AD HOC ANNOUNCEMENT PURSUANT TO ART. 53

LR 7 OCTOBER 2024

- Richemont will sell YNAP to Mytheresa with a cash position

of €555m and no financial debt, subject to customary closing

adjustments

- Mytheresa to issue shares to Richemont representing 33% of

Mytheresa’s fully diluted share capital

- Richemont to provide a €100m revolving credit facility to

YNAP

- Closing of transaction expected in H1 2025, subject to

customary conditions, including regulatory approvals

- Transaction creates multi-brand digital group of significant

scale, global reach as well as exceptional customer

centricity

Today, Mytheresa (NYSE:MYTE) and Richemont (SWX:CFR) announce

that they have entered into binding agreements for the acquisition

of 100% of the share capital of YNAP by Mytheresa. The transaction

aims to create a leading, global, multi-brand digital luxury group

offering a highly curated and strongly differentiated edit of the

most prestigious luxury brands and products to luxury enthusiasts

worldwide.

Transaction Rationale

Mytheresa and YNAP have each earned a strong reputation in the

luxury industry for their pioneering roles in innovation,

authoritative editorial voice and curation, as well as high-quality

customer service. Together, the different storefronts cover a broad

spectrum of the luxury market with distinct propositions in terms

of brand portfolio, customer and geographical focus while sharing

the strategic positioning towards high end customers.

In the medium term, Mytheresa’s vision for the combined group

entails:

- The integration of YNAP’s Luxury division into

Mytheresa, to form one group with three distinct storefronts:

MYTHERESA, NET-A-PORTER and MR PORTER, which is expected to:

- Provide a broader and further differentiated luxury offering

towards customers based on distinctive assortments, marketing and

customer touchpoints;

- Offer luxury brand partners an even broader and specific reach

of luxury consumers worldwide as a result of distinctive curation

and inspiration; and

- Share infrastructure including Mytheresa`s technology platform

and operational best practices to facilitate greater efficiencies

while maintaining their distinct brand identities.

- The separation of the off-price division - comprising

YOOX and THE OUTNET, leading destinations for online off-price

luxury shopping - from the Luxury division to allow for a simpler

and more efficient operating model driving higher growth and

profitability.

- The discontinuation of YNAP’s white label division, once

the Richemont Maisons’ online stores powered by YNAP migrate to

their own chosen platforms.

Michael Kliger, CEO of Mytheresa, said: “I am truly excited by

today’s announcement. With this transaction, Mytheresa aims to

create a pre-eminent, multi-brand, digital, luxury group worldwide.

MYTHERESA, NET-A-PORTER and MR PORTER will offer differentiated but

complementary multi-brand luxury edits based on curation,

inspiration and outmost customer service. The three brands will

share a large part of their infrastructure creating synergies and

efficiencies while maintaining their different brand identities.

The off-price business will benefit from the separation from luxury

and a much simpler operating model driving growth and

profitability. We believe that this transaction will create

significant value for our shareholders, brand partners and most

importantly for our high-end customers.”

Johann Rupert, Chairman of Richemont, said: “We are pleased to

have found such a good home for YNAP. As a trusted partner to many

of the world’s leading global luxury brands, YNAP is renowned for

its pioneering high-end customer services complemented by its

distinctive and inspirational editorial voice. Mytheresa is ideally

placed to build on YNAP’s assets to further delight customers and

brand partners alike across the world by harnessing both companies’

respective strengths.”

Financial consideration

At transaction closing, Richemont will sell YNAP to Mytheresa

with a cash position of €555m and no financial debt, subject to

customary closing adjustments, in exchange for shares to be issued

by Mytheresa representing 33% of Mytheresa’s fully diluted1 share

capital at closing following issuance of the consideration shares.

Richemont will make available a 6-year revolving credit facility of

€100m to finance YNAP’s general corporate needs, including working

capital.

Richemont will have the right to nominate a member and an

observer to the Supervisory Board of Mytheresa following

closing.

Closing of the transaction, which is expected to occur in the

first half of calendar year 2025, is subject to customary

conditions, including the receipt of antitrust approvals.

The transaction is not subject to or conditional on approval by

either Richemont or Mytheresa shareholders.

Richemont’s shareholding in Mytheresa will be subject to a

one-year lock-up period following transaction closing, followed by

a further one-year period in which only certain limited sale

transactions may take place.

As a result of this transaction, Richemont currently expects the

write-down of YNAP net assets to amount to approximately €1.3

billion, which also accounts for the cash to be left in YNAP upon

completion. This value is subject to change until completion date

as it depends on several variables, namely Mytheresa’s share price,

the USD/EUR foreign exchange rate, the value of net assets and

debt-like items of YNAP at completion date.

Conference Call Information

Mytheresa will host a conference call to discuss the transaction

at 8am Eastern Time. Those wishing to participate via webcast

should access the call through Mytheresa’s Investor Relations

website at https://investors.mytheresa.com. Those wishing to

participate via the telephone may dial in at +1 800 715 9871 (USA).

The participant access code will be 3814635. The conference call

replay will be available via webcast through Mytheresa’s Investor

Relations website. The telephone replay will be available from 10am

Eastern Time on October 7, 2024, through October 14, 2024, by

dialing +1 800 770 2030 (USA). The replay passcode will be

3814635.

Forward Looking Statements

This release contains forward-looking statements as that term is

defined in the United States Private Securities Litigation Reform

Act of 1995. All statements contained in this release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, without limitation,

statements regarding the timing and completion of and expected

benefits from the transactions involving Richemont Maisons,

NET-A-PORTER and YNAP, expectations regarding future opportunities

and our market position, our business plans and strategy, future

financial or operating performance, as well as statements that

include the words “expect,” “plan,” “believe,” “estimate,” “may,”

“should,” “anticipate,” “will,” “could,” “aim,” “continue” and

similar statements of a future or forward-looking nature. Such

forward-looking statements are not guarantees of future

performance. Richemont’s forward-looking statements are based on

management’s current expectations and assumptions regarding YNAP’s

business and performance, the economy and other future conditions

and forecasts of future events, circumstances and results. Our

retail stores are heavily dependent on the ability and desire of

consumers to travel and shop and a decline in consumer traffic

could have a negative effect on our comparable store sales and/or

average sales per square foot and store profitability resulting in

impairment charges, which could have a material adverse effect on

our business, results of operations and financial condition.

Reduced travel resulting from economic conditions, retail store

closure orders of civil authorities, travel restrictions, travel

concerns and other circumstances, including disease epidemics and

other health-related concerns, could have a material adverse effect

on us, particularly if such events impact our customers’ desire to

travel to our retail stores. International conflicts or wars,

including resulting sanctions and restrictions on importation and

exportation of finished products and/or raw materials, whether

self-imposed or imposed by international countries, non-state

entities or others, may also impact these forward-looking

statements. As with any projection or forecast, forward-looking

statements are inherently susceptible to uncertainty and changes in

circumstances. Actual results may differ materially from the

forward-looking statements as a result of a number of risks and

uncertainties, many of which are outside Richemont’s control.

Accordingly, you should not rely upon forward-looking statements as

predictions of future events. In addition, the forward-looking

statements made in this release relate only to events or

information as of the date on which the statements are made in this

release. Richemont does not undertake to update, nor does it have

any obligation to provide updates of, or to revise, any

forward-looking statements.

This press release contains “forward-looking statements” within

the meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, and Section 21E of the U.S. Securities Exchange Act of

1934, as amended. All statements other than statements of

historical fact or relating to present facts or current conditions

included in this press release are forward- looking statements.

Forward-looking statements give Mytheresa’s current expectations

and projections relating to the proposed transaction and the

operation of the combined companies; its financial condition,

results of operations, plans, objectives, future performance and

business, including statements relating to financing activities,

future sales, expenses, and profitability; future development and

expected growth of our business and industry; our ability to

execute our business model and our business strategy; having

available sufficient cash and borrowing capacity to meet working

capital, debt service and capital expenditure requirements for the

next twelve months; and projected capital spending. You can

identify forward-looking statements by the fact that they do not

relate strictly to historical or current facts. These statements

may include words such “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would,” or

the negative of these terms or other comparable terminology,

although not all forward-looking statements contain these words.

The forward-looking statements contained in this press release are

based on assumptions that Mytheresa has made in light of its

industry experience and perceptions of historical trends, current

conditions, expected future developments and other factors it

believes are appropriate under the circumstances. As you read and

consider this press release, you should understand that these

statements are not guarantees of performance or results. They

involve risks, uncertainties (many of which are beyond Mytheresa’s

control) and assumptions. Although Mytheresa believes that these

forward-looking statements are based on reasonable assumptions, you

should be aware that many factors could affect its actual operating

and financial performance and cause its performance to differ

materially from the performance anticipated in the forward-looking

statements. Mytheresa believes these factors include, but are not

limited to: the occurrence of any event, change or other

circumstances that could give rise to the termination or

abandonment of the proposed transaction; the expected timing and

likelihood of completion of the proposed transaction with

Richemont, including the timing, receipt and terms and conditions

of any required governmental and regulatory approvals of the

proposed transaction that could reduce anticipated benefits or

cause the parties to abandon the transaction; the risk that the

conditions to closing the proposed transaction may not be satisfied

in a timely manner or at all; the risk that the proposed

transaction and its announcement could have an adverse effect on

the ability of YNAP to retain customers and retain and hire key

personnel and maintain relationships with their brand partners and

customers and on their operating results and businesses generally;

the risk that problems may arise in successfully integrating the

businesses of YNAP and Mytheresa, which may result in the combined

company not operating as effectively and efficiently as expected;

the risk that the combined company may be unable to achieve

cost-cutting synergies or that it may take longer than expected to

achieve those synergies; Mytheresa’s ability to effectively compete

in a highly competitive industry; Mytheresa’s ability to respond to

consumer demands, spending and tastes; Mytheresa’s ability to

respond to any current or future health epidemic or other adverse

public health development; Mytheresa’s ability to acquire new

customers and retain existing customers; consumers of luxury

products may not choose to shop online in sufficient numbers; the

volatility and difficulty in predicting the luxury fashion

industry; Mytheresa’s reliance on consumer discretionary spending;

and Mytheresa’s ability to maintain average order levels and other

factors. Should one or more of these risks or uncertainties

materialize, or should any of these assumptions prove incorrect,

Mytheresa’s actual operating and financial performance may vary in

material respects from the performance projected in these

forward-looking statements.

Mytheresa undertake no obligation to update any forward-looking

statements made in this press release to reflect events or

circumstances after the date of this press release or to reflect

new information or the occurrence of unanticipated events, except

as required by law.

The achievement or success of the matters covered by such

forward-looking statements involves known and unknown risks,

uncertainties and assumptions. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect,

Mytheresa’s results could differ materially from the results

expressed or implied by the forward-looking statements it

makes.

You should not rely upon forward-looking statements as

predictions of future events. Forward-looking statements represent

Mytheresa’s management’s beliefs and assumptions only as of the

date such statements are made.

Further information on these and other factors that could affect

Mytheresa’s financial results is included in filings it makes with

the U.S. Securities and Exchange Commission (“SEC”) from time to

time, including the section titled “Risk Factors” in its annual

report on Form 20-F and on Form 6-K (reporting its quarterly

results). These documents are available on the SEC’s website at

www.sec.gov and on the SEC Filings section of the Investor

Relations section of our website at:

https://investors.mytheresa.com.

About Mytheresa

Mytheresa is one of the leading luxury multi-brand digital

platforms shipping to over 130 countries. Founded as a boutique in

1987, Mytheresa launched online in 2006 and offers ready-to-wear,

shoes, bags and accessories for womenswear, menswear, kidswear as

well as lifestyle products and fine jewelry. The highly curated

edit of up to 250 brands focuses on true luxury brands such as

Bottega Veneta, Brunello Cucinelli, Dolce&Gabbana, Gucci,

Loewe, Loro Piana, Moncler, Prada, Saint Laurent, The Row,

Valentino, and many more. Mytheresa’s unique digital experience is

based on a sharp focus on high-end luxury shoppers, exclusive

product and content offerings, leading technology and analytical

platforms as well as high quality service operations. The NYSE

listed company reported € 913.6 million GMV in fiscal year 2024

(+7% vs. FY23). For more information, please visit

https://investors.mytheresa.com/.

About Richemont

At Richemont, we craft the future. Our unique portfolio

includes prestigious Maisons distinguished by their craftsmanship

and creativity. Richemont’s ambition is to nurture its Maisons and

businesses and enable them to grow and prosper in a responsible,

sustainable manner over the long term.

Richemont operates in three business areas: Jewellery

Maisons with Buccellati, Cartier, Van Cleef & Arpels and

Vhernier; Specialist Watchmakers with A. Lange & S�hne,

Baume & Mercier, IWC Schaffhausen, Jaeger-LeCoultre, Panerai,

Piaget, Roger Dubuis and Vacheron Constantin; and Other,

primarily Fashion & Accessories Maisons with Alaïa, Chloé,

Delvaux, dunhill, Gianvito Rossi, Montblanc, Peter Millar including

G/FORE, Purdey, Serapian as well as Watchfinder & Co. In

addition, Richemont operates NET-A-PORTER, MR PORTER, THE OUTNET,

YOOX and the OFS division.

Richemont ‘A’ shares are listed and traded on the SIX Swiss

Exchange, Richemont’s primary listing, and are included in the

Swiss Market Index ('SMI') of leading stocks. The ‘A’ shares are

also traded on the JSE Johannesburg Stock Exchange, Richemont’s

secondary listing.

About YOOX NET-A-PORTER (YNAP)

YNAP is a world leading online luxury and fashion retailer, with

a distinctive offering including multi-brand in-season online

stores NET-A-PORTER and MR PORTER, and multi-brand off-season

online stores YOOX and THE OUTNET.

Uniquely positioned in the high growth online luxury sector,

YNAP has a client base of c.4 million high-spending customers and

over 900 million visitors worldwide. The Group has offices and

operations in the United States, Europe, Middle East, Japan,

mainland China and Hong Kong SAR, China. It delivers to over 170

countries around the world.

1 Mytheresa’s fully diluted share capital includes outstanding

issued shares, plus probability-adjusted vested and unvested RSU /

PSU and stock options plans.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241006718886/en/

Mytheresa Contacts Media Contacts for public

relations Mytheresa.com GmbH Sandra Romano mobile: +49 152

54725178 email: sandra.romano@mytheresa.com Media Contacts for

business press Mytheresa.com GmbH Lisa Schulz mobile: +49 151

11216490 email: lisa.schulz@mytheresa.com Investor Relations

Contacts Mytheresa.com GmbH Stefanie Muenz mobile: +49 89

127695-1919 email: investors@mytheresa.com Richemont

Contacts Investor / analyst enquiries: +41 22 721 30 03;

investor.relations@cfrinfo.net Media enquiries: +41 22 721 35 07;

pressoffice@cfrinfo.net; richemont@teneo.com Media Contacts for

business press BOC Consult GmbH Ruediger Assion mobile: +49 176

2424 7691 email: ruediger.assion@boc-consult.com

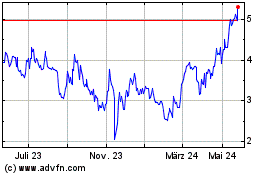

MYT Netherlands Parent BV (NYSE:MYTE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

MYT Netherlands Parent BV (NYSE:MYTE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025