RiverNorth Opportunities Fund, Inc. and RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. Announce Preferred Dividends

21 Oktober 2024 - 11:30PM

Business Wire

RiverNorth Opportunities Fund, Inc. and RiverNorth/DoubleLine

Strategic Opportunity Fund, Inc. are each pleased to announce the

declaration of preferred dividends for the 4th quarter of 2024, as

detailed below.

Ex Date

Record Date

Payable Date

November 1, 2024

November 1, 2024

November 15, 2024

Fund Name

Preferred Stock Series

NYSE

Distribution Per Share

RiverNorth Opportunities Fund,

Inc.

6.000% Series A Perpetual Preferred

Stock

RIVPRA

$0.37500

RiverNorth/DoubleLine Strategic

Opportunity Fund, Inc.

4.375% Series A Cumulative Preferred

Stock

OPPPRA

$0.27344

RiverNorth/DoubleLine Strategic

Opportunity Fund, Inc.

4.750% Series B Cumulative Preferred

Stock

OPPPRB

$0.29688

RiverNorth Capital Management, LLC is an investment management

firm founded in 2000. With $5.2 billion1 in assets under management

as of September 30, 2024, RiverNorth specializes in opportunistic

investment strategies in niche markets where the potential to

exploit inefficiencies is greatest. RiverNorth is an institutional

investment manager to registered funds, private funds and

separately managed accounts.

The distributions were calculated based on the preferred shares

Liquidation Preference of $25.00 per share and most current

quarterly distribution rate per share of $0.37500 for the

RiverNorth Opportunities Fund, Inc.’s 6.00% Series A Perpetual

Preferred Stock, $0.27344 for the RiverNorth/DoubleLine Strategic

Opportunity Fund, Inc.’s 4.375% Series A Cumulative Preferred

Stock, and $0.29688 for RiverNorth/DoubleLine Strategic Opportunity

Fund, Inc.’s 4.75% Series B Cumulative Preferred Stock,

respectively. Distributions may be paid from sources of income

other than ordinary income, such as net realized short-term capital

gains, net realized long-term capital gains and return of capital.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon each Fund’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. If a distribution includes anything other

than net investment income, the Fund provides a Section 19(a)

notice of the best estimate of its distribution sources at that

time. These estimates may not match the final tax characterization

(for the full year’s distributions) contained in shareholders’

1099-DIV forms after the end of the year.

This data is for information only and should not be construed as

an official tax form, nor should it be considered tax or investment

advice. RiverNorth is not a tax advisor and investors should

consult a tax professional for guidance regarding their specific

tax situation. Please consult your legal or tax advisor.

Investors should consider the Fund's investment objective,

risks, charges, and expenses carefully before investing. The

prospectus should be read carefully before investing. For more

information, please read the prospectus, call your financial

professional or call 844.569.4750.

Investing in the Fund involves certain risks, including loss

of principal, that are described in the "Risks" section of each

Prospectus.

Marketing services provided by ALPS Distributors Inc. ALPS and

RiverNorth are not affiliated.

1 Firm AUM reflects Managed Assets which includes the effects of

leverage and investments in affiliated funds.

RiverNorth® is a registered trademark of RiverNorth Capital

Management, LLC. DoubleLine® is a registered trademark of

DoubleLine Capital LP.

©2000-2024 RiverNorth Capital Management, LLC. All rights

reserved.

OPP000139

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021352110/en/

RiverNorth CEF Investor Relations 800-646-0148, Option 1

CEF@rivernorth.com

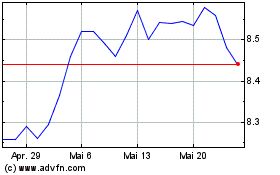

RiverNorth DoubleLine St... (NYSE:OPP)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

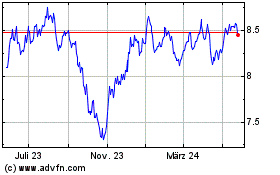

RiverNorth DoubleLine St... (NYSE:OPP)

Historical Stock Chart

Von Nov 2023 bis Nov 2024