SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of May,

2024

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

Nubank surpasses 100 million customers

The company is the first digital banking platform to surpass this milestone

outside of Asia and is honoring its customers in Brazil, Mexico, and Colombia with a tech-first campaign

São Paulo, Brazil, May 8, 2024 - Nubank announced today that it has surpassed 100

million customers in Brazil, Mexico, and Colombia, making it the first digital banking platform to reach this milestone outside of Asia.

The achievement comes on the heels of record 2023 financial results, with over US$1 billion in net profit and over US$8 billion in revenues,

which attest to the solidity, efficiency, and scalability of Nubank’s business model.

Currently, Nubank serves more than 92 million customers in Brazil, over 7 million in Mexico, and

close to 1 million in Colombia, with record levels of satisfaction. According to internal analyses, the company's NPS (Net Promoter Score)

is nearly three times higher than incumbents and other major local fintechs.

True to its mission of "fighting complexity to empower people”, Nubank is leveraging

tech and innovation to drive competition in the sector, and transform millions of lives through inclusion and improved financial management.

The company’s digital model has helped its customers save more than 11 billion dollars in banking fees in 2023 and to spare more

than 440 million hours of waiting in service queues over the past seven years1.

In Brazil, in a twelve month period, Nubank promoted the financial inclusion of 5.7 million people

in the credit card market2. After breaking the access barrier, research showed that 60% of Brazilian customers improved their

financial journey in the first 24 months, through frequent and responsible use of credit cards and other financial products3.

"In 2013, we had set ourselves the ambitious goal to reach one million customers in five

years, which seemed almost impossible at the time. In a decade, we have surpassed 100 million, which is a testament to the trust our customers

place in us and to the power of a truly customer-centric business model. These 100 million customers have written their stories together

with ours, and we want to honor them in a special way," explains David Vélez, founder and CEO of Nubank.

Nubank is launching “You at the center of everything”, a campaign that leverages technology

and innovation to highlight real customers’ journeys through an activation on the Exosphere – the exterior of Sphere in Las

Vegas and the largest LED screen in the world.

The Exosphere activation shows 360 degrees of images of Nubank customers on the exterior of the

venue - which is nearly 112 meters high and more than 157 meters wide. The faces are formed by purple particles, each of which represents

one of Nubank's 100 million customers. Together, they illustrate that Nubank is composed of all their individual stories. Nubank customers

will be featured from May 7th to the 14th on the Exosphere, kickstarting additional local campaigns and customer engagement in Brazil,

Mexico, and Colombia. Nubank’s 100 Million campaign materials are available at www.nubank.com.br/100M.

“Being customer-centric has been guiding us since the very beginning. Today, we want our

customers to see themselves the way we see them: at the center of everything. In reaching this milestone, we want to focus on the real

people and individual stories of empowerment and advance our mission to help improve people’s lives," emphasizes Cristina Junqueira,

co-founder and Chief Growth Officer of Nubank.

A record journey to 100 million customers

Nubank was born in 2013 in Brazil with the mission to fight complexity to empower people in their

daily lives by reinventing financial services, using technology to solve problems, and putting a bank in people's pockets. Betting against

a general fintech trend to begin operations with savings, the company launched a credit card with no fees, with the goal to tackle the

most challenging financial vertical first: lending. The other key differential is the 100% cloud-native platform, which allows for scalable

growth with a low cost structure, and powers some of the fastest data processing capabilities in the industry for product design, credit

and risk models, and personalization.

The company surpassed one million customers in Brazil two years after launching its first product,

three years ahead of forecast and mostly through organic member-get-member dynamics. The savings account, launched in 2017, unlocked further

growth by enabling a suite of products: personal loans, SME solutions, investments, and crypto. Today, the portfolio includes marketplace

and insurance, among others.

Starting in 2019, Nubank began to expand internationally, in Mexico and Colombia, leveraging the

unique combination of cloud-native technology, customer centricity, efficient business model, and brand love. The Mexican customer base

is growing faster than Brazil at similar stages for Savings and Credit Card, and is in its journey to obtain a banking license to keep

expanding its product portfolio into investments, payroll products and higher credit lines, among others. In Colombia, the company introduced

its savings product earlier in the year, which already has over 500,000 customers signed into the launch list.

Footnotes

1 Internal data, to be made available in our ESG report - waiting hours: BR since 2017;

Mexico since 2019; and Colombia since 2021

2 2023 Data Nubank report, data related to the period between July, 2021 and July,

2022

3 Study conducted in partnership with Mastercard

and the Boston Consulting Group, with customers who started banking January–June 2021 and monitoring financial health up to 24 months

after. All data analysis and collection of customer data by Nubank was conducted in accordance with applicable privacy and data protection

legislation.

About Nu

Nu is the world’s largest digital banking platform outside of Asia,

serving over 100 million customers across Brazil, Mexico, and Colombia. The company has been leading an industry transformation by leveraging

data and proprietary technology to develop innovative products and services. Guided by its mission to fight complexity and empower people,

Nu caters to customers’ complete financial journey, promoting financial access and advancement with responsible lending and transparency.

The company is powered by an efficient and scalable business model that combines low cost to serve with growing returns. Nu’s impact

has been recognized in multiple awards, including Time 100 Companies, Fast Company’s Most Innovative Companies, and Forbes World’s

Best Banks. For more information, please visit https://international.nubank.com.br/about/.

Contacts

Investors Relations

Jörg Friedemann

investors@nubank.com.br

|

Media Relations

Leila Suwwan

press@nubank.com.br

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Jorg

Friedemann |

| |

|

Jorg

Friedemann

Investor

Relations Officer |

Date: May

7, 2024

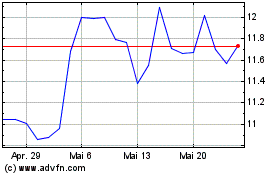

Nu (NYSE:NU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Nu (NYSE:NU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024