Sonoco Announces Pricing of $1.8 Billion of Senior Unsecured Notes

18 September 2024 - 12:00AM

Sonoco Products Company (“Sonoco” or the “Company”) (NYSE: SON), a

global leader in high-value sustainable packaging, today announced

that it has priced an offering (the “Offering”) of senior unsecured

notes in a combined aggregate principal amount of $1.8 billion

(collectively, the “Notes”). The Notes will be issued

in three tranches:

- $500 million in aggregate principal

amount of 4.450% notes due 2026

- $600 million in aggregate principal

amount of 4.600% notes due 2029

- $700 million in aggregate principal

amount of 5.000% notes due 2034

Sonoco expects that the closing of the Offering will occur on

September 19, 2024, subject to the satisfaction of customary

closing conditions.

Sonoco intends to use an amount equal to the net proceeds from

the Offering, together with borrowings under its acquisition term

loan facilities and, if needed, cash on hand or additional

borrowings under its existing revolving credit facility, to fund

the cash consideration payable by Sonoco in connection with

Sonoco’s pending acquisition of Titan Holdings I B.V. (“Eviosys”)

and to pay related fees and expenses.

J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, BofA

Securities, Inc. and Wells Fargo Securities, LLC are serving as

joint book-running managers for the Offering.

Sonoco has an effective shelf registration statement and has

filed a preliminary prospectus supplement dated September 16, 2024

and a base prospectus forming part of the registration statement

(together, the “preliminary prospectus”) with the Securities and

Exchange Commission (the “SEC”) for the Offering. The Offering is

being made only by means of the preliminary prospectus. Before you

invest, you should read the preliminary prospectus (and, when

available, the final prospectus supplement) relating to the

Offering and the documents incorporated by reference therein. You

may get these documents for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, copies of the

preliminary prospectus and, when available, the final prospectus

supplement relating to the Offering may be obtained by contacting

J.P. Morgan Securities LLC, 383 Madison Avenue, New York, New York

10179 collect at 1-212-834-4533, Morgan Stanley & Co. LLC, 1585

Broadway, 29th Floor, New York, NY 10036 toll-free at

1-866-718-1649, BofA Securities, Inc., NC1-022-02-25, 201 North

Tryon Street, Charlotte, NC 28255-0001, Attn: Prospectus Department

toll free at 1-800-294-1322, or Wells Fargo Securities, LLC, 608

2nd Avenue South, Suite 1000, Minneapolis, MN 55402, Attn: WFS

Customer Service toll-free at 1-800-645-3751.

This press release shall not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, the

Notes or any other security. No offer, solicitation, purchase or

sale will be made in any jurisdiction in which such an offer,

solicitation or sale would be unlawful.

About Sonoco:With net sales of approximately

$6.8 billion in 2023, Sonoco has approximately 22,000 employees

working in more than 300 operations around the world, serving some

of the world’s best-known brands. With our corporate purpose of

Better Packaging. Better Life., Sonoco is committed to creating

sustainable products and a better world for our customers,

employees, and communities. Sonoco was named one of America’s Most

Responsible Companies by Newsweek.

Forward-Looking StatementsThis press release

contains certain forward-looking statements. Words, and variations

of words, such as “will,” “may,” “could,” “intend,” “plan,” and

similar expressions are intended to identify those forward-looking

statements, including but not limited to statements about the

timing of the closing of the Offering and the receipt and intended

use of the net proceeds of the Offering. These statements are not

guarantees of future performance and are subject to certain risks,

uncertainties and assumptions that are difficult to predict,

including the ability of the parties to complete the Offering on

the anticipated timing or at all and Sonoco’s ability to complete

the pending acquisition of Eviosys. Therefore, actual results may

differ materially from those expressed or forecasted in such

forward-looking statements. Additional information concerning some

of the factors that could cause materially different results is

included in the preliminary prospectus and the Company’s reports on

forms 10-K, 10-Q and 8-K filed with the U.S. Securities and

Exchange Commission. Such documents are available from EDGAR on the

SEC’s website at www.sec.gov.

Contact Information

Investors Lisa WeeksVice President of Investor

Relations & Communicationslisa.weeks@sonoco.com

843-383-7524

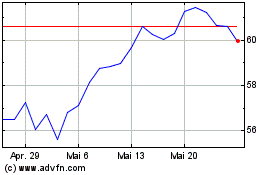

Sonoco Products (NYSE:SON)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Sonoco Products (NYSE:SON)

Historical Stock Chart

Von Nov 2023 bis Nov 2024