false

POS EX

0001678130

No

0001678130

2024-10-31

2024-10-31

0001678130

dei:BusinessContactMember

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As filed with the Securities and Exchange

Commission on October 31, 2024

1933 Act File No. 333-260203

1940 Act File No. 811-23166

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

[X] REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

[ ] Pre-Effective Amendment No.

[X] Post-Effective Amendment No. 4

and

[X] REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT

OF 1940

[X] Amendment No. 23

RiverNorth/DoubleLine Strategic Opportunity

Fund, Inc.

Exact Name of Registrant as Specified in

Charter

360 South Rosemary Avenue, Suite 1420

West Palm Beach, FL 33401

Address of Principal Executive Offices

(561) 484-7185

Registrant's Telephone Number, including

Area Code

Marcus L. Collins, Esq.

RiverNorth Capital Management, LLC

360 South Rosemary Avenue, Suite 1420

West Palm

Beach, FL 33401

Name and Address of Agent for Service

Copies of Communications to:

Joshua B. Deringer

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

(215) 988-2700

APPROXIMATE DATE OF PROPOSED PUBLIC OFFERING: This post-effective

amendment is being filed pursuant to Rule 462(d) under the Securities Act and will be effective upon filing.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, check the following box [ ]

If any securities being registered on this Form will be offered

on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (the “Securities Act”), other

than securities offered in connection with dividend or interest reinvestment plans, check the following box [X]

If this Form is a registration statement pursuant to General

Instruction A.2 or a post-effective amendment thereto, check the following box [X]

If this Form is a registration statement pursuant to General

Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule

462(e) under the Securities Act, check the following box [ ]

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant

to Rule 413(b) under the Securities Act, check the following box [ ]

It is proposed that this filing will become effective (check

appropriate box):

[ ] when declared effective pursuant to section 8(c)

If appropriate, check the following box:

[ ] This post-effective amendment designates a new effective

date for a previously filed post-effective amendment.

[ ] This Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier

effective registration statement for the same offering is: ________.

[ ] This Form is a post-effective amendment filed pursuant

to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration

statement for the same offering is: _______.

[X] This Form is a post-effective amendment filed pursuant

to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration

statement for the same offering is: 333-260203.

Check each box that appropriately characterizes the Registrant:

[X] Registered Closed-End Fund (closed-end company that

is registered under the Investment Company Act of 1940 (the “Investment Company Act”)).

[ ] Business Development Company (closed-end company that

intends or has elected to be regulated as a business development company under the Investment Company Act).

[ ] Interval Fund (Registered Closed-End Fund or a Business

Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

[X] A.2 Qualified (qualified to register securities pursuant

to General Instruction A.2 of this Form).

[ ] Well-Known Seasoned Issuer (as defined by Rule 405 under

the Securities Act).

[ ] Emerging Growth Company (as defined by Rule 12b-2 under

the Securities and Exchange Act of 1934).

[ ] If an Emerging Growth Company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

[ ] New Registrant (registered or regulated under the Investment

Company Act for less than 12 calendar months preceding this filing).

EXPLANATORY NOTE

This Post-Effective Amendment No. 4 to the Registration Statement

on Form N-2 (File Nos. 333-260203 and 811-23166) of the RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (as amended, the

"Registration Statement") is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the "Securities

Act"), solely for the purpose of filing Exhibits a.6, d.1, d.2, k.12, l.5 and l.6 to the Registration Statement. No changes

have been made to Parts A, B or C of the Registration Statement, other than Item 25(2) of Part C as set forth below. Accordingly,

this Post-Effective Amendment No. 4 consists only of the facing page, this explanatory note and Item 25(2) of the Registration

Statement setting forth the exhibits to the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective

Amendment No. 4 shall become effective immediately upon filing with the Securities and Exchange Commission. The contents of the

Registration Statement are hereby incorporated by reference.

PART C - OTHER INFORMATION

Item 25: Financial Statements and Exhibits

The Registrant's audited

financial statements for the fiscal year ended June 30, 2024 have been incorporated by reference into Part B of the Registration

Statement by reference to the Registrant's annual

report for the fiscal year ended June 30, 2024.

| g.1 |

Form of Management Agreement between Registrant and RiverNorth Capital Management, LLC. Filed on September 27, 2016 in Pre-Effective Amendment No. 5 as Exhibit g.1 to Registrant's Registration Statement on Form N-2 (File No. 333- 212400) and incorporated herein by reference. |

| |

|

| g.2 |

Form of Subadvisory Agreement. Filed on September 27, 2016 in Pre-Effective Amendment No. 5 as Exhibit g.2 to Registrant's Registration Statement on Form N-2 (File No. 333- 212400) and incorporated herein by reference. |

| |

|

| h.1 |

Distribution Agreement to be filed by amendment. |

| |

|

| i. |

None. |

| |

|

| j.1 |

Master Custodian Agreement. Filed on September 3, 2020 in Post-Effective Amendment No. 2 as Exhibit j.1 to Registrant’s Registration Statement on Form N-2 (File No. 333-230320) and incorporated herein by reference. |

| |

|

| j.2 |

Letter Agreement incorporating the Custody Agreement as of December 6, 2019, between Registrant and State Street Bank and Trust Company. Filed on September 3, 2020 in Post-Effective Amendment No. 2 as Exhibit j.2 to Registrant’s Registration Statement on Form N-2 (File No. 333-230320) and incorporated herein by reference. |

| |

|

| j.3 |

Custody Agreement between Registrant and Millennium Trust Company. Filed on October 17, 2024 in Pre-Effective Amendment No. 1 as Exhibit j.3 to Registrant’s Registration Statement on Form N-2 (File No. 333-282688) and incorporated herein by reference. |

| |

|

| k.l |

Administration, Bookkeeping and Pricing Services Agreement between Registrant and ALPS Fund Services, Inc. Filed on September 3, 2020 in Post-Effective Amendment No. 2 as Exhibit k.1 to Registrant’s Registration Statement on Form N-2 (File No. 333-230320) and incorporated herein by reference. |

| |

|

| k.2 |

Amendment No. 1 to Administration, Bookkeeping and Pricing Services Agreement between Registrant and ALPS Fund Services, Inc. Filed on December 4, 2020 in Post-Effective Amendment No. 6 as Exhibit k.2 to Registrant’s Registration Statement on Form N-2 (File No. 333-230320) and incorporated herein by reference. |

| |

|

| k.3 |

Agency Agreement with DST Systems, Inc. Filed on September 3, 2020 in Post-Effective Amendment No. 2 as Exhibit k.7 to Registrant’s Registration Statement on Form N-2 (File No. 333-230320) and incorporated herein by reference. |

| |

|

| k.6 |

Adoption Agreement incorporating the Agency Agreement between Registrant and DST Systems, Inc. Filed on December 29, 2021 in Post-Effective Amendment No. 2 as Exhibit k.9 to Registrant’s Registration Statement on Form N-2 (File No. 333-260203) and incorporated herein by reference. |

| |

|

| k.7 |

Franklin Rule 12d1-4 Fund of Funds Investment Agreement. Filed on August 25, 2022 as Exhibit k.12 to Post-Effective Amendment No. 3 to the Registrant's Registration Statement on Form N-2 (File No. 333-260203) and incorporated herein by reference. |

| |

|

| k.8 |

BlackRock Closed-End Funds Rule 12d1-4 Fund of Funds Agreement. Filed on August 25, 2022 as Exhibit k.13 to Post-Effective Amendment No. 3 to the Registrant's Registration Statement on Form N-2 (File No. 333-260203) and incorporated herein by reference. |

| |

|

| k.9 |

Nuveen Closed-End Funds Rule 12d1-4 Investment Agreement. Filed on August 25, 2022 as Exhibit k.14 to Post-Effective Amendment No. 3 to the Registrant's Registration Statement on Form N-2 (File No. 333-260203) and incorporated herein by reference. |

| |

|

| k.10 |

Voya Fund of Funds Investment Agreement. Filed on August 25, 2022 as Exhibit k.15 to Post-Effective Amendment No. 3 to the Registrant's Registration Statement on Form N-2 (File No. 333-260203) and incorporated herein by reference. |

| |

|

k.11

|

Credit Agreement with BNP Paribas. Filed on October 17, 2024 in Pre-Effective Amendment No. 1 as Exhibit k.11 to Registrant’s Registration Statement on Form N-2 (File No. 333-282688) and incorporated herein by reference. |

| |

|

| k.12 |

Subscription Agent and Information Agent Agreement is filed herewith. |

| |

|

| l.1 |

Opinion and consent of Shapiro Sher Guinot & Sandler, P.A. Filed on October 17, 2024 in Pre-Effective Amendment No. 1 as Exhibit l.1 to Registrant’s Registration Statement on Form N-2 (File No. 333-282688) and incorporated herein by reference. |

| |

|

| l.2 |

Opinion and consent of Faegre Drinker Biddle & Reath LLP. Filed on October 17, 2024 in Pre-Effective Amendment No. 1 as Exhibit l.2 to Registrant’s Registration Statement on Form N-2 (File No. 333-282688) and incorporated herein by reference. |

| |

|

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933 and the Investment Company Act of 1940, the Registrant has duly caused this Registration Statement to be signed on

its behalf by the undersigned, thereunto duly authorized, in this City of West Palm Beach, and State of Florida, on the 31st day

of October, 2024.

| |

RIVERNORTH/DOUBLELINE

STRATEGIC OPPORTUNITY FUND, INC. |

|

| |

|

|

|

| |

By: |

/s/ Patrick W. Galley |

|

| |

|

Patrick W. Galley, President |

|

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement has been signed below by the following persons in the capacities and on the date indicated.

| Signature |

|

Title |

|

Date |

| By: |

/s/ Patrick W. Galley |

|

President (Principal Executive Officer) |

|

October 31, 2024 |

| |

Patrick W. Galley |

|

|

|

|

| By: |

/s/ Jonathan M. Mohrhardt |

|

Chief Financial Officer and Treasurer (Principal Financial Officer/ Principal Accounting Officer) |

|

October 31, 2024 |

| |

Jonathan M. Mohrhardt |

|

|

|

|

| By: |

/s/ Patrick W. Galley |

|

Chairman of the Board and Director |

|

October 31, 2024 |

| |

Patrick W. Galley |

|

|

|

|

| |

John K. Carter(1) |

|

Director |

By: |

/s/ Patrick W Galley |

| |

Lisa B. Mougin(1) |

|

Director |

|

Patrick W. Galley |

| |

David M. Swanson(1) |

|

Director |

|

Attorney-In-Fact |

| |

Jerry Raio(1) |

|

Director |

|

October 31, 2024 |

| |

J. Wayne Hutchens(1) |

|

Director |

|

|

| (1) |

Original powers of attorney authorizing Joshua B. Deringer, David L. Williams and Patrick W. Galley to execute Registrant’s Registration Statement, and Amendments thereto, for the directors of the Registrant on whose behalf this Registration Statement were previously executed and were filed on August 15, 2024 as Exhibit t to the Registrant's Registration Statement on Form N-2 (File No. 333-282688) |

INDEX TO EXHIBITS

RiverNorth/DOUBLELINE

STRATEGIC OPPORTUNITY FUND, INC.

ARTICLES SUPPLEMENTARY

RiverNorth/DoubleLine

Strategic Opportunity Fund, Inc. (the “Corporation”), a Maryland corporation, hereby certifies to the State

Department of Assessments and Taxation of Maryland (the “SDAT”) that:

RECITALS

FIRST: The

Corporation is authorized under Article IV of the charter of the Corporation, as amended (the “Charter”),

to issue up to 50,000,000 shares of capital stock, with a par value $0.0001 per share (“Capital Stock”).

SECOND: Pursuant

to Article IV of the Charter, all 50,000,000 such shares of Capital Stock were initially classified as Common Stock, par

value $0.0001 per share (the “Common Stock”).

THIRD: The

Board of Directors of the Corporation (the “Board of Directors”, which term as used herein shall include any

duly authorized committee of the Board of Directors) has previously reclassified 4,930,000 shares of Common Stock as Perpetual

Preferred Stock, par value $0.0001 per share (the “Perpetual Preferred Stock”), such that prior to the date

of these Articles Supplementary the Corporation has the authority to issue 45,070,000 shares of Common Stock and 4,930,000 shares

of Perpetual Preferred Stock. Pursuant to Articles Supplementary previously filed with the SDAT, the Board of Directors has designated

2,530,000 shares of Perpetual Preferred Stock as the 4.375% Series A Perpetual Preferred Shares and 2,400,000 shares of Perpetual

Preferred Stock as the 4.75% Series B Perpetual Preferred Shares.

FOURTH: Pursuant

to resolutions duly adopted at a meeting, the Board of Directors has renamed its one class of Preferred Stock, par value $0.0001

per share (the “Preferred Stock”), as follows:

Current

Name: Perpetual Preferred Stock New Name: Preferred Stock

Prior

to the date of these Articles Supplementary, the Corporation had authorized and designated two series of Preferred Stock, namely

the 4.375% Series A Perpetual Preferred Shares and the 4.75% Series B Perpetual Preferred Shares.

FIFTH:

Pursuant to the authority expressly vested in the Board of Directors by Article IV of the Charter and Section 2-208 of

the Maryland General Corporation Law, the Board of Directors has, by resolutions duly adopted on October 21, 2024 reclassified

from unissued Common Stock and authorized the issuance of an additional 5,743,500 shares of Preferred Stock (the “Additional

Preferred Shares”), having the preferences, conversion and other rights, voting powers, restrictions, limitations as

to dividends, qualifications, and terms and conditions set forth in the Charter.

SIXTH: The

Additional Preferred Shares have been classified by the Board of Directors under authority contained in the Charter as being part

of the existing class of Preferred Stock. After giving effect to the classification of the Additional Preferred Shares set forth

herein, the total number of shares of Common Stock that the Corporation has authority to issue is 39,326,500. After giving effect

to the classification of the Additional Preferred Shares set forth herein, the total number of shares of Preferred Stock that

the Corporation has authority to issue is 10,673,500, all of which are part of the single class of Preferred Stock.

SEVENTH:

Appendix C attached to these Articles Supplementary establishes a new Series of Preferred Stock of the Corporation designated

as the “Series C Term Preferred Shares” and sets forth the preferences, conversion and other rights, voting powers,

restrictions, limitations as to dividends, qualifications, and terms and conditions of redemption, of the Series C Term Preferred

Shares.

EIGHTH:

The Series C Term Preferred Shares have been classified and designated by the Board of Directors under the authority contained

in the Charter.

NINTH:

These Articles Supplementary have been approved by the Board of Directors in the manner and by the vote required by law.

TENTH:

These Articles Supplementary shall be effective upon the acceptance of these Articles Supplementary for record by the SDAT.

ELEVENTH:

The undersigned Chairman and President acknowledges these Articles Supplementary to be the corporate act of the Corporation

and, as to all matters or facts required to be verified under oath, the undersigned acknowledges that, to the best of his knowledge,

information and belief, these matters and facts are true in all material respects and that this statement is made under the penalties

of perjury.

[Signature

Page Begins on the Following Page]

In

Witness Whereof, these Articles

Supplementary are executed on behalf of the Corporation by its Chairman and President and attested to on this 29th day of October,

2024.

| ATTEST: |

|

RIVERNORTH/DOUBLELINE STRATEGIC OPPORTUNITY FUND, INC. |

| |

|

|

|

|

|

|

/s/

Marcus L. Collins |

|

|

/s/ Patrick W. Galley |

|

| Name: |

Marcus L. Collins |

|

Name: |

Patrick W. Galley |

|

| Title: |

Secretary |

|

Title: |

Chairman and President |

|

[Signature

Page to the Articles Supplementary]

APPENDIX C

RiverNorth/DOUBLELINE

STRATEGIC OPPORTUNITY FUND, INC.

6.00%

SERIES C TERM Preferred Shares

This

Appendix establishes a Series of Preferred Shares of RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. Except as set forth

below, this Appendix incorporates by reference the terms set forth with respect to all Series of such Preferred Shares in those

“Articles Supplementary Establishing and Fixing the Rights and Preferences of Perpetual Preferred Shares” dated

October 19, 2020 (the “PP Articles Supplementary”), and except as set forth below, these Articles Supplementary

incorporate by reference the terms set forth with respect to all Series of such Preferred Shares in the PP Articles Supplementary.

This Appendix has been adopted by resolution of the Board of Directors of RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

Capitalized terms used herein but not defined herein have the respective meanings set forth in the PP Articles Supplementary.

Section 1. Designation

as to Series.

Term

Preferred Shares, 6.00% Series C Term Preferred Shares: A series of 5,743,500 shares of Capital Stock classified as Preferred

Shares is hereby designated as the “Series C Term Preferred Shares.” Each share of such Series shall have such preferences,

voting powers, restrictions, limitations as to dividends and distributions, qualifications and terms and conditions of redemption,

in addition to those required by applicable law and those that are expressly set forth in the Charter and the PP Articles Supplementary

(except as the PP Articles Supplementary may be expressly modified by this Appendix), as are set forth in this Appendix C.

The Series C Term Preferred Shares shall constitute a separate series of Capital Stock and of the Preferred Shares and each Series

C Term Preferred Share shall be identical. The following terms and conditions shall apply solely to the Series C Term Preferred

Shares:

Section 2. Number

of Authorized Shares of Series.

The

number of authorized shares is 5,743,500.

Section 3. Date

of Original Issue with respect to Series.

The

Date of Original Issue shall be the date upon which any such shares of Series C Term Preferred Shares are initially issued from

time to time by the Corporation.

Section 4. Fixed

Dividend Rate Applicable to Series.

The

Fixed Dividend Rate is 6.00%.

Section 5. Liquidation

Preference Applicable to Series.

The

Liquidation Preference is $10.00 per share.

Section 6. Term

Redemption Date Applicable to Series.

The

Term Redemption Date is December 1, 2027.

Section 7. Dividend

Payment Dates Applicable to Series.

The

Dividend Payment Dates are February 15, May 15, August 15, and November 15 of each year (each a “Dividend Payment Date”),

commencing on February 15, 2025, or, if any such day is not a Business Day, the next Business Day.

Section 8. Non-Call

Period Applicable to Series.

Not

applicable.

Section 9. Exceptions

to Certain Definitions Applicable to the Series.

The

following definitions contained under the heading “Definitions” in the PP Articles Supplementary are hereby amended

as follows:

All

references to Perpetual Preferred Shares in the PP Articles Supplementary shall include the Series C Term Preferred Shares.

“Redemption

Price” shall mean the Term Redemption Price or the Optional Redemption Price, as applicable.

Section 10. Additional

Definitions Applicable to the Series.

The

following terms shall have the following meanings (with terms defined in the singular having comparable meanings when used in

the plural and vice versa), unless the context otherwise requires:

“Dividend

Period” means, with respect to each Series C Term Preferred Share, in the case of the first Dividend Period, the

period beginning on the Date of Original Issue for such Series to, but excluding, February 15, 2025, and for each subsequent Dividend

Period, the period beginning on and including a Dividend Payment Date to, but excluding, the next Dividend Payment Date or the

Term Redemption Date, as the case may be.

“Term

Redemption Date” means, the date specified as the Term Redemption Date in this Appendix C.

“Term

Redemption Price” has the meaning set forth in Section 11 in this Appendix C.

Section 11. Amendments

to Terms of Preferred Shares Applicable to the Series.

The

following provisions contained under the heading “Terms of the Perpetual Preferred Shares” in the PP Articles Supplementary

are hereby amended as follows:

Section

2.5(b) of the PP Articles Supplementary entitled Conversion to Open End Investment Company Mandatory Redemption

is hereby deleted and replaced with the following new Section 2.5(b):

(b) Term

Redemption. The Corporation shall redeem all Series C Term Preferred Shares on the Term Redemption Date, at a price per

share equal to the Liquidation Preference per share plus an amount equal to all unpaid dividends and distributions on such Series

C Term Preferred Shares accumulated to (but excluding) the Term Redemption Date (whether or not earned or declared by the Corporation,

but excluding interest thereon) (the “Term Redemption Price”).

A

new Section 2.5(c)(iv) shall be inserted immediately following Section 2.5(c)(iii), as follows:

(iv)

Notwithstanding anything herein to the contrary, prior to December 1, 2027, the Series C Term Preferred Shares are not subject

to optional redemption by the Corporation unless the redemption is necessary, in the judgment of the Board of Directors, to maintain

the Corporation’s status as a RIC under Subchapter M of the Internal Revenue Code of 1986.

Section

2.7 of the PP Articles Supplementary entitled Maturity shall not apply to the Series C Term Preferred Shares.

Section

2.8 of the PP Articles Supplementary entitled Rating Agency shall not apply to the Series C Term Preferred Shares.

Section 12. Additional

Terms and Provisions Applicable to the Series.

The

following provisions shall be incorporated into and be deemed part of the PP Articles Supplementary:

No

amendment, alteration or repeal of the obligation to pay the Term Redemption Price on the Term Redemption Date for the Series

C Term Preferred Shares shall be effected without the prior unanimous vote or consent of the Holders of the Series C Term Preferred

Shares.

| |

|

|

+ |

| |

|

|

|

| |

RiverNorth/DoubleLine

Strategic Opportunity

Fund, Inc. |

Subscription Agent: Computershare

Trust Company, N.A.

Information

Agent: Georgeson LLC

Banks, brokers and shareholders call toll-free: (866) 357 - 5086 |

|

| SUBSCRIPTION RIGHTS CERTIFICATE |

VOID IF NOT RECEIVED

BY THE SUBSCRIPTION AGENT BEFORE 5:00 P.M.

EASTERN TIME ON THE EXPIRATION

DATE: November 25, 2024 (unless extended)

RIVERNORTH/ DOUBLELINE

STRATEGIC OPPORTUNITY FUND, INC. SUBSCRIPTION RIGHTS FOR SHARES OF COMMON STOCK AND NEWLY ISSUED 6.00%, 3 YEAR TERM, SERIES C TERM

PREFERRED STOCK.

In order to exercise

your rights, you must complete both sides of this Subscription Rights Certificate.

The registered holder (the

"Holder") of this Subscription Certificate named below, or its assignee, is entitled to the number of rights (each, a

"Right") to purchase shares of common stock, $0.0001 par value (the ''Common Shares"), of RiverNorth/DoubleLine

Strategic Opportunity Fund, Inc. (the ”Fund”) and newly issued shares of Series C preferred stock (the “Series

C Preferred Stock” or “Preferred Shares”) of the Fund as generally described in the Prospectus Supplement dated

October 30, 2024 (the “Prospectus Supplement”). These rights are non-transferrable. Each holder of the Fund's Shares

on the record date ("Record Date Stockholder") of November 5, 2024 (the "Record Date") is entitled to receive

one (1) Right for each Share held of record on the Record Date. The number of Rights to be issued to a Record Date Stockholder

will be rounded up to the nearest number of Rights evenly divisible by six. For every six (6) Rights held, a Holder may subscribe

for and purchase two (2) new Shares of common stock and one new share of Series C Preferred Stock of the Fund (the "Primary

Subscription"). In addition, Record Date Stockholders who fully exercise their Rights may subscribe for additional Common

Shares and Series C Preferred Stock not subscribed for by others in the Primary Subscription ("Over-Subscription Privilege")

subject to the limitations set forth in the Prospectus Supplement. The Over-Subscription Shares will be allocated on a pro rata

basis to Holders who over-subscribed based on the number of Rights originally issued to them. . The Board of Directors of the Fund

has the right in its absolute discretion to eliminate the Over-Subscription Privilege if it considers it to be in the best interest

of the Fund to do so. The Board of Directors may make that determination at any time, without prior notice to Rights Holders or

others, up to and including the fifth day following the expiration date of November 25, 2024 (unless extended by the Board of Directors)

(the "Expiration Date"). Fractional shares will not be issued upon the exercise of the Rights. Accordingly, new Shares

may be purchased only pursuant to the exercise of Rights in integral multiples of six.

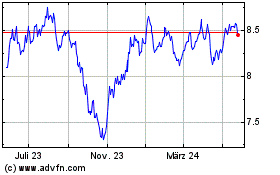

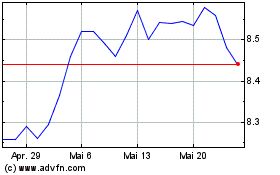

Rights Holders will not

know the subscription price at the time of exercise and will be required initially to pay for both the Common Shares subscribed

for pursuant to the Primary Subscription and, if eligible, any additional Common Shares subscribed for pursuant to the Over-Subscription

Privilege, at the estimated subscription price of $8.51 per Common Share and $10.00 per Series C Preferred Stock. An exercising

Rights Holder will generally have no right to rescind a purchase after the Subscription Agent has received payment. Any refund

in connection with an over-subscription will be delivered as soon as practicable after the Expiration Date and after all over-subscription

allocations, if any, have been effected.

The Rights represented

by this Subscription Rights Certificate may be exercised, as described further in the Prospectus Supplement by delivering to Computershare

Trust Company, N.A. ("Computershare" or the "Subscription Agent"), prior to 5:00 p.m., Eastern Time, on the

Expiration Date of November 25, 2024 (unless extended), either, (1) this Subscription Rights Certificate, properly completed and

executed, together with full payment for all the Rights the Holder elects to exercise under the Primary Subscription and Over-Subscription

Privilege, or (2) a Notice of Guaranteed Delivery guaranteeing delivery of (i) a properly completed and executed Subscription Certificate

and (ii) payment of the estimated Subscription Price in full for each share of Common Share and Series C Preferred Stock subscribed

for under the Primary Subscription Privilege and Over Subscription Privilege (if applicable) (which certificate must then be delivered

by the close of business on the first Business Day after the Expiration Date). This Subscription Rights Certificate may not be

transferred or sold. All Rights not exercised prior to 5:00 p.m. on November 25, 2024 shall be null and void.

| Holder ID |

COY |

Class |

Rights Qty Issued |

Rights Cert # |

| Signature of Owner and U.S. Person for Tax Certification | |

Signature of Co-Owner (if more than one registered holder listed) | |

Date (mm/dd/yyyy) |

| | |

| |

|

■

03QL3B

+

To Subscribe For Your Primary Shares please Complete

Line “A” on the card below. EXAMPLE

Please note that $8.51 is

an estimated price only. The Subscription Price will be determined on November 25, 2024, the Expiration Date (unless extended),

and could be higher or lower than the Estimated Subscription Price depending on changes in the net asset value and share price

of the Shares. The subscription price per Share will be determined based upon a formula equal 90% of the reported NAV or 95% of

the market price per Share, whichever is higher, on the Expiration Date, unless the Offer is extended. Market price per Common

Share will be determined based on the average of the last reported sales price of a Share on the New York Stock Exchange for the

five trading days preceding (and not inclusive of) the Expiration Date.

To subscribe for any Shares

in the Over-Subscription Privilege, please complete line "B" below. Please Note: Only Record Date Shareholders who have

exercised their Primary Subscription in full may apply for shares pursuant to the Over-Subscription Privilege.

Payment of Shares:

Full payment for both the primary subscription and over-subscription shares. Please reference your rights card control number on

your check or cashier’s check (and on the Notice of Guaranteed Delivery, if applicable). For Holders who wish to make such

payment by cashier's check, the cashier's check must have the registered Holder's name imprinted (not simply written) on the check

by the financial institution.

If the aggregate Subscription

Price paid by a Record Date Shareholder is insufficient to purchase the number of Shares that the Holder indicates are being subscribed

for, or a Record Date Shareholder does not specify the number of Common Shares and Preferred Shares to be purchased, then the Record

Date Shareholder will be deemed to have exercised first, the Primary Subscription Right (if not already fully exercised) and second,

the Over-Subscription Privilege to purchase Common Shares and Preferred Shares to the full extent of the payment rendered. If the

aggregate Subscription Price paid by a Record Date Shareholder exceeds the amount necessary to purchase the number of Common Shares

and Preferred Shares for which the Record Date Shareholder has indicated an intention to subscribe, then the Record Date Shareholder

will be deemed to have exercised first the Primary Subscription Right (if not already fully exercised) and second, the Over-Subscription

Privilege to the full extent of the excess payment tendered.

Expiration Date: (November

25, 2024 unless extended)

PLEASE FILL IN ALL APPLICABLE INFORMATION

A. Primary Subscription __________÷

6 and multiplied by 2 = _______Common shares and ______ Preferred $

________________

= $ _______________________________________

| (6 Rights= 2 common + 1 preferred Share) |

No. of Shares Subscribed For |

(Estimated Subscription Price Common |

Subscription Price Preferred |

| B. |

Over-Subscription Privilege* |

|

|

x |

$ |

|

|

| |

= $______________________ |

|

|

|

|

|

|

| |

In addition, I wish to apply for additional shares pursuant to the Over-Subscription Privilege |

|

No. Of Additional

Shares Subscribed For |

|

(Estimated Subscription Price Common) |

|

Subscription Price Preferred |

| * | The Over-Subscription Privilege may only be exercised

if the Primary Subscription is exercised in full, and may only be exercised by Record Date Shareholders, as described in the Prospectus

Supplement. Over-Subscriptions may not be accepted by the Fund and are subject to pro rata reductions. |

| C. Amount of Check Enclosed (Estimated Sub Price of Common *2) + $10.00 per Preferred share | = $ |

|

SECTION 1. TO SUBSCRIBE:

I hereby irrevocably subscribe for the number of Common Shares and Preferred Shares indicated above upon the terms and conditions

specified in the Prospectus Supplement relating thereto, receipt of which is acknowledged. I hereby agree that if I fail to pay

for the Common Shares and Preferred Shares for which I have subscribed (or are deemed to have subscribed for as set forth above),

the Fund may exercise any of the remedies set forth in the Prospectus Supplement.

IMPORTANT: The signature(s)

must correspond in every particular, without alteration, with the name(s) as printed on your Subscription Certificate.

Your Signature must be guaranteed by

an Eligible Guarantor Institution as that term is defined under Rule 17Ad-15 of the Securities Exchange Act of 1934, which may

include:

| a) | a commercial bank or trust company, or |

| b) | a member firm of a domestic stock exchange, or |

| c) | a savings bank or credit union |

| | |

|

| (name of Bank or Firm) | |

(Signature of Officer and title) |

Return Subscription Certificate by first class

mail or overnight courier to: Computershare

|

By Mail:

RiverNorth/DoubleLine Strategic

Opportunity

Fund, Inc. Attn: Corporate Actions Voluntary

Offer |

|

By Express Mail or Overnight Courier:

RiverNorth/DoubleLine Strategic

Opportunity Fund, Inc. Attn: Corporate

Actions Voluntary Offer |

|

For questions pertaining to this

offer, please call:

Georgeson LLC

Banks, brokers and shareholders

call toll-free: (866) 357-5086 |

| P.O. Box 43011 |

|

150 Royall Street, Suite V |

|

|

| Providence, RI 02940-3011 |

|

Canton, MA 02021 |

|

|

NOTICE OF GUARANTEED DELIVERY

For Common Stock

and New Series C

Preferred Stock of

RiverNorth/DoubleLine

Strategic

Opportunity Fund, Inc.

Subscribed for

under the Primary Subscription Privilege

and Pursuant to the Over-Subscription Privilege

As set forth in

the Prospectus Supplement, dated October 30, 2024 (the “Prospectus”), this form or one substantially equivalent hereto

may be used as a means of effecting subscription and payment for all of RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

(the “Fund”) common stock (the “Common Stock”) and new Series C preferred stock (the “Series C Preferred

Stock” or “Preferred Stock”) subscribed for under the Primary Subscription Privilege and pursuant to the Over-Subscription

Privilege. Such form may be delivered by first class mail, overnight courier or sent by email transmission to the Subscription

Agent and must be received prior to 5:00 p.m., Eastern Time, on November 25, 2024, unless such time is extended by Fund as described

in the Prospectus (such date and time, as the same may be extended, the “Expiration Date”). The terms and conditions

of the Rights Offering set forth in the Prospectus are incorporated by reference herein. Capitalized terms used and not otherwise

defined herein have the meaning attributed to them in the Prospectus.

The Subscription Agent is:

Computershare

| If By Mail: |

Computershare Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer

P.O. Box 43011

Providence, RI 02940-3011 |

| |

|

| If By Overnight Courier: |

Computershare Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer

150 Royall Street, Suite V

Canton, MA 02021 |

| |

|

| If By Email: |

canoticeofguarantee@computershare.com |

For information call

the information agent, Georgeson LLC: (866) 357-5086

DELIVERY

OF THIS INSTRUMENT TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE OR TRANSMISSION VIA AN EMAIL ADDRESS OTHER THAN ONE LISTED ABOVE

DOES NOT CONSTITUTE A VALID DELIVERY. THE ABOVE EMAIL ADDRESS CAN ONLY BE USED FOR DELIVERY OF THIS NOTICE OF GUARANTEED DELIVERY.

ANY TRANSMISSION OF OTHER MATERIALS WILL NOT BE ACCEPTED AND WILL NOT BE CONSIDERED A VALID SUBMISSION FOR THE OFFER.

The

undersigned, a member firm of the NYSE, Nasdaq or other national exchange, or bank or trust company

which completes this form must communicate this guarantee and the number of Common Shares subscribed for in connection with this

guarantee (separately disclosed as to the Primary Subscription and the Over- Subscription Privilege) to the Subscription Agent

and must deliver this Notice of Guaranteed Delivery, to the Subscription Agent, prior to 5:00 p.m., New York City time, on the

Expiration Date, guaranteeing delivery of (a) payment in full for all subscribed Common Shares and (b) a properly completed and

signed Subscription Certificate (which certificate and full payment (at the estimated Subscription Price of $8.51 per Common Share

multiplied by 2 plus $10.00 per new Series C Preferred Stock) must then be delivered to the Subscription Agent no later than the

close of business on the next business day after the Expiration Date). Failure to do so will result in a forfeiture of the Rights.

VOLUNTARY CORPORATE

ACTIONS COY:

RIVERNORTH/OPP

GUARANTEE

The

undersigned, a member firm of the NYSE, Nasdaq or other national exchange, or a bank or trust company, having an office or correspondent

in the United States, guarantees delivery to the Subscription Agent prior to 5:00 p.m., Eastern Time, on the next Business Day

after November 25, 2024, which is the Expiration Date, unless extended, as described in the Prospectus) of (a) a properly completed

and executed Rights Certificate and (b) payment in full for all subscribed shares of Common Stock. Participants should notify the

Depositary prior to covering through the submission of a physical security directly to the Depositary based on a guaranteed delivery

that was submitted via the PTOP platform of The Depository Trust Company (“DTC”).

Price

for shares of Common Stock and Preferred Stock subscribed for under the Primary Subscription Privilege and for any additional shares

of Common Stock and Preferred Stock subscribed for pursuant to the Over-Subscription Privilege, subject, in the case of the Over-Subscription

Privilege, to proration, as described in the Prospectus, as subscription for such shares of Common Stock and Preferred Stock is

indicated herein or in the Rights Certificate. Pursuant to the Primary Subscription Privilege, for every six (6) Rights held, a

holder may subscribe for and purchase two (2) new Shares of Common Stock and one new share of Series C Preferred Stock of the Fund.

The Over-Subscription Privilege may only be exercised if the Primary Subscription is exercised in full. The Over-Subscription shares

will be allocated on a pro rata basis to holders who over-subscribed based on the number of Rights originally issued to them.

| RiverNorth/ |

| DoubleLine Strategic Opportunity Fund,

Inc. |

|

Broker Assigned Control #

_____________ |

| 1. |

Primary Subscription |

_____÷ 6 and multiplied by 2 = _____ |

Common shares ______ ______ |

|

Preferred Shares |

| |

__________ |

|

= $____ ____ |

|

|

|

|

| |

(6 Rights= 2 common + 1 preferred Share) No.

of Shares Subscribed For (Estimated Subscription Price Common Subscription Price Preferred |

| |

|

|

|

|

|

|

|

| 2. |

Over-Subscription Privilege* |

|

__________________ |

x |

__________________ |

|

|

| |

________________________ |

|

|

|

= $________________________ |

|

|

| |

In addition, I wish to apply for

additional shares pursuant to the Over-Subscription Privilege |

|

No.

Of Additional Shares Subscribed For |

|

(Estimated Subscription Price Common) |

|

Subscription Price Preferred |

| |

|

|

|

|

|

|

|

| 3. |

Totals |

|

Total number

of Rights to be delivered |

|

Total number of shares of Common Stock and new

Series C preferred subscribed for and/or requested |

|

|

| |

__________Rights

Shares of Preferred Series C |

|

__________Shares of common ____________________ |

|

$______________

Total Payment |

Method of delivery of the Notice of Guaranteed

Delivery (circle one)

| B. | Direct to Computershare, as Subscription Agent. |

Please reference below the registration

of the Rights to be delivered.

PLEASE ASSIGN A UNIQUE CONTROL NUMBER

FOR EACH GUARANTEE SUBMITTED. This number needs to be referenced on any direct delivery of Rights or any delivery through DTC.

| |

|

|

|

| Name of Firm |

|

Authorized Signature |

|

| DTC Participant Number |

|

Title |

|

| Address |

|

Name (Please Type or Print) |

|

| Zip Code |

|

Phone Number |

|

| Contact Name |

|

Date |

|

VOLUNTARY CORPORATE ACTIONS COY: RIVERNORTH/OPP

EXECUTION

VERSION

Subscription

Agent and

Information Agent Agreement

Between

RiverNorth/DoubleLine

Strategic

Opportunity Fund, Inc.

And

Computershare

Trust Company,

N.A., Computershare Inc.

And

Georgeson

LLC

OPP

Computershare rights offering sub agent agreement docx |

Page

1 |

This

SUBSCRIPTION AGENT AGREEMENT (the "Agreement") is entered into as of this 30th day of October 2024 (the

"Effective Date") by and among RiverNorth/DoubleLine Strategic Opportunity Fund, Inc., a company organized and

existing under the laws of the State of Maryland (the "Company"), and Computershare Trust Company, N.A., a national

banking association ("Trust Company"), and Computershare Inc., a Delaware corporation ("Computershare"

and, collectively with Trust Company, the "Agent"). solely for purposes of the services provided under Article

II hereof, Georgeson LLC, a Delaware limited liability company ("Georgeson").

Article

I - SUBSCRIPTION AGENT SERVICES

1.

Appointment.

1.1

Company is making an offer (the "Subscription Offer") to issue to holders of record of its outstanding

shares of common stock, par value $0.0001 per share (the "Common Stock"), at the close of business on

November 5, 2024 (the "Record Date"), the right to subscribe for and purchase (each, a "Right", and

collectively, the "Rights") (i) new shares of common stock (the "Additional Common Stock") at

an initial estimated purchase price of $[ 8.51 ] per share of the Additional Common Stock and (ii) newly issued shares of

6.00% Series C term preferred stock, $0.0001 par value per share (the "Series C Preferred Stock") at the

purchase price of $10 per share of Series C Preferred Stock (each, a "Subscription Price"), payable as

described on the Subscription Form (as defined below) sent to eligible shareholders, upon the terms and conditions set forth

herein. The term "Subscribed" shall mean submitted for purchase from Company by a stockholder in accordance

with the terms of the Subscription Offer, and the term "Subscription(s)" shall mean any such submission.

Company hereby appoints Agent to act as subscription agent in connection with the Subscription Offer and Agent hereby accepts

such appointment in accordance with and subject to the terms and conditions of this Agreement.

1.2

The Subscription Offer will expire at 5:00 p.m., Eastern Time, on November 25, 2024 (the "Expiration Time"), unless

Company shall have extended the period of time for which the Subscription Offer is open, in which event the term "Expiration

Time" shall mean the latest time and date at which the Subscription Offer, as so extended by Company from time to time,

shall expire.

1.3

Company filed a shelf registration statement relating to the Additional Common Stock [and with the Securities and Exchange Commission

(the "SEC") under the Securities Act of 1933, as amended (the "1933 Act"), on November 8, 2021,

which became effective on November 10, 2021. The Subscription Offer will be made pursuant to the Fund’s currently effective

shelf registration statement on file with the SEC, which continues to be effective through November 10, 2024. While the Fund’s

currently effective shelf will technically expire during the rights offering, the Fund has filed a replacement shelf registration

statement, which will extend the Fund’s ability to utilize the existing shelf through the completion of the rights offering.

The terms of the Additional Common Stock are more fully described in the prospectus forming a part of the registration statement

as it was declared effective and the terms of the Series C Preferred Stock are more fully described in the Articles Supplementary

Establishing and Fixing the Rights and Preferences of Term Preferred Shares and the Articles Supplementary classifying the Series

C Preferred Stock. All terms used and not defined herein shall have the same meaning(s) as in the prospectus.

1.4

Promptly after the Record Date, Company will furnish Agent with, or will instruct Agent, in its capacity as transfer agent for

Company, to prepare, a certified list in a format acceptable to Agent of holders of record of the Common Stock at the Record Date,

including each such holder's name, address, taxpayer identification number ("TIN"), share amount with applicable

tax lot detail, any certificate detail and information regarding any applicable account stops or blocks (the "Record Stockholders

List").

1.5

No later than the earlier of (i) forty-five (45) days after the Record Date or (ii) January 15 of the year following the year

in which the Record Date occurs, Company shall deliver to Agent written direction on the adjustment of cost basis for covered

securities that arise from or are affected by the Subscription Offer

in accordance with current Internal Revenue Service regulations (see the Tax Instruction/Cost Basis Information Letter attached

hereto as Exhibit B for additional information)

OPP

Computershare rights offering sub agent agreement docx |

Page

2 |

2.

Subscription of Rights.

2.1

Every six Rights entitle each holder to subscribe, upon payment of the applicable Subscription Price, for (i) two new shares of

the Additional Common Stock and (ii) one new share of the Series C Preferred Stock (the "Basic Subscription Privilege").

No

fractional Rights will be issued. The number of Rights to be issued to a Record Date Stockholder will be rounded up to the nearest

number of Rights evenly divisible by six.

Fractional

shares will not be issued upon the exercise of the Rights. Accordingly, new shares of common stock and Series C Preferred Stock

may be purchased only pursuant to the exercise of Rights in integral multiples of six.

2.2

If subscribing shareholders who exercise their Rights in full are entitled to exercise an oversubscription right, then Company

shall provide Agent with instructions regarding the allocation to such shareholders of the Additional Common Stock and Series

C Preferred Stock after the initial allocation thereof.

2.3

Except as otherwise indicated to Agent by Company in writing, all of the Common Stock delivered hereunder upon the exercise of

the Rights will be delivered free of restrictive legends. Company shall, if applicable, inform Agent as soon as possible in advance

as to whether any Common Stock issued hereunder is to be issued with restrictive legend(s) and, if so, Company shall provide the

appropriate legend(s) and a list identifying the affected shareholders, certificate numbers (if applicable) and share amounts

for such affected shareholders.

3.

Duties of Subscription Agent.

3.1

Agent shall issue the Rights in accordance with this Agreement in the names of the holders of the Common Stock of record on the

Record Date, keep such records as are necessary for the purpose of recording such issuance(s), and furnish a copy of such records

to Company.

3.2

Promptly after Agent receives the Record Stockholders List, Agent shall:

(a) mail or cause to be mailed, by first class mail, to each holder of the Common Stock of record on the Record Date whose address

of record is within the United States of America and Canada, (i) a subscription form with respect to the Rights to which such

stockholder is entitled under the Subscription Offer (the "Subscription Form"), a form of which is attached hereto

as Exhibit A, (ii) a copy of the prospectus and (iii) a return envelope addressed to Agent.

(b)

At the direction of Company, mail or cause to be mailed, to each holder of the Common Stock of record on the Record Date whose

address of record is outside the United States of America and Canada, or is an A.P.O. or a F.P.O. address, a copy of the prospectus.

Agent shall refrain from mailing the Subscription Form to any holder of the Common Stock of record on the Record Date whose address

of record is outside the United States of America and Canada, or is an A.P.O. or a F.P.O. address, and hold such Subscription

Form for the account of such stockholder subject to such stockholder making satisfactory arrangements with Agent for the exercise

or other disposition of the Rights described therein, and effect the exercise, sale or delivery of such Rights in accordance with

the terms of this Agreement if notice of such

arrangements is received at or before 5:00 p.m., Eastern Time, on November 18, 2024. In the event that a request to exercise the

Rights is received from such a holder, Agent will consult with Company for instructions as to the number of shares of the Additional

Common Stock and Series C Preferred Stock, if any, Agent is authorized to issue.

OPP

Computershare rights offering sub agent agreement docx |

Page

3 |

(c)

Upon request by Company, Agent shall mail or deliver a copy of the prospectus (i) to each assignee or transferee of the

Rights upon receiving appropriate documentation satisfactory to Agent to register the assignment or transfer thereof and (ii)

with shares of the Additional Common Stock and Series C Preferred Stock when such are issued to persons other than the

registered holder of the Rights.

(d) Agent shall accept Subscriptions upon the due exercise of the Rights (including payment of each Subscription Price) on or prior

to the Expiration Time in accordance with the Subscription Form.

(e) Agent

shall accept Subscriptions, without further authorization or direction from Company, without procuring supporting legal papers

or other proof of authority to sign (including, without limitation, proof of appointment of a fiduciary or other person acting

in a representative capacity), and without signatures of co-fiduciaries, co-representatives or any other person:

(i)

If the Right is registered in the name of a fiduciary and the Subscription Form is executed by such fiduciary, provided, that

the Additional Common Stock and Series C Preferred Stock is to be issued in the name of such fiduciary;

(ii)

If the Right is registered in the name of joint tenants and the Subscription Form is executed by one of the joint tenants, provided,

that the Additional Common Stock and Series C Preferred Stock is to be issued in the names of such joint tenants; or

(iii)

If the Right is registered in the name of a corporation and the Subscription Form is executed by a person in a manner which

appears or purports to be done in the capacity of an officer or agent thereof, provided, that the Additional Common Stock and

Series C Preferred Stocks is to be issued in the name of such corporation.

| (f) | Each

document received by Agent relating to its duties hereunder shall be dated and time stamped

when received at the applicable address(es) as outlined in the offering documents. |

| (g) | Agent

shall, absent specific and mutually agreed upon instructions between Agent and Company,

follow its normal and customary procedures with respect to the acceptance or rejection

of all Subscriptions received after the Expiration Time. Subscriptions not authorized

to be accepted pursuant to this Section 3 and Subscriptions otherwise failing to comply

with the terms and conditions of the Subscription Form will be rejected and returned

to the applicable shareholder. |

4.

Acceptance of Subscriptions.

4.1

Following Agent's first receipt of Subscriptions, on each business day, or more frequently if reasonably requested as to major

tally figures, forward a report by email to RNOperations@rivernorth.com; (the "Company Representative(s)") as

to the following information, based upon preliminary review (and at all times subject to a final determination by Company) as

of the close of business on the preceding business day or the most recent practicable time prior to such request, as the case

may be: (i) the total number of shares of the Additional Common Stock Subscribed for; (ii) the total number of shares of Series

C Preferred Stock Subscribed for; (iii) the total number of the Rights sold; (iv) the total number of the Rights partially

Subscribed for; (v) the amount of funds received; and (vi) the cumulative totals in categories (i) through (vi), above.

OPP

Computershare rights offering sub agent agreement docx |

Page

4 |

4.2

As promptly as possible following the Expiration Time, advise the Company Representative by email of (i) the number of shares

of the Additional Common Stock Subscribed for; (ii) the number of shares of the Series C Preferred Stock Subscribed for; (iii)

the number of shares of the Additional Common Stock unsubscribed for; and (iv) the number of shares of the Series C Preferred

Stock unsubscribed for.

4.3

Upon acceptance of a Subscription, all funds received by Computershare under this Agreement that are to be distributed or applied

by Computershare in the performance of services hereunder (the "Funds") shall be held by Computershare as agent for

Company and deposited in one or more bank accounts to be maintained by Computershare in its name as agent for Company. Computershare

may hold or invest the Funds through such accounts in: (i) bank accounts, short term certificates of deposit, bank repurchase

agreements, and disbursement accounts with commercial banks with Tier 1 capital exceeding $1 billion or with an average rating

above investment grade by S&P (LT Local Issuer Credit Rating), Moody's (Long Term Rating) and Fitch Ratings, Inc. (LT Issuer

Default Rating) (each as reported by Bloomberg Finance L.P.). (ii) AAA Fixed NAV money market funds that comply with Rule 2a-7

of the Investment Company Act of 1940, as amended ("1940 Act"), a AAA rated 3C-7 fund, or similar, (iii) funds backed

by obligations of, or guaranteed by, the United States of America, municipal securities, or (iv) debt or commercial paper obligations

rated A-1 or P-1 or better by Standard & Poor's Corporation ("S&P") or Moody's Investors Service, Inc. ("Moody's"),

respectively. Computershare shall have no responsibility or liability for any diminution of the Funds that may result from any

deposit or investment made by Computershare in accordance with this paragraph, including any losses resulting from a default by

any bank, financial institution or other third party. Computershare may from time to time receive interest, dividends or other

earnings in connection with such deposits or investments. Computershare shall not be obligated to pay such interest, dividends

or earnings to the Company, any holder or any other party.

5.

Intentionally Omitted,

6.

Completion of Subscription Offer.

6.1

Upon completion of the Subscription Offer, Agent shall request the transfer agent for the Common Stock to issue the appropriate

number of shares of the Additional Common Stock and Series C Preferred Stock as required in order to effectuate the Subscriptions.

6.2

The Rights shall be issued in registered, book-entry form only. Agent shall keep books and records of the registration, transfer

and exchange of the Rights (the "Rights Register").

6.3

All of the Rights issued upon any registration of transfer or exchange of the Rights shall be the valid obligations of Company,

evidencing the same obligations and entitled to the same benefits under this Agreement as the Rights surrendered for such registration

of transfer or exchange; provided, that until such transfer or exchange is registered in the Rights Register, Company and Agent

may treat the registered holder thereof as the owner for all purposes.

6.4

For so long as this Agreement shall be in effect, Company will reserve for issuance and keep available free from preemptive rights

a sufficient number of shares of the Additional Common Stock and Series C Preferred Stock to permit the exercise in full of all

of the Rights issued pursuant to the Subscription Offer.

OPP

Computershare rights offering sub agent agreement docx |

Page

5 |

6.5 Company shall take any and all action, including, without limitation, obtaining the authorization, consent, lack of objection,

registration or approval of any governmental authority, or the taking of any other action under the laws of the United States

of America or any political subdivision thereof, to insure that all of the shares of the Additional Common Stock and Series C

Preferred Stock issuable upon the exercise of the Rights (subject to payment of each Subscription Price) will be duly and validly

issued and fully paid and non-assessable shares of the Common Stock, free from all preemptive rights and taxes, liens, charges

and security interests created by or imposed upon Company with respect thereto.

6.6 Company shall, from time to time, take all action necessary or appropriate to obtain and keep effective all registrations, permits,

consents and approvals of the SEC and any other governmental agency or authority and make such filings under federal and state

laws, which may be necessary or appropriate in connection with the issuance, sale, transfer and delivery of the Rights or the

Additional Common Stock and Series C Preferred Stock issued upon the exercise of the Rights.

7.

Procedure for Discrepancies. Agent shall follow its regular procedures to attempt to reconcile any discrepancies between

the number of shares of Additional Common Stock and Series C Preferred Stock that any Subscription Form may indicate are to be

issued to a stockholder upon the exercise of the Rights and the number that the Record Stockholders List indicates may be issued

to such stockholder. In any instance where Agent cannot reconcile such discrepancies by following such procedures, Agent will

consult with Company for instructions as to the number of shares of Additional Common Stock and Series C Preferred Stock, if any,

Agent is authorized to issue. In the absence of such instructions, Agent is authorized not to issue any shares of Additional Common

Stock and Series C Preferred Stock to such stockholder and will return to the subscribing stockholder (at Agent's option by either

first class mail under a blanket surety bond or insurance protecting Agent and Company from losses or liabilities arising out

of the non-receipt or non-delivery of the Subscription Form or by registered mail insured separately for the value of the applicable

Rights) to such stockholder's address as set forth in the Subscription Form, any Subscription Form delivered to Agent, any other

documents delivered therewith and a letter explaining the reason for the return of such documents.

8.

Procedure for Deficient Items.

8.1

Agent shall examine the Subscription Form(s) received by it as agent to ascertain whether they appear to have been completed and

executed in accordance with the Subscription Offer. In the event that Agent determines that any Subscription Form does not appear

to have been properly completed or executed, or to be in proper form, or any other deficiency in connection with the Subscription

Form appears to exist, Agent shall follow, where possible, its regular procedures to attempt to cause such irregularity to be

corrected. Agent is not authorized to waive any deficiency in connection with the Subscription, unless Company provides written

authorization to waive such deficiency.

8.2

If a Subscription Form specifies that shares of the Additional Common Stock and Series C Preferred Stock are to be issued to a

person other than the person in whose name a surrendered Right is registered, Agent will not issue such shares until such Subscription

Form has been properly endorsed with the signature guaranteed in a manner acceptable to Agent (or otherwise put in proper form

for transfer).

8.3

If any such deficiency is neither corrected nor waived, Agent will return to the subscribing stockholder (at Agent's option by

either first class mail under a blanket surety bond or insurance protecting Agent and Company from losses or liabilities arising

out of the non-receipt or non-delivery of the Subscription Form or by registered mail insured separately for the value of the

applicable Rights) to such stockholder's address as set forth in the Subscription Form, any Subscription Form delivered to Agent,

any other documents delivered therewith and a letter explaining the reason for the return of such documents.

OPP

Computershare rights offering sub agent agreement docx |

Page

6 |

9. Tax Reporting.

9.1

Agent shall prepare and file with the appropriate governmental agency and mail to each stockholder,

as applicable, all appropriate tax information forms, including, but not limited to, Forms 1099-B, covering payments or any other

distributions made by Agent pursuant to this Agreement during each calendar year, or any portion thereof, during which Agent performs

services hereunder, as described in the attached Exhibit B.

9.2

With respect to any surrendering stockholder whose TIN has not been certified as correct,

Agent shall deduct and withhold the appropriate backup withholding tax from any payment made to such stockholder pursuant to the

Internal Revenue Code.

9.3 Should any issue arise regarding federal income tax reporting or withholding, Agent shall

take such reasonable action as Company may reasonably request in writing. Such action may be subject to additional fees.

ARTICLE

II - INFORMATION AGENT SERVICES

1. SERVICES

Georgeson shall perform the information agent services described in the schedule of fees

attached hereto as Exhibit C (such services, collectively, the "IA Services").

2. FEES In

consideration of Georgeson's performance of the IA Services, the Company shall pay Georgeson

the amounts, and pursuant to the terms, set forth on the schedule of fees attached hereto as Exhibit C, together with the

costs and expenses set forth below. The Company acknowledges and agrees that the schedule of fees shall be subject to

adjustment if the Company requests Georgeson to provide services with respect to additional matters or a revised scope of

work.

3.

EXPENSES

In

addition to the fees and charges described in paragraphs (2) and 3(d) hereof, Georgeson shall charge the Company, and the Company

shall be solely responsible, for the following costs and expenses:

| a. | Costs

and expenses incidental to the Subscription Offer, including without limitation the mailing

or delivery of Offer materials; |

| b. | Costs

and expenses relating to Georgeson's work with its agents or other parties involved in

the Subscription Offer, including without limitation charges for bank threshold lists,

data processing, telephone directory assistance, facsimile transmissions or other forms

of electronic communication; |

| c. | Costs

and expenses incurred by Georgeson at the Company's request or for the Company's convenience,

including without limitation for copying, printing of additional and/or supplemental

material and travel by Georgeson's personnel; and |

| d. | Any

other costs and expenses authorized by the Company during the course of the Subscription

Offer, including without limitation those relating to advertising (including production

and posting), media relations and analytical services. |

OPP

Computershare rights offering sub agent agreement docx |

Page

7 |

| e. | The

Company shall pay all applicable taxes incurred in connection with the delivery of the

IA Services or expenses. |

4.

CUSTODIAL CHARGES

Georgeson

agrees to check, itemize and pay on the Company's behalf the charges of brokers and banks, with the exception of Broadridge Financial

Solutions, Inc. (which will bill the Company directly), for forwarding the Company's offering material to beneficial owners. The

Company shall reimburse Georgeson for such broker and bank charges in the manner described in the schedule of fees.

ARTICLE

III - GENERAL PROVISIONS

10.

Authorizations and Protections.

As

agent for Company hereunder, Agent:

10.1

Shall have no duties or obligations other than those specifically set forth herein or as

may subsequently be agreed to in writing by Agent and Company;

10.2

Shall have no obligation to deliver the Additional Common Stock and Series C Preferred Stock

unless Company shall have provided a sufficient number of shares of the Additional Common Stock and Series C Preferred Stock to

satisfy the exercise of the Rights by holders as set forth hereunder;

10.3

Shall be regarded as making no representations and having no responsibilities as to the

validity, sufficiency, value, or genuineness of any certificates, if applicable, or the Rights represented thereby surrendered

hereunder or the Additional Common Stock and Series C Preferred Stock issued in exchange therefor, and will not be required to

or be responsible for and will make no representations as to, the validity, sufficiency, value or genuineness of the Subscription

Offer;

10.4

Shall not be obligated to take any legal action hereunder; if, however, Agent determines

to take any legal action hereunder, and where the taking of such action might, in Agent's judgment, subject or expose it to any

expense or liability, Agent shall not be required to act unless it shall have been furnished with an indemnity satisfactory to

it;

10.5

May rely on and shall be fully authorized and protected in acting or failing to act upon

any certificate, instrument, opinion, notice, letter, telegram, telex, facsimile transmission or other document or security delivered

to Agent and believed by Agent to be genuine and to have been signed by the proper party or parties;

10.6

Shall not be liable or responsible for any recital or statement contained in the Subscription

Offer or any other documents relating thereto;

10.7

Shall not be liable or responsible for any failure of the Company or any other party to

comply with any of its covenants and obligations relating to the Subscription Offer, including without limitation obligations

under applicable securities laws;

10.8

Shall not be liable to any holder of the Rights for any Additional Common Stock, Series

C Preferred Stock or dividends thereon or, if applicable, and any related unclaimed property that has been delivered to a public

official pursuant to applicable abandoned property law;

OPP

Computershare rights offering sub agent agreement docx |

Page

8 |

10.9

May, from time to time, rely on instructions provided by Company concerning the services

provided hereunder. Further, Agent may apply to any officer or other authorized person of Company for instruction, and may consult

with legal counsel for Agent or Company with respect to any matter arising in connection with the services provided hereunder.

Agent and its agents and subcontractors shall not be liable and shall be indemnified by Company under Section 12.2 of this Agreement

for any action taken or omitted by Agent in reliance upon any Company instructions or upon the advice or opinion of such counsel.

Agent shall not be held to have notice of any change of authority of any person, until receipt of written notice thereof from

Company;

10.10

May rely on and be fully authorized and protected in acting or failing to act upon (a) any

guaranty of signature by an eligible guarantor institution that is a member or participant in the Securities Transfer Agents Medallion

Program or other comparable signature guarantee program or insurance program in addition to, or in substitution for, the foregoing;

or (b) any law, act, regulation or any interpretation of the same even though such law, act, or regulation may thereafter have

been altered, changed, amended or repealed;

10.11

Either in connection with, or independent of the instruction term in Section 10.9, above,

Agent may consult counsel satisfactory to Agent (including internal counsel), and the advice of such counsel shall be full and

complete authorization and protection in respect of any action taken, suffered or omitted by Agent hereunder in good faith and

in reliance upon the advice of such counsel;

10.12

May perform any of its duties hereunder either directly or by or through agents or attorneys

and Agent shall not be liable or responsible for any misconduct or negligence on the part of any agent or attorney appointed with

reasonable care hereunder; and

10.13

Is not authorized, and shall have no obligation, to pay any brokers, dealers, or soliciting

fees to any person.

11.

Representations. Warranties and Covenants.

11.1

Agent. Agent represents and warrants to Company that:

| (a) | Governance. Trust

Company is a federally chartered trust company duly organized, validly existing, and

in good standing under the laws of the United States and Computershare is a

corporation duly organized, validly existing, and in good standing under the laws of

the State of Delaware and each has full power, authority and legal right to execute,

deliver and perform this Agreement; and |

| (b) | Compliance

with Laws. The execution, delivery and performance

of this Agreement by Agent has been duly authorized by all necessary action, constitutes

the legal, valid and binding obligation of Agent enforceable against Agent in accordance

with its terms, will not require the consent of any third party that has not been given,

and will not violate, conflict with or result in the breach of any material term, condition

or provision of (A) any existing law, ordinance, or governmental rule or regulation to

which Agent is subject, (B) any judgment, order, writ, injunction, decree or award of

any court, arbitrator or governmental

or regulatory official, body or authority applicable to Agent, (C) Agent's incorporation documents or by- laws, or (D) any material

agreement to which Agent is a party. |

OPP

Computershare rights offering sub agent agreement docx |

Page

9 |

11.2

Company. Company represents and warrants to Agent that:

| (a) | Governance. It

is a corporation duly organized, validly existing and in good standing under the

laws of the State of Maryland, and it has full power, authority and legal right to

enter into and perform this Agreement; |

| (b) | Compliance with

Laws. The execution, delivery and performance of this Agreement by Company has

been duly authorized by all necessary action, constitutes the legal, valid and binding obligation of Company enforceable

against Company in accordance with its terms, will not require the consent of any third party that has not been given, and

will not violate, conflict with or result in the breach of any material term, condition or provision of (A) any existing law,

ordinance, or governmental rule or regulation to which Company is subject, (B) any judgment, order, writ, injunction, decree

or award of any court, arbitrator or governmental or regulatory official, body or authority applicable to Company, (C)

Company's incorporation documents or by-laws, (D) any material agreement to which Company is a party, or (E) any applicable

stock exchange rules; |

| (c) | Securities

Laws. Registration statements under the 1933 Act, 1940 Act and the Securities Exchange

Act of 1934 (the "1934 Act") have been filed and are currently effective, or will be effective Prior to the sale

of any Additional Common Stock and Series C Preferred Stock, and will remain so effective, and all appropriate state securities

law filings have been made with respect to all of the Additional Common Stock and Series C Preferred Stock being offered for sale,

except for any shares of Additional Common Stock or Series C Preferred Stock which are offered in a transaction or series of transactions

which are exempt from the registration requirements of the 1933 Act, 1940 Act, 1934 Act and state securities laws; Company will

immediately notify Agent of any information to the contrary; and |

| (d) | Shares. The

Additional Common Stock and Series C Preferred Stock issued and outstanding on the