The Korea Fund, Inc. Appoints New Agent for its Discount Management Program

16 Dezember 2024 - 10:00PM

Business Wire

The Board of Directors (the “Board”) of The Korea Fund, Inc.

(NYSE: KF) (the “Fund”) has appointed Stifel, Nicolaus &

Company, Incorporated (the “Program Manager”) to serve as its agent

and broker for purposes of implementing the Fund’s Discount

Management Program (the “Program”), with effect as of December 16,

2024.

The Program provides that the Fund may repurchase annually up to

10% of its common shares outstanding as of the close of business on

June 30th of the prior year in open market transactions when such

shares are trading above a specified discount threshold in

accordance with the procedures and parameters (the “Share Purchase

Procedures”) adopted by the Board. The Board may amend the Share

Purchase Procedures, including the discount threshold, from time to

time when it believes such amendment is in the best interest of the

Fund and its shareholders and without prior notice. The Share

Purchase Procedures, including any amendments thereto, are designed

to comply with the conditions set forth in Rule 10b-18 under the

Securities Exchange Act of 1934 (the “Exchange Act”), which

generally provides issuers, such as the Fund, with a safe harbor

from liability for market manipulation when they repurchase their

common stock in the open market in accordance with the conditions

of the Rule. Any repurchases made pursuant to the Program will be

made on a national securities exchange at the prevailing market

price, subject to exchange requirements. The Fund’s share

repurchase activity pursuant to the Program will be disclosed in

its shareholder report for the relevant fiscal period.

The Program is intended to enhance shareholder value by

purchasing Fund shares trading at a discount from their net asset

value (“NAV”) per share, which could result in incremental

accretion to the Fund’s NAV. However, there is no assurance that

share repurchases executed pursuant to the Program will be

effective at reducing any discount in the open market price of Fund

shares. There is also no assurance that the Fund will purchase

shares at any particular discount levels or in any particular

amounts, and the Fund may commence purchasing shares pursuant to

the Program or suspend the Program at any time with or without

prior notice. In addition, the Fund’s ability to purchase its

shares may be limited due to reasons beyond the control of the

Fund, including due to regulatory requirements or other legal

considerations or adverse market conditions. The Board regularly

monitors the effectiveness of the Program and may modify the Share

Purchase Procedures, consistent with applicable law, at any time

when it believes such modification to be in the best interest of

the Fund and its shareholders. The Board also may elect, at any

time, to take actions other than open market purchases pursuant to

the Program to seek to address the value of shareholder

investments.

The Korea Fund, Inc. is a non-diversified, closed-end investment

company. The Fund seeks long-term capital appreciation through

investing primarily in equity securities trading on the Korean

stock exchanges. Its shares are listed on the New York Stock

Exchange under the symbol “KF.”

JPMorgan Asset Management (Asia Pacific) Ltd is the Fund's

Investment Adviser. Investment in closed-end funds involves risks.

Additional risks are associated with international investing, such

as currency fluctuation, government regulations, economic changes

and differences in liquidity, which may increase the volatility of

an investment in the Fund. Foreign securities markets generally

exhibit greater price volatility and are less liquid than the U.S.

market. Additionally, this Fund focuses its investments in certain

geographical regions, thereby increasing its vulnerability to

developments in that region. All of these factors potentially

subject the Fund's shares to greater price volatility. The NAV of

the Fund will fluctuate with the value of the underlying

securities. Closed-end funds trade on their market value, not NAV,

and closed-end funds often trade at a discount to their NAV.

The Fund’s daily New York Stock Exchange closing market price

and NAV, as well as other information, including updated portfolio

statistics and performance are available at www.thekoreafund.com or

by calling the Fund’s stockholder servicing agent at (866) 706

0510.

This press release contains no recommendations to buy or sell

any specific securities and should not be considered investment

advice of any kind. Past performance is no guarantee of future

results and the investment returns generated by the Fund will

fluctuate. There can be no assurance the Fund will meet its stated

objective. There is no assurance that the market price of the

Fund’s shares, either absolutely or relative to NAV, will increase

as a result of any share repurchases. In making any investment

decision, individuals should utilize other information sources and

the advice of their own professional adviser.

Fund shares are not FDIC-insured and are not deposits or other

obligations of, or guaranteed by, any bank. Fund shares involve

investment risk, including possible loss of principal.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216028947/en/

Stockholder Servicing Agent: 866 706 0510 The Korea Fund, Inc.

www.thekoreafund.com

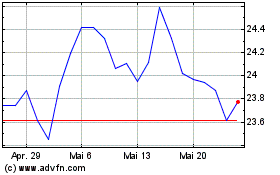

Korea (NYSE:KF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Korea (NYSE:KF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025