Blackstone Remains Committed to Tricon’s

Extensive Housing Development Platform, Including its Pipeline of

$1 Billion of New Single-Family Homes in the U.S. and $2.5 Billion

of New Apartments in Canada

Plans to Improve Quality of Existing U.S.

Single-Family Homes through an Additional $1 Billion of Capital

Projects

All financial and share price-related information is

presented in U.S. dollars unless otherwise indicated.

Blackstone (NYSE: BX) and Tricon Residential Inc. (NYSE: TCN,

TSX: TCN) (“Tricon” or the “Company”) today announced that they

have entered into an arrangement agreement (the “Arrangement

Agreement”) under which Blackstone Real Estate Partners X together

with Blackstone Real Estate Income Trust, Inc. (“BREIT”) will

acquire all outstanding common shares of Tricon (“Common Shares”)

for $11.25 (approximately C$15.17) per Common Share in cash (the

“Transaction”). The Transaction price represents a premium of 30%

to Tricon’s closing share price on the NYSE on January 18, 2024,

the last trading day prior to the announcement of the Transaction,

and a 42% premium to the volume weighted average share price on the

NYSE over the previous 90 days, and equates to a $3.5 billion

equity transaction value based on fully-diluted shares outstanding.

BREIT will maintain its approximately 11% ownership stake

post-closing.

Tricon provides quality rental homes and apartments in great

neighborhoods, along with exceptional resident services through its

tech-enabled operating platform and dedicated on-the-ground

operating teams. Tricon serves communities in high-growth markets

such as Atlanta, Charlotte, Dallas, Tampa and Phoenix as well as

Toronto, Canada. In addition to managing a single-family rental

housing portfolio, Tricon has a single-family rental development

platform in the U.S. with approximately 2,500 houses under

development, as well as numerous land development projects that can

support the future development of nearly 21,000 single-family

homes. The Company also has a Canadian multifamily development

platform that is building approximately 5,500 market-rate and

affordable multifamily rental apartments.

Under Blackstone’s ownership, the Company plans to complete its

$1 billion development pipeline of new single-family rental homes

in the U.S. and $2.5 billion of new apartments in Canada (together

with its existing joint venture partners). The Company will also

continue to enhance the quality of existing single-family homes in

the U.S. through an additional $1 billion of planned capital

projects over the next several years.

“We are proud of the significant and immediate value that this

transaction will deliver to our shareholders, while allowing us to

continue providing an exceptional rental experience for our

residents. Blackstone shares our values and our unwavering

commitment to resident satisfaction, and we look forward to

benefitting from their expertise and capital as we partner in

building thriving communities,” said Gary Berman, President &

CEO of Tricon.

“Tricon provides access to high-quality housing, and we are

fully committed to delivering an exceptional resident experience

together,” said Nadeem Meghji, Global Co-Head of Blackstone Real

Estate. “We are excited that our capital will propel Tricon’s

efforts to add much needed housing supply across the U.S. and in

Toronto, Canada.”

The announcement of the Transaction follows the unanimous

recommendation of a committee (the “Special Committee”) of

independent members of Tricon’s board of directors (the “Board”).

The Board, after receiving the unanimous recommendation of the

Special Committee and in consultation with its financial and legal

advisors, has determined that the Transaction is in the best

interests of Tricon and fair to Tricon shareholders (other than

Blackstone and its affiliates) and recommends that Tricon

shareholders vote in favor of the Transaction.

“Following a thoughtful and comprehensive process, the Special

Committee and Board concluded that the transaction with Blackstone

is in the best interests of Tricon and its shareholders, and that

the transaction price represents compelling and certain value for

Tricon’s shares,” said Peter Sacks, Chair of the Special Committee

and Independent Lead Director of Tricon.

Transaction Details

The Transaction is structured as a statutory plan of arrangement

under the Business Corporations Act (Ontario). Completion of the

Transaction, which is expected to occur in the second quarter of

this year, is subject to customary closing conditions, including

court approval, the approval of Tricon shareholders (as further

described below) and regulatory approval under the Canadian

Competition Act and Investment Canada Act.

As part of the Transaction, Tricon has agreed that its regular

quarterly dividend during the pendency of the Transaction will not

be declared and the Company’s dividend reinvestment plan will be

suspended. If the Arrangement Agreement is terminated, Tricon

intends to resume declaring and paying regular quarterly

distributions and reinstate the dividend reinvestment plan.

The Arrangement Agreement provides for, among other things,

customary representations, warranties and covenants, including

customary non-solicitation covenants from Tricon, subject to the

ability of the Board to accept a superior proposal in certain

circumstances, with a "right to match" in favour of Blackstone, and

conditioned upon payment of a $122,750,000 termination fee to

Blackstone, except that the termination fee will be reduced to

$61,250,000 if the Arrangement Agreement is terminated by the

Company prior to March 3, 2024 in order to enter into a definitive

agreement providing for the implementation of a superior proposal.

In certain circumstances, Blackstone is required to pay a

$526,000,000 reverse termination fee to Tricon upon the termination

of the Arrangement Agreement.

Completion of the Transaction will be subject to various closing

conditions, including the approval of at least (i) two-thirds (66

2/3%) of the votes cast by shareholders present in person or

represented by proxy at the special meeting of shareholders to be

called to approve the Transaction (the “Special Meeting”), voting

as a single class (each holder of Common Shares being entitled to

one vote per Common Share) and (ii) the majority of the holders of

Common Shares present in person or represented by proxy at the

Special Meeting, excluding the votes of Blackstone and its

affiliates, and any other shareholders whose votes are required to

be excluded for the purposes of “minority approval” under

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”) in the context of a

“business combination” as defined thereunder. Further details

regarding the applicable voting requirements will be contained in a

management information circular to be filed with applicable

regulatory authorities and mailed to Tricon shareholders in

connection with the Special Meeting to approve the Transaction.

Copies of the Arrangement Agreement and of the management

information circular for the Special Meeting will be filed with

Canadian securities regulators and will be available on the SEDAR+

profile of Tricon at www.sedarplus.ca. In addition, Tricon will

furnish to the U.S. Securities and Exchange Commission (the “SEC”)

a current report on Form 6-K regarding the Transaction, which will

include as an exhibit thereto the Arrangement Agreement and will be

available at the SEC’s website www.sec.gov. All parties desiring

details regarding the Transaction are urged to read those and other

relevant materials when they become available.

In connection with the Transaction, Tricon will prepare and mail

a Schedule 13E-3 Transaction Statement (the “Schedule 13E-3”). The

Schedule 13E-3 will be filed with the SEC. INVESTORS AND

SHAREHOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE

SCHEDULE 13E-3 AND OTHER MATERIALS FILED WITH THE SEC WHEN THEY

BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

TRICON, THE TRANSACTION AND RELATED MATTERS. In addition to

receiving the Schedule 13E-3 by mail, shareholders will also be

able to obtain these documents, as well as other filings containing

information about Tricon, the Transaction and related matters,

without charge from the SEC’s website (http://www.sec.gov).

BREIT, which made an initial $240 million exchangeable preferred

equity investment in Tricon in 2020 and is maintaining its

ownership stake, has entered into a support agreement whereby it

has agreed to vote its Common Shares in favor of the

Transaction.

Subject to and upon completion of the Transaction, the Common

Shares will no longer be listed on the NYSE or TSX. Tricon will

remain headquartered in Toronto, Ontario.

Formal Valuation and Fairness Opinions

In connection with its review of the Transaction, the Special

Committee retained Scotia Capital Inc. (“Scotiabank”) as

independent valuator and financial advisor to provide financial

advice and prepare a formal valuation of the Common Shares (the

“Formal Valuation”) as required under MI 61-101. Scotiabank

concluded that, as of January 18, 2024, and subject to certain

assumptions, limitations and qualifications, the fair market value

of the Common Shares was in the range of $9.80 to $12.90 per Common

Share. Scotiabank has also provided its oral opinion (to be

subsequently confirmed by delivery of a written opinion) to the

Special Committee that, as of January 18, 2024, and subject to

certain assumptions, limitations and qualifications, the

consideration to be received by the holders of the Common Shares

(other than Blackstone and its affiliates) pursuant to the

Transaction is fair, from a financial point of view, to the holders

of the Common Shares.

Advisors

Morgan Stanley & Co. LLC and RBC Capital Markets, LLC are

acting as financial advisors to Tricon. Scotiabank is acting as

independent financial advisor and independent valuator to the

Special Committee.

Goodmans LLP and Paul, Weiss, Rifkind, Wharton & Garrison

LLP are acting as legal counsel to Tricon in connection with the

Transaction and Osler, Hoskin & Harcourt LLP is acting as

independent legal counsel to the Special Committee.

BofA Securities, Deutsche Bank Securities Inc., J.P. Morgan

Securities LLC and Wells Fargo are acting as Blackstone’s financial

advisors and Simpson Thacher & Bartlett LLP and Davies Ward

Phillips & Vineberg LLP are acting as legal counsel.

About Tricon Residential Inc.

Tricon Residential Inc. (NYSE: TCN, TSX: TCN) is an owner,

operator and developer of a growing portfolio of approximately

38,000 single-family rental homes in the U.S. Sun Belt and

multi-family apartments in Toronto, Canada. Our commitment to

enriching the lives of our employees, residents and local

communities underpins Tricon’s culture and business philosophy. We

provide high-quality rental housing options for families across the

United States and in Toronto, Canada through our technology-enabled

operating platform and dedicated on-the-ground operating teams. Our

development programs are also delivering thousands of new rental

homes and apartments as part of our commitment to help solve the

housing supply shortage. At Tricon, we imagine a world where

housing unlocks life’s potential. For more information, visit

www.triconresidential.com.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We

seek to create positive economic impact and long-term value for our

investors. We do this by relying on extraordinary people and

flexible capital to help strengthen the companies we invest in. Our

over $1 trillion in assets under management include investment

vehicles focused on private equity, real estate, public debt and

equity, infrastructure, life sciences, growth equity,

opportunistic, non-investment grade credit, real assets and

secondary funds, all on a global basis. Further information is

available at www.blackstone.com. Follow @blackstone on LinkedIn, X

(Twitter), and Instagram.

Additional Early Warning Disclosure

BREIT currently indirectly owns 6,815,242 Common Shares and

240,000 preferred units of Tricon PIPE LLC that are exchangeable

into 28,235,294 Common Shares, representing approximately 11% of

the outstanding Common Shares, assuming the conversion of all

preferred units held by BREIT. Pursuant to the support agreement,

BREIT has agreed to exchange at least 75% of its preferred units

for Common Shares prior to the Special Meeting to vote on the

Transaction and the balance of its preferred units prior to

closing. Following the completion of the Transaction, funds

affiliated with Blackstone Real Estate together with BREIT will own

100% of the outstanding Common Shares. Tricon intends to apply to

cease to be a reporting issuer under applicable Canadian securities

laws following the completion of the Transaction. An early warning

report with additional information in respect of the foregoing

matters will be filed and made available on SEDAR+ at

www.sedarplus.ca under Tricon’s profile or may be obtained directly

upon request by contacting the Blackstone contact person named

below. The head office of Blackstone Real Estate and BREIT is

located at 345 Park Avenue, New York, New York 10154. The head

office of Tricon is located at 7 St. Thomas Street, Suite 801,

Toronto, Ontario M5S 2B7.

Forward-Looking

Information

Certain statements contained in this news release may constitute

forward-looking information within the meaning of applicable

Canadian securities laws. Forward-looking information is often, but

not always, identified by the use of words such as "anticipate",

"plan", "expect", "may", "will", "intend", "should", and similar

expressions. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. Forward-looking information in this

news release includes, but is not limited to, the following:

statements with respect to the expected completion of the

Transaction and the timing thereof, the anticipated benefits to the

shareholders of Tricon, satisfaction of the conditions to closing

the Transaction, the holding of the Special Meeting, the suspension

and resumption of quarterly distributions and the Company’s

dividend reinvestment plan, and delisting of the Common Shares and

ceasing to be a reporting issuer following closing of the

Transaction.

Such forward-looking information and statements involve risks

and uncertainties and are based on management’s current

expectations, intentions and assumptions, including expectations

and assumptions concerning receipt of required approvals and the

satisfaction of other conditions to the completion of the

Transaction, and that the Arrangement Agreement will not be amended

or terminated. There can be no assurance that the proposed

Transaction will be completed, or that it will be completed on the

terms and conditions contemplated in the Arrangement Agreement.

Accordingly, although the Company believes that the expectations

and assumptions on which the forward-looking information contained

in this news release is based are reasonable, undue reliance should

not be placed on the forward-looking information because Tricon can

give no assurance that it will prove to be correct. Since

forward-looking information addresses future events and conditions,

by its very nature it involves inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. These include,

but are not limited to: the failure to obtain necessary approvals

or satisfy (or obtain a waiver of) the conditions to closing the

Transaction as contained in the Arrangement Agreement; the

occurrence of any event, change or other circumstance that could

give rise to the termination of the Arrangement Agreement; material

adverse changes in the business or affairs of Tricon; Tricon’s

ability to obtain the necessary Tricon shareholder approval

(including the “minority approval”); the parties’ ability to obtain

requisite regulatory approvals; either party’s failure to

consummate the Transaction when required or on the terms as

originally negotiated; risks related to the disruption of

management time from ongoing business operations due to the

Transaction and possible difficulties in maintaining customer,

supplier, key personnel and other strategic relationships;

potential litigation relating to the Transaction, including the

effects of any outcomes related thereto; the possibility of

unexpected costs and liabilities related to the Transaction;

competitive factors in the industries in which Tricon operates;

interest rates, currency exchange rates, prevailing economic

conditions; and other factors, many of which are beyond the control

of Tricon. Additional factors and risks which may affect Tricon,

its business and the achievement of the forward-looking statements

contained herein are described in Tricon’s annual information form

and Tricon’s management’s and discussion and analysis for the year

ended December 31, 2022 and in the other subsequent reports filed

on the SEDAR+ profile of Tricon at www.sedarplus.ca and Tricon’s

filings with the SEC as well as the Schedule 13E-3 and management

information circular to be filed by Tricon.

The forward-looking information contained in this news release

represents Tricon’s expectations as of the date hereof, and is

subject to change after such date. Tricon disclaims any intention

or obligation to update or revise any forward-looking information

whether as a result of new information, future events or otherwise,

except as required under applicable securities laws.

This press release also includes forward-looking statements

within the meaning of the federal securities laws and the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by the use of forward -looking

terminology such as “outlook,” “indicator,” “believes,” “expects,”

“potential,” “continues,” “identified,” “may,” “will,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates”, “confident,” “conviction” or other

similar words or the negatives thereof. These may include financial

estimates and their underlying assumptions, statements about plans,

objectives, intentions, and expectations with respect to

positioning, including the impact of macroeconomic trends and

market forces, future operations, repurchases, acquisitions, future

performance and statements regarding identified but not yet closed

acquisitions. Such forward-looking statements are inherently

uncertain and there are or may be important factors that could

cause actual outcomes or results to differ materially from those

indicated in such statements. Some of the factors that could cause

actual results to differ materially are, among others, the timing

and ability to consummate the pending transaction; the occurrence

of any event, change or other circumstance that could delay the

closing of the transaction, or result in the termination of the

agreement for the transaction; and adverse effects on BREIT's

common stock because of a failure to complete the transaction.

Other factors include but are not limited to those described under

the section entitled “Risk Factors” in BREIT's prospectus and

annual report for the most recent fiscal year, and any such updated

factors included in BREIT's periodic filings with the SEC, which

are accessible on the SEC's website at www.sec.gov. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

herein (or in BREIT's public filings). Except as otherwise required

by federal securities laws, BREIT undertakes no obligation to

publicly update or revise any forward -looking statements, whether

as a result of new information, future developments or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240119101417/en/

For further information, please contact:

Wissam Francis EVP & Chief Financial Officer Email:

IR@triconresidential.com

Wojtek Nowak Managing Director, Capital Markets

Tricon Media: Tara Tucker Senior Vice President,

Corporate and Public Affairs Email:

mediarelations@triconresidential.com

Blackstone Media:

Jillian Kary 212-583-5379 Jillian.Kary@Blackstone.com

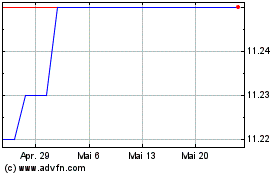

Tricon Residential (NYSE:TCN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Tricon Residential (NYSE:TCN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024