As filed with the Securities and Exchange Commission on August 19, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-8

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

Piper

SANDLER Companies

(Exact name of registrant as specified in its charter)

| Delaware |

|

|

|

30-0168701 |

(State or other jurisdiction of

incorporation or organization)

800 Nicollet Mall, Suite 900

Minneapolis, Minnesota

(Address of Principal Executive

Offices) |

|

|

|

(I.R.S. Employer

Identification No.)

55402

(Zip Code) |

PIPER SANDLER COMPANIES 2024 EMPLOYMENT INDUCEMENT

AWARD PLAN

(Full title of the plan)

John W. Geelan

General Counsel and Secretary

Piper Sandler Companies

800 Nicollet Mall, Suite 900

Minneapolis, Minnesota 55402

(Name and address of agent for service)

(612) 303-6000

(Telephone number, including area code, of agent

for service)

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

|

Accelerated

filer ¨ |

| Non-accelerated filer ¨ |

|

Smaller reporting company ¨ |

| |

|

Emerging growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

PART

I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information required

by Part I of Form S-8 will be sent or given to employees as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the

“Securities Act”). Such documents need not be filed with the U.S. Securities and Exchange Commission (the “Commission”),

either as part of this registration statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

These documents and the documents incorporated by reference in this registration statement pursuant to Item 3 of Part II of Form S-8,

taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART

II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The following documents, which have been filed

by Piper Sandler Companies (hereinafter the “Company” or the “Registrant”) with the Commission pursuant to the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) are incorporated by reference herein and shall be deemed

to be a part hereof:

(a) The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on February 26, 2024;

(b) The

Registrant’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, filed with the Commission on May 7, 2024, and

June 30, 2024, filed with the Commission on August 6, 2024;

(c) The Registrant’s Current Report on Form 8-K filed on May 28, 2024; and

(d) The

description of the Registrant’s Common Stock contained in Exhibit 4.7 to the Registrant’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2019, filed with the Commission on February 28, 2020, including any amendment or report filed for

the purpose of updating such description.

All other documents filed by the Company with the

Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act subsequent to the date of this registration statement and

prior to the filing of a post-effective amendment to this registration statement that indicates that all securities offered hereunder

have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this registration

statement and to be a part hereof from the date of filing of such documents, except as to any portion of any future filings that are deemed

furnished and not filed. In this registration statement, these documents, and the documents enumerated above, are referred to as the “incorporated

documents.”

Any statement contained in an incorporated document

will be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein

or in any other subsequently filed incorporated document modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item

4. Description of Securities.

Not applicable.

Item

5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification

of Directors and Officers.

The Registrant is incorporated under the laws of

the State of Delaware. The Registrant’s amended and restated certificate of incorporation limits the liability of the Registrant’s

directors to the fullest extent permitted by Delaware law. Delaware law provides that directors of a corporation will not be personally

liable for monetary damages for breach of their fiduciary duties as directors, except for liability for any:

| · | breach of their duty of loyalty to the corporation or its stockholders; |

| · | act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| · | unlawful payment of dividends or redemption of shares as provided in Section 174 of the Delaware General Corporation Law; or |

| · | transaction from which the directors derived an improper personal benefit. |

These limitations of liability do not apply to

liabilities arising under federal securities laws and do not affect the availability of equitable remedies such as injunctive relief or

rescission.

In addition, the Registrant’s amended and

restated certificate of incorporation and amended and restated bylaws provide that the Registrant is required to indemnify its officers

and directors under certain circumstances, including those circumstances in which indemnification would otherwise be discretionary, and

the Registrant is required to advance expenses to its officers and directors as incurred in connection with proceedings against them for

which they may be indemnified. Under Delaware law, the right to indemnification and advancement of expenses under the Registrant’s

certificate of incorporation and bylaws may not be eliminated or impaired by an amendment to such provisions after the act or omission

that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification or advancement

of expenses is sought.

The Registrant maintains directors’ and officers’

liability insurance for the benefit of its directors and officers.

Item

7. Exemption From Registration Claimed.

Not applicable.

Item

8. Exhibits.

The exhibits filed herewith or incorporated by

reference herein are set forth in the Exhibit Index filed as part of this registration statement.

EXHIBIT INDEX

| Exhibit No. |

|

Description |

|

Method of Filing |

| 4.1 |

|

Amended and Restated Certificate of Incorporation |

|

(1) |

| 4.2 |

|

Amended and Restated Bylaws (as of February 9, 2023) |

|

(2) |

| 4.3 |

|

Form of Specimen Certificate for Piper Sandler Companies Common Stock |

|

(3) |

| 4.4 |

|

Piper Sandler Companies 2024 Employment Inducement Award Plan |

|

Filed herewith |

| 5.1 |

|

Opinion of Sullivan & Cromwell LLP |

|

Filed herewith |

| 23.1 |

|

Consent of Ernst & Young LLP |

|

Filed herewith |

| 23.2 |

|

Consent of Sullivan & Cromwell LLP |

|

Included in Exhibit 5.1 |

| 24.1 |

|

Power of Attorney |

|

Filed herewith |

| 107 |

|

Filing Fee Table |

|

Filed herewith |

| |

|

|

|

|

| (1) |

|

Filed as Exhibit 3.1 to the Registrant’s Current Report on Form 8-K, filed with the Commission on May 18, 2023, and incorporated herein by reference. |

| (2) |

|

Filed as Exhibit 3.1 to the Registrant’s Current Report on Form 8-K, filed with the Commission on February 10, 2023, and incorporated herein by reference. |

| (3) |

|

Filed as Exhibit 4.1 to the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2017, filed with the Commission on February 26, 2018, and incorporated herein by reference. |

Item

9. Undertakings.

(a) The undersigned Registrant

hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Filing

Fee Tables” or “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement;

provided,

however, that paragraphs (a)(l)(i) and (a)(l)(ii) of this section do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

* * *

(b) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in

this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

* * *

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted

to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has

been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and

is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant

of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit

or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and

has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Minneapolis,

State of Minnesota, on August 7, 2024.

| |

PIPER SANDLER COMPANIES |

| |

(Registrant) |

| |

|

| |

|

| |

By: |

/s/ Chad R. Abraham |

| |

|

Name: Chad R. Abraham |

| |

|

Title: Chairman and Chief Executive Officer |

Pursuant to the requirements of the Securities

Act, this registration statement has been signed by the following persons in the capacities and on the date indicated.

| SIGNATURE |

|

TITLE |

|

DATE |

| |

|

|

|

|

| /s/ Chad R. Abraham |

|

Chairman and Chief Executive Officer |

|

August 19, 2024 |

| Chad R. Abraham |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Katherine P. Clune |

|

Chief Financial Officer |

|

August 19, 2024 |

| Katherine P. Clune |

|

(Principal Financial Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Jonathan J. Doyle |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| William R. Fitzgerald |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Victoria M. Holt |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Robbin Mitchell |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Thomas S. Schreier, Jr. |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Sherry M. Smith |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Philip E. Soran |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Brian R. Sterling |

|

|

|

|

| * |

|

Director |

|

August 19, 2024 |

| Scott C. Taylor |

|

|

|

|

| * | John W. Geelan, by signing his name hereto, does sign this document on behalf of the above noted individuals, pursuant to the powers

of attorney duly executed by such individuals which have been filed as an exhibit to this registration statement. |

| |

By: |

/s/ John W. Geelan |

| |

|

Name: John W. Geelan |

| |

|

Title: Attorney-in-Fact |

Exhibit 4.4

Piper Sandler Companies

2024 Employment Inducement Award Plan

Section 1. Purpose

The purpose of the Plan is to promote the interests

of the Company and its stockholders by giving the Company a competitive advantage in attracting personnel capable of assuring the future

success of the Company and to provide such personnel with an appropriate and material inducement to become employees of the Company (including

in connection with a corporate transaction).

Section 2. Definitions

As used in the Plan, the following terms shall

have the meanings set forth below. To the extent any such term is defined in an applicable Award Agreement, the definition in such

Award Agreement shall control.

(a) “Affiliate” means

any entity directly or indirectly controlling, controlled by or under common control with the Company.

(b) “Award” means

any Restricted Share Award or Restricted Mutual Fund Share Award granted under the Plan.

(c) “Award Agreement” means

any written (including electronic) agreement, contract or other instrument or document evidencing any Award granted under the Plan.

(d) “Board” means

the Board of Directors of the Company.

(e) “Code” means the

Internal Revenue Code of 1986, as amended from time to time, and any regulations promulgated thereunder.

(f) “Change in Control” has

the meaning set forth in the Piper Sandler Companies Amended and Restated 2003 Annual and Long-Term Incentive Plan, as in effect on the

date hereof.

(g) “Committee” means

a committee of Directors designated by the Board to administer the Plan, which initially shall be the Compensation Committee of the Board.

The Committee shall be comprised of not less than such number of Directors as shall be required to permit Awards granted under the Plan

to qualify under Rule 16b-3, and each member of the Committee shall be an Outside Director.

(h) “Company” means

Piper Sandler Companies, a Delaware corporation.

(i) “Corporate Transaction” has

the meaning set forth in the Piper Sandler Companies Amended and Restated 2003 Annual and Long-Term Incentive Plan, as in effect on the

date hereof.

(j) “Director” means

a member of the Board, including any Outside Director.

(k) “Effective Date” means

August 23, 2024.

(l) “Eligible Individual” means

any employee (including any officer) or prospective employee of the Company or any Affiliate who is eligible to receive an employment

inducement award within the meaning of Section 303A.08, or any successor provision, of the New York Stock Exchange Listed Company

Manual.

(m) “Exchange Act” means

the Securities Exchange Act of 1934, as amended from time to time.

(n) “Mutual Fund Share”

means a share of selected mutual funds.

(o) “Outside Director” means

any Director who qualifies as a “non-employee director” within the meaning of Rule 16b-3 and as an “independent

director” pursuant to the requirements of the New York Stock Exchange.

(p) “Participant” means

an Eligible Individual designated to be granted an Award under the Plan.

(q) “Plan” means this

Piper Sandler Companies 2024 Employment Inducement Award Plan, as set forth herein and as hereinafter amended from time to time.

(r) “Restricted Share” means

any Share granted under Section 6 of the Plan.

(s) “Restricted Share Award”

means an Award of Restricted Shares granted under Section 6 of the Plan. All Restricted Share Awards are intended to qualify

as employment inducement awards within the meaning of Section 303A.08, or any successor provision, of the New York Stock Exchange

Listed Company Manual.

(t) “Restricted Mutual Fund Share”

means any Mutual Fund Share granted under Section 7 of the Plan.

(u) “Restricted Mutual Fund Share

Award” means an Award of Restricted Mutual Fund Shares granted under Section 7 of the Plan.

(v) “Rule 16b-3” means

Rule 16b-3, as promulgated by the Securities and Exchange Commission under Section 16(b) of the Exchange Act, as amended

from time to time.

(w) “Share” or “Shares” means

a share or shares of common stock, par value $0.01 per share, of the Company.

Section 3. Administration

(a) Power and Authority of the Committee. The

Plan shall be administered by the Committee. Subject to the terms of the Plan and to applicable law, the Committee shall have full power

and authority to:

(i) designate Participants;

(ii) determine whether and to what extent any

type (or types) of Award is to be granted hereunder;

(iii) determine the number of Shares or Mutual

Fund Shares to be covered by (or the method by which payments or other rights are to be determined in connection with) each Award;

(iv) determine the terms and conditions of any

Award or Award Agreement;

(v) subject to Section 11 hereof, amend

the terms and conditions of any Award or Award Agreement and accelerate the vesting or waive any restrictions relating to any Award;

(vi) determine whether, to what extent and under

what circumstances cash, Shares, Mutual Fund Shares, other securities, other Awards, other property and other amounts payable with respect

to an Award under the Plan shall be deferred either automatically or at the election of the holder thereof or the Committee;

(vii) interpret and administer the Plan and

any instrument or agreement, including an Award Agreement, relating to the Plan;

(viii) adopt, alter, suspend, waive or repeal

such rules, guidelines and practices and appoint such agents as it shall deem advisable or appropriate for the proper administration of

the Plan; and

(ix) make any other determination and take any

other action that the Committee deems necessary or desirable for the administration of the Plan.

Unless otherwise expressly provided in the Plan,

all designations, determinations, interpretations and other decisions under or with respect to the Plan or any Award or Award Agreement

shall be within the sole discretion of the Committee, may be made at any time and shall be final, conclusive and binding upon all persons,

including without limitation, the Company, its Affiliates, shareholders, Eligible Individuals and any holder or beneficiary of any Award.

(b) Action by the Committee; Delegation. Except

to the extent prohibited by applicable law or the applicable rules of a stock exchange, the Committee may delegate all or any part

of its duties and powers under the Plan to one or more persons, including Directors or a committee of Directors, subject to such terms,

conditions and limitations as the Committee may establish in its sole discretion; provided, however, that the

Committee shall not delegate its powers and duties under the Plan with regard to officers or directors of the Company or any Affiliate

who are subject to Section 16 of the Exchange Act and provided, further, that any such delegation may be

revoked by the Committee at any time.

(c) Power and Authority of the Board. Notwithstanding

anything to the contrary contained herein, except to the extent that the grant or exercise of such authority would cause any Award or

transaction to become subject to (or lose an exemption under) the short-swing profit recovery provisions of Section 16 of the Exchange

Act, the Board may, at any time and from time to time, without any further action of the Committee, exercise the powers and duties of

the Committee under the Plan. To the extent that any permitted action taken by the Board conflicts with action taken by the Committee,

the Board action shall control.

Section 4. Shares Available for Awards

(a) Shares Available. Subject

to adjustment as provided in Section 4(c) of the Plan, the aggregate number of Shares that may be the subject of outstanding

Restricted Share Awards and issued under the Plan shall be 50,000. Shares issuable

under the Plan may be authorized but unissued Shares or Shares re-acquired and held in treasury.

(b) Accounting for Restricted Share Awards. For

purposes of this Section 4, if a Restricted Share Award entitles the holder thereof to receive or purchase Shares, the number of

Shares covered by such Restricted Share Award or to which such Restricted Share Award relates shall be counted on the date of grant of

such Restricted Share Award against the aggregate number of Shares available for granting Restricted Share Awards under the Plan. Any

Shares that are used by a Participant as full or partial payment to the Company of the purchase price relating to a Restricted Share Award,

or to satisfy applicable tax obligations relating to a Restricted Share Award, shall again be available for granting Restricted Share

Awards under the Plan. In addition, if any Shares covered by a Restricted Share Award or to which a Restricted Share Award relates are

not purchased or are forfeited, or if a Restricted Share Award otherwise terminates without delivery of any Shares, then the number of

Shares counted against the aggregate number of Shares available under the Plan with respect to such Restricted Share Award, to the extent

of any such failure to purchase, forfeiture or termination, shall again be available for granting Restricted Share Awards under the Plan.

(c) Adjustments. In the

event of any change in corporate capitalization (including, but not limited to, a change in the number of Shares outstanding), such as

a stock split or a corporate transaction, such as any merger, consolidation, separation, including a spin-off, or other distribution of

stock or property of the Company (including any extraordinary cash or stock dividend), any reorganization (whether or not such reorganization

comes within the definition of such term in Section 368 of the Code) or any partial or complete liquidation of the Company, the Committee

or Board shall make such substitution or adjustments in the aggregate number and kind of shares reserved for issuance under the Plan,

in the maximum limitation upon Restricted Share Awards to be granted to any Participant, in the number and kind of shares subject to outstanding

Restricted Share Awards granted under the Plan and/or such other equitable substitutions or adjustments as it may determine to be appropriate

in its sole discretion (including, without limitation, the provision of an amount in cash in consideration for any such Restricted Share

Awards to the extent cash is being provided to the holders of Shares generally); provided, however, that the number

of shares subject to any Restricted Share Award shall always be a whole number. Without limiting the generality of the foregoing, in connection

with any Disaffiliation of a subsidiary of the Company, the Committee shall have the authority to arrange for the assumption or replacement

of Restricted Share Awards with new awards based on shares of the affected subsidiary or by an affiliate of an entity that controls the

subsidiary following the Disaffiliation. For purposes hereof, “Disaffiliation” of a subsidiary shall mean the subsidiary’s

ceasing to be a subsidiary of the Company for any reason (including, without limitation, as a result of a public offering, spin-off, sale

or other distribution or transfer by the Company of the stock of the subsidiary). Notwithstanding the foregoing, to the extent that any

Restricted Share Award is otherwise considered to be deferred compensation under Section 409A of the Code, any adjustment to such

Restricted Share Award will comply with Section 409A of the Code (including current and future guidance issued by the Department

of Treasury and/or the Internal Revenue Service).

Section 5. Eligibility

Any Eligible Individual shall be eligible to be

designated a Participant. In determining which Eligible Individuals shall receive an Award and the terms of any Award, the Committee may

take into account the nature of the services to be rendered by the respective Eligible Individuals, their potential contributions to the

success of the Company or such other factors as the Committee, in its discretion, shall deem relevant. Awards will only be granted to

an Eligible Individual as a material inducement to such Eligible Individual to become an employee of the Company or one of its Affiliates

(including in connection with a corporate transaction) or to be rehired by the Company or one of its Affiliates following a bona fide

interruption of employment. Any grant of an Award shall not become effective unless and until the Eligible Individual actually becomes

an employee of the Company or one of its Affiliates.

Section 6. Restricted Share Awards

The Committee is hereby authorized to grant Restricted

Shares to Eligible Individuals with the following terms and conditions and with such additional terms and conditions not inconsistent

with the provisions of the Plan as the Committee shall determine or as otherwise set forth in the Award Agreement:

(a) Restrictions. Restricted

Shares shall be subject to such restrictions as the Committee may impose (including, without limitation, limitations on transfer, forfeiture

conditions, limitations on the right to vote a Restricted Share or the right to receive any dividend or other right or property with respect

thereto), which restrictions may lapse separately or in combination at such time or times, in such installments or otherwise as the Committee

may deem appropriate.

(b) Stock Certificates; Delivery

of Shares. Any Restricted Shares granted under the Plan shall be evidenced in such manner as the Committee may deem appropriate, including

book-entry registration or issuance of one or more stock certificates. Any certificate issued in respect of Restricted Shares shall be

registered in the name of such Participant and shall bear an appropriate legend referring to the applicable Award Agreement and possible

forfeiture of such Restricted Shares. The Committee may require that the certificates evidencing such Shares be held in custody by the

Company until the restrictions thereon shall have lapsed and that, as a condition of any Award of Restricted Shares, the Participant shall

have delivered a stock power, endorsed in blank, relating to the Shares covered by such Restricted Share Award.

(c) Forfeiture. Except as otherwise

determined by the Committee or provided in an Award Agreement, upon a Participant’s termination of employment (as determined under

criteria established by the Committee) during the applicable restriction period, all applicable Restricted Shares at such time subject

to restriction shall be forfeited and reacquired by the Company; provided, however, that the Committee may, when

it finds that a waiver would be in the best interest of the Company, waive in whole or in part any or all remaining restrictions with

respect to Restricted Shares.

(d) Restrictions. All Shares or other

securities delivered under the Plan pursuant to any Restricted Share Award shall be subject to such stop transfer orders and other restrictions

as the Committee may deem advisable under the Plan, applicable federal or state securities laws and regulatory requirements, and the Committee

may direct appropriate stop transfer orders and cause other legends to be placed on the certificates for such Shares or other securities

to reflect such restrictions.

Section 7. Restricted Mutual Fund Share Awards

The Committee is hereby authorized to grant Restricted

Mutual Fund Shares to Eligible Individuals with the following terms and conditions and with such additional terms and conditions not inconsistent

with the provisions of the Plan as the Committee shall determine or as otherwise set forth in the Award Agreement:

(a) Restrictions. Shares of Restricted

Mutual Funds shall be subject to such restrictions as the Committee may impose (including, without limitation, limitations on transfer,

forfeiture conditions), which restrictions may lapse separately or in combination at such time or times, in such installments or otherwise

as the Committee may deem appropriate.

(b) Election. A Participant may elect to receive

a portion of the Award that would otherwise have been made to the Participant in the form of Restricted Shares instead in the form of

Restricted Mutual Fund Shares.

(c) Form of

the Election. Any such election shall be made at such time, on such form and in accordance with such rules as may be prescribed

for this purpose by the Company. While a Participant is not required to elect to receive any portion of an award in Restricted Mutual

Fund Shares, an election to receive a portion of an award in Restricted Mutual Fund Shares must relate to not more than fifty percent

(50%) of the Participant’s award under the Plan.

(d) No

Reallocation. Unless otherwise determined by the Company, no reallocation in the selected mutual funds shall be permitted after

the Participant has completed and submitted the election form and the deadline for the submitting election forms, if any, has passed.

Such election by the Participant shall also be irrevocable.

(e) Mutual Funds Distributed as Restricted Mutual

Fund Shares. The Company shall select the mutual funds in which Restricted Mutual Fund Shares will be issued, and may add to, remove

or substitute funds at the sole discretion of the Company.

(f) Forfeiture. Except as otherwise determined

by the Committee or provided in an Award Agreement, upon a Participant’s termination of employment (as determined under criteria

established by the Committee) during the applicable restriction period, all applicable Mutual Fund Shares at such time subject to restriction

shall be forfeited and reacquired by the Company; provided, however, that the Committee may, when it finds that

a waiver would be in the best interest of the Company, waive in whole or in part any or all remaining restrictions with respect to Mutual

Fund Shares.

Section 8. General Award Provisions

(a) Consideration for Awards. Awards

may be granted for no cash consideration or for any cash or other consideration as determined by the Committee and required by applicable

law.

(b) Awards May Be Granted Separately or Together.

Awards may, in the discretion of the Committee, be granted either alone or in addition to, in tandem with or in substitution for any other

Award or any award granted under any plan of the Company or any Affiliate. Awards granted in addition to or in tandem with other Awards

or in addition to or in tandem with awards granted under any such other plan of the Company or any Affiliate may be granted either at

the same time as or at a different time from the grant of such other Awards or awards.

(c) Limits on Transfer of Awards. No Award and

no right under any such Award shall be transferable by a Participant otherwise than by will or by the laws of descent and distribution

and the Company shall not be required to recognize any attempted assignment of such rights by any Participant; provided, however,

that, if so determined by the Committee, a Participant may, in the manner established by the Committee, designate a beneficiary or beneficiaries

to exercise the rights of the Participant and receive any property distributable with respect to any Award upon the death of the Participant.

Except as otherwise determined by the Committee, only the Participant shall have any rights with respect to any Award during the Participant’s

lifetime or, if permissible under applicable law, by the Participant’s guardian or legal representative. Except as otherwise determined

by the Committee, no Award or right under any such Award may be pledged, alienated, attached or otherwise encumbered, and any purported

pledge, alienation, attachment or other encumbrance thereof shall be void and unenforceable against the Company or any Affiliate.

Section 9. Change in Control

(a) Impact

of Event. Notwithstanding any other provision of the Plan to the contrary, unless otherwise provided by the Committee

in any Award Agreement, in the event of a Change in Control, the following provisions shall apply:

(i) Continuation, Assumption or Replacement

of Awards. In the event of a Change in Control that is a Corporate Transaction, if the corporation resulting from the Corporate

Transaction (referred to as the “Surviving Entity”) agrees to continue, assume or replace Awards outstanding as of

the date of the Corporate Transaction (with such adjustments as may be required by Section 4(c) above), then such Awards or

replacements therefor shall remain outstanding and be governed by their respective terms, subject to Section 9(a)(iv) below.

The Surviving Entity may elect to continue, assume or replace only some Awards or portions of Awards. For purposes of this Section 9(a)(i),

an Award shall be considered assumed or replaced if, in connection with the Corporate Transaction and in a manner consistent with Code

Section 409A, either (A) the contractual obligations represented by the Award are expressly assumed by the Surviving Entity

with appropriate adjustments to the number and type of securities subject to the Award, or (B) the Participant has received a comparable

equity-based award that preserves the intrinsic value of the Award existing at the time of the Corporate Transaction and is subject to

substantially similar terms and conditions as the Award, in the case of each of clauses (A) and (B), with each such assumed or replaced

(x) Restricted Share Award continuing to be in respect of publicly traded common stock and (y) Restricted Mutual Fund Share

Award continuing to be in respect of substantially similar mutual funds and exchange-traded funds.

(ii) Acceleration. If and

to the extent that outstanding Awards under the Plan are not continued, assumed or replaced in connection with a Corporate Transaction,

then all forms of Awards then outstanding shall fully vest immediately prior to the effective time of the Corporate Transaction. If a

Change in Control described in clause (iv) of such definition occurs, then unless the Committee provides otherwise at the time

of the Change in Control, outstanding Awards shall be dealt with as provided in this paragraph, with the consummation of the dissolution

or liquidation being deemed the “effective time of the Corporate Transaction” for these purposes.

(iii) Payment for Awards. If

and to the extent that outstanding Awards under the Plan are not continued, assumed or replaced consistent with Section 9(a)(i) in

connection with a Corporate Transaction, then the Committee may terminate some or all of such outstanding Awards, in whole or in part,

at or immediately prior to the effective time of the Corporate Transaction in exchange for payments to the holders as provided in this

Section 9(a)(iii). The Committee will not be required to treat all Awards similarly for purposes of this Section 9(a)(iii).

The payment for any Award or portion thereof that is terminated shall be in an amount equal to the fair market value (as determined in

good faith by the Committee) of such Award or portion thereof; provided that the payment in respect of any Restricted Share Award or portion

thereof shall be in an amount equal to the fair market value (as determined in good faith by the Committee) of the consideration that

would otherwise be received in the Corporate Transaction for the number of Shares, subject to the Restricted Share Award or portion thereof

being terminated.

(iv) Termination

After a Change in Control. If, within twenty-four (24) months after a Change in Control or a Corporate Transaction

and in connection with which outstanding Awards are continued, assumed or replaced as described in Section 9(a)(i), a Participant

experiences an involuntary termination of employment for reasons other than Cause (as defined in the applicable Award Agreement), then

outstanding Awards issued to the Participant will become immediately fully vested and non-forfeitable. The protections on termination

in this Section 9(a)(iv) shall be in addition to any termination protections set forth in the applicable Award Agreement, which

shall continue to apply after a Change in Control.

Section 10. Income Tax Withholding

No later than the date as of which an amount first

becomes includible in the gross income of a Participant for federal or foreign income tax purposes with respect to any Award under the

Plan, the Participant shall pay to the Company, or make arrangements satisfactory to the Company regarding the payment of, any federal,

state, local or foreign taxes of any kind required by law to be withheld with respect to such amount. The obligations of the Company under

the Plan shall be conditional on such payment or arrangements, and the Company and its Affiliates shall, to the extent permitted by law,

be entitled to take such action and establish such procedures as it deems appropriate to withhold or collect all applicable payroll, withholding,

income or other taxes from such Participant, including without limitation withholding applicable tax from Participant’s cash compensation

paid by the Company or an Affiliate. In order to assist a Participant in paying all or a portion of the federal, state, local and foreign

taxes to be withheld or collected upon exercise or receipt of (or the lapse of restrictions relating to) an Award, the Committee, in its

discretion and subject to such additional terms and conditions as it may adopt, may permit the Participant to satisfy such tax obligation

by (i) electing to have the Company withhold a portion of the Shares, Mutual Fund Shares or other property otherwise to be delivered

upon exercise or receipt of (or the lapse of restrictions relating to) such Award with a fair market value equal to the amount of such

taxes or (ii) delivering to the Company Shares, Mutual Fund Shares or other property other than the foregoing issuable upon exercise

or receipt of (or the lapse of restrictions relating to) such Award with a fair market value equal to the amount of such taxes. Any such

election must be made on or before the date that the amount of tax to be withheld is determined.

Section 11. Amendment and Termination

(a) Amendments to the Plan. The

Board may amend, alter, suspend, discontinue or terminate the Plan at any time; provided, however, that, notwithstanding

any other provision of the Plan or any Award Agreement, without the approval of the stockholders of the Company, no amendment, alteration,

suspension, discontinuation or termination shall be made that requires stockholder approval under the rules or regulations of the

New York Stock Exchange, any other securities exchange or the Financial Industry Regulatory Authority, Inc. that are applicable to

the Company.

(b) Amendments to Awards. The

Committee may waive any conditions of or rights of the Company under any outstanding Award, prospectively or retroactively. Except as

otherwise provided herein or in an Award Agreement, the Committee may not amend, alter, suspend, discontinue or terminate any outstanding

Award, prospectively or retroactively, if such action would adversely affect the rights of the holder of such Award, without the consent

of the Participant or holder or beneficiary thereof.

(c) Correction of Defects, Omissions

and Inconsistencies. The Committee may correct any defect, supply any omission or reconcile any inconsistency in the Plan

or any Award in the manner and to the extent it shall deem desirable to carry the Plan into effect.

Section 12. General Provisions

(a) No Rights to Awards. No Eligible

Individual or other person shall have any claim to be granted any Award under the Plan, and there is no obligation for uniformity of treatment

of Eligible Individuals or holders or beneficiaries of Awards under the Plan. The terms and conditions of Awards need not be the same

with respect to any Participant or with respect to different Participants.

(b) Award Agreements. No

Participant will have rights under an Award granted to such Participant unless and until an Award Agreement shall have been duly executed

on behalf of the Company and, if requested by the Company, signed by the Participant. Unless otherwise provided in the Award Agreement,

in the event that any provision of an Award Agreement conflicts with or is inconsistent in any respect with the terms of the Plan as set

forth herein or subsequently amended, the terms of the Plan shall control.

(c) No Limit on Other Compensation Plans

or Arrangements. Nothing contained in the Plan shall prevent the Company or any Affiliate from adopting or continuing in

effect other or additional compensation arrangements, and such arrangements may be either generally applicable or applicable only in specific

cases.

(d) No Right to Employment. The

Plan shall not constitute a contract of employment, and adoption of the Plan or the grant of an Award shall not be construed as giving

a Participant the right to be retained as an employee of the Company or an Affiliate, nor shall it affect in any way the right of the

Company or an Affiliate to terminate such employment at any time, with or without cause. In addition, the Company or an Affiliate may

at any time dismiss a Participant from employment free from any liability or any claim under the Plan or any Award, unless otherwise expressly

provided in the Plan or in any Award Agreement.

(e) Governing Law. The Plan

and all Awards granted and actions taken thereunder shall be governed by and construed in accordance with the laws of the State of Delaware,

without reference to principles of conflict of laws thereof.

(f) Severability. If any

provision of the Plan or any Award is or becomes or is deemed to be invalid, illegal or unenforceable in any jurisdiction or would disqualify

the Plan or any Award under any law deemed applicable by the Committee, such provision shall be construed or deemed amended to conform

to applicable laws, or if it cannot be so construed or deemed amended without, in the determination of the Committee, materially altering

the purpose or intent of the Plan or the Award, such provision shall be stricken as to such jurisdiction or Award, and the remainder of

the Plan or any such Award shall remain in full force and effect.

(g) No Trust or Fund Created. Neither

the Plan nor any Award shall create or be construed to create a trust or separate fund of any kind or a fiduciary relationship between

the Company or any Affiliate and an Eligible Individual or any other person. To the extent that any person acquires a right to receive

payments from the Company or any Affiliate pursuant to an Award, such right shall be no greater than the right of any unsecured general

creditor of the Company or any Affiliate.

(h) Other Benefits. No compensation

or benefit awarded to or realized by any Participant under the Plan shall be included for the purpose of computing such Participant’s

compensation under any compensation-based retirement, disability, or similar plan of the Company unless required by law or otherwise provided

by such other plan.

(i) No Fractional Shares or Mutual Fund

Shares. No fractional Shares or Mutual Fund Shares shall be issued or delivered pursuant to any Award granted under the

Plan, and the Committee shall determine whether cash shall be paid in lieu of any fractional Shares or Mutual Fund Shares or whether such

fractional Shares or Mutual Fund Shares or any rights thereto shall be canceled, terminated or otherwise eliminated.

(j) Headings. Headings are

given to the Sections and subsections of the Plan solely as a convenience to facilitate reference. Such headings shall not be deemed in

any way material or relevant to the construction or interpretation of the Plan or any provision thereof.

(k) Section 16 Compliance. The

Plan is intended to comply in all respects with Rule 16b-3 or any successor provision, as in effect from time to time, and in all

events the Plan shall be construed in accordance with the requirements of Rule 16b-3. If any Plan provision does not comply with

Rule 16b-3 as hereafter amended or interpreted, the provision shall be deemed inoperative. The Board, in its absolute discretion,

may bifurcate the Plan so as to restrict, limit or condition the use of any provision of the Plan with respect to persons who are officers

or directors subject to Section 16 of the Exchange Act without so restricting, limiting or conditioning the Plan with respect to

other Eligible Individuals.

Section 13. Term of the Plan

The Plan will become effective on the Effective

Date, and will terminate on the tenth anniversary of the Effective Date or any earlier date of discontinuation or termination established

pursuant to Section 11 of the Plan. However, unless otherwise expressly provided in the Plan or in an applicable Award Agreement,

any Award theretofore granted may extend beyond such date, and the authority of the Committee provided for hereunder with respect to the

Plan and any Awards, and the authority of the Board to amend the Plan, shall extend beyond the termination of the Plan.

Exhibit 5.1

[Letterhead of Sullivan & Cromwell LLP]

August 19, 2024

Piper Sandler Companies,

800 Nicollet Mall, Suite 900,

Minneapolis, Minnesota 55402.

Ladies and Gentlemen:

In

connection with the registration under the Securities Act of 1933 (the “Act”) of 50,000 shares (the “Securities”)

of Common Stock, par value $0.01 per share, of Piper Sandler Companies, a Delaware corporation (the “Company”), issuable

under the Piper Sandler Companies 2024 Employment Inducement Award Plan (the “Plan”), we, as your counsel, have examined

such corporate records, certificates and other documents, and such questions of law, as we have considered necessary or appropriate for

the purposes of this opinion. Upon the basis of such examination, it is our opinion that when the registration statement relating to

the Securities (the “Registration Statement”) has become effective under the Act, the terms of the sale of the Securities

have been duly established in conformity with the Company’s amended and restated certificate of incorporation and the Plan, and

the Securities have been duly issued and sold as contemplated by the Registration Statement and the Plan, the Securities will be validly

issued, fully paid and nonassessable.

In rendering the foregoing opinion, we are not passing

upon, and assume no responsibility for, any disclosure in any registration statement or any related prospectus or other offering material

relating to the offer and sale of the Securities.

The

foregoing opinion is limited to the Federal laws of the United States and the General Corporation Law of the State of Delaware, and we

are expressing no opinion as to the effect of the laws of any other jurisdiction.

We

have relied as to certain factual matters on information obtained from public officials, officers of the Company and other sources

believed by us to be responsible.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit

that we are in the category of persons whose consent is required under Section 7 of the Act.

| |

Very truly yours, |

| |

|

| |

/s/ Sullivan and Cromwell LLP |

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in

the Registration Statement (Form S-8) pertaining to the registration of shares of Piper Sandler Companies common stock for the Piper Sandler

Companies 2024 Employment Inducement Award Plan of our report dated February 26, 2024, with respect to the consolidated financial statements

of Piper Sandler Companies and the effectiveness of internal control over financial reporting of Piper Sandler Companies included in its

Annual Report (10-K) for the year ended December 31, 2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Minneapolis, Minnesota

August 19, 2024

Exhibit 24.1

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS:

That each person whose signature

appears below, as a director and/or officer of Piper Sandler Companies, a Delaware corporation (the “Company”), with

its general offices in the City of Minneapolis, State of Minnesota, does hereby make, constitute and appoint Chad R. Abraham, Katherine

P. Clune and John W. Geelan, or any one of them acting alone, his or her true and lawful attorneys, with full power of substitution and

resubstitution, in his or her name, place and stead, in any and all capacities, to execute and sign a registration statement or registration

statements on Form S-8 covering the registration of securities of the Company to be issued under the Piper Sandler Companies 2024

Employment Inducement Award Plan as approved by the Board of Directors of the Company, and any amendments or post-effective amendments

to such registration statement or statements and documents in connection therewith, all to be filed with the Securities and Exchange Commission

under the Securities Act of 1933, as amended, giving and granting unto said attorneys full power and authority to do and perform such

actions as fully as they might have done or could do if personally present and executing any of said documents.

Dated and effective as of August 19, 2024.

| /s/ Chad R. Abraham |

|

/s/ Thomas S. Schreier, Jr. |

| Chad R. Abraham, Chairman and Chief Executive Officer |

|

Thomas S. Schreier, Jr., Director |

| |

|

|

| /s/ Katherine P. Clune |

|

/s/ Sherry M. Smith |

| Katherine P. Clune, Chief Financial Officer |

|

Sherry M. Smith, Director |

| |

|

|

| /s/ Jonathan J. Doyle |

|

/s/ Philip E. Soran |

| Jonathan J. Doyle, Director |

|

Philip E. Soran, Director |

| |

|

|

| /s/ William R. Fitzgerald |

|

/s/ Brian R. Sterling |

| William R. Fitzgerald, Director |

|

Brian R. Sterling, Director |

| |

|

|

| /s/ Victoria M. Holt |

|

/s/ Scott C. Taylor |

| Victoria M. Holt, Director |

|

Scott C. Taylor, Director |

| |

|

|

| /s/ Robbin Mitchell |

|

|

| Robbin Mitchell, Director |

|

|

S-8

S-8

EX-FILING FEES

0001230245

PIPER SANDLER COMPANIES

Fees to be Paid

0001230245

2024-08-16

2024-08-16

0001230245

1

2024-08-16

2024-08-16

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

PIPER SANDLER COMPANIES

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Stock, par value $0.01 per share ("Common Stock")

|

Other

|

50,000

|

$

256.02

|

$

12,801,000.00

|

0.0001476

|

$

1,889.43

|

|

Total Offering Amounts:

|

|

$

12,801,000.00

|

|

$

1,889.43

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

1,889.43

|

|

1

|

(1) Pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), this Registration Statement shall also cover additional shares of Common Stock which may become issuable under the Piper Sandler Companies 2024 Employment Inducement Award Plan by reason of any stock split, stock dividend, recapitalization, or other similar transaction effected without consideration which results in the increase in the number of outstanding shares of the Registrant's Common Stock.

(2) Estimated solely for purposes of calculating the registration fee. Pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, the proposed maximum offering price per share and proposed maximum aggregate offering price are based on the reported average of the high and low prices of Common Stock as reported on the New York Stock Exchange on August 13, 2024.

|

|

|

v3.24.2.u1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Offerings - Offering: 1

|

Aug. 16, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Stock, par value $0.01 per share ("Common Stock")

|

| Amount Registered | shares |

50,000

|

| Proposed Maximum Offering Price per Unit |

256.02

|

| Maximum Aggregate Offering Price |

$ 12,801,000.00

|

| Fee Rate |

0.01476%

|

| Amount of Registration Fee |

$ 1,889.43

|

| Offering Note |

(1) Pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), this Registration Statement shall also cover additional shares of Common Stock which may become issuable under the Piper Sandler Companies 2024 Employment Inducement Award Plan by reason of any stock split, stock dividend, recapitalization, or other similar transaction effected without consideration which results in the increase in the number of outstanding shares of the Registrant's Common Stock.

(2) Estimated solely for purposes of calculating the registration fee. Pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, the proposed maximum offering price per share and proposed maximum aggregate offering price are based on the reported average of the high and low prices of Common Stock as reported on the New York Stock Exchange on August 13, 2024.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2.u1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

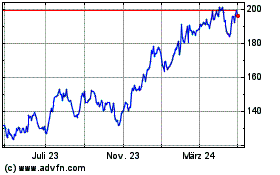

Piper Sandler Companies (NYSE:PIPR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Piper Sandler Companies (NYSE:PIPR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025