UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| | | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission file number 1-8962

The Pinnacle West Capital Corporation Savings Plan

(Full title of the plan)

Pinnacle West Capital Corporation

(Name of issuer)

400 North Fifth Street

P.O. Box 53999

Phoenix, Arizona 85072-3999

(Address of issuer’s principal executive office)

THE PINNACLE WEST CAPITAL CORPORATION SAVINGS PLAN

TABLE OF CONTENTS

| | | | | |

| | PAGE |

| | |

| |

| | |

| FINANCIAL STATEMENTS: | |

| | |

| |

| | |

| |

| | |

| |

| | |

| SUPPLEMENTAL SCHEDULE - | |

| | |

| |

| | |

| |

| | |

| |

NOTE: Supplemental schedules required by section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, other than the schedule listed above, are omitted because of the absence of the conditions under which they are required.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Investment Management Committee and

Benefit Administration Committee of The Pinnacle West

Capital Corporation Savings Plan and Plan Participants:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The Pinnacle West Capital Corporation Savings Plan (the "Plan") as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Schedule

The supplemental schedule of assets (held at end of year) as of December 31, 2023, has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedule reconcile to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in compliance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ DELOITTE & TOUCHE LLP

Tempe, Arizona

June 14, 2024

We have served as the auditor of the Plan since 1979.

THE PINNACLE WEST CAPITAL CORPORATION SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

AS OF DECEMBER 31, 2023 AND 2022

| | | | | | | | | | | | | | |

| | | 2023 | | 2022 |

| ASSETS: | | | | |

| Participant-directed investments at fair value (Notes 2 and 5) | | $ | 1,318,615,204 | | | $ | 1,134,386,348 | |

| Participant-directed investments at contract value (Notes 2 and 4) | | 116,750,080 | | | 134,903,912 | |

| Total investments | | 1,435,365,284 | | | 1,269,290,260 | |

| Receivables: | | | | |

| Notes receivable from participants (Note 1) | | 21,718,223 | | | 20,555,914 | |

| Participant contributions | | 1,598,239 | | | 1,257,016 | |

| Employer contributions | | 499,276 | | | 392,942 | |

| Other receivables | | 15,573,354 | | | 9,234,515 | |

| Total receivables | | 39,389,092 | | | 31,440,387 | |

| Total assets | | 1,474,754,376 | | | 1,300,730,647 | |

| LIABILITIES: | | | | |

| Payable for securities purchased | | 9,144,996 | | | 7,761,731 | |

| Accrued administrative expenses | | 323,366 | | | 300,067 | |

| Total liabilities | | 9,468,362 | | | 8,061,798 | |

| NET ASSETS AVAILABLE FOR BENEFITS | | $ | 1,465,286,014 | | | $ | 1,292,668,849 | |

See notes to financial statements.

THE PINNACLE WEST CAPITAL CORPORATION SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEAR ENDED DECEMBER 31, 2023

| | | | | |

| CONTRIBUTIONS (Note 1): | |

| Participants | $ | 71,408,381 | |

| Employer | 24,766,651 | |

| Rollover | 9,318,608 | |

| Total contributions | 105,493,640 | |

| |

| INVESTMENT INCOME (Note 2): | |

Net realized/unrealized appreciation in fair value of investments | 184,527,593 | |

| Dividend, interest, and other income | 17,228,381 | |

| Interest income on notes receivable from participants | 1,211,937 | |

Total investment income | 202,967,911 | |

| | |

| DEDUCTIONS: | |

| Distributions to participants | 133,469,208 | |

| Administrative expenses (Note 2) | 2,375,178 | |

| Total deductions | 135,844,386 | |

| | |

INCREASE IN NET ASSETS | 172,617,165 | |

| | |

| NET ASSETS AVAILABLE FOR BENEFITS: | |

| | |

| Beginning of year | 1,292,668,849 | |

| End of year | $ | 1,465,286,014 | |

See notes to financial statements.

THE PINNACLE WEST CAPITAL CORPORATION SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF THE PLAN

The following description of The Pinnacle West Capital Corporation Savings Plan (the "Plan") provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan sponsored by Pinnacle West Capital Corporation ("Pinnacle West" or the "Company"). The Plan is administered by two committees, the Benefit Administration Committee and the Investment Management Committee, appointed by the Pinnacle West Board of Directors (together, the "Committee"). The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). The trustee for the Plan is Fidelity Management Trust Company ("Trustee").

The Investment Management Committee appointed an independent fiduciary to manage the Pinnacle West Stock Fund investment option under the Employee Stock Ownership Plan feature in April 2021. The independent fiduciary has the sole authority to vote any shares and to instruct the Trustee accordingly with respect to shares of Pinnacle West common stock held in the Pinnacle West Stock Fund that are not otherwise voted by the Plan participants themselves. The Company froze the Pinnacle West Stock Fund as an investment choice in the Plan on September 30, 2020. See Note 6.

Eligibility

Generally, as defined by the Plan, most active employees of Pinnacle West and its subsidiaries, including Arizona Public Service Company, El Dorado Investment Company and Bright Canyon Energy Corporation (collectively, the "Employer"), are eligible to participate in (1) the pre-tax, Roth 401(k), and after-tax features of the Plan immediately upon employment or, if later, their attainment of age 18 and (2) the matching feature on the first day of the month coincident with or following their attainment of age 18 and completion of six full months of service.

Contributions

The Plan allows participants to contribute up to 50% of their base pay as pre-tax contributions, Roth 401(k) contributions or after-tax contributions, provided that in no event can the combined total contributions made by any participant in any year exceed 50% of their base pay, or the limits imposed by the Internal Revenue Code ("IRC"). Eligible employees who do not affirmatively elect to participate or opt out of the Plan are automatically enrolled as soon as administratively possible after 60 days of employment. Employees automatically enrolled contribute 3% of their base pay as pre-tax contributions. The Plan also allows participants attaining the age of 50 before the end of the calendar year to make catch-up contributions in accordance with Section 414(v) of the IRC. The maximum allowable pre-tax contribution and catch-up contribution may increase in future years as determined annually by the Internal Revenue Service ("IRS"). Participants may elect to set their pre-tax contributions to increase automatically on an annual basis based on the percent increase and effective date designated by the participant, up to the maximum limits permitted under the Plan and the IRC.

Employer contributions are fixed at 75% of the first 6% of base pay for combined pre-tax and/or Roth 401(k) participant contributions (excluding catch-up contributions) for all participants other than employees hired prior to January 1, 2003 and who elected not to participate in the Retirement Account Balance feature of the Pinnacle West Capital Corporation Retirement Plan. Participants hired prior to January 1, 2003, and who elected not to participate in the Retirement Account Balance feature, receive an Employer match of 50% of the first 6% of base pay contributed, in combination, as pre-tax and/or Roth 401(k) participant contributions (excluding catch-up contributions).

Employer contributions are invested in the same investment funds as participants elect for their participant contributions. Noncash contributions, are recorded at fair value. There were no noncash contributions for the year ended December 31, 2023.

The Plan allows rollover contributions from other eligible retirement plans, including 401(k) or other qualified plans (including after-tax dollars), governmental 457(b) plans, Roth 401(k) accounts, 403(b) annuities (including after-tax dollars), or IRAs (excluding after-tax dollars), subject to certain criteria. Rollover contributions are not eligible for employer match.

If a participant elected to reinvest dividends in the Pinnacle West Stock Fund, any dividends paid on balances in the Pinnacle West Stock Fund are reinvested in accordance with the future investment allocations the participant has selected.

Participant Accounts

Individual accounts are maintained for each Plan participant. Allocations of earnings and losses are based on participant account balances. If applicable, each participant has separate accounts that are credited with the participant’s pre-tax contributions, Roth 401(k) contributions, after-tax contributions, rollover contributions, in-plan Roth conversions, the Employer’s matching contributions and an allocation of Plan earnings. If applicable, each participant’s account is charged with withdrawals, an allocation of Plan losses and explicit recordkeeping and administrative fees (see Note 2). A dollar amount is deducted quarterly from each participant’s account for the explicit recordkeeping and administrative fees.

Investment Choices

Participants direct all contributions into one or more of the following (collectively, the "Funds"):

•Age-based investment options ("Target Retirement Date Funds") that include:

•Retirement Income Fund

•Target Retirement 2020 Fund

•Target Retirement 2025 Fund

•Target Retirement 2030 Fund

•Target Retirement 2035 Fund

•Target Retirement 2040 Fund

•Target Retirement 2045 Fund

•Target Retirement 2050 Fund

•Target Retirement 2055 Fund

•Target Retirement 2060 Fund

•Target Retirement 2065 Fund

•Core investment options that include:

•Stable Value Fund (see Note 4)*

•US Bond Index

•Bond Fund*

•Diversified Inflation Fund

•US Large Cap Stock Index

•US Large Cap Stock Fund*

•US Small/Mid Cap Stock Index

•US Small/Mid Cap Stock Fund*

•Non-US Stock Index

•Non-US Stock Fund

•Pinnacle West Stock Fund**

* Separately managed accounts, specific to this Plan only.

** A separately managed account, specific to this Plan only. On September 30, 2020, the Company froze the Pinnacle West Stock Fund (see Note 2).

The Plan provides that in lieu of making their own investment elections in the funds, participants may (a) choose to have an investment allocation suggested for them through the Plan's personal asset manager program or choose to have their portfolio managed for them utilizing the Plan's Managed Account service, both of which provide a personalized mix of the Plan's core investment options; (b) allow their balance to be invested in the Qualified Default Investment Alternative ("QDIA") which is the family of Target Retirement Date Funds that are composed of the core investment options; (c) establish a self-directed brokerage account ("SDA") to invest up to 90% of their vested account balance in permitted investments of the SDA (which excludes the Funds); or (d) elect to have their investment mix of Funds automatically rebalanced according to their investment elections on a quarterly, semiannual or annual basis.

Notes Receivable from Participants

Participants may borrow money from their pre-tax contributions account, Roth 401(k) contributions account, vested Employer contributions account, rollover contributions account, and in-plan Roth conversions. Participants may not borrow against their Employer transfer account, self-directed brokerage fund or their after-tax contributions account.

The minimum participant loan allowed is $1,000. Generally, the maximum participant loan allowed is 50% of the participant’s vested account balance, up to $50,000 reduced by the participant’s highest outstanding loan balance in the 12-month period ending on the day before the loan is made. Only one loan per participant may be outstanding at any one time. Loan terms are up to 15 years for the purchase of the participant's principal residence or up to 5 years for all other purposes. An administrative fee is charged to the participant’s account for each loan. Participants with an outstanding loan may continue to make loan repayments upon termination of employment with the Employer, unless they receive a full distribution of their account balance.

The interest rate for a participant loan is determined at the time the loan is requested and is fixed for the life of the loan. The Trustee currently charges interest at the prime interest rate plus one percent, determined as of the first business day of the month in which the loan is issued. The average interest rate for loans issued during 2023 was 9.19%. Interest rates for outstanding loans as of December 31, 2023 and 2022, ranged from 4.25% to 9.50%. As of December 31, 2023, participant loans have maturities through 2038.

Loans are treated as investments of the participants’ accounts. To fund the loan, transfers are made from the participant’s investment funds on a pro-rata basis. Amounts credited to a participant’s SDA are not available for a loan. Loan repayments are invested in the participant’s investment funds based on the participant’s current investment election or in the QDIA, if the participant does not have a current investment

election in place. Loan repayments, including interest, are generally made through irrevocable payroll deductions. Loan repayments for former participants are made through the automated clearing house system. Loans are secured by the participant’s account balance.

Vesting and Forfeitures

Effective April 1, 2006, each new participant is automatically fully vested in the participant’s pre-tax contributions account, Roth 401(k) contributions account, after-tax contributions account, rollover contributions account, in-plan Roth conversions (consisting of the participant’s contributions and related income and appreciation or depreciation), Employer transfer account, and Employer contributions account (consisting of Employer contributions and related income and appreciation or depreciation).

Withdrawals and Distributions

A participant may, at any time, make a full or partial withdrawal of the balance in the participant’s after-tax contributions account, rollover contributions account, and in-plan Roth conversions. No withdrawals prior to termination of employment are permitted from a participant’s Employer transfer account. No withdrawals prior to termination of employment are permitted from the participant’s pre-tax contributions account and Roth 401(k) contributions account, except under certain limited circumstances relating to financial hardship or after attaining age 59-1/2. Participants who have participated in the Plan for five complete Plan years may withdraw the amount in their Employer contributions account. Participants who are at least age 59-1/2 may withdraw any portion of their pre-tax contributions account, Roth 401(k) contributions account, rollover contributions account, or in-plan Roth conversions while employed with no restrictions on the reason for withdrawal. For all withdrawals and distributions, penalties may apply. Amounts credited to a participant’s SDA are not available for a withdrawal until transferred back into the Funds. When the participant’s employment with the Employer is terminated, the participant can elect to receive a full or partial distribution, as soon as administratively possible, of their Employer contributions account together with the participant’s contributions accounts and Employer transfer account. Participants can take a loan prior to a hardship withdrawal and contributions are not suspended as a result of taking a hardship withdrawal.

Termination of the Plan

It is the Company’s present expectation that the Plan and the payment of Employer contributions will be continued indefinitely. However, continuance of any feature of the Plan is not assumed as a contractual obligation. The Company, at its discretion, may terminate the Plan and distribute net assets, subject to the provisions set forth in ERISA and the IRC, or discontinue the Company's contributions.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP").

Subsequent Events

Subsequent events were evaluated through June 14, 2024, the date the financial statements were issued. On January 12, 2024, Pinnacle West completed the business sale of Bright Canyon Energy, including the transfer of certain employees. As a result of the sale, Bright Canyon Energy is no longer a subsidiary of

Pinnacle West. No other events occurred that require additional disclosure or adjustments to the Plan's financial statements.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Plan’s management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan utilizes various investment instruments. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, liquidity risk, inflation risk and overall market volatility. Market risks include global events which could impact the value of investments, such as a pandemic or international conflict. Due to the level of risk associated with certain investment securities, it is possible that changes in the value of investment securities may occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

Investment Valuation

The Plan’s investments are stated at fair value (except for fully benefit-responsive investment contracts, which are reported at contract value), less costs to sell, if those costs are significant. Fair value is the price that would be received upon the sale of an asset or the amount paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 5 for fair value measurements and disclosures of the Plan’s investments reported at fair value.

The Plan's investment options include a unitized stock fund, which owns shares of Pinnacle West common stock, and together with a small portion of cash maintained for liquidity purposes, is recorded on a unit basis. Pinnacle West's common shares are traded on the New York Stock Exchange ("NYSE") and are valued at the NYSE closing price on the last business day of the plan year (see Note 5). The valuation per share of Pinnacle West's common stock was $71.84 and $76.04 at December 31, 2023 and 2022, respectively. The valuation per unit of the Pinnacle West stock fund was $17.82 and $18.83 at December 31, 2023 and 2022, respectively.

Included in investments at December 31, 2023 and 2022, are shares of Pinnacle West common stock amounting to $47,548,166 and $57,324,123, respectively. This investment represents 3% and 5% of total investments at December 31, 2023 and 2022, respectively. A significant decline in the market value of the stock could have an effect on the net assets available for benefits.

Effective on September 30, 2020, the Company froze the Pinnacle West Stock Fund as an investment choice in the Plan. Plan participants are no longer able to invest future contributions or reinvest dividends in the Pinnacle West Stock Fund or exchange from another investment option into the Pinnacle West Stock Fund. Any portion of a participant's account balance that is invested in the Pinnacle West Stock Fund may remain in the Pinnacle West Stock Fund at this time.

The Stable Value Fund investment option is composed of fully benefit-responsive synthetic guaranteed investment contracts ("SGICs"), which are reported at contract value. Contract value is the relevant measure for fully benefit-responsive investment contracts because it is the amount Plan participants would receive if they were to initiate permitted transactions under the terms of the Plan. Contract value represents contributions

made under each contract, plus earnings, less participant withdrawals, and administrative expenses. The Statement of Net Assets Available for Benefits presents SGICs on a contract value basis (see Note 4).

Income Recognition

Purchases and sales of securities are recorded as of the trade date. Interest income is recorded on the accrual basis. Dividend income is recorded as of the ex-dividend date. Net appreciation (depreciation) includes the Plan’s gain and losses on investments bought and sold as well as held during the year.

Administrative Expenses

Participants pay a quarterly Plan recordkeeping fee. Participants may also pay administrative fees for the origination of a loan, distributions, qualified domestic relation order processing or for other services provided by the Trustee. Participants pay investment, sales, recordkeeping, and administrative expenses charged by the Funds, which are deducted from assets and reflected as a reduction of investment return for the Fund. Some participants utilizing the SDA may pay income tax charges depending on the assets that they may hold in their respective SDA. Pinnacle West pays the remaining Plan administrative expenses, such as legal expenses.

Notes Receivable From Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are recorded as distributions based on the terms of the Plan.

Payment of Benefits

Benefit payments to participants are recorded upon distribution. As of December 31, 2023 and 2022, there were no amounts allocated to accounts of persons who have elected to withdraw from the Plan, but have not yet been paid.

Excess Contributions Payable

The Plan is required to return contributions received during the Plan year in excess of the IRC limits.

Net Realized/Unrealized Appreciation in Fair Value of Investments

Net realized/unrealized appreciation includes the Plan's gains and losses on investments bought and sold during the year as well as unrealized gains and losses related to investments held at year end.

3. FEDERAL INCOME TAX STATUS

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. Plan management has concluded that, as of December 31, 2023 and December 31, 2022, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by the IRS, however, there are currently no audits for any tax periods in progress.

The IRS has determined and informed the Company by a letter dated March 16, 2018, that the Plan and related trust were designed in accordance with the applicable regulations of the IRC. The Plan has been

amended since receiving the determination letter. However, the Company and Plan management believe that the Plan is currently designed and operated in compliance with the applicable requirements of the IRC, and the Plan and related trust continue to be tax-exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

4. INVESTMENT CONTRACTS

The Stable Value Fund is an investment option offered to all participants in the Plan. This investment option consists of three fully benefit-responsive SGICs and accordingly, is recorded at contract value in the Statements of Net Assets Available for Benefits. A SGIC is an investment contract issued by an insurance company or other financial institution ("Wrap Agreement"), backed by a portfolio of bonds, mortgages, or other fixed income instruments. The realized and unrealized gains and losses on the underlying assets are not reflected immediately in the value of the contract, but rather are amortized, usually over the time to maturity or the duration of the underlying investments, through adjustments to the future interest crediting rate. Formulas are provided in each contract that adjust the interest crediting rate to recognize the difference between the fair value and the book value of the underlying assets. The contract provides for an interest crediting rate that may not be less than zero percent per annum. Interest crediting rates are reviewed monthly for resetting. The Wrap Agreement is intended to guarantee that the qualified participant withdrawals will occur at contract value.

Certain events may limit the ability of the Plan to transact at contract value with the issuer. While the events may differ from contract to contract, the events typically include: Plan amendments or changes, company mergers or consolidations, participant investment election changes, group terminations or layoffs, implementation of an early retirement program, termination or partial termination of the Plan, failure to meet certain tax qualifications, participant communication that is designed to influence participants not to invest in the Stable Value Fund, transfers to competing options without meeting the equity wash provisions of the Stable Value Fund (if applicable), Plan sponsor withdrawals without the appropriate notice to the Stable Value Fund’s investment manager and/or wrap contract issuers, any changes in laws or regulations that would result in substantial withdrawals from the Plan, and default by the Plan sponsor in honoring its credit obligations, insolvency, or bankruptcy if such events could result in withdrawals. In general, wrap providers may terminate the contract and settle at other than contract value due to changes in the qualification status of the company or the Plan, breach of material obligations under the contract and misrepresentation by the contract holder, or failure of the underlying portfolio to conform to the pre-established investment guidelines. Plan management believes that the occurrence of such events that would cause the Plan to transact at less than contract value is not probable.

The Plan’s fully benefit-responsive SGICs are included in the Statements of Net Assets Available for Benefits as participant-directed investments at contract value at December 31, 2023 and 2022 of $116,750,080 and $134,903,912, respectively. The fully benefit-responsive SGICs earned interest income of $3,359,513 during the year ended December 31, 2023.

5. FAIR VALUE MEASUREMENTS

The Plan applies fair value measurements to certain investments and provides disclosures of certain assets according to a fair value hierarchy. The hierarchy ranks the quality and reliability of the inputs used to determine fair values, which are then classified and disclosed in one of three categories. The three levels of the fair value hierarchy are:

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 — Other significant observable inputs including quoted prices in active markets for similar assets or liabilities; quoted prices in markets that are not active; and model-derived valuations whose inputs are observable (such as yield curves).

Level 3 — Model-derived valuations with unobservable inputs that are supported by little or no market activity.

Assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurement. Valuation methodologies maximize the use of observable inputs and minimize the use of unobservable inputs. The Plan’s assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the valuation of fair value assets and liabilities and their placement within the fair value hierarchy levels. Investments valued using net asset value ("NAV") as a practical expedient are not classified within the fair value hierarchy.

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2023 and 2022.

Common Stocks: Valued at the closing price reported on the active market on which the individual securities are traded. See Note 2 for additional discussion of Pinnacle West Common Stock.

Short-Term Investments: Consists primarily of mutual funds that seek to provide safety of principal, daily liquidity and a competitive yield by investing in U.S. Government Securities, or money market funds. Valuation is based on the quoted NAV of shares held by the Plan, consistent with the methodology for valuing mutual funds as discussed below.

Mutual Funds: Valued and redeemable at the quoted NAV of shares held by the Plan. The NAV is based on the quoted price at the end of the day on the active market in which the individual funds are traded. Mutual funds are open-ended funds that are registered with the Securities and Exchange Commission.

Self-Directed Brokerage Account: Consists primarily of common stocks, mutual funds, and short-term investments that are valued on the basis of readily determinable market prices.

Common and Collective Trusts: Valued, as a practical expedient, based on the trusts’ NAV of units held by the Plan at year-end. NAV is based on the market prices in active markets of the underlying securities owned by the trusts. The trusts are similar to mutual funds except, among other differences, that the trusts’ shares are offered to a limited group of investors and are not traded on an exchange. Participant redemptions in the trusts do not require a notification period, and may occur on a daily basis at the NAV. The trusts have the ability to implement redemption safeguards which, theoretically, could limit the Plan’s ability to transact in the trusts. However, no such safeguards were in effect during the year and, as such, these safeguards had no effect on participant redemptions during the year or on year-end NAV valuation. The Plan has no unfunded commitments to these trusts as of December 31, 2023 and 2022.

The following table presents by level within the fair value hierarchy, the Plan's assets reported at fair value:

| | | | | | | | | | | |

| | December 31, |

| Quoted Prices in Active Markets (Level 1): | 2023 | | 2022 |

| Common stocks | $ | 90,125,078 | | | $ | 73,222,528 | |

| Short-term investments | 5,364,296 | | | 8,388,037 | |

| Mutual funds | 188,352,995 | | | 161,024,448 | |

| Pinnacle West common stock | 47,548,166 | | | 57,324,123 | |

| Self-directed brokerage account | 111,782,374 | | | 92,480,715 | |

| Total level 1 and fair value hierarchy assets | 443,172,909 | | | 392,439,851 | |

| Investments measured at NAV: | | | |

| Common and collective trusts | 875,442,295 | | | 741,946,497 | |

| Total investments at fair value | $ | 1,318,615,204 | | | $ | 1,134,386,348 | |

6. EXEMPT PARTY-IN-INTEREST TRANSACTIONS

In April 2021, an independent fiduciary began managing the Pinnacle West Stock Fund. These transactions qualify as exempt party-in-interest transactions. As of December 31, 2023 and 2022, the Plan held 661,862 and 753,868 shares, respectively, of Pinnacle West common stock, the sponsoring employer, in the Pinnacle West Stock Fund, with a cost basis of $38,041,669 and $43,924,177, and a fair value of $47,548,166 and $57,324,123, respectively. During the year ended December 31, 2023, the Plan recorded dividend income from Pinnacle West common stock of $2,483,117. As of December 31, 2023 and 2022, the Plan also held $83,478 and $0, respectively, of Pinnacle West common stock, in the Robeco Small/Mid Capitalization Value Equity Fund (See Form 5500, Schedule H). As of December 31, 2023 and 2022, the Plan held $3,451,500 and $6,287,371, respectively, of short-term investments managed by the Trustee, with the majority held within the Stable Value Fund.

Effective on September 30, 2020, the Company froze the Pinnacle West Stock Fund as an investment choice in the Plan. Plan participants are no longer able to invest future contributions or reinvest dividends in the Pinnacle West Stock Fund or exchange from another investment option into the Pinnacle West Stock Fund. Any portion of a participant's account balance that is invested in the Pinnacle West Stock Fund may remain in the Pinnacle West Stock Fund at this time.

Transactions under certain investment managers in 2023 include revenue share agreements with the Trustee that qualify as exempt party-in-interest transactions. Amounts received under these revenue share agreements were immaterial for the year ended December 31, 2023. These revenue share amounts are currently allocated back to participants.

The Plan issues loans to participants which are secured by the vested balances in the participants’ accounts.

Certain employees and officers of the Company, who may also be participants in the Plan, perform financial reporting and other services for the Plan, at no cost to the Plan. The Plan sponsor pays for these services.

7. RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of Net Assets Available for Benefits per the financial statements to Form 5500:

| | | | | | | | | | | | | | |

| | | 2023 | | 2022 |

| Net Assets Available for Benefits per the financial statements | | $ | 1,465,286,014 | | | $ | 1,292,668,849 | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts | | (6,468,938) | | | (9,004,849) | |

| Deemed distribution of participant loans | | (768,002) | | | (737,343) | |

| Net Assets per Form 5500 | | $ | 1,458,049,074 | | | $ | 1,282,926,657 | |

The following is a reconciliation of the Changes in Net Assets Available for Benefits per the financial statements to Form 5500 for the year ended December 31, 2023:

| | | | | | | | |

Increase in Net Assets Available for Benefits per the financial statements | | $ | 172,617,165 | |

Adjustment from contract value to fair value for fully benefit-responsive stable value fund -December 31, 2023 | | (6,468,938) | |

Adjustment from contract value to fair value for fully benefit-responsive stable value fund - December 31, 2022 | | 9,004,849 | |

Deemed distribution of participant loans - 2023 | | (768,002) | |

Deemed distribution of participant loans - 2022 | | 737,343 | |

Net gain per the Form 5500 | | $ | 175,122,417 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| Common Stocks | | | |

| MFS Large Capitalization Growth Equity Fund | US Large Cap Stock Fund | | |

| ADOBE INC | | | $ | 250,572 | |

| AGILENT TECH INC | | | 87,867 | |

| AIR PRODUCTS & CHEMICALS | | | 214,659 | |

| ALPHABET INC CL A | | | 2,142,565 | |

| ALPHABET INC CL C | | | 597,966 | |

| AMAZON.COM INC | | | 2,265,122 | |

| AMETEK INC NEW | | | 417,007 | |

| AMPHENOL CORPORATION CL A | | | 300,463 | |

| AON PLC | | | 65,188 | |

| APPLE INC | | | 2,000,772 | |

| APPLIED MATERIALS INC | | | 188,001 | |

| ARGENX SE SPONSORED ADR | | | 69,619 | |

| ARTHUR J GALLAGHAR AND CO | | | 219,708 | |

| ASML HLDG NV (NY REG SHS) | | | 541,198 | |

| BECTON DICKINSON & CO | | | 155,807 | |

| BOSTON SCIENTIFIC CORP | | | 668,457 | |

| CADENCE DESIGN SYS INC | | | 619,914 | |

| CANADIAN PACIFIC KANSAS C | | | 20,397 | |

| CHIPOTLE MEXICAN GRILL IN | | | 70,896 | |

| CME GROUP INC CL A | | | 162,373 | |

| COLGATE-PALMOLIVE CO | | | 86,645 | |

| COSTAR GROUP INC | | | 409,597 | |

| DATADOG INC CL A | | | 69,187 | |

| EATON CORP PLC | | | 503,314 | |

| ELI LILLY & CO | | | 851,646 | |

| ESTEE LAUDER COS INC CL A | | | 157,950 | |

| GARTNER INC | | | 287,808 | |

| HESS CORP | | | 59,250 | |

| HILTON WORLDWIDE HLDGS IN | | | 395,499 | |

| HOWMET AEROSPACE INC | | | 229,956 | |

| ICON PLC | | | 128,797 | |

| INTUIT INC | | | 447,521 | |

| KKR & CO INC | | | 33,637 | |

| KLA CORP | | | 298,207 | |

| LAM RESEARCH CORP | | | 354,034 | |

| LAS VEGAS SANDS CORP | | | 70,912 | |

| LINDE PLC | | | 623,458 | |

| LULULEMON ATHLETICA INC | | | 154,410 | |

| LVMH MOET HENNESSY ADR | | | 336,434 | |

| MARTIN MARIETTA MATERIALS | | | 151,170 | |

| MARVELL TECH INC | | | 77,981 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| MASTERCARD INC CL A | | | 1,331,991 | |

| META PLATFORMS INC CL A | | | 1,564,857 | |

| MICROSOFT CORP | | | 4,934,365 | |

| MOODYS CORP | | | 33,588 | |

| MSCI INC | | | 535,671 | |

| NVIDIA CORP | | | 2,032,383 | |

| O'REILLY AUTOMOTIVE INC | | | 246,071 | |

| REGENERON PHARMACEUTICALS | | | 122,082 | |

| ROCKWELL AUTOMATION INC | | | 181,320 | |

| SHERWIN WILLIAMS CO | | | 229,247 | |

| SPOTIFY TECH SA | | | 218,915 | |

| STERIS PLC | | | 125,974 | |

| SVCSNOW INC | | | 604,755 | |

| SYNOPSYS INC | | | 522,119 | |

| TAKE-TWO INTERACTV SOFTWR | | | 169,802 | |

| THERMO FISHER SCIENTIFIC | | | 367,307 | |

| TRANSUNION | | | 91,316 | |

| UBER TECH INC | | | 303,294 | |

| UNITEDHEALTH GROUP INC | | | 78,971 | |

| VEEVA SYS INC CL A | | | 93,180 | |

| VERISK ANALYTICS INC | | | 566,576 | |

| VERTEX PHARMACEUTICALS IN | | | 636,783 | |

| VISA INC CL A | | | 1,111,434 | |

| VULCAN MATERIALS CO | | | 628,364 | |

| ZOETIS INC CL A | | | 236,050 | |

| SUBTOTAL | | | $ | 33,752,379 | |

| | | | |

| Robeco Boston Partners Large Capitalization Value Equity Fund | US Large Cap Stock Fund | | |

| ABBOTT LAB | | | $ | 486,840 | |

| ADVANCED MICRO DEVICES IN | | | 443,557 | |

| ALLEGION PLC | | | 235,770 | |

| ALPHABET INC CL A | | | 1,034,684 | |

| AMERICAN EXPRESS CO | | | 390,042 | |

| AMGEN INC | | | 402,076 | |

| AON PLC | | | 157,442 | |

| APPLIED MATERIALS INC | | | 423,975 | |

| ARES MANAGEMENT CORP CL A | | | 146,866 | |

| ARTHUR J GALLAGHAR AND CO | | | 235,899 | |

| AUTOZONE INC | | | 537,807 | |

| AVANTOR INC | | | 337,268 | |

| BERKSHIRE HATHAWAY INC CL | | | 1,154,152 | |

| BOEING CO | | | 450,420 | |

| BORGWARNER INC | | | 101,993 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| BP PLC SPON ADR | | | 314,104 | |

| BRISTOL-MYERS SQUIBB CO | | | 631,575 | |

| BUILDERS FIRSTSOURCE | | | 118,694 | |

| CANADIAN NATL RESOURCES L | | | 397,117 | |

| CATERPILLAR INC | | | 159,662 | |

| CENCORA INC | | | 459,846 | |

| CENOVUS ENERGY INC | | | 400,882 | |

| CENTENE CORP | | | 404,741 | |

| CENTERPOINT ENERGY INC | | | 160,078 | |

| CHUBB LTD | | | 320,920 | |

| CIGNA GROUP (THE) | | | 404,557 | |

| COCA-COLA EUROPACIFIC PAR | | | 261,754 | |

| COGNIZANT TECH SOLUTIONS | | | 312,619 | |

| CONOCOPHILLIPS | | | 493,878 | |

| CRH PLC | | | 472,639 | |

| DEERE & CO | | | 194,737 | |

| DELL TECH INC CL C | | | 414,860 | |

| DISCOVER FIN SVCS | | | 599,654 | |

| DOVER CORP | | | 211,027 | |

| DUPONT DE NEMOURS INC | | | 160,168 | |

| EATON CORP PLC | | | 336,426 | |

| FIRSTENERGY CORP | | | 254,457 | |

| FLEETCOR TECH INC | | | 397,915 | |

| FORTIVE CORP | | | 325,224 | |

| GEN DYNAMICS CORPORATION | | | 544,268 | |

| GLOBAL PAYMENTS INC | | | 444,119 | |

| GOLDMAN SACHS GROUP INC | | | 376,126 | |

| HALLIBURTON CO | | | 232,119 | |

| HOWMET AEROSPACE INC | | | 362,983 | |

| HUNTINGTON BANCSHARES INC | | | 171,631 | |

| ICON PLC | | | 446,118 | |

| INTERCONTINENTAL EXCHANGE | | | 327,625 | |

| JACOBS SOLUTIONS INC | | | 274,916 | |

| JPMORGAN CHASE & CO | | | 1,419,551 | |

| KENVUE INC | | | 303,982 | |

| KEURIG DR PEPPER INC | | | 336,399 | |

| LAM RESEARCH CORP | | | 227,929 | |

| LEIDOS HLDGS INC | | | 298,526 | |

| LKQ CORP | | | 98,113 | |

| MARATHON PETROLEUM CORP | | | 474,455 | |

| MASCO CORPORATION | | | 306,300 | |

| MCKESSON CORP | | | 356,958 | |

| MGM RESORTS INTL | | | 276,793 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| MICROCHIP TECH | | | 426,281 | |

| MICRON TECH INC | | | 450,339 | |

| MOHAWK INDU INC | | | 148,523 | |

| MORGAN STANLEY | | | 785,538 | |

| NICE LTD SPON ADR | | | 146,041 | |

| NXP SEMICONDUCTORS NV | | | 101,978 | |

| OLIN CORP | | | 135,468 | |

| OMNICOM GROUP INC | | | 312,301 | |

| ORACLE CORP | | | 466,001 | |

| OTIS WORLDWIDE CORP | | | 135,547 | |

| PEABODY ENERGY CORP | | | 154,140 | |

| PHILIP MORRIS INTL INC | | | 610,579 | |

| PHILLIPS 66 | | | 339,374 | |

| QUALCOMM INC | | | 154,465 | |

| RAYTHEON TECH CORP | | | 341,608 | |

| SANOFI SPON ADR | | | 609,889 | |

| SCHLUMBERGER LTD | | | 371,409 | |

| SCHWAB CHARLES CORP | | | 304,027 | |

| SS&C TECH HLDGS INC | | | 155,464 | |

| TAKE-TWO INTERACTV SOFTWR | | | 136,325 | |

| TECK RESOURCES LTD SUB VT | | | 225,299 | |

| THE BOOKING HLDGS INC | | | 297,966 | |

| T-MOBILE US INC | | | 487,403 | |

| ULTA BEAUTY INC | | | 190,606 | |

| UNITED RENTALS INC | | | 546,469 | |

| UNITEDHEALTH GROUP INC | | | 573,326 | |

| US FOODS HLDGS CORP | | | 374,814 | |

| WALMART INC | | | 536,798 | |

| WARNER BROS DISCOVERY INC | | | 208,709 | |

| WELLS FARGO & CO | | | 586,358 | |

| WESCO INTL INC | | | 320,287 | |

| WESTINGHOUSE AIR BRAKE TE | | | 302,022 | |

| WHIRLPOOL CORP | | | 93,641 | |

| WILLSCOT MOBILE MINI HLDG | | | 176,620 | |

| SUBTOTAL | | | $ | 33,230,851 | |

| | | | |

| Robeco Small/Mid Capitalization Value Equity Fund | US Small/Mid Cap Stock Fund | | |

| ACUITY BRANDS INC | | | $ | 178,817 | |

| AES CORP | | | 72,053 | |

| AGCO CORP | | | 138,286 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| ALIGHT INC CL A | | | 127,651 | |

| ALLISON TRANSMISSION HLDG | | | 175,729 | |

| AMEDISYS INC | | | 69,679 | |

| AMERIS BANCORP | | | 97,028 | |

| AMKOR TECH INC | | | 114,016 | |

| AMN HEALTHCARE SVCS INC | | | 121,680 | |

| APPLOVIN CORP | | | 107,197 | |

| ARRAY TECH INC | | | 94,685 | |

| ARROW ELECTRONICS INC | | | 110,759 | |

| ASHLAND INC | | | 125,200 | |

| ASSURANT INC | | | 100,589 | |

| ASSURED GUARANTY LTD | | | 181,089 | |

| ATKORE INC | | | 166,240 | |

| AVANTOR INC | | | 125,930 | |

| AVNET INC | | | 123,329 | |

| AXIS CAPITAL HLDGS LTD | | | 141,692 | |

| BEACON ROOFING SUPPLY INC | | | 259,320 | |

| BELDEN INC | | | 64,813 | |

| BELLRING BRANDS INC | | | 149,162 | |

| BERKLEY (WR) CORP | | | 71,922 | |

| BERKSHIRE HILLS BANCORP I | | | 46,333 | |

| BGC GROUP INC A | | | 132,357 | |

| BLOOMIN BRANDS INC | | | 97,765 | |

| BLUE OWL CAPITAL INC A | | | 79,745 | |

| BOWLERO CORP A | | | 200,279 | |

| BOYD GAMING CORP | | | 178,188 | |

| BRADY CORPORATION CL A | | | 116,265 | |

| BRINKER INTL INC | | | 86,187 | |

| BRINKS CO | | | 355,670 | |

| BUCKLE INC (THE) | | | 89,338 | |

| BUILDERS FIRSTSOURCE | | | 108,344 | |

| CACTUS INC CL A | | | 70,461 | |

| CALERES INC | | | 79,007 | |

| CARLISLE COS INC | | | 102,477 | |

| CARS.COM INC | | | 90,923 | |

| CATALYST PHARMACEUTICALS | | | 94,422 | |

| CBOE GLOBAL MARKETS INC | | | 163,561 | |

| CHAMPIONX CORP | | | 79,685 | |

| CHECK POINT SOFTWARE TECH | | | 235,144 | |

| CHEMED CORP | | | 69,001 | |

| CIENA CORP | | | 115,676 | |

| CLEARFIELD INC | | | 100,442 | |

| COHERENT CORP | | | 94,199 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| CONCENTRIX CORP | | | 165,484 | |

| CORECIVIC INC | | | 148,860 | |

| COUSINS PROPERTIES INC | | | 65,331 | |

| CURTISS WRIGHT CORPORATIO | | | 217,443 | |

| DAVE & BUSTERS ENTMT INC | | | 108,185 | |

| DIME COMMUNITY BANCSHARES | | | 65,171 | |

| DROPBOX INC CL A | | | 121,517 | |

| DUN & BRADSTREET HLDGS IN | | | 96,478 | |

| EAST WEST BANCORP INC | | | 239,594 | |

| ECOVYST INC | | | 115,999 | |

| ELDORADO GOLD CORP | | | 119,778 | |

| EMCOR GROUP INC | | | 194,533 | |

| ENACT HLDGS INC | | | 77,165 | |

| ENERPLUS CORP | | | 76,255 | |

| ENERSYS INC | | | 157,498 | |

| ESSENT GROUP LTD | | | 163,441 | |

| ESSEX PROPERTY TR INC | | | 89,506 | |

| EVERCORE INC A | | | 197,734 | |

| EVEREST GROUP LTD | | | 167,243 | |

| EXPEDIA INC | | | 99,574 | |

| EXPRO GROUP HLDGS NV | | | 105,597 | |

| EXTREME NETWORKS INC | | | 104,905 | |

| FEDERAL AGRI MTG NON VTG | | | 243,423 | |

| FIRST ADVANTAGE CORP | | | 124,706 | |

| FIRST CITIZENS BANCSHARES | | | 66,692 | |

| FIRST MERCHANTS CORP | | | 94,702 | |

| FIRSTCASH HLDGS INC | | | 217,756 | |

| FLEX LTD | | | 236,278 | |

| FMC CORP NEW | | | 82,596 | |

| FORTREA HLDGS INC | | | 137,087 | |

| FRONTDOOR INC | | | 143,768 | |

| FTI CONSULTING INC | | | 235,594 | |

| GEN DIGITAL INC | | | 189,041 | |

| GRANITE CONSTRUCTION INC | | | 143,985 | |

| GRAPHIC PACKAGING HLDGS C | | | 150,932 | |

| HAEMONETICS CORP MASS | | | 229,252 | |

| HALOZYME THERAPEUTICS INC | | | 75,398 | |

| HANCOCK WHITNEY CORP | | | 120,260 | |

| HENRY SCHEIN INC | | | 98,423 | |

| HERITAGE COMMERCE CORP | | | 82,653 | |

| HF SINCLAIR CORP | | | 93,969 | |

| HUB GROUP INC CL A | | | 96,997 | |

| HUNTINGTON BANCSHARES INC | | | 132,364 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| ICON PLC | | | 367,425 | |

| INGREDION INC | | | 120,251 | |

| INSIGHT ENTERPRISES INC | | | 90,190 | |

| INTERDIGITAL INC | | | 190,922 | |

| INTERPUBLIC GROUP OF COS | | | 134,150 | |

| INTL GAME TECH PLC | | | 19,872 | |

| JABIL INC | | | 115,934 | |

| JACOBS SOLUTIONS INC | | | 136,550 | |

| JEFFERIES FIN GROUP INC | | | 99,368 | |

| JUNIPER NETWORKS INC | | | 84,195 | |

| KOSMOS ENERGY LTD | | | 89,981 | |

| LAMAR ADVERTISING CO CL A | | | 113,932 | |

| LAMB WESTON HLDGS INC | | | 114,900 | |

| LANDSTAR SYS INC | | | 53,254 | |

| LANTHEUS HLDGS INC | | | 135,346 | |

| LAUREATE EDUCATION INC | | | 251,798 | |

| LCI INDU | | | 127,596 | |

| LEGALZOOM.COM INC | | | 153,465 | |

| LEONARDO DRS INC | | | 151,062 | |

| LITHIA MOTORS INC CL A | | | 304,255 | |

| LIVE NATION ENTERTAINMENT | | | 74,786 | |

| LKQ CORP | | | 52,091 | |

| LPL FINL HLDGS INC | | | 137,255 | |

| MASONITE WORLDWIDE HLDGS | | | 112,175 | |

| MATCH GROUP INC | | | 81,724 | |

| METHANEX CORP | | | 72,508 | |

| MGM RESORTS INTL | | | 95,392 | |

| MIDDLEBY CORP | | | 84,770 | |

| MOLINA HEALTHCARE INC | | | 121,039 | |

| MOLSON COORS BEVERAGE CO | | | 74,064 | |

| NCR ATLEOS CORP | | | 44,961 | |

| NCR VOYIX CORP | | | 62,601 | |

| NETAPP INC | | | 133,033 | |

| NEW JERSEY RESOURCES CORP | | | 47,344 | |

| NEXSTAR MEDIA GROUP INC | | | 208,948 | |

| NISOURCE INC | | | 94,624 | |

| NOBLE CORP PLC | | | 174,965 | |

| NOMAD FOODS LTD | | | 92,022 | |

| NOW INC | | | 61,920 | |

| OLD NATIONAL BANCORP (IND | | | 147,838 | |

| PAR PACIFIC HLDGS INC | | | 159,410 | |

| PATTERSON-UTI ENERGY INC | | | 51,872 | |

| PEAPACK GLADSTONE FINL CO | | | 58,060 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| PEDIATRIX MEDICAL GROUP I | | | 49,430 | |

| PEGASYS INC | | | 61,808 | |

| PENNYMAC FIN SVCS INC | | | 124,955 | |

| PERFORMANCE FOOD GROUP CO | | | 97,778 | |

| PERRIGO CO PLC | | | 37,683 | |

| * | PINNACLE WEST CAPITAL COR | | | 83,478 | |

| PORTLAND GEN ELECTRIC CO | | | 48,888 | |

| PREFERRED BANK LOS ANGELE | | | 109,356 | |

| PROPETRO HLDGS CORP | | | 63,185 | |

| QORVO INC | | | 122,294 | |

| QUIDELORTHO CORP | | | 66,625 | |

| RALPH LAUREN CORP | | | 105,266 | |

| RANGE RESOURCES CORP | | | 81,518 | |

| RENAISSANCERE HLDGS LTD | | | 136,612 | |

| SCIENCE APPLICATIONS INTL | | | 216,068 | |

| SELECT WATER SOLUTIONS IN | | | 59,688 | |

| SENSATA TECH HLDGS PLC | | | 95,841 | |

| SHARKNINJA INC | | | 74,197 | |

| SIMPLY GOOD FOODS CO | | | 89,258 | |

| SKYWORKS SOLUTIONS INC | | | 58,234 | |

| SLM CORP | | | 441,232 | |

| SOUTHSTATE CORP | | | 177,345 | |

| SS&C TECH HLDGS INC | | | 78,587 | |

| STEVEN MADDEN LTD | | | 218,064 | |

| STRIDE INC | | | 69,878 | |

| TD SYNNEX CORP | | | 263,537 | |

| TEGNA INC | | | 207,483 | |

| TEMPUR SEALY INTL INC | | | 198,987 | |

| TEXTRON INC | | | 179,015 | |

| THOR INDU INC | | | 84,194 | |

| TIDEWATER INC | | | 90,642 | |

| TOPGOLF CALLAWAY BRANDS C | | | 86,370 | |

| TRINET GROUP INC | | | 94,906 | |

| UNIVERSAL HEALTH SVCS INC | | | 99,696 | |

| US FOODS HLDGS CORP | | | 175,600 | |

| US SILICA HLDGS INC | | | 57,715 | |

| VALMONT INDU INC | | | 111,151 | |

| VECTOR GROUP LTD | | | 72,305 | |

| VIPER ENERGY INC | | | 182,412 | |

| VIVID SEATS INC-CL A | | | 74,639 | |

| VOYA FIN INC | | | 186,340 | |

| WALKER & DUNLOP INC | | | 105,237 | |

| WEATHERFORD INTL PLC | | | 216,400 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| WEBSTER FIN | | | 84,769 | |

| WESCO INTL INC | | | 365,496 | |

| WESTERN ALLIANCE BANCORP | | | 268,028 | |

| WEX INC | | | 86,186 | |

| WHITE MOUNTAINS INS GROUP | | | 112,876 | |

| WINTR FIN CORP | | | 199,320 | |

| WORLD KINECT CORP | | | 77,926 | |

| SUBTOTAL | | | $ | 23,141,848 | |

| | | | |

| Total common stocks | | | $ | 90,125,078 | |

| | | | |

| Common and Collective Trusts | | | |

| Blackrock US Debt Index NL Fund M | US Bond Index | | $ | 148,269,634 | |

| Northern Trust Collective 1-10 Yr Treasury Inflation-Protected Securities (TIPS) Index Fund - NL - Tier Three | Diversified Inflation Fund | | 38,925,429 |

| SSgA Global All Cap Equity Ex US Index Non-Lending Series Fund Class A | Non-US Stock Index | | 161,134,296 |

| SSgA S&P 500 Index Non-Lending Series Fund Class A | US Large Cap Stock Fund/Index | | 395,843,671 |

| SSgA Russell Small/Mid Cap Index Non-Lending Series Fund

Class A | US Small/Mid Cap Stock Fund/Index | | 109,294,049 |

| William Blair Small/Mid Cap Growth Collective Fund | US Small/Mid Cap Stock Fund | | 21,975,216 |

| Total common and collective trusts | | | $ | 875,442,295 | |

| | | | |

| Mutual Funds | | | |

| * | Fidelity Institutional Money Market: Government Portfolio - Class I | Short-Term Investments*** | | $ | 2,846,838 | |

| * | Fidelity Institutional Money Market: Treasury Portfolio - Class I | Short-Term Investments*** | | 604,662 |

| Federated Treasury Obligations Fund - Institutional Shares | Short-Term Investments*** | | 101,397 |

| American Funds EuroPacific Growth Fund R6 Shares | Non-US Stock Fund | | 119,616,596 |

| Dodge & Cox Income Fund 1 Shares | Bond Fund | | 34,563,800 |

| Metropolitan West Total Return Bond Fund Institutional Shares | Bond Fund | | 34,172,599 |

| Total mutual funds | | | $ | 191,905,892 | |

| | | | |

| SGICs | Stable Value Fund | | |

| RGA Reinsurance Co yield 2.571% | | | |

| Morley Stable Income Bond Fund Common and Collective Trust | | | $ | 38,291,035 | |

| Principal Life Ins Co yield 2.472% | | | |

| Morley Stable Income Bond Fund Common and Collective Trust | | | 34,125,041 |

| Transamerica Premier Life Ins Co yield 2.580% | | | |

| Morley Stable Income Bond Fund Common and Collective Trust | | | 37,865,066 |

| Total SGICs | | | $ | 110,281,142 | |

| | | | |

| Other Investments | | | |

| * | Pinnacle West Common Stock | Pinnacle West Stock Fund | | $ | 47,548,166 | |

FORM 5500, SCHEDULE H, PART IV, LINE 4i

PLAN # 002 EIN # 86-0512431

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) Identity of Issuer, Borrower, Lessor, or Similar Party | (c) Description | (d) Cost** | (e) Current Value |

| Self-Directed Brokerage Account | Self-Directed Brokerage Account | | 111,782,374 |

| BBH STIF Fund | Short-Term Investments*** | | 1,811,399 |

| * | Various participants**** | Participant loans | | 20,950,219 |

| Total other investments | | | $ | 182,092,158 | |

| | | | |

| Total Assets Held for Investment Purposes | | | $ | 1,449,846,565 | |

| | | | |

*Party-in-interest

**Cost information is not required for participant-directed investments and therefore is not included.

***Short-Term Investments represent $2,846,838 held in the Stable Value Fund, $1,811,399 in the US Small/Mid Cap Stock Fund and US Large Cap Stock Fund, $604,662 in the Pinnacle West Stock Fund and $101,397 in the Treasury Fund.

****Interest rates for participant loans as of December 31, 2023, ranged from 4.25% to 9.50% with maturity dates ranging from 2023 to 2038. Presented net of $768,002 in deemed loan distributions.

Exhibit Filed

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 23.1 | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | THE PINNACLE WEST CAPITAL |

| | | CORPORATION SAVINGS PLAN |

| | | | |

| | | | |

| Date: | June 14, 2024 | By | /s/ Shannon Standaert |

| | | | Shannon Standaert |

| | | | Senior Vice President Human Resources & Ethics |

| | | | Arizona Public Service Company |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-157151 on Form S-8 of our report dated June 14, 2024, relating to the financial statements and supplemental schedule of The Pinnacle West Capital Corporation Savings Plan appearing in this Annual Report on Form 11-K for the year ended December 31, 2023.

/s/ DELOITTE & TOUCHE LLP

Tempe, Arizona

June 14, 2024

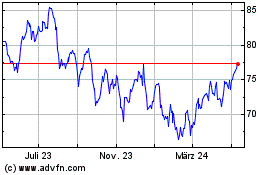

Pinnacle West Capital (NYSE:PNW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

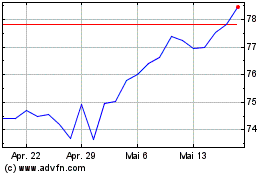

Pinnacle West Capital (NYSE:PNW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025