- New customer rates, record heat positively impact

quarter-over-quarter earnings

- Customer and sales growth continue to reflect a strong Arizona

economy

- Expanded bill assistance, heat relief and energy efficiency

programs provide greater support to customers

Pinnacle West Capital Corp. (NYSE: PNW) today reported

consolidated net income attributable to common shareholders of

$203.8 million, or $1.76 per diluted share of common stock, for the

quarter ended June 30, 2024. This result compares with consolidated

net income of $106.7 million, or $0.94 per diluted share, for the

same period in 2023.

New customer rates, which took effect in March 2024, and record

June heat were the primary drivers in the quarter-over-quarter

improvement. Increases in customer usage and growth, and higher

revenue from a surcharge resulting from the outcome of the

utility’s 2019 Rate Case appeal, also contributed significantly to

the company’s bottom line. These positive factors were partially

offset by higher depreciation and amortization expense mostly due

to increased plant and intangible assets; and higher interest

charges, net of AFUDC.

“Our second quarter was marked by warmer-than-normal

temperatures, including June being the hottest on record in the

Phoenix metropolitan area,” said Pinnacle West Chairman, President

and Chief Executive Officer Jeff Guldner. “Since weather directly

affects how much energy our customers use to cool their homes and

businesses, retail sales and financial results were meaningfully

higher than a year ago.” By comparison, Guldner also noted that

last year’s second-quarter results were negatively impacted by

cooler-than-usual temperatures, including the mildest June on

record since 2009.

Hotter Temperatures Contribute to Increased Customer Energy

Consumption

In addition to 5.5% weather-normalized sales growth and strong

customer growth of 2.1% during the quarter, weather variations also

spurred an increase in energy consumption. The average high and low

temperatures were higher during the 2024 second-quarter than last

year’s comparable period – and were well over historical

averages.

According to the National Weather Service, the average high

temperature in the Phoenix area during the 2024 second quarter was

97.6 degrees Fahrenheit – an increase of 2% over last year’s second

quarter and 1.4% above 10-year historical averages. More so, June

was the warmest on record with an average high temperature of 109.4

degrees and an average overnight low temperature of 84.6 degrees.

The number of residential cooling degree-days (a utility’s measure

of the effects of weather) in this year’s second quarter increased

a noteworthy 52.8% compared to the same period a year ago and was a

remarkable 23.5% higher than historical 10-year averages. June

2024, in fact, had 79.9% more cooling degree-days than in June

2023.

Operationally, Guldner said company employees continue to

execute well, ensuring reliable customer service amidst the extreme

summer temperatures and increased customer demand.

“At APS, we have a saying that the summer season is our time;

it’s when our year-round preparation comes to light,” he said. “For

almost 140 years, our employees and service have helped make it

possible for Arizona to grow and prosper. Their efforts are part of

what has made the region attractive to families, businesses and

investment. As temperatures intensify throughout the West,

providing safe, reliable and affordable energy is more critical

than ever to ensure Arizona remains a comfortable, livable and

thriving environment.”

APS plans years in advance to ensure reliable energy, while not

sacrificing affordability and continuing to build toward a clean

energy future. Resource planners secure a diverse energy mix to

meet demand, including solar and wind power, battery energy storage

and nuclear. When extreme temperatures cause demand to increase

over long stretches, APS utilizes flexible resources like natural

gas to keep homes and businesses cool. As part of the company’s

vigorous planning, APS recently executed agreements on multiple

projects that are scheduled to come online between 2026 and 2028,

including more than 400 megawatts of APS-owned resources.

Additionally, part of delivering on that responsibility to

customers means striving for an industry-leading, best-in-class

customer experience. Company-wide efforts to provide a more

frictionless customer experience continue to pay off as measured by

J.D. Power. Through the first half of 2024, APS ranked in the first

quartile of large investor-owned utilities for both residential and

business overall customer satisfaction. “This progress can only be

achieved through collaborative, cross-functional efforts across our

entire company and from every employee,” said Guldner. “We put our

customers first, and these latest results indicate they appreciate

the service we are delivering.”

Resources Available to Help Customers Manage Energy Use &

Bills

APS provides a variety of resources and money-saving tips to

help customers stay comfortable and manage their electric bills

through summer’s scorching temperatures.

The APS mobile app and aps.com let customers check their energy

use, access energy-saving tips customized to their service plan,

and monitor and report outages.

Additionally, in the face of extreme temperatures and prolonged

heat, APS has expanded its heat-relief initiatives, including

partnering with local community organizations to aid the state’s

most vulnerable populations. This includes support for The

Salvation Army’s network of cooling and hydration stations across

Arizona; a collaboration with the Foundation for Senior Living

offering emergency repair or replacement of AC systems during the

scorching summer months; and homelessness prevention and

eviction-protection assistance program in partnership with St.

Vincent de Paul.

The company also offers a variety of assistance programs for

those who are struggling with their bill. These resources include

the Energy Support programs, which provide limited-income customers

with up to a 60% discount on their monthly bill; Crisis Bill

Assistance, providing up to $1,000 annually to qualified

limited-income customers who experience unexpected financial

hardship; and Project SHARE, a Salvation Army-administered service

providing up to $500 annually in emergency energy bill

assistance.

APS customers needing aid are encouraged to visit

aps.com/support for a full list of assistance programs, including

up-to-date details on year-round financial resources and support.

Solutions range from short-term guest access and safety nets to

long-term crisis and housing support.

Financial Outlook

For 2024, the company continues to estimate its consolidated

earnings guidance will be in the range of $4.60 to $4.80 per

diluted share. Key factors and assumptions underlying this outlook

can be found in the second-quarter 2024 earnings presentation

slides at pinnaclewest.com/investors.

Conference Call and Webcast

Pinnacle West invites interested parties to listen to the live

webcast of management’s conference call to discuss the company’s

2024 second-quarter results, as well as recent developments, at

noon ET (9 a.m. Arizona time) today, August 1. Join the live

webcast at www.pinnaclewest.com/presentations for audio of the call

and slides, or dial (888) 506-0062 or (973) 528-0011 for

international callers and enter participant access code 830240. A

replay of the webcast can be accessed for 30 days at

pinnaclewest.com/presentations. A replay of the call also will be

available until 11:59 p.m. ET, Thursday, Aug. 8, 2024, by calling

(877) 481-4010 in the U.S. and Canada or (919) 882-2331

internationally and entering replay passcode 50835.

General Information

Pinnacle West Capital Corp., an energy holding company based in

Phoenix, has consolidated assets of nearly $26 billion, about 6,500

megawatts of generating capacity and approximately 6,100 employees

in Arizona and New Mexico. Through its principal subsidiary,

Arizona Public Service, the company provides retail electricity

service to approximately 1.4 million Arizona homes and businesses.

For more information about Pinnacle West, visit the company’s

website at pinnaclewest.com.

Dollar amounts in this news release are after income taxes.

Earnings per share amounts are based on average diluted common

shares outstanding. For more information on Pinnacle West’s

operating statistics and earnings, please visit

pinnaclewest.com/investors.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements based on

current expectations. These forward-looking statements are often

identified by words such as "estimate," "predict," "may,"

"believe," "plan," "expect," "require," "intend," "assume,"

"project," "anticipate," "goal," "seek," "strategy," "likely,"

"should," "will," "could," and similar words. Because actual

results may differ materially from expectations, we caution readers

not to place undue reliance on these statements. A number of

factors could cause future results to differ materially from

historical results, or from outcomes currently expected or sought

by Pinnacle West or APS. These factors include, but are not limited

to:

- uncertainties associated with the current and future economic

environment, including economic growth rates, labor market

conditions, inflation, supply chain delays, increased expenses,

volatile capital markets, or other unpredictable effects;

- our ability to manage capital expenditures and operations and

maintenance costs while maintaining reliability and customer

service levels;

- variations in demand for electricity, including those due to

weather, seasonality (including large increases in ambient

temperatures), the general economy or social conditions, customer,

and sales growth (or decline), the effects of energy conservation

measures and distributed generation, and technological

advancements;

- the potential effects of climate change on our electric system,

including as a result of weather extremes such as prolonged drought

and high temperature variations in the area where APS conducts its

business;

- power plant and transmission system performance and

outages;

- competition in retail and wholesale power markets;

- regulatory and judicial decisions, developments, and

proceedings;

- new legislation, ballot initiatives and regulation or

interpretations of existing legislation or regulations, including

those relating to environmental requirements, regulatory and energy

policy, nuclear plant operations and potential deregulation of

retail electric markets;

- fuel and water supply availability;

- our ability to achieve timely and adequate rate recovery of our

costs through our rates and adjustor recovery mechanisms, including

returns on and of debt and equity capital investment;

- the ability of APS to meet renewable energy and energy

efficiency mandates and recover related costs;

- the ability of APS to achieve its clean energy goals (including

a goal by 2050 of 100% clean, carbon-free electricity) and, if

these goals are achieved, the impact of such achievement on APS,

its customers, and its business, financial condition, and results

of operations;

- risks inherent in the operation of nuclear facilities,

including spent fuel disposal uncertainty;

- current and future economic conditions in Arizona;

- the direct or indirect effect on our facilities or business

from cybersecurity threats or intrusions, data security breaches,

terrorist attack, physical attack, severe storms, or other

catastrophic events, such as fires, explosions, pandemic health

events or similar occurrences;

- the development of new technologies which may affect electric

sales or delivery, including as a result of delays in the

development and application of new technologies;

- the cost of debt, including increased cost as a result of

rising interest rates, and equity capital and our ability to access

capital markets when required;

- environmental, economic, and other concerns surrounding

coal-fired generation, including regulation of greenhouse gas

emissions;

- volatile fuel and purchased power costs;

- the investment performance of the assets of our nuclear

decommissioning trust, pension, and other postretirement benefit

plans and the resulting impact on future funding requirements;

- the liquidity of wholesale power markets and the use of

derivative contracts in our business;

- potential shortfalls in insurance coverage;

- new accounting requirements or new interpretations of existing

requirements;

- generation, transmission and distribution facility and system

conditions and operating costs;

- our ability to meet the anticipated future need for additional

generation and associated transmission facilities in our

region;

- the willingness or ability of our counterparties, power plant

participants and power plant landowners to meet contractual or

other obligations or extend the rights for continued power plant

operations; and

- restrictions on dividends or other provisions in our credit

agreements and Arizona Corporation Commission orders.

These and other factors are discussed in the most recent

Pinnacle West/APS Form 10-K and 10-Q along with other public

filings with the Securities and Exchange Commission, which readers

should review carefully before placing any reliance on our

financial statements or disclosures. Neither Pinnacle West nor APS

assumes any obligation to update these statements, even if our

internal estimates change, except as required by law.

PINNACLE WEST CAPITAL CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (unaudited) (dollars and

shares in thousands, except per share amounts)

THREE MONTHS ENDED

SIX MONTHS ENDED

JUNE 30,

JUNE 30,

2024

2023

2024

2023

Operating Revenues

$

1,308,994

$

1,121,703

$

2,260,706

$

2,066,658

Operating Expenses Fuel and purchased power

437,172

407,754

795,036

802,258

Operations and maintenance

272,266

277,238

529,844

527,318

Depreciation and amortization

225,017

195,101

435,311

387,007

Taxes other than income taxes

58,651

57,642

117,815

114,780

Other expenses

2,141

688

2,161

1,298

Total

995,247

938,423

1,880,167

1,832,661

Operating Income

313,747

183,280

380,539

233,997

Other Income (Deductions) Allowance for equity funds

used during construction

8,910

13,034

19,202

28,095

Pension and other postretirement non-service credits - net

12,877

10,474

24,445

20,339

Other income

5,885

6,406

36,492

12,483

Other expense

(3,032

)

(4,813

)

(10,599

)

(8,944

)

Total

24,640

25,101

69,540

51,973

Interest Expense Interest charges

108,891

93,832

208,665

181,951

Allowance for borrowed funds used during construction

(11,036

)

(12,317

)

(24,177

)

(25,039

)

Total

97,855

81,515

184,488

156,912

Income Before Income Taxes

240,532

126,866

265,591

129,058

Income Taxes

32,421

15,897

36,312

17,080

Net Income

208,111

110,969

229,279

111,978

Less: Net income attributable to noncontrolling interests

4,306

4,306

8,612

8,612

Net Income Attributable To Common Shareholders

$

203,805

$

106,663

$

220,667

$

103,366

Weighted-Average Common Shares Outstanding -

Basic

113,695

113,411

113,658

113,385

Weighted-Average Common Shares Outstanding - Diluted

115,803

113,717

115,015

113,657

Earnings Per Weighted-Average Common Share

Outstanding Net income attributable to common shareholders -

basic

$

1.79

$

0.94

$

1.94

$

0.91

Net income attributable to common shareholders - diluted

$

1.76

$

0.94

$

1.92

$

0.91

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801787569/en/

Media Contact: Alan Bunnell (602) 250-3376 Analyst Contact:

Amanda Ho (602) 250-3334 Website: pinnaclewest.com

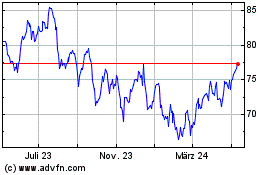

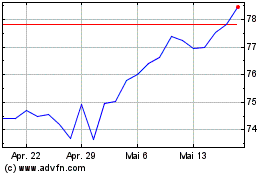

Pinnacle West Capital (NYSE:PNW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Pinnacle West Capital (NYSE:PNW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025