0001364885

false

0001364885

2023-10-12

2023-10-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): October 12, 2023

Spirit AeroSystems Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-33160 |

|

20-2436320 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3801 South Oliver, Wichita, Kansas 67210

(Address of principal executive offices)(Zip Code)

Registrant’s

telephone number, including area code: (316) 526-9000

Not Applicable

(Former name or former address if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share |

|

SPR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On October 12, 2023, Spirit AeroSystems, Inc. (“Spirit”),

a wholly-owned subsidiary of Spirit AeroSystems Holdings, Inc. (the “Company”), and The Boeing Company (“Boeing”)

executed a Memorandum of Agreement (the “MOA”).

Under the MOA, the parties have agreed to the following, among other

matters:

| · | The MOA establishes recurring shipset price increases for the 787 program effective for LN 1164 through LN 1605 with a mutual goal

of concluding negotiations 12 months prior to the delivery of LN 1605, to discuss in good faith potential pricing changes, other interests

and considerations pertaining to LN 1606 and beyond. |

| · | The MOA establishes recurring shipset price reductions on the 737 program (the “Reductions”), effective with Spirit’s

first unit delivery in 2026 through the last unit delivery in June 2033, with such Reductions not to exceed certain amounts per annum

over such period. |

| · | As a result of the aggregate impact of the 787 and 737 recurring shipset pricing adjustments referred to above, the Company

expects increases / (decreases) to its revenue as described below, based upon our cutomer's forecasted production rates and volumes,

which may differ from actual production rates and volumes in any given period: |

| o | 2023 of approximately $60 million; |

| o | 2024 – 2025 of approximately $395 million in the aggregate; |

| o | 2026 – 2028 of approximately ($25) million in the aggregate; and |

| o | 2029 – 2033 of approximately ($240) million in the aggregate. |

| · | Releases of liability and claims through the effective date of the MOA by both parties relating to Boeing’s Commercial Airplanes

division and its airplane programs under the General Terms Agreement for the 787 program and the General Terms Agreement for the 737,

747, 767 and 777 programs (collectively, the “Agreements”). |

| · | Boeing provided funding for tooling and capital through 2025 for certain planned and potential 737 and 787 rate increases, a portion

of which in the amount of approximately $100 million will be received within 10 business days of the effective date. |

| · | The MOA amends the repayment dates for outstanding customer financing received from Boeing in the quarter ended June 29, 2023 to be

as follows: |

| o | December 1, 2025 (in the amount of $90 million), |

| o | December 1, 2026 (in the amount of $45 million), and |

| o | December 1, 2027 (in the amount of $45 million). |

| · | Prior to December 31, 2030, the terms governing assignments in the Agreement will include that Spirit shall not assign any of its

rights or interest in the Agreements or an order without Boeing’s prior written consent, which shall not be unreasonably withheld

consistent with existing obligations, except that Boeing may withhold its consent to an assignment to a Disqualified Person (which includes

any person to which Boeing does not consent in its sole discretion) for any reason and at its sole discretion. An assignment is defined

to include certain specified change of control events set forth in the MOA. In the event of such an assignment to a Disqualified Person

during such period, Spirit will be required to accelerate amounts owed to or to be realized by Boeing totaling up to approximately $945

million related to the Repayments and certain capital, tooling and cash advances (with Boeing having no obligation to make any further

advances) and to repay certain amounts received of up to approximately $245 million. These amounts generally decrease over time. |

| · | After January 1, 2031, the terms governing assignments in the Agreements will revert to the terms existing immediately prior to entry

into the MOA. |

The parties have agreed to negotiate in good faith and execute, on

or before November 17, 2023, such documentation as may be necessary to implement the terms and conditions set forth in the MOA.

The foregoing description of the MOA does not purport to be complete

and is qualified in its entirety by reference to the full text of the MOA, which is attached as Exhibit 10.1 hereto and incorporated by

reference herein.

| Item 2.02 | Results of Operations and Financial Condition. |

Preliminary Unaudited Financial Results for the Quarter Ended

September 28, 2023

In connection with the execution

of the MOA described under Item 1.01 above, the Company is providing certain preliminary estimates of its operating results for the third

quarter ended September 28, 2023. The Company is in the process of finalizing its results for the quarter ended September 28, 2023. Set

forth below are certain estimated preliminary unaudited financial results for the quarter ended September 28, 2023. The estimated preliminary

unaudited financial results set forth below are based only on currently available information as of the date hereof. These results are

preliminary and subject to change. The Company’s financial closing procedures for the quarter ended September 28, 2023 are not yet

complete and, as a result, its final results upon completion of its closing procedures may vary from the estimated preliminary unaudited

results set forth below.

The company will release its

third quarter 2023 results as scheduled at 6:30 a.m. Central Time on Wednesday, November 1, 2023, and will also hold a live webcast and

conference call at 10 a.m. Central Time that same day. The live audio stream and slide presentation can be accessed November 1, 2023,

at http://investor.spiritaero.com/.

In addition, the estimated preliminary results set forth below

are forward-looking statements and are not guarantees of future performance and may differ from actual results. See “Risk

Factors,” “Cautionary Note Regarding Forward-Looking Statements” and the Company’s financial statements and

related notes included in its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q for additional information regarding

factors that could result in differences between the preliminary estimated financial results that are presented below and the actual

financial results the Company will report. These estimates should not be viewed as a substitute for the Company’s full

financial statements prepared in accordance with generally accepted accounting principles (“GAAP”). Accordingly, you

should not place undue reliance on these preliminary unaudited results.

Additionally, the estimates reported below include the presentation

of free cash flow, which is a non-GAAP financial measure. In addition to reporting the Company’s financial information using GAAP,

management believes that certain non-GAAP measures, including free cash flow, provide investors with important perspectives into the Company’s

ongoing business performance. The Company does not intend for the non-GAAP measures to be considered in isolation or as a substitute for

the related GAAP measures. Other companies may define and calculate the measures differently than the Company does, limiting the usefulness

of the measures for comparison with other companies.

All of the estimated preliminary unaudited financial information set

forth below has been prepared by and is the responsibility of the Company’s management and has not been audited, reviewed or compiled

by the Company’s independent registered public accounting firm, Ernst & Young LLP. Accordingly, Ernst & Young LLP does not

express an opinion or any other form of assurance with respect thereto.

Below are certain preliminary

estimates for the Company’s results of operations for the quarter ended September 28, 2023 (in millions). These preliminary results

do not reflect the execution of the MOA described under Item 1.01 above, as the impacts of the MOA will not be incorporated until the

fourth quarter 2023 financial results.

| Preliminary Financial Results | |

| |

|

| | |

| |

|

| | |

3rd Quarter |

| ($ in millions) | |

2023 | |

2022 |

| Net Revenues | |

$1,430 - $1,450 | |

$1,277 |

| Cost of Sales | |

$1,490 - $1,500 | |

$1,194 |

| Gross (Loss) Profit | |

($50) - ($60) | |

$83 |

| Free Cash Flow(1) | |

($135) - ($140) | |

($73) |

| · | Revenue: Revenue of $1,430 to $1,450, up compared to $1,277 for the same period of 2022, primarily

driven by higher production volumes on most Commercial programs as well as higher revenue for Defense and Space and Aftermarket segments

during the third quarter of 2023. |

| · | Gross (Loss) Profit (Net Revenues less Cost of Sales): Gross loss of $50 to $60, down

compared to gross profit of $83 for the same period of 2022, primarily driven by higher changes in estimates recognized in the third

quarter of 2023 including forward loss charges of $100 to $105 primarily related to the Boeing 787 and Airbus A350 programs, as well

as negative cumulative catch-up adjustments of $60 to $65 primarily related to the

Boeing 737 and Airbus A320 programs. |

The forward losses

on the Boeing 787 and Airbus A350 programs were driven by higher estimates of supply chain, labor and other costs. The unfavorable cumulative

catch-up adjustments on the Boeing 737 and Airbus A320 programs were driven by increased supply chain, labor and other costs and, to a

lesser extent, rework costs related to the quality issue on the 737 aft pressure bulkhead and unfavorable foreign currency movements on

the A320 program.

| · | Free Cash Flow(1): Free cash flow usage of $135 to $140, compared to usage of $73

for the same period of 2022, reflects higher negative impacts to working capital, partially offset by the expected $50 customer cash advance

received during the third quarter of 2023. |

Reflected in the results above

are the following expected deliveries by program:

Spirit Shipset Deliveries

(one shipset equals

one aircraft)

| | |

3rd

Quarter | | |

Nine

Months | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| B737 | |

| 83 | | |

| 69 | | |

| 252 | | |

| 200 | |

| B747 | |

| - | | |

| - | | |

| - | | |

| 1 | |

| B767 | |

| 7 | | |

| 7 | | |

| 24 | | |

| 23 | |

| B777 | |

| 9 | | |

| 8 | | |

| 23 | | |

| 19 | |

| B787 | |

| 9 | | |

| 6 | | |

| 25 | | |

| 13 | |

| Total

Boeing | |

| 108 | | |

| 90 | | |

| 324 | | |

| 256 | |

| A220 | |

| 16 | | |

| 12 | | |

| 43 | | |

| 46 | |

| A320

Family | |

| 129 | | |

| 145 | | |

| 423 | | |

| 447 | |

| A330 | |

| 8 | | |

| 8 | | |

| 26 | | |

| 20 | |

| A350 | |

| 12 | | |

| 11 | | |

| 37 | | |

| 37 | |

| Total

Airbus | |

| 165 | | |

| 176 | | |

| 529 | | |

| 550 | |

| Business/Regional

Jet | |

| 59 | | |

| 50 | | |

| 167 | | |

| 149 | |

| Total | |

| 332 | | |

| 316 | | |

| 1,020 | | |

| 955 | |

The tables below provide reconciliations

between the GAAP and non-GAAP measures.

Free Cash

Flow

($ in millions)

| | |

Three months ended |

| | |

September 28, 2023 | |

September 29, 2022 |

| Cash Used in Operations | |

($110) - ($115) | |

($36) |

| Capital Expenditures | |

~(25) | |

(38) |

| Free Cash Flow | |

($135) - ($140) | |

($73) |

(1) Free cash flow is defined

as GAAP cash provided by (used in) operating activities less capital expenditures for property, plant and equipment. Management believes

free cash flow provides investors with an important perspective on the cash available for stockholders, debt repayments including capital

leases, and acquisitions after making the capital investments required to support ongoing business operations and long-term value creation.

Free cash flow does not represent the residual cash flow available for discretionary expenditures as it excludes certain mandatory expenditures.

The most comparable GAAP measure is cash provided by (used in) operating activities. Management uses free cash flow as a measure to assess

both business performance and overall liquidity.

The information in Item 2.02

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities under that Section, nor shall it be deemed to be incorporated by reference into any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such

filing.

| Item 7.01 | Regulation FD Disclosure. |

As a result of the MOA described under Item 1.01 above, the Company

expects to reverse unamortized liabilities, including previously recorded forward losses and material right obligation on the Boeing 787

program of approximately $350-$370 million in the fourth quarter of 2023. Additionally, related to the release of claims, including the

$23 million of anticipated claims related to the Boeing 737 Vertical Fin Attach Fittings previously disclosed, the Company will be reversing

amounts reflected as liabilities for certain claims received and other anticipated claims on its balance sheet in the fourth quarter of

2023.

The information in Item 7.01 shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities under that Section, nor shall it be deemed to be incorporated by reference into any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such

filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

SPIRIT AEROSYSTEMS HOLDINGS, INC. |

| Date: October 18, 2023 |

By: |

/s/ Mark Suchinski |

| |

|

Name: |

Mark Suchinski |

| |

|

Title: |

SVP and CFO |

Exhibit 10.1

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [****], HAS BEEN OMITTED BECAUSE IT IS BOTH (I) NOT MATERIAL AND

(II) THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL.

MEMORANDUM OF AGREEMENT

between

THE BOEING COMPANY

and

SPIRIT AEROSYSTEMS, INC.

This MEMORANDUM OF AGREEMENT (MOA) is effective as of October

12, 2023 (Effective Date) by and between The Boeing Company (Boeing), a Delaware corporation, and Spirit AeroSystems, Inc.

(Spirit), a Delaware corporation. Boeing and Spirit sometimes are referred to herein individually as a Party and collectively

as the Parties.

RECITALS

| A. | The Parties have been in discussions regarding, among other things, pricing and other terms and conditions pertaining to the 737 and

787 programs. |

| B. | The Parties wish to memorialize their agreement on these matters in this MOA, in accordance with the terms set forth below. |

AGREEMENT

NOW, THEREFORE, in consideration of the mutual covenants set forth

herein, the Parties agree as follows:

| 1. | Capitalized Terms. Capitalized terms used and not otherwise defined in this MOA will have the meanings ascribed thereto in

SBP MS-65530-0016 (Sustaining SBP), SBP MS-65530-0019 (787 SBP), GTA BCA-65530-0016 (Sustaining GTA), GTA BCA-65520-0032

(787 GTA), AA-65530-0010 (Sustaining AA), and AA-65520-0026 (787 AA) (collectively, the Agreements). |

| 2. | Definitive Documentation. The Parties will negotiate in good faith and execute, on or before November 17, 2023, such amendments

to the Agreements and other documents as are necessary to implement the agreements set forth in this MOA (Definitive Documentation). |

| 3. | Spirit Board Approval. This MOA is subject to approval by Spirit’s board of directors. If, for any reason, Spirit’s

board does not approve this MOA in its entirety on or before October 19, 2023, all agreements set forth in this MOA are null and void

as if this MOA had never been executed. |

| 4. | Master Schedules. Spirit acknowledges and affirms its

obligations as set forth in the Agreements to support its recovery plans and Boeing-issued master schedules, including the associated

rate breaks issued in accordance with the terms of the Agreements, and subject to the Excusable Delay provisions of the respective Agreements. |

Spirit will demonstrate rate readiness prior to all rate

breaks in accordance with the terms of the Agreements, and will submit rate-readiness plans to Boeing that will address Spirit’s

plans for staffing, training, supply chain readiness, factory capacity, and other appropriate elements as reasonably requested by Boeing.

| 5. | Stability Plan. Spirit will create and implement, to Boeing’s satisfaction, an operational stability plan that: |

| a. | demonstrates reductions in nonconformances, foreign object debris, customer sensitive items, significant repair log items, and sub

tier shortages; |

| b. | increases staffing (as jointly agreed) in support functions, including engineering, quality, lean, and supply chain; |

| c. | provides maintenance plans for all major equipment and facilities; |

| d. | provides work transfer plans (as required by the Agreements) that include key milestones and demonstrate qualified and capable rate

performance prior to full reliance on any new supplier; and |

| e. | provides jointly-coordinated buffer-stock plans (which may include ship in place) for all programs (including two weeks’ worth

of finished goods for 737). |

The Parties will work in good faith to mutually agree to targets for each of the measures contemplated in subsections (a) and (b) of this

Section 5 by no later than November 17, 2023.

| 6. | Supply Chain Health. The Parties agree to work together on systemic, rate constraining, and shared supply chain challenges.

Prior to the end of calendar year 2023, the Parties will jointly establish a collaborative working team and agreed-to cadence with a shared

objective to monitor and mitigate risk and strengthen a supply chain capable of meeting Boeing’s future desired production rates. |

| 7. | 787 Recurring Price. Boeing will pay Spirit $[****] via incremental

787 recurring Shipset Price increases effective at LN 1164 through LN 1605. The per Shipset Price shall be rate variable and as set forth

in Table 7.1 below. Without in any way altering or delaying Boeing’s obligation to pay the $[****] and Spirit’s right to

receive the $[****], as part of the Definitive Documentation, the Parties will jointly determine the allocation of the per Shipset Price

increases for each associated End Item Assembly. |

Table 7.1

| | | |

All Minor Models | |

All Minor Models | |

787-8 | |

787-9 | |

787-10 |

| APM | | |

LN 1164 –

12/31/2025 | |

1/1/2026 –

LN 1605 | |

LN 1606 –

LN 2205 | |

LN 1606 –

LN 2205 | |

LN 1606 –

LN 2205 |

| 0 – 4.9 | | |

$[****] | |

$[****] | |

$[****] | |

$[****] | |

$[****] |

| 5 – 7.9 | | |

$[****] | |

$[****] | |

$[****] | |

$[****] | |

$[****] |

| 8 – 9.9 | | |

$[****] | |

$[****] | |

$[****] | |

$[****] | |

$[****] |

| 10+ | | |

$[****] | |

$[****] | |

$[****] | |

$[****] | |

$[****] |

No later than 10 business days after execution of the Definitive Documentation, Boeing will amend any outstanding purchase orders as necessary

to reflect the pricing shown in the Definitive Documentation. No later than 15 business days after execution of the Definitive Documentation,

the Parties will jointly reconcile pricing for any Products already delivered starting with LN 1164 through such time as the purchase

orders are amended with pricing as shown in the Definitive Documentation. No later than 3 business days after the Parties complete the

reconciliation, Boeing will pay the reconciliation value via wire transfer.

Within 30 days following the delivery of LN 1605 from Spirit

to Boeing, the Parties will reconcile the adjusted pricing set forth in Table 7.1 (as allocated in the Definitive Documentation) against

the 787 Shipset pricing as of 787 SBP Amendment 37. In the event the incremental amounts paid to Spirit do not total $[****], the respective

Party will pay, via wire transfer, any amount due within 10 business days of completing the reconciliation. For clarity, any Shipset pricing

revisions subsequent to this MOA resulting from statement of work revisions/changes will not be applied towards the $[****] incremental

Shipset Price increase.

Parties, at either’s request, agree to meet at a mutually

agreeable time, with a mutual goal of concluding negotiations 12 months prior to the delivery of LN 1605, to discuss in good faith potential

pricing changes, other interests and considerations pertaining to LN 1606 and beyond.

| 9. | 787 Tooling and Capital. Boeing will advance to Spirit up to $[****] for Spirit’s implementation of Tooling and

capital expenditures necessary to support up to 787 Rate [****]. The Parties agree to hold joint reviews 30 days prior to the

issuance of each related purchase order to confirm the amount and asset content of each funded package. Spirit agrees to prioritize

purchased assets to Boeing production requirements, provide Boeing with documentation validating expenditures, and provide Boeing

on-site representatives with observable evidence of assets in place on a periodic basis. Boeing will pay to Spirit, via purchase

order (issued no later than 60 days prior to the respective payment date, unless otherwise

specified below) and invoice, for Tooling and capital expenditures by Spirit, as follows: |

$[****] paid, via wire transfer, within 10 business days

of the Effective Date of this MOA

$[****] paid no later than January 31, 2024

$[****] paid no later than April 30, 2024

$[****] paid no later than July 31, 2024

$[****] paid no later than October 31, 2024

$[****] paid no later than January 31, 2025

$[****] paid no later than April 30, 2025

Spirit will repay to Boeing up to $[****], as further specified

below. Spirit will align the repayment plan to coincide with Spirit’s deliveries to Boeing and will offset payments utilizing the

formula of number of units delivered in the respective time period based on the schedule below, times average shipset price, until the

amount is fully offset for each respective time period. Any variability to this calculation based on the offset of units, or average shipset

price, will be trued up in the fourth quarter of 2027. Spirit will repay to Boeing, via wire transfer, a sum of $[****], as follows:

$[****] paid no later than April 30, 2025

$[****] paid no later than October 31, 2025

$[****] paid no later than April 30, 2026

$[****] paid no later than October 31, 2026

$[****] paid no later than April 30, 2027

$[****] paid no later than October 31, 2027

| 10. | 737 Constraint Matrix. The Parties will amend the Sustaining SBP to replace the 737 Rate [****] Constraint Matrix with the

737 Rate [****] Constraint Matrix set forth in Exhibit 1 hereto. |

| 11. | 737 Recurring Price. Attachment 1 to the Sustaining SBP

is hereby amended to insert the following text as a new subsection at the conclusion of Section 2:

“(f) Notwithstanding

anything else in this SBP, Boeing and Spirit agree to an incremental $[****] 737 recurring Shipset price reduction relative to the pricing

set forth in this SBP at the time the SBP is updated pursuant to the immediately following paragraph, effective with Spirit’s first

unit delivery in 2026 through the last unit delivery of June 2033. For line numbers scheduled to deliver from January 1, 2026, through

December 31, 2028, the Shipset price reduction will be calculated to achieve a total reduction of $[****] per calendar year and $[****]

in aggregate for the three-year period. Boeing and Spirit will perform a reconciliation in the fourth quarter of 2028, and any variations

in actual reductions received by Boeing versus the aforementioned per year amount will be trued up in the fourth quarter of 2028. Similarly,

for line numbers scheduled to deliver from January 1, 2029, through June 30, 2033, the Shipset price reduction will be calculated to

achieve a total reduction of $[****] per calendar year, and $[****] in aggregate for the five-year period. Boeing and Spirit will perform

a reconciliation in the second quarter of 2033, and any variations in actual reductions received by Boeing versus the aforementioned

per year amount will be trued up in the second quarter of 2033. |

Without in any way altering or delaying Boeing’s absolute

right to receive the $[****] Shipset price reduction and Spirit’s absolute obligation to provide the $[****] Shipset price reduction,

by no later than April 12, 2024, the Parties will jointly determine the allocation of the per Shipset price reductions for each associated

End Item Assembly and update SBP Attachment 1 Tables B.1 and B.2 to reflect the agreed Shipset price reductions.”

| 12. | 737 Tooling and Capital Expenditures. Boeing will provide to Spirit up to $[****] for Spirit’s implementation of Tooling

and capital expenditures necessary to support the 737 Rate [****] Constraint Matrix set forth in Exhibit 1 hereto. After the first payment

below, the Parties agree to hold joint reviews 30 days prior to the issuance of each related purchase order to confirm the amount and

asset content of each funded package. Spirit agrees to prioritize purchased assets to Boeing’s production requirements, provide

Boeing with documentation validating expenditures, and provide Boeing on-site representatives with observable evidence of assets in place

on a periodic basis. Boeing will pay to Spirit, via purchase order (issued no later than 60 days prior to the respective payment date,

unless otherwise specified below) and invoice, for Tooling and capital expenditures by Spirit, as follows: |

$[****] paid, via wire transfer, within 10 business days

of the Effective Date

$[****] paid no later than January 31, 2024

$[****] paid no later than April 30, 2024

$[****] paid no later than July 31, 2024

$[****] paid no later than October 31, 2024

$[****] paid no later than January 31, 2025

$[****] paid no later than April 30, 2025

Spirit will submit Certified Tool Lists to Boeing for all

associated Tooling. The above payments are not contingent upon Certified Tool Lists submittal by Spirit or approval by Boeing. Spirit

will provide Certified Tool Lists within 12 months of Tool completion.

| 13. | Cash Advance. The Parties will amend the repayment dates set forth in Section 4 of the 737 Production Rate Advance Memorandum

of Agreement dated April 28, 2023, to be as follows: December 1, 2025 (in the amount of $90,000,000), December 1, 2026 (in the amount

of $45,000,000), and December 1, 2027 (in the amount of $45,000,000). |

| 14. | Settlement and Release of Claims. |

| a. | Spirit Release. Spirit, for itself and for its successors, predecessors, assigns, affiliates, parents, and subsidiaries, and

their respective employees, agents, representatives, officers, directors, attorneys, sureties, and insurers, hereby releases and forever

discharges Boeing and its successors, predecessors, affiliates, parents, and subsidiaries, and their respective employees, agents, representatives,

officers, directors, attorneys, sureties, and insurers, from any and all past and present claims, inclusive of contract change notices,

demands, losses, costs, expenses, rights of action, and causes of action relating to Boeing’s Commercial Airplanes division and

its airplane programs as pertaining to the Agreements that have accrued as of the Effective Date of this MOA (including any additional

unasserted claims), whether known or knowable, suspected or unsuspected, foreseen or unforeseen, existing or claimed to exist, or based

in contract, tort, statutory, or other legal or equitable theory of recovery. Spirit further releases Boeing from any and all liability

for any damages, whether direct or consequential, that may flow from the released claims, demands, losses, costs, expenses, rights of

action, and causes of action. Notwithstanding the above, claims by Spirit arising from the following are not limited, waived, released,

or disclaimed: |

[****]

For the avoidance of doubt, the foregoing release includes

any defamation or business tort claims relating in any way to any of Boeing’s commercial airplane programs.

| b. | Boeing Release. Boeing, for itself and for its successors,

predecessors, assigns, affiliates, parents, and subsidiaries, and their respective employees, agents, representatives, officers, directors,

attorneys, sureties, and insurers, hereby releases and forever discharges Spirit and its successors, predecessors, affiliates, parents,

and subsidiaries, and their respective employees, agents, representatives, officers, directors, attorneys, sureties, and insurers, from

any and all past and present claims, demands, losses, costs, expenses, rights of action, and causes of action relating to Boeing’s

Commercial Airplanes division and its airplane programs as pertaining to the Agreements that have accrued as of the Effective Date of

this MOA (including any additional unasserted claims), whether known or knowable, suspected or unsuspected, foreseen or unforeseen, existing

or claimed to exist, or based in contract, tort, statutory, or other legal or equitable theory of recovery. Boeing further releases Spirit

from any and all liability for any damages, whether direct or consequential, that may flow from the released claims, demands, losses,

costs, expenses, rights of action, and causes of action. Notwithstanding the above, claims by Boeing against Spirit for contribution

(or, if otherwise provided for, indemnity) toward third-party injury and damage or warranty claims are not limited, waived, released,

or disclaimed, except for warranty claims arising out of the vertical fin attach fitting or aft pressure bulkhead elongated holes quality

items recently identified by Spirit and Boeing. For the avoidance of doubt, the foregoing release includes any defamation or business

tort claims relating in any way to any of Boeing’s commercial airplane programs. |

| 15. | Change of Control. Spirit and Boeing will amend the 787 GTA and Sustaining GTA to replace the current Section 20.4 of the 787

GTA and the current Section 28.3 of the Sustaining GTA with the following: |

20.4 (787) / 28.3 (Sustaining) Assignment

The following language shall apply from October 12, 2023,

through December 31, 2030:

Seller shall not assign any of its rights or interest in

this Agreement, the SBP, or any Order, or subcontract all or substantially all of its performance of this Agreement, the SBP, or any Order,

without Boeing’s prior written consent, which shall not be unreasonably withheld, except that Boeing may withhold its consent to

an Assignment to a Disqualified Person (as defined below) for any reason and at its sole discretion. Seller shall provide Boeing with

thirty (30) days notice prior to any proposed assignment (including any proposed Assignment to a Disqualified Person). Seller shall not

delegate any of its duties or obligations under this Agreement; provided that this shall not prohibit Seller from subcontracting as permitted

pursuant to the applicable SBP. Seller may assign its right to monies due or to become due. No assignment, delegation or subcontracting

by Seller, with or without Boeing’s consent, shall relieve Seller of any of its obligations under this Agreement, the SBP, or Order

or prejudice any rights of Boeing against Seller whether arising before or after the date of any assignment. This article does not limit

Seller’s ability to purchase standard commercial supplies or raw material.

The prohibition set forth in this GTA Section

[20.4/28.3] includes, without limitation (and the following shall be deemed to be Assignments to a Disqualified Person by

Seller), in any transaction or series of related transactions: (i) a consolidation or merger of Seller in which a Disqualified

Person directly or indirectly holds, immediately after consummation of the transaction,

more than thirty-five percent (35%) of the voting power of the equity securities of the entity resulting from or surviving such

transaction; (ii) the acquisition directly or indirectly by a Disqualified Person of either (a) more than 35% of the voting power of

the equity securities of Seller or any of its affiliates whose performance is required for the production of the Products or (b)

more than 35% of the voting power of the equity securities of any direct or indirect affiliate of Seller holding more than fifty

percent (50%) of the voting power of the issued and outstanding voting stock of Seller or any of its affiliates whose performance is

required for the production of the Products, in either case for clauses (a) or (b) unless Seller provides and Boeing accepts

Seller’s adequate assurance of continuity of supply, which assurance Boeing may accept or reject at its sole discretion; (iii)

the sale, lease, assignment or transfer to a Disqualified Person, of either (a) all or substantially all of the assets of Seller, or

(b) all or substantially all of the assets used by Seller and its affiliates to produce the Products for any particular airplane

program; (iv) any assignment of Seller’s rights or interest in this Agreement, the SBP, or any Order to a Disqualified Person,

or subcontracting of all or substantially all of Seller’s performance of this Agreement, the SBP, or any Order to a

Disqualified Person; and (v) any other transaction pursuant to which a Disqualified Person obtains the ability to direct or cause

the direction of the management and policies of Seller or any of its subsidiaries whose performance is required for the production

of the Products.

A Disqualified Person is:

(i) a Person, a principal business of which is as an original

equipment manufacturer of commercial aircraft, defense systems, satellites, space launch vehicles or space vehicles;

(ii) a Person that Boeing reasonably believes is unable

to perform this Agreement, for reasons, including but not limited to, financial viability, export and import laws, and demonstrated past

performance failures;

(iii) a Person, that after giving effect to the transaction,

would be the supplier of more than forty percent (40%) by value of the major structural components of any model of Boeing aircraft then

in production, unless it is mutually agreed that significant identifiable benefits will accrue to Boeing as a result of the transaction;

(iv) a Person who is one of the following companies or a

parent, subsidiary or affiliate of one of the following companies: Lufthansa Technique; Israeli Aircraft Industries; HAECO; PEMCO Aeroplex,

EADS/Airbus, or who is an airline or an operator of commercial aircraft in revenue service or a parent, subsidiary or affiliate of an

airline or an operator of commercial aircraft in revenue service; or

(v) any Person to which Boeing does not consent in its

sole discretion. Seller shall not permit any Person described in clause (iv) of the definition of Disqualified Person to hold any

voting stock of Seller at any time that Seller is not a Public Company. Seller shall not enter into any agreement under which any

Person described in clause (iv) of the definition of Disqualified Person is entitled to designate one or more members of

Seller’s board of directors at any time that Seller is a Public Company. A Public Company is any Person (i) with equity

securities registered under Section 12 of the Securities Exchange Act of 1934 or which is subject to the reporting requirements of

Section 15(d) of the Securities Exchange Act of 1934 or (ii) with equity securities traded or quoted in a domestic or foreign

securities exchange or market.

For the avoidance of doubt, Boeing and Seller agree that

HMSGTA MWS and Supplemental License Agreements WS-001/-002/-003 and -004 may be assigned to the third party receiving assignment of this

GTA and its corresponding SBP’s. Any other Supplemental License Agreement between Boeing and Seller will be subject to the assignment

terms of HMSGTA MWS.

Add at end of the 787 GTA Assignment language above

that is effective from October 12, 2023 through December 31, 2030:

In the event of any Assignment to a Disqualified Person:

| 1. | Seller will immediately refund to Boeing an amount equal to all advance payments received from Boeing pursuant to Section 9 (“787

Tooling and Capital”) of the Memorandum of Agreement dated October 12, 2023 (or any definitive document reflecting the payments

set forth in that section), less any repayments received from Seller by Boeing pursuant to that section (or any definitive document reflecting

the repayments set forth in that section); |

If Seller does not refund this amount in full within 10 days

of written notice from Boeing the amount is due, this amount may be set off by Boeing against any amount owing at any time by Boeing to

Seller, regardless of whether any such amount is then due and owing from Boeing to Seller;

| 2. | Seller will immediately refund to Boeing an amount equal

to all payments received from Boeing pursuant to Section 12 [737 Tooling and Capital Expenditures] of the Memorandum of Agreement dated

October 12, 2023 (or any definitive document reflecting the payments set forth in that section), regardless of whether any such amount

is then due and owing from Boeing to Seller. Upon payment from Seller to Boeing, title to all Tooling purchased with funds received from

Boeing pursuant to Section 12 [737 Tooling and Capital Expenditures] of the Memorandum of Agreement dated October 12, 2023 (or any definitive

document reflecting the payments set forth in that section) will transfer from Boeing to Seller. Boeing shall have the exclusive option

to purchase any such Tooling at the original price within 120 days of transfer of title of such Tooling to Seller. |

If Seller does not refund this amount in full within 10 days

of written notice from Boeing the amount is due, this amount may be set off by Boeing against any amount owing at any time by Boeing to

Seller, regardless of whether any such amount is then due and owing from Boeing to Seller;

| 3. | Boeing will have no further obligation to make any payment under Sections 9 or 12 of the Memorandum of Agreement dated October 12,

2023 (or any definitive document reflecting the payments set forth in those sections); |

| 4. | All amounts then owing from Seller to Boeing pursuant to the Memorandum of Agreement dated April 28, 2023, as modified by Section

13 of the Memorandum of Agreement dated October 12, 2023, will become immediately due and payable and, if Seller has not paid in full

within 10 days of written notice from Boeing the amount is due, may be set off by Boeing against any amount owing at any time by Boeing

to Seller, regardless of whether any such amount is then due and owing from Boeing to Seller; and |

| 5. | The then-remaining balance of the Advance Payments due to Boeing pursuant to Section 5.5 of the SBP will become immediately due and

payable and, if Seller has not paid in full within 10 days of written notice from Boeing the amount is due, may be set off by Boeing against

any amount owing at any time by Boeing to Seller, regardless of whether any such amount is then due and owing from Boeing to Seller. |

Boeing may, at its sole discretion, waive the immediately

preceding rights by written notice to Seller and not otherwise.

Add at end of the Sustaining GTA Assignment language

above that is effective from October 12, 2023 through December 31, 2030:

In the event of any Assignment to a Disqualified Person:

| 1. | Any remaining amount of the 737 Shipset price reductions

agreed to in Section 11 (“737 Recurring Price”) of the Parties’ Memorandum of Agreement dated October 12, 2023, that

has not been realized by Boeing through Shipset deliveries upon closing of the assignment transaction will become immediately due and

payable. If Seller does not pay this amount in full within 10 days of written notice from Boeing the amount is due, this amount may be

set off by Boeing against any amount owing at any time by Boeing to Seller, regardless of whether any such amount is then due and owing

from Boeing to Seller. The 737 Shipset pricing reductions agreed to in Section 11 (“737 Recurring Price”) of the Memorandum

of Agreement between the Parties dated October 12, 2023, will

be removed upon receipt of the remaining amount; and |

| 2. | All amounts then owing from Seller to Boeing pursuant to the Memorandum of Agreement dated April 28, 2023, as modified by Section

13 of the Memorandum of Agreement dated October 12, 2023, will become immediately due and payable and, if Seller has not paid in full

within 10 days of written notice from Boeing the amount is due, may be set off by Boeing against any amount owing at any time by Boeing

to Seller, regardless of whether any such amount is then due and owing from Boeing to Seller. |

Boeing may, at its sole discretion, waive the immediately preceding

rights by written notice to Seller and not otherwise.

20.4 (787) / 28.3 (Sustaining) Assignment

The following language shall apply beginning January 1,

2031:

Seller shall not assign any of its rights or interest in this Agreement or any Order, or subcontract all or substantially all of its performance

of this Agreement or any Order, without Boeing’s prior written consent, which shall not be unreasonably withheld, except that Boeing

may withhold its consent to an assignment to a Disqualified Person (as defined below) for any reason and at its sole discretion. Seller

shall provide Boeing with thirty (30) days notice prior to any proposed assignment. Seller shall not delegate any of its duties or obligations

under this Agreement; provided that this shall not prohibit Seller from subcontracting as permitted pursuant to the applicable SBP. Seller

may assign its right to monies due or to become due. No assignment, delegation or subcontracting by Seller, with or without Boeing’s

consent, shall relieve Seller of any of its obligations under this Agreement or Order or prejudice any rights of Boeing against Seller

whether arising before or after the date of any assignment. This article does not limit Seller’s ability to purchase standard commercial

supplies or raw material.

The prohibition set forth in this GTA Section

[20.4/28.3] includes, without limitation (and the following shall, subject to the immediately following sentence, be deemed to be

"assignments"): (i) a consolidation or merger of Seller in which a Disqualified Person directly or indirectly holds,

immediately after consummation of the transaction more than fifty percent (50%) of the voting power of the issued and outstanding

voting stock of the corporation resulting from or surviving such transaction; (ii) the acquisition directly or indirectly by a

Disqualified Person of voting stock of any corporate Seller having more than fifty percent (50%) of the voting power of the issued

and outstanding voting stock of Seller; (iii) the sale, assignment or transfer of all or substantially all of the assets of Seller

to a Disqualified Person; and (iv) where Seller is a partnership, acquisition of control of such partnership by a Disqualified

Person. Any consolidation, merger, acquisition of voting stock or sale, assignment or transfer of all or substantially all of the

assets of Seller that is not prohibited by the immediately preceding sentence shall not constitute an “assignment” for

purposes of this GTA and shall not be prohibited by, or require Boeing’s consent under, this Section [20.4/28.3].

A Disqualified Person is:

(i) a Person, a principal business of which is as an original

equipment manufacturer of commercial aircraft, defense systems, satellites, space launch vehicles or space vehicles;

(ii) a Person that Boeing reasonably believes is unable

to perform this Agreement, for reasons, including but not limited to, financial viability, export and import laws, and demonstrated past

performance failures;

(iii) a Person, that after giving effect to the transaction,

would be the supplier of more than forty percent (40%) by value of the major structural components of any model of Boeing aircraft then

in production, unless it is mutually agreed that significant identifiable benefits will accrue to Boeing as a result of the transaction;

or

(iv) a Person who is one of the following companies or a

parent, subsidiary or affiliate of one of the following companies: Lufthansa Technique; Israeli Aircraft Industries; HAECO; PEMCO Aeroplex,

EADS/Airbus, or who is an airline or an operator of commercial aircraft in revenue service or a parent, subsidiary or affiliate of an

airline or an operator of commercial aircraft in revenue service.

Seller shall not permit any Person described in clause (iv)

of the definition of Disqualified Person to hold any voting stock of Seller at any time that Seller is not a Public Company. Seller shall

not enter into any agreement under which any Person described in clause (iv) of the definition of Disqualified Person is entitled to designate

one or more members of Seller’s board of directors at any time that Seller is a Public Company. A Public Company is any Person (i)

with equity securities registered under Section 12 of the Securities Exchange Act of 1934 or which is subject to the reporting requirements

of Section 15(d) of the Securities Exchange Act of 1934 or (ii) with equity securities traded or quoted in a domestic or foreign securities

exchange or market.

For the avoidance of doubt, Boeing and Seller agree that

HMSGTA MWS and Supplemental License Agreements WS-001/-002/-003 and -004 may be assigned to the third party receiving assignment of this

GTA and its corresponding SBP’s. Any other Supplemental License Agreement between Boeing and Seller will be subject to the assignment

terms of HMSGTA MWS.

| 16. | Repudiation. Spirit and Boeing will amend the 787 GTA and the Sustaining GTA to add the following new 787 GTA Section 8.5 and

Sustaining GTA Section 13.3:

[8.5/13.3] Repudiation |

The Parties agree that repudiation by Seller of timely delivery

under GTA BCA-65530-0016, GTA BCA-65520-0032, SBP MS-65530-0019, or SBP MS-65530-0016 would cause irreparable harm to Boeing for which

damages would not be an adequate remedy. Accordingly, in the event Seller repudiates timely delivery under any of the aforementioned agreements,

Boeing will be entitled to equitable relief, including but not limited to, specific performance and preliminary and permanent injunctions.

| 17. | Complete Agreement. This MOA constitutes the complete and exclusive agreement between the Parties with respect to the subject

matter set forth herein and supersedes all previous agreements between the Parties relating thereto, whether written or oral. Except as

expressly provided in this MOA, however, all other terms and conditions of the Agreements remain in full force and effect. |

| 18. | Governing Law and Jurisdiction. This MOA is governed by the laws of the state of Washington, exclusive of Washington's conflict

of laws principles. This MOA excludes the application of the 1980 United Nations Convention on Agreements for the International Sale of

Goods. Boeing and Spirit hereby irrevocably consent to and submit themselves exclusively to the jurisdiction of the applicable courts

of King County, Washington and the federal courts of Washington State for the purpose of any suit, action or other judicial proceeding

arising out of or connected with this MOA. Boeing and Spirit hereby waive and agree not to assert by way of motion, as a defense, or otherwise,

in any such suit, action or proceeding, any claim that (a) Boeing and Spirit are not personally subject to the jurisdiction of the above-named

courts; (b) the suit, action, or proceeding is brought in an inconvenient forum; or (c) the venue of the suit, action, or proceeding is

improper. |

| 19. | No Admission of Liability. The Parties acknowledge that this MOA reflects a compromise resolution by the Parties of certain

claims and that nothing contained in this MOA constitutes or will be construed as an acknowledgement or admission of liability or absence

of liability in any way on the part of the Parties, each of which expressly denies any liability or wrongdoing in connection with such

claims, and the Parties agree not to issue any public statement or comment to the contrary. |

| 20. | Confidential Treatment. The information contained

herein is confidential business information. The Parties will limit the disclosure of this MOA's contents to employees with a need to

know and who understand that they are not to disclose its contents to any other person or entity without the prior written consent of

the other Party. Notwithstanding the above, the Parties may file this MOA with the SEC if legally required to do so but must give the

other Party two business days’ advance notice and will omit confidential information as permitted by applicable law as appropriate

after providing the other Party the opportunity to provide comments. Nothing in this section will prevent either Party from making reasonable

disclosures during the course of its earnings calls. |

| 21. | Interpretation. Each Party has had the opportunity to draft, review, and edit this MOA. Accordingly, no presumption for or

against either Party arising out of drafting all or any part of this MOA will be applied in any action relating to or arising from this

MOA; and the Parties hereby waive the benefit of any statute or common-law rule providing that, in cases of uncertainty, language should

be interpreted against the Party who caused the uncertainty to exist. |

EXECUTED as of the Effective Date by the duly authorized

representatives of the Parties.

| THE BOEING COMPANY |

|

SPIRIT AEROSYSTEMS, INC. |

|

/s/ Ihssane Mounir

|

|

/s/ Mark Suchinski |

| Signature |

|

Signature |

| |

|

|

| |

|

|

| Ihssane Mounir |

|

Mark Suchinski |

| |

|

|

| |

|

|

| Senior Vice President |

|

Senior Vice President & CFO |

| |

|

|

| October 12, 2023 |

|

October 12, 2023 |

| Date |

|

Date |

Exhibit 1

[****]

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

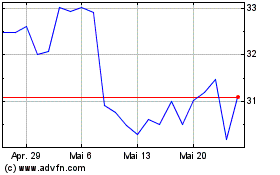

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024