Marcus & Millichap’s Institutional Property Advisors Brokers Three Multifamily Property Sales in Tacoma for $102.6 Million

21 November 2024 - 6:30PM

Business Wire

Institutional Property Advisors (IPA), a division of Marcus

& Millichap (NYSE: MMI), announced today the sale of three

multifamily assets totaling 557 units in Tacoma, Washington for

$102.6 million. The properties are Monterra, Miramonte, and

Heatherstone Apartments.

“Located in a multifamily market with one of the largest housing

imbalances in the nation, these acquisitions provide the buyers

with opportunity to capitalize on embedded rental and operational

upside,” said Giovanni Napoli, IPA executive director. Napoli and

IPA’s Philip Assouad, Ryan Harmon, Nick Ruggiero, and Anthony

Palladino represented the seller, Goodman Real Estate and procured

the buyer, American Capital Group.

The properties are in Tacoma’s Parkland neighborhood, which is

easily accessible from Interstate 5, Washington State Routes 512

and 7. Employment hubs in Seattle and Tacoma are a short commute.

Shopping and entertainment at Tacoma Mall, Lakewood Towne Center,

and South Hill Mall are nearby. Also nearby are Joint Base

Lewis-McChord, Pacific Lutheran University, Bates Technical

College, and Clover Park Technical College.

Miramonte is a 120-unit property constructed in 1991. Community

amenities include an outdoor fireside lounge, swimming pool, and

fitness center. The property’s one-, two- and three-bedroom units

have fireplaces, large kitchens, and walk-in closets.

Built in 1990, Monterra is a 280-unit asset with an outdoor

swimming pool, barbecue area, and a clubhouse with an indoor pool

and spa. The property’s one-, two- and three-bedroom apartments

have vaulted ceilings, fireplaces, and full-size washers and

dryers.

Completed in 1993, Heatherstone Apartments is a 157-unit,

11-residential building property. Ten of the units were built in

1993, and one unit was completed in 2009. Community amenities

include a clubhouse with a lounge and leasing office, heated

outdoor swimming pool, and a dog park. Apartments have washers and

dryers, and a private balcony or patio with storage.

About Institutional Property Advisors (IPA)

Institutional Property Advisors (IPA) is a division of Marcus

& Millichap (NYSE: MMI), a leading commercial real estate

services firm in North America. IPA’s combination of real estate

investment and capital markets expertise, industry-leading

technology, and acclaimed research offer customized solutions for

the acquisition, disposition and financing of institutional

properties and portfolios. For more information, please visit

www.institutionalpropertyadvisors.com.

About Marcus & Millichap, Inc. (NYSE: MMI)

Marcus & Millichap, Inc. is a leading national brokerage

firm specializing in commercial real estate investment sales,

financing, research and advisory services. As of December 31, 2023,

the Company had 1,783 investment sales and financing professionals

in over 80 offices who provide investment brokerage and financing

services to sellers and buyers of commercial real estate. The

Company also offers market research, consulting and advisory

services to our clients. Marcus & Millichap closed 7,546

transactions in 2023, with a sales volume of approximately $43.6

billion. For additional information, please visit

www.MarcusMillichap.com.

About American Capital Group

Founded in 1986, American Capital Group (ACG) is an experienced,

vertically integrated development and investment company. With a

focus on multifamily opportunities in the Western U.S., ACG has

developed and acquired more than 110 properties totaling over

21,000 units across 10 states. ACG’s current portfolio consists of

approximately $2 billion in assets under management. For more

information visit: www.acg.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121028974/en/

Gina Relva, VP of Public Relations

Gina.Relva@MarcusMillichap.com

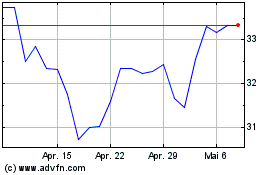

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

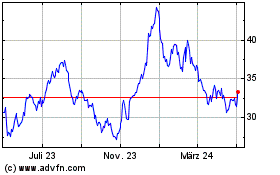

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024