UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): December 29, 2008

MEDNAX, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Florida

|

|

001-12111

|

|

26-3667538

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer Identification No.)

|

1301 Concord Terrace

Sunrise, Florida 33323

(Address of principal executive office)

Registrant’s telephone number, including area code (954) 384-0175

Pediatrix Medical Group, Inc.

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Introduction

Effective at 11:59 p.m. on December 31, 2008 (the “Effective Time”), MEDNAX, Inc., a Florida corporation (“Mednax”) and Pediatrix Medical Group, Inc., a Florida corporation (“Pediatrix”), completed a

holding company formation transaction that established Pediatrix as a wholly owned subsidiary of Mednax. In the reorganization, each outstanding share of Pediatrix common stock, par value $0.01 per share, and attached preferred share purchase right

(collectively, the “Pediatrix Common Stock”) was converted into one share of Mednax common stock, par value $0.01 per share, and attached preferred share purchase right (the “Mednax Purchase Rights” and collectively with such

common stock, the “Mednax Common Stock”). Mednax Common Stock is traded on the New York Stock Exchange under the symbol “

MD

”.

|

Item 1.01

|

Entry into a Material Definitive Agreement,

|

|

Item 3.03

|

Material Modifications to Rights of Security Holders,

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers,

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On December 29, 2008, Pediatrix entered into an Agreement and Plan of Merger (the “Merger Agreement”), with Mednax, which at the time was a wholly owned subsidiary of Pediatrix, and PMG Merger Sub,

Inc., a Florida corporation (“PMG Merger Sub”), which at the time was a wholly owned subsidiary of Mednax, for the purpose of forming a holding company for Pediatrix by merging PMG Merger Sub with and into Pediatrix (the

“Merger”), with Pediatrix being the surviving corporation. As a result of the Merger, Pediatrix became a direct wholly owned subsidiary of Mednax and changed its name to Mednax Services, Inc. The Merger was effected in accordance with

Section 607.11045 of the Florida Business Corporation Act, as amended (the “FBCA”), and became effective at the Effective Time. In accordance with the FBCA, the Amended and Restated Articles of Incorporation of Mednax (the

“Mednax Articles”) are substantially identical to those of Pediatrix immediately prior to the Merger.

In accordance with the

Merger Agreement, at the Effective Time, each share of Pediatrix Common Stock issued and outstanding immediately prior to the Effective Time was converted into one fully paid and non-assessable share of Mednax Common Stock. Also at the Effective

Time, each share of restricted Pediatrix Common Stock that was restricted under any stock or incentive compensation plan, agreement or arrangement of Pediatrix or otherwise immediately prior to the Effective Time, whether or not then vested or

exercisable, was converted into a restricted share of Mednax Common Stock, restricted on substantially the same terms and conditions (including, without limitation, vesting schedule) as applied to such share of restricted Pediatrix Common Stock

immediately prior to the Merger. Further, each option or other right to purchase Pediatrix Common Stock issued under any stock option or incentive compensation plan or arrangement of Pediatrix (each, a “Pediatrix Option”) that was

outstanding immediately prior to the Effective Time, whether or not then vested or exercisable, was converted into an option to purchase the same number of shares of Mednax Common Stock, on substantially the same terms and conditions (including,

without limitation, vesting schedule and per share exercise price) as applied to such Pediatrix Option.

1

As a result of the foregoing, immediately following the Merger, the former holders of Pediatrix Common

Stock owned Mednax Common Stock of the same class evidencing the same proportional interests in Mednax and having the same designations, rights, powers and preferences, and qualifications, limitations and restrictions thereof, as those previously

held in Pediatrix. The capitalization of Mednax immediately following the Merger was the same as the capitalization of Pediatrix immediately prior to the Merger. In addition, the consolidated assets and liabilities of Mednax immediately following

the Merger were the same as those of Pediatrix immediately prior to the Merger. The Merger qualified as a reorganization under section 368(a) of the Internal Revenue Code of 1986, as amended, and, as a result, the shareholders of Pediatrix will not

recognize gain or loss for United States federal income tax purposes.

Upon the Effective Time, the Mednax Common Stock (including the

Mednax Purchase Rights) was deemed to be registered under Section 12(b) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12g-3(a) promulgated thereunder. For purposes of Rule 12g-3(a), Mednax is the successor issuer to

Pediatrix.

The Mednax Common Stock will trade on the New York Stock Exchange under the “MD” ticker symbol in place of the

Pediatrix Common Stock.

In connection with the Merger, Mednax entered into an Assignment and Joinder Agreement, dated as of

January 1, 2009, among Pediatrix, the Guarantors identified therein and Wachovia Bank, National Association, in its capacity as Administrative Agent (the “Assignment and Joinder”), in order to effectuate the assignment by Pediatrix

and the assumption by Mednax of all of the rights and obligations of Pediatrix under that certain Credit Agreement, dated September 3, 2008, among Pediatrix, certain of its subsidiaries, as guarantors, the lenders named therein, Wachovia Bank,

National Association, as Administrative Agent, Bank of America, N.A., as Syndication Agent, and U.S. Bank, N.A., as Documentation Agent.

In addition, on December 29, 2008, Mednax also entered into an Amended and Restated Preferred Share Purchase Rights Plan (the “Mednax Rights Plan”) with Computershare Trust Company, N.A., as rights agent (the “Rights

Agent”), that provides for the issuance of the Mednax Purchase Rights on terms substantially identical (including, without limitation, the expiration date thereof) to those of the Preferred Share Purchase Rights Plan of Pediatrix that was

terminated in connection with the reorganization as more fully described below. Reference is made to the Form 8-A of Pediatrix filed with the Securities and Exchange Commission on December 18, 2008 for a more complete description of the Mednax

Purchase Rights.

The foregoing descriptions of the Merger Agreement, Assignment and Joinder and Mednax Rights Plan are qualified in their

entirety by reference to the full text of the Merger Agreement, Assignment and Joinder and Mednax Rights Plan, copies of which are attached to this Current Report on Form 8-K as Exhibits 2.1, 10.1 and 4.2, respectively, and incorporated herein by

reference.

In connection with the Merger, on December 29, 2008, Pediatrix and the Rights Agent entered into Amendment No. 2 (the

“Plan Amendment”) to the Rights Agreement, dated as of March 31, 1999, as amended (the “Pediatrix Rights Plan”), between Pediatrix and the Rights Agent, in order to terminate the Pediatrix Rights Plan as of the Effective

Time and provide for Mednax to enter into the Mednax Rights Plan.

2

In conjunction with the approval of the Mednax Rights Plan, the Board of Directors of Mednax (the

“Board”) adopted Articles of Amendment (the “Articles of Amendment”) to the Mednax Articles designating the Series A Junior Participating Preferred Stock of Mednax (the “Mednax Series A Preferred Stock”). The Articles

of Amendment were filed with the Secretary of State of the State of Florida on December 29, 2008, and became effective upon their filing. The designation, rights, powers and preferences, qualifications, limitations and restrictions of the

Mednax Series A Preferred Stock are identical to those of the Series A Junior Participating Preferred Stock of Pediatrix.

The foregoing

descriptions of the Plan Amendment and Articles of Amendment are qualified in their entirety by reference to the full text of the Plan Amendment and the Articles of Amendment, copies of which are attached to this Current Report on Form 8-K as

Exhibits 4.1 and 3.2, respectively, and incorporated herein by reference.

Upon the Effective Time, Cesar L. Alvarez, Waldemar A. Carlo,

M.D., Michael B. Fernandez, Roger K. Freeman, M.D., Paul G. Gabos, Dany Garcia, Pascal J. Goldschmidt, M.D., Manuel Kadre, Roger J. Medel, M.D., and Enrique J. Sosa, Ph.D., were appointed as directors of Mednax, to serve until the next annual

meeting of shareholders of Mednax or until successors have been duly elected and qualified. The Board adopted the committee structure of the board of directors of Pediatrix as it existed immediately prior to the Effective Time and each of the

directors was appointed to serve on the same committees of the Board as such director had served on for the Pediatrix board of directors immediately prior to the Effective Time. Because Pediatrix is now a wholly owned subsidiary of Mednax, each of

these persons resigned as a director of Pediatrix.

Also as of the Effective Time, the executive officers of Pediatrix were elected to

serve as the officers of Mednax, to serve until the next annual meeting of directors or until their respective successors have been duly elected and qualified. Accordingly, as of the Effective Time, Roger J. Medel, M.D., became the Chief Executive

Officer of Mednax, Joseph M. Calabro became the President and Chief Operating Officer of Mednax, Karl B. Wagner became the Chief Financial Officer of Mednax, and Thomas W. Hawkins became the Senior Vice President, General Counsel and Secretary of

Mednax. In connection with the Merger, the employment agreements, dated August 20, 2008, between Pediatrix and each of Dr. Medel and Messrs. Calabro, Wagner and Hawkins (the “Employment Agreements”), were amended pursuant to

amendments, dated December 29, 2008 (the “Employment Amendments”), in order to conform the terms of the Employment Agreements with the terms of the reorganization and confirm that the reorganization did not constitute a Change in

Control under the Employment Agreements (as defined therein).

Pursuant to the Merger Agreement, Pediatrix assigned to Mednax, and Mednax

assumed from Pediatrix, all of Pediatrix’s outstanding obligations pursuant to its stock option plans, incentive compensation plans, employee stock purchase plans and other benefit plans pursuant to which Pediatrix Common Stock was issuable,

effective as of the Effective Time. As of the Effective Time, Mednax amended the Pediatrix 1996 Employee Non-Qualified Stock Purchase

3

Plan, as amended and restated, the Pediatrix Amended and Restated Stock Option Plan, the Pediatrix 2004 Incentive Compensation Plan, as amended, and the

Pediatrix 2008 Incentive Compensation Plan (collectively, the “Stock Plans” and such amendments, the “Plan Amendments”) to reflect their assignment to and assumption by Mednax and to make additional technical modifications

recognizing that Mednax is the new plan sponsor and the issuer of equity under each of the Stock Plans.

The foregoing description of the

Employment Amendments is qualified in its entirety by reference to the full text of the Employment Amendments, copies of which are attached to this Current Report on Form 8-K as Exhibits 10.2, 10.3, 10.4 and 10.5 and incorporated herein by

reference.

The foregoing description of the Plan Amendments is qualified in its entirety by reference to the full text of each of the 1996

Employee Non-Qualified Stock Purchase Plan of Mednax, Inc., as amended and restated, the First Amendment, dated December 29, 2008, to the Pediatrix Medical Group, Inc. Amended and Restated Stock Option Plan, the Second Amendment, dated

December 29, 2008, to the Pediatrix Medical Group, Inc. 2004 Incentive Compensation Plan and the First Amendment, dated December 29, 2008, to the Pediatrix Medical Group, Inc. 2008 Incentive Compensation Plan, copies of which are attached

to this Current Report on Form 8-K as Exhibits 10.6, 10.7, 10.8 and 10.9, respectively, and incorporated herein by reference.

On

December 29, 2008, Mednax filed the Mednax Articles with the Secretary of State of the State of Florida, which became effective upon filing. In accordance with Section 607.11045 of the FBCA, the Mednax Articles are substantially identical

to the charter of Pediatrix in effect immediately prior to the Effective Time.

Also on December 29, 2008, the Board approved the

Amended and Restated By-laws of Mednax (the “By-laws”), which By-laws are substantially identical to the by-laws of Pediatrix in effect immediately prior to the Effective Time. The By-laws became effective as of the Effective Time.

The foregoing descriptions of the Mednax Articles, Articles of Amendment and By-laws are qualified in their entirety by reference to the

full text of the Mednax Articles, Articles of Amendment and By-laws, copies of which are attached to this Current Report on Form 8-K as Exhibits 3.1, 3.2 and 3.3, respectively, and incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

On January 2, 2009,

Mednax issued a press release announcing the holding company reorganization (the “Release”). A copy of the Release is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated herein by reference. The information

contained in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it

be deemed incorporated by reference in any filing by Mednax under the Securities Act of 1933, as amended.

4

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

2.1

|

|

Agreement and Plan of Merger, dated as of December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and PMG Merger Sub, Inc.

|

|

|

|

|

3.1

|

|

Amended and Restated Articles of Incorporation of Mednax, Inc.

|

|

|

|

|

3.2

|

|

Articles of Amendment Designating Series A Junior Participating Preferred Stock of Mednax, Inc.

|

|

|

|

|

3.3

|

|

Amended and Restated By-laws of Mednax, Inc.

|

|

|

|

|

4.1

|

|

Amendment No. 2, dated as of December 29, 2008, to Rights Agreement, dated March 31, 1999, between Pediatrix Medical Group, Inc. and Computershare Trust Company, N.A. (successor rights

agent to BankBoston, N.A.), as rights agent.

|

|

|

|

|

4.2

|

|

Amended and Restated Preferred Share Purchase Rights Plan, dated as of December 29, 2008, by and between Mednax, Inc. and Computershare Trust Company, N.A.

|

|

|

|

|

10.1

|

|

Assignment and Joinder Agreement, dated as of January 1, 2009, among Mednax, Inc., Mednax Services, Inc., the Guarantors identified on the signature pages thereto and Wachovia Bank,

National Association, in its capacity as Administrative Agent.

|

|

|

|

|

10.2

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Roger J. Medel, M.D.

|

|

|

|

|

10.3

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Joseph M. Calabro.

|

|

|

|

|

10.4

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Karl B. Wagner.

|

|

|

|

|

10.5

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Thomas W. Hawkins.

|

|

|

|

|

10.6

|

|

1996 Employee Non-Qualified Stock Purchase Plan of Mednax, Inc., as amended and restated, dated January 1, 2009.

|

|

|

|

|

10.7

|

|

First Amendment, dated December 29, 2008, to Pediatrix Medical Group, Inc. Amended and Restated Stock Option Plan.

|

|

|

|

|

10.8

|

|

Second Amendment, dated December 29, 2008, to Pediatrix Medical Group, Inc. 2004 Incentive Compensation Plan.

|

|

|

|

|

10.9

|

|

First Amendment, dated December 29, 2008, to Pediatrix Medical Group, Inc. 2008 Incentive Compensation Plan.

|

|

|

|

|

99.1

|

|

Press release of Mednax, Inc. dated January 2, 2009.

|

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDNAX, INC.

|

|

|

|

|

|

|

Date: January 2, 2009

|

|

|

|

By:

|

|

/s/ Karl B. Wagner

|

|

|

|

|

|

|

|

|

|

Name:

|

|

Karl B. Wagner

|

|

|

|

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

6

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

2.1

|

|

Agreement and Plan of Merger, dated as of December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and PMG Merger Sub, Inc.

|

|

|

|

|

3.1

|

|

Amended and Restated Articles of Incorporation of Mednax, Inc.

|

|

|

|

|

3.2

|

|

Articles of Amendment Designating Series A Junior Participating Preferred Stock of Mednax, Inc.

|

|

|

|

|

3.3

|

|

Amended and Restated By-laws of Mednax, Inc.

|

|

|

|

|

4.1

|

|

Amendment No. 2, dated as of December 29, 2008, to Rights Agreement, dated March 31, 1999, between Pediatrix Medical Group, Inc. and Computershare Trust Company, N.A. (successor rights

agent to BankBoston, N.A.), as rights agent.

|

|

|

|

|

4.2

|

|

Amended and Restated Preferred Share Purchase Rights Plan, dated as of December 29, 2008, by and between Mednax, Inc. and Computershare Trust Company, N.A.

|

|

|

|

|

10.1

|

|

Assignment and Joinder Agreement, dated as of January 1, 2009, among Mednax, Inc., Mednax Services, Inc., the Guarantors identified on the signature pages thereto and Wachovia Bank,

National Association, in its capacity as Administrative Agent.

|

|

|

|

|

10.2

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Roger J. Medel, M.D.

|

|

|

|

|

10.3

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Joseph M. Calabro.

|

|

|

|

|

10.4

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Karl B. Wagner.

|

|

|

|

|

10.5

|

|

Amendment Agreement, dated December 29, 2008, between Mednax, Inc., Pediatrix Medical Group, Inc. and Thomas W. Hawkins.

|

|

|

|

|

10.6

|

|

1996 Employee Non-Qualified Stock Purchase Plan of Mednax, Inc., as amended and restated, dated January 1, 2009.

|

|

|

|

|

10.7

|

|

First Amendment, dated December 29, 2008, to Pediatrix Medical Group, Inc. Amended and Restated Stock Option Plan.

|

|

|

|

|

10.8

|

|

Second Amendment, dated December 29, 2008, to Pediatrix Medical Group, Inc. 2004 Incentive Compensation Plan.

|

|

|

|

|

10.9

|

|

First Amendment, dated December 29, 2008, to Pediatrix Medical Group, Inc. 2008 Incentive Compensation Plan.

|

|

|

|

|

99.1

|

|

Press release of Mednax, Inc. dated January 2, 2009.

|

7

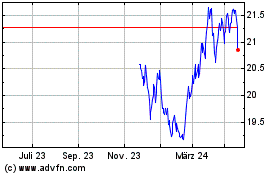

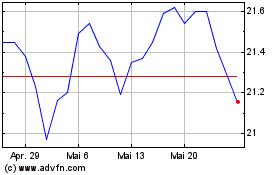

PIMCO Dynamic Income Str... (NYSE:PDX)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

PIMCO Dynamic Income Str... (NYSE:PDX)

Historical Stock Chart

Von Jun 2023 bis Jun 2024