UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One):

☒ ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from ________ to __________

Commission File Number 8-04077

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Oppenheimer & Co. Inc. 401(k) Plan

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Oppenheimer Holdings Inc.

85 Broad Street

New York, NY 10004

Oppenheimer & Co. Inc. 401(k) Plan

| | | | | |

Contents |

| |

Report of Independent Registered Public Accounting Firm | 1 | |

| |

Statement of Net Assets Available for Plan Benefits | 3 | |

| |

Statement of Changes in Net Assets Available for Plan Benefits | 4 | |

| |

Notes to Financial Statements | 5-10 |

| |

Schedule of Assets Held at End of Year | Schedule 1 |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants

Oppenheimer & Co. Inc. 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of Oppenheimer & Co. Inc. 401(k) Plan (the “Plan”) as of December 31, 2023 and 2022; the related statement of changes in net assets available for benefits for the years ended December 31, 2023 and 2022; and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets of the Plan as of December 31, 2023 and 2022, and the changes in its net assets for the years ended December 31, 2023 and 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis of Opinion

The Plan’s management is responsible for these financial statements. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and are required to be independent with respect to the Plan in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

To the Plan Administrator and Plan Participants

Oppenheimer & Co. Inc. 401(k) Plan

Supplemental Information

The supplemental information in the accompanying schedule of assets held at end of year as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with Department of Labor’s Rules and Regulations for Reporting under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Plante & Moran, PLLC

We have served as the Plan’s auditor since 2007.

Clinton Township, Michigan

June 10, 2024

Oppenheimer & Co. Inc. 401(k) Plan

Statement of Net Assets Available for Plan Benefits

| | | | | | | | | | | |

| December 31 | | December 31 |

| 2023 | | 2022 |

| | | |

| Assets | | | |

| Participant - directed investments: | | | |

| Money market funds | $ | 55,799,779 | | | $ | 53,065,076 | |

| Mutual funds | 510,031,777 | | | 425,199,332 | |

| Oppenheimer Holdings Inc. - Common stock | 25,335,358 | | | 27,093,317 | |

| Cash surrender value of life insurance policies | 162,390 | | | 340,874 | |

| | | |

| Total investments at fair value | 591,329,304 | | | 505,698,599 | |

| | | |

| Contributions receivable - Employer | 4,059,706 | | | 4,090,139 | |

| Cash | 45,896 | | | 6,808 | |

| Participant notes receivable | 7,581,136 | | | 6,976,385 | |

| | | |

| Net Assets Available for Plan Benefits | $ | 603,016,042 | | | $ | 516,771,931 | |

See Notes to Financial Statements.

Oppenheimer & Co. Inc. 401(k) Plan

Statement of Changes in Net Assets Available for Plan Benefits

| | | | | | | | | | | |

| Year Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 |

| Additions | | | |

| Contributions: | | | |

| Employees | $ | 32,119,913 | | | $ | 30,589,581 | |

| Employer | 4,257,714 | | | 4,152,067 | |

| Rollover | 2,088,504 | | | 3,302,526 | |

| | | |

| Total contributions | 38,466,131 | | | 38,044,174 | |

| | | |

| Investment income: | | | |

| Dividends | 23,122,586 | | | 18,330,292 | |

| Net realized and unrealized gains (loss) | 60,496,497 | | | (129,415,491) | |

| | | |

| Total investment income (loss) | 83,619,083 | | | (111,085,199) | |

| | | |

| Interest from participant notes receivable | 446,015 | | | 320,623 | |

| | | |

| Total additions (loss) | 122,531,229 | | | (72,720,402) | |

| | | |

| Deductions | | | |

| Benefits paid to participants and beneficiaries | 36,187,170 | | | 34,988,167 | |

| Administrative expenses | 96,421 | | | 117,869 | |

| Life insurance premiums | 3,527 | | | 5,728 | |

| | | |

| Total deductions | 36,287,118 | | | 35,111,764 | |

| | | |

| Net Increase (Decrease) in Net Assets Available for Plan Benefits | 86,244,111 | | | (107,832,166) | |

| | | |

| Net Assets Available for Plan Benefits | | | |

| Beginning of year | 516,771,931 | | | 624,604,097 | |

| | | |

| End of year | $ | 603,016,042 | | | $ | 516,771,931 | |

| | | |

See Notes to Financial Statements.

Oppenheimer & Co. Inc. 401(k) Plan

| | |

|

|

| Notes to Financial Statements |

December 31, 2023 and 2022 |

Note 1 - Description of the Plan

The following description of the Oppenheimer & Co. Inc. 401(k) Plan (the “Plan”) provides only general information. Participants should refer to the Plan agreement for a more complete description of the Plan’s provisions.

General - The Plan is a defined contribution plan covering all eligible employees of Oppenheimer & Co. Inc. and Oppenheimer Trust Company of Delaware (collectively, the "Company"). The Company is a subsidiary of Oppenheimer Holdings Inc. (the "Parent"). Employees of the Company who are at least 18 years of age shall be eligible to make elective deferrals into the Plan upon date of hire. Participants who are at least 18 years of age and who have completed one year of service and are employed on the last day of the Plan year shall be eligible to receive a discretionary contribution from the Company.

During the Plan years ended December 31, 2022 as permitted under the plan agreement, the Plan adopted a new formula used in computing the discretionary contributions from the Company. There were no changes to the formula during the Plan year ended December 31, 2023.

Contributions - Employees may make salary deferral contributions up to 50 percent of compensation subject to tax deferral limitations established by the Internal Revenue Code. Participants who have reached the age of 50 by the end of the Plan year may also make catch-up contributions to the maximum allowed by the Plan. Participants may also make contributions to the Plan in the form of a rollover of funds from another qualified plan (excluding any after-tax contributions) or Individual Retirement Accounts (IRA’s).

The Company may contribute to the Plan a discretionary amount (the “Employer Discretionary Contribution”). The Employer Discretionary Contribution is determined by Oppenheimer Holdings Inc.’s Board of Directors and is subject to guidelines set forth in the Plan agreement.

Employer Discretionary Contributions, including amounts allocated for rebates received, for the year ended December 31, 2023 and December 31, 2022 were determined as follows:

•3.00% of the first $30,000 of a participant’s eligible compensation

•2.75% of the next $10,000 of a participant’s eligible compensation

•1.50% of the next $25,000 of a participant’s eligible compensation

•0.6835% of the next $35,000 of a participant’s eligible compensation

•0.315% of the next $75,000 of a participant’s eligible compensation

Oppenheimer & Co. Inc. 401(k) Plan

| | |

|

|

| Notes to Financial Statements |

December 31, 2023 and 2022 |

The Plan receives rebates of certain mutual fund stockholder service fees. These rebates are placed in a non-settlor account. All amounts in the Plan's non-settlor account will be allocated to participants based on the formula outlined above.

Note 1 - Description of the Plan (Continued)

To the extent that the total amount in the Plan's non-settlor account is less than the amount to be allocated, the Company will make up the shortfall. For the year ended December 31, 2023 and 2022, the total Employer Discretionary Contribution was $4,257,714 and $4,152,067, respectively.

Vesting - All participants are immediately and fully vested in all employee elective deferrals and rollovers and the income derived from the investment of such contributions.

Participants will be vested in employer discretionary contributions plus the income thereon upon the completion of service with the Company or an affiliate at the following rate:

| | | | | | | | |

| Years of Service | | Vested Percentage |

| | |

| Less than 2 years | | 0 | % |

| | |

| 2 years but less than 3 | | 20 | % |

| | |

| 3 years but less than 4 | | 40 | % |

| | |

| 4 years but less than 5 | | 60 | % |

| | |

| 5 years but less than 6 | | 80 | % |

| | |

| 6 years or more | | 100 | % |

All years of service with the Company or an affiliate are counted to determine a participant’s non-forfeitable percentage.

At December 31, 2023 and 2022, forfeited non-vested accounts totaled $336,993 and $315,643, respectively. These accounts were used to reduce employer contributions for the 2023 and 2022 Plan years.

Notwithstanding the vesting schedule specified above, a participant shall be 100 percent vested in his or her Employer Discretionary Contribution upon the attainment of normal retirement age, death, or disability if still employed with the Company or an affiliate upon the occurrence of one of these events.

Oppenheimer & Co. Inc. 401(k) Plan

| | |

|

|

| Notes to Financial Statements |

December 31, 2023 and 2022 |

Note 1 - Description of the Plan (Continued)

Participant Accounts - Each participant's account is credited with the participant’s contribution and allocations of the Company's contributions and Plan earnings. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account. Participants may direct the investments of their account balances into various investment options offered by the Plan.

Participants may invest in Company Stock under the Plan to a maximum of twenty-five percent (25%).

Payment of Benefits - Payment of vested benefits under the Plan will be made in the event of a participant’s termination of employment, death, retirement, or financial hardship and may be paid in either a lump-sum distribution or over a certain period of time as determined by Internal Revenue Service (IRS) rules or by participant election.

Termination - While it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions set forth in the plan document and the Employee Retirement Income Security Act of 1974 (ERISA). Upon termination of the Plan, participants become 100 percent vested in their accounts.

Participant Notes Receivable - Active participants may borrow from their account balances and must be adequately collateralized using not more than 50 percent of the participant’s vested account balance. Interest is stated at a reasonable rate determined on the note date. The notes receivable and interest repayments are reinvested in accordance with the participant’s current investment selection.

Administrative Expenses - Administrative expenses of the Plan are paid by the Plan as provided in the Plan document.

Party-in-Interest Transactions - Certain plan assets are in investments of the Parent of the Company, therefore, these transactions qualify as party-in-interest transactions as defined under ERISA guidelines.

Oppenheimer & Co. Inc. 401(k) Plan

| | |

|

|

| Notes to Financial Statements |

December 31, 2023 and 2022 |

Note 2 - Summary of Significant Accounting Policies

Investment Valuation - The Plan's investments are stated at fair value. See Note 4 for additional information on the fair value measurement methodologies used to value the Plan's assets.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Participant Notes Receivable - Participant notes receivable are recorded at their unpaid principal balances plus any accrued interest. Participant notes receivable are written off when deemed uncollectible.

Benefit Payments - Benefits are recorded when paid.

Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risk and Uncertainties - The Plan invests in various securities including mutual funds, money market funds and Oppenheimer Holdings Inc. common stock. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility.

Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statement of net assets available for Plan benefits.

Oppenheimer & Co. Inc. 401(k) Plan

| | |

|

|

| Notes to Financial Statements |

December 31, 2023 and 2022 |

Note 3 - Tax Status

The Plan has received a determination letter from the Internal Revenue Service indicating that the Plan, as designed, is qualified for tax-exempt treatment under the applicable section of the Internal Revenue Code ("IRC"). Although the plan has been amended since receiving the determination letter, management believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC. Accordingly, no provision for income taxes has been made in the accompanying statements.

The plan administration believes the Plan is no longer subject to tax examinations for years prior to 2020.

Note 4 - Fair Value

Accounting standards require certain assets and liabilities be reported at fair value in the financial statements and provide a framework for establishing that fair value. The framework for determining fair value is based on a hierarchy that prioritizes the inputs and valuation techniques used to measure fair value.

The following tables present information about the Plan’s assets measured at fair value on a recurring basis at December 31, 2023 and 2022.

Level 1 - The Plan's Level 1 investments included Oppenheimer Holding Inc. Common stock, money market funds and mutual funds. Common stock is valued at the closing price reported in the active markets in which the individual securities are traded. Share prices of each mutual and money market fund, referred to as the fund's NAV, are based on the closing market prices and accruals of securities in the respective fund's total portfolio (total value of the fund) divided by the number of fund shares currently issued and outstanding.

Level 2 - Fair values determined by Level 2 inputs use other inputs that are observable, either directly or indirectly. These Level 2 inputs include quoted prices for similar assets in active markets and other inputs such as interest rates and yield curves that are observable at commonly quoted intervals. The Plan's Level 2 investments include the cash surrender value of life insurance policies.

Level 3 - Level 3 inputs are unobservable inputs, including inputs that are available in situations where there is little, if any, market activity for the related asset. The plan had no Level 3 investments at December 31, 2023 or 2022.

In instances where inputs used to measure fair value fall into different levels in the above fair value hierarchy, fair value measurements in their entirety are categorized based on the lowest level input that is significant to the valuation. The Plan’s assessment of the significance of particular inputs to these fair value measurements requires judgment and considers factors specific to each asset.

Oppenheimer & Co. Inc. 401(k) Plan

| | |

|

|

| Notes to Financial Statements |

December 31, 2023 and 2022 |

Note 4 - Fair Value (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Assets at Fair Value as of December 31, 2023 |

| | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Balance at December 31, 2023 |

| | | | | | |

| Mutual funds | | $ | 510,031,777 | | | $ | — | | | $ | 510,031,777 | |

| Common stock - Oppenheimer Holdings Inc. | | 25,335,358 | | | — | | | 25,335,358 | |

| Money market funds | | 55,799,779 | | | — | | | 55,799,779 | |

| Cash surrender value life insurance policies | | — | | | 162,390 | | | 162,390 | |

| | | | | | |

| Total investments at fair value | | $ | 591,166,914 | | | $ | 162,390 | | | $ | 591,329,304 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Assets at Fair Value as of December 31, 2022 |

| | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Balance at December 31, 2022 |

| | | | | | |

| Mutual funds | | $ | 425,199,332 | | | $ | — | | | $ | 425,199,332 | |

| Common stock - Oppenheimer Holdings Inc. | | 27,093,317 | | | — | | | 27,093,317 | |

| Money market funds | | 53,065,076 | | | — | | | 53,065,076 | |

| Cash surrender value life insurance policies | | — | | | 340,874 | | | 340,874 | |

| | | | | | |

| Total investments at fair value | | $ | 505,357,725 | | | $ | 340,874 | | | $ | 505,698,599 | |

The Plan’s policy is to recognize transfers between levels of the fair value hierarchy as of the beginning of the reporting period. There were no transfers between levels of the fair value hierarchy during 2023 and 2022.

Oppenheimer & Co. Inc. 401(k) Plan

Schedule of Assets Held at End of Year

Form 5500, Schedule H, Item 4i

EIN 13-5657518, Plan Number 001

December 31, 2023

| | | | | | | | | | | |

(a)(b)

Identity of Issuer, Borrower,

Lessor, or Similar Party | (c) Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value | (d)

Cost | (e)

Current Value |

| | | |

| Oppenheimer Holdings Inc. ** | Oppenheimer Holdings Inc. - Common stock | * | $ | 25,335,358 | |

| Federated Hermes | Governmental Obligations Fund - Money market fund | * | 55,783,772 | |

| DWS | Government Money Market Series - Money market fund | * | 16,007 | |

| Artisan Partners | Artisan Mid Cap Fund - Mutual fund | * | 31,146,812 | |

| American Funds | Growth Fund of America - Mutual fund | * | 69,765,700 | |

| Columbia | Columbia Dividend Income Fund - Mutual fund | * | 19,815,466 | |

| Cohen & Steers | Cohen & Steers Real Estate Securities Fund - Mutual fund | * | 15,814,028 | |

| DFA | DFA Inflation - Protected Securities I - Mutual fund | * | 5,552,514 | |

| American Funds | EuroPacific Growth Fund - Mutual fund | * | 34,974,727 | |

| First Eagle | First Eagle Global Fund - Mutual fund | * | 42,213,734 | |

| Invesco | Invesco Small Cap Growth Fund - Mutual fund | * | 22,013,594 | |

| Fidelity | Fidelity 500 Index Fund - Mutual fund | * | 64,196,352 | |

| Invesco | Invesco Developing Markets Fund - Mutual fund | * | 13,120,628 | |

| JPMorgan | JPMorgan Core Bond Fund - Mutual fund | * | 11,082,854 | |

| Loomis Sayles | Loomis Sayles Bond Fund - Mutual fund | * | 15,953,552 | |

| MFS Investment Management | MFS International New Discovery Fund - Mutual fund | * | 11,826,269 | |

| American Funds | American Balanced Fund - Mutual fund | * | 31,845,879 | |

| Allspring | Allspring Growth Administrator Fund - Mutual fund | * | 26,990,276 | |

| MFS Investment Management | MFS Mid Cap Value Federated R4 - Mutual fund | * | 7,160,155 | |

| Vanguard | Vanguard Intermediate - Term Treasury Fund - Mutual fund | * | 11,923,911 | |

| Franklin | Franklin Small Cap Value Fund - Mutual fund | * | 23,289,381 | |

| American Funds | Washington Mutual Investors Fund - Mutual fund | * | 51,345,945 | |

| Insurance contracts | Policy Number 4000302 | * | 1,676 | |

| Policy Number 4000306 | * | 147,298 | |

| Policy Number 4000347 | * | 13,416 | |

| | | |

| Participants** | Participant notes receivable, with interest rates ranging from 4.25 percent to 9.50 percent | - | 7,581,136 | |

| Total | | $ | 598,910,440 | |

| | | |

| *Cost information not required | | |

| **Party-in-interest, as defined by ERISA | | |

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Nos. 333-129390 and 333-111225) on Form S-8 of our report dated June 10, 2024 appearing in the annual report on Form 11-K of Oppenheimer & Co. Inc. 401(k) Plan as of December 31, 2023 and 2022 and for the years then ended.

/s/ Plante & Moran, PLLC

Clinton Township, Michigan

June 10, 2024

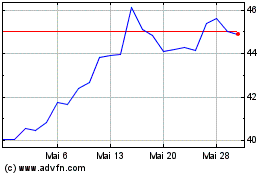

Oppenheimer (NYSE:OPY)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

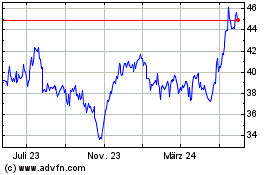

Oppenheimer (NYSE:OPY)

Historical Stock Chart

Von Jun 2023 bis Jun 2024