0001410384false00014103842024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 6, 2024

Q2 HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36350 | | 20-2706637 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

10355 Pecan Park Boulevard

Austin, Texas 78729

(Address of Principal Executive Offices, and Zip Code)

(833) 444-3469

Registrant's Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | QTWO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2024, Q2 Holdings, Inc. (the "Company") issued a press release regarding its financial results for the third quarter ended September 30, 2024. A copy of the Company's press release is furnished herewith as Exhibit 99.1.

The information furnished in this Current Report under this Item 2.02 and the exhibit furnished herewith shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated November 6, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Q2 HOLDINGS, INC. |

| |

November 6, 2024 | /s/ David J. Mehok David J. Mehok Chief Financial Officer |

FOR IMMEDIATE RELEASE

Q2 Holdings, Inc. Announces Third Quarter 2024 Financial Results

AUSTIN, Texas (November 6, 2024)—Q2 Holdings, Inc. (NYSE: QTWO), a leading provider of digital transformation solutions for financial services, today announced results for its third quarter ending September 30, 2024.

GAAP Results for the Third Quarter 2024

•Revenue for the third quarter of $175.0 million, up 13 percent year-over-year and up 1 percent from the second quarter of 2024.

•GAAP gross margin for the third quarter of 50.9 percent, up from 47.8 percent in the prior-year quarter and 50.2 percent in the second quarter of 2024.

•GAAP net loss for the third quarter of $11.8 million compared to GAAP net loss of $23.2 million for the prior-year quarter and GAAP net loss of $13.1 million for the second quarter of 2024.

Non-GAAP Results for the Third Quarter 2024

•Non-GAAP revenue for the third quarter of $175.0 million, up 13 percent year-over-year and up 1 percent from the second quarter of 2024.

•Non-GAAP gross margin for the third quarter of 56.0 percent, up from 53.9 percent for the prior-year quarter and 55.7 percent from the second quarter of 2024.

•Adjusted EBITDA for the third quarter of $32.6 million, up from $19.7 million for the prior-year quarter and $29.9 million from the second quarter of 2024.

For a reconciliation of our GAAP to non-GAAP results, please see the tables below.

“We achieved solid bookings success across our business lines in the third quarter, highlighted by six Enterprise and Tier 1 deals, including three with Top 50 U.S. banks,” said Q2 Chairman and CEO Matt Flake. “Additionally, our strong financial performance enabled us to reach our total revenue Rule of 30 target during the quarter. We believe these results and our continued success in winning and expanding our relationships with financial institutions of all sizes reflects our position as a leader in the market.”

Third Quarter Highlights

Six Enterprise & Tier 1 Contracts Demonstrate Continued Broad-Based Sales Success

•Signed two Enterprise & one Tier 1 digital banking contracts, including:

◦Two new banks, one for Q2’s retail solutions, and the other to utilize its retail, SMB and commercial solutions.

◦One expansion with an Enterprise Bank, adding commercial solutions.

•Signed two Enterprise & one Tier 1 relationship pricing contracts, including:

◦Two new banks, highlighted by a top 50 US bank.

◦One expansion with an Enterprise Bank, adding treasury pricing solutions.

•Signed a new contract with Envisant, to utilize our Q2 Fabric offering, which combines Helix's embedded finance platform with Q2's digital banking capabilities.

•Subscription Annualized Recurring Revenue increased to $654.6 million, up 20 percent year-over-year.

•Remaining Performance Obligations total, or Backlog, increased by $78 million sequentially and a record $467 million year-over-year, resulting in a total committed Backlog of over $2.0 billion at quarter-end, representing 4 percent sequential growth and 30 percent year-over-year growth.

Q2's Comprehensive Solutions Continue to Drive Robust Bookings

Q2 delivered broad-based bookings activity in the quarter across digital banking and relationship pricing with both new and existing customers. The third quarter was the strongest cross-sale bookings quarter so far in 2024, with nearly 50% of incremental annual recurring revenue (ARR) bookings coming from existing customers.

The versatility of Q2's digital banking platform continued to be a differentiator in the quarter, as the three Enterprise & Tier 1 wins included two Top 50 banks as well as a new Tier 1 bank, formed through an acquisition. The largest digital banking win was with a Tier 2 bank which adopted the entire platform of retail, SMB and commercial solutions, further diversifying the bookings strength in the third quarter.

Relationship pricing saw meaningful bookings in the quarter, highlighted by three Enterprise & Tier 1 wins, including two top 50 banks, and the largest overall ARR deal in the quarter, which was also the fifth largest relationship pricing deal in company history.

Helix bookings activity included a significant renewal and expansion with one of its largest customers in the quarter, as well as a material net new Q2 Fabric win with Envisant, a credit union service organization.

“We are pleased with our third quarter results, which exceeded our guidance and achieved our total revenue Rule of 30 target set at the beginning of 2023," said Q2 Prospective CFO Jonathan Price. "Our subscription revenue now accounts for over 80% of our total revenue, reflecting the strength of our business model. We've made substantial progress in free cash flow generation, and as we look ahead, we remain focused on growing our higher-margin recurring revenue streams and improving operational efficiency.”

Financial Outlook

As of November 6, 2024, Q2 Holdings is providing guidance for its fourth quarter of 2024 and updated guidance for its full year 2024, which represents Q2 Holdings’ current estimates on Q2 Holdings’ operations and financial results. The financial information below represents forward-looking, non-GAAP financial information, including estimates of non-GAAP revenue and adjusted EBITDA. GAAP net loss is the most comparable GAAP measure to adjusted EBITDA. Adjusted EBITDA differs from GAAP net loss in that it excludes items such as depreciation and amortization, stock-based compensation, transaction-related costs, interest and other (income) expense, income taxes, lease and other restructuring charges, gain on extinguishment of debt and the impact to deferred revenue from purchase accounting. Q2 Holdings is unable to predict with reasonable certainty the ultimate outcome of these exclusions without unreasonable effort. Therefore, Q2 Holdings has not provided guidance for GAAP net loss or a reconciliation of the forward-looking adjusted EBITDA guidance to GAAP net loss. However, it is important to note that these excluded items could be material to Q2's results computed in accordance with GAAP in future periods.

Q2 Holdings is providing guidance for the fourth quarter of 2024 as follows:

•Total non-GAAP revenue of $178.1 million - $181.1 million, which would represent year-over-year growth of 10 to 12 percent.

•Adjusted EBITDA of $34.3 million - $36.3 million, representing 19 to 20 percent of non-GAAP revenue for the quarter.

Q2 Holdings is providing updated guidance for the full-year 2024 as follows:

•Total non-GAAP revenue of $691.5 million - $694.5 million, which would represent year-over-year growth of 11 percent.

•Adjusted EBITDA of $122.0 million - $124.0 million, representing 18 percent of non-GAAP revenue for the year.

Conference Call Details

| | | | | | | | |

| Date: | Wednesday, November 6, 2024 | |

| Time: | 5:00 p.m. EST | |

| Hosts: | Matt Flake, Chairman & CEO / Jonathan Price, Prospective CFO / Kirk Coleman, President | |

| Conference Call Registration: | https://registrations.events/direct/Q4I6081012 | |

| Webcast Registration: | https://events.q4inc.com/attendee/265196731 | |

| | |

All participants must register using the above links (either the webcast or conference call). A webcast of the conference call and financial results will be accessible from the investor relations section of the Q2 website at http://investors.Q2.com/. In addition, a live conference call dial-in will be available upon registration. Participants should dial in at least 10 minutes before the start of the conference call. An archived replay of the webcast will be available on this website for a limited time after the call. Q2 has used, and intends to continue to use, its investor relations website as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

About Q2 Holdings, Inc.

Q2 is a leading provider of digital transformation solutions for financial services, serving banks, credit unions, alternative finance companies, and fintechs in the U.S. and internationally. Q2 enables its financial institution and fintech customers to provide comprehensive, data-driven digital engagement solutions for consumers, small businesses and corporate clients. Headquartered in Austin, Texas, Q2 has offices worldwide and is publicly traded on the NYSE under the stock symbol QTWO. To learn more, please visit Q2.com. Follow us on LinkedIn and X to stay up to date.

Use of Non-GAAP Measures

Q2 uses the following non-GAAP financial measures: non-GAAP revenue; adjusted EBITDA; adjusted EBITDA margin; non-GAAP gross margin; non-GAAP gross profit; non-GAAP sales and marketing expense; non-GAAP research and development expense; non-GAAP general and administrative expense; non-GAAP operating expense; non-GAAP operating income (loss); and free cash flow. Management believes that these non-GAAP financial measures are useful measures of operating performance because they exclude items that Q2 does not consider indicative of its core performance.

In the case of non-GAAP revenue, Q2 adjusts revenue to exclude the impact to deferred revenue from purchase accounting adjustments. In the case of adjusted EBITDA, Q2 adjusts net loss for such items as interest and other (income) expense, taxes, depreciation and amortization, stock-based compensation, transaction-related costs, lease and other restructuring charges, gain on extinguishment of debt and the impact to deferred revenue from purchase accounting. In the case of adjusted EBITDA margin, Q2 calculates adjusted EBITDA margin by dividing adjusted EBITDA by non-GAAP revenue. In the case of non-GAAP gross margin and non-GAAP gross profit, Q2 adjusts gross profit and gross margin for stock-based compensation, amortization of acquired technology, transaction-related costs, lease and other restructuring charges and the impact to deferred revenue from purchase accounting. In the case of non-GAAP sales and marketing expense, non-GAAP research and development expense, and non-GAAP general and administrative expense, Q2 adjusts the corresponding GAAP expense to exclude stock-based compensation. Non-GAAP operating expense is calculated by taking the sum of non-GAAP sales and marketing expenses, non-GAAP research and development expense, and non-GAAP general and administrative expense. In the case of non-GAAP operating income (loss), Q2 adjusts operating income (loss), for stock-based compensation, transaction-related costs, amortization of acquired technology, amortization of acquired intangibles, lease and other restructuring charges, and the impact to deferred revenue from purchase accounting. In the case of free cash flow, Q2 adjusts net cash provided by (used in) operating activities for purchases of property and equipment and capitalized software development costs.

There are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be completely comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation between companies. Certain items that are excluded from these non-GAAP financial measures can have a material impact on operating and net income (loss). As a result, these non-GAAP financial measures have limitations and should be considered

in addition to, not as a substitute for or superior to, the closest GAAP measures, or other financial measures prepared in accordance with GAAP. A reconciliation to the closest GAAP measures of these non-GAAP measures is contained in tabular form on the attached unaudited condensed consolidated financial statements.

Q2’s management uses these non-GAAP measures as measures of operating performance; to prepare Q2’s annual operating budget; to allocate resources to enhance the financial performance of Q2’s business; to evaluate the effectiveness of Q2’s business strategies; to provide consistency and comparability with past financial performance; to facilitate a comparison of Q2’s results with those of other companies, many of which use similar non-GAAP financial measures to supplement their GAAP results; and in communication with our board of directors concerning Q2’s financial performance.

Forward-looking Statements

This press release contains forward-looking statements, including statements about: our position as a leader in the market; our continued success in winning and expanding our relationships with financial institutions of all sizes; our ability to continue to drive robust bookings; the versatility of our digital banking platform and its ability to continue to differentiate us in the market; the strength, sophistication of and continued momentum selling our relationship pricing platform; continued focus by financial institutions on relationship profitability; the ability of Q2 Fabric to allow customers to pursue their own unique growth objectives; the strength of our business model and execution; our positioning for continued growth; our continued focus on growing our high-margin recurring revenue streams and improving operational efficiency; our ability to drive sustainable, profitable growth and driving shareholder value; our ability to execute against our three-year target framework; and our quarterly and annual financial guidance. The forward-looking statements contained in this press release are based upon our historical performance and its current plans, estimates, and expectations and are not a representation that such plans, estimates or expectations will be achieved. Factors that could cause actual results to differ materially from those described herein include risks related to: (a) global economic uncertainties and challenges or changes in the financial services industry and credit markets, including as a result of recent bank failures, mergers and acquisitions within the banking sector, inflation, higher and shifting interest rates and any potential financial regulations and their potential impacts on our prospects' and customers' operations, the timing of prospect and customer implementations and purchasing decisions, our business sales cycles and on account holder or end user, or End User, usage of our solutions; (b) the risk of increased or new competition in our existing markets and as we enter new markets or new segments of existing markets, or as we offer new solutions; (c) the risks associated with the development of our solutions, including artificial intelligence, or AI, based solutions, and changes to the market for our solutions compared to our expectations; (d) quarterly fluctuations in our operating results relative to our expectations and guidance and the accuracy of our forecasts; (e) the risks and increased costs associated with managing growth and global operations, including hiring, training, retaining and motivating employees to support such growth, particularly in light of recent macroeconomic challenges, including increased competition for talent, employee turnover, labor shortages and wage inflation; (f) the risks associated with our transactional business which are typically driven by End User behavior and can be influenced by external drivers outside of our control; (g) the risks associated with effectively managing our business and cost structure in an uncertain economic environment, including as a result of challenges in the financial services industry and the effects of seasonality and unexpected trends; (h) the risks associated with geopolitical uncertainties, including the heightened risk of state-sponsored cyberattacks or cyber fraud on financial services and other critical infrastructure, and political uncertainty or discord, including related to the 2024 U.S. presidential election; (i) the risks associated with accurately forecasting and managing the impacts of any economic downturn or challenges in the financial services industry on our customers and their End Users, including in particular the impacts of any downturn on financial technology companies, or FinTechs, or alternative finance companies, or Alt-FIs, and our arrangements with them, which represent a newer market opportunity for us, a more complex revenue model for us and which may be more vulnerable to an economic downturn than our financial institution customers; (j) the challenges and costs associated with selling, implementing and supporting our solutions, particularly for larger customers with more complex requirements and longer implementation processes, including risks related to the timing and predictability of sales of our solutions and the impact that the timing of bookings may have on our revenue and financial performance in a period; (k) the risk that errors, interruptions or delays in our solutions or Web hosting negatively impacts our business and sales; (l) the risks associated with cyberattacks, financial transaction fraud, data and privacy breaches and breaches of security measures within our products, systems and infrastructure or the products, systems and infrastructure of third parties upon which we rely and the resultant costs and liabilities and harm to our business and reputation and our ability to sell our solutions; (m) the difficulties and risks associated with developing and selling complex new solutions and enhancements, including those using AI with the technical and regulatory specifications and functionality required by our customers and relevant governmental authorities; (n) risks associated with operating within and selling into a regulated industry, including risks related to evolving regulation of

AI and machine learning, the receipt, collection, storage, processing and transfer of data and increased regulatory scrutiny in financial technology and related services, including specifically on banking-as-a-service, or BaaS, services; (o) the risks associated with our sales and marketing capabilities, including partner relationships and the length, cost and unpredictability of our sales cycle; (p) the risks inherent in third-party technology and implementation partnerships that could cause harm to our business; (q) the risk that we will not be able to maintain historical contract terms such as pricing and duration; (r) the general risks associated with the complexity of our customer arrangements and our solutions; (s) the risks associated with integrating acquired companies and successfully selling and maintaining their solutions; (t) litigation related to intellectual property and other matters and any related claims, negotiations and settlements; (u) the risks associated with further consolidation in the financial services industry; (v) the risks associated with selling our solutions internationally and with the continued expansion of our international operations; and (w) the risk that our debt repayment obligations may adversely affect our financial condition and that we may not be able to obtain capital when desired or needed on favorable terms.

Additional information relating to the uncertainty affecting the Q2 business is contained in Q2's filings with the Securities and Exchange Commission. These documents are available on the SEC Filings section of the Investor Relations section of Q2's website at http://investors.Q2.com/. These forward-looking statements represent Q2's expectations as of the date of this press release. Subsequent events may cause these expectations to change, and Q2 disclaims any obligations to update or alter these forward-looking statements in the future, whether as a result of new information, future events or otherwise.

Q2 Holdings, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 320,294 | | | $ | 229,655 | |

| Restricted cash | | 1,854 | | | 3,977 | |

| Investments | | 87,558 | | | 94,353 | |

| Accounts receivable, net | | 57,924 | | | 42,899 | |

| Contract assets, current portion, net | | 7,228 | | | 9,193 | |

| Prepaid expenses and other current assets | | 17,559 | | | 11,625 | |

| Deferred solution and other costs, current portion | | 24,256 | | | 27,521 | |

| Deferred implementation costs, current portion | | 9,666 | | | 8,741 | |

| Total current assets | | 526,339 | | | 427,964 | |

| Property and equipment, net | | 34,248 | | | 41,178 | |

| Right of use assets | | 31,055 | | | 35,453 | |

| Deferred solution and other costs, net of current portion | | 28,798 | | | 26,090 | |

| Deferred implementation costs, net of current portion | | 24,795 | | | 21,480 | |

| Intangible assets, net | | 101,147 | | | 121,572 | |

| Goodwill | | 512,869 | | | 512,869 | |

| Contract assets, net of current portion and allowance | | 10,072 | | | 12,210 | |

| Other long-term assets | | 3,492 | | | 2,609 | |

| Total assets | | $ | 1,272,815 | | | $ | 1,201,425 | |

| | | | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Accounts payable and accrued liabilities | | $ | 58,753 | | | $ | 62,404 | |

| | | | |

| Deferred revenues, current portion | | 141,267 | | | 118,723 | |

| Lease liabilities, current portion | | 10,784 | | | 10,436 | |

| Total current liabilities | | 210,804 | | | 191,563 | |

| Convertible notes, net of current portion | | 491,951 | | | 490,464 | |

| Deferred revenues, net of current portion | | 25,324 | | | 17,350 | |

| Lease liabilities, net of current portion | | 39,357 | | | 45,588 | |

| Other long-term liabilities | | 10,262 | | | 7,981 | |

| Total liabilities | | 777,698 | | | 752,946 | |

| | | | |

| Stockholders' equity: | | | | |

| Common stock | | 6 | | | 6 | |

| Additional paid-in capital | | 1,160,098 | | | 1,075,278 | |

| Accumulated other comprehensive loss | | (593) | | | (1,111) | |

| Accumulated deficit | | (664,394) | | | (625,694) | |

| Total stockholders' equity | | 495,117 | | | 448,479 | |

| Total liabilities and stockholders' equity | | $ | 1,272,815 | | | $ | 1,201,425 | |

Q2 Holdings, Inc.

Condensed Consolidated Statements Of Comprehensive Loss

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

Revenues (1) | | $ | 175,021 | | | $ | 154,967 | | | $ | 513,419 | | | $ | 462,506 | |

Cost of revenues (2) | | 85,962 | | | 80,834 | | | 255,281 | | | 241,248 | |

| Gross profit | | 89,059 | | | 74,133 | | | 258,138 | | | 221,258 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Sales and marketing | | 25,558 | | | 26,123 | | | 78,736 | | | 82,968 | |

| Research and development | | 36,901 | | | 34,542 | | | 107,522 | | | 103,063 | |

| General and administrative | | 31,495 | | | 28,084 | | | 92,954 | | | 79,903 | |

| Transaction-related costs | | — | | | 3 | | | — | | | 24 | |

| Amortization of acquired intangibles | | 4,776 | | | 5,250 | | | 14,392 | | | 15,764 | |

| Lease and other restructuring charges | | 3,129 | | | 3,303 | | | 5,222 | | | 7,576 | |

| Total operating expenses | | 101,859 | | | 97,305 | | | 298,826 | | | 289,298 | |

| Loss from operations | | (12,800) | | | (23,172) | | | (40,688) | | | (68,040) | |

Total other income, net (3) | | 3,263 | | | 1,011 | | | 7,892 | | | 22,238 | |

| Loss before income taxes | | (9,537) | | | (22,161) | | | (32,796) | | | (45,802) | |

| Provision for income taxes | | (2,260) | | | (1,006) | | | (5,904) | | | (1,503) | |

| Net loss | | $ | (11,797) | | | $ | (23,167) | | | $ | (38,700) | | | $ | (47,305) | |

| Other comprehensive income (loss): | | | | | | | | |

| Unrealized gain on available-for-sale investments | | 383 | | | 423 | | | 560 | | | 1,285 | |

| Foreign currency translation adjustment | | 230 | | | (470) | | | (42) | | | (307) | |

| Comprehensive loss | | $ | (11,184) | | | $ | (23,214) | | | $ | (38,182) | | | $ | (46,327) | |

| | | | | | | | |

| Net loss per common share: | | | | | | | | |

| Net loss per common share, basic and diluted | | $ | (0.20) | | | $ | (0.40) | | | $ | (0.65) | | | $ | (0.81) | |

| Weighted average common shares outstanding, basic and diluted | | 60,310 | | | 58,492 | | | 59,974 | | | 58,223 | |

(1) Includes deferred revenue reduction from purchase accounting of zero and $0.1 million for the three months ended September 30, 2024 and 2023, respectively, and zero and $0.3 million for the nine months ended September 30, 2024 and 2023, respectively.

(2) Includes amortization of acquired technology of $5.5 million and $5.9 million for the three months ended September 30, 2024 and 2023, respectively, and $16.5 million and $17.6 million for the nine months ended September 30, 2024 and 2023, respectively.

(3) Includes a gain of $19.9 million related to the early extinguishment of a portion of our 2026 Notes and 2025 Notes for the nine months ended September 30, 2023.

Q2 Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (38,700) | | | $ | (47,305) | |

| Adjustments to reconcile net loss to net cash from operating activities: | | | | |

| Amortization of deferred implementation, solution and other costs | | 19,851 | | | 19,184 | |

| Depreciation and amortization | | 52,819 | | | 53,764 | |

| Amortization of debt issuance costs | | 1,517 | | | 1,608 | |

| Amortization of premiums and discounts on investments | | (852) | | | (2,791) | |

| Stock-based compensation expense | | 69,456 | | | 59,819 | |

| Deferred income taxes | | 2,074 | | | (120) | |

| Gain on extinguishment of debt | | — | | | (19,312) | |

| Other non-cash items | | 1,231 | | | 4,186 | |

| Changes in operating assets and liabilities: | | (14,680) | | | (35,318) | |

| Net cash provided by operating activities | | 92,716 | | | 33,715 | |

| Cash flows from investing activities: | | | | |

| Net maturities of investments | | 8,208 | | | 102,559 | |

| Purchases of property and equipment | | (5,253) | | | (4,568) | |

| | | | |

| Capitalized software development costs | | (17,589) | | | (19,322) | |

| Net cash provided by (used in) investing activities | | (14,634) | | | 78,669 | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| Payment for maturity of 2023 convertible notes | | — | | | (10,908) | |

| Payment for repurchases of convertible notes | | — | | | (149,640) | |

| Proceeds from capped calls related to convertible notes | | — | | | 139 | |

| | | | |

| | | | |

| Debt issuance costs related to revolving credit agreement | | (942) | | | — | |

| Proceeds from the exercise of stock options and ESPP | | 11,448 | | | 4,322 | |

| | | | |

| Net cash provided by (used in) financing activities | | 10,506 | | | (156,087) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | | (72) | | | (137) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | | 88,516 | | | (43,840) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 233,632 | | | 201,902 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 322,148 | | | $ | 158,062 | |

Q2 Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP revenue | | $ | 175,021 | | | $ | 154,967 | | | $ | 513,419 | | | $ | 462,506 |

| Deferred revenue reduction from purchase accounting | | — | | | 76 | | | — | | | 275 | |

| Non-GAAP revenue | | $ | 175,021 | | | $ | 155,043 | | | $ | 513,419 | | | $ | 462,781 | |

| | | | | | | | |

| GAAP gross profit | | $ | 89,059 | | | $ | 74,133 | | | $ | 258,138 | | | $ | 221,258 | |

| Stock-based compensation | | 3,010 | | | 3,373 | | | 9,575 | | | 10,323 | |

| Amortization of acquired technology | | 5,504 | | | 5,885 | | | 16,512 | | | 17,648 | |

| | | | | | | | |

| Lease and other restructuring charges | | 391 | | | 132 | | | 986 | | | 561 | |

| Deferred revenue reduction from purchase accounting | | — | | | 76 | | | — | | | 275 | |

| Non-GAAP gross profit | | $ | 97,964 | | | $ | 83,599 | | | $ | 285,211 | | | $ | 250,065 | |

| | | | | | | | |

Non-GAAP gross margin: | | | | | | | | |

| Non-GAAP gross profit | | $ | 97,964 | | | $ | 83,599 | | | $ | 285,211 | | | $ | 250,065 | |

| Non-GAAP revenue | | 175,021 | | | 155,043 | | | 513,419 | | | 462,781 | |

| Non-GAAP gross margin | | 56.0 | % | | 53.9 | % | | 55.6 | % | | 54.0 | % |

| | | | | | | | |

| GAAP sales and marketing expense | | $ | 25,558 | | | $ | 26,123 | | | $ | 78,736 | | | $ | 82,968 | |

| Stock-based compensation | | (4,443) | | | (4,050) | | | (12,783) | | | (13,133) | |

| Non-GAAP sales and marketing expense | | $ | 21,115 | | | $ | 22,073 | | | $ | 65,953 | | | $ | 69,835 | |

| | | | | | | | |

| GAAP research and development expense | | $ | 36,901 | | | $ | 34,542 | | | $ | 107,522 | | | $ | 103,063 | |

| Stock-based compensation | | (4,735) | | | (3,908) | | | (13,203) | | | (11,691) | |

| Non-GAAP research and development expense | | $ | 32,166 | | | $ | 30,634 | | | $ | 94,319 | | | $ | 91,372 | |

| | | | | | | | |

| GAAP general and administrative expense | | $ | 31,495 | | | $ | 28,084 | | | $ | 92,954 | | | $ | 79,903 | |

| Stock-based compensation | | (12,136) | | | (9,778) | | | (33,895) | | | (24,672) | |

| Non-GAAP general and administrative expense | | $ | 19,359 | | | $ | 18,306 | | | $ | 59,059 | | | $ | 55,231 | |

| | | | | | | | |

| GAAP operating loss | | $ | (12,800) | | | $ | (23,172) | | | $ | (40,688) | | | $ | (68,040) | |

| Deferred revenue reduction from purchase accounting | | — | | | 76 | | | — | | | 275 | |

| Stock-based compensation | | 24,324 | | | 21,109 | | | 69,456 | | | 59,819 | |

| Transaction-related costs | | — | | | 3 | | | — | | | 24 | |

| Amortization of acquired technology | | 5,504 | | | 5,885 | | | 16,512 | | | 17,648 | |

| Amortization of acquired intangibles | | 4,776 | | | 5,250 | | | 14,392 | | | 15,764 | |

| Lease and other restructuring charges | | 3,520 | | | 3,435 | | | 6,208 | | | 8,137 | |

| Non-GAAP operating income | | $ | 25,324 | | | $ | 12,586 | | | $ | 65,880 | | | $ | 33,627 | |

| | | | | | | | |

| Reconciliation of GAAP net loss to adjusted EBITDA: | | | | | | | | |

| GAAP net loss | | $ | (11,797) | | | $ | (23,167) | | | $ | (38,700) | | | $ | (47,305) | |

| Deferred revenue reduction from purchase accounting | | — | | | 76 | | | — | | | 275 | |

| Stock-based compensation | | 24,324 | | | 21,109 | | | 69,456 | | | 59,819 | |

| Transaction-related costs | | — | | | 3 | | | — | | | 24 | |

| Depreciation and amortization | | 17,651 | | | 18,286 | | | 52,819 | | | 53,764 | |

| Lease and other restructuring charges | | 3,520 | | | 3,435 | | | 6,208 | | | 8,137 | |

| Provision for income taxes | | 2,260 | | | 1,006 | | | 5,904 | | | 1,503 | |

| Gain on extinguishment of debt | | — | | | — | | | — | | | (19,869) | |

| Interest and other (income) expense, net | | (3,348) | | | (1,091) | | | (7,973) | | | (2,593) | |

| Adjusted EBITDA | | $ | 32,610 | | | $ | 19,657 | | | $ | 87,714 | | | $ | 53,755 | |

| | | | | | | | |

| Adjusted EBITDA margin | | 18.6 | % | | 12.7 | % | | 17.1 | % | | 11.6 | % |

Q2 Holdings, Inc.

Reconciliation of Free Cash Flow

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 92,716 | | | $ | 33,715 | |

| Purchases of property and equipment | | (5,253) | | | (4,568) | |

| Capitalized software development costs | | (17,589) | | | (19,322) | |

| Free cash flow | | $ | 69,874 | | | $ | 9,825 | |

Q2 Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Revenue Outlook

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 Outlook | | Full Year 2024 Outlook |

| | Low | | High | | Low | | High |

| | | | | | | | |

| GAAP revenue | | $ | 178,100 | | | $ | 181,100 | | | $ | 691,500 | | | $ | 694,500 | |

| Deferred revenue reduction from purchase accounting | | — | | | — | | | — | | | — | |

| Non-GAAP revenue | | $ | 178,100 | | | $ | 181,100 | | | $ | 691,500 | | | $ | 694,500 | |

| | | | | | | | | | | | | | |

| MEDIA CONTACT: | | INVESTOR CONTACT: |

Jean Kondo | | Josh Yankovich |

| Q2 Holdings, Inc. | | Q2 Holdings, Inc. |

M: +1-510-823-4728 | | O: +1-512-682-4463 |

jean.kondo@Q2.com | | josh.yankovich@Q2.com |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

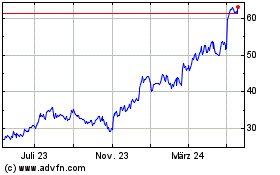

Q2 (NYSE:QTWO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

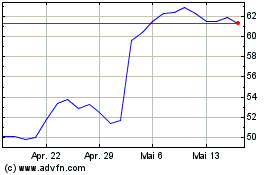

Q2 (NYSE:QTWO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024