NETSTREIT Corp. Announces $275.0 Million in Additional Financing Commitments and Amendments to Existing Credit Facilities

16 Januar 2025 - 2:00PM

Business Wire

NETSTREIT Corp. (NYSE: NTST) (the “Company”) today

announced the closing of $275.0 million in additional financing

commitments and amendments to its existing credit facilities

agented by PNC Bank, National Association (the “PNC Credit

Agreement”), Wells Fargo Bank, National Association (the “Wells

Fargo Credit Agreement”) and Truist Bank (the “Truist Credit

Agreement”).

The PNC Credit Agreement was amended and restated and provides

for credit facilities in an aggregate initial amount of $875.0

million, consisting of a new $175.0 million senior unsecured term

loan (the “New Term Loan”), the existing $200.0 million senior

unsecured term loan (the “Existing Term Loan”), and an upsized,

$500.0 million revolving credit facility (which has been increased

from $400.0 million under the existing PNC Credit Agreement) (the

“Revolving Facility”). The New Term Loan and the amended Revolving

Facility initially mature in January 2029 and include, at the

Company's election, a one-year option to extend the maturity to

January 2030. The New Term Loan was fully funded on the closing

date and the Company has hedged the entire $175.0 million New Term

Loan at an all-in fixed interest rate of 5.12% through January

2030.

In addition, the Wells Fargo Credit Agreement was amended and

restated to extend the maturity date of the existing $175.0 million

senior unsecured term loan (the “Amended Term Loan”) thereunder

from January 2027 to January 2029 with an option, at the Company's

election, to extend the maturity to January 2030.

Among other changes, each of the PNC Credit Agreement, Wells

Fargo Credit Agreement and Truist Credit Agreement were also

amended to remove certain financial covenants and provide for

revised, improved pricing when the Company meets certain investment

grade rating and leverage targets.

Wells Fargo Bank, National Association; U.S. Bank National

Association; Capital One, National Association; and Truist Bank

acted as Syndication Agents for the Revolving Facility. The

Huntington National Bank; Bank of America, N.A.; Regions Bank; TD

Bank, N.A.; and Mizuho, Ltd. acted as Documentation Agents for the

Revolving Facility. Wells Fargo Securities, LLC; PNC Capital

Markets LLC; U.S. Bank National Association; Capital One, National

Association; and Truist Securities, Inc. acted as Joint Lead

Arrangers for the Revolving Facility. Wells Fargo Securities, LLC;

PNC Capital Markets LLC; and U.S. Bank National Association acted

as Joint Bookrunners for the Revolving Facility.

Capital One, National Association; Truist Bank; and The

Huntington National Bank acted as Syndication Agents for the New

Term Loan. PNC Capital Markets, LLC; Capital One, National

Association; Truist Securities, Inc.; and The Huntington National

Bank acted as Joint Lead Arrangers for the New Term Loan. PNC

Capital Markets, LLC acted as Sole Bookrunner for the New Term

Loan.

Bank of America, N.A.; Regions Bank; and TD Bank, N.A., acted as

Syndication Agents for the Amended Term Loan. Wells Fargo

Securities, LLC; BOFA Securities, Inc.; Regions Capital Markets;

and TD Bank, N.A. acted as Joint Lead Arrangers for the Amended

Term Loan. Wells Fargo Securities, LLC, acted as the sole

Bookrunner for the Amended Term Loan.

Cooley LLP acted as counsel to the Company and Alston & Bird

LLP acted as counsel to the Administrative Agents.

About NETSTREIT Corp.

NETSTREIT is an internally managed real estate investment trust

(REIT) based in Dallas, Texas that specializes in acquiring

single-tenant net lease retail properties nationwide. The growing

portfolio consists of high-quality properties leased to e-commerce

resistant tenants with healthy balance sheets. Led by a management

team of seasoned commercial real estate executives, NETSTREIT’s

strategy is to create the highest quality net lease retail

portfolio in the country with the goal of generating consistent

cash flows and dividends for its investors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116090161/en/

Investor Relations ir@netstreit.com 972-597-4825

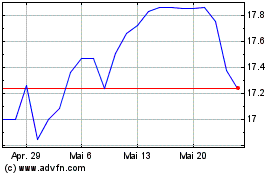

NetSTREIT (NYSE:NTST)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

NetSTREIT (NYSE:NTST)

Historical Stock Chart

Von Jan 2024 bis Jan 2025