Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Mai 2024 - 11:01PM

Edgar (US Regulatory)

Nuveen

S&P

500

Dynamic

Overwrite

Fund

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

LONG-TERM

INVESTMENTS

-

100.6%

X

–

COMMON

STOCKS

-

99

.2

%

X

307,548,145

Automobiles

&

Components

-

1.4%

507

(b)

Adient

PLC

$

16,690

5,866

Gentex

Corp

211,880

2,285

(b)

Goodyear

Tire

&

Rubber

Co/The

31,373

2,305

Harley-Davidson

Inc

100,821

2,241

Lear

Corp

324,676

20,298

(b)

Tesla

Inc

3,568,185

1,213

Thor

Industries

Inc

142,333

742

(b)

Visteon

Corp

87,267

Total

Automobiles

&

Components

4,483,225

Banks

-

3.5%

52,009

(c)

Bank

of

America

Corp

1,972,181

22,295

Citigroup

Inc

1,409,936

89

Cullen/Frost

Bankers

Inc

10,019

85

First

Citizens

BancShares

Inc/NC,

Class

A

138,975

4,948

First

Horizon

Corp

76,199

24,320

JPMorgan

Chase

&

Co

4,871,297

4,203

Synovus

Financial

Corp

168,372

376

(b)

Texas

Capital

Bancshares

Inc

23,143

2,090

Webster

Financial

Corp

106,109

29,478

Wells

Fargo

&

Co

1,708,545

2,496

Wintrust

Financial

Corp

260,557

Total

Banks

10,745,333

Capital

Goods

-

5.8%

506

Acuity

Brands

Inc

135,977

1,294

AGCO

Corp

159,188

4,907

(b)

Boeing

Co/The

947,002

2,021

BWX

Technologies

Inc

207,395

563

Carlisle

Cos

Inc

220,612

4,996

Caterpillar

Inc

1,830,684

1,029

Curtiss-Wright

Corp

263,362

3,017

Deere

&

Co

1,239,203

5,038

Eaton

Corp

PLC

1,575,282

740

EMCOR

Group

Inc

259,147

930

Esab

Corp

102,830

2,181

Fortune

Brands

Innovations

Inc

184,665

5,399

Graco

Inc

504,591

1,527

HEICO

Corp

291,657

8,713

Honeywell

International

Inc

1,788,343

6,141

Illinois

Tool

Works

Inc

1,647,815

936

Lennox

International

Inc

457,478

1,101

Lincoln

Electric

Holdings

Inc

281,239

2,947

Lockheed

Martin

Corp

1,340,502

595

(b)

MasTec

Inc

55,484

1,258

(b)

Middleby

Corp/The

202,274

1,377

Oshkosh

Corp

171,726

2,476

Owens

Corning

412,997

4,993

(b),(d)

Plug

Power

Inc

17,176

16,125

Raytheon

Technologies

Corp

1,572,671

2,981

Sensata

Technologies

Holding

PLC

109,522

2,008

Timken

Co/The

175,559

1,360

Toro

Co/The

124,617

914

(b)

Trex

Co

Inc

91,172

511

Valmont

Industries

Inc

116,651

Nuveen

S&P

500

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Capital

Goods

(continued)

637

Watsco

Inc

$

275,165

686

WESCO

International

Inc

117,498

3,189

(b)

WillScot

Mobile

Mini

Holdings

Corp

148,289

927

WW

Grainger

Inc

943,037

Total

Capital

Goods

17,970,810

Commercial

&

Professional

Services

-

0.6%

3,007

Booz

Allen

Hamilton

Holding

Corp

446,360

425

(b)

CACI

International

Inc,

Class

A

161,003

463

(b)

Clarivate

PLC

3,440

786

(b)

Clean

Harbors

Inc

158,230

2,600

(b)

ExlService

Holdings

Inc

82,680

318

(b)

FTI

Consulting

Inc

66,872

2,741

(b)

GEO

Group

Inc/The

38,703

2,665

KBR

Inc

169,654

1,061

RB

Global

Inc

80,816

1,108

Science

Applications

International

Corp

144,472

4,200

SS&C

Technologies

Holdings

Inc

270,354

998

TransUnion

79,640

3,554

Vestis

Corp

68,486

Total

Commercial

&

Professional

Services

1,770,710

Consumer

Discretionary

Distribution

&

Retail

-

6.3%

67,878

(b),(c)

Amazon.com

Inc

12,243,834

839

(b)

AutoNation

Inc

138,922

1,137

Dick's

Sporting

Goods

Inc

255,666

515

(b)

Five

Below

Inc

93,411

9,417

Home

Depot

Inc/The

3,612,360

343

Lithia

Motors

Inc

103,195

7,215

Lowe's

Cos

Inc

1,837,876

3,604

Macy's

Inc

72,044

38

(b)

MercadoLibre

Inc

57,454

303

Murphy

USA

Inc

127,018

392

(b)

PDD

Holdings

Inc,

ADR

45,570

372

(b)

RH

129,553

6,256

(b)

Valvoline

Inc

278,830

753

(b)

Wayfair

Inc,

Class

A

51,114

627

Williams-Sonoma

Inc

199,091

Total

Consumer

Discretionary

Distribution

&

Retail

19,245,938

Consumer

Durables

&

Apparel

-

1.0%

1,316

(b)

Capri

Holdings

Ltd

59,615

233

(b)

Deckers

Outdoor

Corp

219,314

8,589

KB

Home

608,788

4,505

Leggett

&

Platt

Inc

86,271

3,702

(b)

Mattel

Inc

73,337

1,396

Meritage

Homes

Corp

244,942

12,271

NIKE

Inc,

Class

B

1,153,228

4,109

(b)

Sonos

Inc

78,318

4,744

(b)

Taylor

Morrison

Home

Corp

294,934

4,723

Tempur

Sealy

International

Inc

268,361

11,692

(b)

Under

Armour

Inc,

Class

A

86,287

Total

Consumer

Durables

&

Apparel

3,173,395

Consumer

Services

-

2.1%

3,882

Aramark

126,243

331

Booking

Holdings

Inc

1,200,828

2,995

Boyd

Gaming

Corp

201,623

555

(b)

Bright

Horizons

Family

Solutions

Inc

62,915

979

(b)

DoorDash

Inc,

Class

A

134,828

Shares

Description

(a)

Value

Consumer

Services

(continued)

2,395

(b)

DraftKings

Inc,

Class

A

$

108,757

2,846

Hyatt

Hotels

Corp

454,279

8,883

McDonald's

Corp

2,504,561

1,641

(b)

Planet

Fitness

Inc

102,776

1,485

Service

Corp

International/US

110,202

2,073

(b)

Six

Flags

Entertainment

Corp

54,561

12,028

Starbucks

Corp

1,099,239

3,429

Travel

+

Leisure

Co

167,884

7,284

Wendy's

Co/The

137,231

Total

Consumer

Services

6,465,927

Consumer

Staples

Distribution

&

Retail

-

2.3%

1,370

Albertsons

Cos

Inc,

Class

A

29,373

2,512

(b)

BJ's

Wholesale

Club

Holdings

Inc

190,033

410

Casey's

General

Stores

Inc

130,565

3,962

Costco

Wholesale

Corp

2,902,679

1,590

(b)

Performance

Food

Group

Co

118,678

5,221

Target

Corp

925,213

2,961

(b)

US

Foods

Holding

Corp

159,805

40,986

Walmart

Inc

2,466,128

Total

Consumer

Staples

Distribution

&

Retail

6,922,474

Energy

-

3.9%

1,160

(b)

Antero

Resources

Corp

33,640

3,476

ChampionX

Corp

124,754

1,457

Cheniere

Energy

Inc

234,985

2,132

Chesapeake

Energy

Corp

189,386

18,545

Chevron

Corp

2,925,288

838

Chord

Energy

Corp

149,365

4,421

(b)

CNX

Resources

Corp

104,866

11,647

ConocoPhillips

1,482,430

4,475

Equitrans

Midstream

Corp

55,893

33,891

Exxon

Mobil

Corp

3,939,491

1,270

HF

Sinclair

Corp

76,670

4,787

Liberty

Energy

Inc

99,187

9,638

Magnolia

Oil

&

Gas

Corp,

Class

A

250,106

6,358

Marathon

Petroleum

Corp

1,281,137

4,582

Murphy

Oil

Corp

209,397

11,967

NOV

Inc

233,595

4,978

Permian

Resources

Corp

87,911

4,093

Range

Resources

Corp

140,922

3,108

SM

Energy

Co

154,934

14,618

(b)

Southwestern

Energy

Co

110,804

8,230

TechnipFMC

PLC

206,655

156

Texas

Pacific

Land

Corp

90,248

6,953

(b)

Transocean

Ltd

43,665

Total

Energy

12,225,329

Equity

Real

Estate

Investment

Trusts

(REITs)

-

2.1%

5,517

Agree

Realty

Corp

315,131

6,767

American

Homes

4

Rent,

Class

A

248,890

5,198

Americold

Realty

Trust

Inc

129,534

15,872

Brixmor

Property

Group

Inc

372,198

7,025

Cousins

Properties

Inc

168,881

3,215

CubeSmart

145,382

1,740

EastGroup

Properties

Inc

312,800

6,011

Equity

LifeStyle

Properties

Inc

387,109

10,582

First

Industrial

Realty

Trust

Inc

555,978

4,174

Gaming

and

Leisure

Properties

Inc

192,296

10,252

Healthcare

Realty

Trust

Inc

145,066

Nuveen

S&P

500

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Equity

Real

Estate

Investment

Trusts

(REITs)

(continued)

1,542

Hudson

Pacific

Properties

Inc

$

9,946

10,680

Independence

Realty

Trust

Inc

172,268

320

Innovative

Industrial

Properties

Inc

33,133

2,264

Lamar

Advertising

Co,

Class

A

270,345

3,983

Macerich

Co/The

68,627

8,772

NNN

REIT

Inc

374,915

5,266

Omega

Healthcare

Investors

Inc

166,774

3,825

Outfront

Media

Inc

64,222

5,255

Pebblebrook

Hotel

Trust

80,980

7,163

Phillips

Edison

&

Co

Inc

256,937

1,421

PotlatchDeltic

Corp

66,815

9,487

Prologis

Inc

1,235,398

3,334

Rexford

Industrial

Realty

Inc

167,700

1,110

Ryman

Hospitality

Properties

Inc

128,327

13,021

SITE

Centers

Corp

190,758

965

SL

Green

Realty

Corp

53,200

1,074

Sun

Communities

Inc

138,095

1,196

WP

Carey

Inc

67,502

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

6,519,207

Financial

Services

-

8.3%

890

(b)

Affirm

Holdings

Inc

33,161

2,624

Ally

Financial

Inc

106,508

6,384

American

Express

Co

1,453,573

5,651

Annaly

Capital

Management

Inc

111,268

15,838

(b),(c)

Berkshire

Hathaway

Inc,

Class

B

6,660,195

1,444

BlackRock

Inc

1,203,863

1,147

(b)

Block

Inc

97,013

13,049

Charles

Schwab

Corp/The

943,965

304

(b)

Coinbase

Global

Inc,

Class

A

80,596

4,161

Corebridge

Financial

Inc

119,546

5,499

Equitable

Holdings

Inc

209,017

3,860

Goldman

Sachs

Group

Inc/The

1,612,283

1,068

Interactive

Brokers

Group

Inc,

Class

A

119,306

8,753

Intercontinental

Exchange

Inc

1,202,925

3,908

KKR

&

Co

Inc

393,067

508

LPL

Financial

Holdings

Inc

134,214

7,480

Mastercard

Inc,

Class

A

3,602,143

7,780

MGIC

Investment

Corp

173,961

14,535

Morgan

Stanley

1,368,616

440

PennyMac

Financial

Services

Inc

40,080

4,239

Radian

Group

Inc

141,879

3,649

(b)

Robinhood

Markets

Inc,

Class

A

73,454

4,781

(b)

Rocket

Cos

Inc,

Class

A

69,564

3,398

S&P

Global

Inc

1,445,679

6,607

(b),(d)

SoFi

Technologies

Inc

48,231

1,592

(b)

Toast

Inc,

Class

A

39,673

1,119

Tradeweb

Markets

Inc,

Class

A

116,566

14,045

Visa

Inc,

Class

A

3,919,678

4,222

Voya

Financial

Inc

312,090

8,999

Western

Union

Co/The

125,806

Total

Financial

Services

25,957,920

Food,

Beverage

&

Tobacco

-

2.6%

188

(b)

Boston

Beer

Co

Inc/The,

Class

A

57,231

846

Cal-Maine

Foods

Inc

49,787

46,630

Coca-Cola

Co/The

2,852,823

1,222

(b)

Darling

Ingredients

Inc

56,835

6,799

Flowers

Foods

Inc

161,476

646

(b)

Freshpet

Inc

74,846

2,784

Ingredion

Inc

325,310

Shares

Description

(a)

Value

Food,

Beverage

&

Tobacco

(continued)

485

Lancaster

Colony

Corp

$

100,701

16,493

PepsiCo

Inc

2,886,440

11,325

Philip

Morris

International

Inc

1,037,597

4,686

(b)

Pilgrim's

Pride

Corp

160,824

3,247

(b)

Post

Holdings

Inc

345,091

2,100

(b)

Simply

Good

Foods

Co/The

71,463

Total

Food,

Beverage

&

Tobacco

8,180,424

Health

Care

Equipment

&

Services

-

5.4%

18,190

Abbott

Laboratories

2,067,476

1,223

(b)

Acadia

Healthcare

Co

Inc

96,886

43

(b)

Amedisys

Inc

3,963

23,584

(b)

Boston

Scientific

Corp

1,615,268

279

Chemed

Corp

179,098

1,373

CONMED

Corp

109,950

10,546

CVS

Health

Corp

841,149

1,637

(b)

Doximity

Inc,

Class

A

44,052

1,958

Elevance

Health

Inc

1,015,301

2,253

Encompass

Health

Corp

186,053

2,404

(b)

Enovis

Corp

150,130

5,911

(b)

Envista

Holdings

Corp

126,377

2,780

(b)

Globus

Medical

Inc,

Class

A

149,119

757

(b)

Haemonetics

Corp

64,610

1,783

Humana

Inc

618,202

639

(b)

ICU

Medical

Inc

68,577

767

(b)

Inari

Medical

Inc

36,801

481

(b)

Inspire

Medical

Systems

Inc

103,314

3,572

(b)

Intuitive

Surgical

Inc

1,425,549

697

(b)

Lantheus

Holdings

Inc

43,381

1,911

McKesson

Corp

1,025,920

15,485

Medtronic

PLC

1,349,518

1,383

(b)

Merit

Medical

Systems

Inc

104,762

5,175

(b)

Neogen

Corp

81,662

1,008

(b)

Omnicell

Inc

29,464

2,090

(b)

Option

Care

Health

Inc

70,099

433

(b)

Penumbra

Inc

96,637

230

(b)

QuidelOrtho

Corp

11,026

162

(b)

Shockwave

Medical

Inc

52,752

361

(b)

STAAR

Surgical

Co

13,819

1,122

(b)

Tandem

Diabetes

Care

Inc

39,730

3,394

(b)

Teladoc

Health

Inc

51,249

1,806

(b)

Tenet

Healthcare

Corp

189,829

8,674

UnitedHealth

Group

Inc

4,291,028

1,340

(b)

Veeva

Systems

Inc,

Class

A

310,465

Total

Health

Care

Equipment

&

Services

16,663,216

Household

&

Personal

Products

-

1.2%

1,282

(b)

BellRing

Brands

Inc

75,676

22,455

Procter

&

Gamble

Co/The

3,643,324

Total

Household

&

Personal

Products

3,719,000

Insurance

-

2.3%

2,124

American

Equity

Investment

Life

Holding

Co

119,411

1,136

American

Financial

Group

Inc/OH

155,041

5,688

Arthur

J

Gallagher

&

Co

1,422,228

4,942

Fidelity

National

Financial

Inc

262,420

650

Hanover

Insurance

Group

Inc/The

88,511

196

Kinsale

Capital

Group

Inc

102,849

117

(b)

Markel

Group

Inc

178,013

Nuveen

S&P

500

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Insurance

(continued)

8,946

Marsh

&

McLennan

Cos

Inc

$

1,842,696

4,947

Old

Republic

International

Corp

151,972

1,422

Primerica

Inc

359,709

1,161

Reinsurance

Group

of

America

Inc

223,934

436

RenaissanceRe

Holdings

Ltd

102,473

965

RLI

Corp

143,274

1,002

Selective

Insurance

Group

Inc

109,388

6,012

Travelers

Cos

Inc/The

1,383,602

7,525

Unum

Group

403,792

Total

Insurance

7,049,313

Materials

-

1.8%

2,176

Alcoa

Corp

73,527

2,414

Ashland

Inc

235,051

7,632

(b)

Axalta

Coating

Systems

Ltd

262,464

3,411

Berry

Global

Group

Inc

206,297

2,824

Cabot

Corp

260,373

4,941

Chemours

Co/The

129,751

4,597

(b)

Cleveland-Cliffs

Inc

104,536

4,146

Crown

Holdings

Inc

328,613

12,941

Element

Solutions

Inc

323,266

10,647

Graphic

Packaging

Holding

Co

310,679

3,334

HB

Fuller

Co

265,853

14,773

Hecla

Mining

Co

71,058

11,656

Huntsman

Corp

303,406

212

(b)

Ingevity

Corporation

10,112

1,550

Louisiana-Pacific

Corp

130,061

1,379

Minerals

Technologies

Inc

103,811

2,400

(b),(d)

MP

Materials

Corp

34,320

225

NewMarket

Corp

142,790

3,302

Olin

Corp

194,158

555

Reliance

Inc

185,470

2,738

Royal

Gold

Inc

333,516

3,446

RPM

International

Inc

409,902

1,203

Scotts

Miracle-Gro

Co/The

89,732

1,579

Sensient

Technologies

Corp

109,251

3,858

Silgan

Holdings

Inc

187,344

2,718

Southern

Copper

Corp

289,521

199

Stepan

Co

17,918

8,818

Tronox

Holdings

PLC

152,992

3,022

United

States

Steel

Corp

123,237

1,794

Westlake

Corp

274,123

Total

Materials

5,663,132

Media

&

Entertainment

-

8.7%

44,594

(b),(c)

Alphabet

Inc,

Class

A

6,730,572

37,014

(b),(c)

Alphabet

Inc,

Class

C

5,635,752

16

(b)

AMC

Entertainment

Holdings

Inc,

Class

A

60

40,347

Comcast

Corp,

Class

A

1,749,043

1,498

(b)

IAC

Inc

79,903

1,107

(b)

Liberty

Media

Corp-Liberty

Formula

One,

Class

A

65,025

1,131

(b)

Liberty

Media

Corp-Liberty

Live,

Class

A

47,898

16,581

Meta

Platforms

Inc

8,051,402

3,464

(b)

Netflix

Inc

2,103,790

2,539

(b)

Pinterest

Inc,

Class

A

88,027

1,382

(b)

ROBLOX

Corp,

Class

A

52,765

641

(b)

Roku

Inc

41,774

21,538

(d)

Sirius

XM

Holdings

Inc

83,567

721

(b)

Spotify

Technology

SA

190,272

704

TKO

Group

Holdings

Inc

60,833

Shares

Description

(a)

Value

Media

&

Entertainment

(continued)

2,279

(b)

TripAdvisor

Inc

$

63,333

14,897

Walt

Disney

Co/The

1,822,797

872

(b)

Ziff

Davis

Inc

54,971

Total

Media

&

Entertainment

26,921,784

Pharmaceuticals,

Biotechnology

&

Life

Sciences

-

7.5%

15,731

AbbVie

Inc

2,864,615

2,527

(b)

Alkermes

PLC

68,406

5,222

(c)

Amgen

Inc

1,484,719

913

(b)

BioMarin

Pharmaceutical

Inc

79,741

10,304

Bristol-Myers

Squibb

Co

558,786

1,543

Bruker

Corp

144,949

5,710

Danaher

Corp

1,425,901

5,649

(b)

Elanco

Animal

Health

Inc

91,966

6,385

Eli

Lilly

&

Co

4,967,274

1,149

(b)

Exact

Sciences

Corp

79,350

4,414

(b)

Exelixis

Inc

104,744

1,621

(b)

Halozyme

Therapeutics

Inc

65,942

1,132

(b)

Ionis

Pharmaceuticals

Inc

49,072

862

(b)

Jazz

Pharmaceuticals

PLC

103,802

18,193

Johnson

&

Johnson

2,877,951

395

(b)

Medpace

Holdings

Inc

159,639

23,452

Merck

&

Co

Inc

3,094,491

3,026

(b)

Mural

Oncology

PLC

14,797

904

(b)

Neurocrine

Biosciences

Inc

124,680

50,011

Pfizer

Inc

1,387,805

186

(b)

Repligen

Corp

34,209

399

(b)

Sarepta

Therapeutics

Inc

51,655

3,729

Thermo

Fisher

Scientific

Inc

2,167,333

798

(b)

United

Therapeutics

Corp

183,317

2,534

(b)

Vertex

Pharmaceuticals

Inc

1,059,237

Total

Pharmaceuticals,

Biotechnology

&

Life

Sciences

23,244,381

Real

Estate

Management

&

Development

-

0.1%

1,231

(b)

Jones

Lang

LaSalle

Inc

240,156

1,785

(b)

Zillow

Group

Inc,

Class

C

87,072

Total

Real

Estate

Management

&

Development

327,228

Semiconductors

&

Semiconductor

Equipment

-

10.2%

5,912

Analog

Devices

Inc

1,169,334

11,856

(c)

Applied

Materials

Inc

2,445,063

3,687

Broadcom

Inc

4,886,786

34,415

Intel

Corp

1,520,111

861

(b)

Lattice

Semiconductor

Corp

67,356

3,050

Marvell

Technology

Inc

216,184

9,246

Microchip

Technology

Inc

829,459

1,740

MKS

INSTRUMENTS

INC

231,420

18,369

NVIDIA

Corp

16,597,493

10,222

QUALCOMM

Inc

1,730,585

693

(b)

Semtech

Corp

19,051

10,200

Texas

Instruments

Inc

1,776,942

521

Universal

Display

Corp

87,762

597

(b)

Wolfspeed

Inc

17,612

Total

Semiconductors

&

Semiconductor

Equipment

31,595,158

Software

&

Services

-

10.9%

3,572

(b)

Adobe

Inc

1,802,431

993

(b)

Altair

Engineering

Inc,

Class

A

85,547

2,425

Amdocs

Ltd

219,147

387

(b)

BILL

Holdings

Inc

26,595

Nuveen

S&P

500

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Software

&

Services

(continued)

937

(b)

BlackLine

Inc

$

60,511

2,883

(b)

Box

Inc,

Class

A

81,647

805

(b)

Cloudflare

Inc,

Class

A

77,948

581

(b)

Crowdstrike

Holdings

Inc,

Class

A

186,263

382

(b)

DocuSign

Inc

22,748

7,313

(b)

Dropbox

Inc,

Class

A

177,706

1,426

(b)

Dynatrace

Inc

66,223

515

(b)

Elastic

NV

51,624

1,172

(b)

Five9

Inc

72,793

340

(b)

Globant

SA

68,646

2,467

(b)

GoDaddy

Inc,

Class

A

292,784

2,495

Intuit

Inc

1,621,750

673

(b)

Manhattan

Associates

Inc

168,405

55,232

Microsoft

Corp

23,237,206

55

(b),(d)

MicroStrategy

Inc,

Class

A

93,751

192

(b)

MongoDB

Inc

68,859

2,273

(b)

Nutanix

Inc,

Class

A

140,290

370

(b)

Okta

Inc

38,709

14,001

Oracle

Corp

1,758,666

4,962

(b)

Palantir

Technologies

Inc,

Class

A

114,176

380

Pegasystems

Inc

24,563

1,278

(b)

RingCentral

Inc,

Class

A

44,398

7,476

Salesforce

Inc

2,251,622

2,769

(b)

SentinelOne

Inc,

Class

A

64,545

237

(b)

Snowflake

Inc,

Class

A

38,299

1,641

(b)

Teradata

Corp

63,457

632

(b)

Trade

Desk

Inc/The,

Class

A

55,249

1,346

(b)

Twilio

Inc,

Class

A

82,308

3,241

(b)

UiPath

Inc,

Class

A

73,473

1,252

(b)

Unity

Software

Inc

33,428

410

(b)

Wix.com

Ltd

56,367

1,207

(b)

Workday

Inc,

Class

A

329,209

2,638

(b)

Zoom

Video

Communications

Inc,

Class

A

172,446

Total

Software

&

Services

33,823,789

Technology

Hardware

&

Equipment

-

7.1%

108,834

(c)

Apple

Inc

18,662,854

1,206

(b)

Arrow

Electronics

Inc

156,129

3,111

Avnet

Inc

154,243

3,370

(b)

Ciena

Corp

166,647

43,703

Cisco

Systems

Inc

2,181,216

1,796

(b)

Coherent

Corp

108,874

5,255

Dell

Technologies

Inc,

Class

C

599,648

691

(b)

IPG

Photonics

Corp

62,667

1,321

(b)

Pure

Storage

Inc,

Class

A

68,679

Total

Technology

Hardware

&

Equipment

22,160,957

Telecommunication

Services

-

0.5%

1,094

(b)

United

States

Cellular

Corp

39,931

37,283

Verizon

Communications

Inc

1,564,395

Total

Telecommunication

Services

1,604,326

Transportation

-

1.6%

942

Copa

Holdings

SA,

Class

A

98,119

1,506

(b)

GXO

Logistics

Inc

80,963

2,294

Knight-Swift

Transportation

Holdings

Inc

126,216

397

(b)

Saia

Inc

232,245

15,981

(b)

Uber

Technologies

Inc

1,230,377

6,904

Union

Pacific

Corp

1,697,901

8,871

United

Parcel

Service

Inc,

Class

B

1,318,496

Shares

Description

(a)

Value

Transportation

(continued)

1,308

(b)

XPO

Inc

$

159,615

Total

Transportation

4,943,932

Utilities

-

2.0%

1,280

ALLETE

Inc

76,339

2,908

Brookfield

Renewable

Corp,

Class

A

71,450

469

Clearway

Energy

Inc,

Class

C

10,810

11,288

Consolidated

Edison

Inc

1,025,063

16,505

Duke

Energy

Corp

1,596,198

9,953

Essential

Utilities

Inc

368,759

3,823

IDACORP

Inc

355,118

2,125

New

Jersey

Resources

Corp

91,184

18,838

NextEra

Energy

Inc

1,203,937

13,405

OGE

Energy

Corp

459,792

837

Otter

Tail

Corp

72,317

3,380

PNM

Resources

Inc

127,223

7,972

Portland

General

Electric

Co

334,824

69

Southwest

Gas

Holdings

Inc

5,253

1,283

(b),(d)

Sunnova

Energy

International

Inc

7,865

5,242

Vistra

Corp

365,105

Total

Utilities

6,171,237

Total

Common

Stocks

(cost

$104,772,148)

307,548,145

Shares

Description

(a)

Value

X

–

EXCHANGE-TRADED

FUNDS

-

1

.4

%

X

4,247,815

3,500

SPDR

S&P

500

ETF

Trust

$

1,830,745

9,300

Vanguard

Total

Stock

Market

ETF

2,417,070

Total

Exchange-Traded

Funds

(cost

$3,536,709)

4,247,815

Type

Description

(e)

Number

of

Contracts

Notional

Amount

(f)

Exercise

Price

Expiration

Date

Value

OPTIONS

PURCHASED

-

0

.0

%

Put

S&P

500

Index

15

$

6,750,000

$

4500

4/19/24

$

2,513

Total

Options

Purchased

(cost

$6,036)

15

$

6,750,000

2,513

Total

Long-Term

Investments

(cost

$108,314,893)

311,798,473

Shares

Description

(a)

Coupon

Value

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

-

0.1%

304,034

(g)

State

Street

Navigator

Securities

Lending

Government

Money

Market

Portfolio

5.340%(h)

$

304,034

Total

Investments

Purchased

with

Collateral

from

Securities

Lending

(cost

$304,034)

304,034

Nuveen

S&P

500

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

0.1%

X

–

REPURCHASE

AGREEMENTS

-

0

.1

%

X

235,960

$

236

(i)

Fixed

Income

Clearing

Corp

(FICC)

1.600%

4/01/24

$

235,960

Total

Repurchase

Agreements

(cost

$235,960)

235,960

Total

Short-Term

Investments

(cost

$235,960)

235,960

Total

Investments

(cost

$

108,854,887

)

-

100

.8

%

312,338,467

Other

Assets

&

Liabilities,

Net

- (0.8)%

(

2,625,234

)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

309,713,233

Options

Written

Type

Description

(e)

Number

of

Contracts

Notional

Amount

(f)

Exercise

Price

Expiration

Date

Value

Call

S&P

500

Index

(30)

$

(

15,600,000

)

$

5,200

4/05/24

$

(

199,350

)

Call

Russell

2000

Index/Old

(22)

(

4,840,000

)

2,200

4/19/24

(

25,960

)

Call

S&P

500

Index

(100)

(

51,350,000

)

5,135

4/19/24

(

1,474,500

)

Call

S&P

500

Index

(30)

(

15,600,000

)

5,200

4/19/24

(

284,550

)

Call

S&P

500

Index

(25)

(

13,250,000

)

5,300

4/19/24

(

87,875

)

Call

S&P

500

Index

(15)

(

7,875,000

)

5,250

4/30/24

(

118,650

)

Call

S&P

500

Index

(50)

(

26,300,000

)

5,260

4/30/24

(

367,500

)

Call

S&P

500

Index

(20)

(

10,600,000

)

5,300

4/30/24

(

104,000

)

Call

S&P

500

Index

(50)

(

26,500,000

)

5,300

5/10/24

(

350,000

)

Total

Options

Written

(premiums

received

$2,126,177)

(342)

$(171,915,000)

$(3,012,385)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

307,548,145

$

–

$

–

$

307,548,145

Exchange-Traded

Funds

4,247,815

–

–

4,247,815

Options

Purchased

2,513

–

–

2,513

Investments

Purchased

with

Collateral

from

Securities

Lending

304,034

–

–

304,034

Short-Term

Investments:

Repurchase

Agreements

–

235,960

–

235,960

Investments

in

Derivatives:

Options

Written

(3,012,385)

–

–

(3,012,385)

Total

$

309,090,122

$

235,960

$

–

$

309,326,082

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

derivatives.

(d)

Investment,

or

a

portion

of

investment,

is

out

on

loan

for

securities

lending.

The

total

value

of

the

securities

out

on

loan

as

of

the

end

of

the

reporting

period

was

$281,283.

(e)

Exchange-traded,

unless

otherwise

noted.

(f)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

(g)

The

Fund

may

loan

securities

representing

up

to

one

third

of

the

value

of

its

total

assets

(which

includes

collateral

for

securities

on

loan)

to

broker

dealers,

banks,

and

other

institutions.

The

collateral

maintained

by

the

Fund

shall

have

a

value,

at

the

inception

of

each

loan,

equal

to

not

less

than

100%

of

the

value

of

the

loaned

securities.

The

cash

collateral

received

by

the

Fund

is

invested

in

this

money

market

fund.

(h)

The

rate

shown

is

the

one-day

yield

as

of

the

end

of

the

reporting

period.

(i)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.600%

dated

3/28/24

to

be

repurchased

at

$236,002

on

4/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

4.750%

and

maturity

date

2/15/41,

valued

at

$240,745.

ADR

American

Depositary

Receipt

ETF

Exchange-Traded

Fund

REIT

Real

Estate

Investment

Trust

S&P

Standard

&

Poor's

SPDR

Standard

&

Poor's

Depositary

Receipt

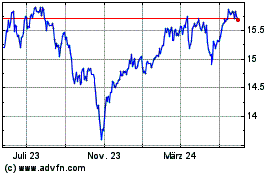

Nuveen S&P 500 Dynamic O... (NYSE:SPXX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Nuveen S&P 500 Dynamic O... (NYSE:SPXX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024