthier, cleaner and safer. Whether our customers are accelerating life sciences research, solving complex analytical challenges, increasing productivity in their laboratories, improving patient health through diagnostics or the development and manufacture of life-changing therapies, we are here to support them. Our global team delivers an unrivaled combination of innovative technologies, purchasing convenience and pharmaceutical services through our industry-leading brands, including Thermo Scientific, Applied Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services, Patheon and PPD. For more information, please visit www.thermofisher.com.

Safe Harbor Statement

The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements that involve a number of risks and uncertainties. Important factors that could cause actual results to differ materially from those indicated by forward-looking statements include risks and uncertainties relating to: the COVID-19 pandemic; the need to develop new products and adapt to significant technological change; implementation of strategies for improving growth; general economic conditions and related uncertainties; dependence on customers' capital spending policies and government funding policies; the effect of economic and political conditions and exchange rate fluctuations on international operations; use and protection of intellectual property; the effect of changes in governmental regulations; any natural disaster, public health crisis or other catastrophic event; and the effect of laws and regulations governing government contracts, as well as the possibility that expected benefits related to recent or pending acquisitions, may not materialize as expected. Additional important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in our most recent annual report on Form 10-K, and subsequent quarterly reports on Form 10-Q, which are on file with the SEC and available in the “Investors” section of our website under the heading “SEC Filings.” While we may elect to update forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if estimates change and, therefore, you should not rely on these forward-looking statements as representing our views as of any date subsequent to today.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Income (unaudited) | | | | | | | | |

| | Three months ended |

| | September 28, | | % of | | September 30, | | % of |

| (Dollars in millions except per share amounts) | | 2024 | | Revenues | | 2023 | | Revenues |

| Revenues | | $ | 10,598 | | | | | $ | 10,574 | | | |

| Costs and operating expenses: | | | | | | | | |

| Cost of revenues (a) | | 6,180 | | | 58.3 | % | | 6,145 | | | 58.1 | % |

| Selling, general and administrative expenses (b) | | 1,739 | | | 16.4 | % | | 1,578 | | | 14.9 | % |

| Amortization of acquisition-related intangible assets | | 450 | | | 4.2 | % | | 584 | | | 5.6 | % |

| Research and development expenses | | 346 | | | 3.3 | % | | 319 | | | 3.0 | % |

| Restructuring and other costs (c) | | 45 | | | 0.4 | % | | 84 | | | 0.8 | % |

| Total costs and operating expenses | | 8,759 | | | 82.7 | % | | 8,710 | | | 82.4 | % |

| Operating income | | 1,838 | | | 17.3 | % | | 1,864 | | | 17.6 | % |

| Interest income | | 277 | | | | | 246 | | | |

| Interest expense | | (356) | | | | | (359) | | | |

| Other income/(expense) (d) | | (16) | | | | | 14 | | | |

| Income before income taxes | | 1,742 | | | | | 1,765 | | | |

| Provision for income taxes (e) | | (99) | | | | | (53) | | | |

| Equity in earnings/(losses) of unconsolidated entities | | (14) | | | | | (17) | | | |

| Net income | | 1,629 | | | | | 1,695 | | | |

| Less: net income/(losses) attributable to noncontrolling interests and redeemable noncontrolling interest (f) | | — | | | | | (20) | | | |

| Net income attributable to Thermo Fisher Scientific Inc. | | $ | 1,630 | | | 15.4 | % | | $ | 1,715 | | | 16.2 | % |

| | | | | | | | |

| Earnings per share attributable to Thermo Fisher Scientific Inc.: | | | | | | | | |

| Basic | | $ | 4.26 | | | | | $ | 4.44 | | | |

| Diluted | | $ | 4.25 | | | | | $ | 4.42 | | | |

| Weighted average shares: | | | | | | | | |

| Basic | | 382 | | | | | 386 | | | |

| Diluted | | 384 | | | | | 388 | | | |

| | | | | | | | |

| Reconciliation of adjusted operating income and adjusted operating margin | | | | | | | | |

| GAAP operating income | | $ | 1,838 | | | 17.3 | % | | $ | 1,864 | | | 17.6 | % |

| Cost of revenues adjustments (a) | | 9 | | | 0.1 | % | | 14 | | | 0.1 | % |

| Selling, general and administrative expenses adjustments (b) | | 21 | | | 0.2 | % | | 14 | | | 0.1 | % |

| Restructuring and other costs (c) | | 45 | | | 0.4 | % | | 84 | | | 0.8 | % |

| Amortization of acquisition-related intangible assets | | 450 | | | 4.2 | % | | 584 | | | 5.6 | % |

| Adjusted operating income (non-GAAP measure) | | $ | 2,362 | | | 22.3 | % | | $ | 2,560 | | | 24.2 | % |

| | | | | | | | |

| Reconciliation of adjusted net income | | | | | | | | |

| GAAP net income attributable to Thermo Fisher Scientific Inc. | | $ | 1,630 | | | | | $ | 1,715 | | | |

| Cost of revenues adjustments (a) | | 9 | | | | | 14 | | | |

| Selling, general and administrative expenses adjustments (b) | | 21 | | | | | 14 | | | |

| Restructuring and other costs (c) | | 45 | | | | | 84 | | | |

| Amortization of acquisition-related intangible assets | | 450 | | | | | 584 | | | |

| Other income/expense adjustments (d) | | 3 | | | | | (9) | | | |

| Provision for income taxes adjustments (e) | | (139) | | | | | (192) | | | |

| Equity in earnings/losses of unconsolidated entities | | 14 | | | | | 17 | | | |

| Noncontrolling interests adjustments (f) | | (6) | | | | | (19) | | | |

| Adjusted net income (non-GAAP measure) | | $ | 2,026 | | | | | $ | 2,208 | | | |

| | | | | | | | |

| Reconciliation of adjusted earnings per share | | | | | | | | |

| GAAP diluted EPS attributable to Thermo Fisher Scientific Inc. | | $ | 4.25 | | | | | $ | 4.42 | | | |

| Cost of revenues adjustments (a) | | 0.02 | | | | | 0.04 | | | |

| Selling, general and administrative expenses adjustments (b) | | 0.05 | | | | | 0.03 | | | |

| Restructuring and other costs (c) | | 0.12 | | | | | 0.22 | | | |

| Amortization of acquisition-related intangible assets | | 1.17 | | | | | 1.50 | | | |

| Other income/expense adjustments (d) | | 0.01 | | | | | (0.02) | | | |

| Provision for income taxes adjustments (e) | | (0.36) | | | | | (0.49) | | | |

| Equity in earnings/losses of unconsolidated entities | | 0.04 | | | | | 0.04 | | | |

| Noncontrolling interests adjustments (f) | | (0.02) | | | | | (0.05) | | | |

| Adjusted EPS (non-GAAP measure) | | $ | 5.28 | | | | | $ | 5.69 | | | |

| | | | | | | | |

| Reconciliation of free cash flow | | | | | | | | |

| GAAP net cash provided by operating activities | | $ | 2,167 | | | | | $ | 2,414 | | | |

| Purchases of property, plant and equipment | | (271) | | | | | (332) | | | |

| Proceeds from sale of property, plant and equipment | | 20 | | | | | 66 | | | |

| Free cash flow (non-GAAP measure) | | $ | 1,915 | | | | | $ | 2,148 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Business Segment Information | | Three months ended |

| | September 28, | | % of | | September 30, | | % of |

| (Dollars in millions) | | 2024 | | Revenues | | 2023 | | Revenues |

| | | | | | | | |

| Revenues | | | | | | | | |

| Life Sciences Solutions | | $ | 2,387 | | | 22.5 | % | | $ | 2,433 | | | 23.0 | % |

| Analytical Instruments | | 1,808 | | | 17.1 | % | | 1,754 | | | 16.6 | % |

| Specialty Diagnostics | | 1,129 | | | 10.7 | % | | 1,083 | | | 10.2 | % |

| Laboratory Products and Biopharma Services | | 5,740 | | | 54.2 | % | | 5,728 | | | 54.2 | % |

| Eliminations | | (467) | | | -4.4 | % | | (424) | | | -4.0 | % |

| Consolidated revenues | | $ | 10,598 | | | 100.0 | % | | $ | 10,574 | | | 100.0 | % |

| | | | | | | | |

| Segment income and segment income margin | | | | | | | | |

| Life Sciences Solutions | | $ | 845 | | | 35.4 | % | | $ | 872 | | | 35.9 | % |

| Analytical Instruments | | 451 | | | 24.9 | % | | 468 | | | 26.7 | % |

| Specialty Diagnostics | | 293 | | | 25.9 | % | | 283 | | | 26.1 | % |

| Laboratory Products and Biopharma Services | | 773 | | | 13.5 | % | | 937 | | | 16.4 | % |

| Subtotal reportable segments | | 2,362 | | | 22.3 | % | | 2,560 | | | 24.2 | % |

| Cost of revenues adjustments (a) | | (9) | | | -0.1 | % | | (14) | | | -0.1 | % |

| Selling, general and administrative expenses adjustments (b) | | (21) | | | -0.2 | % | | (14) | | | -0.1 | % |

| Restructuring and other costs (c) | | (45) | | | -0.4 | % | | (84) | | | -0.8 | % |

| Amortization of acquisition-related intangible assets | | (450) | | | -4.2 | % | | (584) | | | -5.6 | % |

| Consolidated GAAP operating income | | $ | 1,838 | | | 17.3 | % | | $ | 1,864 | | | 17.6 | % |

| | | | | | | | |

|

| | | | | | | | |

| (a) Adjusted results in 2024 and 2023 exclude charges for the sale of inventory revalued at the date of acquisition and accelerated depreciation on manufacturing assets to be abandoned due to facility consolidations. |

| (b) Adjusted results in 2024 and 2023 exclude certain third-party expenses, principally transaction/integration costs related to recent acquisitions, charges/credits for changes in estimates of contingent acquisition consideration, and charges associated with product liability litigation. Adjusted results in 2024 also exclude $5 of accelerated depreciation on fixed assets to be abandoned due to facility consolidations. |

| (c) Adjusted results in 2024 and 2023 exclude restructuring and other costs consisting principally of severance, impairments of long-lived assets, net charges/credits for pre-acquisition litigation and other matters, net gains on the sale of real estate, and abandoned facility and other expenses of headcount reductions and real estate consolidations. |

| (d) Adjusted results in 2024 and 2023 exclude net gains/losses on investments. |

| (e) Adjusted results in 2024 and 2023 exclude incremental tax impacts for the reconciling items between GAAP and adjusted net income, incremental tax impacts as a result of tax rate/law changes, and the tax impacts from audit settlements. |

| (f) Adjusted results exclude the incremental impacts for the reconciling items between GAAP and adjusted net income attributable to noncontrolling interests. |

| Note: |

| Consolidated depreciation expense is $291 and $269 in 2024 and 2023, respectively. |

|

|

| | | | | | | | | | | |

| Organic and Core organic revenue growth | | Three months ended | |

| | September 28, 2024 | |

| Revenue growth | | 0 | % | |

| Acquisitions | | 1 | % | |

| Currency translation | | 0 | % | |

| Organic revenue growth (non-GAAP measure) | | 0 | % | |

| COVID-19 testing revenue | | 0 | % | |

| | | |

| Core organic revenue growth (non-GAAP measure) | | 0 | % | |

| | | |

| | | |

| | | |

| |

| |

| |

| |

| | | |

| | | |

| Note: | |

For more information related to non-GAAP financial measures, refer to the section titled “Supplemental Information Regarding Non-GAAP Financial Measures” of this release. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Income (unaudited) | | | | | | | | |

| | Nine months ended |

| | September 28, | | % of | | September 30, | | % of |

| (Dollars in millions except per share amounts) | | 2024 | | Revenues | | 2023 | | Revenues |

| Revenues | | $ | 31,484 | | | | | $ | 31,971 | | | |

| Costs and operating expenses: | | | | | | | | |

| Cost of revenues (a) | | 18,326 | | | 58.2 | % | | 18,905 | | | 59.1 | % |

| Selling, general and administrative expenses (b) | | 5,156 | | | 16.4 | % | | 4,897 | | | 15.3 | % |

| Amortization of acquisition-related intangible assets | | 1,514 | | | 4.8 | % | | 1,775 | | | 5.5 | % |

| Research and development expenses | | 1,016 | | | 3.2 | % | | 1,010 | | | 3.2 | % |

| Restructuring and other costs (c) | | 151 | | | 0.5 | % | | 379 | | | 1.2 | % |

| Total costs and operating expenses | | 26,163 | | | 83.1 | % | | 26,966 | | | 84.3 | % |

| Operating income | | 5,321 | | | 16.9 | % | | 5,005 | | | 15.7 | % |

| Interest income | | 851 | | | | | 570 | | | |

| Interest expense | | (1,073) | | | | | (985) | | | |

| Other income/(expense) (d) | | (2) | | | | | (32) | | | |

| Income before income taxes | | 5,096 | | | | | 4,558 | | | |

| Provision for income taxes (e) | | (507) | | | | | (151) | | | |

| Equity in earnings/(losses) of unconsolidated entities | | (75) | | | | | (58) | | | |

| Net income | | 4,514 | | | | | 4,349 | | | |

| Less: net income/(losses) attributable to noncontrolling interests and redeemable noncontrolling interest (f) | | 9 | | | | | (16) | | | |

| Net income attributable to Thermo Fisher Scientific Inc. | | $ | 4,505 | | | 14.3 | % | | $ | 4,365 | | | 13.7 | % |

| | | | | | | | |

| Earnings per share attributable to Thermo Fisher Scientific Inc.: | | | | | | | | |

| Basic | | $ | 11.79 | | | | | $ | 11.31 | | | |

| Diluted | | $ | 11.75 | | | | | $ | 11.25 | | | |

| Weighted average shares: | | | | | | | | |

| Basic | | 382 | | | | | 386 | | | |

| Diluted | | 383 | | | | | 388 | | | |

| | | | | | | | |

| Reconciliation of adjusted operating income and adjusted operating margin | | | | | | | | |

| GAAP operating income | | $ | 5,321 | | | 16.9 | % | | $ | 5,005 | | | 15.7 | % |

| Cost of revenues adjustments (a) | | 25 | | | 0.1 | % | | 73 | | | 0.2 | % |

| Selling, general and administrative expenses adjustments (b) | | (24) | | | -0.1 | % | | 28 | | | 0.1 | % |

| Restructuring and other costs (c) | | 151 | | | 0.5 | % | | 379 | | | 1.2 | % |

| Amortization of acquisition-related intangible assets | | 1,514 | | | 4.8 | % | | 1,775 | | | 5.5 | % |

| Adjusted operating income (non-GAAP measure) | | $ | 6,987 | | | 22.2 | % | | $ | 7,260 | | | 22.7 | % |

| | | | | | | | |

| Reconciliation of adjusted net income | | | | | | | | |

| GAAP net income attributable to Thermo Fisher Scientific Inc. | | $ | 4,505 | | | | | $ | 4,365 | | | |

| Cost of revenues adjustments (a) | | 25 | | | | | 73 | | | |

| Selling, general and administrative expenses adjustments (b) | | (24) | | | | | 28 | | | |

| Restructuring and other costs (c) | | 151 | | | | | 379 | | | |

| Amortization of acquisition-related intangible assets | | 1,514 | | | | | 1,775 | | | |

| Other income/expense adjustments (d) | | (8) | | | | | 36 | | | |

| Provision for income taxes adjustments (e) | | (190) | | | | | (534) | | | |

| Equity in earnings/losses of unconsolidated entities | | 75 | | | | | 58 | | | |

| Noncontrolling interests adjustments (f) | | (6) | | | | | (19) | | | |

| Adjusted net income (non-GAAP measure) | | $ | 6,042 | | | | | $ | 6,161 | | | |

| | | | | | | | |

| Reconciliation of adjusted earnings per share | | | | | | | | |

| GAAP diluted EPS attributable to Thermo Fisher Scientific Inc. | | $ | 11.75 | | | | | $ | 11.25 | | | |

| Cost of revenues adjustments (a) | | 0.07 | | | | | 0.19 | | | |

| Selling, general and administrative expenses adjustments (b) | | (0.06) | | | | | 0.07 | | | |

| Restructuring and other costs (c) | | 0.39 | | | | | 0.98 | | | |

| Amortization of acquisition-related intangible assets | | 3.95 | | | | | 4.57 | | | |

| Other income/expense adjustments (d) | | (0.02) | | | | | 0.09 | | | |

| Provision for income taxes adjustments (e) | | (0.50) | | | | | (1.38) | | | |

| Equity in earnings/losses of unconsolidated entities | | 0.20 | | | | | 0.15 | | | |

| Noncontrolling interests adjustments (f) | | (0.02) | | | | | (0.05) | | | |

| Adjusted EPS (non-GAAP measure) | | $ | 15.76 | | | | | $ | 15.87 | | | |

| | | | | | | | |

| Reconciliation of free cash flow | | | | | | | | |

| GAAP net cash provided by operating activities | | $ | 5,377 | | | | | $ | 4,683 | | | |

| Purchases of property, plant and equipment | | (920) | | | | | (1,074) | | | |

| Proceeds from sale of property, plant and equipment | | 40 | | | | | 76 | | | |

| Free cash flow (non-GAAP measure) | | $ | 4,498 | | | | | $ | 3,685 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Business Segment Information | | Nine months ended |

| | September 28, | | % of | | September 30, | | % of |

| (Dollars in millions) | | 2024 | | Revenues | | 2023 | | Revenues |

| | | | | | | | |

| Revenues | | | | | | | | |

| Life Sciences Solutions | | $ | 7,027 | | | 22.3 | % | | $ | 7,508 | | | 23.5 | % |

| Analytical Instruments | | 5,277 | | | 16.8 | % | | 5,226 | | | 16.3 | % |

| Specialty Diagnostics | | 3,355 | | | 10.7 | % | | 3,300 | | | 10.3 | % |

| Laboratory Products and Biopharma Services | | 17,221 | | | 54.7 | % | | 17,322 | | | 54.2 | % |

| Eliminations | | (1,397) | | | -4.4 | % | | (1,385) | | | -4.3 | % |

| Consolidated revenues | | $ | 31,484 | | | 100.0 | % | | $ | 31,971 | | | 100.0 | % |

| | | | | | | | |

| Segment income and segment income margin | | | | | | | | |

| Life Sciences Solutions | | $ | 2,551 | | | 36.3 | % | | $ | 2,525 | | | 33.6 | % |

| Analytical Instruments | | 1,289 | | | 24.4 | % | | 1,321 | | | 25.3 | % |

| Specialty Diagnostics | | 886 | | | 26.4 | % | | 860 | | | 26.1 | % |

| Laboratory Products and Biopharma Services | | 2,262 | | | 13.1 | % | | 2,554 | | | 14.7 | % |

| Subtotal reportable segments | | 6,987 | | | 22.2 | % | | 7,260 | | | 22.7 | % |

| Cost of revenues adjustments (a) | | (25) | | | -0.1 | % | | (73) | | | -0.2 | % |

| Selling, general and administrative expenses adjustments (b) | | 24 | | | 0.1 | % | | (28) | | | -0.1 | % |

| Restructuring and other costs (c) | | (151) | | | -0.5 | % | | (379) | | | -1.2 | % |

| Amortization of acquisition-related intangible assets | | (1,514) | | | -4.8 | % | | (1,775) | | | -5.5 | % |

| Consolidated GAAP operating income | | $ | 5,321 | | | 16.9 | % | | $ | 5,005 | | | 15.7 | % |

| | | | | | | | |

| | | | | | | | |

| (a) Adjusted results in 2024 and 2023 exclude charges for inventory write-downs associated with large-scale abandonment of product lines, accelerated depreciation on manufacturing assets to be abandoned due to facility consolidations, and charges for the sale of inventory revalued at the date of acquisition. |

| (b) Adjusted results in 2024 and 2023 exclude certain third-party expenses, principally transaction/integration costs related to recent acquisitions, charges/credits for changes in estimates of contingent acquisition consideration, and charges associated with product liability litigation. Adjusted results in 2024 also exclude $5 of accelerated depreciation on fixed assets to be abandoned due to facility consolidations. |

| (c) Adjusted results in 2024 and 2023 exclude restructuring and other costs consisting principally of severance, impairments of long-lived assets, net charges for pre-acquisition litigation and other matters, net gains on the sale of real estate, and abandoned facility and other expenses of headcount reductions and real estate consolidations. Adjusted results in 2023 also exclude $26 of contract termination costs associated with facility closures. |

| (d) Adjusted results in 2024 and 2023 exclude net gains/losses on investments. |

| (e) Adjusted results in 2024 and 2023 exclude incremental tax impacts for the reconciling items between GAAP and adjusted net income, incremental tax impacts as a result of tax rate/law changes and the tax impacts from audit settlements. |

| (f) Adjusted results exclude the incremental impacts for the reconciling items between GAAP and adjusted net income attributable to noncontrolling interests. |

| | | | | | | | |

| Notes: |

| Consolidated depreciation expense is $852 and $792 in 2024 and 2023, respectively. |

For more information related to non-GAAP financial measures, refer to the section titled “Supplemental Information Regarding Non-GAAP Financial Measures” of this release. |

|

| | | | | | | | | | | | | | |

| Condensed Consolidated Balance Sheets (unaudited) | | | | |

| | | | |

| | September 28, | | December 31, |

| (In millions) | | 2024 | | 2023 |

| | | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 4,645 | | | $ | 8,077 | |

| Short-term investments | | 2,000 | | | 3 | |

| Accounts receivable, net | | 8,255 | | | 8,221 | |

| Inventories | | 5,430 | | | 5,088 | |

| Other current assets | | 3,453 | | | 3,200 | |

| Total current assets | | 23,783 | | | 24,589 | |

| Property, plant and equipment, net | | 9,412 | | | 9,448 | |

| Acquisition-related intangible assets, net | | 16,262 | | | 16,670 | |

| Other assets | | 4,180 | | | 3,999 | |

| Goodwill | | 46,726 | | | 44,020 | |

| Total assets | | $ | 100,364 | | | $ | 98,726 | |

| | | | |

| | | | |

| Liabilities, redeemable noncontrolling interest and equity | | | | |

| Current liabilities: | | | | |

| Short-term obligations and current maturities of long-term obligations | | $ | 4,116 | | | $ | 3,609 | |

| Other current liabilities | | 10,485 | | | 10,403 | |

| Total current liabilities | | 14,601 | | | 14,012 | |

| Other long-term liabilities | | 5,466 | | | 6,564 | |

| Long-term obligations | | 31,197 | | | 31,308 | |

| Redeemable noncontrolling interest | | 127 | | | 118 | |

| Total equity | | 48,972 | | | 46,724 | |

| Total liabilities, redeemable noncontrolling interest and equity | | $ | 100,364 | | | $ | 98,726 | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Cash Flows (unaudited) | | | | |

| | | | |

| | Nine months ended |

| | September 28, | | September 30, |

| (In millions) | | 2024 | | 2023 |

| | | | |

| Operating activities | | | | |

| Net income | | $ | 4,514 | | | $ | 4,349 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 2,367 | | | 2,567 | |

| Change in deferred income taxes | | (1,007) | | | (631) | |

| | | | |

| Other non-cash expenses, net | | 477 | | | 658 | |

| Changes in assets and liabilities, excluding the effects of acquisitions | | (973) | | | (2,260) | |

| Net cash provided by operating activities | | 5,377 | | | 4,683 | |

| | | | |

| Investing activities | | | | |

| Purchases of property, plant and equipment | | (920) | | | (1,074) | |

| Proceeds from sale of property, plant and equipment | | 40 | | | 76 | |

| Proceeds from cross-currency interest rate swap interest settlements | | 203 | | | 36 | |

| Acquisitions, net of cash acquired | | (3,132) | | | (3,660) | |

| Purchases of investments | | (2,065) | | | (200) | |

| | | | |

| Other investing activities, net | | 14 | | | 56 | |

| Net cash used in investing activities | | (5,861) | | | (4,766) | |

| | | | |

| Financing activities | | | | |

| Net proceeds from issuance of debt | | 1,204 | | | 3,466 | |

| Repayment of debt | | (1,107) | | | (2,000) | |

| Net proceeds from issuance of commercial paper | | — | | | 1,620 | |

| Repayment of commercial paper | | — | | | (1,935) | |

| Purchases of company common stock | | (3,000) | | | (3,000) | |

| Dividends paid | | (434) | | | (387) | |

| | | | |

| | | | |

| Other financing activities, net | | 212 | | | 42 | |

| Net cash used in financing activities | | (3,126) | | | (2,194) | |

| | | | |

| Exchange rate effect on cash | | 182 | | | (92) | |

| Decrease in cash, cash equivalents and restricted cash | | (3,427) | | | (2,369) | |

| Cash, cash equivalents and restricted cash at beginning of period | | 8,097 | | | 8,537 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 4,670 | | | $ | 6,168 | |

| | | | |

| | | | |

| Free cash flow (non-GAAP measure) | | $ | 4,498 | | | $ | 3,685 | |

| | | | |

| | | | |

| | | | |

| Note: |

For more information related to non-GAAP financial measures, refer to the section titled “Supplemental Information Regarding Non-GAAP Financial Measures” of this release. |

|

Supplemental Information Regarding Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures such as organic revenue growth, which is reported revenue growth, excluding the impacts of acquisitions/divestitures and the effects of currency translation. We also report Core organic revenue growth, which is reported revenue growth, excluding the impacts of COVID-19 testing revenue, and excluding the impacts of acquisitions/divestitures and the effects of currency translation. We report these measures because Thermo Fisher management believes that in order to understand the company’s short-term and long-term financial trends, investors may wish to consider the impact of acquisitions/divestitures, foreign currency translation and/or COVID-19 testing on revenues. Thermo Fisher management uses these measures to forecast and evaluate the operational performance of the company as well as to compare revenues of current periods to prior periods.

We report adjusted operating income, adjusted operating margin, adjusted net income, and adjusted EPS. We believe that the use of these non-GAAP financial measures, in addition to GAAP financial measures, helps investors to gain a better understanding of our core operating results and future prospects, consistent with how management measures and forecasts the company’s core operating performance, especially when comparing such results to previous periods, forecasts, and to the performance of our competitors. Such measures are also used by management in their financial and operating decision-making and for compensation purposes. To calculate these measures we exclude, as applicable:

•Certain acquisition-related costs, including charges for the sale of inventories revalued at the date of acquisition, significant transaction/acquisition-related costs, including changes in estimates of contingent acquisition-related consideration, and other costs associated with obtaining short-term financing commitments for pending/recent acquisitions. We exclude these costs because we do not believe they are indicative of our normal operating costs.

•Costs/income associated with restructuring activities and large-scale abandonments of product lines, such as reducing overhead and consolidating facilities. We exclude these costs because we believe that the costs related to restructuring activities are not indicative of our normal operating costs.

•Equity in earnings/losses of unconsolidated entities; impairments of long-lived assets; and certain other gains and losses that are either isolated or cannot be expected to occur again with any predictability, including gains/losses on investments, the sale of businesses, product lines, and real estate, significant litigation-related matters, curtailments/settlements of pension plans, and the early retirement of debt. We exclude these items because they are outside of our normal operations and/or, in certain cases, are difficult to forecast accurately for future periods.

•The expense associated with the amortization of acquisition-related intangible assets because a significant portion of the purchase price for acquisitions may be allocated to intangible assets that have lives of up to 20 years. Exclusion of the amortization expense allows comparisons of operating results that are consistent over time for both our newly acquired and long-held businesses and with both acquisitive and non-acquisitive peer companies.

•The noncontrolling interest and tax impacts of the above items and the impact of significant tax audits or events (such as changes in deferred taxes from enacted tax rate/law changes), the latter of which we exclude because they are outside of our normal operations and difficult to forecast accurately for future periods.

We report free cash flow, which is operating cash flow excluding net capital expenditures, to provide a view of the continuing operations’ ability to generate cash for use in acquisitions and other investing and financing activities. The company also uses this measure as an indication of the strength of the company. Free cash flow is not a measure of cash available for discretionary expenditures since we have certain non-discretionary obligations such as debt service that are not deducted from the measure.

Thermo Fisher Scientific does not provide GAAP financial measures on a forward-looking basis because we are unable to predict with reasonable certainty and without unreasonable effort items such as the timing and amount of future restructuring actions and acquisition-related charges as well as gains or losses from sales of real estate and businesses, the early retirement of debt and the outcome of legal proceedings. The timing and amount of these items are uncertain and could be material to Thermo Fisher Scientific’s results computed in accordance with GAAP.

The non-GAAP financial measures of Thermo Fisher Scientific’s results of operations and cash flows included in this press release are not meant to be considered superior to or a substitute for Thermo Fisher Scientific’s results of operations prepared in accordance with GAAP. Reconciliations of such non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the tables above.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.125Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes200Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes3200Due2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.40Due2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_A1.45SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes175Due2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.500Due2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.375Due2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.95Due2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.875Due2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes2375Due2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes3650Due2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes2.875Due2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.500Due2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.875Due2049Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

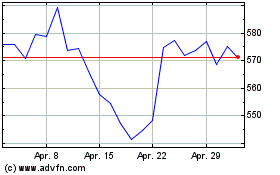

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025