Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

23 Oktober 2024 - 6:03PM

Edgar (US Regulatory)

Pioneer Floating

Rate Fund, Inc.

Schedule of

Investments | August 31, 2024

Schedule of Investments | 8/31/24

(unaudited)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| UNAFFILIATED ISSUERS — 147.8%

|

|

|

| Senior Secured Floating Rate Loan

Interests — 128.2% of Net Assets*(a)

|

|

|

| Advanced Materials — 1.7%

|

|

| 851,557

| Gemini HDPE LLC, 2027 Advance, 8.514% (Term SOFR + 300 bps), 12/31/27

| $ 855,389

|

| 1,339,098

| Groupe Solmax, Inc., Initial Term Loan, 10.346% (Term SOFR + 475 bps), 5/29/28

| 1,271,864

|

|

| Total Advanced Materials

| $2,127,253

|

|

|

|

|

|

| Advertising Sales — 0.4%

|

|

| 522,568

| Clear Channel Outdoor Holdings, Inc., 2024 Refinancing Term Loan, 9.361% (Term SOFR + 400 bps), 8/21/28

| $ 521,479

|

|

| Total Advertising Sales

| $521,479

|

|

|

|

|

|

| Advertising Services — 1.5%

|

|

| 982,423

| Dotdash Meredith, Inc., Term B Loan, 9.442% (Term SOFR + 400 bps), 12/1/28

| $ 984,061

|

| 972,613

| Summer (BC) Bidco B LLC, Extended Facility B, 10.595% (Term SOFR + 500 bps), 2/15/29

| 975,652

|

|

| Total Advertising Services

| $1,959,713

|

|

|

|

|

|

| Airlines — 1.1%

|

|

| 770,833

| AAdvantage Loyality IP, Ltd. (American Airlines, Inc.), Initial Term Loan, 10.294% (Term SOFR + 475 bps), 4/20/28

| $ 798,645

|

| 494,950

| American Airlines, Inc., Seventh Amendment Extended Term Loan, 8.201% (Term SOFR + 275 bps), 2/15/28

|

494,924

|

| 135,528

| SkyMiles IP, Ltd. (Delta Air Lines, Inc.), Initial Term Loan, 9.032% (Term SOFR + 375 bps), 10/20/27

| 138,697

|

|

| Total Airlines

| $1,432,266

|

|

|

|

|

|

| Apparel Manufacturers — 0.8%

|

|

| 954,128

| Hanesbrands Inc., Initial Tranche B Term Loan, 8.997% (Term SOFR + 375 bps), 3/8/30

| $ 956,961

|

|

| Total Apparel Manufacturers

| $956,961

|

|

|

|

|

|

| Appliances — 0.9%

|

|

| 1,147,146

| Osmosis Buyer Ltd., 2024 Refinancing Term B Loan, 8.843% (Term SOFR + 350 bps), 7/31/28

| $ 1,149,557

|

|

| Total Appliances

| $1,149,557

|

|

|

|

|

|

| Applications Software — 2.3%

|

|

| 353,737

| Central Parent LLC, First Lien 2024 Refinancing Term Loan, 8.585% (Term SOFR + 325 bps), 7/6/29

| $ 350,576

|

1Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Applications Software — (continued)

|

|

| 540,587

| EP Purchaser LLC, First Lien Closing Date Term Loan, 9.096% (Term SOFR + 350 bps), 11/6/28

| $ 543,740

|

| 872,276(b)

| Loyalty Ventures, Inc., Term B Loan, 11.778% (LIBOR + 650 bps), 11/3/27

|

8,723

|

| 1,452,373

| RealPage, Inc., First Lien Initial Term Loan, 8.361% (Term SOFR + 300 bps), 4/24/28

| 1,396,093

|

| 634,689

| SS&C Technologies Holdings, Inc., Term B-8 Loan, 7.247% (Term SOFR + 200 bps), 5/9/31

| 637,069

|

|

| Total Applications Software

| $2,936,201

|

|

|

|

|

|

| Athletic Equipment — 0.5%

|

|

| 249,375

| Amer Sports Co., Initial USD Term Loan, 8.346% (Term SOFR + 325 bps), 2/17/31

| $ 250,622

|

| 403,988

| Recess Holdings, Inc., First Lien Amendment No. 3 Term Loan, 9.752% (Term SOFR + 450 bps), 2/20/30

| 405,628

|

|

| Total Athletic Equipment

| $656,250

|

|

|

|

|

|

| Auction House & Art Dealer — 0.4%

|

|

| 485,000

| Sotheby's, 2021 Second Refinancing Term Loan, 10.063% (Term SOFR + 450 bps), 1/15/27

| $ 473,885

|

|

| Total Auction House & Art Dealer

| $473,885

|

|

|

|

|

|

| Auto Parts & Equipment — 3.8%

|

|

| 411,718

| Adient US LLC, Term B-2 Loan, 7.997% (Term SOFR + 275 bps), 1/31/31

| $ 413,336

|

| 636,734

| American Axle & Manufacturing, Inc., New Tranche B Term Loan, 8.327% (Term SOFR + 300 bps), 12/13/29

|

639,719

|

| 1,824,728

| First Brands Group LLC, First Lien 2021 Term Loan, 10.514% (Term SOFR + 500 bps), 3/30/27

| 1,805,720

|

| 1,989,291

| IXS Holdings, Inc., Initial Term Loan, 9.597% (Term SOFR + 425 bps), 3/5/27

| 1,940,802

|

|

| Total Auto Parts & Equipment

| $4,799,577

|

|

|

|

|

|

| Auto Repair Centers — 1.0%

|

|

| 1,265,000

| Champions Holdco, Inc., Intial Term Loan, 9.852% (Term SOFR + 475 bps), 2/23/29

| $ 1,239,172

|

|

| Total Auto Repair Centers

| $1,239,172

|

|

|

|

|

|

| Auto-Truck Trailers — 0.8%

|

|

| 977,500

| Novae LLC, Tranche B Term Loan, 10.497% (Term SOFR + 500 bps), 12/22/28

| $ 957,950

|

|

| Total Auto-Truck Trailers

| $957,950

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/242

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Beverages — 1.1%

|

|

| 163,333

| Naked Juice LLC, First Lien Initial Term Loan, 8.685% (Term SOFR + 325 bps), 1/24/29

| $ 143,484

|

| 492,525

| Pegasus BidCo B.V., 2024-1 Term Dollar Loan, 8.868% (Term SOFR + 375 bps), 7/12/29

|

494,372

|

| 772,372

| Triton Water Holdings, Inc., 2024 First Lien Incremental Term Loan, 9.335% (Term SOFR + 400 bps), 3/31/28

| 776,474

|

|

| Total Beverages

| $1,414,330

|

|

|

|

|

|

| Broadcast Service & Programing — 0.4%

|

|

| 468,473

| Univision Communications, Inc., First Lien Initial Term Loan, 8.611% (Term SOFR + 325 bps), 1/31/29

| $ 455,590

|

|

| Total Broadcast Service & Programing

| $455,590

|

|

|

|

|

|

| Building & Construction — 1.1%

|

|

| 500,000

| DG Investment Intermediate Holdings 2, Inc., Second Lien Initial Term Loan, 12.111% (Term SOFR + 675 bps), 3/30/29

| $ 481,041

|

| 968,930

| Service Logic Acquisition, Inc., First Lien Closing Date Initial Term Loan, 9.514% (Term SOFR + 400 bps), 10/29/27

| 971,352

|

|

| Total Building & Construction

| $1,452,393

|

|

|

|

|

|

| Building & Construction Products — 1.6%

|

|

| 1,432,833

| Cornerstone Building Brands, Inc., Tranche B Term Loan, 8.687% (Term SOFR + 325 bps), 4/12/28

| $ 1,397,012

|

| 488,650

| LHS Borrower LLC, Initial Term Loan, 10.097% (Term SOFR + 475 bps), 2/16/29

|

460,553

|

| 150,000

| MI Windows and Doors LLC, 2024 Incremental Term Loan, 8.747% (Term SOFR + 350 bps), 3/28/31

| 150,914

|

|

| Total Building & Construction Products

| $2,008,479

|

|

|

|

|

|

| Building Production — 1.5%

|

|

| 487,500

| Chariot Buyer LLC, First Lien Initial Term Loan, 8.597% (Term SOFR + 325 bps), 11/3/28

| $ 487,500

|

| 318,608

| Jeld-Wen, Inc., Replacement 2023 Term B Loan, 7.361% (Term SOFR + 200 bps), 7/28/28

|

319,239

|

| 742,524

| Koppers Inc., Incremental Term B-1 Loan, 8.34% (Term SOFR + 300 bps), 4/10/30

|

747,164

|

| 249,375

| Potters Industries, LLC, 2024 Incremental Term Loan, 9.085% (Term SOFR + 375 bps), 12/14/27

|

251,128

|

| 131,670

| Summit Materials LLC, Term B-2 Loan, 7.054% (Term SOFR + 175 bps), 1/12/29

| 132,658

|

|

| Total Building Production

| $1,937,689

|

|

|

|

|

3Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Building-Air & Heating — 0.5%

|

|

| 221,903

| EMRLD Borrower LP, Initial Term B Loan, 7.557% (Term SOFR + 250 bps), 5/31/30

| $ 222,104

|

| 350,000

| EMRLD Borrower LP, Term Loan B, 7.557% (Term SOFR + 250 bps), 8/4/31

| 350,481

|

|

| Total Building-Air & Heating

| $572,585

|

|

|

|

|

|

| Building-Heavy Construction — 0.6%

|

|

| 734,887

| Osmose Utilities Services, Inc., First Lien Initial Term Loan, 8.611% (Term SOFR + 325 bps), 6/23/28

| $ 732,787

|

|

| Total Building-Heavy Construction

| $732,787

|

|

|

|

|

|

| Building-Maintenance & Service — 0.7%

|

|

| 927,844

| ArchKey Holdings, Inc., First Lien Initial Term Loan, 10.611% (Term SOFR + 525 bps), 6/29/28

| $ 931,711

|

|

| Total Building-Maintenance & Service

| $931,711

|

|

|

|

|

|

| Cable & Satellite Television — 3.7%

|

|

| 1,907,654

| Altice France S.A., USD TLB-[14] Loan, 10.801% (Term SOFR + 550 bps), 8/15/28

| $ 1,440,279

|

| 964,335

| CSC Holdings LLC, 2022 Refinancing Term Loan, 9.837% (Term SOFR + 450 bps), 1/18/28

|

924,154

|

| 989,911

| DIRECTV Financing LLC, 2024 Refinancing Term B Loan, 10.611% (Term SOFR + 525 bps), 8/2/29

|

988,055

|

| 1,023,872

| Radiate Holdco LLC, Amendment No. 6 Term B Loan, 8.611% (Term SOFR + 325 bps), 9/25/26

|

825,070

|

| 500,000

| Virgin Media Bristol LLC, Facility Q, 8.701% (Term SOFR + 325 bps), 1/31/29

| 482,625

|

|

| Total Cable & Satellite Television

| $4,660,183

|

|

|

|

|

|

| Casino Hotels — 1.7%

|

|

| 1,483,603

| Century Casinos, Inc., Term B Facility Loan, 11.442% (Term SOFR + 600 bps), 4/2/29

| $ 1,433,531

|

| 776,994

| Fertitta Entertainment LLC, Initial B Term Loan, 9.087% (Term SOFR + 375 bps), 1/27/29

| 776,792

|

|

| Total Casino Hotels

| $2,210,323

|

|

|

|

|

|

| Casino Services — 0.9%

|

|

| 265,335

| Caesars Entertainment, Inc., Incremental Term B1 Loan, 7.997% (Term SOFR + 275 bps), 2/6/31

| $ 265,749

|

| 730,318

| Everi Holdings, Inc., Term B Loan, 7.861% (Term SOFR + 250 bps), 8/3/28

|

733,969

|

Pioneer Floating Rate Fund,

Inc. | 8/31/244

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Casino Services — (continued)

|

|

| 33,703

| Lucky Bucks LLC, Priority First Out Exit Term Loan, 12.94% (Term SOFR + 750 bps), 10/2/28

| $ 30,923

|

| 67,607

| Lucky Bucks LLC, Priority Second Out Term Loan, 12.94% (Term SOFR + 750 bps), 10/2/29

| 55,100

|

|

| Total Casino Services

| $1,085,741

|

|

|

|

|

|

| Cellular Telecom — 0.4%

|

|

| 536,146

| CCI Buyer, Inc., First Lien Initial Term Loan, 9.335% (Term SOFR + 400 bps), 12/17/27

| $ 537,989

|

|

| Total Cellular Telecom

| $537,989

|

|

|

|

|

|

| Chemicals-Diversified — 3.0%

|

|

| 1,000,000

| ARC Falcon I, Inc., Second Lien Initial Term Loan, 12.347% (Term SOFR + 700 bps), 9/30/29

| $ 937,500

|

| 194,537

| Geon Performance Solutions, LLC (Fka. Echo US Holdings, LLC), 2024 Refinancing Term Loan, 9.846% (Term SOFR + 425 bps), 8/18/28

|

195,996

|

| 448,875

| Ineos Quattro Holdings UK Ltd., 2029 Tranche B Dollar Term Loan, 9.597% (Term SOFR + 425 bps), 4/2/29

|

450,558

|

| 297,000

| Ineos Quattro Holdings UK Ltd., 2030 Tranche B Dollar Term Loan, 9.097% (Term SOFR + 375 bps), 3/14/30

|

297,867

|

| 687,750

| Ineos US Finance LLC, 2030 Dollar Term Loan, 8.497% (Term SOFR + 325 bps), 2/18/30

|

686,783

|

| 1,298,405

| LSF11 A5 Holdco LLC, 2024 Refinancing Term Loan, 8.861% (Term SOFR + 350 bps), 10/15/28

| 1,298,405

|

|

| Total Chemicals-Diversified

| $3,867,109

|

|

|

|

|

|

| Chemicals-Plastics — 0.3%

|

|

| 398,985

| Bakelite US Holdco, Inc., New Term Loan, 8.835% (Term SOFR + 350 bps), 5/29/29

| $ 401,645

|

|

| Total Chemicals-Plastics

| $401,645

|

|

|

|

|

|

| Chemicals-Specialty — 3.7%

|

|

| 348,383

| Avient Corporation, Term B-8 Loan, 7.307% (Term SOFR + 200 bps), 8/29/29

| $ 350,032

|

| 733,135

| Axalta Coating Systems Dutch Holding B B.V. (Axalta Coating Systems U.S. Holdings, Inc.), Term B-6 Dollar Facility, 7.335% (Term SOFR + 200 bps), 12/20/29

|

736,388

|

| 748,120

| Element Solutions Inc. (Macdermid, Inc.), Tranche B-2 Term Loan, 7.247% (Term SOFR + 200 bps), 12/18/30

|

751,527

|

| 247,505

| H.B. Fuller Company, 2024 Amendment Refinancing Term B Loan, 7.247% (Term SOFR + 200 bps), 2/15/30

|

248,433

|

| 770,015

| Mativ Holdings, Inc., Term B Loan, 9.111% (Term SOFR + 375 bps), 4/20/28

|

770,496

|

5Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Chemicals-Specialty — (continued)

|

|

| 446,625

| Nouryon Finance B.V., 2024 B-1 Dollar Term Loan, 8.628% (Term SOFR + 350 bps), 4/3/28

| $ 448,486

|

| 397,000

| Nouryon Finance B.V., 2024 B-2 Dollar Term Loan, 8.821% (Term SOFR + 350 bps), 4/3/28

|

398,427

|

| 964,859

| Olympus Water US Holding Corp., Term B-5 Dollar Loan, 8.847% (Term SOFR + 350 bps), 6/20/31

| 969,080

|

|

| Total Chemicals-Specialty

| $4,672,869

|

|

|

|

|

|

| Commercial Services — 2.1%

|

|

| 494,975

| AEA International Holdings (Luxembourg) S.a.r.l, First Lien New Term Loan, 8.033% (Term SOFR + 275 bps), 9/7/28

| $ 495,593

|

| 1,000,000

| DS Parent, Inc., Term Loan B, 10.835% (Term SOFR + 550 bps), 1/31/31

|

991,250

|

| 600,000

| PG Polaris Bidco S.a.r.l., Initial Term Loan, 8.835% (Term SOFR + 350 bps), 3/26/31

|

602,550

|

| 225,499

| Pre-Paid Legal Services, Inc., First Lien Initial Term Loan, 9.111% (Term SOFR + 375 bps), 12/15/28

|

225,875

|

| 332,500

| Vestis Corp., Term B-1 Loan, 7.371% (Term SOFR + 225 bps), 2/22/31

| 331,513

|

|

| Total Commercial Services

| $2,646,781

|

|

|

|

|

|

| Computer Data Security — 0.6%

|

|

| 804,646

| Precisely Software, Inc., First Lien Third Amendment Term Loan, 9.514% (Term SOFR + 400 bps), 4/24/28

| $ 789,810

|

|

| Total Computer Data Security

| $789,810

|

|

|

|

|

|

| Computer Services — 3.3%

|

|

| 1,381,028

| Ahead DB Holdings LLC, First Lien Term B-3 Loan, 8.798% (Term SOFR + 350 bps), 2/1/31

| $ 1,385,776

|

| 353,000(c)

| Amazon Holdco, Inc., Seven-Year Term Loan, 7/30/31

|

352,779

|

| 889,000

| Fortress Intermediate 3, Inc., Initial Term Loan, 9.002% (Term SOFR + 375 bps), 6/27/31

|

891,223

|

| 705,948

| MAG DS Corp., Initial Term Loan, 10.935% (Term SOFR + 550 bps), 4/1/27

|

649,472

|

| 946,845

| Peraton Corp., First Lien Term B Loan, 9.097% (Term SOFR + 375 bps), 2/1/28

| 928,697

|

|

| Total Computer Services

| $4,207,947

|

|

|

|

|

|

| Computer Software — 2.2%

|

|

| 1,221,875

| Cornerstone OnDemand, Inc., First Lien Initial Term Loan, 9.111% (Term SOFR + 375 bps), 10/16/28

| $ 1,157,727

|

Pioneer Floating Rate Fund,

Inc. | 8/31/246

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Computer Software — (continued)

|

|

| 775,000

| Flash Charm, Inc., First Lien Incremental Term Loan, 8.748% (Term SOFR + 350 bps), 3/2/28

| $ 771,402

|

| 980,834

| Help/Systems Holdings, Inc., Term Loan, 9.347% (Term SOFR + 400 bps), 11/19/26

| 907,884

|

|

| Total Computer Software

| $2,837,013

|

|

|

|

|

|

| Computers-Integrated Systems — 1.2%

|

|

| 667,780

| Atlas CC Acquisition Corp., First Lien Term B Loan, 9.569% (Term SOFR + 425 bps), 5/25/28

| $ 516,277

|

| 135,819

| Atlas CC Acquisition Corp., First Lien Term C Loan, 9.569% (Term SOFR + 425 bps), 5/25/28

|

105,005

|

| 913,560

| NCR Atleos LLC, Term Loan B, 10.097% (Term SOFR + 475 bps), 3/27/29

| 923,553

|

|

| Total Computers-Integrated Systems

| $1,544,835

|

|

|

|

|

|

| Consulting Services — 1.4%

|

|

| 1,021,556

| Ankura Consulting Group LLC, 2024 Repricing Term Loan, 9.564% (Term SOFR + 425 bps), 3/17/28

| $ 1,026,451

|

| 740,757

| First Advantage Holdings LLC, First Lien Term B-1 Loan, 8.111% (Term SOFR + 275 bps), 1/31/27

| 744,739

|

|

| Total Consulting Services

| $1,771,190

|

|

|

|

|

|

| Containers-Paper & Plastic — 1.7%

|

|

| 767,223

| Pregis TopCo LLC, First Lien Initial Term Loan, 9.247% (Term SOFR + 400 bps), 7/31/26

| $ 770,100

|

| 345,000

| Ring Container Technologies Group LLC, 2024 Refinancing Term Loan, 7.997% (Term SOFR + 275 bps), 8/12/28

|

346,581

|

| 399,000

| SupplyOne, Inc., Term B Loan, 9.497% (Term SOFR + 425 bps), 4/19/31

|

403,190

|

| 682,980

| Trident TPI Holdings, Inc., Tranche B-6 Initial Term Loan, 9.332% (Term SOFR + 400 bps), 9/15/28

| 686,511

|

|

| Total Containers-Paper & Plastic

| $2,206,382

|

|

|

|

|

|

| Cruise Lines — 0.8%

|

|

| 622,506

| Carnival Corp., 2024 Term Loan Repricing Advance , 7.997% (Term SOFR + 275 bps), 8/8/27

| $ 625,618

|

| 390,000

| LC Ahab US Bidco LLC, Initial Term Loan, 8.747% (Term SOFR + 350 bps), 5/1/31

| 391,950

|

|

| Total Cruise Lines

| $1,017,568

|

|

|

|

|

7Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Diagnostic Equipment — 0.4%

|

|

| 491,139

| Curia Global, Inc., First Lien 2021 Term Loan, 9.102% (Term SOFR + 375 bps), 8/30/26

| $ 454,918

|

|

| Total Diagnostic Equipment

| $454,918

|

|

|

|

|

|

| Dialysis Centers — 1.2%

|

|

| 1,702,258

| U.S. Renal Care, Inc., Closing Date Term Loan, 10.361% (Term SOFR + 500 bps), 6/20/28

| $ 1,480,964

|

|

| Total Dialysis Centers

| $1,480,964

|

|

|

|

|

|

| Direct Marketing — 0.5%

|

|

| 668,794

| Red Ventures LLC (New Imagitas, Inc.), First Lien Term B-4 Loan, 8.247% (Term SOFR + 300 bps), 3/3/30

| $ 663,465

|

|

| Total Direct Marketing

| $663,465

|

|

|

|

|

|

| Disposable Medical Products — 0.6%

|

|

| 450,851

| Medline Borrower LP, Refinancing Term Loan, 7.997% (Term SOFR + 250 bps), 10/23/28

| $ 452,368

|

| 369,471

| Sotera Health Holdings LLC, 2024 Refinancing Term Loan, 8.497% (Term SOFR + 325 bps), 5/30/31

| 369,702

|

|

| Total Disposable Medical Products

| $822,070

|

|

|

|

|

|

| Distribution & Wholesale — 2.8%

|

|

| 496,257

| AIP RD Buyer Corp., 2023 First Lien Incremental Term Loan, 9.747% (Term SOFR + 450 bps), 12/22/28

| $ 499,358

|

| 586,500

| AIP RD Buyer Corp., First Lien Term Loan B, 9.497% (Term SOFR + 425 bps), 12/22/28

|

590,349

|

| 810,000(c)

| Barentz Midco B.V., USD Facility B2, 3/1/31

|

816,750

|

| 431,922

| Gates Corp., Initial B-5 Dollar Term Loan, 7.497% (Term SOFR + 225 bps), 6/4/31

|

433,643

|

| 852,955

| Patriot Container Corp. (aka Wastequip), First Lien Closing Date Term Loan, 9.097% (Term SOFR + 375 bps), 3/20/25

|

838,561

|

| 403,208

| Windsor Holdings III LLC, 2024 Dollar Refinancing Term B Loan, 9.311% (Term SOFR + 400 bps), 8/1/30

| 406,124

|

|

| Total Distribution & Wholesale

| $3,584,785

|

|

|

|

|

|

| E-Commerce — 0.8%

|

|

| 310,000

| Match Group, Inc. (fka The Match Group, Inc.), 2020 Refinancing Term Loan, 7.244% (Term SOFR + 175 bps), 2/13/27

| $ 310,388

|

Pioneer Floating Rate Fund,

Inc. | 8/31/248

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| E-Commerce — (continued)

|

|

| 197,039

| Stubhub Holdco Sub LLC, Extended USD Term B Loan, 9.997% (Term SOFR + 475 bps), 3/15/30

| $ 196,916

|

| 492,479

| TouchTunes Music Group LLC, First Lien Tranche B-1 Term Loan, 10.085% (Term SOFR + 475 bps), 4/2/29

| 491,555

|

|

| Total E-Commerce

| $998,859

|

|

|

|

|

|

| Electric-Generation — 3.6%

|

|

| 408,908

| Compass Power Generation LLC, Tranche B-2 Term Loan, 9.611% (Term SOFR + 425 bps), 4/14/29

| $ 412,805

|

| 1,116,521

| Eastern Power LLC (Eastern Covert Midco LLC), Term Loan, 10.497% (Term SOFR + 525 bps), 4/3/28

| 1,119,313

|

| 410,000

| Edgewater Generation LLC, Refinancing Term Loan, 9.497% (Term SOFR + 425 bps), 8/1/30

|

414,185

|

| 815,059

| Generation Bridge Northeast LLC, Term Loan B, 8.747% (Term SOFR + 350 bps), 8/22/29

|

822,445

|

| 387,500

| Hamilton Projects Acquiror LLC, Term Loan, 8.997% (Term SOFR + 375 bps), 5/31/31

|

391,548

|

| 498,747

| Vistra Operations Company LLC, 2018 Incremental Term Loan, 7.247% (Term SOFR + 200 bps), 12/20/30

|

500,555

|

| 907,725

| Vistra Zero Operating Company LLC, Initial Term Loan, 7.997% (Term SOFR + 275 bps), 4/30/31

| 913,080

|

|

| Total Electric-Generation

| $4,573,931

|

|

|

|

|

|

| Electric-Integrated — 1.1%

|

|

| 1,050,244

| Constellation Renewables LLC, TLB, 7.307% (Term SOFR + 225 bps), 12/15/27

| $ 1,053,308

|

| 260,464

| Talen Energy Supply LLC, Initial Term B Loan, 8.596% (Term SOFR + 350 bps), 5/17/30

|

262,316

|

| 111,905

| Talen Energy Supply LLC, Initial Term C Loan, 8.596% (Term SOFR + 350 bps), 5/17/30

| 112,700

|

|

| Total Electric-Integrated

| $1,428,324

|

|

|

|

|

|

| Electronic Composition — 1.1%

|

|

| 1,010,214

| Natel Engineering Co., Inc., Initial Term Loan, 11.611% (Term SOFR + 625 bps), 4/30/26

| $ 873,835

|

| 581,953(c)

| Synaptics, Inc., First Amendment Incremental Term Loan, 7.85% (Term SOFR + 225 bps), 12/2/28

| 581,044

|

|

| Total Electronic Composition

| $1,454,879

|

|

|

|

|

9Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Engines — 1.1%

|

|

| 423,721

| Arcline FM Holdings LLC, 2024-2 First Lien New Term Loan, 9.742% (Term SOFR + 450 bps), 6/23/28

| $ 425,840

|

| 1,015,895

| LSF12 Badger Bidco LLC, Initial Term Loan, 11.247% (Term SOFR + 600 bps), 8/30/30

| 1,000,656

|

|

| Total Engines

| $1,426,496

|

|

|

|

|

|

| Enterprise Software & Services — 2.3%

|

|

| 755,000

| Boxer Parent Company, Inc., 2031 New Dollar Term Loan, 9.005% (Term SOFR + 375 bps), 7/30/31

| $ 754,371

|

| 900,000

| Cloud Software Group, Inc., First Lien Third Amendment Term Loan, 9.835% (Term SOFR + 450 bps), 3/21/31

|

905,531

|

| 178,093

| Open Text Corp., 2023 Replacement Term Loan, 7.497% (Term SOFR + 225 bps), 1/31/30

|

179,139

|

| 633,412

| Project Alpha Intermediate Holding, Inc., 2024 Refinancing Term Loan, 9.002% (Term SOFR + 375 bps), 10/28/30

|

637,328

|

| 397,000

| Quartz AcquireCo LLC, Additional Term B-1 Loan, 8.085% (Term SOFR + 275 bps), 6/28/30

| 397,993

|

|

| Total Enterprise Software & Services

| $2,874,362

|

|

|

|

|

|

| Fiduciary Banks — 0.6%

|

|

| 730,943(c)

| Chrysaor Bidco S.a r.l., USD Facility B Loan, 7/17/31

| $ 733,970

|

|

| Total Fiduciary Banks

| $733,970

|

|

|

|

|

|

| Finance-Investment Banker — 0.5%

|

|

| 688,063

| Hudson River Trading LLC, Term Loan, 8.319% (Term SOFR + 300 bps), 3/20/28

| $ 688,432

|

|

| Total Finance-Investment Banker

| $688,432

|

|

|

|

|

|

| Finance-Leasing Company — 1.0%

|

|

| 412,055

| Castlelake Aviation One Designated Activity Co., 2023 Incremental Term Loan, 8.089% (Term SOFR + 275 bps), 10/22/27

| $ 413,961

|

| 374,976

| Castlelake Aviation One Designated Activity Co., Initial Term Loan, 7.839% (Term SOFR + 250 bps), 10/22/26

|

376,421

|

| 483,432

| Fly Funding II S.a r.l., Replacement Loan, 7.12% (LIBOR + 175 bps), 8/11/25

| 471,698

|

|

| Total Finance-Leasing Company

| $1,262,080

|

|

|

|

|

|

| Food-Confectionery — 0.7%

|

|

| 900,000(c)

| Fiesta Purchaser, Inc., Initial Term Loan, 9.247% (Term SOFR + 400 bps), 2/12/31

| $ 906,610

|

|

| Total Food-Confectionery

| $906,610

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2410

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Food-Dairy Products — 1.3%

|

|

| 1,684,375

| Chobani LLC, 2020 New Term Loan, 8.611% (Term SOFR + 325 bps), 10/25/27

| $ 1,693,218

|

|

| Total Food-Dairy Products

| $1,693,218

|

|

|

|

|

|

| Food-Misc/Diversified — 1.1%

|

|

| 700,000

| B&G Foods, Inc., TLB, 8.557% (Term SOFR + 350 bps), 10/10/29

| $ 695,813

|

| 726,530

| Simply Good Foods USA, Inc., Initial Term Loan, 7.852% (Term SOFR + 250 bps), 3/17/27

| 728,346

|

|

| Total Food-Misc/Diversified

| $1,424,159

|

|

|

|

|

|

| Footwear & Related Apparel — 0.2%

|

|

| 230,625

| Crocs, Inc., 2024 Refinancing Term Loan, 7.497% (Term SOFR + 225 bps), 2/20/29

| $ 231,821

|

|

| Total Footwear & Related Apparel

| $231,821

|

|

|

|

|

|

| Gambling (Non-Hotel) — 0.8%

|

|

| 1

| Bally's Corp., Term B Facility Loan, 8.794% (Term SOFR + 325 bps), 10/2/28

| $ 1

|

| 223,875

| Flutter Entertainment Plc, Term B Loan, 7.585% (Term SOFR + 225 bps), 11/29/30

|

224,434

|

| 492,500

| Light and Wonder International, Inc., Term B-2 Loan, 7.592% (Term SOFR + 225 bps), 4/15/29

|

493,462

|

| 288,000

| PCI Gaming Authority, Term B Facility Loan, 7.342% (Term SOFR + 200 bps), 7/18/31

| 286,650

|

|

| Total Gambling (Non-Hotel)

| $1,004,547

|

|

|

|

|

|

| Golf — 0.5%

|

|

| 663,250

| Topgolf Callaway Brands Corp., Intial Term Loan, 8.247% (Term SOFR + 300 bps), 3/15/30

| $ 658,069

|

|

| Total Golf

| $658,069

|

|

|

|

|

|

| Hazardous Waste Disposal — 0.6%

|

|

| 751,312

| JFL-Tiger Acquisition Co., Inc., Initial Term Loan, 9.842% (Term SOFR + 450 bps), 10/17/30

| $ 755,069

|

|

| Total Hazardous Waste Disposal

| $755,069

|

|

|

|

|

|

| Hotels & Motels — 1.1%

|

|

| 921,973

| Playa Resorts Holding B.V., 2022 Term Loan, 8.028% (Term SOFR + 275 bps), 1/5/29

| $ 922,089

|

| 493,769

| Travel + Leisure Co., 2023 Incremental Term Loan, 8.661% (Term SOFR + 325 bps), 12/14/29

| 495,826

|

|

| Total Hotels & Motels

| $1,417,915

|

|

|

|

|

11Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Human Resources — 0.7%

|

|

| 967,500

| Ingenovis Health, Inc., First Lien Initial Term Loan, 9.611% (Term SOFR + 425 bps), 3/6/28

| $ 862,688

|

|

| Total Human Resources

| $862,688

|

|

|

|

|

|

| Independent Power Producer — 0.4%

|

|

| 457,663

| EFS Cogen Holdings I LLC, Term B Advance, 9.096% (Term SOFR + 350 bps), 10/1/27

| $ 460,492

|

|

| Total Independent Power Producer

| $460,492

|

|

|

|

|

|

| Insurance Brokers — 0.8%

|

|

| 635,906

| HIG Finance 2 Ltd., 2024 Dollar Term Loan, 8.747% (Term SOFR + 350 bps), 2/15/31

| $ 638,052

|

| 377,155

| USI, Inc., 2024 Term Loan, 8.085% (Term SOFR + 275 bps), 9/27/30

| 377,587

|

|

| Total Insurance Brokers

| $1,015,639

|

|

|

|

|

|

| Internet Content — 0.7%

|

|

| 867,056

| MH Sub I LLC (Micro Holding Corp.), 2023 May Incremental First Lien Term Loan, 9.497% (Term SOFR + 425 bps), 5/3/28

| $ 865,702

|

|

| Total Internet Content

| $865,702

|

|

|

|

|

|

| Internet Financial Svcs — 0.4%

|

|

| 439,127

| ION Trading Finance Ltd., 2024 Dollar Term Loan, 9.346% (Term SOFR + 400 bps), 4/1/28

| $ 440,820

|

|

| Total Internet Financial Svcs

| $440,820

|

|

|

|

|

|

| Investment Management & Advisory Services — 1.8%

|

|

| 644,582

| Allspring Buyer LLC, Initial Term Loan, 8.887% (Term SOFR + 325 bps), 11/1/28

| $ 644,099

|

| 584,981

| Edelman Financial Engines Center LLC, 2024 Refinancing Term Loan, 8.497% (Term SOFR + 325 bps), 4/7/28

|

586,261

|

| 190,000(c)

| GTCR Everest Borrower LLC, Term Loan B, 6/3/31

|

189,189

|

| 1,036,470

| Russell Investments US Institutional Holdco, Inc., 2027 Term Loan, 10.252% (Term SOFR + 500 bps), 5/30/27

| 915,548

|

|

| Total Investment Management & Advisory Services

| $2,335,097

|

|

|

|

|

|

| Lasers-System & Components — 0.6%

|

|

| 817,485

| Coherent Corp., Term B1 Loan, 7.747% (Term SOFR + 250 bps), 7/2/29

| $ 821,164

|

|

| Total Lasers-Syst/Components

| $821,164

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2412

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Lottery Services — 0.6%

|

|

| 788,000

| Scientific Games Holdings LP, 2024 Refinancing Dollar Term Loan, 8.318% (Term SOFR + 300 bps), 4/4/29

| $ 785,866

|

|

| Total Lottery Services

| $785,866

|

|

|

|

|

|

| Medical Diagnostic Imaging — 0.8%

|

|

| 1,071,990

| US Radiology Specialists, Inc., TLB, 10.585% (Term SOFR + 475 bps), 12/15/27

| $ 1,075,676

|

|

| Total Medical Diagnostic Imaging

| $1,075,676

|

|

|

|

|

|

| Medical Information Systems — 2.2%

|

|

| 786,291

| athenahealth Group, Inc., Initial Term Loan, 8.497% (Term SOFR + 325 bps), 2/15/29

| $ 782,640

|

| 932,651

| Gainwell Acquisition Corp., First Lien Term B Loan, 9.435% (Term SOFR + 400 bps), 10/1/27

|

848,713

|

| 970,000

| One Call Corp., First Lien Term B Loan, 11.046% (Term SOFR + 550 bps), 4/22/27

|

943,325

|

| 254,773

| Waystar Technologies, Inc., First Lien Initial Term Loan, 7.997% (Term SOFR + 275 bps), 10/22/29

| 255,888

|

|

| Total Medical Information Systems

| $2,830,566

|

|

|

|

|

|

| Medical Labs & Testing Services — 3.6%

|

|

| 714,375

| Charlotte Buyer, Inc., First Lien First Refinancing Term Loan, 10.077% (Term SOFR + 475 bps), 2/11/28

| $ 719,119

|

| 979,751

| eResearchTechnology, Inc., First Lien Tranche B-1 Term Loan, 9.247% (Term SOFR + 400 bps), 2/4/27

|

986,365

|

| 1,433,025

| FC Compassus LLC, Term B-1 Loan, 9.569% (Term SOFR + 425 bps), 12/31/26

| 1,413,321

|

| 991,128

| Phoenix Guarantor Inc., First Lien Tranche B-4 Term Loan, 8.497% (Term SOFR + 325 bps), 2/21/31

|

993,674

|

| 496,173

| U.S. Anesthesia Partners, Inc., First Lien Initial Term Loan, 9.707% (Term SOFR + 425 bps), 10/1/28

| 487,180

|

|

| Total Medical Labs & Testing Services

| $4,599,659

|

|

|

|

|

|

| Medical-Drugs — 1.7%

|

|

| 250,000

| Endo Finance Holdings, Inc., Initial Term Loan, 9.783% (Term SOFR + 450 bps), 4/23/31

| $ 249,937

|

| 528,675

| Financiere Mendel, Additional Term USD Facility 1, 8.354% (Term SOFR + 325 bps), 11/12/30

|

530,162

|

| 716,613

| Jazz Pharmaceuticals, Inc., Term Loan B, 7.497% (Term SOFR + 225 bps), 5/5/28

|

718,056

|

| 705,882

| Padagis LLC, Term B Loan, 10.326% (Term SOFR + 475 bps), 7/6/28

| 654,706

|

|

| Total Medical-Drugs

| $2,152,861

|

|

|

|

|

13Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Medical-Generic Drugs — 1.1%

|

|

| 913,438

| Amneal Pharmaceuticals LLC, Initial Term Loan, 10.747% (Term SOFR + 550 bps), 5/4/28

| $ 928,662

|

| 497,468

| Perrigo Company Plc, Initial Term B Loan, 7.597% (Term SOFR + 225 bps), 4/20/29

| 497,157

|

|

| Total Medical-Generic Drugs

| $1,425,819

|

|

|

|

|

|

| Medical-Hospitals — 1.2%

|

|

| 261,584

| EyeCare Partners LLC, Tranche B Term Loan, 9.989% (Term SOFR + 461 bps), 11/30/28

| $ 167,414

|

| 974,990

| Knight Health Holdings LLC, Term B Loan, 10.611% (Term SOFR + 525 bps), 12/23/28

|

489,932

|

| 895,000

| LifePoint Health, Inc., First Lien 2024 Incremental Term Loan, 9.342% (Term SOFR + 400 bps), 5/17/31

| 898,468

|

|

| Total Medical-Hospitals

| $1,555,814

|

|

|

|

|

|

| Medical-Wholesale Drug Distribution — 0.3%

|

|

| 444,375

| CVET Midco 2 LP, First Lien Initial Term Loan, 10.335% (Term SOFR + 500 bps), 10/13/29

| $ 430,627

|

|

| Total Medical-Wholesale Drug Distribution

| $430,627

|

|

|

|

|

|

| Metal Processors & Fabrication — 1.1%

|

|

| 641,630

| Grinding Media, Inc. (Molycop, Ltd.), First Lien Initial Term Loan, 9.569% (Term SOFR + 400 bps), 10/12/28

| $ 641,630

|

| 726,049

| WireCo WorldGroup, Inc., 2023 Refinancing Term Loan, 9.032% (Term SOFR + 375 bps), 11/13/28

| 729,679

|

|

| Total Metal Processors & Fabrication

| $1,371,309

|

|

|

|

|

|

| Metal-Aluminum — 1.1%

|

|

| 1,434,432

| Arsenal AIC Parent LLC, 2024-A Refinancing Term B Loan, 8.56% (Term SOFR + 325 bps), 8/18/30

| $ 1,439,363

|

|

| Total Metal-Aluminum

| $1,439,363

|

|

|

|

|

|

| Mining Services — 0.1%

|

|

| 176,166

| Flame NewCo LLC, First Lien New Money Exit Term Loan, 7.347% (Term SOFR + 200 bps), 6/30/28

| $ 168,899

|

|

| Total Mining Services

| $168,899

|

|

|

|

|

|

| Office Automation & Equipment — 0.7%

|

|

| 870,750

| Pitney Bowes, Inc., Refinancing Tranche B Term Loan, 9.361% (Term SOFR + 400 bps), 3/17/28

| $ 876,192

|

|

| Total Office Automation & Equipment

| $876,192

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2414

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Oil&Gas Drilling — 0.6%

|

|

| 700,000

| WaterBridge Midstream Operating LLC, Term Loan B, 10.089% (Term SOFR + 475 bps), 6/27/29

| $ 700,437

|

|

| Total Oil&Gas Drilling

| $700,437

|

|

|

|

|

|

| Pastoral & Agricultural — 0.5%

|

|

| 633,750

| Alltech, Inc., Term B Loan, 9.361% (Term SOFR + 400 bps), 10/13/28

| $ 632,363

|

|

| Total Pastoral & Agricultural

| $632,363

|

|

|

|

|

|

| Pharmacy Services — 0.3%

|

|

| 341,250

| Option Care Health, Inc., 2021 First Lien Refinancing Term Loan, 7.497% (Term SOFR + 225 bps), 10/27/28

| $ 343,468

|

|

| Total Pharmacy Services

| $343,468

|

|

|

|

|

|

| Physical Practice Management — 0.3%

|

|

| 423,531

| Sound Inpatient Physicians, Inc., Tranche B Term Loan, 9.096% (Term SOFR + 350 bps), 6/28/28

| $ 357,884

|

|

| Total Physical Practice Management

| $357,884

|

|

|

|

|

|

| Physical Therapy & Rehabilitation Centers — 2.2%

|

|

| 914,667

| Summit Behavioral Healthcare LLC, First Lien Tranche B-1 Term Loan, 9.307% (Term SOFR + 425 bps), 11/24/28

| $ 887,226

|

| 2,157,092

| Upstream Newco, Inc., First Lien August 2021 Incremental Term Loan, 9.764% (Term SOFR + 425 bps), 11/20/26

| 1,960,258

|

|

| Total Physical Therapy & Rehabilitation Centers

| $2,847,484

|

|

|

|

|

|

| Pipelines — 3.9%

|

|

| 1,059,844

| Brazos Delaware II LLC, Refinancing Term Loan, 8.255% (Term SOFR + 350 bps), 2/11/30

| $ 1,067,793

|

| 648,329

| Buckeye Partners LP, 2024 Tranche B-4 Term Loan, 7.247% (Term SOFR + 200 bps), 11/22/30

|

649,849

|

| 614,106

| GIP III Stetson I LP (GIP III Stetson II LP), 2023 Initial Term Loan, 8.747% (Term SOFR + 350 bps), 10/31/28

|

617,432

|

| 208,947

| GIP Pilot Acquisition Partners LP, Amendment No. 1 Refinancing Term Loan, 7.818% (Term SOFR + 250 bps), 10/4/30

|

209,861

|

| 467,431

| M6 ETX Holdings II MidCo LLC, Initial Term Loan, 9.847% (Term SOFR + 450 bps), 9/19/29

|

469,878

|

15Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Pipelines — (continued)

|

|

| 922,687

| NGL Energy Operating LLC, Initial Term Loan, 8.997% (Term SOFR + 375 bps), 2/3/31

| $ 922,303

|

| 986,782

| Traverse Midstream Partners LLC, Advance, 8.752% (Term SOFR + 350 bps), 2/16/28

| 991,222

|

|

| Total Pipelines

| $4,928,338

|

|

|

|

|

|

| Printing-Commercial — 0.3%

|

|

| 384,038

| Cimpress Plc, 2024 Refinancing Tranche B-1 Term Loan, 8.247% (Term SOFR + 300 bps), 5/17/28

| $ 385,238

|

|

| Total Printing-Commercial

| $385,238

|

|

|

|

|

|

| Professional Sports — 0.4%

|

|

| 500,000

| Formula One Management Ltd., First Lien Facility B Loan, 7.585% (Term SOFR + 225 bps), 1/15/30

| $ 502,875

|

|

| Total Professional Sports

| $502,875

|

|

|

|

|

|

| Property & Casualty Insurance — 2.3%

|

|

| 794,602

| Asurion LLC, New B-10 Term Loan, 9.347% (Term SOFR + 400 bps), 8/19/28

| $ 788,581

|

| 244,317

| Asurion LLC, New B-11 Term Loan, 9.597% (Term SOFR + 425 bps), 8/19/28

|

243,309

|

| 483,750

| Asurion LLC, New B-9 Term Loan, 8.611% (Term SOFR + 325 bps), 7/31/27

|

479,085

|

| 1,348,379

| Sedgwick Claims Management Services, Inc. (Lightning Cayman Merger Sub, Ltd.), 2024 Term Loan, 8.252% (Term SOFR + 300 bps), 7/31/31

| 1,351,076

|

|

| Total Property & Casualty Insurance

| $2,862,051

|

|

|

|

|

|

| Protection-Safety — 0.5%

|

|

| 658,350

| Prime Security Services Borrower LLC, 2024 First Lien Refinancing Term B-1 Loan, 7.60% (Term SOFR + 225 bps), 10/13/30

| $ 660,236

|

|

| Total Protection-Safety

| $660,236

|

|

|

|

|

|

| Publishing — 1.8%

|

|

| 847,875

| Cengage Learning, Inc., First Lien Term B Loan, 9.538% (Term SOFR + 425 bps), 3/24/31

| $ 851,728

|

| 786,000

| Houghton Mifflin Harcourt Co., First Lien Term B Loan, 10.597% (Term SOFR + 525 bps), 4/9/29

|

747,069

|

| 677,791

| McGraw-Hill Education, Inc., 2024 Term Loan, 9.228% (Term SOFR + 400 bps), 8/6/31

| 681,180

|

|

| Total Publishing

| $2,279,977

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2416

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Publishing-Periodicals — 0.3%

|

|

| 366,563

| MJH Healthcare Holdings LLC, 2024 Refinancing Term B Loan, 8.597% (Term SOFR + 325 bps), 1/28/29

| $ 366,677

|

|

| Total Publishing-Periodicals

| $366,677

|

|

|

|

|

|

| Recreational Centers — 1.7%

|

|

| 920,000

| Bulldog Purchaser Inc., First Lien Term Loan, 9.585% (Term SOFR + 425 bps), 6/30/31

| $ 924,313

|

| 1,246,875

| Fitness International LLC, Term B Loan, 10.505% (Term SOFR + 525 bps), 2/12/29

| 1,245,316

|

|

| Total Recreational Centers

| $2,169,629

|

|

|

|

|

|

| Recycling — 0.6%

|

|

| 825,231

| LTR Intermediate Holdings, Inc., Initial Term Loan, 9.861% (Term SOFR + 450 bps), 5/5/28

| $ 800,474

|

|

| Total Recycling

| $800,474

|

|

|

|

|

|

| REITS-Storage — 0.2%

|

|

| 189,050

| Iron Mountain Information Management LLC, Amendment No.1 Incremental Term B Loan, 7.247% (Term SOFR + 200 bps), 1/31/31

| $ 188,991

|

|

| Total REITS-Storage

| $188,991

|

|

|

|

|

|

| Rental Auto & Equipment — 1.2%

|

|

| 690,000

| Albion Financing 3 S.a r.l. (Albion Financing LLC), 2024 Amended U.S. Dollar Term Loan, 9.826% (Term SOFR + 425 bps), 8/16/29

| $ 696,900

|

| 398,997

| Avis Budget Car Rental LLC, New Tranche C Term Loan, 8.347% (Term SOFR + 300 bps), 3/16/29

|

399,995

|

| 416,859

| Hertz Corp., Initial Term B Loan, 8.861% (Term SOFR + 350 bps), 6/30/28

|

376,606

|

| 80,991

| Hertz Corp., Initial Term C Loan, 8.861% (Term SOFR + 350 bps), 6/30/28

| 73,170

|

|

| Total Rental Auto & Equipment

| $1,546,671

|

|

|

|

|

|

| Retail — 5.7%

|

|

| 530,863

| Great Outdoors Group LLC, Term B-2 Loan, 9.111% (Term SOFR + 375 bps), 3/6/28

| $ 531,693

|

| 672,413

| Harbor Freight Tools USA, Inc., Replacement Term Loan, 7.747% (Term SOFR + 250 bps), 6/11/31

|

664,218

|

| 999,750

| Highline Aftermarket Acquisition LLC, 2024-1 First Lien Refinancing Term Loan, 9.247% (Term SOFR + 400 bps), 11/9/27

| 1,008,498

|

| 725,183

| Kodiak BP LLC, 2024-1 Term Loan, 9.085% (Term SOFR + 375 bps), 3/12/28

|

729,035

|

17Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Retail — (continued)

|

|

| 1,018,500

| Michaels Cos, Inc., Term Loan B, 9.846% (Term SOFR + 425 bps), 4/15/28

| $ 838,989

|

| 969,191

| Petco Health & Wellness Co., Inc., First Lien Initial Term Loan, 8.846% (Term SOFR + 325 bps), 3/3/28

|

900,015

|

| 1,018,500

| PetSmart LLC, Initial Term Loan, 9.097% (Term SOFR + 375 bps), 2/11/28

| 1,014,998

|

| 1,221,949

| RVR Dealership Holdings LLC, Term Loan, 9.097% (Term SOFR + 375 bps), 2/8/28

| 1,101,587

|

| 431,250

| Torrid LLC, Closing Date Term Loan, 10.933% (Term SOFR + 550 bps), 6/14/28

| 398,906

|

|

| Total Retail

| $7,187,939

|

|

|

|

|

|

| Retail-Catalog Shopping — 0.3%

|

|

| 489,162

| Medical Solutions Holdings, Inc., First Lien Initial Term Loan, 8.602% (Term SOFR + 325 bps), 11/1/28

| $ 374,821

|

|

| Total Retail-Catalog Shopping

| $374,821

|

|

|

|

|

|

| Retail-Misc/Diversified — 0.6%

|

|

| 399,000

| Peer Holding III B.V., Facility B4, 8.585% (Term SOFR + 325 bps), 10/28/30

| $ 400,828

|

| 360,000

| Peer Holding III B.V., Term Loan B5, 8.332% (Term SOFR + 300 bps), 7/1/31

| 361,650

|

|

| Total Retail-Misc/Diversified

| $762,478

|

|

|

|

|

|

| Retail-Restaurants — 0.3%

|

|

| 384,000

| 1011778 B.C. Unlimited Liability Co., Term B-6 Loan, 6.997% (Term SOFR + 175 bps), 9/20/30

| $ 381,680

|

|

| Total Retail-Restaurants

| $381,680

|

|

|

|

|

|

| Schools — 0.3%

|

|

| 422,647

| Fugue Finance LLC, Existing Term Loan, 9.057% (Term SOFR + 400 bps), 1/31/28

| $ 426,345

|

|

| Total Schools

| $426,345

|

|

|

|

|

|

| Security Services — 2.6%

|

|

| 1,390,030

| Allied Universal Holdco LLC (f/k/a USAGM Holdco LLC), Initial U.S. Dollar Term Loan, 9.097% (Term SOFR + 375 bps), 5/12/28

| $ 1,383,340

|

| 1,954,746

| Garda World Security Corp., Tenth Additional Term Loan, 8.832% (Term SOFR + 350 bps), 2/1/29

| 1,959,633

|

|

| Total Security Services

| $3,342,973

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2418

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Semiconductor Equipment — 0.9%

|

|

| 1,088,362

| Ultra Clean Holdings, Inc., Sixth Amendment Term Loan, 8.747% (Term SOFR + 350 bps), 2/25/28

| $ 1,095,164

|

|

| Total Semiconductor Equipment

| $1,095,164

|

|

|

|

|

|

| Telecom Services — 0.8%

|

|

| 1,008,660

| Windstream Services LLC, Initial Term Loan, 11.597% (Term SOFR + 625 bps), 9/21/27

| $ 1,015,595

|

|

| Total Telecom Services

| $1,015,595

|

|

|

|

|

|

| Telephone-Integrated — 0.8%

|

|

| 500,000

| Level 3 Financing, Inc., Term B-1, 11.838% (Term SOFR + 656 bps), 4/15/29

| $ 504,166

|

| 500,000

| Level 3 Financing, Inc., Term B-2, 11.838% (Term SOFR + 656 bps), 4/15/30

| 503,625

|

|

| Total Telephone-Integrated

| $1,007,791

|

|

|

|

|

|

| Television — 0.2%

|

|

| 290,000

| Gray Television, Inc., Term F Loan, 10.592% (Term SOFR + 525 bps), 6/4/29

| $ 278,348

|

|

| Total Television

| $278,348

|

|

|

|

|

|

| Theaters — 1.4%

|

|

| 592,515

| Cinemark USA, Inc., Term Loan, 8.585% (Term SOFR + 325 bps), 5/24/30

| $ 595,848

|

| 1,193,136

| Cirque du Soleil Canada, Inc., Refinancing Term Loan, 9.085% (Term SOFR + 375 bps), 3/8/30

| 1,186,239

|

|

| Total Theaters

| $1,782,087

|

|

|

|

|

|

| Transportation Services — 2.6%

|

|

| 1,167,000

| AIT Worldwide Logistics Holdings, Inc., First Lien Initial Term Loan, 9.968% (Term SOFR + 475 bps), 4/6/28

| $ 1,169,918

|

| 1,010,666

| Carriage Purchaser, Inc., Term B Loan, 9.611% (Term SOFR + 425 bps), 10/2/28

| 1,015,404

|

| 368,322

| First Student Bidco Inc., TLB-2 Loan, 8.435% (Term SOFR + 300 bps), 7/21/28

|

369,732

|

| 533,578

| First Student Bidco, Inc., Initial Term B Loan, 8.596% (Term SOFR + 300 bps), 7/21/28

|

535,722

|

| 162,725

| First Student Bidco, Inc., Initial Term C Loan, 8.596% (Term SOFR + 300 bps), 7/21/28

| 163,378

|

|

| Total Transportation Services

| $3,254,154

|

|

|

|

|

19Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Transport-Rail — 0.3%

|

|

| 332,000

| Genesee & Wyoming Inc., Initial Term Loan, 7.335% (Term SOFR + 200 bps), 4/10/31

| $ 332,302

|

|

| Total Transport-Rail

| $332,302

|

|

|

|

|

|

| Veterinary Diagnostics — 0.8%

|

|

| 366,560

| Elanco Animal Health Inc., Term Loan, 7.192% (Term SOFR + 175 bps), 8/1/27

| $ 366,527

|

| 703,270

| Southern Veterinary Partners LLC, First Lien 2024-2 New Term Loan, 8.997% (Term SOFR + 375 bps), 10/5/27

| 708,251

|

|

| Total Veterinary Diagnostics

| $1,074,778

|

|

|

|

|

|

| Total Senior Secured Floating Rate Loan Interests

(Cost $165,556,524)

| $163,115,657

|

|

|

|

|

| Shares

|

|

|

|

|

|

|

|

| Common Stocks — 0.8% of Net Assets

|

|

|

| Construction & Engineering — 0.0%†

|

|

| 9,729(d)

| LB New Holdco

| $ 43,780

|

|

| Total Construction & Engineering

| $43,780

|

|

|

|

|

|

| Metals & Mining — 0.0%†

|

|

| 2,625(d)

| Flame Co.

| $ 13,125

|

|

| Total Metals & Mining

| $13,125

|

|

|

|

|

|

| Passenger Airlines — 0.6%

|

|

| 40,684(d)

| Grupo Aeromexico SAB de CV

| $ 803,934

|

|

| Total Passenger Airlines

| $803,934

|

|

|

|

|

|

| Pharmaceuticals — 0.2%

|

|

| 7,594(d)

| Endo, Inc.

| $ 205,038

|

|

| Total Pharmaceuticals

| $205,038

|

|

|

|

|

|

| Total Common Stocks

(Cost $1,047,415)

| $1,065,877

|

|

|

|

|

Principal

Amount

USD ($)

|

|

|

|

|

|

|

|

| Asset Backed Securities — 2.4% of Net Assets

|

|

| 1,000,000(a)

| Assurant CLO IV, Ltd., Series 2019-4A, Class E, 12.544% (3 Month Term SOFR + 726 bps), 4/20/30 (144A)

| $ 995,415

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2420

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Asset Backed Securities — (continued)

|

|

| 1,000,000

| JPMorgan Chase Bank NA - CACLN, Series 2021-3, Class G, 9.812%, 2/26/29 (144A)

| $ 1,022,803

|

| 1,000,000(a)

| Octagon Investment Partners XXI, Ltd., Series 2014-1A, Class DRR, 12.378% (3 Month Term SOFR + 726 bps), 2/14/31 (144A)

| 992,496

|

|

| Total Asset Backed Securities

(Cost $2,998,741)

| $3,010,714

|

|

|

|

|

|

| Collateralized Mortgage

Obligations—2.1% of Net Assets

|

|

| 370,000(a)

| Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2, 11.349% (SOFR30A + 600 bps), 10/25/41 (144A)

| $ 390,350

|

| 230,000(a)

| Federal Home Loan Mortgage Corp. STACR REMIC Trust, Series 2021-DNA7, Class B2, 13.149% (SOFR30A + 780 bps), 11/25/41 (144A)

|

248,668

|

| 490,000(a)

| Federal Home Loan Mortgage Corp. STACR REMIC Trust, Series 2021-HQA3, Class B2, 11.599% (SOFR30A + 625 bps), 9/25/41 (144A)

|

510,777

|

| 250,000(a)

| Federal Home Loan Mortgage Corp. STACR REMIC Trust, Series 2022-DNA1, Class B2, 12.449% (SOFR30A + 710 bps), 1/25/42 (144A)

|

267,813

|

| 320,000(a)

| Federal Home Loan Mortgage Corp. STACR REMIC Trust, Series 2022-DNA2, Class B2, 13.849% (SOFR30A + 850 bps), 2/25/42 (144A)

|

353,200

|

| 710,000(a)

| STACR Trust, Series 2018-HRP2, Class B2, 15.963% (SOFR30A + 1,061 bps), 2/25/47 (144A)

| 878,625

|

|

| Total Collateralized Mortgage Obligations

(Cost $2,453,965)

| $2,649,433

|

|

|

|

|

|

| Commercial Mortgage-Backed

Securities—1.0% of Net Assets

|

|

| 478,794(a)

| BX Trust, Series 2022-PSB, Class F, 12.67% (1 Month Term SOFR + 733 bps), 8/15/39 (144A)

| $ 474,022

|

| 37,119(a)

| FREMF Mortgage Trust, Series 2020-KF74, Class C, 11.716% (SOFR30A + 636 bps), 1/25/27 (144A)

|

34,113

|

| 1,000,000

| Wells Fargo Commercial Mortgage Trust, Series 2015-C28, Class E, 3.00%, 5/15/48 (144A)

| 767,699

|

|

| Total Commercial Mortgage-Backed Securities

(Cost $1,318,534)

| $1,275,834

|

|

|

|

|

21Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Corporate Bonds — 8.3% of Net Assets

|

|

|

| Airlines — 1.2%

|

|

| 940,000

| Grupo Aeromexico SAB de CV, 8.50%, 3/17/27 (144A)

| $ 946,355

|

| 729,000

| VistaJet Malta Finance Plc/Vista Management Holding, Inc., 6.375%, 2/1/30 (144A)

| 597,789

|

|

| Total Airlines

| $1,544,144

|

|

|

|

|

|

| Banks — 0.9%

|

|

| 1,000,000(e)(f)

| Citigroup, Inc., 4.70% (SOFR + 323 bps)

| $ 992,844

|

| 255,000(e)(f)

| ING Groep NV, 4.25% (5 Year CMT Index + 286 bps)

| 204,120

|

|

| Total Banks

| $1,196,964

|

|

|

|

|

|

| Chemicals — 0.7%

|

|

| 250,000

| Element Solutions, Inc., 3.875%, 9/1/28 (144A)

| $ 236,379

|

| 300,000

| SCIL IV LLC/SCIL USA Holdings LLC, 5.375%, 11/1/26 (144A)

|

295,602

|

| 390,000

| Tronox, Inc., 4.625%, 3/15/29 (144A)

| 355,418

|

|

| Total Chemicals

| $887,399

|

|

|

|

|

|

| Commercial Services — 0.4%

|

|

| 500,000

| Garda World Security Corp., 6.00%, 6/1/29 (144A)

| $ 471,810

|

|

| Total Commercial Services

| $471,810

|

|

|

|

|

|

| Electric — 0.2%

|

|

| 300,000

| Vistra Operations Co. LLC, 4.375%, 5/1/29 (144A)

| $ 287,207

|

|

| Total Electric

| $287,207

|

|

|

|

|

|

| Iron & Steel — 0.3%

|

|

| 500,000

| Metinvest BV, 7.75%, 10/17/29 (144A)

| $ 328,965

|

|

| Total Iron & Steel

| $328,965

|

|

|

|

|

|

| Lodging — 0.4%

|

|

| 500,000

| Station Casinos LLC, 4.50%, 2/15/28 (144A)

| $ 479,885

|

|

| Total Lodging

| $479,885

|

|

|

|

|

|

| Media — 1.2%

|

|

| 300,000

| Charter Communications Operating LLC/Charter Communications Operating Capital, 2.25%, 1/15/29

| $ 265,106

|

| 200,000

| CSC Holdings LLC, 11.75%, 1/31/29 (144A)

|

176,601

|

| 510,000

| McGraw-Hill Education, Inc., 8.00%, 8/1/29 (144A)

|

507,878

|

| 1,000,000

| Sinclair Television Group, Inc., 5.50%, 3/1/30 (144A)

| 597,560

|

|

| Total Media

| $1,547,145

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2422

Schedule of Investments | 8/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Mining — 0.7%

|

|

| 925,000

| First Quantum Minerals, Ltd., 8.625%, 6/1/31 (144A)

| $ 924,637

|

|

| Total Mining

| $924,637

|

|

|

|

|

|

| Oil & Gas — 0.5%

|

|

| 600,000

| Hilcorp Energy I LP/Hilcorp Finance Co., 6.875%, 5/15/34 (144A)

| $ 606,901

|

|

| Total Oil & Gas

| $606,901

|

|

|

|

|

|

| Pipelines — 0.2%

|

|

| 300,000

| Venture Global Calcasieu Pass LLC, 3.875%, 8/15/29 (144A)

| $ 283,615

|

|

| Total Pipelines

| $283,615

|

|

|

|

|

|

| Real Estate — 0.3%

|

|

| 390,000

| Kennedy-Wilson, Inc., 5.00%, 3/1/31

| $ 339,254

|

|

| Total Real Estate

| $339,254

|

|

|

|

|

|

| REITs — 0.7%

|

|

| 390,000

| Starwood Property Trust, Inc., 7.25%, 4/1/29 (144A)

| $ 405,960

|

| 500,000

| Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 10.50%, 2/15/28 (144A)

| 513,028

|

|

| Total REITs

| $918,988

|

|

|

|

|

|

| Telecommunications — 0.6%

|

|

| 275,000

| Level 3 Financing, Inc., 10.50%, 5/15/30 (144A)

| $ 294,654

|

| 500,000

| Windstream Escrow LLC/Windstream Escrow Finance Corp., 7.75%, 8/15/28 (144A)

| 488,053

|

|

| Total Telecommunications

| $782,707

|

|

|

|

|

|

| Total Corporate Bonds

(Cost $10,891,471)

| $10,599,621

|

|

|

|

|

|

| Insurance-Linked Securities — 1.0% of Net

Assets#

|

|

|

| Event Linked Bonds — 1.0%

|

|

|

| Multiperil – U.S. — 0.6%

|

|

| 250,000(a)

| Matterhorn Re, 10.621%, (SOFR + 525 bps), 3/24/25 (144A)

| $ 247,325

|

| 250,000(a)

| Residential Re, 11.162%, (3 Month U.S. Treasury Bill + 605 bps), 12/6/25 (144A)

|

238,925

|

| 250,000(a)

| Sanders Re III, 8.522%, (3 Month U.S. Treasury Bill + 341 bps), 4/7/26 (144A)

| 245,725

|

|

|

|

|

|

|

| $731,975

|

|

|

|

|

23Pioneer Floating Rate Fund, Inc. | 8/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Windstorm – North Carolina — 0.2%

|

|

| 250,000(a)

| Cape Lookout Re, 14.702%, (3 Month U.S. Treasury Bill + 959 bps), 3/28/25 (144A)

| $ 249,100

|

|

| Windstorm – U.S. Regional — 0.2%

|

|

| 250,000(a)

| Commonwealth Re, 8.875%, (3 Month U.S. Treasury Bill + 376 bps), 7/8/25 (144A)

| $ 251,750

|

|

| Total Event Linked Bonds

| $1,232,825

|

|

|

|

|

Face

Amount

USD ($)

|

|

|

|

|

|

|

|

| Reinsurance Sidecars — 0.0%†

|

|

|

| Multiperil – U.S. — 0.0%†

|

|

| 250,000(d)(g)+

| Harambee Re 2018, 12/31/24

| $ 100

|

| 250,000(d)(g)+

| Harambee Re 2019, 12/31/24

| 125

|

|

|

|

|

|

|

| $225

|

|

|

|

|

|

| Multiperil – Worldwide — 0.0%†

|

|

| 12,278(g)+

| Alturas Re 2022-2, 12/31/27

| $ 1,016

|

| 199,590(d)(g)+

| Lorenz Re 2019, 6/30/25

|

1,637

|

| 244,914(d)(h)+

| Woburn Re 2019, 12/31/24

| 33,713

|

|

|

|

|

|

|

| $36,366

|

|

|

|

|

|

| Total Reinsurance Sidecars

| $36,591

|

|

|

|

|

|

| Total Insurance-Linked Securities

(Cost $1,313,684)

| $1,269,416

|

|

|

|

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2424

Schedule of Investments | 8/31/24

(unaudited) (continued)

| Shares

|

|

|

|

|

| Value

|

|

| SHORT TERM INVESTMENTS — 4.0% of Net Assets

|

|

|

| Open-End Fund — 4.0%

|

|

| 5,063,902(i)

| Dreyfus Government Cash Management,

Institutional Shares, 5.19%

| $ 5,063,902

|

|

|

|

|

|

|

| $5,063,902

|

|

|

|

|

|

| TOTAL SHORT TERM INVESTMENTS

(Cost $5,063,902)

| $5,063,902

|

|

|

|

|

|

| TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 147.8%

(Cost $190,644,236)

| $188,050,454

|

|

| OTHER ASSETS AND LIABILITIES — (47.8)%

| $(60,833,789)

|

|

| net assets — 100.0%

| $127,216,665

|

|

|

|

|

|

|

|

|

| bps

| Basis Points.

|

| CMT

| Constant Maturity Treasury Index.

|

| FREMF

| Freddie Mac Multifamily Fixed-Rate Mortgage Loans.

|

| LIBOR

| London Interbank Offered Rate.

|

| REIT

| Real Estate Investment Trust.

|

| SOFR

| Secured Overnight Financing Rate.

|

| SOFR30A

| Secured Overnight Financing Rate 30 Day Average.

|

| (144A)

| The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At August 31, 2024,

the value of these securities amounted to $16,967,103, or 13.3% of net assets.

|

| (a)

| Floating rate note. Coupon rate, reference index and spread shown at August 31, 2024.

|

| (b)

| Security is in default.

|

| (c)

| All or a portion of this senior loan position has not settled. Rates do not take effect until settlement date. Rates shown, if any, are for the settled portion.

|

| (d)

| Non-income producing security.

|

| (e)

| Security is perpetual in nature and has no stated maturity date.

|

| (f)

| The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at August 31, 2024.

|

| (g)

| Issued as preference shares.

|

| (h)

| Issued as participation notes.

|

| (i)

| Rate periodically changes. Rate disclosed is the 7-day yield at August 31, 2024.

|

25Pioneer Floating Rate Fund, Inc. | 8/31/24

| *

| Senior secured floating rate loan interests in which the Fund invests generally pay interest at rates that are periodically re-determined by reference to a base lending rate plus a premium. These base lending

rates are generally (i) the lending rate offered by one or more major European banks, such as LIBOR or SOFR, (ii) the prime rate offered by one or more major United States banks, (iii) the rate of a certificate

of deposit or (iv) other base lending rates used by commercial lenders. The interest rate shown is the rate accruing at August 31, 2024.

|

| +

| Security is valued using significant unobservable inputs (Level 3).

|

| †

| Amount rounds to less than 0.1%.

|

| #

| Securities are restricted as to resale.

|

| Restricted Securities

| Acquisition date

| Cost

| Value

|

| Alturas Re 2022-2

| 4/11/2023

| $—

| $1,016

|

| Cape Lookout Re

| 3/16/2022

| 250,000

| 249,100

|

| Commonwealth Re

| 6/15/2022

| 250,000

| 251,750

|

| Harambee Re 2018

| 12/19/2017

| 5,311

| 100

|

| Harambee Re 2019

| 12/20/2018

| —

| 125

|

| Lorenz Re 2019

| 6/26/2019

| 30,352

| 1,637

|

| Matterhorn Re

| 3/10/2022

| 250,000

| 247,325

|

| Residential Re

| 10/28/2021

| 250,000

| 238,925

|

| Sanders Re III

| 3/22/2022

| 250,000

| 245,725

|

| Woburn Re 2019

| 1/30/2019

| 28,021

| 33,713

|

| Total Restricted Securities

|

|

| $1,269,416

|

| % of Net assets

|

|

| 1.0%

|

FORWARD FOREIGN

CURRENCY EXCHANGE CONTRACTS

Currency

Purchased

| In

Exchange for

| Currency

Sold

| Deliver

| Counterparty

| Settlement

Date

| Unrealized

Appreciation

|

| USD

| 498,232

| MXN

| 9,164,481

| State Street Bank & Trust Co.

| 9/27/24

| $34,859

|

| TOTAL FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

| $34,859

|

Principal amounts are denominated

in U.S. dollars (“USD”) unless otherwise noted.

| MXN

| — Mexican Peso

|

| USD

| — United States Dollar

|

Pioneer Floating Rate Fund,

Inc. | 8/31/2426

Schedule of Investments | 8/31/24

(unaudited) (continued)

Various inputs are used in

determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

| Level 1

| –

| unadjusted quoted prices in active markets for identical securities.

|

| Level 2

| –

| other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

|

| Level 3

| –

| significant unobservable inputs (including the Adviser’s own assumptions in determining fair value of investments).

|

The following is a summary of the

inputs used as of August 31, 2024 in valuing the Fund’s investments:

|

| Level 1

| Level 2

| Level 3

| Total

|

| Senior Secured Floating Rate Loan Interests

| $—

| $163,115,657

| $—

| $163,115,657

|

| Common Stocks

|

|

|

|

|

| Construction & Engineering

| —

| 43,780

| —

| 43,780

|

| Metals & Mining

| —

| 13,125

| —

| 13,125

|

| Passenger Airlines

| —

| 803,934

| —

| 803,934

|

| All Other Common Stocks

| 205,038

| —

| —

| 205,038

|

| Asset Backed Securities

| —

| 3,010,714

| —

| 3,010,714

|

| Collateralized Mortgage Obligations

| —

| 2,649,433

| —

| 2,649,433

|

| Commercial Mortgage-Backed Securities

| —

| 1,275,834

| —

| 1,275,834

|

| Corporate Bonds

| —

| 10,599,621

| —

| 10,599,621

|

| Insurance-Linked Securities

|

|

|

|

|

| Reinsurance Sidecars

|

|

|

|

|

| Multiperil – U.S.

| —

| —

| 225

| 225

|

| Multiperil – Worldwide

| —

| —

| 36,366

| 36,366

|

| All Other Insurance-Linked Securities

| —

| 1,232,825

| —

| 1,232,825

|

| Open-End Fund

| 5,063,902

| —

| —

| 5,063,902

|

| Total Investments in Securities

| $5,268,940

| $182,744,923

| $36,591

| $188,050,454

|

| Other Financial Instruments

|

|

|

|

|

| Net unrealized appreciation on forward foreign currency exchange contracts

| $—

| $34,859

| $—

| $34,859

|

| Total Other Financial Instruments

| $—

| $34,859

| $—

| $34,859

|

Transfers are calculated on the

beginning of period values. During the period ended August 31, 2024, a security valued at $639,476 was transferred from Level 3 to Level 2, due to valuing the security using observable inputs. There were no other

transfers in or out of Level 3 during the period.

27Pioneer Floating Rate Fund, Inc. | 8/31/24

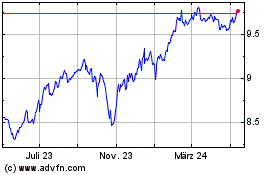

Pioneer Floating Rate (NYSE:PHD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

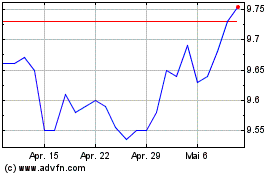

Pioneer Floating Rate (NYSE:PHD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024