RLI Announces Hurricane Beryl and Hurricane Helene Loss Estimates

07 Oktober 2024 - 10:10PM

Business Wire

RLI Corp. (NYSE: RLI) – RLI Corp. (RLI) announced today an

estimated range of pretax net catastrophe losses from Hurricanes

Beryl and Helene of $35 to $40 million, to be reflected in the

third quarter of 2024. This range is net of reinsurance

recoverables and is subject to change due to the complexity of the

claims and preliminary nature of the information currently

available.

“Our thoughts are with everyone impacted by these devastating

storms,” RLI Corp. President & CEO Craig Kliethermes.

“Following these events, our claim team has responded rapidly to

assess the widespread damage and is helping affected policyholders

recover as quickly as possible. We remain dedicated to providing

superior support to our customers.”

RLI Corp. will release its third quarter 2024 earnings after

market close on Monday, October 21, 2024. The company will hold its

quarterly conference call to discuss third quarter results on

Tuesday, October 22, 2024, at 10 a.m. CDT.

This news release includes forward-looking statements (within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934) including,

without limitation, statements reflecting our current expectations

about our catastrophe losses resulting from Hurricanes Beryl and

Helene. As noted above, loss estimates are subject to change due to

the complexity of the claims and preliminary nature of the

information currently available. In addition, various risk factors

that could affect our future results are listed in RLI’s filings

with the SEC, including the Annual Report on Form 10-K for the year

ended December 31, 2023.

ABOUT RLI

RLI Corp. (NYSE: RLI) is a specialty insurer serving niche

property, casualty and surety markets. The company provides deep

underwriting expertise and superior service to commercial and

personal lines customers nationwide. RLI’s products are offered

through its insurance subsidiaries RLI Insurance Company, Mt.

Hawley Insurance Company and Contractors Bonding and Insurance

Company. All of RLI’s subsidiaries are rated A+ “Superior” by AM

Best Company. RLI has paid and increased regular dividends for 49

consecutive years and delivered underwriting profits for 28

consecutive years. To learn more about RLI, visit

www.rlicorp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241007586136/en/

Aaron Diefenthaler Chief Investment Officer & Treasurer

309-693-5846 Aaron.Diefenthaler@rlicorp.com

RLI (NYSE:RLI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

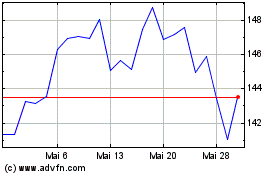

RLI (NYSE:RLI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024