UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission

File Number: 001-39601

MINISO Group Holding Limited

8F, M Plaza, No. 109, Pazhou Avenue

Haizhu District, Guangzhou 510000, Guangdong Province

The People’s Republic of China

(Address

of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

Exhibit 99.1 — HKEx Announcement — Annual Results Announcement for the Fiscal Year Ended June 30, 2023

Exhibit 99.2 — Press Release — MINISO Announces US$200 Million Share Repurchase Program

Exhibit 99.3 — HKEx Announcement — Voluntary Announcement — Intention to Conduct On-Market Share Repurchase

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | MINISO Group Holding Limited |

| | |

| | |

| | By |

: |

/s/ Jingjing Zhang |

| Name |

: |

Jingjing Zhang |

| Title |

: |

Chief Financial Officer |

Date: September 15,

2023

Exhibit 99.2

MINISO Announces US$200 Million Share Repurchase

Program

GUANGZHOU, China, Sept. 15, 2023 /PRNewswire/

-- MINISO Group Holding Limited (NYSE: MNSO; HKEX: 9896) (“MINISO”, “MINISO Group” or the “Company”),

a global value retailer offering a variety of trendy lifestyle products featuring IP design, today announced that, following the expiration

of the share repurchase program the Company adopted in September 2022, the board of directors of the Company (the “Board”)

authorized and approved a new share repurchase program on September 15, 2023 (the “2023 Share Repurchase Program”), under

which the Company may repurchase up to US$200 million in value of its outstanding ordinary shares and/or American depositary shares representing

its ordinary shares (collectively, the “Shares”) over a period of 12 months starting from the date on which the 2023 Share

Repurchase Program was approved. The Company expects to fund repurchases under the 2023 Share Repurchase Program from surplus cash on

its balance sheet.

The Board believes that a share repurchase in

the present conditions will demonstrate the Company’s confidence in its business outlook and prospects and would benefit the Company

and create value for the shareholders of the Company (the “Shareholders”) ultimately.

The Company’s proposed repurchases under

the 2023 Share Repurchase Program may be made from time to time on the open market at prevailing market prices, in privately negotiated

transactions, in block trades, and/or through other legally permissible means, depending on market conditions and in accordance with applicable

rules and regulations and its insider trading policy.

The Company shall conduct the repurchase by exercising

its powers under the repurchase mandate to be given or to be given to the Board pursuant to the resolutions of the Shareholders passed

at the annual general meeting of the Company each year to repurchase the Shares not exceeding 10% of the total number of the issued Shares

(the “Share Repurchase Mandate”) as at the date of such annual general meeting, with each mandate to expire upon whichever

is the earliest of: (a) the conclusion of the next annual general meeting of the Company; (b) the expiration of the period within

which the next annual general meeting of the Company is required by the memorandum and articles of the association of the Company or by

any applicable laws to be held; and (c) the date on which the authority given under the ordinary resolution approving the Share Repurchase

Mandate is revoked or varied by an ordinary resolution of the Shareholders.

For the period from September 15, 2023 to

the date of holding the upcoming annual general meeting of the Company before the end of 2023, the Company will repurchase under the authority

of the repurchase mandate granted by the Shareholders passed on December 28, 2022, and for the subsequent periods under the 2023

Share Repurchase Program, the Company will repurchase under the repurchase mandate to be granted by the Shareholders at the upcoming annual

general meeting, subject to the approval of the Shareholders and the general mandate conditions as specified above. It is the intention

of the Board to implement the 2023 Share Repurchase Program during the 12-month period only in such a way and only to such an extent that

would not cause a mandatory general offer obligation to arise under Rule 26 of the Codes on Takeovers and Mergers and Share Buy-backs.

The Company will conduct the share repurchase

in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”).

Pursuant to Rule 10.06(2)(e) of the Listing Rules an issuer shall not purchase its shares on The Stock Exchange of Hong

Kong Limited (the “Stock Exchange”) at any time after inside information has come to its knowledge until the information is

made publicly available. In particular, during the period of one month immediately preceding the earlier of (i) the date of the board

meeting for the approval of the issuer’s results for any year, half-year, quarterly or any other interim period; and (ii) the

deadline for the issuer to announce its results for any year or half-year under the Listing Rules, or quarterly or any other interim period,

and ending on the date of the results announcement, the issuer shall not purchase its shares on the Stock Exchange, unless the circumstances

are exceptional.

The Company will conduct the proposed share repurchase

in compliance with the memorandum and articles of association of the Company, the Listing Rules, the Codes on Takeovers and Mergers and

Share Buy-backs, the Companies Law of the Cayman Islands and all applicable laws and regulations to which the Company is subject to.

The Board believes that the current financial

resources of the Company would enable it to implement the share repurchase without causing any material impact on its working capital.

The Board will review the 2023 Share Repurchase

Program periodically, and may authorize adjustment of its terms and size.

Shareholders and potential investors should

note that any repurchase may be done subject to market conditions and at the Board’s absolute discretion. There is no assurance

of the timing, quantity or price of any repurchase. Shareholders and potential investors should therefore exercise caution when dealing

in the Shares.

About MINISO Group

MINISO

Group is a global value retailer offering a variety of trendy lifestyle products featuring IP design. The Company serves consumers primarily

through its large network of MINISO stores, and promotes a relaxing, treasure-hunting and engaging shopping experience full of delightful

surprises that appeals to all demographics. Aesthetically pleasing design, quality and affordability are at the core of every product

in MINISO's wide product portfolio, and the Company continually and frequently rolls out products with these qualities. Since the opening

of its first store in China in 2013, the Company has built its flagship brand "MINISO" as a globally recognized retail

brand and established a massive store network worldwide. For more information, please visit https://ir.miniso.com/.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by words or phrases such as "may", "will", "expect", "anticipate",

"aim", "estimate", "intend", "plan", "believe", "is/are likely to", "potential",

"continue" or other similar expressions. MINISO may also make written or oral forward-looking statements in its periodic reports

to the U.S. Securities and Exchange Commission (the "SEC") and The Stock Exchange of Hong Kong Limited (the "HKEX"),

in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors

or employees to third parties. Statements that are not historical facts, including statements about MINISO's beliefs and expectations,

are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual

results to differ materially from those contained in any forward-looking statement, including but not limited to the following: MINISO's

mission, goals and strategies; future business development, financial conditions and results of operations; the expected growth of the

retail market and the market of branded variety retail of lifestyle products in China and globally; expectations regarding demand for

and market acceptance of MINISO's products; expectations regarding MINISO's relationships with consumers, suppliers, MINISO Retail Partners,

local distributors, and other business partners; competition in the industry; proposed use of proceeds; and relevant government policies

and regulations relating to MINISO's business and the industry. Further information regarding these and other risks is included in MINISO's

filings with the SEC and the HKEX. All information provided in this press release and in the attachments is as of the date of this press

release, and MINISO undertakes no obligation to update any forward-looking statement, except as required under applicable law.

Investor Relations Contacts:

Raine Hu

MINISO Group Holding Limited

Email: ir@miniso.com

Phone: +86 (20) 36228788 Ext.8039

Eric Yuan

Christensen Advisory

Email: miniso@christensencomms.com

Phone: +86 1380 111 0739

Exhibit 99.3

Hong Kong Exchanges and Clearing Limited and

The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its

accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole

or any part of the contents of this announcement.

MINISO Group

Holding Limited

名創優品集團控股有限公司

(A company incorporated

in the Cayman Islands with limited liability)

(Stock Code:

9896)

VOLUNTARY ANNOUNCEMENT

INTENTION TO

CONDUCT ON-MARKET SHARE REPURCHASE

This is a voluntary announcement made by MINISO

Group Holding Limited (the “Company”) to provide its shareholders and potential investors with information in relation

to the latest developments regarding the Company.

Reference is made to the announcement of the Company

dated September 29, 2022 in relation to the share purchase program (“2022 Share Repurchase Program”) adopted by

the Company to conduct share repurchase from the open market over a 12-month period.

The board (the “Board”) of

directors (the “Directors”) of the Company wishes to announce that on September 15, 2023, following the expiration

of the 2022 Share Repurchase Program, the Board has authorised and approved a new share repurchase program (the “2023 Share Repurchase

Program”), under which the Company may repurchase up to US$200 million in value of its outstanding ordinary shares and/or American

depositary shares representing its ordinary shares (the “Shares”) from the open market over a 12-month period starting

from the date on which the 2023 Share Repurchase Program was approved. The Company expects to fund repurchases under the 2023 Share Repurchase

Program from surplus cash on its balance sheet.

The Board believes that a share repurchase in

the present conditions will demonstrate the Company’s confidence in its business outlook and prospects and would benefit the Company

and create value for the shareholders of the Company (the “Shareholders”) ultimately.

The Company’s proposed repurchases under

the 2023 Share Repurchase Program may be made from time to time on the open market at prevailing market prices, in privately negotiated

transactions, in block trades, and/or through other legally permissible means, depending on market conditions and in accordance with applicable

rules and regulations and its insider trading policy.

The Company shall conduct the repurchases by exercising

its powers under the repurchase mandate given or to be given to the Board pursuant to the resolutions of the Shareholders passed at the

annual general meeting of the Company each year to repurchase the Shares not exceeding 10% of the total number of the issued Shares (the

“Share Repurchase Mandate”) as at the date of such annual general meeting, with each mandate to expire upon whichever

is the earliest of: (a) the conclusion of the next annual general meeting of the Company; (b) the expiration of the period within

which the next annual general meeting of the Company is required by the memorandum and articles of the association of the Company or by

any applicable laws to be held; and (c) the date on which the authority given under the ordinary resolution approving the Share Repurchase

Mandate is revoked or varied by an ordinary resolution of the Shareholders.

For the period from September 15, 2023 to

the date of holding the upcoming annual general meeting of the Company before the end of 2023, the Company will repurchase under the authority

of the repurchase mandate granted by the Shareholders passed on December 28, 2022, and for the subsequent periods under the 2023

Share Repurchase Program, the Company will repurchase under the repurchase mandate to be granted by the Shareholders at the upcoming annual

general meeting, subject to the approval of the Shareholders and the general mandate conditions as specified above. It is the intention

of the Board to implement the 2023 Share Repurchase Program during the 12-month period only in such a way and only to such an extent that

would not cause a mandatory general offer obligation to arise under Rule 26 of the Codes on Takeovers and Mergers and Share Buy-backs.

The Company will conduct the share repurchase

in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing

Rules”). Pursuant to Rule 10.06(2)(e) of the Listing Rules, an issuer shall not purchase its shares on The Stock Exchange

of Hong Kong Limited (the “Stock Exchange”) at any time after inside information has come to its knowledge until the

information is made publicly available. In particular, during the period of one month immediately preceding the earlier of (i) the

date of the board meeting for the approval of the issuer’s results for any year, half-year, quarterly or any other interim period;

and (ii) the deadline for the issuer to announce its results for any year or half-year under the Listing Rules, or quarterly or any

other interim period, and ending on the date of the results announcement, the issuer shall not purchase its shares on the Stock Exchange,

unless the circumstances are exceptional.

The Company will conduct the proposed share repurchase

in compliance with the memorandum and articles of association of the Company, the Listing Rules, the Codes on Takeovers and Mergers and

Share Buy-backs, the Companies Law of the Cayman Islands and all applicable laws and regulations to which the Company is subject to.

The Board believes that the current financial

resources of the Company would enable it to implement the share repurchase without causing any material impact on its working capital.

The Board will review the 2023 Share Repurchase

Program periodically, and may authorize adjustment of its terms and size.

Shareholders and potential investors should

note that any repurchase may be done subject to market conditions and at the Board’s absolute discretion. There is no assurance

of the timing, quantity or price of any repurchase. Shareholders and potential investors should therefore exercise caution when dealing

in the Shares.

| |

By Order of the Board |

| |

MINISO Group Holding Limited |

| |

Mr. YE Guofu |

| |

Executive Director and Chairman |

Hong Kong, September 15, 2023

As of the date of this announcement, the board

of directors of the Company comprises Mr. YE Guofu as executive Director, Ms. XU Lili, Mr. ZHU Yonghua and Mr. WANG

Yongping as independent non-executive Directors.

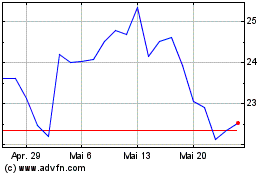

MINISO (NYSE:MNSO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

MINISO (NYSE:MNSO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024