Form 8-K - Current report

16 Januar 2024 - 1:04PM

Edgar (US Regulatory)

LEGGETT & PLATT INC false 0000058492 0000058492 2024-01-11 2024-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 11, 2024

LEGGETT & PLATT, INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Missouri |

|

001-07845 |

|

44-0324630 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| No. 1 Leggett Road, Carthage, MO |

|

64836 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code 417-358-8131

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which registered |

| Common Stock, $.01 par value |

|

LEG |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

The information contained in Item 2.06 under “Additional Impairment” regarding the impairment of certain long-lived assets, including customer relationships, technology, and trademark intangibles in our Bedding Products segment, and the estimated impact on the Company’s completed fourth quarter and year-end 2023 results of operations, is incorporated herein by reference. The Company is not otherwise updating guidance for, or reporting upon, its 2023 year-end financial results. These financial results will be released on February 8, 2024.

On January 16, 2024, the Company issued a press release disclosing, in part, an intangible impairment charge impacting the Company’s completed fourth quarter and year-end 2023 results of operations. The press release is attached as Exhibit 99.1 and the “Fourth Quarter 2023 Impairment Charge” section in such press release is incorporated herein by reference.

This information is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information shall not be incorporated by reference into any document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 2.05 |

Costs Associated with Exit or Disposal Activities. |

On January 11, 2024, the Board approved, and the Company committed to a restructuring plan primarily associated with our Bedding Products segment, and to a lesser extent our Furniture, Flooring & Textile (“FF&T”) Products segment (the “Restructuring Plan”).

In response to evolving markets, the Company anticipates taking actions pursuant to the Restructuring Plan to improve manufacturing and distribution efficiency, advance its product strategy, and further support customer needs. The Restructuring Plan is designed to create a portfolio of products and an operating footprint aligned with the markets we serve. The bedding market has experienced unprecedented change in recent years and the competitive landscape has continued to evolve. Optimizing our manufacturing and distribution footprint should reduce complexity, improve overall efficiency and align capacity with anticipated future market demand. These actions are expected to allow us to further integrate our specialty foam and innerspring capabilities, while maintaining our service and quality levels.

We plan to consolidate between 15 and 20 of 50 production and distribution facilities in the Bedding Products segment. Also, in our FF&T Products segment, we plan to consolidate a small number of production facilities in our Home Furniture and Flooring Products business units. The production in the affected facilities is expected to be consolidated into other facilities, or in a few cases, eliminated. Also, we expect to reduce workforce levels over time by 900 to 1,100.

In total, the initiatives across the segments are expected to reduce annual sales by approximately $100 million. Additionally, we anticipate receiving between $60 and $80 million in pre-tax net cash proceeds from the sale of real estate associated with the Restructuring Plan. These transactions are expected to be largely complete by the end of 2025.

In aggregate, we expect to incur restructuring and restructuring-related costs between $65 and $85 million, of which approximately half are anticipated to be incurred in 2024 and the remainder in 2025. This includes $30 to $40 million in cash costs, the majority of which are anticipated to be incurred in 2024. In the first half of 2024, we anticipate $20 to $25 million of restructuring and restructuring-related costs (approximately half in cash costs). The Company anticipates that the Restructuring Plan will be substantially complete by the end of 2025.

2

In addition, on January 11, 2024, we concluded that the Company, upon adoption of the Restructuring Plan, will incur non-cash impairment charges related to long-lived assets and inventory obsolescence. The aggregate pre-tax estimates of the restructuring and asset impairment costs, as well as the inventory obsolescence charges are shown in the table below.

|

|

|

|

|

|

|

|

|

| Estimated Pre-Tax Costs To Be Incurred with Restructuring Plan |

|

| Type of Cost (in millions) |

|

Amount

for each Type

of Cost |

|

|

Amount

of Costs

Resulting in

Cash Expenditures |

|

| Restructuring Costs |

|

|

|

|

|

|

|

|

| Employee Termination Costs |

|

$ |

10-15 |

|

|

$ |

10-15 |

|

| Other Exit Costs, primarily facility closure and asset relocation |

|

|

20-25 |

|

|

|

20-25 |

|

| Total Restructuring Costs |

|

|

30-40 |

|

|

|

30-40 |

|

| Restructuring Related Costs |

|

|

|

|

|

|

|

|

| Long-Lived Asset Impairment (primarily property, plant and equipment; and operating lease right-of-use asset impairments)1 |

|

|

25-30 |

|

|

|

|

|

| Inventory Obsolescence and Other |

|

|

10-15 |

|

|

|

|

|

| Total Restructuring Related Costs |

|

|

35-45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Estimated Pre-Tax Costs |

|

$ |

65-85 |

|

|

$ |

30-40 |

|

|

|

|

|

|

|

|

|

|

| 1 |

Operating lease right-of-use asset impairment charges of approximately $10-$15 million are expected to be recorded as a non-cash charge in the period of the impairments; however, the associated lease liabilities will be settled in cash over the remaining lease terms. |

Substantially all of the above costs are expected to be incurred in the Bedding Products segment, but approximately $4 to $5 million are expected in the FF&T Products segment, of which roughly half are expected to be cash costs.

3

| Item 2.06 |

Material Impairments. |

To the extent applicable, the information contained in Item 2.05 is incorporated into this Item 2.06 by reference.

Additional Impairment

Our long-lived assets are tested for recoverability at year end and whenever events or circumstances indicate the carrying value may not be recoverable. In addition to, and unrelated to the Restructuring Plan, the Company concluded that an impairment existed in our Bedding Products segment with respect to certain long-lived assets, including customer relationships, technology, and trademark intangibles related to prior year acquisitions.

Macroeconomic factors have negatively impacted consumer confidence in the bedding industry and prolonged weak demand has created disruption and financial instability with some of our customers. As such, recent efforts by certain customers to improve their financial position were considered a triggering event, late in the fourth quarter of 2023, to review the long-lived assets for potential impairment. We conducted an evaluation and determined in early January 2024, that our sales and earnings forecasts should be reduced. Based on this determination, and after further analysis, we concluded, on January 12, 2024 that the Company will record an estimated pre-tax impairment charge of approximately $450 million related to long-lived assets (primarily the intangibles). This impairment charge will not result in future cash expenditures, and will be recorded as a non-cash charge in the fourth quarter of 2023.

| Item 7.01 |

Regulation FD Disclosure. |

On January 16, 2024, the Company issued a press release disclosing the Restructuring Plan and the intangible impairment charge impacting the Company’s fourth quarter 2023 results of operations. The press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Also attached hereto as Exhibit 99.2 and incorporated herein by reference are presentation materials regarding the Restructuring Plan.

This information is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. This information shall not be incorporated by reference into any document filed under the Securities Act, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements. This Current Report on Form 8-K contains “forward-looking” statements including the estimates of the amounts, types and timing of costs (cash and non-cash) and impairment charges (including inventory obsolescence) aggregately and by segment; the amount of reduction of sales; the amount and timing of proceeds from the sale of facilities; the number of Bedding Products segment and FF&T Products segment facilities to be consolidated; the amount of pre-tax impairment charge related to long-lived assets; and the underlying assumptions relating to the forward-looking statements. These statements are identified either by the context in which they appear or by use of words such as “anticipate,” “estimate,” “expected,” “plan,” or the like. All such forward-looking statements are expressly qualified by the cautionary statements described in this provision. Any forward-looking statement reflects only the beliefs of the Company or its management at the time the statement is made. Because all forward-looking statements deal with the future, they are subject to risks, uncertainties and developments which might cause actual events or results to differ materially from those envisioned or reflected in any forward-looking statement. Moreover, we do not have, and do not undertake, any duty to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement was made. For all of these reasons, forward-looking statements should not be relied upon as a prediction of actual future events, objectives, strategies, trends or results.

It is not possible to anticipate and list all risks, uncertainties and developments which may cause actual events or results to differ from forward-looking statements. However, some of these risks and uncertainties include the following: (i) the preliminary nature of the estimates related to the Restructuring Plan and the pre-tax impairment charge related to long-lived assets, and the possibility that all or some of the estimates may change as the Company’s analysis develops and additional information is obtained; (ii) our ability to timely implement the Restructuring Plan in a manner that will positively impact our financial condition and results of operation; (iii) our ability to timely dispose of assets pursuant to the Restructuring Plan and obtain expected proceeds; (iv) the impact of the Restructuring Plan on the Company’s relationships with its employees, customers and vendors; (v) factors that may cause the Company to be unable to achieve the expected benefits of the Restructuring Plan; (vi) fluctuations in the number of employees impacted; and (vii) the risks and uncertainties detailed from time to time in reports filed by the Company with the Securities and Exchange Commission, including reports filed on Forms 8-K, 10-Q and 10-K.

4

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

EXHIBIT INDEX

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1* |

|

Press Release dated January 16, 2024 |

|

|

| 99.2* |

|

Restructuring Plan Presentation Materials |

|

|

| 101.INS |

|

Inline XBRL Instance Document (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the inline XBRL document) |

|

|

| 101.SCH** |

|

Inline XBRL Taxonomy Extension Schema |

|

|

| 101.LAB** |

|

Inline XBRL Taxonomy Extension Label Linkbase |

|

|

| 101.PRE** |

|

Inline XBRL Taxonomy Extension Presentation Linkbase |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the inline XBRL document contained in Exhibit 101) |

| * |

Denotes furnished herewith. |

| ** |

Denotes filed herewith. |

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

LEGGETT & PLATT, INCORPORATED |

|

|

|

|

| Date: January 16, 2024 |

|

|

|

By: |

|

/s/ JENNIFER J. DAVIS |

|

|

|

|

|

|

Jennifer J. Davis |

|

|

|

|

|

|

Executive Vice President – |

|

|

|

|

|

|

General Counsel |

6

Exhibit 99.1

FOR IMMEDIATE RELEASE: JANUARY 16, 2024

LEGGETT & PLATT ANNOUNCES RESTRUCTURING PLAN

TO DRIVE IMPROVED PERFORMANCE AND PROFITABLE GROWTH

Carthage, Mo., January 16, 2024 —

| |

• |

|

Continuing to adapt Bedding Products strategy to advance innovative, higher-value content and provide additional

product solutions for our customers |

| |

• |

|

Optimizing manufacturing and distribution footprint to enhance the efficiency of our business while maintaining

ability to service our customers |

| |

• |

|

Executing plan initiatives expected to generate $40 to $50 million of annualized EBIT benefit when fully

implemented in late 2025 |

| |

• |

|

Withdrawing company’s long-term financial targets |

| |

• |

|

Recording an estimated $450 million long-lived asset impairment charge in 4Q23 related to prior year

acquisitions in Bedding Products segment |

Diversified manufacturer Leggett & Platt announced that it is implementing a

Restructuring Plan primarily in its Bedding Products segment and to a lesser extent, in its Furniture, Flooring & Textile Products segment. In response to evolving markets, the Company is taking actions to improve manufacturing and

distribution efficiency, advance its product strategy, and further support customer needs. These actions are expected to generate $40 to $50 million in EBIT benefit on an annualized run-rate basis when

fully implemented in late 2025.

President and CEO Mitch Dolloff commented, “We are taking actions to create a more focused, agile organization with

a portfolio of products and operating footprint aligned with the markets we serve. The bedding market has experienced unprecedented change in recent years and the competitive landscape has continued to evolve. Reshaping our Bedding Products strategy

is expected to better position us for long-term success as the leading provider of bedding solutions across the value chain. In addition, optimizing our operating footprint in both Bedding Products and Furniture, Flooring & Textile Products

will reduce complexity and enhance the efficiency of our business. Looking forward, we expect to advance key product growth, improve profitability, and drive enhanced value for customers and shareholders.”

OVERVIEW OF INITIATIVES

The major Bedding

Products initiatives that are part of the Restructuring Plan include:

| |

• |

|

Refocusing Strategy: We are continuing to reshape our Bedding Products business to focus on innovative,

higher-value content, driven by customer and end-consumer needs. We are proud of our long history of providing product solutions our customers value and see further opportunities to do so in both innersprings

and specialty foam, from components to private label finished goods. |

| |

• |

|

Optimizing Manufacturing and Distribution Footprint: We plan to consolidate certain locations across the

Bedding Products segment, reducing our manufacturing and distribution footprint of 50 facilities to approximately 30 to 35 facilities. Creating a new and more efficient regional distribution network will support our ability to maintain sufficient

manufacturing capacity in fewer, higher-output facilities to effectively serve our customers and better align with anticipated future market demand. These actions should allow us to integrate our specialty foam and innerspring capabilities while

maintaining market-leading service and product quality levels and improving overall efficiency. |

The initiatives outlined above are expected to enable profitable growth through expanded product

capabilities and increased content at attractive price points, reduce costs, and create shareholder value.

In Furniture, Flooring & Textile

Products we plan to consolidate a small number of production facilities in Home Furniture and Flooring Products to better align capacity with regional demand and drive operating efficiencies.

FINANCIAL IMPACT

In total, the initiatives are

expected to reduce annual sales by approximately $100 million and generate $40 to $50 million in EBIT benefit on an annualized run-rate basis when fully implemented in late 2025, with some of the

benefit starting to be realized in the second half of 2024. Additionally, we anticipate receiving approximately $60 to $80 million in net cash proceeds from the sale of real estate associated with the initiatives, with transactions largely

complete by the end of 2025.

We expect to incur restructuring and restructuring-related costs of $65 to $85 million, of which approximately half are

anticipated to be incurred in 2024 and the remainder in 2025. This includes $30 to $40 million in cash costs, the majority of which are anticipated to be incurred in 2024. In the first half of 2024, we anticipate $20 to $25 million of

restructuring and restructuring-related costs (approximately half in cash costs).

LONG-TERM FINANCIAL TARGETS

In connection with the Restructuring Plan, we are withdrawing our previously stated Total Shareholder Return goal of

11-14% and financial targets, including revenue growth, EBIT margin, and dividend payout ratio. Revised financial targets will be issued at a future date. We are not changing our objectives of maintaining our

investment grade debt ratings and our current dividend practices.

FOURTH QUARTER 2023 IMPAIRMENT CHARGE

In addition, but unrelated to the Restructuring Plan, we are impairing an estimated $450 million of long-lived assets (primarily intangibles) associated

with prior year acquisitions in the Bedding Products segment. Prolonged weak demand and changing market dynamics have created disruption and financial instability for some of our customers. As a result, recent efforts by certain customers to improve

their financial position are expected to reduce our future sales and earnings. We are not otherwise updating guidance for, or reporting upon, our fourth quarter 2023 or full year 2023 financial results. These financial results and 2024 full year

guidance will be released on February 8, 2024.

— — — — — — — — — — — — — —

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

FOR MORE INFORMATION: Visit Leggett’s website at www.leggett.com.

COMPANY DESCRIPTION: Leggett & Platt (NYSE: LEG) is a diversified manufacturer that designs and produces a broad variety of engineered components and

products that can be found in many homes and automobiles. The 141-year-old Company is a leading supplier of bedding components and private label finished goods;

automotive seat comfort and convenience systems; home and work furniture components; geo components; flooring underlayment; hydraulic cylinders for material handling and heavy construction applications; and aerospace tubing and fabricated

assemblies.

FORWARD-LOOKING STATEMENTS: This press release contains “forward-looking” statements including the positioning of the

Company for long-term success as the leading provider of bedding solutions across the value chain; reducing complexity and enhancing the efficiency of our business; advancing key product growth; improving profitability; driving enhanced value for

customers and shareholders; integrating our specialty foam and innerspring capabilities; delivering profitable growth through expanded product capabilities; increasing content at attractive price points; reducing costs; creating shareholder value;

the amounts and timing of restructuring and restructuring related costs (cash and non-cash); the amount and timing of EBIT benefit; the amount and timing of the reduction of sales; the amount and timing of

proceeds from the sale of facilities; the number of Bedding Product segment production and distribution facilities to be consolidated; reduced future sales and earnings; the amount of long-lived asset impairment; the maintenance of our investment

grade debt ratings and current dividend practices; and the underlying assumptions

2 of 3

relating to the forward-looking statements. These statements are identified either by the context in which they appear or by use of words such as “anticipate,” “estimate,”

“expected,” “plan, “should,” or the like. All such forward-looking statements are expressly qualified by the cautionary statements described in this provision. Any forward-looking statement reflects only the beliefs of the

Company or its management at the time the statement is made. Because all forward-looking statements deal with the future, they are subject to risks, uncertainties and developments which might cause actual events or results to differ materially from

those envisioned or reflected in any forward-looking statement. Moreover, we do not have, and do not undertake, any duty to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement was

made. For all of these reasons, forward-looking statements should not be relied upon as a prediction of actual future events, objectives, strategies, trends or results.

It is not possible to anticipate and list all risks, uncertainties and developments which may cause actual events or results to differ from forward-looking

statements. However, some of these risks and uncertainties include the following: (i) the preliminary nature of the estimates related to the Restructuring Plan, and the amount of long-lived asset impairment, and the possibility that all or some

of the estimates may change as the Company’s analysis develops, and additional information is obtained; (ii) our ability to timely implement the Restructuring Plan in a manner that will positively impact our financial condition and results

of operation; (iii) our ability to timely dispose of assets pursuant to the Restructuring Plan and obtain expected proceeds; (iv) the impact of the Restructuring Plan on the Company’s relationships with its employees, customers and

vendors; (v) our ability to accurately forecast future sales and earnings; (vi) factors that may cause the Company to be unable to achieve the expected benefits of the Restructuring Plan; (vii) sufficient cash generation to pay the

dividend at current levels; and (viii) the risks and uncertainties detailed from time to time in reports filed by the Company with the Securities and Exchange Commission, including reports filed on Forms

8-K, 10-Q and 10-K.

CONTACT: Investor Relations, (417) 358-8131 or invest@leggett.com

Cassie J. Branscum, Vice President of Investor Relations

Kolina A. Talbert, Manager of Investor Relations

3 of 3

Restructuring PLAN January 16, 2024

LEG (NYSE) www.leggett.com Exhibit 99.2

Statements in this presentation that

are not historical in nature are “forward-looking.” These statements include the estimates of the amounts and timing of the Restructuring Plan costs (cash and non-cash) and impairment charges aggregately and by segment; the amount and

timing of annual EBIT benefit; the amount of annual sales reduction; the immaterial impact of estimated sales reduction; the amount and timing of proceeds from the sale of real estate, and the use of these proceeds for debt reduction; the number of

Bedding Product segment facilities to be consolidated; the maintenance of our investment grade debt ratings and current dividend practices; and the underlying assumptions relating to the forward-looking statements. All such forward-looking

statements are expressly qualified by the cautionary statements described in this provision. Any forward-looking statement reflects only the beliefs of the Company at the time the statement is made. Because all forward-looking statements deal with

the future, they are subject to risks, uncertainties and developments which might cause actual events or results to differ materially from those envisioned or reflected in any forward-looking statement. Moreover, we do not have, and do not

undertake, any duty to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement was made. For all these reasons, forward-looking statements should not be relied upon as a prediction of

actual future events, objectives, strategies, trends, or results. Some of the risks and uncertainties and developments which may cause actual events or results to differ from forward-looking statements include the following: the preliminary nature

of the estimates related to the Restructuring Plan, and the possibility that all or some of the estimates may change as the Company’s analysis develops, and additional information is obtained; our ability to timely implement the Restructuring

Plan in a manner that will positively impact our financial condition and results of operation; our ability to timely dispose of real estate pursuant to the Restructuring Plan and obtain expected proceeds; the impact of the Restructuring Plan on the

Company’s relationships with its employees, customers and vendors; global inflationary and deflationary impacts; macro-economic impacts; pandemics; demand for our products and our customers’ products; our manufacturing facilities’

ability to remain fully operational; goodwill and long-lived asset impairment; inability to issue commercial paper or borrow under the credit facility; inability to collect receivables; inability to pass along raw material price increases; inability

to maintain profit margins; conflict between China and Taiwan; changes in our capital needs; changing tax rates; market conditions; increased trade costs; foreign country operational risks; price and product competition; cost and availability of raw

materials, parts, labor and energy costs; cash generation to pay the dividend; political risks; ability to grow acquired businesses; disruption to our rod mill; disruption to our operations and supply chain from weather-related events and other

impacts; foreign currency fluctuation; our ability to manage working capital; anti-dumping duties; data privacy; cybersecurity incidents; customer bankruptcies and losses; climate change regulations; ESG risks; bank failures; cash repatriation;

litigation risks; and other risk factors in Leggett’s most recent Form 10-K and Form 10-Q. Market and Industry Data Unless we indicate otherwise, we base the information concerning our markets/industry contained herein on our general knowledge

of and expectations concerning those markets/industry, on data from various industry analyses, on our internal research, and on adjustments and assumptions that we believe to be reasonable. However, we have not independently verified data from

market/industry analyses and cannot guarantee their accuracy or completeness. Forward-Looking Statements

Driving improved performance &

profitable growth Implementing a Restructuring Plan to improve profitability and better align with the markets we serve Key initiatives primarily related to the Bedding Products segment Continuing to reshape product and commercial strategy

Optimizing manufacturing and distribution footprint Smaller actions within the Furniture, Flooring, and Textile Products segment Aligning capacity with regional demand Driving operating efficiencies

Headwinds Actions We Are Taking

Evolving competitive landscape and shifting product preferences Prioritizing innovative, higher-value content and product solutions while maintaining market leading service and product quality levels Abnormal demand trends Aligning capacity with

anticipated future market demand and driving operating efficiencies Limited integration of Specialty Foam Greater integration of specialty foam and innerspring capabilities BEDDING HEADWINDS & THE PATH FORWARD

Bedding products INITIATIVES Enabling

profitable growth via expanded product capabilities, increased content Reducing costs Creating value for our customers and shareholders FOOTPRINT: Higher output manufacturing locations with sufficient capacity to meet customer needs More efficient,

regional distribution network From 50 to ~30–35 facilities PRODUCTS: Innovative, higher-value content and additional product solutions Components to private label finished goods Leveraging specialty foam and innerspring technologies

EXPECTED FINANCIAL IMPACT EBIT benefit

driven by optimized Bedding footprint Expect to begin realizing in the second half of 2024 Expect to see full benefit on an annualized run-rate basis by late 2025 Sales reduction primarily related to geographic changes within Bedding Real estate

sales of property associated with initiatives expected to be substantially complete by the end of 2025 Proceeds expected to primarily be used for debt reduction $40–$50 million Annual EBIT Benefit $60–$80 million Cash from Real Estate

~$100 million Annual Sales Reduction

EXPECTED restructuring costs Bedding

Products restructuring and restructuring-related costs (at midpoint of range): ~$33M cash ~$38M non-cash Furniture, Flooring & Textile Products restructuring and restructuring-related costs (at midpoint of range): ~$2M cash ~$2M non-cash

$65–$85 million Total Restructuring Costs $30–$40 million Restructuring Cash Costs $35–$45 million Restructuring Non-cash Costs Approximately half of costs are anticipated to be incurred in 2024

FINANCIAL TARGETS Withdrawing

previously stated TSR goal of 11-14% and financial targets, including: 6-9% annual revenue growth 11.5-12.5% EBIT margin ~50% dividend payout ratio Revised targets will be issued at a future date Not changing our objectives of maintaining investment

grade debt ratings and our current dividend practices

For Additional Information Ticker: LEG

(NYSE) Website: www.leggett.com Email: invest@leggett.com Phone: (417) 358-8131 Find our Fact Book and Sustainability Report at www.leggett.com Cassie Branscum Vice President, Investor Relations Kolina Talbert Manager, Investor Relations

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

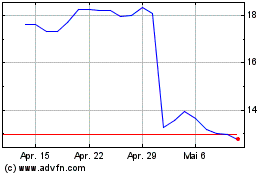

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024