2nd UPDATE: Spirit, Boeing Reach Agreement On 787 Program Claims

12 Januar 2011 - 9:29PM

Dow Jones News

Spirit AeroSystems Holdings Inc. (SPR) on Wednesday became the

first company to disclose a deal with Boeing Co. (BA) covering

compensation for the three-year delay in its 787 passenger

plane.

The terms of the deal agreed to last month weren't disclosed,

but Spirit said it would "include any impact of the agreement" when

it reports earnings on Feb. 10, two weeks after Boeing's own

quarterly release.

Its shares were recently up 10% at $22.53, their highest level

since last May..

Spirit, other suppliers and 787 customers have all been in talks

with Boeing over compensation and other penalties for the

successive delays in the 787 program caused by production and

design problems.

Suppliers who built up production of parts for the 787s expected

entry into service have been left sitting on inventory, while

airline customers were left to continue using older, les efficient

planes.

Phil Anderson, Spirit's chief financial officer, said in a

statement that the companies "developed a fair and equitable

framework that reflects the current program financial realities."

The company last year said it was shifting resources to other

projects as it awaited further guidance on the 787 production

schedule.

Boeing had hoped to wrap up talks with all affected customers

and suppliers by the end of last year, but an onboard fire on a

test flight in November is expected to lead to another delay in the

787's first delivery to an airline.

The company declined comment Wednesday, but said before the

November incident that negotiations continued "in an orderly

fashion."

Analysts have speculated that the final bill could run into the

billions, but Boeing has sought to minimize the cash impact.

Reparations are likely to involve a mix of cash penalties and

nonfinancial "credits" such as subsidized freighter conversions or

guaranteed future delivery slots, according to a person familiar

with the process.

One of the most closely watched negotiations is with

International Lease Finance Corp., which remains the largest 787

customer. Observers said could it set a benchmark for reparations

with other customers.

Boeing has been insourcing some production work from its array

of 787 partners to alleviate quality-control and supply-chain

issues. The outsourcing was intended to share the financial burden

of the program.

The company has restarted test flights of the 787 as it seeks

certification from regulators, but has not officially updated

guidance that launch customer All Nippon Airways Co. (ALNPY,

9202.TO) would receive its first plane next month.

A senior European regulator, which is assessing the plane in

parallel with its U.S. counterparts, said this week that it was

looking for certification by mid-year, if not later.

Boeing shares were recently up 1.9% at $70.28 in a broader

market rally.

-By Doug Cameron and Matt Jarzemsky, Dow Jones Newswires;

212-416-2240; matthew.jarzemsky@dowjones.com

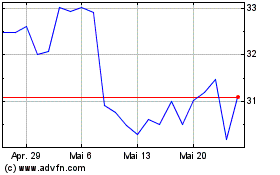

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024