- 2Q 2021 INVOICED SALES INCREASED 76.0% VS 2Q 2020 AND 17.7%

VS 2Q 2019, AMID A PERDURING DISRUPTION OF THE ENTIRE SUPPLY CHAIN

(COST/AVAILABILITY OF RAW MATERIAL, PRODUCTION AND

SHIPPING)

- 2Q 2021 WRITTEN ORDERS INCREASED EVEN AT HIGHER PACE: 102.4%

VS 2Q 2020, 27.4% VS 2Q 2019. 2Q 2021 24.7% ABOVE 1Q 2021

- 1H 2021 INVOICED SALES INCREASED 45.7% VS 1H 2020 AND 5.8%

VS 1H 2019

- WRITTEN ORDERS DURING FIRST 36 WEEKS OF 2021 INCREASED 35.0%

VS SAME PERIOD IN 2020 AND 14.3% VS SAME PERIOD IN 2019

- 2Q 2021 GROSS MARGIN OF 36.1%, INCREASED FROM 26.1% IN 2Q

2020 AND 27.9% IN 2Q 2019 DESPITE SPIKE IN COST OF

MATERIALS

- 1H 2021 GROSS MARGIN OF 36.2%, INCREASED FROM 30.8% IN 1H

2020 AND 29.1% IN 1H 2019

- 2Q 2021 OPERATING PROFIT OF €1.5 MILLION, IMPROVING FROM A

LOSS OF (€7.7) MILLION IN 2Q 2020 AND (€7.8) MILLION IN 2Q 2019,

DESPITE THE SPIKE IN TRANSPORTATION COSTS AND €1.4 MILLION OF

EXTRAORDINARY COSTS RELATED TO MEASURES TAKEN BY CANADIAN CUSTOM ON

IMPORTS OF FURNITURE FROM VIETNAM AND CHINA

- 1H 2021 OPERATING PROFIT OF €4.8 MILLION, IMPROVING FROM

OPERATING LOSS OF (€12.7) MILLION IN 1H 2020 AND (€10.8) MILLION IN

1H 2019. 1H 2021 OPERATING PROFIT IS THE HIGHEST REPORTED SINCE 1H

2006 RESULTS

- AVAILABLE CASH OF €55.1 MILLION AS OF JUNE 30, 2021,

INCREASED FROM €33.2 MILLION AS OF JUNE 30, 2020, AND €41.6 MILLION

AS OF JUNE 30, 2019

The Board of Directors of Natuzzi S.p.A. (NYSE: NTZ) (“we”,

“Natuzzi” or the “Company” and, together with its subsidiaries, the

“Group”) approved today the Company’s consolidated financial

results for its second quarter and half year ended June 30,

2021.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210924005555/en/

Pasquale Natuzzi, Chairman of the Group, commented, “I am

encouraged to see a change in trajectory of our business, amid the

numerous challenges that are characterizing the supply chain in

2021, probably one of the most complex years I have witnessed in my

60-year experience. The supply chain disruption remains a challenge

that is affecting our ability to properly serve the growing demand.

The furniture market continues reporting solid growth in most of

the geographies where we operate, and this is providing a positive

tailwind to our business. More than by the positive results of the

first part of this year, however, I am encouraged to see how

effectively the new governance is helping our Group to accelerate

its retail and brand transformation. Antonio Achille, our new CEO,

had an incredible jump-start in the business and I am now

collaborating with him and our Board of Directors to further

strengthen our organization by bringing new talents on board, such

as Mario De Gennaro, who is joining as new Chief HR &

Organization Officer and who brings more than 25 years of

experience in people-led transformations.”

Antonio Achille, CEO of the Group added: “I am pleased to see

our business record significant growth for the fourth consecutive

quarter and the best semester, in terms of operating profit, in the

last 15 years.

I am also particularly excited to see an improvement in “the

quality” of our sales: growth is primarily coming from our branded

business, which is now 87% of our total business compared to 78% in

the first semester of 2019. The strength of our brands combined

with an increasing discipline on product offering and the

continuous effort to become a more customer-centric organization

has allowed us to accelerate the growth of our brands. We believe

our dual-brand strategy is paying off. “Natuzzi Italia”, our

ambassador of the “made in Italy”, targets the Global luxury

customer while “Natuzzi Editions”, entirely designed in Italy,

offers an exciting collection with a more affordable price point,

tailoring store assortment to the needs of individual markets. We

are achieving solid growth for both brands in all key

geographies.

I am also encouraged to see the trajectory of our retail in

those geographies, most notably the United States, where we have

built a strong team and have invested in defining a winning retail

model. The retail model we have in place in the United States

continues improving, with like-for-like written orders that, in 2Q

2021, grew by 250% compared to 2Q 2020 and 68% compared to 2Q 2019

(at retail value in USD). Our top stores in the Unites States are

trending at an average pace of USD 4 million in annual retail sales

per store, with an integrated gross margin of 74% during the first

semester of 2021. The encouraging improvement of these DOS is the

result of a strong management team and organization, adequate

merchandising, and the implementation of the “quick program”, which

is based on stocked products and aimed at improving the service

level and sales of our best-sellers. We intend to apply this recipe

and the experience gained in the United States to all DOS in our

key markets, so as to improve the productivity of our store

network. This is a key part of our journey to become a successful,

vertically integrated global luxury and designer furniture brand.

We intend to continue this journey with passion and

persistence.

Despite these encouraging results, we remain extremely vigilant

as our business environment remains characterized by unprecedented

supply-chain disruptions on all its key dimensions: cost and

availability of raw material, production and shipping. We continue

to remain extremely vigilant to mitigate these effects as we are

not yet seeing signs of a return to more stabilized supply

chain.

In addition, we still have significant challenges ahead of us,

primarily related to the modernization of our Italian

manufacturing.

Our operations team is working hard to meet growing demand and

overcome the challenges our production and global supply chain are

experimenting. With demand acceleration outpacing production

acceleration, our team is implementing a number of initiatives to

increase weekly production and improve production capacity such as

expanding our supply base in Italy, assembling four new production

lines in Romania, and engaging additional outsourcers in Europe. We

are also accelerating the ramp-up of our production facilities in

Mexico, an initiative that we expect to be a game changer in our

ability to serve our Natuzzi Edition business in North and Central

America in a timely and cost-effective manner.

In the short term, the price increases we recently implemented,

together with increased operating leverage, helped protect margins

from spikes in raw materials and transportation costs during the

quarter. Our focus is centered on the reduction of our backlog.

Despite the effort of our management, the situation remains

extremely complex in terms of both raw material costs, supply chain

and production capacity.

In the long term, I believe that our global supply chain, with a

combination of in-house manufacturing and outsourcing, will be a

competitive advantage over other companies that completely

outsource their production and often rely only on one market for

their production. If you completely outsource the production, and

to a great extent the design of your collections, as other

companies do, you will never be able to deliver the luxury Brand

experience we aspire to deliver with Natuzzi’s Brands, chiefly with

Natuzzi Italia. No single luxury brand, that I am aware of, relies

100% on outsourcing: in the long run your customer will not accept

it.

In these first months since my arrival, we have also worked with

our leadership team to sharpen our strategic vision to capitalize

on the positive momentum and accelerate growth. Our leadership team

is now aligned and incentivized to achieve this vision, also with a

stock option plan that our Board of Directors has agreed to

implement starting from 2022.

I am participating in this stock option plan, which I strongly

wanted for our key management team to ensure complete alignment

with the interests of the Company’s shareholders. Creating value

for them, based on resetting the fundamentals of our business

model, is my primary mission.

Together with the leadership team, in the coming months, we

intend to execute our strategy by leveraging the strength of the

Natuzzi brands, expanding our retail presence in specific markets,

such as the United States, China and Europe, accelerating our

digital presence and making our operations more flexible and closer

to market demand, while maintaining a rigorous approach to working

capital management. I am truly excited about and committed to the

journey we are on.”

2Q 2021 Consolidated

Revenue

2Q 2021 consolidated revenue amounted to €108.4 million, an

increase of 76.0% from €61.6 million in 2Q 2020 and of 17.7% from

€92.2 million in 2Q 2019.

Excluding “other sales” of €2.9 million, 2Q 2021 invoiced sales

from upholstered and other home furnishings products amounted to

€105.5 million, an increase of 76.8% compared to 2Q 2020 and of

19.4% compared to 2Q 2019.

To provide a better understanding of the different growth

drivers of our operating model, revenues are hereafter described

according the three main dimensions of our business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. Branded/Unbranded business

The Group operates in the branded business (with the Natuzzi

Italia, Natuzzi Editions and Divani&Divani by Natuzzi brands)

and the unbranded business, the latter with collections dedicated

to large-scale distribution.

A1. Branded business. Natuzzi Group’s strategy, which

aims at capitalizing on the strengths of its brands representing

the finest spirit of Italian design and the unique craftmanship

details of “Made in Italy”, continues to deliver positive results.

Natuzzi’s branded invoiced sales amounted to €91.4 million, an

increase of 75.0% compared to 2Q 2020 and of 28.3% compared to 2Q

2019.

Within the branded business, Natuzzi is pursuing a dual-brands

strategy:

- Natuzzi Italia, our luxury furniture brand, offers

products entirely designed and manufactured in Italy and targets an

affluent and more sophisticated global consumer with a highly

inspirational collection that is largely the same across all our

global stores to best represent our Brand. Natuzzi Italia products

are almost exclusively sold in mono-brand stores (directly operated

or franchises) and our strategy is to expand our distribution

through mono-brand stores. In 2Q 2021, Natuzzi Italia invoiced

sales amounted to €40.0 million, an increase of 96.0% compared to

2Q 2020 and of 26.4% compared to 2Q 2019.

- Natuzzi Editions, our affordable luxury brand, offers

products entirely designed in Italy and produced in different

districts strategically located to best serve individual markets

(mainly China, Romania, Brazil and Vietnam). We plan to establish

an additional production facility in Mexico to serve North America

starting from 2022. Natuzzi Editions products are distributed in

Italy under the brand Divani&Divani by Natuzzi. The store

merchandising of Natuzzi Editions, starting from a common

collection, is tailored to best fit the opportunities of each

market. Natuzzi Editions products are sold primarily through

galleries and selected mono-brand franchise stores. We intend to

build a growing presence of DOS and franchised operated stores

(“FOS”) in geographies where it would make sense to do so. In 2Q

2021, Natuzzi Editions invoiced sales amounted to €51.4 million, an

increase of 61.5% compared to 2Q 2020 and of 29.9% compared to 2Q

2019.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €14.1 million, an increase of 89.4% compared

to 2Q 2020 and a decrease of 17.7% compared to 2Q 2019. The Group’s

strategy is to focus on fewer large accounts and serve them with a

more efficient go-to-market model.

B. Key Markets

In 2Q 2021, the Group recorded an increase in invoiced sales

across all of its key geographies as compared to 2Q 2020 and 2Q

2019:

— North America: invoiced sales increased by

92.2% compared to 2Q 2020 and by 32.2% compared to 2Q 2019;

— Greater China: invoiced sales increased by

37.0% compared to 2Q 2020 and by 30.7% compared to 2Q 2019;

— Western and Southern Europe: invoiced sales

increased by 80.1% compared to 2Q 2020 and by 5.8% compared to 2Q

2019;

— Emerging Markets: invoiced sales increased

by 78.7% compared to 2Q 2020 and by 18.1% compared to 2Q 2019;

— Rest of the world (which includes Central

and South America and the rest of the Asia-Pacific regions):

invoiced sales increased by 71.2% compared to 2Q 2020 and by 18.6%

compared to 2Q 2019.

C. Distribution

Natuzzi sells its branded collections through mono-brand stores

(DOS or FOS) and galleries (i.e., mono-brand points-of-sale in

multi-brand stores and high-end department stores).

As of June 30, 2021, the Group distributed its branded

collections in 109 countries through 577 mono-brand stores (54 DOS

and 523 FOS). In our quest to provide our customers with an

enhanced experience of our brands, we continue to expand our

mono-brand network, both DOS and FOS. During 2Q 2021, 27 new

mono-brand stores were added to our network, including 23 located

in China.

As of June 30, 2021, the Group sold its branded collections also

through 562 Natuzzi galleries.

C1. Mono-brand direct retail. During 2Q 2021, direct

retail invoiced sales amounted to €19.2 million, an increase of

116.3% compared to 2Q 2020 and of 18.0% compared to 2Q 2019.

Natuzzi's retail adventure is relatively recent, as the first

stores were opened on a trial basis in the last decade of the

Group's 60-year history. The market in which our retail model is

most advanced is the United States. Summarized below are some

numbers and information relating to our U.S. DOS performance, which

we believe might be relevant as the retail model implemented in the

United States is the retail model that is now being extended to the

rest of our network.

- As of June 30, 2021, we had 12 DOS in the United States, of

which seven are located in Florida;

- 2Q 2021 retail value written orders on like-for-like basis

increased by 250% compared to 2Q 2020 and by 68% compared to 2Q

2019;

- During the first six months of 2021, our top six DOS trend at

an annualized pace of $4.0 million retail sales on average;

- For the first six months of 2021, we had an integrated gross

margin for our U.S. DOS of 74%; and

- For the first six months of 2021, the average order value

increased by 20.4% compared to full year 2019.

Jason Camp, President of Natuzzi Americas with nearly 25 years

of experience in the U.S. furniture industry (including leadership

positions at Bassett Furniture and Restoration Hardware), commented

on the Company’s performance in the United States as follows: “We

are very encouraged by our strong growth in the United States.

Despite the industry tailwinds, our strategy is driving market

share growth. In truth, we are just getting started. We see

numerous opportunities to drive additional organic growth, build

scale with the expansion of our retail business and drive

significant profitability.”

C2. Mono-brand franchise (FOS). The Group also sells its

branded collections through FOS. From a customer perspective, the

experience in our FOS is highly comparable to that of DOS and we

continue to invest in partnering with franchisees to elevate our

customers’ store experience. The Group remains strategically

focused on expanding its international retail distribution network

in key markets through the opening of primarily new franchise

stores.

In 2Q 2021, invoiced sales from franchise stores amounted to

€33.6 million, an increase of 81.5% compared to 2Q 2020 and of

61.6% compared to 2Q 2019.

C3. Wholesale. The Group also sells its products through

the wholesale channel, consisting primarily of Natuzzi-branded

galleries in multi-brand stores as well as mass distributors

selling unbranded products.

In 2Q 2021, branded invoiced sales from this channel amounted to

€38.5 million, an increase of 55.3% compared to 2Q 2020 and of

13.0% compared to 2Q 2019.

With the aim of more efficiently leveraging the values and

lifestyle of the Natuzzi brand, the Company intends to

strategically transform part of its gallery partnerships into

franchise agreements through the opening of Natuzzi mono-brand

stores.

In 2Q 2021, invoiced sales for unbranded products, which were

entirely sold through the wholesale channel, amounted to €14.1

million, an increase of 89.4% compared to 2Q 2020 and a decrease of

17.7% compared to 2Q 2019.

Gross margin

In 2Q 2021, we had a gross margin of 36.1%, which increased from

26.1% in 2Q 2020 and 27.9% in 2Q 2019, mainly due to a better

product mix, with an increase in Branded sales, and higher

operating leverage in 2Q 2021.

In 2Q 2021, the Company recognized labor-related costs of €0.8

million in connection with an incentive program to reduce the

redundant workforce at its Italian plants.

The improvement in gross margin has been achieved despite the

unprecedented inflationary spike in raw materials.

To offset this cost pressure, our management worked to increase

production efficiency. In addition, we applied a selected price

increase to offset the increased cost of raw materials. The price

increases, which in some markets have been of up to 15% since the

beginning of the year, have generally been well accepted by our

business partners and end customers, confirming the strengths of

our brands.

We continue to remain vigilant to mitigate this inflationary

pressure on gross margin as we are not yet seeing signs of a return

to more stabilized material costs.

Operating expenses

In 2Q 2021, management continued its effort to rationalize

operating expenses (which include selling expenses, administrative

expenses, other operating income/expenses and the impairment of

trade receivables) and achieve a more flexible overhead

structure.

As a percentage of sales, during 2Q 2021 operating expenses were

34.8% (€37.7 million) down from 38.7% in 2Q 2020 (at €23.8 million)

and down from 36.4% (at €33.5 million in 2Q 2019), notwithstanding

increased transportation costs (representing 12.9% on revenue vs

8.8% in 2Q 2020 and 9.2% in 2Q 2019, mainly due to shipping cost

increase).

Operating expenses were also affected by the impact of

extraordinary costs related to anti-dumping measures recently

imposed by Canadian customs on goods imported from China and

Vietnam. In 2Q 2021, these extra-costs, mainly consisting of

demurrage, additional transportation and legal costs, totaled €1.4

million, or 1.3% on revenue, of which €1.1 million under selling

expenses and €0.3 million under administrative expenses.

Shipping costs continue increasing and we see no sign of

potential reduction in import tariffs especially to North America

from Asia. For these reasons, we are accelerating our efforts to

bring the production of “Natuzzi Editions” closer to end

markets.

In 2Q 2021, the Company recorded €1.7 million in other income,

including €0.5 million in capital gain, from the sale of a piece of

land near its headquarters.

Key Results summary: 2Q

2021

To conclude, below is a summary of our 2Q 2021 performance. In

2Q 2021, the Company reported improved results compared to 2Q 2020

and pre-pandemic 2Q 2019:

- total revenue amounted to €108.4 million, an increase of 76.0%

compared to 2Q 2020 and of 17.7% compared to 2Q 2019;

- total written orders amounted to €103.6 million, an increase of

102.4% compared to 2Q 2020 and of 27.4% compared to 2Q 2019;

- we had a gross margin of 36.1%, which increased from 26.1% in

2Q 2020 and 27.9% in 2Q 2019;

- we had an operating profit of €1.5 million, which increased

from an operating loss of (€7.7) million in 2Q 2020 and (€7.8)

million in 2Q 2019; and

- we had a net loss of (€0.1) million, which includes

extraordinary demurrage, handling and legal costs of €1.4 million

related to duties imposed by Canadian customs. 2Q 2021 net loss of

(€0.1) million compares to a loss of (€9.1) million in 2Q 2020 and

a loss of (€10.5) million in 2Q 2019.

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the second quarter of 2021 and

2020on the basis of IFRS -IAS (expressed in millions Euro, except

per ordinary share)

Second Quarter ended

on

Change

Percentage of revenue

30-Jun-21

30-Jun-20

%

30-Jun-21

30-Jun-20

Revenue

108.4

61.6

76.0%

100.0%

100.0%

Cost of Sales

(69.3)

(45.5)

52.2%

-63.9%

-73.9%

Gross profit

39.2

16.1

143.3%

36.1%

26.1%

Other income

1.7

0.9

1.5%

1.5%

Selling Expenses, of which:

(31.1)

(17.2)

80.6%

-28.7%

-28.0%

extraordinary costs

(1.1)

0.0

-1.0%

0.0%

Administrative expenses, of which:

(8.2)

(6.1)

33.5%

-7.6%

-10.0%

extraordinary costs

(0.3)

0.0

-0.3%

0.0%

Impairment on trade receivables

0.0

(1.3)

0.0%

-2.2%

Other expenses

(0.1)

(0.1)

-0.1%

-0.1%

Operating profit/(loss)

1.5

(7.7)

1.4%

-12.5%

Finance income

0.0

0.1

0.0%

0.1%

Finance costs

(1.7)

(1.4)

-1.6%

-2.3%

Net exchange rate gains/(losses)

0.2

(0.4)

0.1%

-0.6%

Gain from disposal and loss of control of a subsidiary

0.0

0.0

0.0%

0.0%

Net finance income/(costs)

(1.5)

(1.7)

-1.4%

-2.8%

Share of profit/(loss) of equity-method investees

0.9

0.5

0.8%

0.8%

Profit/(Loss) before tax

0.8

(8.9)

0.8%

-14.5%

Income tax expense

(0.9)

(0.2)

-0.8%

-0.3%

Profit/(Loss) for the period

(0.1)

(9.1)

-0.1%

-14.7%

Profit/(Loss) attributable to: Owners of the Company

(0.3)

(8.9)

Non-controlling interests

0.3

(0.2)

Profit/(loss) per Ordinary Share

(0.01)

(0.16)

Key Results summary: half year

2021

In the first half of 2021, the Company reported improved results

compared to 1H 2020 and 1H 2019:

- total revenue amounted to €209.9 million, an increase of 45.7%

compared to 1H 2020 and of 5.8% compared to 1H 2019;

- total written orders amounted to €186.6 million, an increase of

49.1% compared to 1H 2020 and of 7.3% compared to 1H 2019;

- we had a gross margin of 36.2%, which increased from 30.8% in

1H 2020 and 29.1% in 1H 2019;

- we had an operating profit of €4.8 million, benefitting also

from €2.6 million savings deriving from the adoption of temporary

COVID-related public measures on the cost of labor, mainly in

Italy. The 1H 2021 operating profit increased from an operating

loss of (€12.7) million in 1H 2020 and (€10.8) million in 1H 2019;

and

- we had a net profit of €5.9 million, which includes

extraordinary demurrage, handling and legal costs of €1.4 million

related to duties imposed by Canadian customs. 1H 2021 net profit

of €5.9 million compares to a net loss of (€16.9) million in 1H

2020 and a net loss of (€15.2) million in 1H 2019.

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the first half of 2021 and 2020on

the basis of IFRS-IAS (expressed in millions Euro, except per share

data)

First Half ended on

Change

Percentage of revenue

30-Jun-21

30-Jun-20

%

30-Jun-21

30-Jun-20

Revenue

209.9

144.1

45.7%

100.0%

100.0%

Cost of Sales

(134.0)

(99.7)

34.4%

-63.8%

-69.2%

Gross profit

76.0

44.3

71.3%

36.2%

30.8%

Other income

3.0

1.9

1.4%

1.3%

Selling expenses, of which:

(58.9)

(42.2)

39.5%

-28.0%

-29.3%

extraordinary costs

(1.1)

0.0

-0.5%

0.0%

Administrative expenses, of which:

(15.3)

(14.5)

5.5%

-7.3%

-10.0%

extraordinary costs

(0.3)

0.0

-0.2%

0.0%

Impairment on trade receivables

0.0

(1.8)

0.0%

-1.3%

Other expenses

(0.1)

(0.4)

0.0%

-0.3%

Operating profit/(loss)

4.8

(12.7)

2.3%

-8.8%

Finance income

0.0

0.2

0.0%

0.1%

Finance costs

(3.3)

(3.1)

-1.6%

-2.1%

Net exchange rate gains/(losses)

(0.6)

(2.0)

-0.3%

-1.4%

Gain from disposal and loss of control of a subsidiary

4.8

0.0

2.3%

0.0%

Net finance income/(costs)

0.8

(4.9)

0.4%

-3.4%

Share of profit/(loss) of equity-method investees

2.0

0.9

0.9%

0.6%

Profit/(Loss) before tax

7.6

(16.7)

3.6%

-11.6%

Income tax expense

(1.7)

(0.2)

-0.8%

-0.2%

Profit/(Loss) for the period

5.9

(16.9)

2.8%

-11.7%

Profit/(Loss) attributable to: Owners of the Company

5.8

(16.6)

Non-controlling interests

0.1

(0.3)

Profit/(loss) per Ordinary Share

0.11

(0.30)

Balance sheet and cash

flow

In the first half of 2021, the Company used €6.5 million from

operating activities as a result of:

- a profit for the period of €5.9 million;

- adjustments for non-monetary items of €6.6 million, of which

depreciation and amortization of €10.4 million;

- (€14.5) million of cash used mainly due to higher working

capital needed to meet the increased production for the period, of

which (€13.1) million of inventory and (€7.3) million of trade

receivables, partially offset by trade and other payables;

- interest and taxes paid of (€4.5) million.

During the first half of 2021, €6.5 million of cash were

provided by investing activities, mainly due to €8.1 million

collected from the sale of a piece of land near the Company’s

headquarters (€2.6 million) and of one of its Italian subsidiaries

(€5.5 million), partially offset by €1.2 million invested in

capital expenditures.

In the same period, €5.2 million of additional cash were

generated by financing activities.

As a result, cash position as of June 30, 2021 improved to €55.1

million, compared to €48.2 million as of December 31, 2020.

As of June 30, 2021, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of (€1.9) million,

compared to €0.9 million as of December 31, 2020.

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of financial position (condensed)on the basis of

IFRS-IAS(Expressed in millions of Euro) 30-Jun-21

31-Dec-20 ASSETS Non-current assets

179.8

184.0

Current assets

197.5

172.0

TOTAL ASSETS

377.2

356.0

EQUITY AND LIABILITIES Equity attributable to Owners

of the Company

83.0

74.3

Non-controlling interests

1.3

1.0

Non-current liabilities

102.1

104.0

Current liabilities

190.9

176.7

TOTAL EQUITY AND LIABILITIES

377.2

356.0

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

30-Jun-21 31-Dec-20 Net cash

provided by (used in) operating activities

(6.5)

12.3

Net cash provided by (used in) investing activities

6.5

2.3

Net cash provided by (used in) financing activities

5.2

(5.6)

Increase (decrease) in cash and cash equivalents

5.1

9.0

Cash and cash equivalents, beginning of the year

46.1

37.8

Effect of movements in exchange rates on cash held

0.4

(0.8)

Cash and cash equivalents, end of the period

51.6

46.1

For the purpose of the statements of cash flow,

cash and cash equivalents comprise the following: (Expressed in

millions of Euro)

30-Jun-21 31-Dec-20 Cash and cash

equivalents in the statement of financial position

55.1

48.2

Bank overdrafts repayable on demand

(3.5)

(2.1)

Cash and cash equivalents in the statement of cash flows

51.6

46.1

NON-GAAP financial

information

Return on Capital Employed (ROCE)

The goal of our strategy is to create value for our Company and

its shareholders, measured in terms of increased value per share.

We are increasingly focusing on margin generation and capital

efficiency as key performance indicators to drive our capital

allocation choices and, more broadly, our management decisions. To

track this progress, we will begin to share with our investors

metrics that directionally provide a sense of our value creation

journey.

With this release, we will periodically provide details on

ROCE.

ROCE was 5.1% for the trailing twelve months as of the end of 2Q

2021 compared to (17.9)% and (15.6)% for the trailing twelve months

as of the end of 2Q 2020 and 2Q 2019, respectively. See the ROCE

calculation(1) in the table below.

(€ in thousands, unaudited)

30-June-21(1)

30-June-20(1) 30-June-19(1) Operating

profit/(loss) (trailing twelve months )

6,797

(24,374)

(28,156)

TOTAL ASSETS [A]

364,826

355,360

379,870

Non Current Liabilities:

105,955

112,944

86,977

Less: Long-term borrowings

(11,888)

(13,328)

(10,943)

Non-Current liabilities, net of bank debt [B]

94,066

99,616

76,034

Current liabilities:

177,853

142,184

160,510

Less: Bank overdraft and short-term borrowings

(33,486)

(18,704)

(28,600)

Less: Current portion of long-term borrowings

(6,301)

(4,213)

(9,078)

Current liabilities, net of bank debt [C]

138,067

119,266

122,832

CAPITAL EMPLOYED [A-B-C]

132,693

136,478

181,004

ROCE

5.1%

(17.9)%

(15.6)%

(1) Income statement accounts represent the activity for the

trailing twelve months ended as of each of the balance sheet dates.

Balance sheet accounts represent the average account balance for

the four quarters ended as of each of the balance sheet dates.

The Company calculates ROCE by taking the operating

profit/(loss) divided by capital employed. Capital employed equals

total assets less non-current and current liabilities, both net of

bank debt. Other companies may calculate ROCE differently, limiting

the usefulness of this measure for comparative purposes.

The Company believes that this non-GAAP measure of financial

results provides useful information to management and investors

regarding certain financial and business trends relating to the

Company’s financial condition and results of operations. Company

management uses this non-GAAP measure to compare Company

performance to that of prior periods for trend analyses, for

budgeting and planning purposes and for assessing the effectiveness

of capital allocation over time.

Company management does not consider this non-GAAP measure in

isolation or as an alternative to financial measures determined in

accordance with GAAP. The principal limitations of this non-GAAP

financial measure is that it excludes significant expenses and

income that are required by GAAP to be recognized in the Company’s

consolidated financial statements. In addition, it is subject to

inherent limitations as it reflects the exercise of judgments by

management about which expenses and income are excluded or included

in determining this non-GAAP financial measure. In order to

compensate for these limitations, management presents this non-GAAP

financial measures in connection with GAAP results. The Company

urges investors to review the reconciliation of this non-GAAP

financial measures to the comparable GAAP financial measure and not

to rely on any single financial measure to evaluate the

business.

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS

Certain statements included in this press release constitute

forward-looking statements within the meaning of the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements may be expressed in a variety of ways, including the use

of future or present tense language. Words such as “estimate,”

“forecast,” “project,” “anticipate,” “likely,” “target,” “expect,”

“intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,”

“should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,”

“opportunities,” “trends,” “ambition,” “objective,” “aim,”

“future,” “potentially,” “outlook” and words of similar meaning may

signify forward-looking statements. These statements involve risks

and uncertainties that could cause the Company’s actual results to

differ materially from those stated or implied by such

forward-looking statements including, but not limited to, potential

risks and uncertainties described at page 3 of this document

relating to the supply-chain, the cost and availability of raw

material, production and shipping and the modernization of our

Italian manufacturing and those relating to the duration, severity

and geographic spread of the COVID-19 pandemic, actions that may be

taken by governmental authorities to contain the COVID-19 pandemic

or to mitigate its impact, the potential negative impact of

COVID-19 on the global economy, consumer demand and our supply

chain, and the impact of COVID-19 on the Company's financial

condition, business operations and liquidity. Additional

information about potential factors that could affect the Company’s

business and financial results is included in the Company’s filings

with the U.S. Securities and Exchange Commission, including the

Company’s most recent Annual Report on Form 20-F. The Company

undertakes no obligation to update any of the forward-looking

statements after the date of this press release.

Additional Information

This news release is just one part of the Company’s financial

disclosures and should be read in conjunction with other

information filed with the U.S. Securities and Exchange Commission,

available at

https://www.natuzzigroup.com/en-EN/ir/financial-release.html under

the “SEC Filings” section.

About Natuzzi S.p.A.

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of

the most renowned brands in the production and distribution of

design and luxury furniture. With a global retail network of 577

mono-brand stores and 562 galleries as of June 30, 2021, Natuzzi

distributes its collections worldwide. Natuzzi products embed the

finest spirit of Italian design and the unique craftmanship details

of the “Made in Italy”, where a predominant part of its production

takes place. Natuzzi has been listed on the New York Stock Exchange

since May 13, 1993. Always committed to social responsibility and

environmental sustainability, Natuzzi S.p.A. is ISO 9001 and 14001

certified (Quality and Environment), ISO 45001 certified (Safety on

the Workplace) and FSC® certified (Forest Stewardship Council).

www.natuzzi.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210924005555/en/

Natuzzi Investor Relations Piero Direnzo | tel.

+39.080.8820.812 | pdirenzo@natuzzi.com

Natuzzi Corporate Communication Vito Basile (Press

Office) | tel. +39.080.8820.676 | vbasile@natuzzi.com

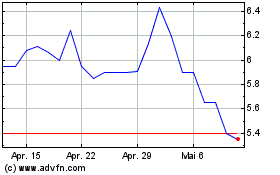

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

Von Jan 2024 bis Jan 2025