Amended Current Report Filing (8-k/a)

09 April 2020 - 10:18PM

Edgar (US Regulatory)

0000763744FALSE00007637442020-04-082020-04-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 8, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LCI INDUSTRIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-13646

|

13-3250533

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

3501 County Road 6 East,

|

Elkhart,

|

Indiana

|

46514

|

|

|

|

|

|

|

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

Registrant's telephone number, including area code:

|

|

|

(574)

|

535-1125

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

LCII

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

This Current Report on Form 8-K/A (Amendment No. 1) is being filed to update the Form 8-K filed by LCI Industries (the “Company”) on April 8, 2020, to add Item 2.03, Item 5.02, and forward-looking statement disclosures.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

As previously disclosed, the Company is party to an existing credit facility that provides for certain term loans and a $600 million variable interest rate revolving credit facility agreement with institutional lenders (the "Revolving Credit Facility"). The material terms of the Revolving Credit Facility are described under "Item 8. Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - Note 8. - Long-Term Indebtedness" in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 27, 2020, which is incorporated herein by reference.

Over the past several weeks, the Company borrowed a series of draws under the Revolving Credit Facility to increase its cash position and improve financial flexibility in response to the COVID-19 pandemic. As of the date of this filing, the Company has outstanding borrowings under the Revolving Credit Facility of approximately $440 million, and remaining availability of approximately $160 million. The Company anticipates continuing to make draws under the Revolving Credit Facility in the near term, as part of its preparation and response to the COVID-19 pandemic. As of the most recent quarter end, the Company was in compliance with its loan covenants.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As part of a series of actions and support activities in response to the COVID-19 pandemic, the base salary of the Company’s President and Chief Executive Officer, Jason Lippert, will be reduced by 25%, beginning on April 20, 2020. This salary reduction is intended to remain in place until further clarity can be achieved regarding the impact of the pandemic on the global economy and the Company.

Item 8.01 Other Events

a. Reference is made to the press release dated April 8, 2020, the text of which is attached hereto as Exhibit 99.1, for a description of the events reported pursuant to this Form 8-K.

Item 9.01 Financial Statements and Exhibits

Exhibits

99.1 Press Release dated April 8, 2020

104 Cover Page Interactive Date File (formatted as Inline XBRL and contained in Exhibit 101).

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the impact of the COVID-19 pandemic on the Company’s business and certain actions the Company is taking in response thereto. All statements other than statements of historical or current fact are, or may be deemed to be, forward-looking statements. Such statements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual outcomes and results to differ materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to, the effects of the COVID-19 pandemic and other adverse public health developments on the global economy, the Company’s business, operations and financial position, and the business and operations of the Company’s suppliers and customers. A further list and description of these risks and uncertainties and other risks and uncertainties are discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, and in the Company’s subsequent filings with the Securities and Exchange Commission. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

LCI INDUSTRIES

|

|

|

(Registrant)

|

|

|

|

|

|

By: /s/ Brian M. Hall

Brian M. Hall

Chief Financial Officer

|

|

|

|

|

|

Dated:

|

April 9, 2020

|

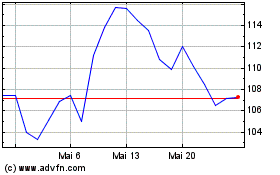

LCI Industries (NYSE:LCII)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

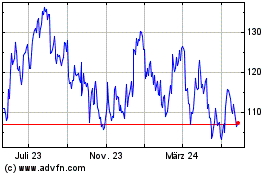

LCI Industries (NYSE:LCII)

Historical Stock Chart

Von Jul 2023 bis Jul 2024