UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form SD

SPECIALIZED DISCLOSURE REPORT

Oshkosh Corporation

(Exact Name of the Registrant as Specified in Charter)

|

Wisconsin

|

1-31371

|

|

(State or Other Jurisdiction)

|

(Commission file number)

|

|

1917 Four Wheel Drive, Oshkosh, Wisconsin

|

54902

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Ignacio A. Cortina

Executive Vice President, Chief Legal Officer and Secretary

|

(920) 502-3023

|

(Name and telephone number, including area code, of the

person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

|

☒

|

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the

reporting period from January I to December 31, 2023.

|

|

☐

|

Rule 13q-l under the Securities Exchange Act (17 CFR 240.13q-l) for the fiscal year ended ______.

|

Section 1 - Conflict Minerals Disclosure

Items 1.01

and 1.02 Conflict Minerals Disclosure and Report; Exhibits

Conflict Minerals Disclosure

Oshkosh Corporation is providing a Conflict Minerals Report as

Exhibit 1.01 hereto, and it is publicly available at www.oshkoshcorp.com under the "Investors" section and within the "SEC Filings" tab.

Section 2 - Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3 - Exhibits

Item 3.01 Exhibits

Exhibit 1.01 - Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the duly authorized undersigned.

OSHKOSH CORPORATION

By: /s/Ignacio A. Cortina

Ignacio A. Cortina

Executive Vice President, Chief Legal Officer and Secretary Date: May 31, 2024

Exhibit 1.01

Oshkosh Corporation

Conflict Minerals Report

for the Year Ended December 31, 2023

Oshkosh Corporation (“Oshkosh”) has prepared this conflict minerals report on Form SD for the year ended December 31, 2023, to comply with Rule 13p-1 under

the Securities Exchange Act of 1934 (the “Conflict Minerals Rule”). The Securities and Exchange Commission (“SEC”) adopted the Conflict Minerals Rule to implement reporting and disclosure requirements related to conflict minerals as directed by the

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”).

Oshkosh and its subsidiaries are committed to responsible supply chain management. This means Oshkosh endeavors to procure materials and

parts from suppliers that, among other important values, demonstrate a respect for the human rights and individual dignity of all participants within its supply chain. Starting with the 2013 reporting period, we took specific actions to fully

implement the requirements of the Dodd-Frank Act related to the supply chain for tin, tungsten, tantalum, and gold (“3TG”). Since then, we have expanded and improved upon these actions to ensure ongoing effectiveness of our conflict minerals program.

We continue to support the responsible mining and sourcing of 3TG within the Democratic Republic of the Congo or an adjoining country (“Covered Countries”) and do not knowingly procure materials or parts that finance or benefit armed groups within the

Covered Countries.

Oshkosh is a leading designer, manufacturer and marketer of a broad range of specialty vehicles and vehicle bodies. The Company

maintains three reportable segments:

|

•

|

Access Equipment – aerial work platforms and telehandlers used in a wide variety of construction, industrial, institutional

and general maintenance applications to position workers and materials at elevated heights, as well as carriers and wreckers. Access Equipment customers include equipment rental companies, construction contractors, manufacturing companies,

home improvement centers and towing companies.

|

|

•

|

Defense – tactical trucks, trailers, supply parts and services sold to the U.S. military and to other militaries around the

world, other specialty vehicles for the U.S. government, as well as, for a portion of 2023, snow removal vehicles for military and civilian airports. In addition, the Defense segment offers engineering and product development services to

customers in the motorsports and multiple ground vehicle markets through Pratt Miller.

|

|

•

|

Vocational – (Previously Fire & Emergency and Commercial) custom and commercial firefighting vehicles and equipment,

Aircraft Rescue and Firefighting (ARFF) vehicles, simulators, mobile command and control vehicles and other emergency vehicles primarily sold to fire departments, airports and other governmental units, as well as broadcast vehicles sold to

broadcasters and TV stations. Refuse and recycling collection vehicles sold to commercial and municipal waste haulers, concrete mixers sold to ready-mix companies and field service vehicles and truck-mounted cranes sold to mining,

construction and other companies. Aviation ground support products, gate equipment, and airport services provided to commercial airlines, airports, air-freight carriers, ground handling and military customers.

|

Each of our business segments sells complex vehicles for use by a wide variety of industries and service providers around the world.

Because of this complexity and the wide variety of functionality that our vehicles offer, the list of components needed to manufacture these products is extensive.

We know that 3TG are common and essential to our industry. The engines, electronic control modules, electrical harnesses, weld wire, and

microprocessors that manufacturers in the vehicle and transportation equipment industry use as production inputs are known, in at least some cases, to contain 3TG. However, Oshkosh has not been able to specifically identify any 3TG in our products that

was mined in the Covered Countries by persons that finance or benefit armed groups in the Covered Countries.

We also know that Oshkosh does not purchase ore or unrefined 3TG from mines and is generally many steps removed in the supply chain from

the mining and refining of 3TG. We purchase materials and parts from a wide network of suppliers and must rely on those suppliers to assist with the collection of data used to attempt to identify the ultimate source of the minerals that our suppliers

use in their manufacturing processes.

We purchase materials or parts directly from approximately 4,400 different suppliers. We refer to these direct suppliers as our Tier 1

suppliers, and many of these suppliers have equally large and diverse supply chains that provide materials or parts in the manufacture of their products. This pattern is repeated through our supply chain. For materials or parts that are subject to

many manufacturing steps, we estimate there may be more than 5 tiers of suppliers between us and a smelter or refiner that processes 3TG that a particular product may contain.

Oshkosh expends significant effort to ensure that its direct material supply base contains the optimal number of Tier 1 suppliers. This

is an ongoing effort to identify and engage suppliers that offer the appropriate balance of innovation and technology and competitive pricing to ensure our products continue to provide our customers with the best value in the marketplace. In addition,

to comply with the U.S. Government’s small business procurement rules, regulations, and guidelines, our defense segment works with and supports hundreds of small businesses that have limited resources and technical knowledge with which to conduct 3TG

supply chain investigations.

Many of our suppliers, including most of these small businesses, are not directly subject to the Conflict Minerals Rule. Further, many

do not possess the resources and/or requisite technical expertise with which to perform detailed investigations of their own 3TG supply chains. We have made significant progress toward understanding the source of the 3TG in our supply chain; however,

working with a broad, deep and highly varied supply base is and will remain a challenge.

|

2.

|

Actions Taken in Support of Our Conflict Minerals Program

|

Over the course of the last several years, Oshkosh has expended significant resources to identify the source of 3TG in its products.

While a percentage of the world’s 3TG does originate in the Covered Countries, a significant portion does not. Further, a large amount is from scrap or recycled sources. So, it is important for us to learn as much about the source of any 3TG in our

products as is feasible. We have taken specific actions to bolster our understanding of the 3TG within our supply chain.

Framework

We designed our conflict minerals program to substantially conform to the framework outlined in The Organization for Economic

Co-operation and Development (OECD) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (OECD Guidance) and the related Supplements for gold and for tin, tantalum, and tungsten.

Internal Team

Our cross functional team is comprised of staff level positions and experienced leaders from the finance, supply chain, legal,

sustainability, and risk functions and continues to monitor our program status. The steering team we established at the outset of our program, as well as our senior executive management team, remain engaged on an as needed basis to ensure we continue

to make progress toward our goals.

Training – Internal and External

As part of our program, we send to each supplier a copy of the Electronic Industry Citizenship Coalition® (EICC®) and the Global

e-Sustainability Initiative (GeSI) template (the “EICC-GeSI template”). We also make training from expert resources on the template available to our suppliers to answer questions on the content, purpose, and format of the template. This template was

developed to facilitate the disclosure and communication of information regarding smelters or refiners that provide materials or parts to a company’s supply chain. The template includes questions regarding a direct supplier’s conflict minerals policy,

engagement with its direct suppliers, and a listing of the smelters or refiners the direct supplier and its suppliers use. In addition, the template contains questions about the origin of conflict minerals included in the direct supplier’s products.

Our internal training program includes communications on any changes impacting the reporting and regulatory requirements relating to conflict minerals and

refresher updates for both existing and new employees. We offer training events for our existing supply chain employees, and we include conflict minerals content in our new employee training program.

Conflict Minerals Policy

We review Oshkosh’s internal and external conflict minerals policies annually

and consider potential updates. This helps to keep current the shared expectations we place on both our employees and our suppliers and ensure that they are clear and understandable. The internal policy is part of our global conflict minerals

program, and the external policy can be found on Oshkosh’s website at:

www.oshkoshcorp.com, under the “Our Story” section under the “Ethics” tab.

Supplier Terms and Conditions and Supplier Code of Conduct

We communicate our expectations of suppliers through our Oshkosh Supplier Code of Conduct as well as through our commercial terms and

conditions for the purchase of products. We require suppliers to develop processes to understand the origin of materials in their products so that steps can be taken to confirm that their products are not produced with 3TG sourced from the Covered

Countries that finance or benefit armed groups in the Covered Countries.

Violation Reporting Processes

Employees and suppliers can report violations of any of Oshkosh’s policies through our Hot Line process. In addition, we have

established a process specifically for conflict minerals questions and concerns.

Records Maintenance

We have retained all relevant documentation from our surveys and due diligence that we describe below.

|

3.

|

Reasonable Country of Origin Inquiry and Due Diligence

|

Supplier Surveys

We adopted a risk-based survey process for our suppliers. Due to the complexity and depth of our supply base, we surveyed suppliers who

together represented a significant majority of our direct material expenditures in 2023. We highlighted for follow-up any supplier whose survey response suggested a greater likelihood of manufacturing products containing 3TG from a Covered Country. We

believe and have confirmed that this risk-based approach is consistent with the process that many of our global manufacturing peer companies follow.

We sent the EICC-GeSI template to our Tier 1 suppliers. As a result of our approach, we sent surveys to suppliers representing

approximately 93% of our 2023 expenditures for direct materials and components.

Survey Responses and Follow-up Engagement

Our protocol for the survey of Oshkosh suppliers required at least five follow-up inquiries to any supplier who did not respond to the

initial survey. These follow-up efforts included engagement electronically, and directly from Oshkosh personnel. We reviewed all responses against defined criteria we developed to determine which required further engagement. These criteria included

untimely or incomplete responses as well as inconsistencies in the data reported. When a supplier survey response indicated a greater likelihood of products containing 3TG from a Covered Country, we utilized a supplier risk escalation/disposition

process that was developed for this purpose. In these instances, Oshkosh personnel interface directly with the supplier to better understand the content and the specific risks contained in the supplier’s survey response.

The majority of the responses we received provided data at the company level or division/segment level, rather than at a part number

level. That is, the supplier provided data regarding the supplier or a division or segment generally rather than as to specific materials or parts that the supplier provides to Oshkosh.

Our supplier responses included names of smelters or refiners, although there was no reliable information indicating that any of the 3TG

that suppliers may have obtained from these smelters or refiners was actually contained in materials or parts that the supplier supplied to us. Therefore, Oshkosh was unable to confirm the identity or location of all of the smelters or refiners that

may be in our supply chain. We were able to match 352 (350 in the prior year) of the smelters or refiners that supplier responses identified to the Responsible Minerals Initiative (formerly the Conflict-Free Sourcing Initiative) (“RMI”) list. Many of

the smelters or refiners we were able to match to the list either were certified as conflict free or were actively working toward conflict free certification. As to the remainder that we were able to identify as “active” smelters or refiners based on

the list, no certification status was available. This does not definitively mean that these smelters or refiners are sourcing from the Covered Countries or financing or benefiting armed groups within the Covered Countries, and we have discovered no

reliable information indicating that they are. Given the uncertainties surrounding smelters and refiners that supplier responses identified, we have elected not to present smelter and refiner names in this report.

Virtually all responses to our surveys supported our conclusion that 3TG in materials or parts supplied to us were not likely sourced in

a Covered Country. In the small number of cases where our process indicated further investigation was appropriate, we solicited additional information regarding whether the minerals reported were contained in the materials or parts supplied to us,

whether any of the 3TG that these suppliers reported were known to have originated in a Covered Country, and whether any of the 3TG that these suppliers reported was financing or benefitting armed groups in Covered Countries. After follow-up, we were

able to confirm either that these suppliers did not present a risk or that the additional information did not allow us to reach a determination regarding origin.

Foreign Sourcing & Sanctions Compliance

The Company does not source any conflict minerals directly from smelters or refiners in Russia. The Company also suspended new orders

and shipments into and out of Russia and Belarus following the Russian Government’s invasion of Ukraine in February 2022 to promote compliance with applicable economic sanctions laws.

The Company also does not source any conflict minerals directly from smelters or refiners subject to any economic sanctions administered

by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) nor does it knowingly source indirectly from such parties. The Company maintains a robust, risk-based economic sanctions compliance program that prohibits transactions

with such parties.

|

4.

|

Improvement Actions – Reporting Year 2022 to 2023

|

Our improvement initiatives for the 2023 reporting period were focused in the following areas:

|

a.

|

Continued partnership with Assent Inc. to further enhance our supplier survey process – we utilized Assent’s extensive

supplier database to increase outreach efforts to historically unresponsive suppliers. We conducted a pre-campaign outreach initiative to build awareness for our suppliers on the importance of completing this request. We also used Assent’s

expertise to help educate suppliers on conflict minerals reporting requirements. We managed a multi-tiered follow up campaign to strive for a higher supplier response rate. We also leveraged Assent’s experience to benchmark our process

against their clientele.

|

|

b.

|

Data extraction and supplier risk assessment – we improved our ability to identify suppliers that accounted for a significant

amount of our direct material spend. As a result, our supplier survey process was more focused, allowing us to target those specific suppliers whose survey

responses indicated a higher risk of sourcing from a Covered Country. We engaged those suppliers directly in an attempt to determine the specific risk factors in effect and how those risks could best be addressed.

|

|

c.

|

Supplier risk escalation/disposition – we continued to refine and utilize our supply chain conflict minerals risk

escalation/disposition process. This step-by-step methodology guides an

individual through the process of identifying and mitigating 3TG risk and includes a process flowchart with decision points and next steps, work instructions, and a checklist of action steps for supply chain personnel to take when a potential

3TG supply chain risk is identified through the supplier survey process. This process is highly tailored toward one-on-one, interpersonal engagement between our personnel and the supplier to ensure any potential risk is fully understood and

appropriate risk mitigation actions are developed.

|

|

d.

|

Supplier survey responses - we continued to make improvements to our supplier survey process in an attempt to increase the

response rate and our understanding of the 3TG in our supply chain. These improvements included specific outreach to historically non-responsive suppliers. We used historical data that suppliers provided to create a more targeted follow up

campaign, helping increase our response rate.

|

|

e.

|

Supplier inquires – enhancements were made in the supplier inquiry process where we communicated more timely responses and/or

clarifications thereby allowing some historically non-responsive suppliers to provide insight into 3TG usage.

|

|

f.

|

Smelter or refiner information – through continued engagement with the Responsible Minerals Initiative, we received more

information from our suppliers for this reporting period regarding smelters or refiners that may be in our supply chain.

|

|

g.

|

Best practice benchmarking – we have maintained our participation in both formal and informal peer group discussions and

reviews. We continued to be a participant in AIAG (Automotive Industry Action Group) and MAPI (Manufacturers Alliance for Productivity and Innovation) discussion forums and educational sessions.

|

|

h.

|

Proactive outreach – we continued to conduct an outreach initiative with Assent to target all suppliers with any previous

connection to a Russian-affiliated smelter with the continued goal to bring awareness to our suppliers on applicable restrictions and guidelines.

|

|

5.

|

Future Actions to Improve Our Conflict Minerals Program

|

Oshkosh will continue to identify and implement improvements to better our conflict minerals program with our main areas of focus in the

following areas:

|

a.

|

Evolve our supplier data management system to increase the reliability of supplier contact information, resulting in higher

response rates.

|

|

b.

|

Enhance our data mining and extraction processes to identify potential 3TG risk within our supply chain to improve our ability

to fully disclose, evaluate, and address those risks. This includes a partnership with FRDM (frdm.co) that affords the ability to dig into our multi-tiered supply-chain that normally would not be visible.

|

|

c.

|

Further engage suppliers with 3TG content in the products they provide to improve our understanding of their supply chains and

develop risk mitigation steps as appropriate which may include, but is not limited to, product genome analysis software that is currently being implemented.

|

|

d.

|

Collaborate internally with team members who own the relationships with historically unresponsive suppliers to educate them on

the importance of 3TG reporting.

|

|

e.

|

Continue to exchange information and best practices within the Responsible Minerals Initiative program, AIAG, and MAPI to

increase our understanding of conflict minerals best practices and the smelters or refiners in our supply chain to better understand the ultimate source and conflict status of the minerals in our multi-tiered and complex supply chain.

|

|

f.

|

Work with Assent to benchmark results and best practices year over year to improve our solicitation efforts and follow up

procedures, with a goal of continuous response improvement.

|

|

g.

|

Continue to work within industry established frameworks, our trade associations, human rights-focused organizations, and other

groups to identify and implement best practices related to conflict minerals.

|

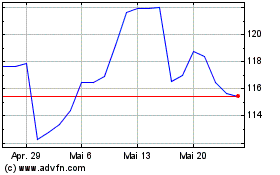

Oshkosh (NYSE:OSK)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Oshkosh (NYSE:OSK)

Historical Stock Chart

Von Jun 2023 bis Jun 2024