0001816708FALSE00018167082024-07-082024-07-080001816708us-gaap:CommonStockMember2024-07-082024-07-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 8, 2024

____________________________

OWLET, INC.

(Exact name of registrant as specified in its charter)

____________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-39516 | | 85-1615012 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

3300 North Ashton Boulevard, Suite 300 Lehi, Utah | 84043 |

| (Address of principal executive offices) | (Zip Code) |

(844) 334-5330

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, $0.0001 par value per share | | OWLT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

| | | | | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On July 8, 2024, the Board of Directors (the “Board”) of the Company appointed Amanda Twede Crawford, the Company’s current Vice President, Financial Planning and Analysis, to serve as the Company’s Chief Financial Officer and principal financial officer and principal accounting officer, effective July 9, 2024, to succeed Kathryn Scolnick in these positions. Ms. Scolnick, the Company’s Chief Financial Officer and principal financial officer and principal accounting officer, transitioned out of these positions effective July 9, 2024, but will remain employed by the Company in an advisory role through September 6, 2024 (the “Separation Date”) to provide transition support.

Ms. Crawford, age 37, has served as the Company’s Vice President, Financial Planning and Analysis from March 2022 to July 2024. Prior to joining the Company, Ms. Crawford served in various positions at Swire Coca-Cola, USA, a beverages company (“Coca-Cola”). From February 2020 to March 2022, Ms. Crawford served as the Vice President of Finance at Coca-Cola and, from July 2014 to February 2020 she served as Coca-Cola’s Vice President, Corporate Controller. During her tenure at Coca-Cola, Ms. Crawford had responsibility for financial accounting and reporting, financial statement audit, budget and financial forecasting processes, accounting operations, financial analysis, mergers & acquisitions buy-side due diligence, risk management, and corporate insurance. Earlier in her career, Ms. Crawford was an Audit Associate with PricewaterhouseCoopers. Ms. Crawford is a Certified Public Accountant and holds a B.S. in Accounting and a Master of Accounting degree from the University of Utah’s David Eccles School of Business.

Ms. Crawford was not appointed as the Company’s Chief Financial Officer pursuant to any arrangement or understanding between her and any other person. There are no family relationships that exist between Ms. Crawford and any directors or executive officers of the Company. In addition, Ms. Crawford is not a party to any related party transaction reportable under Item 404(a) of Regulation S-K.

The Company expects Ms. Crawford to enter into the Company’s standard indemnification agreement for directors and officers.

Crawford’s Promotion Arrangement

In connection with Ms. Crawford’s appointment, on July 9, 2024, the Company and Ms. Crawford executed a promotion letter (the “Promotion Letter”) pursuant to which Ms. Crawford’s annual base salary was increased to $300,000 and her annual cash bonus opportunity was increased to 35% of her annual base salary based on the achievement of company goals and Ms. Crawford’s individual performance, subject to her continued employment with the Company through the payment date. Ms. Crawford is also eligible to receive, subject to approval by the Board, an equity award with a target value of between $200,000 to $300,000 at the time of grant in the form of restricted stock units with vesting terms to be determined. Under the Promotion Letter, if Ms. Crawford’s employment with the Company is terminated without “cause” (as defined in the Promotion Letter), Ms. Crawford will be paid six months of her then current salary as severance and, if Ms. Crawford’s employment is either (i) terminated by the Company without Cause or (ii) terminated by her for Good Reason (as defined in the Promotion Letter), after a Change in Control Transaction (as defined in the Company’s Executive Change in Control Severance Plan (the “CIC Severance Plan”), then all of Ms. Crawford’s then-unvested equity awards will automatically vest on the date of such termination, contingent, in each such termination scenario, upon her timely execution and delivery of a separation agreement and general release of claims and continued compliance with all applicable restrictive covenants. In addition, Ms. Crawford is eligible to participate in the Company’s CIC Severance Plan.

Scolnick’s Separation Agreement

In connection with Ms. Scolnick’s separation, on July 9, 2024, the Company and Ms. Scolnick entered into a Separation and Release Agreement (the “Separation Agreement”). Under the Separation Agreement, Ms. Scolnick will continue to be paid her base salary and vest into outstanding equity awards while providing transition services through the Separation Date. Subject to the timely delivery of an effective release of claims on or within a short period following the Separation Date, Ms. Scolnick is entitled to receive (i) her continued base salary and target bonus for six months at the weekly rate of $9,014.42 (less applicable tax withholding), (ii) reimbursement of COBRA premiums for the period commencing October 1, 2024 and ending on the earlier of September 30, 2025 or the date on which she becomes eligible for medical coverage through another entity, (iii) the accelerated vesting of all of Ms. Scolnick’s unvested stock options and restricted stock units and (iv) outplacement services. In the event that there is a Change of Control (as defined in the CIC Severance Plan) within three months following the Separation Date, Ms. Scolnick will be entitled to receive an additional $50,000 representing the difference between the severance payable under the Separation Agreement and the severance payable under the CIC Severance Plan in the event of a Change in Control.

| | | | | |

| Item 7.01. | Regulation FD Disclosure |

A copy of the press release announcing the Chief Financial Officer transition is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1 furnished under Item 9.01 hereunder, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Furthermore, the information in this Item 7.01, including Exhibit 99.1 furnished under Item 9.01 hereunder, shall not be deemed incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | |

Exhibit No. | Description |

99.1 | |

| |

104 | Cover Page Interactive Data file (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Owlet, Inc. |

| | |

| Date: July 9, 2024 | By: | /s/ Kurt Workman |

| Name: | Kurt Workman |

| Title: | Chief Executive Officer |

Owlet Announces CFO Transition and Re-Affirms 2024 Financial Goals

Owlet to Report Second Quarter 2024 Financial Results on August 12, 2024

LEHI, Utah--(BUSINESS WIRE)-- Owlet, Inc. (“Owlet” or the “Company”) (NYSE:OWLT), the pioneer of smart infant monitoring, today announced that Kate Scolnick, Chief Financial Officer (“CFO”), will be departing the Company to pursue other opportunities. Amanda Twede Crawford, Owlet’s Vice President, Financial Planning and Analysis, will assume the role of CFO. Kate will remain at the Company in an advisory role for a transition period through September 2024.

“On behalf of the Board of Directors and Owlet, I want to thank Kate for her executive leadership and significant contributions since joining our management team prior to our initial public listing. Over the last three and a half years she has been instrumental in supporting our top line growth, margin expansion and profitability objectives, and with her help we are on track to achieve our 2024 operational and financial goals,” said Kurt Workman, Owlet Chief Executive Officer and Co-Founder. “Along with public company execution rigor and commitment to our Company’s mission, Kate has established and developed executive talent in our finance and operations teams. Since joining Owlet in 2022, Amanda Twede Crawford has been a key financial leader and we’re excited for her to be moving into the CFO role. We anticipate this will be a smooth transition and wish Kate continued success in her future endeavors.”

Amanda brings over 15 years of finance and accounting experience to Owlet. Prior to Owlet, she held multiple positions at Swire Coca-Cola, USA including Vice President of Finance and Corporate Controller. She began her career at PricewaterhouseCoopers and is a Certified Public Accountant. She holds a Master of Accounting degree from the University of Utah.

Workman continued, “In addition to this change, I’d like to provide some color on Owlet’s strong momentum and business performance thus far in 2024. The entire Owlet team has worked hard to put us in position to execute on our strategic operational goals for the remainder of 2024 and beyond. We continue to make strong inroads outside of our core US market, especially in the EU and UK, and are expanding our presence in the large remote patient monitoring segment following two landmark FDA clearances last year. Importantly, we continue to see accelerating product sell-through to parents, and we remain focused and progressing towards our stated goal of reaching and maintaining Adjusted EBITDA breakeven. We’re excited to share more on our upcoming financial results call.”

Owlet will release its second quarter 2024 financial results after the market closes on August 12, 2024. Owlet will issue a copy of the earnings release via Business Wire and include a copy on Owlet’s Investor Relations website at www.investors.owletcare.com. Owlet’s Chief Executive Officer, Kurt Workman, President, Jonathan Harris, and Chief Financial Officer, Amanda Twede Crawford, will host a conference call that same day at 4:30 p.m. ET to discuss these results and provide a business update.

To access the conference call by telephone, please dial (404) 975-4839 (Domestic) or (833) 470-1428 (Toll-Free) and reference Access Code 458341. To listen to the conference call via live audio webcast, please visit the Events section of Owlet’s Investor Relations website at investors.owletcare.com. The archived webcast will also be available on Owlet’s Investor Relations website shortly after the completion of the call.

About Owlet, Inc.

Owlet’s digital health infant monitoring platform is transforming the journey of parenting. The Company (NYSE:OWLT), a small-cap healthcare growth equity, offers FDA-authorized medical and consumer pediatric wearables and an integrated HD visual and audio camera that provide real-time data and insights to parents who safeguard health, optimize wellness, and ensure peaceful sleep, for their children.

Since 2012, over 2 million parents worldwide have used Owlet’s platform contributing to one of the largest collections of consumer infant health and sleep data. The Company continues to develop software and digital data solutions to bridge the current healthcare gap between hospital and home and bring new insights to parents and caregivers globally. Owlet believes that every child deserves to live a long, happy, and healthy life. To learn more, visit www.owletcare.com.

Investor Contacts:

Mike Cavanaugh ICR Westwicke Phone: +1.617.877.9641 mike.cavanaugh@westwicke.com

Media Contacts: pr@owletcare.com owlet@diffusionpr.com

Source: Owlet, Inc.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s expected achievement of its financial goals. In some cases, you can identify forward-looking statements by terms such as “estimate,” “may,” “believes,” “plans,” “expects,” “anticipates,” “intends,” “goal,” “potential,” “upcoming,” “outlook,” “guidance,” the negation thereof, or similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on the Company’s expectations at the time such statements are made, speak only as of the dates they are made and are susceptible to a number of risks, uncertainties and other factors. The Company’s actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by our forward-looking statements. Many important factors could affect the Company’s future results and cause those results to differ materially from those expressed in or implied by the Company’s forward-looking statements. Such factors include, but are not limited to, (i) the regulatory pathway for Owlet’s products, including submissions to, actions taken by and decisions and responses from regulators, such as the FDA and similar regulators outside of the United States, as well as Owlet’s ability to obtain and maintain regulatory approval or certification for our products and other regulatory requirements and legal proceedings; (ii) Owlet’s competition and the Company’s ability to profitably grow and manage growth; (iii) the Company’s ability to enhance future operating and financial results or obtain additional financing to continue as a going concern; (iv) Owlet’s ability to obtain additional financing in the future, as well as risks associated with the Company’s current loan and debt agreements, including compliance with debt covenants, restrictions on the Company’s access to capital, the impact of the Company’s overall debt levels and the Company’s ability to generate sufficient future cash flows to meet Owlet’s debt service obligations and operate Owlet’s business; (v) the ability of Owlet to implement strategic initiatives, reduce costs, grow revenues, develop and launch new products, innovate and enhance existing products, meet customer demands and adapt to changes in consumer preferences and retail trends; (vi) Owlet’s ability to acquire, defend and protect its intellectual property and satisfy regulatory requirements, including but not limited to requirements concerning privacy and data protection, breaches and loss, as well as other risks associated with Owlet’s digital platforms and technologies; (vii) Owlet’s ability to maintain relationships with customers, manufacturers and suppliers and retain Owlet’s management and key employees; (viii) Owlet’s ability to upgrade and maintain its information technology systems; (ix) changes in applicable laws or regulations; (x) the impact of and disruption to Owlet’s business, financial condition, operations, supply chain and logistics due to economic and other conditions beyond the Company’s control, such as health epidemics or pandemics, macro-economic uncertainties, social unrest, hostilities, natural disasters or other catastrophic events; (xi) the possibility that Owlet may be adversely affected by other economic, business, regulatory, competitive or other factors, such as changes in discretionary consumer spending and consumer preferences; and (xii) other risks and uncertainties set forth in the Company’s other releases, public statements and filings with the U.S. Securities and Exchange Commission (the “SEC”), including those identified in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 and as any such factors may be updated from time to time in the Company’s other filings with the SEC. All such forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Moreover, the Company operates in an evolving environment. Except as required by law, the Company assumes no obligation to update any forward-looking statements after the date of this press release, whether because of new information, future events or otherwise, although Owlet may do so from time to time.

v3.24.2

Cover

|

Jul. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 08, 2024

|

| Entity Registrant Name |

OWLET, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39516

|

| Entity Tax Identification Number |

85-1615012

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Lehi

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84043

|

| City Area Code |

844

|

| Local Phone Number |

334-5330

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001816708

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

3300 North Ashton Boulevard

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

OWLT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

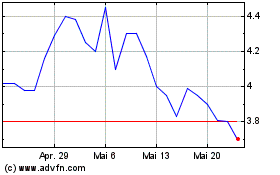

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024