UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number 001-40889

TRICON RESIDENTIAL INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name)

7 St. Thomas Street, Suite 801

Toronto, Ontario, Canada M5S 2B7

(416) 925-7228

(Address and telephone number of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| | | | | | | | |

| Exhibit Number | | Description |

99.1 | |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | Tricon Residential Inc. |

| | | |

| Date: February 27, 2024 | | | | By: | | /s/ David Veneziano |

| | | | | | | | Name: | | David Veneziano |

| | | | | | | | Title: | | Chief Legal Officer and Corporate Secretary |

Tricon Reports Strong Q4 2023 Results

Toronto, Ontario - February 27, 2024 - Tricon Residential Inc. (NYSE: TCN, TSX: TCN) ("Tricon" or the "Company"), an owner, operator and developer of single-family rental homes in the U.S. Sun Belt and multi-family rental apartments in Canada, announced today its consolidated financial results for the three and twelve months ended December 31, 2023.

All financial information is presented in U.S. dollars unless otherwise indicated.

The Company's operational and financial highlights of the quarter include:

•Net loss from continuing operations was $35.5 million in Q4 2023; basic and diluted loss per share from continuing operations were both $0.14;

•Core funds from operations ("Core FFO") was $45.7 million and Core FFO per share was $0.15 in Q4 2023, compared to $96.8 million and $0.31 in the prior year, a decrease of 52.9% and 51.6% year-over-year, respectively. The prior-year result included $50.3 million of net performance fees earned on the sale of the U.S. multi-family rental portfolio;1

•Same home NOI growth for the single-family rental portfolio in Q4 2023 was 6.2% year-over-year and same home NOI margin was 69.3%. Same home operating metrics remained consistently strong, including occupancy of 97.4%, annualized turnover of 14.8% and blended rent growth of 6.0%;1

•The Company acquired 264 homes during the quarter for a total acquisition cost of $75.6 million, and disposed of 135 non-core homes for total proceeds of $49.2 million; and

•On January 19, 2024, the Company announced that it had entered into an arrangement agreement (the "Arrangement Agreement"), under which Blackstone Real Estate Partners X L.P. (“BREP X”) together with Blackstone Real Estate Income Trust, Inc. (collectively with BREP X and their respective affiliates, “Blackstone”) will acquire all outstanding common shares of the Company and each holder of common shares (other than Blackstone and dissenting shareholders) will be entitled to receive $11.25 per common share in cash. The transactions contemplated by the Arrangement Agreement (collectively, the "Transaction") are expected to be completed in the second quarter of 2024 and are subject to customary closing conditions, including court approval, the approval of Tricon shareholders and regulatory approval under the Canadian Competition Act (which was obtained on February 19, 2024) and Investment Canada Act. Subject to and upon completion of the Transaction, the Company expects that the common shares will no longer be listed on the NYSE or TSX and that the Company will apply to cease to be a reporting issuer under applicable Canadian securities laws.

“Tricon ended 2023 on a high note, with strong same home NOI growth of 6.2% and Core FFO per share of $0.56 for the year, solidly within the range of our financial guidance. We achieved these results in the face of economic uncertainty and rising interest rates, while delivering an exceptional resident experience”, said Gary Berman, President & CEO of Tricon. “I would like to commend the entire Tricon team for their commitment to resident satisfaction and operational excellence that are instrumental to our success.”

1 Non-IFRS measures are presented to illustrate alternative relevant measures to assess the Company's performance. For the basis of presentation of the Company’s non-IFRS measures and reconciliations, refer to the “Non-IFRS Measures” section and Appendix A. For definitions of the Company’s non-IFRS measures, refer to Section 6 of Tricon's MD&A.

Financial Highlights

| | | | | | | | | | | | | | | | | |

| For the periods ended December 31 | Three months | | Twelve months |

| | | |

| (in thousands of U.S. dollars, except per share amounts which are in U.S. dollars, unless otherwise indicated) | 2023 | 2022 | | 2023 | 2022 |

| | | | | |

Financial highlights on a consolidated basis | | | | | |

Net (loss) income from continuing operations, including: | $ | (35,470) | | $ | 55,883 | | | $ | 121,824 | | $ | 779,374 | |

Fair value gain on rental properties | 2,029 | | 56,414 | | | 210,936 | | 858,987 | |

| | | | | |

| | | | | |

| | | | | |

Basic (loss) earnings per share attributable to shareholders of Tricon from continuing operations | (0.14) | | 0.19 | | | 0.42 | | 2.82 | |

Diluted (loss) earnings per share attributable to shareholders of Tricon from continuing operations | (0.14) | | 0.11 | | | 0.41 | | 1.98 | |

| | | | | |

Net income from discontinued operations | — | | 1,829 | | | — | | 35,106 | |

Basic earnings per share attributable to shareholders of Tricon from discontinued operations | — | | 0.01 | | | — | | 0.13 | |

Diluted earnings per share attributable to shareholders of Tricon from discontinued operations | — | | 0.01 | | | — | | 0.11 | |

| | | | | |

Dividends per share | $ | 0.058 | | $ | 0.058 | | | $ | 0.232 | | $ | 0.232 | |

| | | | | |

Weighted average shares outstanding - basic | 273,847,034 | | 274,684,779 | | | 273,657,451 | | 274,483,264 | |

Weighted average shares outstanding - diluted | 275,664,083 | | 311,222,080 | | | 275,543,799 | | 311,100,493 | |

| | | | | |

Non-IFRS(1) measures on a proportionate basis | | | | | |

Core funds from operations ("Core FFO") | $ | 45,651 | | $ | 96,841 | | | $ | 172,597 | | $ | 237,288 | |

Adjusted funds from operations ("AFFO") | 38,159 | | 88,694 | | | 139,110 | | 198,264 | |

| | | | | |

Core FFO per share(2) | 0.15 | | 0.31 | | | 0.56 | | 0.76 | |

AFFO per share(2) | 0.12 | | 0.28 | | | 0.45 | | 0.64 | |

| | | | | |

(1) Non-IFRS measures are presented to illustrate alternative relevant measures to assess the Company's performance. For the basis of presentation of the Company’s non-IFRS measures and reconciliations, refer to the “Non-IFRS Measures” section and Appendix A. For definitions of the Company’s non-IFRS measures, refer to Section 6 of Tricon's MD&A.

(2) Core FFO per share and AFFO per share are calculated using the total number of weighted average potential dilutive shares outstanding, including the assumed exchange of preferred units issued by Tricon PIPE LLC, which were 310,408,201 and 310,287,917 for the three and twelve months ended December 31, 2023, and 311,222,080 and 311,100,493 for the three and twelve months ended December 31, 2022, respectively.

Net loss from continuing operations in the fourth quarter of 2023 was $35.5 million compared to net income of $55.9 million in the fourth quarter of 2022, and included:

•Fair value gain on rental properties of $2.0 million compared to $56.4 million in the fourth quarter of 2022, attributable to a moderation in home price appreciation within the single-family rental portfolio.

•Fair value loss of $23.2 million on derivative financial instruments compared to a gain of $25.8 million in the fourth quarter of 2022, and foreign exchange loss of $13.9 million compared to $0.2 million in the prior year period. The fair value loss on derivative financial

instruments was primarily driven by an unrealized loss on the exchange and redemption options associated with the preferred units issued by Tricon PIPE LLC, correlated with an increase in Tricon's share price.

•Revenue from single-family rental properties increased by 14.3% to $206.8 million from $180.9 million in the fourth quarter of 2022, driven primarily by growth of 3.6% in the single-family rental portfolio to 37,183 homes, a 3.2% increase in total portfolio occupancy to 95.0%, and a 5.2% year-over-year increase in average effective monthly rent.

•Direct operating expenses increased by 15.7% to $67.5 million from $58.4 million in the fourth quarter of 2022, primarily reflecting an expansion in the rental portfolio and higher property tax expenses associated with increasing property value assessments, as well as general cost and labor market inflationary pressures.

•Revenue from strategic capital services (previously reported as Revenue from private funds and advisory services) of $19.6 million compared to $14.8 million in the fourth quarter of 2022, primarily attributable to a $6.2 million increase in performance fees earned from the U.S. residential development portfolio, partially offset by a decrease in property management fees of $1.5 million following the Company's sale of the U.S. multi-family rental portfolio in October 2022.

•Interest expense of $80.3 million compared to $71.1 million in the fourth quarter of 2022, attributable to a 0.12% increase in the weighted average interest rate, driven by elevated benchmark interest rates, in addition to an increase in the outstanding debt balance ($5.8 billion as at December 31, 2023 compared to $5.7 billion as at December 31, 2022).

Net income from continuing operations for the year ended December 31, 2023 was $121.8 million compared to $779.4 million for the year ended December 31, 2022, and included:

•Fair value gain on rental properties of $210.9 million compared to $859.0 million in the prior year for the same reasons discussed above.

•Revenue from single-family rental properties of $795.3 million and direct operating expenses of $261.9 million compared to $645.6 million and $209.1 million in the prior year, respectively, which translated to a net operating income ("NOI") increase of $96.9 million, attributable to the continued expansion of the single-family rental portfolio and strong rent growth.

•Revenue from strategic capital services of $54.5 million compared to $160.1 million in the prior year, primarily attributable to $99.9 million of performance fees earned from the sale of Tricon’s remaining 20% equity interest in the U.S. multi-family rental portfolio in October 2022.

•Interest expense of $316.5 million compared to $213.9 million in the prior year, primarily attributable to a 0.74% increase in the weighted average interest rate, as discussed above, in addition to a 14.4% increase in the average outstanding debt balance throughout the year.

Core FFO for the fourth quarter of 2023 was $45.7 million, a decrease of $51.2 million or 53% compared to $96.8 million in the fourth quarter of 2022. A year-over-year variance of $50.3 million in Core FFO is attributable to net performance fees recognized in the fourth quarter of 2022 with respect to the sale of Tricon's remaining 20% equity interest in the U.S. multi-family rental portfolio. This reduction was partly offset by NOI growth in the SFR business and strong performance from U.S. residential developments. During the twelve months ended December 31, 2023, Core FFO decreased by $64.7 million or 27% to $172.6 million compared to $237.3 million in the prior year, for the reasons noted above.

AFFO for the three and twelve months ended December 31, 2023 was $38.2 million and $139.1 million, respectively, a decrease of $50.5 million (57%) and $59.2 million (30%) from the same periods in the prior year. This change in AFFO was driven by the decrease in Core FFO discussed above, partially offset by lower recurring capital expenditures as a result of disciplined cost containment and scoping refinement when turning homes, and the absence of recurring capital expenditures from the U.S. multi-family rental portfolio following its sale.

Single-Family Rental Operating Highlights

The measures presented in the table below and throughout this press release are on a proportionate basis, reflecting only the portion attributable to Tricon's shareholders based on the Company's ownership percentage of the underlying entities and exclude the percentage associated with non-controlling and limited partners' interests, unless otherwise stated. A list of these measures, together with a description of the information each measure reflects and the reasons why management believes the measure to be useful or relevant in evaluating the underlying performance of the Company’s businesses, is set out in Section 6 of Tricon's MD&A.

| | | | | | | | | | | | | | | | | |

| For the periods ended December 31 | Three months | | Twelve months |

| | | |

| (in thousands of U.S. dollars, except percentages and homes) | 2023 | 2022 | | 2023 | 2022 |

| | | | | |

Total rental homes managed | | | | 37,716 | | 36,259 | |

Total proportionate net operating income (NOI)(1) | $ | 80,300 | | $ | 73,744 | | | $ | 309,538 | | $ | 275,543 | |

Total proportionate net operating income (NOI) growth(1) | 8.9 | % | 24.2 | % | | 12.3 | % | 24.3 | % |

Same home net operating income (NOI) margin(1) | 69.3 | % | 69.8 | % | | 69.0 | % | 69.0 | % |

Same home net operating income (NOI) growth(1) | 6.2 | % | N/A | | 6.2 | % | N/A |

Same home occupancy | 97.4 | % | 97.6 | % | | 97.4 | % | 97.8 | % |

Same home annualized turnover | 14.8 | % | 13.2 | % | | 16.8 | % | 17.2 | % |

Same home average quarterly rent growth - renewal | 6.6 | % | 6.8 | % | | 6.6 | % | 6.5 | % |

Same home average quarterly rent growth - new move-in | 3.7 | % | 9.8 | % | | 7.7 | % | 15.5 | % |

Same home average quarterly rent growth - blended | 6.0 | % | 7.3 | % | | 6.9 | % | 8.2 | % |

(1) Non-IFRS measures are presented to illustrate alternative relevant measures to assess the Company's performance. For the basis of presentation of the Company’s non-IFRS measures and reconciliations, refer to the “Non-IFRS Measures” section and Appendix A. For definitions of the Company’s non-IFRS measures, refer to Section 6 of Tricon's MD&A.

Single-family rental NOI was $80.3 million for the fourth quarter of 2023, an increase of $6.6 million or 8.9% compared to the same period in 2022. The growth in NOI was primarily attributable to a $9.9 million or 9.6% increase in rental revenues as a result of a 5.5% increase in the average monthly rent ($1,837 in Q4 2023 compared to $1,741 in Q4 2022), 2.5% portfolio growth (Tricon's proportionate share of rental homes was 21,994 in Q4 2023 compared to 21,464 in Q4 2022), and a 0.4% increase in occupancy (94.6% in Q4 2023 compared to 94.2% in Q4 2022). This favorable growth in rental revenue was partially offset by a $4.4 million or 12.9% increase in direct operating expenses reflecting incremental costs associated with a larger portfolio of homes, higher property taxes from increased assessed property values, elevated property management costs reflecting a tighter labor market and higher other direct costs associated with smart-home technology and higher utility rates.

Single-family rental same home NOI growth was 6.2% in the fourth quarter of 2023 compared to the same period last year. This favorable change was driven by a 6.9% increase in revenue from rental properties as a result of a 5.9% higher average monthly rent ($1,782 in Q4 2023 compared to $1,682 in Q4 2022), and an improvement in bad debt (0.6% in Q4 2023 compared to 1.3% in Q4 2022), partially offset by slightly lower occupancy (97.4% in Q4 2023 compared to 97.6% in Q4 2022). Same home operating expense increased by 8.5%, attributable primarily to a 14.5%

increase in property taxes, partially offset by proactive cost containment in repair and maintenance expenses.

Single-Family Rental Investment Activity

The Company expanded its single-family rental portfolio during the quarter by acquiring 264 homes (254 wholly-owned homes for $71.2 million and ten homes owned through joint ventures for $4.4 million), bringing its total managed portfolio to 37,716 homes. The homes were purchased at an average cost per home of $286,000, including up-front renovations, for a total acquisition cost of $75.6 million, of which Tricon's share was approximately $72.6 million.

During the quarter, Tricon also disposed of 135 homes for a total of $49.2 million (132 wholly-owned homes for $48.5 million and three homes owned through joint ventures for $0.7 million) at an average price of $365,000 per home.

Adjacent Residential Businesses Highlights

Quarterly highlights of the Company's adjacent residential businesses include:

•In the Canadian multi-family business, the proportionate total portfolio's occupancy remained strong at 96.9%, and included The Taylor as a stabilized property for the first time this quarter.

At The Selby, annualized turnover was 17.6% compared to 24.0% during the same period in the prior year. Blended rent growth was 6.6% during the quarter, driven by healthy new-lease and renewal rent growth.

•In Tricon's Canadian residential development portfolio, The Ivy welcomed its first residents to the 231-unit mixed-use rental community during the quarter, and 15% of the building was leased as of December 31, 2023. Leasing velocity at Maple House continued to gain momentum, with 34% of its units leased as of December 31, 2023, reflecting the positive market response to Maple House’s location, design and architecture.

•Tricon's investments in U.S. residential developments generated $20.4 million of distributions to the Company in Q4 2023, including $6.2 million in performance fees. The U.S. residential developments also generated investment income of $6.9 million, an increase of $3.0 million from the same period in the prior year. The increase was primarily driven by strong demand for new housing, bolstered by builders offering customer incentives to maintain a healthy sales velocity despite escalating mortgage rates.

Balance Sheet and Liquidity

Tricon's liquidity consists of a $500 million corporate credit facility with approximately $330 million of undrawn capacity as at December 31, 2023. The Company also had approximately $171 million of unrestricted cash on hand, resulting in total liquidity of $501 million.

As at December 31, 2023, Tricon’s pro-rata net debt (excluding exchangeable instruments) was $3.0 billion, reflecting a pro-rata net debt to assets ratio of 37.4%. For the three months ended December 31, 2023, Tricon's pro-rata net debt to Adjusted EBITDAre ratio was 8.4x.2

2023 Guidance Update

The following table shows the most recent guidance and actual results for the Company's Core FFO per share, same home metrics and acquisitions for the year ended December 31, 2023. Tricon achieved Core FFO per share and same home results that were near the midpoint of guidance, and slightly exceeded its acquisitions guidance for the year.

2 Non-IFRS measures are presented to illustrate alternative relevant measures to assess the Company's performance. For the basis of presentation of the Company’s non-IFRS measures and reconciliations, refer to the “Non-IFRS Measures” section and Appendix A. For definitions of the Company’s non-IFRS measures, refer to Section 6 of Tricon's MD&A.

| | | | | | | | | | | | | | | | | |

For the year ended December 31 | | | | | | | |

| (in billions of U.S. dollars, except per share amounts which are in U.S. dollars, unless otherwise indicated) | 2023 Recent guidance | 2023 Actual | |

| | | | | | | |

Core FFO per share | $0.55 | - | 0.58 | $0.56 | | | |

| | | | | | | |

Same home revenue growth | 6.0% | - | 6.5% | 6.3% | | | |

Same home expense growth | 6.0% | - | 6.5% | 6.3% | | | |

Same home NOI growth | 6.0% | - | 6.5% | 6.2% | | | |

Single-family rental acquisitions (homes)(1) | ~1,850 | 1,888 | | | |

Single-family rental acquisitions ($ in billions)(1) | ~$0.6 | $0.6 | | | |

| | | | | | | |

(1) Single-family rental acquisition costs include initial purchase price, closing costs and up-front renovation costs. These acquisition home counts and costs are presented on a consolidated basis and Tricon's share represents approximately 60%.

Note: Non-IFRS measures are presented to illustrate alternative relevant measures to assess the Company's performance. Refer to the “Non-IFRS Measures” section and Section 6 of the Company's MD&A for definitions.

Quarterly Dividend

Pursuant to and during the pendency of the Arrangement Agreement, the Company intends that its regularly quarterly dividend will not be declared and has agreed that the dividend reinvestment plan will be suspended. If the Arrangement Agreement is terminated, the Company intends to resume declaring and paying regular quarterly dividends on the common shares and to reinstate its dividend reinvestment plan.

About this press release

This press release should be read in conjunction with the Company’s Financial Statements and Management’s Discussion and Analysis (the "MD&A") for the year ended December 31, 2023, which are available on Tricon’s website at www.triconresidential.com and have been filed under the Company's profile on SEDAR+ (www.sedarplus.ca) as well as with the SEC as part of the Company’s annual report filed on Form 40-F. The financial information therein is presented in U.S. dollars. Shareholders have the ability to receive a hard copy of the complete audited Financial Statements free of charge upon request. The Company will not be holding a conference call following the release.

The Company has also made available on its website supplemental information for the three and twelve months ended December 31, 2023. For more information, visit www.triconresidential.com.

More information concerning the Transaction can be found in the Company’s management information circular dated February 15, 2024, which has been filed under the Company’s profile on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov).

About Tricon Residential Inc.

Tricon Residential Inc. (NYSE: TCN, TSX: TCN) is an owner, operator and developer of a growing portfolio of approximately 38,000 single-family rental homes in the U.S. Sun Belt and multi-family apartments in Canada. Our commitment to enriching the lives of our employees, residents and local communities underpins Tricon’s culture and business philosophy. We provide high-quality rental housing options for families across the United States and Canada through our technology-enabled operating platform and dedicated on-the-ground operating teams. Our development programs are also delivering thousands of new rental homes and apartments as part of our commitment to help solve the housing supply shortage. At Tricon, we imagine a world where housing unlocks life’s potential. For more information, visit www.triconresidential.com.

For further information, please contact:

| | | | | |

Wissam Francis

EVP & Chief Financial Officer

| Wojtek Nowak Managing Director, Capital Markets

|

| Email: IR@triconresidential.com |

* * * *

Forward-Looking Information

This news release contains forward-looking statements pertaining to expected future events, financial and operating results, and projections of the Company, including statements related to targeted financial performance and leverage; the Company's growth plans; the pace, availability and pricing of anticipated home acquisitions; anticipated rent growth, fee income and other revenue; development plans, costs and timelines; and the impact of such factors on the Company. This news release also contains forward-looking statements pertaining to the anticipated benefits of the Transaction; shareholder approvals, court approval, required regulatory approvals and other conditions required to complete the Transaction; the anticipated timing of the completion of the Transaction; future distributions by the Company; and the de-listing of the Common Shares from the TSX and the NYSE and ceasing to be a reporting issuer. All such forward-looking information and statements involve risks and uncertainties and are based on management’s current expectations, intentions and assumptions in light of its understanding of relevant current market conditions, its business plans, and its prospects. If unknown risks arise, or if any of the assumptions underlying the forward-looking statements prove incorrect, actual results may differ materially from management expectations as projected in such forward-looking statements. Examples of such risks include, but are not limited to, the failure to obtain necessary approvals or satisfy (or obtain a waiver of) the conditions to closing the Transaction, the occurrence of any event, change or other circumstance that could give rise to the termination of the Transaction, the Company or Blackstone’s failure to consummate the Transaction when required or on the terms as originally negotiated, risks related to the disruption of management time from ongoing business operations due to the Transaction and possible difficulties in maintaining customer, supplier, key personnel and other strategic relationships, potential litigation relating to the Transaction, including the effects of any outcomes related thereto, the Company's inability to execute its growth strategies; the impact of changing economic and market conditions, increasing competition and the effect of fluctuations and cycles in the Canadian and U.S. real estate markets; changes in the attitudes, financial condition and demand of the Company's demographic markets; rising interest rates and volatility in financial markets; the potential impact of reduced supply of labor and materials on expected costs and timelines; rates of inflation and economic uncertainty; developments and changes in applicable laws and regulations; and the aftermath of COVID-19. Accordingly, although the Company believes that its anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable law.

Non-IFRS Measures

The Company has included herein certain non-IFRS financial measures and non-IFRS ratios, including, but not limited to: "proportionate" metrics, net operating income ("NOI"), NOI margin, funds from operations ("FFO"), core funds from operations ("Core FFO"), adjusted funds from operations ("AFFO"), Core FFO per share, AFFO per share, Adjusted EBITDAre as well as certain key indicators of the performance of our businesses which are supplementary financial measures. These measures are commonly used by entities in the real estate industry as useful metrics for measuring performance. We utilize these measures in managing our business, including performance measurement and capital allocation. In addition, certain of these measures are used in measuring compliance with our debt covenants. We believe that providing these performance measures on a supplemental basis is helpful to investors and shareholders in assessing the overall performance of the Company’s business. However, these measures are not recognized under and do not have any standardized meaning prescribed by IFRS as issued by the IASB, and are not necessarily comparable to similar measures presented by other publicly traded entities. These measures should be considered as supplemental in nature and not as a substitute for related financial information prepared in accordance with IFRS. Because non-IFRS financial measures, non-IFRS ratios and supplementary financial measures do not have standardized meanings prescribed under IFRS, securities regulations require that such measures be clearly defined, identified, and reconciled to their nearest IFRS measure. The calculation and reconciliation of the non-IFRS financial measures and the requisite disclosure for non-IFRS ratios used herein are provided in Appendix A below. The definitions of the Company’s non-IFRS measures are provided in the "Glossary and Defined Terms" section as well as Section 6 of Tricon's MD&A.

The non-IFRS financial measures, non-IFRS ratios and supplementary financial measures presented herein should not be construed as alternatives to net income (loss) or cash flow from the Company’s activities, determined in accordance with IFRS, as indicators of Tricon’s financial performance. Tricon’s method of calculating these measures may differ from other issuers’ methods and, accordingly, these measures may not be comparable to similar measures presented by other publicly-traded entities.

Appendix A - Reconciliations

RECONCILIATION OF NET INCOME TO FFO, CORE FFO AND AFFO

| | | | | | | | | | | | | | | | | | | | | | | |

| For the periods ended December 31 | Three months | | Twelve months |

| | | |

| (in thousands of U.S. dollars) | 2023 | 2022 | Variance | | 2023 | 2022 | Variance |

| | | | | | | |

Net (loss) income from continuing operations attributable to Tricon's shareholders | $ | (38,260) | | $ | 53,339 | | $ | (91,599) | | | $ | 114,190 | | $ | 773,835 | | $ | (659,645) | |

| | | | | | | |

Fair value gain on rental properties | (2,029) | | (56,414) | | 54,385 | | | (210,936) | | (858,987) | | 648,051 | |

Fair value loss on Canadian development properties | — | | — | | — | | | — | | 440 | | (440) | |

Unrealized loss (gain) on derivative financial instruments | 28,183 | | (25,818) | | 54,001 | | | 20,085 | | (184,809) | | 204,894 | |

| | | | | | | |

Limited partners' share of FFO adjustments | 17,527 | | 49,834 | | (32,307) | | | 113,482 | | 283,338 | | (169,856) | |

FFO attributable to Tricon's shareholders | $ | 5,421 | | $ | 20,941 | | $ | (15,520) | | | $ | 36,821 | | $ | 13,817 | | $ | 23,004 | |

| | | | | | | |

Core FFO from U.S. and Canadian multi-family rental | 386 | | 868 | | (482) | | | 970 | | 8,173 | | (7,203) | |

Income from equity-accounted investments in multi-family rental properties | (4,768) | | (1,051) | | (3,717) | | | (5,297) | | (1,550) | | (3,747) | |

Income from equity-accounted investments in Canadian residential developments | (1,614) | | (7,690) | | 6,076 | | | (4,348) | | (11,198) | | 6,850 | |

Performance fees revenue from the sale of U.S. multi-family rental portfolio | — | | 99,866 | | (99,866) | | | — | | — | | — | |

| Performance fees payments associated with U.S. multi-family rental divestiture | — | | (49,577) | | 49,577 | | | — | | (49,577) | | 49,577 | |

| Current income tax adjustment | (1,077) | | — | | (1,077) | | | (448) | | — | | (448) | |

Deferred income tax expense | 1,969 | | 5,601 | | (3,632) | | | 25,899 | | 189,179 | | (163,280) | |

Current tax impact on sale of U.S. multi-family rental portfolio | — | | — | | — | | | — | | (29,835) | | 29,835 | |

| | | | | | | |

Interest on Due to Affiliate | 4,245 | | 4,245 | | — | | | 16,981 | | 17,022 | | (41) | |

Amortization of deferred financing costs, discounts and lease obligations | 6,638 | | 5,581 | | 1,057 | | | 24,481 | | 19,284 | | 5,197 | |

Equity-based, non-cash and one-time compensation(1) | 8,832 | | 8,383 | | 449 | | | 20,851 | | 54,716 | | (33,865) | |

Other adjustments | 25,619 | | 9,674 | | 15,945 | | | 56,687 | | 27,257 | | 29,430 | |

Core FFO attributable to Tricon's shareholders | $ | 45,651 | | $ | 96,841 | | $ | (51,190) | | | $ | 172,597 | | $ | 237,288 | | $ | (64,691) | |

| | | | | | | |

Recurring capital expenditures(2) | (7,492) | | (8,147) | | 655 | | | (33,487) | | (39,024) | | 5,537 | |

AFFO attributable to Tricon's shareholders | $ | 38,159 | | $ | 88,694 | | $ | (50,535) | | | $ | 139,110 | | $ | 198,264 | | $ | (59,154) | |

(1) Includes non-cash performance fees expense. Performance fees expense is accrued based on changes in the unrealized carried interest liability of the underlying Investment Vehicles and is hence added back to Core FFO as a non-cash expense. Performance fees are paid and deducted in arriving at Core FFO only when the associated fee revenue has been realized.

(2) Recurring capital expenditures represent ongoing costs associated with maintaining and preserving the quality of a property after it has been renovated. Capital expenditures related to renovations or value-enhancement are excluded from recurring capital expenditures.

RECONCILIATION OF SINGLE-FAMILY RENTAL TOTAL AND SAME HOME NOI

| | | | | | | | | | | | | | | | | |

| For the periods ended December 31 | Three months | | Twelve months |

| | | |

(in thousands of U.S. dollars) | 2023 | 2022 | | 2023 | 2022 |

| | | | | |

Net operating income (NOI), proportionate same home portfolio | $ | 56,670 | | $ | 53,382 | | | $ | 219,872 | | $ | 206,991 | |

Net operating income (NOI), proportionate non-same home | 23,630 | | 20,362 | | | 89,666 | | 68,552 | |

Net operating income (NOI), proportionate total portfolio | 80,300 | | 73,744 | | | 309,538 | | 275,543 | |

Limited partners' share of NOI(1) | 58,951 | | 48,778 | | | 223,843 | | 160,953 | |

Net operating income from single-family rental properties per financial statements | $ | 139,251 | | $ | 122,522 | | | $ | 533,381 | | $ | 436,496 | |

(1) Represents the limited partners' interest in the NOI from SFR JV-1, SFR JV-2 and SFR JV-HD.

RECONCILIATION OF PROPORTIONATE TOTAL PORTFOLIO GROWTH METRICS

| | | | | | | | | | | | | | |

For the three months ended December 31 | | | | |

| (in thousands of U.S. dollars) | 2023 | 2022 | Variance | % Variance |

| | | | |

Total revenue from rental properties | $ | 118,735 | $ | 107,778 | $ | 10,957 | | 10.2 | % |

Total direct operating expenses | 38,435 | 34,034 | 4,401 | | 12.9 | % |

| | | | |

Net operating income (NOI)(1) | $ | 80,300 | $ | 73,744 | $ | 6,556 | | 8.9 | % |

Net operating income (NOI) margin(1) | 67.6 | % | 68.4 | % | | |

(1) Non-IFRS measures; refer to Section 6 of the MD&A for definitions.

| | | | | | | | | | | | | | |

For the twelve months ended December 31 | | | | |

| (in thousands of U.S. dollars) | 2023 | 2022 | Variance | % Variance |

| | | | |

Total revenue from rental properties | $ | 458,940 | $ | 407,227 | $ | 51,713 | | 12.7 | % |

Total direct operating expenses | 149,402 | 131,684 | 17,718 | | 13.5 | % |

| | | | |

Net operating income (NOI)(1) | $ | 309,538 | $ | 275,543 | $ | 33,995 | | 12.3 | % |

Net operating income (NOI) margin(1) | 67.4 | % | 67.7 | % | | |

(1) Non-IFRS measures; refer to Section 6 of the MD&A for definitions.

RECONCILIATION OF PROPORTIONATE SAME HOME GROWTH METRICS

| | | | | | | | | | | | | | |

For the three months ended December 31 | | | | |

| (in thousands of U.S. dollars) | 2023 | 2022 | Variance | % Variance |

| | | | |

Total revenue from rental properties | $ | 81,778 | $ | 76,531 | $ | 5,247 | | 6.9 | % |

Total direct operating expenses | 25,108 | 23,149 | 1,959 | | 8.5 | % |

| | | | |

Net operating income (NOI)(1) | $ | 56,670 | $ | 53,382 | $ | 3,288 | | 6.2 | % |

Net operating income (NOI) margin(1) | 69.3 | % | 69.8 | % | | |

(1) Non-IFRS measures; refer to Section 6 of the MD&A for definitions.

| | | | | | | | | | | | | | |

For the twelve months ended December 31 | | | | |

| (in thousands of U.S. dollars) | 2023 | 2022 | Variance | % Variance |

| | | | |

Total revenue from rental properties | $ | 318,842 | $ | 300,083 | $ | 18,759 | | 6.3 | % |

Total direct operating expenses | 98,970 | 93,092 | 5,878 | | 6.3 | % |

| | | | |

Net operating income (NOI)(1) | $ | 219,872 | $ | 206,991 | $ | 12,881 | | 6.2 | % |

Net operating income (NOI) margin(1) | 69.0 | % | 69.0 | % | | |

(1) Non-IFRS measures; refer to Section 6 of the MD&A for definitions.

PROPORTIONATE BALANCE SHEET

| | | | | | | | | | | | | | | | | | | | |

| (in thousands of U.S. dollars, except per share amounts which are in U.S. dollars, unless otherwise specified) | Rental portfolio | Development portfolio | Corporate assets and liabilities | Tricon proportionate results | IFRS reconciliation | Consolidated results/Total |

| A | B | C | D = A+B+C | E | D+E |

| | | | | | |

Assets | | | | | | |

Rental properties | $ | 7,141,499 | | $ | — | | $ | — | | $ | 7,141,499 | | $ | 5,049,293 | | $ | 12,190,792 | |

Equity-accounted investments in multi-family rental properties | 51,925 | | — | | — | | 51,925 | | — | | 51,925 | |

Equity-accounted investments in Canadian residential developments | — | | 99,336 | | — | | 99,336 | | — | | 99,336 | |

Canadian development properties | — | | 169,763 | | — | | 169,763 | | — | | 169,763 | |

Investments in U.S. residential developments | — | | 154,971 | | — | | 154,971 | | — | | 154,971 | |

Restricted cash | 59,367 | | 248 | | 1,261 | | 60,876 | | 60,575 | | 121,451 | |

Goodwill, intangible and other assets | 4,849 | | — | | 145,684 | | 150,533 | | 2,531 | | 153,064 | |

Deferred income tax assets | 41,218 | | — | | 43,569 | | 84,787 | | — | | 84,787 | |

Cash | 79,734 | | 2,737 | | 8,650 | | 91,121 | | 79,618 | | 170,739 | |

Other working capital items(1) | 9,546 | | 2,191 | | 34,971 | | 46,708 | | 4,889 | | 51,597 | |

| | | | | | |

Total assets | $ | 7,388,138 | | $ | 429,246 | | $ | 234,135 | | $ | 8,051,519 | | $ | 5,196,906 | | $ | 13,248,425 | |

| | | | | | |

Liabilities | | | | | | |

Debt | $ | 2,756,492 | | $ | 44,939 | | $ | 182,077 | | $ | 2,983,508 | | $ | 2,794,492 | | $ | 5,778,000 | |

Due to Affiliate | — | | — | | 262,422 | | 262,422 | | — | | 262,422 | |

Other liabilities(2) | 166,238 | | 7,952 | | 132,768 | | 306,958 | | 2,402,414 | | 2,709,372 | |

Deferred income tax liabilities | — | | — | | 629,090 | | 629,090 | | — | | 629,090 | |

Total liabilities | $ | 2,922,730 | | $ | 52,891 | | $ | 1,206,357 | | $ | 4,181,978 | | $ | 5,196,906 | | $ | 9,378,884 | |

| | | | | | |

Non-controlling interest | — | | — | | 5,777 | | 5,777 | | — | | 5,777 | |

| | | | | | |

Net assets attributable to Tricon's shareholders | $ | 4,465,408 | | $ | 376,355 | | $ | (977,999) | | $ | 3,863,764 | | $ | — | | $ | 3,863,764 | |

| | | | | | |

Net assets per share(3) | $ | 16.38 | | $ | 1.38 | | $ | (3.59) | | $ | 14.17 | | | |

Net assets per share (CAD)(3) | $ | 21.66 | | $ | 1.83 | | $ | (4.75) | | $ | 18.74 | | | |

| | | | | | |

(1) Other working capital items include amounts receivable and prepaid expenses and deposits.

(2) Other liabilities include long-term incentive plan, performance fees liability, derivative financial instruments, other liabilities, limited partners' interests, dividends payable, resident security deposits and amounts payable and accrued liabilities.

(3) As at December 31, 2023, common shares outstanding were 272,637,823 and the USD/CAD exchange rate was 1.3226.

TOTAL AUM

| | | | | | | | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| (in thousands of U.S. dollars) | Balance | % of total AUM | | Balance | % of total AUM |

| | | | | |

Third-party AUM | $ | 8,186,312 | | 50.1 | % | | $ | 8,120,344 | | 50.7 | % |

Principal AUM | 8,160,357 | | 49.9 | % | | 7,882,908 | | 49.3 | % |

Total AUM | $ | 16,346,669 | | 100.0 | % | | $ | 16,003,252 | | 100.0 | % |

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDAre

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | Total proportionate results | IFRS reconciliation | Consolidated results/Total |

| | | |

For the three months ended December 31, 2023 | | | |

Net loss attributable to Tricon's shareholders from continuing operations | $ | (38,260) | | $ | — | | $ | (38,260) | |

Interest expense | 41,618 | | 38,634 | | 80,252 | |

Current income tax expense | 503 | | — | | 503 | |

Deferred income tax expense | 1,969 | | — | | 1,969 | |

Amortization and depreciation expense | 4,525 | | — | | 4,525 | |

Fair value loss (gain) on rental properties | 18,946 | | (20,975) | | (2,029) | |

| | | |

Unrealized loss on derivative financial instruments | 24,735 | | 3,448 | | 28,183 | |

Look-through EBITDAre adjustments from non-consolidated affiliates | (6,939) | | — | | (6,939) | |

EBITDAre, consolidated | $ | 47,097 | | $ | 21,107 | | $ | 68,204 | |

| | | |

Equity-based, non-cash and one-time compensation | 8,832 | | — | | 8,832 | |

Other adjustments(1) | 24,146 | | (2,013) | | 22,133 | |

Limited partners' share of EBITDAre adjustments | — | | (19,094) | | (19,094) | |

Non-controlling interest's share of EBITDAre adjustments | (150) | | — | | (150) | |

Adjusted EBITDAre | $ | 79,925 | | $ | — | | $ | 79,925 | |

| | | |

Adjusted EBITDAre (annualized) | | | $ | 319,700 | |

(1) Includes the following adjustments: | | | | | | | | | | | |

| (in thousands of U.S. dollars) | Proportionate | IFRS reconciliation | Consolidated |

| | | |

Transaction costs | $ | 5,472 | | $ | (2,013) | | $ | 3,459 | |

Realized and unrealized foreign exchange loss | 13,928 | | — | | 13,928 | |

| | | |

Lease payments on right-of-use assets | (1,640) | | — | | (1,640) | |

| | | |

Other EBITDAre adjustments* | 6,386 | | — | | 6,386 | |

| | | |

Total other adjustments | $ | 24,146 | | $ | (2,013) | | $ | 22,133 | |

*For the three and twelve months ended December 31, 2023, adjustments included professional fees related to enterprise resource planning ("ERP") system implementation and consulting, SOX-related system implementation and consulting, costs incurred to process COVID-related backlogs as well as other non-cash adjustments. These expenses are one-time in nature and are expected to normalize in the coming months.

PRO-RATA ASSETS

Tricon's pro-rata assets include its share of total assets of non-consolidated entities on a look-through basis, which are shown as equity-accounted investments on its proportionate balance sheet.

| | | | | |

| (in thousands of U.S. dollars) | December 31, 2023 |

| |

Pro-rata assets of consolidated entities(1) | $ | 7,900,258 | |

| |

| |

Canadian multi-family rental properties(2) | 110,288 | |

Canadian residential developments(2),(3) | 274,074 | |

Pro-rata assets of non-consolidated entities | 384,362 | |

| |

Pro-rata assets, total | $ | 8,284,620 | |

Pro-rata assets (net of cash), total(4) | $ | 8,122,646 | |

(1) Includes proportionate total assets presented in the proportionate balance sheet table above excluding equity-accounted investments in multi-family rental properties and equity-accounted investments in Canadian residential developments.

(2) In Q4 2023, The Taylor was reclassified from the residential development segment to Tricon's multi-family rental business segment.

(3) Excludes right-of-use assets under ground leases of $34,649.

(4) Reflects proportionate cash and restricted cash of $151,997 as well as pro-rata cash and restricted cash of non-consolidated entities of $9,977.

PRO-RATA NET DEBT TO ASSETS

| | | | | |

| (in thousands of U.S. dollars, except percentages) | December 31, 2023 |

| |

Pro-rata debt of consolidated entities | $ | 2,983,508 | |

| |

| |

Canadian multi-family rental properties(1) | 56,295 | |

Canadian residential developments(1),(2) | 156,428 | |

Pro-rata debt of non-consolidated entities | 212,723 | |

| |

Pro-rata debt, total | $ | 3,196,231 | |

Pro-rata net debt, total(3) | $ | 3,034,257 | |

| |

Pro-rata net debt to assets | 37.4 | % |

(1) In Q4 2023, The Taylor was reclassified from the residential development segment to Tricon's multi-family rental business segment.

(2) Excludes lease obligations under ground leases of $34,649.

(3) Reflects proportionate cash and restricted cash of $151,997 as well as pro-rata cash and restricted cash of non-consolidated entities of $9,977.

RECONCILIATION OF PRO-RATA DEBT AND ASSETS OF NON-CONSOLIDATED ENTITIES TO CONSOLIDATED BALANCE SHEET

| | | | | |

| (in thousands of U.S. dollars) | December 31, 2023 |

| |

| |

| |

| |

| |

| |

| |

Equity-accounted investments in Canadian multi-family rental properties | |

Tricon's pro-rata share of assets(1) | $ | 110,288 | |

Tricon's pro-rata share of debt | (56,295) | |

Tricon's pro-rata share of working capital and other | (2,068) | |

Equity-accounted investments in Canadian multi-family rental properties | $ | 51,925 | |

| |

| |

| |

Equity-accounted investments in Canadian residential developments | |

Tricon's pro-rata share of assets(1),(2) | $ | 274,074 | |

Tricon's pro-rata share of debt(2) | (156,428) | |

Tricon's pro-rata share of working capital and other | (18,310) | |

Equity-accounted investments in Canadian residential developments | $ | 99,336 | |

(1) In Q4 2023, The Taylor was reclassified from the residential development segment to Tricon's multi-family rental business segment.

(2) Excludes right-of-use assets and lease obligations under ground leases of $34,649.

PRO-RATA NET DEBT TO ADJUSTED EBITDAre

| | | | | |

| (in thousands of U.S. dollars) | December 31, 2023 |

| |

Pro-rata debt of consolidated entities, excluding facilities related to non-income generating assets(1) | $ | 2,785,267 | |

| |

| |

Canadian multi-family rental properties debt | 56,295 | |

Pro-rata debt of non-consolidated entities (stabilized properties) | 56,295 | |

| |

Pro-rata debt (stabilized properties), total | $ | 2,841,562 | |

Pro-rata net debt (stabilized properties), total(2) | $ | 2,686,950 | |

| |

Adjusted EBITDAre (annualized)(3) | $ | 319,700 | |

Pro-rata net debt to Adjusted EBITDAre (annualized) | 8.4x |

(1) Excludes $44,939 of development debt directly related to the consolidated Canadian development portfolio and $153,302 of warehouse facilities related to acquisitions of vacant single-family homes, which do not fully contribute to Adjusted EBITDAre.

(2) Reflects proportionate cash and restricted cash (excluding cash held at development entities and excess cash held at single-family rental joint venture entities) of $149,012 as well as pro-rata cash and restricted cash of non-consolidated entities for stabilized properties of $5,600.

(3) Adjusted EBITDAre is a non-IFRS measure. Refer to the "Glossary and Defined Terms" section for definition and the Reconciliation of net income to Adjusted EBITDAre table above.

Glossary and Defined Terms

The non-IFRS financial measures, non-IFRS ratios and KPI supplementary financial measures discussed throughout this press release for each of the Company’s business segments are calculated based on Tricon's proportionate share of each portfolio or business and are defined and discussed below and in Section 6 of the MD&A, which definitions and discussion are incorporated herein by reference. These measures are commonly used by entities in the real estate industry as useful metrics for measuring performance; however, they do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other publicly-traded entities. These measures should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with IFRS. See Appendix A for a reconciliation to IFRS financial measures where applicable.

Adjusted EBITDAre is a metric that management believes to be helpful in evaluating the Company’s operating performance across and within the real estate industry. Further, management considers it to be a more accurate reflection of the Company’s leverage ratio, especially as it adjusts for and negates non-recurring and non-cash items. The Company’s definition of EBITDAre reflects all adjustments that are specified by the National Association of Real Estate Investment Trusts (“NAREIT”). In addition to the adjustments prescribed by NAREIT, Tricon excludes fair value gains that arise as a result of reporting under IFRS.

EBITDAre represents net income from continuing operations, excluding the impact of interest expense, income tax expense, amortization and depreciation expense, fair value changes on rental properties, fair value changes on derivative financial instruments and adjustments to reflect the entity’s share of EBITDAre of unconsolidated entities. Adjusted EBITDAre is a normalized figure and is defined as EBITDAre before stock-based compensation, unrealized and realized foreign exchange gains and losses, transaction costs and other non-recurring items, and reflects only Tricon’s share of results from consolidated entities (by removing non-controlling interests’ and limited partners’ share of reconciling items).

The Company also discloses its Net Debt to Adjusted EBITDAre ratio to assist investors in accounting for the Company’s unconsolidated joint ventures and equity-accounted investments, in both debt and Adjusted EBITDAre, by calculating pro-rata leverage on a look-through basis (excluding debt directly related to the Canadian development portfolio as well as warehouse and subscription facilities related to acquisitions of vacant single-family homes, which do not fully contribute to Adjusted EBITDAre).

Cost to maintain is defined as the annualized repairs and maintenance expense, turnover expense net of applicable resident recoveries and recurring capital expenditures per home in service. The metric provides insight into the costs needed to maintain a property's current condition and is indicative of a portfolio's operational efficiency.

Pro-rata net assets represents the Company's proportionate share of total consolidated assets as well as assets of non-consolidated entities on a look-through basis (which are shown as equity-accounted investments on its proportionate balance sheet), less its cash and restricted cash.

Pro-rata net debt represents the Company's total current and long-term debt per its consolidated financial statements, less its cash and restricted cash (excluding debt directly related to the Canadian development portfolio as well as warehouse and subscription facilities related to acquisitions of vacant single-family homes, which do not fully contribute to Adjusted EBITDAre).

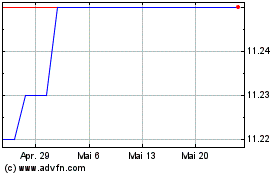

Tricon Residential (NYSE:TCN)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Tricon Residential (NYSE:TCN)

Historical Stock Chart

Von Feb 2024 bis Feb 2025