|

|

|

|

|

|

|

|

|

CREDIT DEFAULT CONTRACTS OUTSTANDING at 10/31/07 (Unaudited)

|

|

|

|

|

|

|

|

Upfront

|

|

|

|

Fixed payments

|

Unrealized

|

|

Swap counterparty /

|

premium

|

Notional

|

|

Termination

|

received (paid) by

|

appreciation/

|

|

Referenced debt*

|

received (paid)**

|

amount

|

|

date

|

fund per annum

|

(depreciation)

|

|

|

Bank of America, N.A.

|

|

|

|

|

|

|

|

Abitibibowater Inc.,

|

|

|

|

|

|

|

|

6 1/2%, 6/15/13

|

$--

|

$245,000

|

|

12/20/08

|

550 bp

|

$(297)

|

|

|

|

DJ ABX NA CMBX BBB Index

|

267

|

389,000

|

|

10/12/52

|

(134 bp)

|

78,704

|

|

|

|

DJ CDX NA HY Series 9

|

|

|

|

|

|

|

|

Index

|

20,048

|

10,692,000

|

|

12/20/12

|

(375 bp)

|

170,938

|

|

|

|

Ford Motor Co., 7.45%,

|

|

|

|

|

|

|

|

7/16/31

|

--

|

935,000

|

|

3/20/12

|

(525 bp)

|

12,122

|

|

|

|

Ford Motor Credit Co.,

|

|

|

|

|

|

|

|

7%, 10/1/13

|

--

|

2,805,000

|

|

3/20/12

|

285 bp

|

(161,217)

|

|

|

|

Idearc, Inc, T/L B

|

--

|

1,150,000

|

|

6/20/12

|

(152 bp)

|

3,131

|

|

|

|

Kinder Morgan, Inc.,

|

|

|

|

|

|

|

|

6 1/2%, 9/1/12

|

--

|

3,850,000

|

|

6/20/12

|

(89 bp)

|

113,427

|

|

|

|

L-3 Communications

|

|

|

|

|

|

|

|

Corp. 7 5/8%, 6/15/12

|

--

|

460,000

|

|

6/20/11

|

(101 bp)

|

(2,575)

|

|

|

|

Nalco, Co.

|

|

|

|

|

|

|

|

7.75%,11/15/11

|

--

|

175,000

|

|

9/20/12

|

350 bp

|

6,227

|

|

|

|

XL Capital Assurance

|

|

|

|

|

|

|

|

Inc.

|

--

|

540,000

|

|

12/20/12

|

400 bp

|

1,194

|

|

|

|

Bear Stearns Credit Products, Inc.

|

|

|

|

|

|

|

|

Claire's Stores,

|

|

|

|

|

|

|

|

9 5/8%, 6/1/15

|

--

|

140,000

|

|

6/20/12

|

230 bp

|

(6,346)

|

|

|

|

Bear Stearns International, Ltd.

|

|

|

|

|

|

|

|

DJ ABX NA CMBX BBB Index

|

2,262

|

467,070

|

|

10/12/52

|

(134 bp)

|

96,545

|

|

|

|

Citibank, N.A.

|

|

|

|

|

|

|

|

Abitibibowater Inc.,

|

|

|

|

|

|

|

|

6 1/2%, 6/15/13

|

--

|

245,000

|

|

12/20/08

|

725 bp

|

4,777

|

|

|

|

First Data Corp., 4.7%,

|

|

|

|

|

|

|

|

8/1/13

|

--

|

365,000

|

|

12/20/12

|

(505 bp)

|

383

|

|

|

|

Freescale

|

|

|

|

|

|

|

|

Semiconductor, 8 7/8%,

|

|

|

|

|

|

|

|

12/15/14

|

--

|

430,000

|

|

9/20/12

|

495 bp

|

(3,760)

|

|

|

|

Idearc, Inc, 8%,

|

|

|

|

|

|

|

|

11/15/16

|

--

|

1,185,000

|

|

12/20/12

|

(215 bp)

|

7,667

|

|

|

|

Credit Suisse First Boston International

|

|

|

|

|

|

|

|

Ukraine Government,

|

|

|

|

|

|

|

|

7.65%, 6/11/13

|

--

|

2,175,000

|

|

10/20/11

|

194 bp

|

32,536

|

|

|

|

Credit Suisse International

|

|

|

|

|

|

|

|

Advanced Micro Devices,

|

|

|

|

|

|

|

|

7 3/4%, 11/1/12

|

--

|

420,000

|

|

6/20/09

|

(165 bp)

|

(10,826)

|

|

|

|

Dynegy Holdings Inc.,

|

|

|

|

|

|

|

|

6 7/8%, 4/1/11

|

--

|

295,000

|

|

6/20/17

|

297 bp

|

(22,159)

|

|

|

|

Freeport-McMoRan Copper

|

|

|

|

|

|

|

|

& Gold, Inc.

|

--

|

1,180,200

|

|

3/20/12

|

(82 bp)

|

(8,618)

|

|

|

|

Freeport-McMoRan Copper

|

|

|

|

|

|

|

|

& Gold, Inc.

|

--

|

1,180,000

|

|

3/20/12

|

41 bp

|

(10,476)

|

|

|

|

Neiman Marcus Group,

|

|

|

|

|

|

|

|

Inc., 9%, 10/15/15

|

--

|

700,000

|

|

3/20/12

|

(64 bp)

|

19,252

|

|

|

|

Republic of Peru,

|

|

|

|

|

|

|

|

8 3/4%, 11/21/33

|

--

|

1,205,000

|

|

4/20/17

|

125 bp

|

1,202

|

|

|

|

Sungard Data Systems,

|

|

|

|

|

|

|

|

Inc., 4 7/8%, 1/15/14

|

--

|

1,175,000

|

|

3/20/10

|

(48 bp)

|

20,249

|

|

|

|

Deutsche Bank AG

|

|

|

|

|

|

|

|

DJ CDX NA IG Series 8

|

|

|

|

|

|

|

|

Index 7-10% tranche

|

--

|

7,132,000

|

|

6/20/12

|

22 bp

|

(144,875)

|

|

|

|

DJ LCDX NA Series 9.1

|

|

|

|

|

|

|

|

Index 15-100% tranche

|

--

|

5,650,000

|

|

12/20/12

|

61.56 bp

|

(52,974)

|

|

|

|

Nalco, Co. 7.75%,

|

|

|

|

|

|

|

|

11/15/11

|

--

|

160,000

|

|

12/20/12

|

363 bp

|

5,711

|

|

|

|

Republic of Argentina,

|

|

|

|

|

|

|

|

8.28%, 12/31/33

|

--

|

1,375,000

|

|

8/20/12

|

(380 bp)

|

(16,012)

|

|

|

|

Republic of Brazil,

|

|

|

|

|

|

|

|

12 1/4%, 3/6/30

|

--

|

1,500,000

|

|

10/20/17

|

105 bp

|

(16,967)

|

|

|

|

Republic of Indonesia,

|

|

|

|

|

|

|

|

6.75%, 2014

|

--

|

1,125,000

|

|

9/20/16

|

292 bp

|

93,698

|

|

|

|

Republic of Peru,

|

|

|

|

|

|

|

|

8 3/4%, 11/21/33

|

--

|

1,205,000

|

|

4/20/17

|

126 bp

|

2,759

|

|

|

|

Republic of Turkey,

|

|

|

|

|

|

|

|

11 7/8%, 1/15/30

|

--

|

1,810,000

|

|

6/20/14

|

195 bp

|

16,137

|

|

|

|

Republic of Venezuela,

|

|

|

|

|

|

|

|

9 1/4%, 9/15/27

|

--

|

1,175,000

|

|

6/20/14

|

220 bp

|

(79,916)

|

|

|

|

Russian Federation,

|

|

|

|

|

|

|

|

7 1/2%, 3/31/30

|

--

|

2,210,000

|

|

6/20/17

|

61 bp

|

(41,470)

|

|

|

|

Russian Federation,

|

|

|

|

|

|

|

|

7.5%, 3/31/30

|

--

|

1,500,000

|

|

8/20/17

|

86 bp

|

(2,000)

|

|

|

|

United Mexican States,

|

|

|

|

|

|

|

|

7.5%, 4/8/33

|

--

|

1,080,000

|

|

4/20/17

|

66 bp

|

4,658

|

|

|

|

United Mexican States,

|

|

|

|

|

|

|

|

7.5%, 4/8/33

|

--

|

2,945,000

|

|

3/20/14

|

56 bp

|

8,668

|

|

|

|

|

|

|

|

|

|

Goldman Sachs International

|

|

|

|

|

|

|

|

Any one of the

|

|

|

|

|

|

|

|

underlying securities

|

|

|

|

|

|

|

|

in the basket of BB

|

|

|

|

|

|

|

|

CMBS securities

|

--

|

7,487,000

|

|

(a)

|

2.461%

|

233,512

|

|

|

|

DJ CDX NA HY Series 5

|

|

|

|

|

|

|

|

Index

|

--

|

|

|

12/20/10

|

(395 bp)

|

|

|

|

|

DJ CDX NA HY Series 8

|

|

|

|

|

|

|

|

Index

|

220,877

|

14,690,000

|

|

6/20/12

|

35 bp

|

41,341

|

|

|

|

DJ CDX NA HY Series 9

|

|

|

|

|

|

|

|

Index 25-35% tranche

|

--

|

5,580,000

|

|

12/20/10

|

108.65 bp

|

(58,856)

|

|

|

|

DJ CDX NA IG Series 8

|

|

|

|

|

|

|

|

Index 30-100% tranche

|

--

|

47,479,000

|

|

6/20/12

|

(2.75 bp)

|

83,180

|

|

|

|

General Motors Corp.,

|

|

|

|

|

|

|

|

7 1/8%, 7/15/13

|

--

|

2,720,000

|

|

9/20/08

|

620 bp

|

106,198

|

|

|

|

General Motors Corp.,

|

|

|

|

|

|

|

|

7 1/8%, 7/15/13

|

--

|

580,000

|

|

9/20/08

|

620 bp

|

22,645

|

|

|

|

Lehman Brothers

|

|

|

|

|

|

|

|

Holdings, 6 5/8%,

|

|

|

|

|

|

|

|

1/18/12

|

--

|

2,375,000

|

|

9/20/17

|

(67.8 bp)

|

54,599

|

|

|

|

Merrill Lynch & Co.,

|

|

|

|

|

|

|

|

5%, 1/15/15

|

--

|

2,375,000

|

|

9/20/12

|

48 bp

|

(35,245)

|

|

|

|

Merrill Lynch & Co.,

|

|

|

|

|

|

|

|

5%, 1/15/15

|

--

|

2,375,000

|

|

9/20/17

|

(59.8 bp)

|

35,963

|

|

|

|

JPMorgan Chase Bank, N.A.

|

|

|

|

|

|

|

|

DJ CDX NA CMBX AAA Index

|

--

|

10,557,000

|

|

3/15/49

|

(7 bp)

|

188,562

|

|

|

|

DJ CDX NA HY Series 9

|

|

|

|

|

|

|

|

Index 25-35% tranche

|

--

|

5,722,000

|

|

12/20/10

|

105.5 bp

|

(65,683)

|

|

|

|

DJ CDX NA IG Series 9

|

|

|

|

|

|

|

|

Index 30-100% tranche

|

--

|

16,780,000

|

|

12/20/12

|

(5.8 bp)

|

15,457

|

|

|

|

First Data Corp., 4.7%,

|

|

|

|

|

|

|

|

8/1/13

|

--

|

365,000

|

|

12/20/12

|

(507 bp)

|

88

|

|

|

|

Freeport-McMoRan Copper

|

|

|

|

|

|

|

|

& Gold, Inc.

|

--

|

2,360,300

|

|

3/20/12

|

(85 bp)

|

(34,960)

|

|

|

|

General Motors Corp.,

|

|

|

|

|

|

|

|

7 1/8%, 7/15/13

|

--

|

460,000

|

|

9/20/08

|

500 bp

|

12,523

|

|

|

|

Idearc, Inc T/L B L

|

--

|

1,150,000

|

|

6/20/12

|

79 bp

|

(35,004)

|

|

|

|

Republic of Argentina,

|

|

|

|

|

|

|

|

8.28%, 12/31/33

|

--

|

1,385,000

|

|

6/20/14

|

235 bp

|

(110,531)

|

|

|

|

Republic of Indonesia,

|

|

|

|

|

|

|

|

6.75%, 3/10/14

|

--

|

1,870,000

|

|

6/20/17

|

171.5 bp

|

(9,648)

|

|

|

|

Republic of Turkey,

|

|

|

|

|

|

|

|

11 7/8%, 1/15/30

|

--

|

1,945,000

|

|

5/20/17

|

230 bp

|

11,228

|

|

|

|

Republic of Turkey,

|

|

|

|

|

|

|

|

11 7/8%, 1/15/30

|

--

|

1,435,000

|

|

5/20/17

|

244 bp

|

23,924

|

|

|

|

Russian Federation,

|

|

|

|

|

|

|

|

7 1/2%, 3/31/30

|

--

|

1,580,000

|

|

5/20/17

|

60 bp

|

(28,972)

|

|

|

|

Russian Federation,

|

|

|

|

|

|

|

|

7.5%, 3/31/30

|

--

|

1,500,000

|

|

8/20/17

|

85 bp

|

(3,145)

|

|

|

|

Russian Federation,

|

|

|

|

|

|

|

|

7.5%, 3/31/30

|

--

|

2,250,000

|

|

8/20/12

|

65 bp

|

(368)

|

|

|

|

Lehman Brothers Special Financing, Inc.

|

|

|

|

|

|

|

|

Bear Stearns Co. Inc.,

|

|

|

|

|

|

|

|

5.3%, 10/30/15

|

--

|

2,375,000

|

|

9/20/17

|

(77 bp)

|

43,371

|

|

|

|

Community Health

|

|

|

|

|

|

|

|

Systems, 8 7/8%, 7/15/15

|

--

|

380,000

|

|

12/20/12

|

360 bp

|

(5,875)

|

|

|

|

DJ ABX NA CMBX BBB Index

|

481

|

116,767

|

|

10/12/52

|

(134 bp)

|

24,469

|

|

|

|

DJ CDX NA CMBX AA Index

|

(2,155)

|

68,000

|

(F)

|

3/15/49

|

(15 bp)

|

2,526

|

|

|

|

DJ CDX NA CMBX AAA Index

|

--

|

36,746,000

|

|

3/15/49

|

(7 bp)

|

518,625

|

|

|

|

DJ CDX NA HY Series 8

|

|

|

|

|

|

|

|

Index 35-60% tranche

|

--

|

31,139,000

|

|

6/20/12

|

104 bp

|

(588,847)

|

|

|

|

DJ CDX NA HY Series 8

|

|

|

|

|

|

|

|

Index 35-60% tranche

|

--

|

86,378,000

|

|

6/20/12

|

95 bp

|

(1,969,788)

|

|

|

|

DJ CDX NA HY Series 9

|

|

|

|

|

|

|

|

Index 25-35% tranche

|

--

|

22,600,000

|

|

12/20/10

|

90 bp

|

(354,933)

|

|

|

|

DJ CDX NA HY Series 9

|

|

|

|

|

|

|

|

Index 25-35% tranche

|

--

|

22,600,000

|

|

12/20/10

|

104.5 bp

|

(252,941)

|

|

|

|

DJ CDX NA IG Series 8

|

|

|

|

|

|

|

|

Index

|

17,878

|

1,144,000

|

|

6/20/12

|

35 bp

|

3,896

|

|

|

|

DJ CDX NA IG Series 8

|

|

|

|

|

|

|

|

Index 30-100% tranche

|

--

|

17,768,850

|

|

6/20/12

|

(3.125 bp)

|

33,815

|

|

|

|

DJ CDX NA IG Series 8

|

|

|

|

|

|

|

|

Index 30-100% tranche

|

--

|

86,339,150

|

|

6/20/12

|

(8 bp)

|

(22,013)

|

|

|

|

DJ CDX NA IG Series 9

|

|

|

|

|

|

|

|

Index

|

(40,724)

|

8,230,000

|

|

12/20/12

|

60 bp

|

(35,786)

|

|

|

|

DJ CDX NA IG Series 9

|

|

|

|

|

|

|

|

Index

|

258,408

|

52,546,000

|

|

12/20/12

|

(60 bp)

|

226,880

|

|

|

|

DJ LCDX NA Series 9.1

|

|

|

|

|

|

|

|

Index 15-100% tranche

|

--

|

5,650,000

|

(F)

|

12/20/12

|

59.3 bp

|

(62,676)

|

|

|

|

Fed Republic of Brazil,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.25%, 3/6/30

|

--

|

230,000

|

|

8/20/12

|

113 bp

|

3,751

|

|

|

|

Fed Republic of Brazil,

|

|

|

|

|

|

|

|

12.25%, 3/6/30

|

--

|

230,000

|

|

8/20/12

|

120 bp

|

4,431

|

|

|

|

Freescale

|

|

|

|

|

|

|

|

Semiconductor, 8 7/8%,

|

|

|

|

|

|

|

|

12/15/14

|

--

|

1,143,000

|

|

6/20/10

|

(228 bp)

|

34,713

|

|

|

|

Freescale

|

|

|

|

|

|

|

|

Semiconductor, 8 7/8%,

|

|

|

|

|

|

|

|

12/15/14

|

--

|

1,143,000

|

|

6/20/12

|

355 bp

|

(64,881)

|

|

|

|

Goldman Sachs Group,

|

|

|

|

|

|

|

|

Inc., 6.6%, 1/15/12

|

--

|

1,720,000

|

|

9/20/12

|

45.5 bp

|

(9,837)

|

|

|

|

Goldman Sachs Group,

|

|

|

|

|

|

|

|

Inc., 6.6%, 1/15/12

|

--

|

2,375,000

|

|

9/20/17

|

(58 bp)

|

1,979

|

|

|

|

Morgan Stanley Dean

|

|

|

|

|

|

|

|

Witter, 6.6%, 4/1/12

|

--

|

2,375,000

|

|

9/20/12

|

48 bp

|

(21,351)

|

|

|

|

Morgan Stanley Dean

|

|

|

|

|

|

|

|

Witter, 6.6%, 4/1/12

|

--

|

2,375,000

|

|

9/20/17

|

(60.5 bp)

|

17,110

|

|

|

|

Republic of Argentina,

|

|

|

|

|

|

|

|

8.28%, 12/31/33

|

--

|

1,960,000

|

|

5/20/17

|

296 bp

|

(158,474)

|

|

|

|

Republic of Argentina,

|

|

|

|

|

|

|

|

8.28%, 12/31/33

|

--

|

685,000

|

|

9/20/12

|

(469 bp)

|

(33,674)

|

|

|

|

Republic of Ecuador,

|

|

|

|

|

|

|

|

10%, 8/15/30

|

--

|

1,110,000

|

|

5/20/12

|

540 bp

|

(12,143)

|

|

|

|

Republic of Ecuador,

|

|

|

|

|

|

|

|

10%, 8/15/30

|

--

|

1,120,000

|

|

6/20/12

|

600 bp

|

5,813

|

|

|

|

Republic of Ecuador,

|

|

|

|

|

|

|

|

10%, 8/15/30

|

--

|

665,000

|

|

5/20/12

|

540 bp

|

(7,874)

|

|

|

|

Republic of Peru,

|

|

|

|

|

|

|

|

8 3/4%, 11/21/33

|

--

|

2,330,000

|

|

10/20/16

|

215 bp

|

152,076

|

|

|

|

Republic of Turkey,

|

|

|

|

|

|

|

|

11 7/8%, 1/15/30

|

--

|

2,780,000

|

|

5/20/17

|

228 bp

|

26,571

|

|

|

|

Republic of Venezuela,

|

|

|

|

|

|

|

|

9 1/4%, 9/15/27

|

--

|

2,340,000

|

|

5/20/08

|

(130 bp)

|

(16,029)

|

|

|

|

Republic of Venezuela,

|

|

|

|

|

|

|

|

9 1/4%, 9/15/27

|

--

|

2,340,000

|

|

5/20/12

|

183 bp

|

(103,883)

|

|

|

|

Solectron Global

|

|

|

|

|

|

|

|

Finance Ltd, 8%, 3/15/16

|

--

|

191,000

|

|

3/20/12

|

380 bp

|

25,448

|

|

|

|

United Mexican States,

|

|

|

|

|

|

|

|

7.5%, 4/8/33

|

--

|

1,310,000

|

|

4/20/17

|

67 bp

|

6,637

|

|

|

|

XL Capital Assurance

|

|

|

|

|

|

|

|

Inc.

|

--

|

1,620,000

|

|

12/20/12

|

400 bp

|

3,582

|

|

|

|

Merrill Lynch Capital Services, Inc.

|

|

|

|

|

|

|

|

General Motors Corp.,

|

|

|

|

|

|

|

|

7 1/8%, 7/15/13

|

--

|

1,895,000

|

|

9/20/08

|

500 bp

|

51,588

|

|

|

|

Merrill Lynch International

|

|

|

|

|

|

|

|

Dynegy Holdings Inc.,

|

|

|

|

|

|

|

|

6 7/8%, 4/1/11

|

--

|

295,000

|

|

6/20/17

|

295 bp

|

(22,502)

|

|

|

|

Morgan Stanley Capital Services, Inc.

|

|

|

|

|

|

|

|

Advanced Micro Devices,

|

|

|

|

|

|

|

|

7 3/4%, 11/1/12

|

--

|

1,100,000

|

|

6/20/09

|

190 bp

|

(23,909)

|

|

|

|

Aramark Services, Inc.,

|

|

|

|

|

|

|

|

8.5%, 2/1/15

|

--

|

250,000

|

|

12/20/12

|

355 bp

|

(1,597)

|

|

|

|

DJ ABX NA CMBX BBB Index

|

118

|

162,464

|

|

10/12/52

|

(134 bp)

|

33,493

|

|

|

|

DJ CDX NA HY Series 7

|

|

|

|

|

|

|

|

Index

|

122,218

|

2,573,000

|

|

12/20/09

|

(325 bp)

|

74,793

|

|

|

|

DJ CDX NA IG Series 7

|

|

|

|

|

|

|

|

Index 10-15% tranche

|

102,920

|

2,573,000

|

|

12/20/09

|

0 bp

|

(84,858)

|

|

|

|

DJ CDX NA IG Series 8

|

|

|

|

|

|

|

|

Index

|

42,285

|

3,517,000

|

|

6/20/12

|

35 bp

|

(698)

|

|

|

|

Dominican Republic,

|

|

|

|

|

|

|

|

8 5/8%, 4/20/27

|

--

|

2,340,000

|

|

11/20/11

|

(170 bp)

|

(34,751)

|

|

|

|

Dynegy Holdings Inc.,

|

|

|

|

|

|

|

|

6 7/8%, 4/1/11

|

--

|

295,000

|

|

6/20/12

|

225 bp

|

(11,362)

|

|

|

|

Freeport-McMoRan Copper

|

|

|

|

|

|

|

|

& Gold, Inc.

|

--

|

1,180,200

|

|

3/20/12

|

(83 bp)

|

(16,533)

|

|

|

|

Freeport-McMoRan Copper

|

|

|

|

|

|

|

|

& Gold, Inc.

|

--

|

3,540,700

|

|

3/20/12

|

44 bp

|

(19,309)

|

|

|

|

General Motors Corp.,

|

|

|

|

|

|

|

|

7 1/8%, 7/15/13

|

--

|

465,000

|

|

9/20/08

|

500 bp

|

11,265

|

|

|

|

Nalco, Co. 7.75%,

|

|

|

|

|

|

|

|

11/15/11

|

--

|

175,000

|

|

9/20/12

|

330 bp

|

4,507

|

|

|

|

Republic of Venezuela,

|

|

|

|

|

|

|

|

9 1/4%, 9/15/27

|

--

|

1,570,000

|

|

10/12/12

|

339 bp

|

6,663

|

|

|

|

Total

|

|

|

|

|

|

$(2,052,217)

|

* Payments related to the reference debt are made upon a credit default event.

** Upfront premium is based on the difference between the original spread on issue and the market spread on day of execution.

(a) Terminating on the date on which the notional amount is reduced to zero or the date on which the assets securing the reference entity are liquidated.

(F) Is valued at fair value following procedures approved by the Trustees.

NOTES

(a) Percentages indicated are based on net assets of $1,127,040,039

.

(b) The aggregate identified cost on a tax basis is $1,114,705,062, resulting in gross unrealized appreciation and depreciation of $53,091,086 and $32,878,149, respectively, or net unrealized appreciation of $20,212,937.

(NON) Non-income-producing security.

(STP) The interest rate and date shown parenthetically represent the new interest rate to be paid and the date the fund will begin accruing interest at this rate.

(RES) Restricted, excluding 144A securities, as to public resale. The total market value of restricted securities held at October 31, 2007 was $37,139 or less than 0.1% of net assets.

(PIK) Income may be received in cash or additional securities at the discretion of the issuer.

(SEG) This security was pledged and segregated with the custodian to cover margin requirements for futures contracts at October 31, 2007.

(FWC) Forward commitments.

(c) Senior loans are exempt from registration under the Securities Act of 1933, as amended, but contain certain restrictions on resale and cannot be sold publicly. These loans pay interest at rates which adjust periodically. The interest rates shown for senior loans are the current interest rates at October 31, 2007. Senior loans are also subject to mandatory and/or optional prepayment which cannot be predicted. As a result, the remaining maturity may be substantially less than the stated maturity shown. Senior loans are purchased or sold on a when-issued or delayed delivery basis and may be settled a month or more after the trade date, which from time to time can delay the actual investment of available cash balances; interest income is accrued based on the terms of the securities. Senior loans can be acquired through an agent, by assignment from another holder of the loan, or as a participation interest in another holder's portion of the loan. When the fund invests in a loan or participation, the fund is subject to the risk that an intermediate participant between the fund and the borrower will fail to meet its obligations to the fund, in addition to the risk that the borrower under the loan may default on its obligations.

(d) The fund may lend securities, through its agents, to qualified borrowers in order to earn additional income. The loans are collateralized by cash and/or securities in an amount at least equal to the market value of the securities loaned.

The market value of securities loaned is determined daily and any additional required collateral is allocated to the fund on the next business day. The risk of borrower default will be borne by the fund's agents; the fund will bear the risk of loss with respect to the investment of the cash collateral. At October 31, 2007, the value of securities loaned amounted to $3,002,267. The fund received cash collateral of $3,065,160 which is pooled with collateral of other Putnam funds into 54 issues of short-term investments.

The fund invests in Putnam Prime Money Market Fund, an open-end management investment company managed by Putnam Investment Management, LLC ("Putnam Management"), the fund's manager, a wholly-owned subsidiary of Putnam, LLC. Investments in Putnam Prime Money Market Fund are valued at its closing net asset value each business day. Management fees paid by the fund are reduced by an amount equal to the management and administrative fees paid by Putnam Prime Money Market Fund with respect to assets invested by the fund in Putnam Prime Money Market Fund. Income distributions earned by the fund totaled $218,310 for the period ended October 31, 2007. During the period ended October 31, 2007, cost of purchases and proceeds of sales of investments in Putnam Prime Money Market Fund aggregated $34,651,496 and $94,973,905, respectively.

(F) Is valued at fair value following procedures approved by the Trustees.

(R) Real Estate Investment Trust.

(S) Securities on loan, in part or in entirety, at October 31, 2007.

(U) A portion of the position represents unfunded loan commitments. As of October 31, 2007, the fund had unfunded loan commitments of $937,269, which could be extended at the option of the borrower, pursuant to the following loan agreements with the following borrowers:

|

|

|

|

Borrower

|

Unfunded commitments

|

|

|

Community Health

|

$79,781

|

|

Golden Nugget

|

114,545

|

|

Hub Intl

|

43,294

|

|

Iasis Healthcare

|

34,102

|

|

Isle of Capri

|

124,118

|

|

MEG Energy

|

186,429

|

|

NRG Energy

|

355,000

|

|

Totals

|

$937,269

|

At October 31, 2007, liquid assets totaling $184,587,383 have been designated as collateral for open forward commitments, swap contracts, forward contracts, options and futures contracts.

144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

TBA after the name of a security represents to be announced securities.

The rates shown on Floating Rate Bonds (FRB) and Floating Rate Notes (FRN) are the current interest rates at October 31, 2007.

The dates shown on debt obligations are the original maturity dates.

Inverse Floating Rate Bonds (IFB) are securities that pay interest rates that vary inversely to changes in the market interest rates. As interest rates rise, inverse floaters produce less current income. The interest rates shown are the current interest rates at October 31, 2007.

DIVERSIFICATION BY COUNTRY

Distribution of investments by country of issue at October 31, 2007: (as a percentage of Portfolio Value)

|

|

|

|

Argentina

|

1.8%

|

|

Austria

|

1.0

|

|

Canada

|

1.3

|

|

Cayman Islands

|

1.1

|

|

France

|

2.6

|

|

Germany

|

6.8

|

|

Ireland

|

2.6

|

|

Japan

|

6.7

|

|

|

|

|

Luxembourg

|

1.3

|

|

Mexico

|

0.8

|

|

Russia

|

1.3

|

|

Spain

|

0.6

|

|

Sweden

|

0.9

|

|

Turkey

|

0.6

|

|

United Kingdom

|

1.9

|

|

United States

|

66.1

|

|

Other

|

2.6

|

|

Total

|

100.0%

|

Security valuation

Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing

price for certain markets. If no sales are reported -- as in the case of some securities traded over-the-counter -- a security is valued at its last reported bid price. Market quotations are not considered to be readily available for certain debt

obligations; such investments are valued at fair value on the basis of valuations furnished by an independent pricing service or dealers, approved by the Trustees. Such services or dealers determine valuations for normal institutional-size trading

units of such securities using methods based on market transactions for comparable securities and various relationships, generally recognized by institutional traders, between securities. Many securities markets and exchanges outside the U.S. close

prior to the close of the New York Stock Exchange and therefore the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange.

Accordingly, on certain days, the fund will fair value foreign equity securities taking into account multiple factors, including movements in the U.S. securities markets. The number of days on which fair value prices will be used will depend on

market activity and it is possible that fair value prices will be used by the fund to a significant extent.

Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate. Certain investments, including certain restricted securities and derivatives, are also valued at fair

value following procedures approved by the Trustees. Such valuations and procedures are reviewed periodically by the Trustees. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from

an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security at a given point in time and does not reflect an actual market price, which may be

different by a material amount.

Stripped securities

The fund may invest in stripped securities which represent a participation in securities that may be structured in classes with rights to receive

different portions of the interest and principal. Interest-only securities receive all of the interest and principal-only securities receive all of the principal. If the interest-only securities experience greater than anticipated prepayments of

principal, the fund may fail to recoup fully its initial investment in these securities. Conversely, principal-only securities increase in value if prepayments are greater than anticipated and decline if prepayments are slower than anticipated. The

market value of these securities is highly sensitive to changes in interest rates.

Forward currency contracts

The fund may buy and sell forward currency contracts, which are agreements between two parties to buy and sell currencies at a set price on a

future date. These contracts are used to protect against a decline in value relative to the U.S. dollar of the currencies in which its portfolio securities are denominated or quoted (or an increase in the value of a currency in which securities a

fund intends to buy are denominated, when a fund holds cash reserves and short term investments), or for other investment purposes. The U.S. dollar value of forward currency contracts is determined using current forward currency exchange rates

supplied by a quotation service. The market value of the contract will fluctuate with changes in currency exchange rates. The contract is marked to market daily and the change in market value is recorded as an unrealized gain or loss. When the

contract is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The fund could be exposed to risk if the value of the currency

changes unfavorably, if the counterparties to the contracts are unable to meet the terms of their contracts or if the fund is unable to enter into a closing position. Risks may exceed amounts recognized on the statement of assets and liabilities.

Forward currency contracts outstanding at period end, if any, are listed after the fund's portfolio.

Futures and options contracts

The fund may use futures and options contracts to hedge against changes in the values of securities the fund owns or expects to purchase, or

for other investment purposes. The fund may also write options on swaps or securities it owns or in which it may invest to increase its current returns.

The potential risk to the fund is that the change in value of futures and options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from changes in the value

of the underlying instruments, if there is an illiquid secondary market for the contracts, or if the counterparty to the contract is unable to perform. Risks may exceed amounts recognized on the statement of assets and liabilities. When the contract

is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Realized gains and losses on purchased options are included in realized

gains and losses on investment securities. If a written call option is exercised, the premium originally received is recorded as an addition to sales proceeds. If a written put option is exercised, the premium originally received is recorded as a

reduction to the cost of investments.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. The fund and the broker agree to exchange an amount of cash equal to the daily fluctuation in the

value of the futures contract. Such receipts or payments are known as "variation margin." Exchange traded options are valued at the last sale price or, if no sales are reported, the last bid price for purchased options and the last ask price for

written options. Options traded over-the-counter are valued using prices supplied by dealers. Futures and written option contracts outstanding at period end, if any, are listed after the fund's portfolio.

Total return swap contracts

The fund may enter into total return swap contracts, which are arrangements to exchange a market-linked return for a periodic payment, both based

on a notional principal amount. To the extent that the total return of the security or index underlying the transaction exceeds or falls short of the offsetting interest rate obligation, the fund will receive a payment from or make a payment to the

counterparty. Total return swap contracts are marked-to-market daily based upon quotations from market makers and the change, if any, is recorded as unrealized gain or loss. Payments received or made are recorded as realized gains or loss. Certain

total return swap contracts may include extended effective dates. Income related to these swap contracts is accrued based on the terms of the contract. The fund could be exposed to credit or market risk due to unfavorable changes in the fluctuation

of interest rates or in the price of the underlying security or index, the possibility that there is no liquid market for these agreements or that the counterparty may default on its obligation to perform. Risk of loss may exceed amounts recognized

on the statement of assets and liabilities. Total return swap contracts outstanding at period end, if any, are listed after the fund's portfolio.

Interest rate swap contracts

The fund may enter into interest rate swap contracts, which are arrangements between two parties to exchange cash flows based on a notional

principal amount, to manage the fund's exposure to interest rates. Interest rate swap contracts are marked-to-market daily based upon quotations from an independent pricing service or market makers and the change, if any, is recorded as unrealized

gain or loss. Payments received or made are recorded as realized gains or loss. Certain interest rate swap contracts may include extended effective dates. Income related to these swap contracts is accrued based on the terms of the contract. The fund

could be exposed to credit or market risk due to unfavorable changes in the fluctuation of interest rates or if the counterparty defaults on its obligation to perform. Risk of loss may exceed amounts recognized on the statement of assets and

liabilities. Interest rate swap

contracts outstanding at period end, if any, are listed after the fund's portfolio.

Credit default contracts

The fund may enter into credit default contracts where one party, the protection buyer, makes an upfront or periodic payment to a counterparty, the protection seller, in exchange for the right to receive a contingent payment. The maximum amount of the payment may equal the notional amount, at par, of the underlying index or security as a result of a related credit event. Payments are made upon a credit default event of the disclosed primary referenced obligation or all other equally ranked obligations of the reference entity. An upfront payment received by the fund, as the protection seller, is recorded as a liability on the fund's books. An upfront payment made by the fund, as the protection buyer, is recorded as an asset on the fund's books. Periodic payments received or paid by the fund are recorded as realized gains or losses. The credit default contracts are marked-to-market daily based upon quotations from an independent pricing service or market makers and the change, if any, is recorded as unrealized gain or loss. Payments received or made as a result of a credit event or termination of the contract are recognized, net of a proportional amount of the upfront payment, as realized gains or losses. In addition to bearing the risk that the credit event will occur, the fund could be exposed to market risk due to unfavorable changes in interest rates or in the price of the underlying security or index, the possibility that the fund may be unable to close out its position at the same time or at the same price as if it had purchased comparable publicly traded securities or that the counterparty may default on its obligation to perform. Risks of loss may exceed amounts recognized on the statement of assets and liabilities. Credit default contracts outstanding at period end, if any, are listed after the fund's portfolio.

TBA purchase commitments

The fund may enter into "TBA" (to be announced) commitments to purchase securities for a fixed unit price at a future date beyond customary settlement time. Although the unit price has been established, the principal value has not been finalized. However, the amount of the commitments will not significantly differ from the principal amount. The fund holds, and maintains until settlement date, cash or high-grade debt obligations in an amount sufficient to meet the purchase price, or the fund may enter into offsetting contracts for the forward sale of other securities it owns. Income on the securities will not be earned until settlement date. TBA purchase commitments may be considered securities themselves, and involve a risk of loss if the value of the security to be purchased declines prior to the settlement date, which risk is in addition to the risk of decline in the value of the fund's other assets.

Unsettled TBA purchase commitments are valued at fair value of the underlying securities, according to the procedures described under "Security valuation" above. The contract is marked-to-market daily and the change in market value is recorded by the fund as an unrealized gain or loss.

Although the fund will generally enter into TBA purchase commitments with the intention of acquiring securities for its portfolio or for delivery pursuant to options contracts it has entered into, the fund may dispose of a commitment prior to settlement if Putnam Management deems it appropriate to do so.

TBA sale commitments

The fund may enter into TBA sale commitments to hedge its portfolio positions or to sell mortgage-backed securities it owns under delayed delivery arrangements. Proceeds of TBA sale commitments are not received until the contractual settlement date. During the time a TBA sale commitment is outstanding, equivalent deliverable securities or an offsetting TBA purchase commitment deliverable on or before the sale commitment date, are held as "cover" for the transaction.

Unsettled TBA sale commitments are valued at fair value of the underlying securities, generally according to the procedures described under "Security valuation" above. The contract is marked-to-market daily and the change in market value is recorded by the fund as an unrealized gain or loss. If the TBA sale commitment is closed through the acquisition of an offsetting purchase commitment, the fund realizes a gain or loss. If the fund delivers securities under the commitment, the fund realizes a gain or a loss from the sale of the securities based upon the unit price established at the date the commitment was entered into. TBA sale commitments outstanding at period end, if any, are listed after the fund's portfolio.

Dollar rolls

To enhance returns, the fund may enter into dollar rolls (principally using TBAs) in which the fund sells securities for delivery in the current month and simultaneously contracts to purchase similar securities on a specified future date. During the period between the sale and subsequent purchase, the fund will not be entitled to receive income and principal payments on the securities sold. The fund will, however, retain the difference between the initial sales price and the forward price for the future purchase. The fund will also be able to earn interest on the cash proceeds that are received from the initial sale. The fund may be exposed to market or credit risk if the price of the security changes unfavorably or the counterparty fails to perform under the terms of the agreement.

For additional information regarding the fund please see the fund's most recent annual or semiannual shareholder report filed on the Securities and Exchange Commission's Web site, www.sec.gov, or visit Putnam's Individual Investor Web site at www.putnaminvestments.com

Item 2. Controls and Procedures:

(a) The registrant's principal executive officer and principal financial officer have concluded, based on their evaluation of the effectiveness of the design and operation of the registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the design and operation of such procedures are generally effective to provide reasonable assurance that information required to be disclosed by the registrant in this report is recorded, processed, summarized and reported within the time periods specified in the Commission's rules and forms.

(b) Changes in internal control over financial reporting:

During the period, Putnam Fiduciary Trust Company, the fund's transfer agent, began utilizing shareholder systems and systems support provided by DST Systems, Inc. and certain of its

affiliates.

Item 3. Exhibits:

Separate certifications for the principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended, are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Putnam Premier Income Trust

By (Signature and Title):

/s/ Janet C. Smith

Janet C. Smith

Principal Accounting Officer

Date: December 28, 2007

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title):

/s/ Charles E. Porter

Charles E. Porter

Principal Executive Officer

Date: December 28, 2007

By (Signature and Title):

/s/ Steven D. Krichmar

Steven D. Krichmar

Principal Financial Officer

Date: December 28, 2007

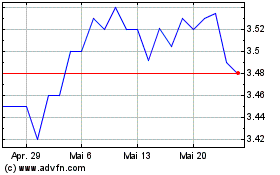

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024