- Report of Foreign Issuer (6-K)

09 August 2011 - 12:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2011

PEARSON plc

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address of principal executive office)

Indicate by check mark whether the Registrant files or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark whether the Registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes No X

This Report includes the following documents:

1. A press release from Pearson plc announcing 'Acquisition'

9 August 2011

PEARSON TO ACQUIRE STARK HOLDING IN GERMANY

Pearson, the world's leading learning company, is today announcing the acquisition of Stark Holding ("Stark") from Syntegra Capital.

Stark is a leading provider of education materials including test preparation resources for pupils and teachers. The company is widely recognised for its high quality products, particularly in Maths, German and English. In addition, Stark develops lesson preparation materials for teachers and career advice books. Stark had revenues of approximately €20m in the fiscal year ended 31 July 2010, and has gross assets estimated at €32.6 million.

Pearson's expertise in learning technologies and high quality digital content combined with Stark's core business presents a significant opportunity. It also diversifies Pearson's business in Germany - which currently includes higher education textbooks and digital resources, English Language teaching material and Professional books - broadening Pearson's capabilities in line with its business elsewhere in the world.

Pearson expects the acquisition to enhance adjusted EPS and to generate a return above Pearson's cost of capital from 2012, its first full year after acquisition. The acquisition is subject to regulatory approval.

John Fallon, chief executive of Pearson's International business, said:

"In many countries around the world, we see growing numbers of students wanting help to prepare for important examinations and to make the transition from school to college or University. Stark is already highly respected by German teachers, students and parents; with access to Pearson's digital solutions, it can play a bigger role in helping students to learn more effectively."

ENDS

For more information:

Luke Swanson/ Simon Mays-Smith/ Charles Goldsmith + 44 (0)20 7010 2310

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PEARSON plc

Date: 09 August, 2011

By: /s/ STEPHEN JONES

-----------------------

Stephen Jones

Deputy Secretary

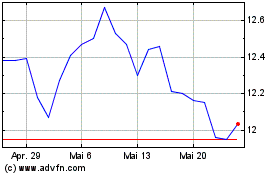

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024