0001366561false00013665612024-11-082024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2024

Smartsheet Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Washington | 001-38464 | 20-2954357 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

500 108th Ave NE, Suite 200

Bellevue, WA 98004

(Address of principal executive offices and zip code)

(844) 324-2360

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, no par value per share | SMAR | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 – Other Events.

As previously disclosed on a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 24, 2024, Smartsheet Inc. (“Smartsheet”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), dated as of September 24, 2024, by and among Smartsheet, Einstein Parent, Inc. (“Parent”), and Einstein Merger Sub, Inc., a wholly owned subsidiary of Parent (“Merger Sub”), pursuant to which Merger Sub will merge with and into Smartsheet (the “Merger”), with Smartsheet surviving the Merger as a wholly owned subsidiary of Parent. Parent and Merger Sub are affiliates of investment funds managed by Blackstone Inc., Vista Equity Partners, and a wholly owned subsidiary of the Abu Dhabi Investment Authority.

The waiting period with respect to the Merger under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), expired at 11:59 p.m. Eastern Time on November 12, 2024. The expiration of the HSR Act waiting period satisfies certain conditions to the closing of the Merger. The Merger remains subject to other closing conditions, including certain regulatory actions and approval by Smartsheet’s shareholders. Assuming the satisfaction of necessary closing conditions, the Merger is expected to close in the fourth quarter of Smartsheet’s fiscal year ending January 31, 2025.

Additionally, the “go-shop” period established pursuant to the terms of the Merger Agreement expired at 11:59 p.m. Pacific Time on November 8, 2024. During the “go-shop” period, Smartsheet’s Board of Directors, with the assistance of Smartsheet’s financial advisor, actively solicited alternative acquisition proposals from potentially interested third parties. Smartsheet did not receive any alternative acquisition proposals during the “go-shop” period.

Additional Information and Where to Find It

In connection with the proposed transaction, Smartsheet filed with the SEC a definitive proxy statement on November 4, 2024, which has been mailed to Smartsheet’s shareholders. Smartsheet has and will continue to file relevant materials with the SEC in connection with the proposed transaction. SMARTSHEET’S SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Shareholders of Smartsheet can obtain a free copy of these documents at the website maintained by the SEC at www.sec.gov or free of charge at https://investors.smartsheet.com/.

Participants in the Solicitation

Smartsheet and its directors, executive officers, other members of its management and employees may be deemed to be participants in the solicitation of proxies of Smartsheet’s shareholders in connection with the proposed transaction under SEC rules. Information about Smartsheet’s directors and executive officers is set forth under the captions “Proposal 1–Election of Directors,” “Non-Employee Director Compensation,” “Executive Officers,” “Security Ownership of Certain Beneficial Owners, Directors, and Management,” “Executive Compensation,” “Pay Versus Performance” and “Equity Compensation Plan Information” sections of the definitive proxy statement for Smartsheet’s 2024 annual meeting of shareholders, filed with the SEC on May 1, 2024, and in Smartsheet’s definitive proxy statement with respect to the proposed transaction and any other relevant documents that are filed or will be filed with the SEC relating to the proposed transaction. You may obtain free copies of these documents using the sources indicated above.

Forward-Looking Statements

This communication may contain forward-looking statements including, among other things, statements regarding the ability of the parties to complete the proposed transaction and the expected timing of completion of the proposed transaction; the prospective performance and outlook of Smartsheet’s business, performance and opportunities; as well as any assumptions underlying any of the foregoing. When used in this communication, or any other documents, words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“forecast,” “goal,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” and similar expressions should be considered forward-looking statements made in good faith by Smartsheet, as applicable. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are subject to risks, uncertainties, and assumptions that could cause Smartsheet’s actual results to differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks include, but are not limited to, risks and uncertainties related to: (i) the ability to obtain the requisite approval from shareholders of Smartsheet; (ii) the risk that the proposed transaction may not be completed in a timely manner or at all; (iii) the possibility that competing offers or acquisition proposals for Smartsheet will be made; (iv) the possibility that any or all of the various conditions to the consummation of the proposed transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, including in circumstances that would require Smartsheet to pay a termination fee or other expenses; (vi) the effect of the pendency of the proposed transaction on Smartsheet’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and others with whom it does business, its business generally or its stock price; (vii) risks related to diverting management’s attention from Smartsheet’s ongoing business operations or the loss of one or more members of the management team; (viii) the risk that shareholder litigation in connection with the proposed transaction may result in significant costs of defense, indemnification and liability; (ix) Smartsheet’s ability to achieve future growth and sustain its growth rate; (x) Smartsheet’s ability to attract and retain talent; (xi) Smartsheet’s ability to attract and retain customers (including government customers) and increase sales to its customers; (xii) Smartsheet’s ability to develop and release new products and services and to scale its platform; (xiii) Smartsheet’s ability to increase adoption of its platform through its self-service model; (xiv) Smartsheet’s ability to maintain and grow its relationships with channel and strategic partners; (xv) the highly competitive and rapidly evolving market in which Smartsheet participates; (xvi) Smartsheet’s ability to identify targets for, execute on, or realize the benefits of, potential acquisitions; and (xvii) Smartsheet’s international expansion strategies. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the definitive proxy statement filed with the SEC in connection with the proposed transaction. While the list of factors presented here and in the definitive proxy statement are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Should any of these risks or uncertainties materialize, actual results could differ materially from expectations. Except as required by applicable law, Smartsheet assumes no obligation to, and does not currently intend to, update or supplement any such forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date of this communication.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| SMARTSHEET INC. |

| |

| By: | /s/ Pete Godbole |

| Name: Pete Godbole |

| Title: Chief Financial Officer & Treasurer |

Date: November 14, 2024

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

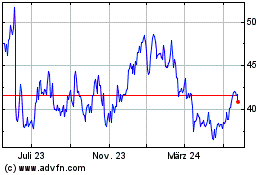

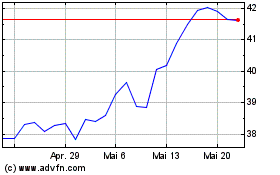

Smartsheet (NYSE:SMAR)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Smartsheet (NYSE:SMAR)

Historical Stock Chart

Von Nov 2023 bis Nov 2024